by Calculated Risk on 10/30/2009 02:08:00 PM

Friday, October 30, 2009

Report: CIT to File Bankruptcy on Sunday

From the WSJ: CIT, Icahn Reach Tentative Deal Over Lender's Restructuring

As part of further discussions with CIT, Mr. Icahn has agreed to back down while the company restructures in bankruptcy court. ...This debt-for-equity swap makes the most sense and would allow CIT to continue to operate.

The company plans to file for bankruptcy in New York as soon as Sunday night or early Monday, said people familiar with the matter. CIT is poised to enter bankruptcy with enough creditor support to approve its reorganization plan and shorten its stay in Chapter 11 ...

... CIT asked bondholders to vote on a prepackaged bankruptcy plan, which would give most bondholders new debt it values at 70 cents on the dollar, and all the equity in a restructured company.

Note: CIT provides financing for about one million small businesses, so a prepackaged bankruptcy that allows the company to continue to operate would be helpful. Small businesses are already having trouble obtaining credit, and this might be impacting hiring plans (see from Melinda Pitts at Macroblog: Prospects for a small business-fueled employment recovery )

Restaurant Index Shows Contraction, Less Capital Spending

by Calculated Risk on 10/30/2009 11:21:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

The restaurant business is still contracting ...

Note: Any reading below 100 shows contraction for this index. The index is a year-over-year index, so the headline index might be slow to recognize a pickup in business, but the underlying details suggests ongoing weakness.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Uncertain as Restaurant Performance Index Declined in September for Second Consecutive Month

[T]he National Restaurant Association’s ... Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.5 in September, down 0.4 percent from August and its 23rd consecutive month below 100.

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 96.0 in September – unchanged from August and tied for the second-lowest level on record. In addition, September represented the 25th consecutive month below 100, which signifies contraction in the current situation indicators.

...

The outlook for capital spending fell considerably from recent months. Thirty-seven percent of restaurant operators plan to make a capital expenditure for equipment, expansion or remodeling in the next six months, down sharply from 45 percent who reported similarly last month.

emphasis added

Cartoon: Recession is Over!

by Calculated Risk on 10/30/2009 09:48:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

Actually the recession is not "officially" over until the National Bureau of Economic Research (NBER) determines the end of the recession.

It took the National Bureau of Economic Research (NBER) Business Cycle Dating Committee over a year and half after the 2001 recession ended to call the trough of the cycle. And it took 21 months after the 1990-1991 recession ended for NBER to date the end of the recession.

The previous NBER announcements make it clear that NBER will not date the trough of the recession until certain economic indicators - like real GDP - are above the pre-recession levels. Any downturn before economic activity reaches pre-recession levels will probably be considered a continuation of the recession that started in December 2007.

Here is the NBER dating procedure.

September PCE and Saving Rate

by Calculated Risk on 10/30/2009 08:38:00 AM

From the BEA: Personal Income and Outlays, September 2009

Personal income decreased $0.1 billion, or less than 0.1 percent, and disposable personal income (DPI) decreased $0.2billion, or less than 0.1 percent, in September, according to the Bureau of Economic

Analysis. Personal consumption expenditures (PCE) decreased $47.2 billion, or 0.5 percent.

...

Real DPI -- DPI adjusted to remove price changes -- decreased 0.1 percent in September, compared with a decrease of 0.2 percent in August.

Real PCE -- PCE adjusted to remove price changes -- decreased 0.6 percent in September, in contrast to an increase of 1.0 percent in August.

...

Personal saving -- DPI less personal outlays -- was $355.6 billion in September, compared with $307.0 billion in August. Personal saving as a percentage of disposable personal income was 3.3 percent in September, compared with 2.8 percent in August.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the September Personal Income report. The saving rate was 3.3% in September. (3.1% with three month average)

Although the saving rate declined in Q3, households are still saving more than during the last few years (when the saving rate was around 1.0%). The saving rate will probably continue to rise as households save more to repair their household balance sheets (and because an aging population usually pushes the saving rate higher) This increase in the saving rate - if it happens as expected - will keep pressure on personal consumption expenditures for the next year or two.

