by Calculated Risk on 2/17/2010 09:28:00 AM

Wednesday, February 17, 2010

Industrial Production, Capacity Utilization Increase in January

From the Fed: Industrial production and Capacity Utilization

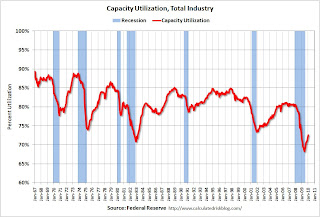

Industrial production increased 0.9 percent in January following a gain of 0.7 percent in December. Manufacturing production rose 1.0 percent in January, with increases for most of its major components, while the indexes for both utilities and mining advanced 0.7 percent. At 101.1 percent of its 2002 average, output in January was 0.9 percent above its year-earlier level. The capacity utilization rate for total industry rose 0.7 percentage point to 72.6 percent, a rate 8.0 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 6% from the record low set in June (the series starts in 1967).

Capacity utilization at 72.6% is still far below normal - and far below the the pre-recession levels of 80.5% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

Also - this is the highest level for industrial production since Dec 2008, but production is still 10.1% below the pre-recession levels at the end of 2007.

Housing Starts increase Slightly in January

by Calculated Risk on 2/17/2010 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 591 thousand (SAAR) in January, up 2.8% from the revised December rate, and up 24% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for eight months.

Single-family starts were at 484 thousand (SAAR) in January, up 1.5% from the revised December rate, and 36% above the record low in January and February 2009 (357 thousand). Just like for total starts, single-family starts have been at about this level for eight months.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:It is important to note that many home builders started a few extra spec homes in January hoping to have them completed and sold before the home buyer tax credit expires. It takes about six months to build an average home, so the builders couldn't wait to start construction until the expected buying rush in April since they have to close by the end of June.

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 591,000. This is 2.8 percent (±11.5%)* above the revised December estimate of 575,000 and is 21.1 percent (±12.3%) above the January 2009 rate of 488,000.

Single-family housing starts in January were at a rate of 484,000; this is 1.5 percent (±11.3%)* above the revised December figure of 477,000.

Housing Completions:

Privately-owned housing completions in January were at a seasonally adjusted annual rate of 659,000. This is 12.4 percent (±7.8%) below the revised December estimate of 752,000 and is 15.3 percent (±10.5%) below the January 2009 rate of 778,000.

Single-family housing completions in January were at a rate of 427,000; this is 12.9 percent (±7.1%) below the revised December rate of 490,000.

As I've noted before, this low of starts is both good news and bad news. The good news is the excess housing inventory is being absorbed - a necessary step for housing (and the economy) to recover.

The bad news is economic growth will probably be sluggish - and unemployment elevated - until residential investment picks up.

MBA: Mortgage Purchase Applications Decline

by Calculated Risk on 2/17/2010 07:00:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.1 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 1.2 percent from the previous week and the seasonally adjusted Purchase Index decreased 4.0 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages remained unchanged at 4.94 percent, with points increasing to 1.09 from 1.06 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The 4 week average of the seasonally adjusted purchase index declined to 221.7, just above the 12 year low set in early January.

Refinance activity also declined even with rates below 5%, since most borrowers who are able to refinance already have - and the other half of homeowners with mortgages are unable to refinance for several reasons. (see: Dina ElBoghdady and Renae Merle at the WaPo: Refinancing unavailable for many borrowers ).

Tuesday, February 16, 2010

LA Area Port Traffic in January

by Calculated Risk on 2/16/2010 09:50:00 PM

Note: this data is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of the nation's container port traffic.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was down 0.7% compared to January 2009. (down 4.2% compared to last year using three month average)

Loaded outbound traffic was up 31.8% from January 2009. (+25.5% using three months average) This was an easy YoY comparison for exports, because U.S. exports fell off a cliff in near the end of 2008.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline at the end of the year. Import traffic will decline sharply in February, but that is just the seasonal pattern.

Exports recovered somewhat in the first half of 2009, however export traffic has essentially been flat since last summer. Export growth was one of the key drivers of the economy in 2009, but it now appears - based on traffic - that export growth has stalled.

