by Calculated Risk on 3/08/2010 11:03:00 PM

Monday, March 08, 2010

Stress Test Update

In the previous post I praised the Fed's short-term liquidity facilities. Another program that I supported was the Treasury's Stress Tests (conducted by the Fed). Here is what I wrote in early 2008:

One of the key elements of the Financial Stability Plan is to build "Financial Stability Trust" by conducting "A Comprehensive Stress Test for Major Banks" and providing investors and the public "Increased Balance Sheet Transparency and Disclosure".and

Although lacking in details, this is a very good idea.

The real answer is to stress test the banks, and put them in three categories: 1) no additional capital needed, 2) some additional capital needed, and 3) preprivatization.Although no banks were placed in the "preprivatize" category (I probably would have preprivatized a couple), these tests were an important step in providing metrics for the banks.

The following graphs compare the actual performance of the U.S. economy versus the two stress test scenarios - baseline and more severe - for GDP, house prices and unemployment.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows real GDP (in red) and the two stress test scenarios (baseline and more severe). For this graph I lined up real Q4 GDP.

So far GDP is performing slightly better than the baseline scenario.

It is important to remember that GDP was revised down substantially for 2008 after the stress test scenarios were released.

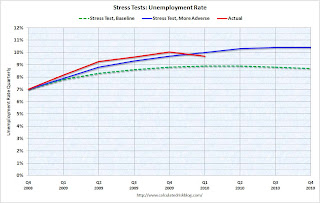

The second graph is quarterly for the unemployment rate.

The second graph is quarterly for the unemployment rate.For most of the last year the unemployment rate has been higher than the more severe scenario. Now, in Q1 with the unemployment rate at 9.7%, the rate is slightly better than the more severe scenario.

And the third graph is for house prices using the Case-Shiller Composite 10 Index.

The heavy government support for house prices has kept prices well above the baseline scenario. This has obviously been very beneficial for the banks.

The heavy government support for house prices has kept prices well above the baseline scenario. This has obviously been very beneficial for the banks.So far the economy is somewhat tracking the baseline scenario (slightly better for GDP, much better for house prices, and worse for unemployment). The key to the stress tests was to establish these metrics and have the banks raise adequate capital to survive the more severe scenario.

One of the problems with the stress tests was that the scenarios ended in 2010. And one of the policies has been to extend and hope (commonly called "extend and pretend") and this has pushed many problems out beyond the horizon of the stress tests.

Also I wouldn't judge the success of the stress tests by these graphs. Just establishing metrics was the key. The criteria for success be if any of the 19 banks get into trouble over the next couple of years and require additional support.

Some Praise for the Fed

by Calculated Risk on 3/08/2010 07:14:00 PM

I think the Fed deserves praise for the successful completion of the short-term liquidity facilities. As NY Fed Executive VP Brian Sack noted today:

With the wind-down of these short-term liquidity facilities, it is a good time to look back and assess their performance. The bottom line here is simple: These programs were an unquestionable success. We have witnessed a remarkable improvement in the functioning of short-term credit markets and an impressive recovery in the stability of large financial firms. While a whole range of government actions contributed to this recovery, giving financial institutions greater confidence about their access to funding, and that of their counterparties, was most likely a crucial step toward achieving stability.I've praised Chairman Bernanke several times (and thereby indirectly the entire Fed staff) about the liquidity facilities, while lambasting him on other aspects of his performance (like regulatory oversight). Every now and then I think we should pause and recognize a job well done.

Moreover, the exit from these facilities has been quite smooth. At their peak, these facilities provided more than $1.5 trillion of credit to the economy. Today, the remaining balance across them is around $20 billion. It is impressive that the Fed was able to remove itself from such a large amount of credit extension without creating any significant problems for financial markets or institutions. That success largely reflects the effective design of those programs, as most were structured to provide credit under terms that would be less and less appealing as markets renormalized. This design worked incredibly well, as activity in most of the facilities gradually declined to near zero, allowing the Fed to simply turn them off with no market disruption.

emphasis added

I agree with Sack's assessment. These short-term liquidity facilities were creative, well designed, and very effective. Nice work and thanks!

Make sure to read his entire speech. It is the best explanation of the exit strategy I've read.

NY Fed's Sack: Preparing for a Smooth (Eventual) Exit

by Calculated Risk on 3/08/2010 05:01:00 PM

From Brian Sack, Executive Vice President, Federal Reserve Bank of New York: Preparing for a Smooth (Eventual) Exit. Excerpts on MBS:

The Federal Reserve is approaching the scheduled end of its large-scale asset purchases. We have bought $169 billion of agency debt to date, nearly fulfilling our plan to purchase "about $175 billion." For MBS, we have only about $30 billion of purchases remaining to reach our $1.25 trillion target. In addition, we completed $300 billion of purchases of Treasury securities late last year. Looking across these programs, we have now purchased $1.69 trillion of assets, bringing us 98 percent of the way through our scheduled purchases.I recommend reading the entire speech, especially the section titled: Market Conditions: At Risk on Exit?

