by Calculated Risk on 1/27/2010 06:31:00 PM

Wednesday, January 27, 2010

Unemployment Rate and Presidential Disapproval

From Pew Research: It's All About Jobs, Except When It's Not

Recent history shows that the public response to all presidents has been shaped to some degree by rising or falling unemployment. However, only Ronald Reagan's ratings in his first term have borne as close a connection as have Obama's to changes in the unemployment rate.

In fact, the relationship between unemployment and presidential approval varies from crystal clear to murky. Indeed since 1981 there have been a number of times when the ties between changes in joblessness rates and public judgments of the president have been weak or even indiscernible. But the link is strongest when unemployment rises precipitously. And it weakens, or even disappears entirely, when other concerns -- such as national security -- become dominant public issues.

Click on graph for larger image in new window.

This graph shows the relationship between the unemployment rate and approval rating. The report also breaks it down by each President starting with Reagan.

Although other factors matter - like 9/11 or the Iran-Contra scandal - it mostly is "the unemployment rate, stupid!", especially when the unemployment rate is high.

DataQuick on California: Record Notices of Default filed in 2009

by Calculated Risk on 1/27/2010 03:54:00 PM

Click on graph for larger image in new window.

This graph shows the Notices of Default (NOD) by year through 2009 in California from DataQuick.

There were a record number of NODs filed in California last year, however the pace slowed in the 2nd half.

From DataQuick: Another Drop in California Mortgage Defaults

The number of California homes entering the foreclosure process declined again during fourth quarter 2009 amid signs that the worst may be over in hard-hit entry-level markets, while slowly spreading to more expensive neighborhoods. There are mixed signals for 2010: It's unclear how much of the drop in mortgage defaults is due to shifting market conditions, and how much is the result of changing foreclosure policies among lenders and loan servicers, a real estate information service reported.In terms of units, the peak of the foreclosure crisis may be over, but the mid-to-high end foreclosures are increasing - and the values of these properties is much higher than the low end starter properties. This suggests that prices may have bottomed in some low end areas, but we will see further price declines in many mid-to-high end areas.

A total of 84,568 Notices of Default ("NODs") were recorded at county recorder offices during the October-to-December period. That was down 24.3 percent from 111,689 for the prior quarter, and up 12.4 percent from 75,230 in fourth-quarter 2008, according to San Diego-based MDA DataQuick.

NODs reached an all-time high in first-quarter 2009 of 135,431, a number that was inflated by activity put off from the prior four months. In the second quarter of last year, NODs totaled 124,562. The low of recent years was in the third quarter of 2004 at 12,417, when housing market annual appreciation rates were around 20 percent.

"Clearly, many lenders and servicers have concluded that the traditional foreclosure process isn't necessarily the best way to process market distress, and that losses may be mitigated with so-called short sales or when loan terms are renegotiated with homeowners," said John Walsh, DataQuick president.

While many of the loans that went into default during fourth quarter 2009 were originated in early 2007, the median origination month for last quarter's defaulted loans was July 2006, the same month as during the prior three quarters. The median origination month during the last quarter of 2008 was June 2006. This means the foreclosure process has moved forward through one month of bad loans during the past 12 months.

"Mid 2006 was clearly the worst of the 'loans gone wild' period and it's taking a long time to work through them. We're also watching foreclosure activity start to move into more established mid-level and high-end neighborhoods. Homeowners there were able to make their payments longer than homeowners in entry-level neighborhoods, but because of the recession and job losses, that's changing. Foreclosure activity is a lagging indicator of distress," Walsh said.

The state's most affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for 52.0 percent of all default activity a year ago. In fourth-quarter 2009 that fell to 34.9 percent. ...

emphasis added

FOMC Statement: No Change

by Calculated Risk on 1/27/2010 02:15:00 PM

Information received since the Federal Open Market Committee met in December suggests that economic activity has continued to strengthen and that the deterioration in the labor market is abating. Household spending is expanding at a moderate rate but remains constrained by a weak labor market, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software appears to be picking up, but investment in structures is still contracting and employers remain reluctant to add to payrolls. Firms have brought inventory stocks into better alignment with sales. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.I think the most important point in the FOMC statement was that they reiterated the ending dates for the Fed facilities and MBS purchases. The Fed is giving advance warning that these facilities will expire as previously announced. It would take a major credit or economic event to change these dates at this point.