TransUnion: Mortgage Delinquencies at All Time High

by Calculated Risk on 2/16/2010 07:32:00 PM

From TransUnion: TransUnion Finds National Mortgage Delinquencies Jumped 10.24 Percent at End of 2009 (ht jb)

TransUnion's quarterly analysis of trends in the mortgage industry found that mortgage loan delinquency (the ratio of borrowers 60 or more days past due) increased for the 12th straight quarter, hitting an all-time national average high of 6.89 percent for the fourth quarter of 2009. This quarter marks the first time the mortgage delinquency rate increase did not decelerate after doing so for three consecutive periods.The MBA reports on Q4 delinquency and foreclosure rates on Friday.

This statistic, which is traditionally seen as a precursor to foreclosure, increased 10.24 percent from the previous quarter's 6.25 percent average. Year-over-year, mortgage borrower delinquency is up approximately 50 percent (from 4.58 percent).

...

"At the national level, these results are in part due to seasonality effects. Consumers tend to run low on cash at the end of the year, after spending for the holidays, but before receiving year-end bonuses and tax refunds," said FJ Guarrera, vice president of TransUnion's financial services business unit. ... "The continuing rise in foreclosures, in conjunction with low consumer confidence in the housing market, continues to hinder housing value appreciation and impede recovery in the mortgage industry. Furthermore, there is wave of adjustable rate mortgages (ARMs) that have yet to reset. Many of these are Option and Alt-A loans. When the interest rates on these loans reset many consumers potentially will not be able to meet their debt obligations."

....

TransUnion's forecasts for 2010 are slightly more pessimistic than before due to questions concerning house price appreciation, the continued high level of unemployment, and the potential eroding of consumer confidence as the effects of the government stimulus begin to fade.

"We believe that the 60-day mortgage delinquency rate will peak between 7.5 and 8 percent over the course of 2010, depending on the prevailing economic conditions associated with the housing market," said Guarrera.

emphasis added

CNBC's Olick: Treasury Concerned about Next Wave of Foreclosures

by Calculated Risk on 2/16/2010 04:35:00 PM

From Diana Olick at CNBC: What Mortgage Modifications Say About the Housing Market

Treasury officials today said they are still concerned about a coming wave of foreclosures, many from pay option ARMs and many from the prime jumbo basket, particularly hard hit by unemployment.Olick also notes that the HAMP report for January has been delayed by weather until tomorrow. And she reports that only 2/3 of HAMP borrowers are current on their payments.

A couple of comments:

The main reason 1/3 of HAMP borrowers are delinquent is because some servicers didn't adequately pre-qualify borrowers before putting them in the program. The Treasury recently changed the guidelines for placing borrowers in to a trial program, and these more stringent pre-qualification requirements must be implemented by June. Most servicers have already started using the new requirements, and the number of new trial modifications will probably slow dramatically.

As James Haggerty at the WSJ noted this morning:

Loan servicers ... seem to have "nearly exhausted the supply of plausible candidates for loan modifications" and will find that many loans are "unredeemable," [a] S&P study says.Note: the HAMP report tomorrow will be for January. Although the number of permanent modifications probably increased significantly, the actual number will still be very low compared to the number of HAMP trial modifications. Also - it is the report for February that will be VERY interesting because the servicers have been instructed to remove many of the delinquent borrowers from the program after Jan 31, 2010.

Distressed Sales: Sacramento as an Example

by Calculated Risk on 2/16/2010 02:43:00 PM

This will probably be the year of the "short sale", especially after the Home Affordable Foreclosure Alternatives starts (scheduled for April 5th).

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the January data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. Almost 69 percent of all resales (single family homes and condos) were distressed sales in January.

Note: This data is not seasonally adjusted, and the decline in sales from December to January was about normal. The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs had been declining, and the percent of short sales had been steadily increasing. In January REOs were up to 45% - the highest percent since last September - and the percent short sales declined slightly to 23.6%.

The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs had been declining, and the percent of short sales had been steadily increasing. In January REOs were up to 45% - the highest percent since last September - and the percent short sales declined slightly to 23.6%.

Now that the trial modification period has ended, I expect the REO sales to increase. Also, I expect the percentage of short sales to be higher in 2010 than in 2009 - but probably not as high as foreclosures (it will be interesting to watch).

Also total sales in January were off 23.4% compared to January 2009; the eight month in a row with declining YoY sales.