My view is that the purchase programs have helped to hold down longer-term interest rates, thereby supporting economic activity. With the conclusion of the programs approaching, the Desk has been tapering the pace of its purchases of agency debt and MBS. However, even as the pace of our purchases has slowed, longer-term interest rates have remained low, and MBS spreads over Treasury yields have remained tight. This pattern suggests that the effects of the purchases have been primarily associated with the stock of the Fed's holdings rather than with the flow of its purchases. In that case, the market effects of the purchase program will only slowly unwind as the balance sheet shrinks gradually over time.

...

Chairman Bernanke noted that the Fed's holdings of agency debt and MBS are being allowed to roll off the balance sheet, without reinvestment, as those securities mature or are prepaid, and that the FOMC may choose to redeem some of its holdings of Treasury securities in the future, as well.

With this approach, the FOMC would be shrinking its balance sheet in a gradual and passive manner. That, in my view, is a crucial message for the markets. It should limit any reversal of the portfolio balance effects described earlier, effectively putting reductions in asset holdings in the background for now as a policy instrument. As long as this approach is maintained, it would leave the adjustment of short-term interest rates as the more active policy instrument—the one that would carry the bulk of the work in tightening financial conditions when appropriate.

This approach is cautious in several dimensions. First, a decision to shrink the balance sheet more aggressively could be disruptive to market functioning. Second, a more aggressive approach would risk an immediate and substantial rise in longer-term yields that, at this time, would be counterproductive for achieving the FOMC's objectives. Third, the effects of swings in the balance sheet on the economy are difficult to calibrate and subject to considerable uncertainty, given our limited history with this policy tool. And fourth, policymakers do not need to use this tool to tighten financial conditions. They can tighten financial conditions as much as needed by raising short-term interest rates, offsetting any lingering portfolio balance effects arising from the still-elevated portfolio.

Even under this cautious strategy of relying only on redemptions, the Federal Reserve could achieve a considerable decline in the size of its balance sheet over time. From now to the end of 2011, we project that more than $200 billion of the agency debt and MBS held by the Federal Reserve will mature or be prepaid, though the actual total will depend on the path of long-term interest rates and the prepayment behavior of mortgage holders. Thus, the Fed's asset holdings would shrink meaningfully if the FOMC maintains its current strategy of not reinvesting those proceeds. In addition, about $140 billion of Treasury securities mature between now and the end of 2011, giving the FOMC scope to reduce its asset holdings even further if it chooses to not replace some of those maturing securities.

While the passive strategy of relying on redemptions may be appropriate for now, it might not be sufficient over the longer-term. One problem is that relying only on redemptions would still leave some MBS holdings on our balance sheet for several decades. As indicated in the minutes from the January meeting, the FOMC intends to return to a Treasuries-only portfolio over time. This consideration could motivate the FOMC to sell its agency debt and mortgage-backed securities at some point, once the economic recovery has progressed sufficiently.

emphasis added

Sack believes there will be little increase in the spread between mortgage rates and the Ten Year Treasury yield when the MBS purchase program ends. Right now the Fed plans on letting the MBS roll off the balance sheet, so in Sack's view the impact on rates should be gradual.

Employment: March Madness

by Calculated Risk on 3/08/2010 03:43:00 PM

If you thought Snowmageddon distorted the employment figures in February, just wait until March. (ht JH)

The BLS could report a March headline number of 200,000 net payroll jobs, and that could be viewed as a weak report.

The March report will be distorted by two factors: 1) any bounce back from the snow storms, and 2) the decennial Census hiring that picked up sharply in March.

Many analysts considered the February BLS report - showing a headline net loss of 36,000 jobs - as an improvement over January because of snow factors. The general view is the snowstorms subtracted 50,000 to 150,000 payroll jobs from the report. I think this is a huge unknown, but I think the actual impact was fairly low.

Also in February, the Census added 15,000 workers. Although this number is NSA (Not Seasonally Adjusted), there really is no seasonal factor for this hiring. If we estimate job losses at 50,000 ex-Census in February, this would imply a range of 0 to 100,000 jobs would have been added without snow factors - if the analysts are correct about the impact of the snow storm.

Also the Census will add something like 100,000 workers to the March report. Luckily the Census Bureau reports the Census hiring - May will be the really crazy month with 100s of thousands of workers added to follow-up on anyone who didn't mail back the Census (Mail it back!).