With substantial resource slack continuing to restrain cost pressures and with longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve is in the process of purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt. In order to promote a smooth transition in markets, the Committee is gradually slowing the pace of these purchases, and it anticipates that these transactions will be executed by the end of the first quarter. The Committee will continue to evaluate its purchases of securities in light of the evolving economic outlook and conditions in financial markets.

In light of improved functioning of financial markets, the Federal Reserve will be closing the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility, the Commercial Paper Funding Facility, the Primary Dealer Credit Facility, and the Term Securities Lending Facility on February 1, as previously announced. In addition, the temporary liquidity swap arrangements between the Federal Reserve and other central banks will expire on February 1. The Federal Reserve is in the process of winding down its Term Auction Facility: $50 billion in 28-day credit will be offered on February 8 and $25 billion in 28-day credit wil be offered at the final auction on March 8. The anticipated expiration dates for the Term Asset-Backed Securities Loan Facility remain set at June 30 for loans backed by new-issue commercial mortgage-backed securities and March 31 for loans backed by all other types of collateral. The Federal Reserve is prepared to modify these plans if necessary to support financial stability and economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that economic and financial conditions had changed sufficiently that the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted.

There is some concern about what will happen when the Fed stops buying agency MBS. The important thing to remember is that there will be buyers; it is just a matter of price. My guess is that mortgage rates will rise about 35 bps relative to the Ten Year treasury when the Fed stops buying MBS. It could be more or less ...

Another important point in the Fed statement was the recognition that the housing sector is not as strong as it appeared in November or December. They just removed the language on housing:

Jan, 2010: No comment.

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Nov, 2009: "Activity in the housing sector has increased over recent months"

One-month Treasury Bill Rates turn Negative

by Calculated Risk on 1/27/2010 12:58:00 PM

While we wait for the FOMC, there are signs of more economic weakness ... (update: this isn't a sign of a "flight to quality" or a panic - just too much money looking for a parking place).

From Bloomberg: U.S. One-Month Bill Rate Negative for First Time Since March (ht jb)

Treasury one-month bill rates turned negative for the first time in 10 months, as issuance declines while investors seek the most easily-traded securities amid a renewal of risk aversion.The Ten Year yield is back down to 3.61%.

The rate on the four-week security dropped to negative 0.0101 percent, the lowest since it reached negative 0.015 percent on March 26. The Treasury sold $10 billion of four-week bills on Jan. 26 at a rate of zero percent ...

And from the Chicago Fed: Midwest Manufacturing Output Decreased in December

More on New Home Sales and the FOMC Statement

by Calculated Risk on 1/27/2010 11:25:00 AM

As I mentioned in the New Home sales post this morning, the FOMC statement today will probably be changed to reflect the renewed weakness in the housing market. This includes the decline in new home sales, housing starts, and other indicators including mortgage applications and builder confidence.

The first two sentences in the last FOMC statement are no longer operative.

From the FOMC December 16, 2009 statement:

Information received since the Federal Open Market Committee met in November suggests that economic activity has continued to pick up and that the deterioration in the labor market is abating. The housing sector has shown some signs of improvement over recent months.Most indicators suggest economic activity has picked up, but the labor market and the housing sector have shown renewed signs of deterioration.

I expect the main statement points will remain the same: the target range for the federal funds rate will remain at 0 to 1/4 percent, expectations are for the MBS purchase plan to be completed by the end of the first quarter of 2010, and the "exceptionally low levels of the federal funds rate for an extended period" phrase will be included.

Here is more on the "distressing gap" between existing and new home sales.

The following graph shows the ratio of existing home sales divided by new home sales through November.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This ratio is just off from the all time high last month when existing home sales were artificially boosted by the first time home buyer tax credit.

The ratio of existing to new home sales increased at first because of the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent increase in the ratio was partially due to the timing of the first time home buyer tax credit (before the extension) - and partially because the tax credit spurred existing home sales more than new home sales.

