by Calculated Risk on 2/14/2010 12:11:00 PM

Sunday, February 14, 2010

Weekly Summary and a Look Ahead

The U.S. markets will be closed on Monday for Presidents' Day, but there might be some more news from Europe and China.

On Tuesday, the Empire Manufacturing Survey (February) and the NAHB Housing Market Index survey (February) will be released. The consensus is for a slight uptick in builder confidence to 16 or 17 from 15 in January.

On Wednesday, the Census Bureau will release Housing Starts for January. The consensus is for an increase to close to 600,000 since many homebuilders started a few extra spec homes trying to beat the deadline for the homebuyer tax credit. As an example, here is a quote from Andrew Konovodoff, president of Town and Country Homes (from Daily Herald):

"Last year 50 percent of our buyers purchased homes using a tax credit and so far this year 35 percent of buyers have used one," Konovodoff said. "We are not a spec builder, but even we have started spec homes in anticipation of a rush this spring. Currently we have 30 homes that can close by the end of June."Also on Wednesday, the Fed will release the Industrial Production and Capacity Utilization numbers for January. The consensus is for a 0.8% increase. The FOMC minutes for the January meeting will also be released.

On Thursday the Producer Price Index, initial weekly Unemployment Claims, and the Philly Fed Survey will all be released.

And on Friday, the Consumer Price Index and more bank failures.

There will be several Fed speeches during the week, and the West Coast port data and the Department of Transportation vehicle miles driven for December will probably be released.

And a summary of last week ...

The Census Bureau reported that the U.S. trade deficit increased to $40.2 billion, up from $36.4 billion in November.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through December 2009.

Both imports and exports increased in December. On a year-over-year basis, exports are up 7.4% and imports are up 4.6%. This is an easy comparison because of the collapse in trade at the end of 2008.

The MBA reported that the "seasonally adjusted Purchase Index decreased 7.0 percent from one week earlier".

The MBA reported that the "seasonally adjusted Purchase Index decreased 7.0 percent from one week earlier". This graph shows the MBA Purchase Index and four week moving average since 1990.

The decline in mortgage applications since October appears significant.

The BLS released the Job Openings and Labor Turnover Summary for December.

This graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.

This graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.According to the JOLTS report, there were 4.073 million hires in December, and 4.238 million separations, or 165 thousand net jobs lost. The comparable CES report showed a loss of 150 thousand jobs in December (after revisions).

Separations have declined sharply from earlier in 2009, but hiring has not picked up. Quits (light blue on graph) are at a new low too. Usually "quits" are employees who have already found a new job (as opposed to layoffs and other discharges).

The low turnover rate is another indicator of a very weak labor market.

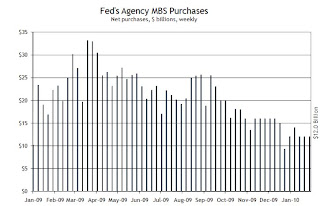

The following graph is from the Atlanta Fed Financial Highlights, and shows the Fed MBS purchases by week:

From the Atlanta Fed:

From the Atlanta Fed: The Fed purchased an additional $11 billion net in MBS through the week of Feb 10th, bringing the total to $1.188 trillion or just over 95% complete.The Fed purchased a net total of $12 billion of agency-backed MBS through the week of February 3, bringing its total purchases up to $1.177 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 94% complete).

"Optimism has clearly stalled in spite of the improvements in the economy in the second half of 2009. Small business owners entered 2010 the same way they left 2009 – depressed. The quarterly Index readings have been below 90 for 7 quarters, indicative of the severity and pervasiveness of this recession."

Best wishes to all.