Add the numbers up: If the economy added no jobs in February (after snow effects) and no jobs in March, the March employment number would be 150,000 (50,000 bounce back from the snow, 0 for March, and 100,000 Census hiring).

If the economy added 50,000 jobs in February (after snow) - the consensus view - and adds another 50,000 in March, the March number will be around 250,000. And remember it takes 100,000 to 150,000 net jobs added per month to stay up with population growth. So a headline number of 250,000 - though an improvement - would still be a weak report because it just means 50,000 in March after distortions.

And if the economy added 100,000 jobs in February (very unlikely in my view), and another 100,000 in March - the bounce back would be 150,000 + 100,000 for March + 100,000 for the Census - and we would see a report of 350,000 jobs!

The Census distortions will last most of the year. The Census will add jobs through May, and then subtract jobs for the following 6+ months. Right now it is making the payroll report look better and will lower the unemployment rate slightly over the next few months (just 0.1% to 0.2%), and starting in June, Census hiring will make the payroll report look worse - but the net will be close to zero by the end of the year.

ECB's Jürgen Stark: Lost Decade Possible

by Calculated Risk on 3/08/2010 01:15:00 PM

Jürgen Stark, Member of the Executive Board, European Central Bank, spoke at the NABE Economic Policy Conference that is being held in Arlington, Va. Stark's talk was titled: "Is the Global Economy Headed for a Lost Decade? A European Perspective".

From MarketWatch: 'Lost decade' possible for global economy, ECB's Stark says

"The failure to address long-overdue reform challenges promptly might result in a 'lost decade' for the global economy," Stark warned Monday ... "Only partial progress has been made so far, and the distortions that led to global imbalances are still present."Stark apparently discussed the need for reform of financial oversight, flexible exchange rates (China), and more balanced trade.

...

Despite some stability, "substantial fragilities remain and the outlook is fraught with risks," Stark said.

Stark is also concerned about global stagflation.

And more from Reuters: ECB's Stark rebuffs European rescue fund idea

My view is another lost decade in the U.S. is unlikely, and I'm more concerned with deflationary pressures in the short term (next year or so) than stagflation.

Note: As I mentioned in the weekly schedule, Brian Sack, Executive Vice President, Federal Reserve Bank of New York will speak tonight (5 PM ET) on the Fed's Balance Sheet Policies. That is of more immediate interest!

Unemployment Rate and Level of Education

by Calculated Risk on 3/08/2010 11:06:00 AM

I haven't looked at this in some time ...

UPDATE: According to the Census Bureau, in 2008 of the 25 years and over workers population (edit):

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

Note that the unemployment rate increased sharply for all four categories in 2008 and into 2009.

Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - but education didn't seem to matter as far as the recovery rate in unemployment following the 2001 recession. All four groups recovered slowly.

The recovery rates following the great recession might be different than following the 2001 recession. I'd expect the unemployment rate to fall faster for workers with higher levels of education, since their skills are more transferable, than for workers with less education. I’d also expect the unemployment rate for workers with lower levels of education to stay elevated longer in this “recovery” because there is no building boom this time. Just a guess and it isn't happening so far ... currently the unemployment rate for the highest educated group is still increasing.

For more on the impact of education here is a graphic and some links from the BLS based on 2008 data: Education pays ...

Bloomberg: Banks Face Writedowns after FDIC Auctions

by Calculated Risk on 3/08/2010 09:17:00 AM

From James Sterngold at Bloomberg: ‘On the Edge’ Banks Facing Writedowns After FDIC Loan Auctions (ht jb)

A Federal Deposit Insurance Corp. plan to auction more than $1 billion in assets seized from failed banks next month ... may trigger writedowns that weaken lenders nationwide."This problem" is many small and regional banks are carrying loans above market value. The FDIC auction will establish market value (update: actually examiners can consider the distressed nature of the auction) - and the fear is this will lead to significant losses for many banks - and more bank failures.

...

The auctions may have wider repercussions. Of the $50.4 billion in loans seized from failed banks currently held by the FDIC, 63 percent involve participations by other lenders, according to data provided by agency spokesman Greg Hernandez.

“These banks can’t believe that the regulator they pay to protect them is going to sell these loans to someone who can flip them and cause them serious losses,” said Robert Reynolds, a lawyer at Reynolds Reynolds & Duncan LLC in Tuscaloosa, Alabama, ... “Our banks just cannot believe they’re being treated in a way that ultimately hurts the FDIC’s insurance fund, because some of them are right on the edge.”

...

“We have a number of banks teetering on the edge, and we don’t need this problem,” [John J. Collins, president of Community Bankers of Washington in Lakewood, Washington] said in an interview.