Thursday, October 29, 2009

Mark Zandi on the Great Recession

by Calculated Risk on 10/29/2009 10:55:00 PM

Testimony from Mark Zandi of Economy.com: The Impact of the Recovery Act on Economic Growth (ht Professor Brad DeLong). A few excerpts:

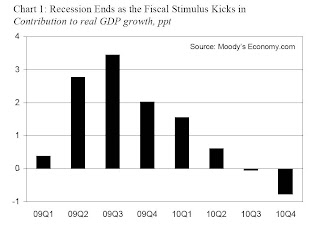

The Great Recession has finally given way to recovery. This downturn will go into the record books as the longest, broadest and most severe since the Great Depression (see Table 1). The recession was twice the length of the average economic contraction, and it dragged down nearly every industry and region in the country. Its final toll in terms of increased unemployment and falling real GDP will be greater than that seen during any other recession on record.The following graph shows Mark Zandi's estimate of the impact of the stimulus package:

...

The housing market crash that was at the recession's center is also moderating. House prices are probably not done falling, but home sales have come off the bottom, and the free fall in housing construction is over. After reducing housing starts to levels last seen during World War II, builders have finally begun to put up a few more homes. There is still a surfeit of vacant existing homes for sale and rent, but inventories of new homes are increasingly lean in a number of markets.

Retailers and manufacturers have also worked hard to reduce bloated inventories. The plunge in inventories in the second quarter was the largest on record and came after a year of steady destocking. Inventories are now so thin that manufacturing production is picking up quickly, as otherwise stores will not have enough on their shelves and in warehouses to meet demand even at currently depressed levels.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This suggests that all the growth in Q3 was due to the stimulus package, and the impact will now wane - only 2% in Q4, and 1.5% in Q1 2010 - and then the package will be a drag on the economy in the 2nd half of 2010.

And on the job loss recovery:

Although the recession is over, the economy is struggling. Job losses have slowed significantly since the beginning of the year, but payrolls are still shrinking, and unemployment is still rising. The nation's jobless rate will top 10% in coming months ...Clearly Zandi is still very worried.

Whether the recovery becomes self-sustaining or recedes back into recession depends first on how businesses respond to recent improvements in sales and profitability. As the benefit of the stimulus fades, businesses must fill the void by hiring and investing more actively. To date, there is not much evidence that they are doing this. At most, firms are curtailing layoffs and no longer cutting back on orders for equipment and software.

... Unless hiring revives, job growth will not resume and unemployment will continue to rise, depressing wages and ultimately short-circuiting consumer spending and the recovery itself.

It is possible that firms will resume hiring soon. There is historically a lag between a pickup in production and increased hiring. In the past, however, during the gap between increased production and increased full-time hiring, businesses boosted working hours and brought on more temporary employees. None of this has happened so far; hours worked remain stuck at a record low, and temporary jobs continue to decline.

A more worrisome possibility is that firms are too shell-shocked to resume hiring. Smaller businesses are struggling to obtain credit; their principal lenders, small banks, face intense pressure, while another key source, credit card lenders, has aggressively tightened its underwriting standards. ...

... Businesses may also wonder if demand for their products will soon fade, given that the recent improvement is supported by the monetary and fiscal stimulus and an inventory swing, all of which are temporary.

Whatever the reason, unless hiring resumes soon, the severe stress in the job market will not abate. With nearly 26 million workers—17% of the workforce—unemployed or underemployed, and those with jobs working a record-low number of hours, workers' nominal compensation threatens to decline. It is not unusual for real compensation—nominal compensation adjusted for inflation—to turn down in a recession, but it would be unprecedented, save during the Great Depression, for nominal compensation to decline.