On timing issues: New home sales are counted when the contract is signed, and usually before construction begins. So to close before the original Dec 1st deadline, the contract had to be signed early this Summer. Existing home sales are counted when escrow closes. And the recent surge in existing home sales was primarily due to buyers rushing to beat the tax credit.

The second graph shows the same information with existing home sales (left axis), and new home sales (right axis). This is updated through the December data released this morning.

The second graph shows the same information with existing home sales (left axis), and new home sales (right axis). This is updated through the December data released this morning.Although distressed sales will stay elevated for some time, I expect this gap to eventually close - probably from an eventual increase in new home sales and a decrease in existing home sales. This just shows the housing market is far from healthy.

New Home Sales Decline Sharply in December

by Calculated Risk on 1/27/2010 10:00:00 AM

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 342 thousand. This is a sharp decrease from the revised rate of 370 thousand in November (revised from 355 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. In December 2009, a record low 23 thousand new homes were sold (NSA); this ties the previous record low set in December 1966.

Sales in December 2008 were at 26 thousand.  The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 4% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 4% above the low in January.

Sales of new one-family houses in December 2009 were at a seasonally adjusted annual rate of 342,000 ... This is 7.6 percent (±14.6%)* below the revised November rate of 370,000 and is 8.6 percent (±15.2%)* below the December 2008 estimate of 374,000.And another long term graph - this one for New Home Months of Supply.

There were 8.1 months of supply in December. Rising, but still significantly below the all time record of 12.4 months of supply set in January.

There were 8.1 months of supply in December. Rising, but still significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of December was 231,000. This represents a supply of 8.1 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, and sales might have bottomed too. New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of excess housing inventory declines much further.

Obviously this is another very weak report. I expect the Fed will change their statement on housing today. I'll have more later ...

MBA: Mortgage Applications Decline

by Calculated Risk on 1/27/2010 07:39:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 10.9 percent on a seasonally adjusted basis from one week earlier. ...

“Refinance activity fell substantially last week,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Although rates remain low, there appears to be a smaller pool of borrowers who are willing and able to refinance at today’s rates.”

The Refinance Index decreased 15.1 percent from the previous week and the seasonally adjusted Purchase Index decreased 3.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.02 percent from 5.00 percent, with points decreasing to 1 from 1.05 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is at about the same level as September 1997. There are many cash buyers (mostly investors at the low end), but this decline in mortgage applications is significant. Also, it appears the refinance boom is ending.

Tuesday, January 26, 2010

Existing Home Inventory: A long way from Normal

by Calculated Risk on 1/26/2010 09:56:00 PM

James Hagerty at the WSJ writes about existing home inventory: Housing Momentum Builds but Perils Persist

Inventories of homes listed for sale are down sharply across the U.S. and have reached very low levels in some areas ... The decrease in supplies has sparked a return of bidding wars on lower-end properties in some neighborhoods, but the national picture is mixed.We've been discussing the bidding wars on low end properties since last spring - and that frenzy was driven by a combination of a high number of foreclosures at the low end pushing down prices (what housing economist Tom Lawler called "destickification"), and the first time home buyer tax credit. In some areas - like San Diego - the frenzy has moved up to more expensive areas.

But the national picture is still ugly.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.29 million in December from 3.52 million in November. This is not seasonally adjusted and December is usually the lowest month of the year - and this decline was mostly seasonal.

Inventory levels are still well above normal even though the number of units For Sale has been falling for some time.

The second graph shows the year-over-year percentage change in inventory and the months of supply.

The second graph shows the year-over-year percentage change in inventory and the months of supply.Note the sharp increase in mid-2005 - that was one of the signals that helped me call the end of the boom phase of the housing bubble.

The YoY change has been negative since mid-2008, indicating that inventory is declining. However the months of supply is still above normal (usually 4 to 6 months), even with sales (the denominator) being pushed artificially high.

In a normal market, sales would be about 6% of owner occupied units per year, or close to 5 million units per year. Six months of inventory would be something under 2.5 million units - so at 3.3 million, the level of inventory is still a long way from normal. And this doesn't include all the various shadow inventory that will come on the market.

In a normal year, inventory starts to increase in January (many homeowners remove their homes from the market during the holidays). I wouldn't be surprised if the YoY change was no longer negative some time early in 2010. And I'd expect inventory levels to be above normal levels for an extended period.