Sunday, March 07, 2010

Short Sales and 2nd Liens

by Calculated Risk on 3/07/2010 11:04:00 PM

A couple of articles tonight that fit together with my earlier post: Housing: A Tale of Boom and Bust and a Puzzle The puzzle is when the banks will start moving ahead with distressed sales (foreclosures and short sales).

First David Streitfeld at the NY Times writes about the Treasury's HAFA program: Short-Sale Program to Pay Homeowners to Sell at a Loss

Taking effect on April 5, the program could encourage hundreds of thousands of delinquent borrowers who have not been rescued by the loan modification program to shed their houses through a process known as a short sale, in which property is sold for less than the balance of the mortgage. Lenders will be compelled to accept that arrangement, forgiving the difference between the market price of the property and what they are owed.Short sales under HAFA are much better than foreclosures for many borrowers because HAFA requires lenders to agree not to pursue a deficiency judgment (one of the key stumbling blocks for eliminating 2nds). And this is also better for the 2nd lien holders too since they get something (note: the program also includes a deed-in-lieu of foreclosure option with similar payments and requirements).

...

Under the new program, the servicing bank, as with all modifications, will get $1,000. Another $1,000 can go toward a second loan, if there is one. And for the first time the government would give money to the distressed homeowners themselves. They will get $1,500 in “relocation assistance.”

Should the incentives prove successful, the short sales program could have multiple benefits. For the investment pools that own many home loans, there is the prospect of getting more money with a sale than with a foreclosure.

For the borrowers, there is the likelihood of suffering less damage to credit ratings. And as part of the transaction, they will get the lender’s assurance that they will not later be sued for an unpaid mortgage balance.

emphasis added

Of course short sale fraud is also a huge concern. Streitfeld quotes economist Tom Lawler:

Short sales are “tailor-made for fraud,” said Mr. Lawler, a former executive at the mortgage finance company Fannie Mae.And from James Hagerty at the WSJ: Home-Saving Loans Afoot

Rep. Frank said banks' reluctance to write down second mortgages is blocking efforts to reduce the first-lien mortgage balances of many borrowers who owe far more on their loans than the current values of their homes. ...As Hagerty notes, the banks are reluctant to write down the 2nd liens because they might still have value even after foreclosure. That is because 2nd liens are recourse, and the lenders could pursue the borrower for a deficiency judgment (or sell the loans to a collector). Frequently the most cost effective course of action for 2nd lien holders is to wait and do nothing. And that is frustrating for the 1st lien holder (commonly Fannie or Freddie).

Many second liens have little value because of the plunge in home prices, Rep. Frank wrote, adding: "Yet because accounting rules allow holders of these seconds to carry the loans at artificially high values, many refuse to acknowledge the losses and write down the loans."

Is $1,000 enough to get 2nd lien holders to sign off and give up the right to a deficiency judgment? I expect that the lenders will pick and choose ... but this should help.

Update: the WSJ has a copy of Barney Frank's letter to the four large banks.

Report: Fed to Keep Supervision Authority of Large Banks

by Calculated Risk on 3/07/2010 08:56:00 PM

The Financial Times reports: Big bank oversight to stay with Fed

Chris Dodd ... is set to propose this week that the 23 largest institutions stay under the Fed’s oversight ... At issue ... was the regulation of several hundred state chartered institutions that also want to remain under the Fed’s supervision.The Fed has been lobbying hard, and according to the Financial Times, has the backing of Secretary Geithner and many of the bank lobbying associations.

...

“The Fed feels it is gaining some momentum,” said [an unidentified Senate aide].

excerpted with permission

The regional Fed presidents have been arguing for the Fed to retain supervision authority too. Dr. Altig at Macroblog quotes from Atlanta Fed President Dennis Lockhart's speech last week:

"... the Fed must play a central role in a defense structure designed to prevent or manage future crises. My key argument is the indivisibility of monetary authority, the lender-of-last-resort role, and a substantial direct role in bank supervision. Only the Fed can act as lender of last resort because only the monetary authority can print money in an emergency. To make sound decisions, the lender of last resort needs intimate hard and qualitative knowledge of individual financial institutions, their connectedness to counterparties, and the capacity of management.It is probably true that supervision authority helps the Fed respond to a crisis, but what about preventing a crisis? The recent track record unfortunately speaks for itself.

"There is sentiment in Washington that would separate these tightly linked functions that are so critical in responding to a financial crisis. Removing the central bank from a supervision role designed to provide totally current, firsthand knowledge and information will weaken defenses against recurrence of financial instability. Flawed defenses could be calamitous in a future we cannot see."