Falling nominal compensation will further corrode already-fragile consumer spending. Lower- and middle-income households, who are saving little and cannot borrow, will be forced to rein in spending. The transition from recovery to expansion will be anything but graceful and could even be short-circuited.

Note: NBER will not call the end of the recession until some time after real GDP is above the pre-recession levels (and other indicators too). That would take at least four more quarters of growth at 3%, so the end of the official recession will not be announced until late in 2010 at the earliest. If GDP slips next year that will probably be considered part of the "Great Recession" ...

For more on recession dating, see: Is the Recession Over?

Random Thoughts on the Q3 GDP Report

by Calculated Risk on 10/29/2009 07:29:00 PM

After the Q1 GDP report was released, I wrote: GDP Report: The Good News. The headline number in Q1 was ugly, but there was a clear shift in the negative GDP contributions from leading sectors to lagging sectors.

Here is a repeat of the table from that earlier post showing a simplified typical temporal order for emerging from a recession:

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Now look at the Q3 GDP report from leading to lagging sectors:

This is exactly what I'd expect a recovery to look like.

Unfortunately ... the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), will both be under pressure for some time. The Census Bureau report this morning showed that there are still far too many excess housing units (homes and rental units) available. There cannot be a sustained recovery in RI without a boom in new home sales and housing starts, and it is difficult to imagine a boom in new home sales with the large overhang of housing units.

It takes household formation to reduce the excess inventory, and household formation requires job creation so that individuals and families will feel more confident and move out of their parent's basements. Some day there will be a boom in household formation, once job creation returns, but usually the first jobs in a recovery are from RI and PCE - so the economy is in sort of a circular trap.

That is why we need policies aimed at job creation and household formation. As housing economist Tom Lawler wrote today in a note to clients: "policies that move renter households into owned homes but that don't stimulate household formations MAKE MATTERS WORSE!"

And the other leading sector, PCE, is also under pressure. The personal saving rate declined in Q3 to 3.3%, but the decline was probably temporary. I expect the saving rate to increase over the next year or two to around 8% - as households repair their balance sheets - and that will be a constant drag on PCE.

I expect Q4 GDP to be similar to Q3, however I think growth in 2010 will be sluggish - with downside risks. I think RI and PCE will be sluggish in 2010, and the stimulus will fade (and become a drag in the 2nd half of 2010).

Here is a look at investment:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Residential investment (RI) had declined for 14 consecutive quarters, and the increase in Q3 2009 was the first since 2005.

This puts RI as a percent of GDP at 2.5%, just barely above the record low - since WWII - set last quarter.

The second graph shows non-residential investment as a percent of GDP.

The second graph shows non-residential investment as a percent of GDP.Business investment in equipment and software increased 1.1% (annualized), breaking a streak of 6 consecutive quarterly declines.

Investment in non-residential structures was only off 9.0% (annualized) and will probably be revised down (this happened last quarter). I expect non-residential investment in structures to decline sharply over the next several quarters. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

When the supplemental data is released, I'll post graphs of investment in retail, offices, and hotels, and a breakdown of residential investment.

Some possibly interesting notes:

Moody's Projects Further House Price Declines, Market and More

by Calculated Risk on 10/29/2009 04:00:00 PM

I'm working on a GDP post for later ... Click on graph for larger image in new window.

From Doug Short of dshort.com (financial planner).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The S&P was up 2.24% today ...

From Bloomberg: Moody’s May Downgrade Mortgage Bonds With New Outlook (ht Brian)

Moody’s Investors Service said it’s planning a review of U.S. home-loan securities that will likely lead to another round of rating changes based on a new view that property prices won’t bottom until next year’s third quarter.And the Fed has finished its $300 billion Treasury purchase program - from Bloomberg: Fed Ends Treasury Buys That Capped Rates

The firm will boost its loss projections by “significant” amounts for prime-jumbo, Alt-A, option adjustable-rate and subprime mortgages backing bonds issued between 2005 and 2008, also after seeing higher losses per foreclosure than expected ... Recent data showing rising home prices doesn’t prove the slump is over, the company said.

