by Calculated Risk on 7/27/2009 05:58:00 PM

Monday, July 27, 2009

"Precipitous" House Price Declines at the High End

From the Chicago Tribune: Luxury prices keep falling (ht Ann)

Real estate agents say they have never seen prices drop so precipitously when dealing with opulent, often empty high-end homes along the North Shore ... "It is a phenomenon we've never seen in our lifetime," said real estate agent Jason Hartong with Rubloff Residential Properties, who has seen some multimillion-dollar price tags cut nearly in half.The problems are movin' on up the value chain.

...

Developers, many now in bankruptcy, were caught by surprise, as well. Vacant and unfinished homes dot the Chicago suburbs, with for sale signs that tout the "New Price."

For instance, a custom-built stone home at 750 Sheridan Rd. in Winnetka priced at $5.5 million in November 2007 is going for $3.3 million.

Option ARMs: Good News, Bad News

by Calculated Risk on 7/27/2009 04:04:00 PM

The good news, according to a Barclays Capital report, is not as many Option ARMs will recast in 2011 as forecast earlier by Credit Suisse.

The bad news is borrowers are defaulting en masse before the recast.

From Bloomberg: Option ARM Defaults Shrink Size of Recast Wave, Barclays Says (ht Brian)

The wave of “option” adjustable- rate mortgages recasting to higher payments, projected by some economists to represent a looming source of foreclosures that will hurt housing markets over the next few years, will be smaller “than feared” because many borrowers will default before their bills change, Barclays Capital analysts said.Also some of the loans (mostly Wells Fargo) will probably recast later than the Credit Suisse chart.

...

About 40 percent of borrowers with option ARMs are already delinquent, and “many” of the others will start missing payments before their obligations change, the Barclays mortgage- bond analysts wrote in a July 24 report. ...

“The additional risk really will only be for borrowers who manage to stay current over the next couple of years and might default due to a payment shock,” the New York-based analysts including Sandeep Bordian and Jasraj Vaidya wrote.

...

More than $750 billion of option ARMs were originated between 2004 and 2008 ...

Also on Option ARMs from the WSJ a couple weeks ago: Pick-a-Pay Loans: Worse Than Subprime

This suggests the recast related problems will happen sooner than the Credit Suisse chart suggests. That is good news in that the problems might not linger as long, and also suggests further price pressure in the short term for the mid-to-high end areas with significant Option ARM activity.

UPDATE on Wells Fargo Option ARM portfolio, from Q2 recorded comments (ht HealdsburgBubble):

The Pick-a-Pay portfolio also performed as expected as we continued to de-risk the portfolio. I want to highlight some key points that are important for every investor to understand about this portfolio:

First, not all option ARM portfolios are alike and we believe we have the best portfolio in the industry. While recently reported industry data, as of April 2009, indicates 37 percent of all industry option ARM loans are at least 60 days past due, our portfolio is performing significantly better with only 18 percent 60 days or more past due as of June 30. Not surprisingly, our non-impaired portfolio is performing significantly better than our impaired portfolio with only 4.7 percent 60 days or more past due. In fact, 92 percent of the non-impaired portfolio is current, compared with 62 percent of the impaired portfolio. In addition, while many other option ARM loans have recast periods as short as five years, our Pick-a-Pay loans generally have ten-year contractual recasts. As a result, we have virtually no loans where the terms recast over the next three years, allowing us more time to work with borrowers as they weather the current economic downturn.

emphasis added

Housing: Remember the Two Bottoms!

by Calculated Risk on 7/27/2009 02:30:00 PM

With my post yesterday, Economy: A Little Sunshine and the New Home sales report this morning - it is worth repeating: There will probably be two bottoms for Residential Real Estate.

The first will be for new home sales, housing starts and residential investment. The second bottom will be for prices. Sometimes these bottoms can happen years apart. I think it is likely that we've seen the bottom for new home sales and single family starts, but not for prices.

It is way too early to try to call the bottom in prices. House prices will probably fall for another year or more. My original prediction (a few years ago) was that real house prices would fall for 5 to 7 years (after 2005), and we could start looking for a bottom in the 2010 to 2012 time frame for the bubble areas. That still seems reasonable to me.

However it is important to note that some lower priced areas - with heavy distressed sales activity - might be at or near the bottom.

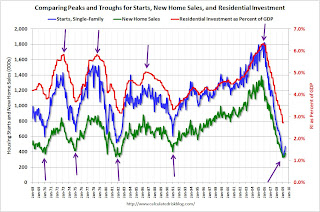

For the first bottom, we have several possible measure - the following graph shows three of the most commonly used: Starts, New Home Sales, and Residential Investment (RI) as a percent of GDP. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

We could use any of these three measures to determine the first bottom, and then use the other two to confirm the bottom. But this says nothing about prices.  The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index.