BofA signs up for HAMP Second Lien Program

by Calculated Risk on 1/26/2010 06:32:00 PM

From BofA: Bank of America Becomes First Mortgage Servicer to Sign Contract for Home Affordable Second-Lien Modification Program

Bank of America announced that it is the first mortgage servicer to sign an agreement formally committing to participation in the pending second-lien component of the federal government's Home Affordable Modification Program (HAMP)And more from HousingWire: BofA Signs up as First Servicer for HAMP Second Lien Program

...

Bank of America has systems in place to begin implementing the Second Lien Modification Program (2MP) with the release of final program policies and guidelines by federal regulatory agencies, which is expected soon. 2MP will require modifications that reduce the monthly payments on qualifying home equity loans and lines of credit under certain conditions, including completion of a HAMP modification on the first mortgage on the property.

This program was announced in April 2009, and is still in process. Here are the guidelines for the HAMP 2nd lien program. I don't have high hopes for this program.

NY Times: AIG Hearing Preview

by Calculated Risk on 1/26/2010 03:49:00 PM

From the NY Times Dealbook: A Preview of the House’s A.I.G. Hearing

DealBook has obtained the prepared testimony of three of the witnesses called by the House Oversight and Government Reform Committee: Thomas C. Baxter, general counsel of the Federal Reserve Bank of New York; Stephen Friedman, the former chairman of the New York Fed, and Elias Habayeb, the former chief financial officer of A.I.G.Dealbook provides the statements of all three.

In his prepared remarks, Mr. Baxter defended the A.I.G. bailout, saying a bankruptcy by the insurer “would have had catastrophic consequences for our financial system and our economy.” He called the decision to rescue A.I.G. “a difficult one,” but one that the Fed’s policymakers felt compelled to make.The TARP Inspector General Neil Barofsky will also testify although Dealbook doesn't provide his statement. Barofsky's comments on the AIG bailout, the benefits to counterparties, and his investigations into possible misconduct will be closely scrutinized.

Mr. Baxter explained that the New York Fed felt compelled to pay out A.I.G.’s counterparties in full to unwind derivative contracts because “there was little time, and substantial execution risk and attendant harm of not getting the deal done by the deadline of Nov. 10,” when A.I.G. was scheduled to report its earning and could face downgrades from credit ratings agencies. That would have led to more collateral calls and even greater liquidity problems for A.I.G., Mr. Baxter said.

He added, “Even in a best-case scenario, we did not expect that the counterparties would offer anything more than a modest discount to par.” Under the circumstance, he said, “the Federal Reserve had little or no bargaining power.”

Oil Prices and China

by Calculated Risk on 1/26/2010 01:50:00 PM

Two weeks ago I suggested it might be time to start looking for signs of demand destruction for oil (like we did in the first half of 2008). So far domestic demand (as far as vehicle miles) is still increasing slightly, however demand growth in China might be slowing ...

From MarketWatch: Oil slumps on expected rise in supplies, China worries

Oil futures fell on Tuesday, pressured by concerns that China's attempt to slow its growth will curb demand and expectations that U.S. crude-oil supplies are rising.I think that needs a graph!

...

"China is really the driving force in this market," said Dan Flynn, energy trader at PFGBest.

...

Broad concerns about weak growth and demand globally were also heightened ahead of supply data due Tuesday and Wednesday, Flynn said.

"We still have an oil glut in the market place. All in all, [oil trading] should remain sideways to lower," he said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Shanghai SSE Composite Index and the Cushing, OK WTI Spot Price oil prices on a weekly basis (in blue).

The SSE Composite Index closed down 2.42% to 3,019.39 and oil prices are off from the recent high.

There appears to be a relationship between the two although the Shanghai Composite turned down in last 2007 and early 2008 - well before oil prices collapsed.

Case Shiller House Price Seasonal Adjustment

by Calculated Risk on 1/26/2010 11:11:00 AM

Case-Shiller released the November house price index this morning and most news reports focused on the small decrease, not seasonally adjusted (NSA), from October to November. As I noted earlier, the seasonally adjusted (SA) data showed a small price increase from October to November.