“The overhang of impending foreclosures and the continued rise in unemployment rates will impact home prices negatively in the coming months,” New York-based Moody’s said.

emphasis added

NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

by Calculated Risk on 10/29/2009 01:48:00 PM

Note from NMHC: "Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged."

So the increase in the index to 31 implies lower occupancy rates and lower rents - "looser" apartment conditions - but at a slower pace of contraction than the previous quarter.

From the National Multi Housing Council (NMHC): Apartment Market Conditions Improving, Bid-Ask Spread Narrowing

Only one index—the one measuring market tightness (vacancies and rent levels)—remained below 50 (index numbers below 50 indicate worsening conditions), but it also showed improvement over the prior quarter, rising from 20 to 31.

“The broad improvements in sales volume and debt and equity financing suggest the transactions market may finally be thawing,” noted NMHC Chief Economist Mark Obrinsky. “Nearly half (45 percent) of respondents indicated that the gap between what sellers are asking for and what buyers are offering—the bid-ask spread—has narrowed.”

“But the economic headwinds remain strong,” Obrinsky added, “as the employment market continues to sag, demand for apartment residences continues to slip. Though this quarter’s Market Tightness Index is improved compared to last quarter, it still indicates higher vacancies and lower rents.”

...

The Market Tightness Index rose from 20 to 31. Nearly half (49 percent) said markets were looser (with higher vacancies and lower rents), while 11 percent said markets were tighter. This was the ninth straight quarter in which the index remained below 50, but the fourth consecutive quarter in which the index measure has risen. For the year, the Market Tightness Index averaged 20, the lowest on record (since 1999).

emphasis added

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

This data is for apartment buildings. The data released earlier today from the Census Bureau - showing a record rental vacancy rate - includes all rental units.

Hotel RevPAR Off 14 Percent

by Calculated Risk on 10/29/2009 11:47:00 AM

From HotelNewsNow.com: New Orleans ADR, RevPAR increase in STR weekly numbers

For the industry, in year-over-year measurements, occupancy fell 6.3 percent to end the week at 59.0 percent, ADR dropped 8.3 percent to US$100.04, and RevPAR decreased 14.1 percent to US$59.03.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was late in 2008, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

The above graph shows two key points:

The HotelNewsNow press release has two graphs on room rates (ADR: Average Daily Rate) and RevPAR variance comprared to 2008.

The HotelNewsNow press release has two graphs on room rates (ADR: Average Daily Rate) and RevPAR variance comprared to 2008.This graph shows the RevPAR variance by day, and indicates that business travel (weekdays) is still off more than leisure travel (weekends).

This has been an ongoing story ...

Q3: Record Rental Vacancy Rate, Homeownership Rate Increases Slightly

by Calculated Risk on 10/29/2009 10:00:00 AM

This morning the Census Bureau reported the homeownership and vacancy rates for Q3 2009. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate increased slightly to 67.6% and is now at the levels of Q2 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

The small increase in the homeownership rate in Q3 might by related to the first-time home buyer tax credit, but I expect the rate to decline further.

The homeowner vacancy rate was 2.6% in Q3 2009. A normal rate for recent years appears to be about 1.7%.

A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.9% above normal, and with approximately 75.3 million homeowner occupied homes; this suggests there are close to 675 thousand excess vacant homes.

And as expected, as a result of the first-time homebuyer tax credit ...

The rental vacancy rate increased to a record 11.1% in Q3 2009.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 11.1% to 8%, there would be 3.1% X 40 million units or about 1.25 million units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 11.1% to 8%, there would be 3.1% X 40 million units or about 1.25 million units absorbed.

These excess units will keep pressure on rents and house prices for some time.