Housing: A Tale of Boom and Bust and a Puzzle

by Calculated Risk on 3/07/2010 04:32:00 PM

Leslie Berkman at the Press Enterprise writes about how the housing bubble and bust impacted a small city in Socal: Turnkey Tales: Moreno Valley is prime example of housing boon and a bust. An excerpt:

Last year the inventory of bank-owned homes for sale began to dwindle in Moreno Valley and throughout Inland Southern California as banks began to delay the foreclosure process.That is happening in many areas - I've heard a number of stories of homeowners staying in their homes and not paying their mortgage, and the banks not foreclosing - and, at the same time, there is intense competition for any home that comes on the market.

For some, it's a puzzle, though.

Bianca Ward, an assistant to [Mike Novak-Smith, an agent with Re/Max], said her parents had no way of keeping an investment home they owned in Moreno Valley after renters left a year ago and her mother's wages at a casino were cut in half because of the poor economy. Ward said she stayed in the house for seven months without paying rent or the mortgage before moving into a home she bought for herself in Hemet.

"I was waiting any second for the bank to knock on the door ... But that didn't happen," Ward said.

She said the bank repeatedly has delayed foreclosing on the house although her parents would like to get it over with so they can start rebuilding their credit. Meanwhile, she said, "no one is watering the lawn. It is probably an eyesore for the former neighbors."

Whatever the reason for the lower volume of available bank-owned homes for sale, the competition for them now is intense, with banks routinely receiving multiple offers, many of them above list price. "The average house gets seven or eight bids and the average bid is 10 percent above the asking price," said Novak-Smith.

This is a real mystery right now. With 14 percent of mortgages delinquent or in foreclosure according to the MBA - why aren't the lenders foreclosing? Is this because of modifications? Are lenders waiting for the HAFA short sale program? And why do Fannie, Freddie and the FHA have a record number of REOs waiting to sell if the market is so "intense"?

There is much more in the article.

UPDATE: To be clear, I have my own views why the lenders are not foreclosing. Part of it is policy - it is government policy to restrict supply and boost demand to support asset prices and limit the losses for the banks. Part of it is inadequate staffing. Another reason is the lenders are making an effort to find alternatives to foreclosure (modifications, short sales, deed-in-lieu). Of course a majority of modifications will eventually redefault, but that still restricts supply for now. It isn't one reason - and the real puzzle is when (and how many) distressed sales will hit the market.

Weekly Summary and a Look Ahead

by Calculated Risk on 3/07/2010 12:15:00 PM

The focus this week will be on the February Retail Sales report to be released by the Census Bureau on Friday. The consensus is for a decline of -0.2% from January and for a slight increase ex-auto. Blame it on the snow ...

On Monday, FDIC Chairman Sheila Bair, Jürgen Stark, Member of the Executive Board, European Central Bank, and Brian Sack, Executive Vice President, Federal Reserve Bank of New York - and others - will be speaking at the NABE Economic Policy Conference that is being held in Arlington, Va. The topic is: The New Normal? Policy Choices After the Great Recession

Stark's talk is titled: "Is the Global Economy Headed for a Lost Decade? A European Perspective". Might be interesting.

Sack will discuss "Implementing the Fed's Balance Sheet Policies" and he will probably comment on the MBS purchase program.

There will be much more from the NABE conference on Tuesday like "The State of the States" discussion. Also on Tuesday the Job Openings and Labor Turnover Survey (JOLTS) for January will be released. This report has been showing very little hiring and turnover in the labor market.

On Wednesday, the MBA Mortgage Applications Index, the Regional and State Employment and Unemployment report, and the Wholesale Inventory report will be released.

On Thursday, the closely watched initial weekly unemployment claims, and the January U.S. Trade Balance (consensus is for a slightly larger trade deficit of around $41 billion). Also the Q4 Fed Flow of Funds report will be released (Always interesting!)

And on Friday, the Retail Sales report, Consumer Sentiment (some improvement expected), Business Inventories and another round of bank failures. Once again I'm thinking Puerto Rico will make an appearance.

And a summary of last week ...

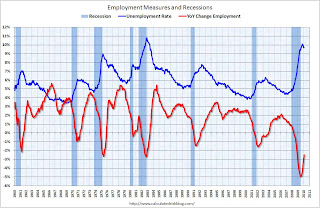

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 36,000 in February. The economy has lost almost 3.3 million jobs over the last year, and 8.43 million jobs since the beginning of the current employment recession.

The unemployment rate is at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Note: the impact of the weather on the survey is unknown. Census hiring was 15,000 (NSA).

Employment-Population Ratio

The Employment-Population ratio ticked up slightly to 58.5% in February, after plunging since the start of the recession. This is about the same level as in 1983.

