by Calculated Risk on 3/07/2010 12:15:00 PM

Sunday, March 07, 2010

Weekly Summary and a Look Ahead

The focus this week will be on the February Retail Sales report to be released by the Census Bureau on Friday. The consensus is for a decline of -0.2% from January and for a slight increase ex-auto. Blame it on the snow ...

On Monday, FDIC Chairman Sheila Bair, Jürgen Stark, Member of the Executive Board, European Central Bank, and Brian Sack, Executive Vice President, Federal Reserve Bank of New York - and others - will be speaking at the NABE Economic Policy Conference that is being held in Arlington, Va. The topic is: The New Normal? Policy Choices After the Great Recession

Stark's talk is titled: "Is the Global Economy Headed for a Lost Decade? A European Perspective". Might be interesting.

Sack will discuss "Implementing the Fed's Balance Sheet Policies" and he will probably comment on the MBS purchase program.

There will be much more from the NABE conference on Tuesday like "The State of the States" discussion. Also on Tuesday the Job Openings and Labor Turnover Survey (JOLTS) for January will be released. This report has been showing very little hiring and turnover in the labor market.

On Wednesday, the MBA Mortgage Applications Index, the Regional and State Employment and Unemployment report, and the Wholesale Inventory report will be released.

On Thursday, the closely watched initial weekly unemployment claims, and the January U.S. Trade Balance (consensus is for a slightly larger trade deficit of around $41 billion). Also the Q4 Fed Flow of Funds report will be released (Always interesting!)

And on Friday, the Retail Sales report, Consumer Sentiment (some improvement expected), Business Inventories and another round of bank failures. Once again I'm thinking Puerto Rico will make an appearance.

And a summary of last week ...

Click on graph for larger image.

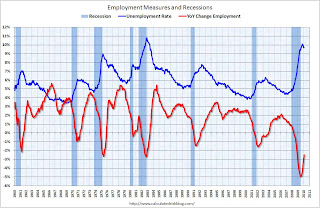

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 36,000 in February. The economy has lost almost 3.3 million jobs over the last year, and 8.43 million jobs since the beginning of the current employment recession.

The unemployment rate is at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Note: the impact of the weather on the survey is unknown. Census hiring was 15,000 (NSA).

Employment-Population Ratio

The Employment-Population ratio ticked up slightly to 58.5% in February, after plunging since the start of the recession. This is about the same level as in 1983.

The Employment-Population ratio ticked up slightly to 58.5% in February, after plunging since the start of the recession. This is about the same level as in 1983.This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

Part Time for Economic Reasons

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 8.8 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 8.8 million. The all time record of 9.2 million was set in October. The increase this month might have been weather related.

For much more on the employment report see:

1) Employment Report: 36K Jobs Lost, 9.7% Unemployment Rate for graphs of unemployment rate and a comparison to previous recessions.

2) Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

3) Diffusion Index and Temporary Help

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for February (red, light vehicle sales of 10.4 million SAAR from AutoData Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for February (red, light vehicle sales of 10.4 million SAAR from AutoData Corp).This is a 3.5% decline from the January sales rate.

This is the lowest level since September - when sales fell sharply after the "Cash-for-clunkers" program ended in August. The current level of sales are very low, and are still below the lowest point for the '90/'91 recession (even with a larger population).

From Zach Fox at SNL Financial: Credit Suisse: $1 trillion worth of ARMs still face resets

Source: SNL Financial, posted with permission.

Source: SNL Financial, posted with permission.This graph shows the numbers of ARMs resetting and recasting over the next few year. Resets are not a huge worry right now - because interest rates are so low - but if interest rates rise, this could lead to more defaults in the future.

Recasts - when the loans reamortize - are a concern, although it is unclear how large the payment shock will be. For borrowers with negative equity, any payment shock might be lead to default.

This graph (ht Tom Lawler) shows the REO inventory for Fannie, Freddie and FHA through Q4 2009. REO: Real Estate Owned.

This graph (ht Tom Lawler) shows the REO inventory for Fannie, Freddie and FHA through Q4 2009. REO: Real Estate Owned.Even with all the delays in foreclosure, the REO inventory has increased sharply over the last two quarters, from 135,868 at the end of Q2 2009, to 153,007 in Q3 2009, and 172,357 at the end of Q4 2009.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Residential construction spending increased slighltly in January, and nonresidential spending declined.

Private residential construction spending is now 61.4% below the peak of early 2006.

Private non-residential construction spending is 25.8% below the peak of late 2008.

Best wishes to all.