House price data has a clear seasonal pattern, and I think the headlines for this data should be the Seasonally Adjusted number.

The following graph shows the month-to-month change of the Case-Shiller Composite 10 index for both the NSA and SA data (annualized). Note that Case-Shiller uses a three-month moving average to smooth the data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Blue line is the NSA data. There is a clear seasonal pattern for house prices.

The red line is the SA data as provided by Case-Shiller.

The seasonal adjustment appears pretty good in the '90s, however it appears insufficient now. Still the SA data is probably a better indicator than the NSA data - and to be consistent I've kept reporting the SA data.

The second graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

NOTE: This is using the Seasonally Adjusted (SA) composite 10 series. The Stress Test scenarios use the Composite 10 index and starts in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and starts in December. Here are the numbers:

Case-Shiller Composite 10 Index, November: 157.66

Stress Test Baseline Scenario, November: 140.86

Stress Test More Adverse Scenario, November: 128.54

This puts house prices 12% above the baseline scenario and 22% above the more adverse scenario.

Case Shiller House Prices Increase Slightly in November

by Calculated Risk on 1/26/2010 09:00:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for November this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted data - some sites report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.4% from the peak, and up about 0.2% in November.

The Composite 20 index is off 29.5% from the peak, and up 0.2% in November.

NOTE: S&P reported this as "down", but they were using the NSA data. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 4.5% from November 2008.

The Composite 20 is off 5.3% from November 2008.

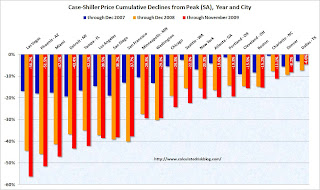

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

In Las Vegas, house prices have declined 56.2% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.6% from the peak. Several cities are showing price increases in 2009 including San Diego, San Francisco, Denver and Dallar. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

The impact of the massive government effort to support house prices led to small increases in prices over the Summer, and the question is what happens to prices as these programs end over the next 6 months. I expect further price declines in many cities.

Monday, January 25, 2010

ATA Truck Tonnage Index Increases in December

by Calculated Risk on 1/25/2010 11:11:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Jumped 2.1 Percent in December Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index climbed 2.1 percent in December, following a 2.6 percent increase in November. The latest gain boosted the SA index from 106.2 (2000=100) in November to 108.4 in December, its highest level since November 2008.As ATA Chief Economist Bob Costello noted, trucking benefited from the inventory correction, however he believes that is nearing completion.

...

ATA Chief Economist Bob Costello said that while tonnage jumped again on a month-to-month basis, the rate of increase may slow in the coming months. “The robust tonnage numbers in November and December were aided by better economic growth as well as a positive inventory effect,” Costello noted. “However, economic activity is expected to moderate in the current quarter, which will keep a lid on tonnage growth.”

...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

Obama to Propose Partial 3 Year Budget Freeze

by Calculated Risk on 1/25/2010 07:56:00 PM

From McClatchy Newspapers: Officials: Obama will propose three-year spending freeze

President Barack Obama will propose a three-year freeze in non-security discretionary spending, senior administration officials said Monday.This is an important issue, but I'd rather wait to address the deficit until after we see clear signs of a recovery.

His budget proposal, to be unveiled in part with Wednesday's State of the Union speech and in detail next week, will urge Congress to keep overall spending at $447 billion a year for agencies other than those charged with national security and mandatory-spending programs such as Social Security and Medicare.

The freeze would take effect with the 2011 fiscal year starting Oct. 1 ...

It also wouldn't affect a 154 billion [dollar] jobs plan pending before Congress and backed by Obama, the officials said. One aide said that plan would be exempt because it would take effect this year, before the freeze.

Administration officials, who spoke on the condition of anonymity to not upstage the president, said that the three-year freeze would save $250 billion over a decade — if it's approved by an election-year Congress.

After three years, the total spent would be the lowest as a percentage of the total economy in 50 years. Spending on those agencies has increased by an average of 5 percent a year since 1993, the officials said.

