by Calculated Risk on 10/28/2009 03:17:00 PM

Wednesday, October 28, 2009

Report: The WaMu "Bank Run" Rumors were True

In July 2008 there were persistent rumors of a bank run at WaMu. According to a fascinating piece by Kirsten Grind at the Puget Sound Business Journal, the bank run was more than a rumor ...

From Ms. Grind: The downfall of Washington Mutual

To recreate WaMu’s final days, the Puget Sound Business Journal examined hundreds of pages of documents obtained through the Freedom of Information Act and interviewed dozens of former WaMu executives and employees, as well as government regulators and outside observers.There is much more in the article.

...

These interviews show that WaMu suffered through not one but two bank runs in its final months. ...

In early July 2008, hundreds of people lined up outside the headquarters of IndyMac Bank in Pasadena, Calif. ... Fearing the bank was on the verge of failure, customers were pulling out their money. The line stretched down the block. ...

Two blocks away, managers at a large, white-columned WaMu branch watched the commotion. Soon, their own customers began asking, “Is my money safe?”

...

Through a flurry of sometimes heated emails, managers ... worked out a rough plan. WaMu’s deposit team would forecast the potential size of a run, based on daily data about cash outflows. Branch managers would try to reassure anxious customers. ...

Despite these efforts, WaMu suffered a $9.4 billion run — seven times bigger than IndyMac’s. Southern California became the epicenter, although customers all around the country pulled out cash. Unlike IndyMac, however, WaMu executives kept the five-alarm fire under wraps. No lines formed down the block. No TV cameras splashed the news. Shareholders never knew, either.

emphasis added

Ms. Grind also notes that the Inspector General is expected to release a report on the WaMu failure soon.

Another Home Buyer Tax Credit Update

by Calculated Risk on 10/28/2009 12:53:00 PM

Yesterday I heard a compromise had been reached on extending and expanding eligibility for the home buyer tax credit, and that the housing tax credit would be attached to the extension of unemployment benefits, and that the Senate would vote today - and a House vote would follow shortly.

Hold on ...

Albert Buzzo at CNBC reports: Senate Vote On Home-Buyer Tax Credit Unlikely Today. Buzzo says there is "no chance" the Senate will vote today on the home buyer's tax credit.

There was hope last night that a vote on one of several versions might be voted on Wednesday but a battle over legislation extending unemployment benefits is taking priority and right now there's "no agreement" on that issue ...CNBC's Diana Olick provides the same details that I heard on the tax credit: A Compromise on Home Buyer Tax Credit? and adds:

[T]here may have been a bit of a revolt among Democrats who didn't want the controversial measure attached to the Unemployment Insurance bill.And from Andy Sullivan and Corbett Daly at Reuters:

Reid had wanted to attach a bill to extend the homebuyer credit as an amendment to a bill to lengthen insurance benefits for unemployed workers. The Senate voted 87-13 on Tuesday to take up the insurance benefit bill, but did not attach the homebuyer tax credit to the measure as Reid had wanted.As Ms. Olick concluded: "Stay tuned. It could all change dramatically."

Despite that apparent roadblock, Senate Finance Committee Chairman Max Baucus, who has been involved in negotiations over the tax credit, told Reuters late on Tuesday that he expected the Senate would vote on the bill sometime this week.

New and Existing Home Sales: The Distressing Gap

by Calculated Risk on 10/28/2009 11:30:00 AM

Note: For graphs based on the new home sales report this morning, please see: New Home Sales Decrease in September

This is obvious but worth stating: new home sales are far more important for employment and the economy than existing home sales. When an existing home is sold, the housing stock doesn't change, and the only direct contribution to the economy are the transaction costs. When a new home is sold, the housing stock of the nation increases, and there is a significant amount of spending on material and labor.

During the housing bust, new home sales fell much further than existing home sales (as a percent of sales). I've jokingly referred to the difference in percentage declines as the "Distressing" gap, because of all the distressed sales of existing homes.

More recently the gap has been supported by misdirected government policy.

Here is a graph of the "gap":  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through September.

I believe this gap was initially caused by distressed sales, but more recently the gap has also been widened as a result of the first-time home buyer tax credit.

The second graph shows the same information, but as a ratio for existing home sales divided by new home sales. The ratio is now at an all time record high.

The ratio is now at an all time record high.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio.

The ratio could decline because of an increase in new home sales, or a decrease in existing home sales - I expect a combination of both.

Although I think we've seen the bottom for new home sales, I think we will see further declines in existing home sales as the impact of the home-buyer tax credit wanes, and as we see fewer distressed sales in low priced areas.

New Home Sales Decrease in September

by Calculated Risk on 10/28/2009 10:00:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 402 thousand. This is a decrease from the revised rate of 417 thousand in August (revised from 429 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. Sales in September 2009 (31 thousand) were below September 2008 (35 thousand). This is the 3rd lowest sales for September since the Census Bureau started tracking sales in 1963.

In September 2009, 31 thousand new homes were sold (NSA); the record low was 28 thousand in September 1981; the record high for September was 99 thousand in 2005. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 22% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 22% above the low in January.

Sales of new one-family houses in September 2009 were at a seasonally adjusted annual rate of 402,000 ...And another long term graph - this one for New Home Months of Supply.