On financing, over half the sales were either all cash (26.7%) or FHA loans (28.5%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

NAHB Builder Confidence Increases Slightly, Still Very Depressed

by Calculated Risk on 2/16/2010 01:00:00 PM

Note: any number under 50 indicates that more builders view sales conditions as poor than good. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 17 in February. This is an increase from 15 in January.

The record low was 8 set in January 2009. This is still very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May.

Housing starts will be released tomorrow, and both the HMI and housing starts are moving sideways.

Press release from the NAHB: (added) Builder Confidence Improves in February

Builder confidence in the market for newly built, single-family homes rose two points to 17 in February ...

“Builders are just beginning to see the anticipated effects of the home buyer tax credit on consumer demand,” said NAHB Chief Economist David Crowe. “Meanwhile, another source of encouragement is the improving employment market, which is key to any sustainable economic or housing recovery. That said, several limiting factors are still weighing down builder expectations, including the large number of foreclosed homes on the market, the lack of available credit for new and existing projects, and inappropriately low appraisals tied to the use of distressed properties as comps.”

...

The HMI for February gained two points to 17, its highest level since November of 2009, with two out of three of its component indexes also rising. The component gauging current sales conditions rose two points to 17, while the component gauging sales expectations in the next six months rose a single point to 27. Meanwhile, the component gauging traffic of prospective buyers remained flat, at 12.

Regionally, February’s HMI results were mixed. While the Midwest and South each registered two-point gains, to 13 and 19, respectively, the Northeast and West each registered one-point declines, to 19 and 14, respectively.

Capital One Credit Card Charge-Offs Increase to 10.41%

by Calculated Risk on 2/16/2010 10:36:00 AM

From Reuters: Capital One credit card defaults rise in January (ht jb)

Capital One Financial Corp's U.S. credit-card defaults rose in January, in a sign that consumers continue to remain under stress, it said in a regulatory filing.

Capital One said the annualized net charge-off rate -- debts the company believes it will never collect -- for U.S. credit cards rose to 10.41 percent in January from 10.14 percent in December.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Capital One credit card annualized net charge-off rate is now at 10.41% - above the peak in 2005.

As Reuters notes, Capital One is usually the first to report monthly credit card charge-offs. The other major credit card issuers will report later today.

NY Fed: Manufacturing Conditions Improve in February

by Calculated Risk on 2/16/2010 08:30:00 AM

The headline number showed improvement, but two key numbers to watch are new orders and inventories. The new order index fell, and the inventory index rose sharply - and the declining gap between new orders and inventory points to a possible future slowdown in production.

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved at a healthy pace in February. The general business conditions index climbed 9 points, to 24.9. The new orders index fell, though it remained positive, and the shipments index inched downward as well. The inventories index rose sharply, to 0.0, its highest reading in considerably more than a year.Below is the general business conditions index. Note that the data only goes back to July 2001 (chart from Jan 2002). Any reading above zero is expansion, so this index shows manufacturing was expanding since August. (chart from NY Fed)

...

Employment indexes were positive for a second consecutive month, although at relatively low levels.

Monday, February 15, 2010

Housing Reports: Another Wave of Distressed Sales

by Calculated Risk on 2/15/2010 10:25:00 PM

James Hagerty at the WSJ reports on two studies, one from John Burns Real Estate Consulting Inc., and another from Standard & Poor's Financial Services LLC that both forecast most modification efforts will eventually fail - and that mods have just delayed foreclosures. The Burns forecast is for another 5 million distressed sales over the next few years. See the WSJ: Foreclosures Seen Still Hitting Prices

Hagerty reports that Burns study suggests prices will be mostly flat unless the economy turns down, and the S&P study forecasts further price declines.

S&P says current trends suggest that 70% of [modified loans] eventually will redefault.This will be the year of the short sale.

...

Loan servicers ... seem to have "nearly exhausted the supply of plausible candidates for loan modifications" and will find that many loans are "unredeemable," the S&P study says.

As a result, servicers increasingly are looking to arrange "short sales," in which homes are sold for less than their loan balances.

Juncker: Greece has March 16 Deadline to Show Progress

by Calculated Risk on 2/15/2010 07:15:00 PM

Based on reports from Dow Jones: Juncker: Euro Zone Ready To Support Greece If Needed and the BBC: Greece 'may cut spending further', here are some comments from Jean-Claude Juncker, Luxembourg's prime minister and chairman of the 16 euro-zone finance ministers:

It looks like this will be an issue next month (or tomorrow - you never know).