The Employment-Population ratio ticked up slightly to 58.5% in February, after plunging since the start of the recession. This is about the same level as in 1983.This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

Part Time for Economic Reasons

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 8.8 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 8.8 million. The all time record of 9.2 million was set in October. The increase this month might have been weather related.

For much more on the employment report see:

1) Employment Report: 36K Jobs Lost, 9.7% Unemployment Rate for graphs of unemployment rate and a comparison to previous recessions.

2) Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

3) Diffusion Index and Temporary Help

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for February (red, light vehicle sales of 10.4 million SAAR from AutoData Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for February (red, light vehicle sales of 10.4 million SAAR from AutoData Corp).This is a 3.5% decline from the January sales rate.

This is the lowest level since September - when sales fell sharply after the "Cash-for-clunkers" program ended in August. The current level of sales are very low, and are still below the lowest point for the '90/'91 recession (even with a larger population).

From Zach Fox at SNL Financial: Credit Suisse: $1 trillion worth of ARMs still face resets

Source: SNL Financial, posted with permission.

Source: SNL Financial, posted with permission.This graph shows the numbers of ARMs resetting and recasting over the next few year. Resets are not a huge worry right now - because interest rates are so low - but if interest rates rise, this could lead to more defaults in the future.

Recasts - when the loans reamortize - are a concern, although it is unclear how large the payment shock will be. For borrowers with negative equity, any payment shock might be lead to default.

This graph (ht Tom Lawler) shows the REO inventory for Fannie, Freddie and FHA through Q4 2009. REO: Real Estate Owned.

This graph (ht Tom Lawler) shows the REO inventory for Fannie, Freddie and FHA through Q4 2009. REO: Real Estate Owned.Even with all the delays in foreclosure, the REO inventory has increased sharply over the last two quarters, from 135,868 at the end of Q2 2009, to 153,007 in Q3 2009, and 172,357 at the end of Q4 2009.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Residential construction spending increased slighltly in January, and nonresidential spending declined.

Private residential construction spending is now 61.4% below the peak of early 2006.

Private non-residential construction spending is 25.8% below the peak of late 2008.

Best wishes to all.

Graphs: Duration of Unemployment

by Calculated Risk on 3/07/2010 08:48:00 AM

Here are two graphs that show the weeks unemployed over the last 40 years. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the number of unemployed in four categories as provided by the BLS: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Note: The BLS reports 15+ weeks, so the 15 to 26 weeks number was calculated.

The second graph shows the same information as a percent of the civilian labor force. It appears there was more turnover in the '70s and '80s, since the 'less than 5 weeks' category was much higher as a percent of the civilian labor force than in recent years. This changed in the early '90s - perhaps as a result of more careful hiring practices or changes in demographics or maybe other reasons - but if the level of normal turnover was the same as in the '80s, the current unemployment rate would probably be the highest since WWII.

It appears there was more turnover in the '70s and '80s, since the 'less than 5 weeks' category was much higher as a percent of the civilian labor force than in recent years. This changed in the early '90s - perhaps as a result of more careful hiring practices or changes in demographics or maybe other reasons - but if the level of normal turnover was the same as in the '80s, the current unemployment rate would probably be the highest since WWII.

What really makes the current period stand out is the number of people (and percent) that have been unemployed for 27 weeks or more. In the early '80s, the 27 weeks or more unemployed peaked at 2.9 million or 2.6% of the civilian labor force.

In January, there were 6.3 million people unemployed for 27 weeks or more, or 4.1% of the labor force. The number declined slightly in February, but this is much higher than earlier periods.

Saturday, March 06, 2010

Shiller: Homeownership and American Culture

by Calculated Risk on 3/06/2010 09:07:00 PM

From Robert Shiller in the NY Times: Mom, Apple Pie and Mortgages. Shiller asks:

[W]hat is the long-term justification for putting taxpayers on the line to subsidize homeownership? Is this nothing more than a sacred cow in American society — a political necessity because so many voters own homes and are mindful of their resale value?Shiller argues that home ownership is part of the American culture, and that the reason for subsidizing housing is the "preservation of a sense of national identity".

[T]he best answer isn’t found in traditional economics but rather in American culture: a long-standing feeling that owning homes in healthy communities is connected to individual liberties that embody our national identity.Shiller adds on renting:

[We] should rethink the idea of renting, which could be a viable option for many more Americans and needn’t endanger the traditional values of individual liberty and good citizenship.This is an interesting debate. There are probably advantages to society of a fairly high homeownership rate (as opposed to tax advantages to the individual) - perhaps homeownership creates a stronger bond to the community (more community involvement, awareness of crime, and more), and homeowners tend to keep up their properties (unless they have negative equity!). Shiller argues for other psychological benefits that are harder to quantify.