Note: I have a long history of being a deficit hawk, but I don't want to see a repeat of the mistakes of 1937, see: A comment on the Deficit and National Debt

Fed MBS Purchase Program 92% Complete

by Calculated Risk on 1/25/2010 05:38:00 PM

From the Atlanta Fed weekly Financial Highlights:  Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

[T]the agency MBS purchase program nears its goal of $1.25 trillion.The Fed purchased an additional $12 billion net in MBS over the last week, bringing the total to over $1.15 trillion or just over 92% complete.The Fed purchased a net total of $14 billion of agency-backed MBS through the week of January 13. This brings its total purchases up to $1.14 trillion, and by the end of the first quarter 2010 the Fed will purchase $1.25 trillion (thus, it is 91% complete).

And on the concerns about the Fed ending the MBS purchase program from David Cho, Neil Irwin and Dina ElBoghdady at the WaPo: Stakes are high as government plans exit from mortgage markets

The wind-down of federal support for mortgage rates, set to end in two months, is a momentous test of whether the Obama administration and the Federal Reserve have succeeded in jump-starting the housing market and ensuring it can hold its own. ...The Fed has already slowed the MBS purchases, and 30 year mortgage rates are still hovering around 5%. I expect no change to the FOMC statement on Wednesday concerning the MBS purchase program.

Keeping the mortgage rates at historic lows ... was viewed within the administration as a central plank of the economic strategy last year, senior officials said. ... the policy ... helped revitalize home buying in some parts of the country and put money in the pockets of millions of homeowners who were able to refinance into lower monthly payments, the officials added.

"We did what we thought was necessary to stabilize the market, but we don't think the government should continue special efforts forever," said Michael S. Barr, an assistant secretary at the Treasury Department. "As you bring stability, private participants come back in. We do expect this now that the market has stabilized. I'm not going to say there will be no effect on rates, but we do think you are seeing market signs and market signals that there should be an orderly transition."

...

Administration and Fed officials expressed confidence that rates will rise only modestly -- perhaps a quarter of a percentage point. They attribute their optimism to the lengthy notice they have given the market.

CRE and Moral and Social Constraints to Strategic Defaults

by Calculated Risk on 1/25/2010 03:03:00 PM

On Tishman Speyer and Blackrock's strategic default on Peter Cooper Village and Stuyvesant Town ...

From the WSJ:

The Stuyvesant Town deal is one of several Tishman Speyer did at the top of the market that the company is trying to save. But the company itself isn't threatened. It took advantage of easy credit and investors' eagerness to buy into real estate during the good times. As a result, it didn't put much of its own cash into deals.Yes, it was a highly leveraged deal with little money at risk. And the debt was secured based on fantasy proforma statements (not unlike many stated income borrowers).

Tishman and Blackrock tried for a loan modification, but when they couldn't obtain one on acceptable terms, they choose to walk away because the property is worth far less than they owe even though they could afford to continue to make the payments.

In research paper last year on homeowners with negative equity walking away: Moral and Social Constraints to Strategic Default on Mortgages by Guiso, Sapienza and Zingales, the authors wrote:

"[P]eople who know someone who defaulted are 82% more likely to declare their intention to do so." And "as defaults become more common", there is a "contagion effect that reduces the social stigma associated with default".

Imagine a homeowner who bought at the top, "took advantage of easy credit", put little or money down, and now finds themselves owing far more than the property is worth. And now imagine they hear of large landlords (or Morgan Stanley last year) just walking away from CRE loans. Does that reduce the social stigma and contribute to residential strategic defaults?

Update: Diana Olick at CNBC asks a similar question: Strategic Defaults

More on Existing Home Sales

by Calculated Risk on 1/25/2010 12:14:00 PM

Earlier the NAR released the existing home sales data for December; here are a few more graphs ...  Click on graph for larger image in new window.

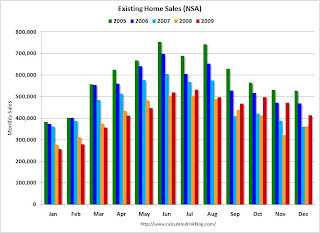

Click on graph for larger image in new window.

This graph shows NSA monthly existing home sales for 2005 through 2009 (see Red columns for 2009).

Sales (NSA) in December were much higher than in December 2007 and 2008.

The second graph shows existing home sales (left axis) through December, and new home sales (right axis) through November. The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent spike in existing home sales was due primarily to the first time homebuyer tax credit.