Predictions on Mortgage Rates after the Fed Stops Buying

by Calculated Risk on 2/15/2010 03:51:00 PM

From Carolyn Said at the San Francisco Chronicle: Mortgage rates poised to jump as Fed cuts funds. The following predictions are excerpts from her article:

And a couple earlier predictions:Guy Cecala, publisher of Inside Mortgage Finance. "My opinion is that rates will go up a full percentage point initially," meaning that 30-year fixed conforming loans, now hovering around 5 percent, would hit 6 percent. Keith Gumbinger, vice president of HSH Associates, which compiles mortgage loan data, thinks that rates will slowly rise to about 5.75 percent after the Fed withdraws. Julian Hebron, branch manager at RPM Mortgage's San Francisco office, anticipates a bump up to around 5.5 percent by summer ... Christopher Thornberg, principal at Beacon Economics in Los Angeles [said] "Clearly, when they stop printing all that money, it's going to be a shock to the system. I have to assume that when they pull back on it, it will cause a 100- to 200-basis-points rise" to rates of 6 percent or 7 percent ...

My own estimate is for an increase in the spread - relative to the 10 Year Treasury - of about 35 bps (maybe 50 bps).

Labor Underutilization Rate by Household Income

by Calculated Risk on 2/15/2010 01:52:00 PM

The following chart is based on data from a research paper by Andrew Sum and Ishwar Khatiwada at the Center for Labor Market Studies, Northeastern University (ht Ann):

"Labor Underutilization Problems of U.S. Workers Across Household Income Groups at the End of the Great Recession: A Truly Great Depression Among the Nation’s Low Income Workers Amidst Full Employment Among the Most Affluent"

Update: Bob Herbert at the NY Times wrote about this paper last week: The Worst of the Pain and so did Ryan McCarthy at Huffington Post: 'No Labor Market Recession For America's Affluent,' Low-Wage Workers Hit Hardest: STUDY  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the labor underutilization rates by household income based on the author's research and calculations.

"At the end of calendar year 2009, as the national economy was recovering from the recession of 2007-2009, workers in different segments of the income distribution clearly found themselves in radically different labor market conditions. A true labor market depression faced those in the bottom two deciles of the income distribution, a deep labor market recession prevailed among those in the middle of the distribution, and close to a full employment environment prevailed at the top. There was no labor market recession for America’s affluent."A few notes:

emphasis added

Unemployed Underemployed Labor force reserve or hidden unemployment: "workers who express a desire for immediate employment but are not actively looking for work and thus are not counted as unemployed."

Some Morning Greece

by Calculated Risk on 2/15/2010 11:18:00 AM

A few articles this morning ...

From Bloomberg: Europe Economy Chief Calls for More Steps by Greece

The European Union’s top economic official said Greece should take more measures to cut the region’s largest budget deficit as evidence emerged that the nation may have used swaps to mask its swelling debt.From The Times: Greece refuses EU austerity measures demand

... Olli Rehn, the new EU Commissioner for Economic and Monetary Affairs said: "Our view is that risks... are materialising, and therefore there is a clear case for additional measures.”And on the swaps from Simon Johnson at Baseline Scenario: Goldman Goes Rogue – Special European Audit To Follow

...

[George Papaconstantinou, Greece's Finance Minister] said: “If we announce today new measures, will that stop markets attacking Greece?

"My guess is that what will stop markets attacking Greece at the moment is a further more explicit message that makes operational what has been decided last Thursday at the European council."

Remember Greece is a small country with about 10 million people. And they have a special problem because the previous government published false data on the size of their debt and deficit. The larger problem is how a single currency works when different countries have different issues ...

From Paul Krugman: The Making of a Euromess

I’ve been troubled by reporting that focuses almost exclusively on European debts and deficits ... For the truth is that lack of fiscal discipline isn’t the whole, or even the main, source of Europe’s troubles — not even in Greece, whose government was indeed irresponsible (and hid its irresponsibility with creative accounting).

No, the real story behind the euromess lies not in the profligacy of politicians but in the ... policy [of] adopting a single currency well before the continent was ready for such an experiment.