There are negatives too; as an example, homeownership reduces geographic mobility, especially right now, and that makes it harder for some homeowners to move for employment reasons.

And of course withdrawing all of the subsidies for housing would lead to plummeting house prices. So any unwinding of the housing subsidies, like government subsidized mortgage rates, would probably have to be reduced gradually. This is an interesting discussion as we decide what to do with Fannie and Freddie.

Volcker on Derivatives "Abuse"

by Calculated Risk on 3/06/2010 06:38:00 PM

From Bloomberg: Volcker Criticizes Greek Budget Derivatives ‘Abuse’ (ht jb)

“Surely the recent revelations about the use (and abuse) of complex derivatives in obscuring the extent of Greek financial obligations reinforces the need for greater transparency and less complexity,” Volcker said in the text of a speech to the American Academy in Berlin.Ouch.

And at the same event, Bloomberg quotes European Central Bank President Jean-Claude Trichet as saying:

“what I fear really is that we are currently underestimating the systemic instability which is associated with” derivatives.Hopefully a video of Volcker's speech will be available soon.

Christopher Thornberg on Double Dip Recession

by Calculated Risk on 3/06/2010 03:16:00 PM

One of the economists who correctly forecast the housing bust was Christopher Thornberg while at The Anderson School at UCLA. He is now at Beacon Economics. Here are a few comments from Thronberg yesterday ...

From the Contra Costa Times: State's revised jobless rate a cause for worry

[T]he nation and California could tumble back into a fresh economic nose-dive, warned some analysts, including Christopher Thornberg, partner and economist with Beacon Economics.And from Jane Wells at CNBC: 'The Good News—The Recession is Over. The Bad News...'

"There is a substantial chance of a double-dip recession," Thornberg said.

...

"We're at the bottom now right now, but when the stimulus wears off, things could get worse," Thornberg said.

[Chris Thornberg] says that the recession has ended (hurray!), but that's mostly due to massive government intervention. When that aid starts to dry up, "We're gonna have a double dip...but that's not gonna happen."I disagree with Thornberg on 2010 - I don't think it will be a "good year", but I do think we will see sluggish and choppy growth. I suppose 2010 might feel like a "good year" compared to 2008 and 2009. He is also more pessimistic about 2011 than I am.

What?

He says politicians and the Fed will likely continue fiddling with policy to avoid going back into recession ...

"Enjoy 2010 because it's going to be a good year. 2011 is not." [Thornberg said]. When I asked about 2012, he answered, "It depends how bad 2011 is."

Accidental Landlords and the Shadow Inventory

by Calculated Risk on 3/06/2010 10:32:00 AM

From Hilary Stout at the NY Times: The Renter Roadblock (ht Brian)

Over the past year or two, many owners who couldn’t sell — or didn’t dare try — made a ... calculation [to rent]. Rather than accept an impossibly low offer (if they even had an offer), they decided to rent out their properties. The idea was to cover expenses while waiting for the market to right itself.These accidental landlords are part of the "shadow inventory".

But in recent months, a number of these accidental landlords have been surprised to find renewed buyer interest in their properties. The problem is, the renters are happily in place.

My definition of "shadow inventory" are units that aren't currently listed on the market, but will probably be listed soon. This includes REOs (bank Real Estate Owned) that are not currently listed, foreclosures in process and seriously delinquent loans (although some of these may be cured, and some may already be listed as short sales), unlisted new high rise condos (these properties are not included in the new home inventory report) and homeowners waiting for a better market.

That last category includes all the accidental landlords that we've been discussing for years. As the NY Times article suggests, some of these accidental landlords might test the market this year. And there are probably quite a few of them - in a recent interview with Jon Lansner of the O.C. Register, Scott Monroe of South Coast Apartment Association said

"... our members are saying that they are competing quite a bit with what historically has not been a competitor for us - that's the gray market or the shadow market - which are condominium rentals and single family home rentals and things of that nature. There is just a lot of product on the market."My estimate is about 3.6 million units were converted from owner occupied (or 2nd home) to rental over the last 5 years.

This included investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), and homeowners renting their previous homes instead of selling. But whatever the reason, many of these properties will probably be offered for sale again - especially the properties owned by the accidental landlords.