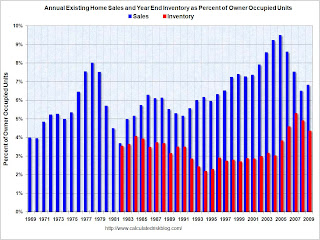

Eventually - when the housing market is more healthy - the ratio of existing to new home sales will probably return to the historical relationship. The third graph shows existing home sales and year end inventory as a percent of total owner occupied homes.

The third graph shows existing home sales and year end inventory as a percent of total owner occupied homes.

Both sales and inventory are above the normal range, although reported inventory has been declining for two years.

Both sales and inventory are being heavily impacted by government policies (boosting sales through tax credits and low mortgage rates, and limiting inventory through modification programs). There is probably a substantial "shadow inventory" that will come on the market, but the timing and size of the inventory are unknown.

The term "shadow inventory" is used in different ways. I consider all of the following to be "shadow inventory":

Probably the most important point to remember is that what matters for the economy and jobs is new home sales and residential investment. Until the excess housing inventory is reduced (both home and the rental units), new residential investment will be under pressure.REOs. There are bank owned properties that have not been put on the market yet. Foreclosures in process and seriously delinquent loans (although some of these may be in the modification process). New high rise condos. These properties are not included in the new home inventory report from the Census Bureau, and do not show up anywhere unless they are listed. Homeowners waiting for a better market. These are homeowners waiting for better market conditions to sell.

Existing Home Sales decline Sharply in December

by Calculated Risk on 1/25/2010 10:00:00 AM

The NAR reports: December Existing-Home Sales Down but Prices Rise; 2009 Sales Up

Existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 16.7 percent to a seasonally adjusted annual rate of 5.45 million units in December from 6.54 million in November, but remain 15.0 percent above the 4.74 million-unit level in December 2008.

For all of 2009 there were 5,156,000 existing-home sales, which was 4.9 percent higher than the 4,913,000 transactions recorded in 2008; it was the first annual sales gain since 2005.

...

Total housing inventory at the end of December fell 6.6 percent to 3.29 million existing homes available for sale, which represents a 7.2-month supply at the current sales pace, up from a 6.5-month supply in November.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Dec 2009 (5.45 million SAAR) were 16.7% lower than last month, and were 15% higher than Dec 2008 (4.74 million SAAR).

Of course many of the transactions in November were due to first-time homebuyers rushing to beat the initial expiration of the tax credit (that has now been extended). That pushed sales far above the historical normal level; based on normal turnover, existing home sales would be in the 4.5 to 5.0 million SAAR range.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.29 million in December from 3.52 million in November. The all time record high was 4.57 million homes for sale in July 2008.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.29 million in December from 3.52 million in November. The all time record high was 4.57 million homes for sale in July 2008. This is not seasonally adjusted and December is usually the lowest month of the year - so this decline is mostly seasonal.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 7.2 months in December.

A normal market has under 6 months of supply, so this is still high.

This decline was expected. I'll have more later ... but remember to ignore the median prices (that is distorted by the mix), and to focus more on new home sales than existing home sales.

Stuyvesant Town turned over to Creditors

by Calculated Risk on 1/25/2010 08:45:00 AM

A story we have been following since the property was purchased ...

From the NY Times: Huge N.Y. Housing Complex Is Returned to Creditors

The owners of Stuyvesant Town and Peter Cooper Village ... have decided to turn over the properties to creditors, officials said Monday morning.More from the WSJ: Tishman Venture Gives Up Stuyvesant Project

The decision by Tishman Speyer Properties and BlackRock Realty comes four years after the $5.4 billion purchase of the complexes’ 110 buildings and 11,227 apartments in what was the most expensive real estate deal of its kind in American history.

The venture acquired the 56-building, 11,000-unit property for $5.4 billion in 2006 ... By some accounts, Stuyvesant Town is only valued at $1.8 billion now ... all the equity investors—including the California Public Employees' Retirement System, a Florida pension fund and the Church of England—and many of the debtholders, including Government of Singapore Investment Corp., or GIC, and Hartford Financial Services Group, are in danger of seeing most, if not all, of their investments wiped out.