NY Times: Worries Grow as Government Housing Support "Winds Down"

by Calculated Risk on 2/15/2010 08:42:00 AM

From David Streitfeld at the NY Times: U.S. Housing Aid Winds Down, and Cities Worry

Streitfeld discusses the Fed's MBS purchase program (95% complete and scheduled to end next month), the housing tax credit (contracts must be signed by the end of April, and deals closed by the end of June), and the slight tightening of FHA requirements.

Here is a list compiled in December of many Government housing support programs. Some have already ended (like the extension of the HAMP trial mods on Jan 31, 2010), and, as Streitfeld noted, others will end over the next few months.

One program that is being ramped up is Home Affordable Foreclosure Alternatives (HAFA: short sales and deed-in-lieu) that starts on April 5, 2010.

Retail Vacancy Rate: "Improvement by Subtraction"

by Calculated Risk on 2/15/2010 12:20:00 AM

Here is a solution for some of the vacant retail space ...

From the Columbus Dispatch: Razing cuts retail vacancy rate

Fewer storefronts were empty last year in Columbus than the year before, but only because two white-elephant malls were torn down ... The demolition of the Columbus City Center mall Downtown and Consumer Square East in the Brice Road area took 1.1 million square feet of empty retail space out of the market. That cut retail vacancies to 15.1 percent in 2009 from 16.9 percent in 2008.That helped a little, but the forecast is for the vacancy rate to stay in the 14% to 15% range through 2012. Maybe they can demolish a few more malls ...

Sunday, February 14, 2010

Five Million Workers to Exhaust Unemployment Benefits by June

by Calculated Risk on 2/14/2010 08:48:00 PM

Note: Scroll down or click here for a look ahead and weekly summary.

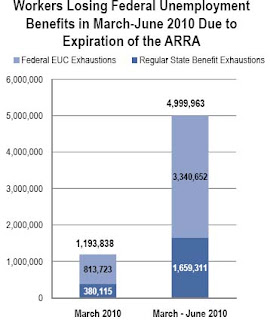

Back in December, the qualification dates for existing tiers of unemployment benefits were extended for an additional two months. Time is up at the end of February.

Now another extension is needed or millions of workers will lose benefits over the next few months.

The National Employment Law Project (NELP) released a new report last week showing that ...

1.2 million jobless workers will become ineligible for federal unemployment benefits in March unless Congress extends the unemployment safety net programs from the American Recovery and Reinvestment Act (ARRA). By June, this number will swell to nearly 5 million unemployed workers nationally who will be left without any jobless benefits.

...

Currently, 5.6 million people are accessing one of the federal extensions (34-53 weeks of Emergency Unemployment Compensation; 13-20 weeks of Extended Benefits, a program normally funded 50 percent by the states).

This table shows the NELP's projections:

This table shows the NELP's projections: Of the almost 1.2 million workers facing a cut off of benefits in March alone:The following graph is based on the January employment report and shows the number of workers unemployed for 27 weeks or more ...380,000 workers will exhaust their 26 weeks of state benefits without accessing the temporary EUC extension program or the permanent federal program of Extended Benefits. Another 814,000 workers will not be eligible to continue receiving EUC past their current tier of benefits.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are a record 6.31 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.1% of the civilian workforce. (note: records started in 1948).

The current qualification dates extension being considered is for another three months. Cynics might argue that some Senators want to limit the extension to an additional three months, so they can use the popular benefit extension in May to once again extend the homebuyer tax credit - hopefully the cynics are wrong!

Housing Market Index, Housing Starts and the Expiring Tax Credit

by Calculated Risk on 2/14/2010 04:43:00 PM

The NAHB Housing Market Index for February, and Housing Starts for January will both be released this week, see: Weekly Summary and a Look Ahead.

As a review, here is a graph showing the relationship between the two series: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the December data for single family starts.

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month. Since the NAHB index declined in January (it is released a month ahead of starts), we usually wouldn't expect much of an increase in January single family housing starts.

However there might be an increase in starts (single family) in January since many builders started a few extra homes in anticipation of the expiration of the first time home buyer tax credit. It takes about six months to build an average home, so the builders can't wait until the expected buying rush in April to start building a home - they have to close by the end of June.