China Central Banker on Exchange Rate Policy

by Calculated Risk on 3/06/2010 09:08:00 AM

A few quotes:

From Dow Jones: Zhou Signals Yuan Policy Shift

"We don't rule out that during some special periods--such as the Asian Financial crisis and the global financial crisis this time--we adopted special policies, including a special exchange rate mechanism," [China central bank Gov. Zhou Xiaochuan] said at a news briefing during the annual session of the legislature, the National People's Congress.Bloomberg: Zhou Says China Should Be ‘Very Cautious’ in Crisis Exit

"Sooner or later, we will exit the policies," he said

“We must be very cautious about the timing of normalizing the policies, and this includes the renminbi rate policy,” Zhou said at a press briefing in Beijing today, using another term for the Chinese currency. A global recovery “isn’t solid,” he said.From Reuters: Days of "special" yuan policy numbered-China c.banker

"Practice has shown that these policies have been positive, contributing to the recovery of both our country's economy and the global economy," Zhou told a news conference."Basically stable" probably gives some room for appreciation of the yuan.

But he added: "The problem of how to exit from these policies arises sooner or later."

...

"If we are to exit from these irregular policies and return to ordinary economic policies, we must be extremely prudent about our choice of timing. This also includes the renminbi exchange rate policy," he added.

...

Zhou was speaking after the bank issued a statement reaffirming a pledge made a day earlier by Premier Wen Jiabao to keep the yuan "basically stable" in 2010.

China had been letting the yuan appreciate slowly, but pegged the yuan to the dollar when the financial crisis started. This has helped China recover, but the fixed exchange rate is a key issue that needs to be resolved.

Friday, March 05, 2010

Unofficial Problem Bank List at 641 Banks

by Calculated Risk on 3/05/2010 10:14:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

Failure Friday contributed to a drop in the number of institutions on the Unofficial Problem Bank List. This week, the list includes 641 institutions with aggregate assets of $325.5 billion, down from 644 institutions and 325.9 billion last week.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

There were 2 additions this week -- Mountain 1st Bank & Trust Company, Hendersonville, NC ($803 million Ticker: FFIS.OB); and Bank of Coral Gables, Coral Gables, FL ($159 million).

Removals include the 4 failures this Friday -- Sun American Bank ($536 million); Centennial Bank ($215 million); Bank of Illinois ($212 million); and Waterfield Bank ($156 million). There was one other removal as the OCC terminated the Formal Agreement against Community National Bank, Waterloo, IA ($235 million).

The other change is a Prompt Corrective Action Order issued against First Federal Bank of North Florida ($393 million), which has been operating under a Cease & Desist Order since November 2009.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #26: Centennial Bank, Ogden, Utah

by Calculated Risk on 3/05/2010 08:12:00 PM

Death by one thousand small cuts

The Fed sanguinates

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of the Insured Deposits of Centennial Bank, Ogden, Utah

The Federal Deposit Insurance Corporation (FDIC) approved the payout of the insured deposits of Centennial Bank, Ogden, Utah. ...Another bank that no one wanted ...

The FDIC was unable to find another financial institution to take over the banking operations of Centennial Bank. ...

As of December 31, 2009, Centennial Bank had approximately $215.2 million in total assets and $205.1 million in total deposits. ...

Centennial Bank is the 26th FDIC-insured institution to fail this year and the second in Utah since Barnes Banking Company, Kaysville, was closed on January 15, 2010. The FDIC estimates the cost of the failure to its Deposit Insurance Fund to be approximately $96.3 million.

Bank Failure #24 & #25: Illinois and Maryland

by Calculated Risk on 3/05/2010 06:12:00 PM

Bankers sneer at citizens:

Our loss,... your burden.

February rain.

March green shoots did not flower

These banks push daisies.

by Soylent Green is People

From the FDIC: Heartland Bank and Trust Company, Bloomington, Illinois, Assumes All of the Deposits of Bank of Illinois, Normal, Illinois

Bank of Illinois, Normal, Illinois, was closed today by the Illinois Department of Financial Professional Regulation – Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: FDIC Creates a New Depository Institution to Assume the Operations of Waterfield Bank, Germantown, Maryland

As of December 31, 2009, Bank of Illinois had approximately $211.7 million in total assets and $198.5 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $53.7 million. ... Bank of Illinois is the 24th FDIC-insured institution to fail in the nation this year, and the third in Illinois. The last FDIC-insured institution closed in the state was George Washington Savings Bank, Orland Park, on February 19, 2010.

Waterfield Bank, Germantown, Maryland, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...No one wanted Waterfield ...

As of December 31, 2009, Waterfield Bank had $155.6 million in assets and $156.4 million in deposits. At the time of closing, the amount of deposits exceeding the insurance limits totaled about $407,000. ...

The FDIC estimates that the cost to its Deposit Insurance Fund will be $51.0 million. Waterfield Bank is the 25th bank to fail in the nation this year and the first in Maryland. The last FDIC-insured institution to fail in the state was Bradford Bank, Baltimore, on August 28, 2009.