The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index.

Although the Case-Shiller data only goes back to 1987, look at what happened following the early '90s housing bust. RI as a percent of GDP bottomed in Q1 1991, but real house prices didn't bottom until Q4 1996 - more than 5 years later!

Something similar will most likely happen again. Indicators like new home sales, housing starts and residential investment will bottom long before house prices.

Economists and analysts care about these housing indicators (starts, sales, RI) because they impact GDP and employment. However most people (homeowners, potential homebuyers) think 'house prices' when we talk about a housing bottom - so we have to be aware that there will be two different housing bottoms. And a bottom in starts and new home sales doesn't imply a bottom in prices.

Report: 5000+ CRE NODs in March

by Calculated Risk on 7/27/2009 01:36:00 PM

CRE: Commercial Real Estate. NOD: Notice of Default.

From Bloomberg: Almost $165 Billion in Commercial Mortgages to Come Due in ’09

Almost $165 billion in U.S. commercial real estate [shops, offices, hotels, apartment buildings and land] loans will mature this year and need to be sold or refinanced as rents and occupancies fall, according to First American CoreLogic.These defaults will push down CRE prices and also hit many regional and local banks that had excessive loan concentrations in Construction & Development (C&D) and CRE loans. The FDIC will be very busy ...

...

More than 5,000 properties in the 10 biggest U.S. metropolitan areas got at least one default notice in March, marking the first time that’s happened in First American records going back to January 2003.

...

“As long as prices contract, we expect loan performance will worsen and that will make financing difficult,” Sam Khater, senior economist for First American, said in an interview. “Delinquencies and notices of default are rising, and we expect that to continue.”

Distressing Gap: Ratio of Existing to New Home Sales

by Calculated Risk on 7/27/2009 11:38:00 AM

For graphs based on the new home sales report this morning, please see: New Home Sales increase in June, Highest since November 2008

Last week the National Association of Realtors (NAR) reported that distressed properties accounted 31 percent of sales in June. Distressed sales include REO sales (foreclosure resales) and short sales, and based on the 4.89 million existing home sales (SAAR) that puts distressed sales at about a 1.5 million annual rate in June.

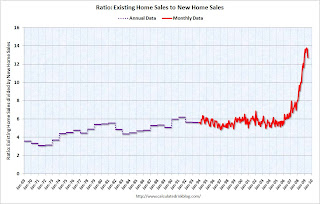

All this distressed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This is an update including June new and existing home sales data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through June.

As I've noted before, I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.  The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio. The small decline in June ratio was because of the increase in new home sales.

The ratio could decline because of increase in new home sales, or a decrease in existing home sales - or a combination of both.  The third graph shows the ratio back to 1969 (annual data before 1994).

The third graph shows the ratio back to 1969 (annual data before 1994).

Note: the NAR has changed their data collection over time and the older data does not include condos: Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began.

New Home Sales increase in June, Highest since November 2008

by Calculated Risk on 7/27/2009 10:00:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 384 thousand. This is an increase from the revised rate of 345 thousand in May. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the 2nd lowest sales for June since the Census Bureau started tracking sales in 1963.

In June 2009, 36 thousand new homes were sold (NSA); the record low was 34 thousand in June 1982; the record high for June was 115 thousand in 2005. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in June 2009 were at a seasonally adjusted annual rate of 384,000 ...And another long term graph - this one for New Home Months of Supply.

This is 11.0 percent (±13.2%)* above the revised May rate of 346,000, but is 21.3 percent (±11.4%) below the June 2008 estimate of 488,000.

There were 8.8 months of supply in June - significantly below the all time record of 12.4 months of supply set in January.

There were 8.8 months of supply in June - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of June was 281,000. This represents a supply of 8.8 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply for inventory has peaked, and there is some chance that sales of new homes has bottomed for this cycle - but we won't know for many months. However any recovery in sales will likely be modest because of the huge overhang of existing homes for sale.

I'll have more later ...

San Diego: High-Rise Condos Sit Vacant

by Calculated Risk on 7/27/2009 08:37:00 AM

From Peter Hong at the LA Times: San Diego high-rise condo market goes from frenzy to fizzle

Drive through California's sprawling inland suburbs and you'll spot the familiar mileposts of a real estate bust: foreclosure signs, brown lawns and abandoned subdivisions.Many of these new high-rise condos are part of the shadow inventory since they are not included in the new home sales report. High-rise condos were overbuilt in a number of cities like Miami, Las Vegas, San Diego, Chicago - and it will take several years to absorb all the inventory (or the units will be converted to rentals). Just another fine mess ... and of course a number of banks (like "Condo King" Corus Bank) will fail because of these projects.

To see the damage in downtown San Diego, walk a few blocks. Then look straight up.

