by Calculated Risk on 2/11/2010 05:15:00 PM

Thursday, February 11, 2010

Fed MBS Purchase Program 95% Complete

The countdown continues ...

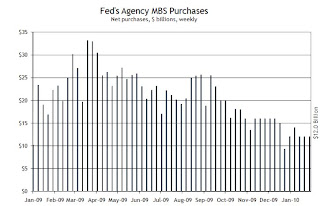

The following graph is from the Atlanta Fed Financial Highlights, and shows the Fed MBS purchases by week:  Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

The Fed purchased an additional $11 billion net in MBS through the week of Feb 10th, bringing the total to $1.188 trillion or just over 95% complete.The Fed purchased a net total of $12 billion of agency-backed MBS through the week of February 3, bringing its total purchases up to $1.177 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 94% complete). In the first nine months of the program (January-September 2009), the Fed’s average weekly purchase of MBS was $23.3 billion. Since October 2009, however, it has declined to $14.6 billion per week; the Fed needs to purchase only about $9.2 billion per week through March 2010 to reach its goal.

Mortgage rates were just under 5% last week, from Freddie Mac: 30-Year Fixed-Rate Mortgage Dips Below 5 Percent Again

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.97 percent with an average 0.7 point for the week ending February 11, 2010, down from last week when it averaged 5.01 percent. Last year at this time, the 30-year FRM averaged 5.16 percent.However, with the Ten Year Treasury yield increasing today to 3.73% (from around 3.6% last week), I expect rates to be above 5% again next week.