Here are some comments from the Feb 2nd D.R. Horton conference call:

In [Q2 2010], we expect strong closings since homes must close by June 30th for the extended tax credit. ... We expect [Q3] will be the most challenging as the tax credit for home sales will have expired. As we move past the selling season, we'll be able to get a better read on core demand and we'll adjust our business accordingly.”Residential investment1 is one of the best leading indicators for the economy, and the best indicators for RI are the NAHB HMI, housing starts, and new home sales. Usually housing starts lead changes in unemployment too - see Housing Starts, Vacant Units and the Unemployment Rate - so the sideways movement in the NAHB HMI and housing starts suggest unemployment will stay elevated for some time.

...

We are prepared for the spring selling season and for current demand created by the Federal home buyer tax credit with our current spec level.

We will continue to manage our spec levels very closely as we move closer to the April 30th sales contract deadline for the home buyer tax credit.

Note 1: The largest components of residential investment are new home construction, and home improvement. This also includes brokers' commissions and some minor categories.

Weekly Summary and a Look Ahead

by Calculated Risk on 2/14/2010 12:11:00 PM

The U.S. markets will be closed on Monday for Presidents' Day, but there might be some more news from Europe and China.

On Tuesday, the Empire Manufacturing Survey (February) and the NAHB Housing Market Index survey (February) will be released. The consensus is for a slight uptick in builder confidence to 16 or 17 from 15 in January.

On Wednesday, the Census Bureau will release Housing Starts for January. The consensus is for an increase to close to 600,000 since many homebuilders started a few extra spec homes trying to beat the deadline for the homebuyer tax credit. As an example, here is a quote from Andrew Konovodoff, president of Town and Country Homes (from Daily Herald):

"Last year 50 percent of our buyers purchased homes using a tax credit and so far this year 35 percent of buyers have used one," Konovodoff said. "We are not a spec builder, but even we have started spec homes in anticipation of a rush this spring. Currently we have 30 homes that can close by the end of June."Also on Wednesday, the Fed will release the Industrial Production and Capacity Utilization numbers for January. The consensus is for a 0.8% increase. The FOMC minutes for the January meeting will also be released.

On Thursday the Producer Price Index, initial weekly Unemployment Claims, and the Philly Fed Survey will all be released.

And on Friday, the Consumer Price Index and more bank failures.

There will be several Fed speeches during the week, and the West Coast port data and the Department of Transportation vehicle miles driven for December will probably be released.

And a summary of last week ...

The Census Bureau reported that the U.S. trade deficit increased to $40.2 billion, up from $36.4 billion in November.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through December 2009.

Both imports and exports increased in December. On a year-over-year basis, exports are up 7.4% and imports are up 4.6%. This is an easy comparison because of the collapse in trade at the end of 2008.

The MBA reported that the "seasonally adjusted Purchase Index decreased 7.0 percent from one week earlier".

The MBA reported that the "seasonally adjusted Purchase Index decreased 7.0 percent from one week earlier". This graph shows the MBA Purchase Index and four week moving average since 1990.

The decline in mortgage applications since October appears significant.

The BLS released the Job Openings and Labor Turnover Summary for December.

This graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.

This graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.According to the JOLTS report, there were 4.073 million hires in December, and 4.238 million separations, or 165 thousand net jobs lost. The comparable CES report showed a loss of 150 thousand jobs in December (after revisions).

Separations have declined sharply from earlier in 2009, but hiring has not picked up. Quits (light blue on graph) are at a new low too. Usually "quits" are employees who have already found a new job (as opposed to layoffs and other discharges).

The low turnover rate is another indicator of a very weak labor market.

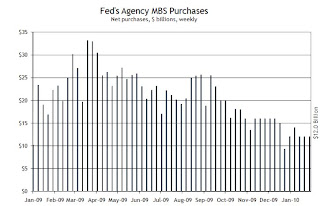

The following graph is from the Atlanta Fed Financial Highlights, and shows the Fed MBS purchases by week:

From the Atlanta Fed:

From the Atlanta Fed: The Fed purchased an additional $11 billion net in MBS through the week of Feb 10th, bringing the total to $1.188 trillion or just over 95% complete.The Fed purchased a net total of $12 billion of agency-backed MBS through the week of February 3, bringing its total purchases up to $1.177 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 94% complete).

"Optimism has clearly stalled in spite of the improvements in the economy in the second half of 2009. Small business owners entered 2010 the same way they left 2009 – depressed. The quarterly Index readings have been below 90 for 7 quarters, indicative of the severity and pervasiveness of this recession."

Best wishes to all.