There you'll see hundreds of unsold luxury condominiums stacked in vacant high-rises. ... Downtown San Diego, a 2.2-square-mile area, is now awash in condos. ... An additional 1,000 units that were under construction when the market soured are slated to be completed this year, adding to the glut and putting further downward pressure on prices.

Merle Hazard Video: Bailout

by Calculated Risk on 7/27/2009 12:06:00 AM

Some of Merle's other videos:

Merle Hazard Meets Arthur Laffer

H-E-D-G-E

Mark to Market.

Merle chats with Stanford economist John Taylor

And that inspires Merle: Inflation or Deflation

Sunday, July 26, 2009

Herald Tribune: Lenders Ignored Mortgage Fraud Red Flags

by Calculated Risk on 7/26/2009 09:33:00 PM

From the Herald Tribune series on mortgage fraud in Florida: Lenders failed to heed red flags

Fraudulent property flippers had an unlikely accomplice during the real estate boom -- the lending industry."It is difficult to get a man to understand something, when his salary depends upon his not understanding it!"

A yearlong Herald-Tribune investigation into thousands of suspicious Florida flip deals found that lenders of all kinds approved risky deals and ignored obvious red flags for mortgage fraud.

...

What makes the flipping fraud so egregious is not just that it happened, but that it would have been so easy to stop.

Using public records and Internet searches, the Herald-Tribune identified hundreds of deals that exhibited classic red flags for fraud. They include sales between family members and business partners in which prices increased $100,000 or more overnight. In other cases, flippers repeatedly traded properties from their company to their own name, each time increasing the price and the amount they borrowed.

Lenders knew they were writing bad loans, but did it anyway because they were making so much money on underwriting fees, said Jack McCabe, a Deerfield Beach-based real estate consultant ...

Upton Sinclair, 1935, "I, Candidate for Governor: And How I Got Licked"

Economy: A Little Sunshine

by Calculated Risk on 7/26/2009 04:14:00 PM

This will be a very busy week for economic news, and some of the key data will be new home sales for June released on Monday, the Case-Shiller home price index for May released on Tuesday, and Q2 GDP from the BEA on Friday.

At the beginning of this dark and dreary1 economic year, I was looking for a little sunshine. I argued that three key data series would find a bottom in 2009, and that the drag on employment and GDP from these industries would slow or stop.

This doesn't mean green shoots - just the end of cliff diving. So it is probably time for a review ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA.

Sales in June were at a 9.7 million at a Seasonally Adjusted Annual Rate (SAAR), up from 9.1 million in February.

Although this increase barely shows up on the graph, this is a fairly significant rebound, and I expect light vehicle sales over 10 million SAAR later this year. Total housing starts were at 582 thousand (SAAR) in June, up sharply over the last two months from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 582 thousand (SAAR) in June, up sharply over the last two months from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 470 thousand (SAAR) in June; 31 percent above the record low in January and February (357 thousand).

Although I don't expect much of a pickup from here (and I expect starts in July to be slightly lower than June based on permit activity), it appears likely that housing starts have bottomed. For more on housing starts, see Housing Starts: A Little Bit of Good News  The third graph shows New Home Sales vs. recessions for the last 45 years. New one-family house sales in May 2009 were 342 thousand SAAR.

The third graph shows New Home Sales vs. recessions for the last 45 years. New one-family house sales in May 2009 were 342 thousand SAAR.

Sales were barely above the record low of 329 thousand SAAR in January. Of the three key series, this is the one that is still closest to the bottom - and the June numbers (Monday) will be interesting.

Here is what I wrote at the beginning of the year:

2009 will be a grim economic year. The unemployment rate will rise all year, house prices will fall, commercial real estate (CRE) will get crushed ... but there might be a few rays of sunshine too.And on the dark side, CRE is still getting crushed - resulting in the seizure of many regional and local banks, house prices are still falling (that is my view) and the unemployment rate is still rising. But there is a little sunshine.

... my guess is all three of these series [housing starts, new home sales, new vehicle sales] will find a bottom (or at least the pace of decline will slow significantly). This means that the drag on employment in these industries, and the drag on GDP, will slow or stop.

These will be rays of sunshine in a very dark season. That doesn't mean a thaw, but it will be a beginning ...

1 From Longfellow ...

The day is cold, and dark, and dreary

It rains, and the wind is never weary;

The vine still clings to the mouldering wall,

But at every gust the dead leaves fall,

And the day is dark and dreary.

My life is cold, and dark, and dreary;

It rains, and the wind is never weary;

My thoughts still cling to the mouldering Past,

But the hopes of youth fall thick in the blast,

And the days are dark and dreary.

Be still, sad heart! and cease repining;

Behind the clouds is the sun still shining;

Thy fate is the common fate of all,

Into each life some rain must fall,

Some days must be dark and dreary.

Henry Wadsworth Longfellow, 1842