This is 3.6 percent (±10.2%)* below the revised August rate of 417,000 and is 7.8 percent (±12.0%)* below the September 2008 estimate of 436,000.

There were 7.5 months of supply in September - significantly below the all time record of 12.4 months of supply set in January.

There were 7.5 months of supply in September - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of September was 251,000. This represents a supply of 7.5 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, and new homes sales has probably also bottomed for this cycle. Sales were probably impacted by the end of the first-time home buyer tax credit (because of timing, new home sales are impacted before existing home sales).

New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of existing homes declines much further.

I'll have more later ...

MBA: Mortgage Applications Decrease

by Calculated Risk on 10/28/2009 08:32:00 AM

The MBA reports: Mortgage Applications Decrease

The Market Composite Index, a measure of mortgage loan application volume, decreased 12.3 percent on a seasonally adjusted basis from one week earlier. ...The purchase index is off almost 17% over the last 3 weeks, and the refinance index is off about 30%.

The Refinance Index decreased 16.2 percent from the previous week and the seasonally adjusted Purchase Index decreased 5.2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.04 percent from 5.07 percent, with points increasing to 1.25 from 1.13 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

It appears the post home buyer tax credit slump has started, although apparently the tax credit will be extended and the eligibility expanded - so the slump might be delayed ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

The Purchase index declined to 254.9, and the 4-week moving average declined to 280.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Tuesday, October 27, 2009

Report: GMAC in Talks for Bailout, and Summary

by Calculated Risk on 10/27/2009 08:23:00 PM

A busy day ... here is a summary:

Income eligibility for first-time home buyers stays at $75,000 for individuals, and $150,000 for couples. For move-up buyers, income eligibility is $125,000 for individuals and $250,000 for couples. There is a minimum 5 year residency requirement - in their current home - for move-up home buyers. The tax credit is the lesser of $7,290 or 10% of the purchase price. The credit runs from Dec. 1, 2009 to April 30, 2010, with an additional 60 day period to close escrow. (So end of April to sign contract, end of June to close escrow) Expect bill to be signed by Friday, packaged with the unemployment benefit extension.

Boston Properties Inc. ... reported Tuesday ... that gross rents declined 17% when comparing what new tenants are paying with the rent that had been paid by old tenants occupying that space. ... The results follow similar releases Monday by SL Green Realty Corp. (SLG), one of New York's largest office landlords, and Liberty Property Trust (LRY), of Malvern, Pa., which owns 700 properties including offices and light manufacturing.Earlier I posted some interesting comments from the Liberty Property Trust conference call.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and up about 1.0% in August.

The Composite 20 index is off 31.3% from the peak, and up 1.0% in August.

Prices increased in 16 of the 20 Case-Shiller cities.

Home Buyer Tax Credit to be Extended and Eligibility Expanded

by Calculated Risk on 10/27/2009 06:03:00 PM

UPDATE: I was told this is a done deal, but I haven't seen an announcement yet - so it might still change. The tax credit was expanded to move-up and higher income buyers. The amount of the credit was reduced to a maximum of $7,290.

From Bloomberg: Senate Close to Deal Replacing Homebuyer Tax Credit

The details:

This is obviously bad economics, but it must be good politics. The first-time home buyer impact will fade (and will probably cost over $100,000 per additional home sold). The move-up portion will probably be even less effective.

Apparently this tax credit will be combined with the extension of the unemployment benefits to avoid a veto (the real reason the extension was being held up).

Update on Housing Tax Credit

by Calculated Risk on 10/27/2009 03:56:00 PM

Here is more on the housing tax credit debate ...

First, from Reuters: Democrats Agree to Extend Home-Buyer Tax Credit: Dodd

"We're close, we're close but I can't get into any details until it's a done deal," said Republican Senator Johnny Isakson.I've heard reports that the "phase out" proposal is off the table, and the tax credit will run through April (backers of course will then try to extend it again). The latest report is the credit would be expanded with higher income limits, and would include certain move-up buyers (those who have lived in their current home for some number of years - perhaps five or more).

...

Dodd and Isakson want to extend the credit through June of next year and broaden it to anyone buying a primary residence, not just first-time buyers.

The details are changing constantly ...

CRE: Liberty Property Trust Conference Call Comments

by Calculated Risk on 10/27/2009 02:37:00 PM

Here are some comments worth reading for an understanding of the office and industrial CRE space from the Liberty Property Trust conference call. (ht Brian) Note: Liberty Property Trust owns both office and industrial properties.

LRY: During the third quarter we sold $63 million in operating properties at a 9.5% cap rate.That is worth reading twice. Rents fell off a cliff in Q3, and the are projecting a significant decline over the next year. Combine that with double digit cap rates - and that means a serious decline in property values. UPDATE: the decline in rents in Q3 was in the pipeline: "[F]rom our perspective, what this quarter is showing is the effect of leases signed this year finally commencing and you seeing what's happening to the rents. So what you're seeing today is the effect of the decline in the rents over the over the first three quarters of the year."

With respect to dispositions for 2009 through the end of the third quarter, we have sold $145 million in assets. We think the total for the year will be approximately $175 million. We see less activity for us in the sales area in 2010. We anticipate sales activity in 2010 to be in the 75 to $125 million range. The cap rate on these sales will be in the 9 to 11% range.

And the final item to discuss, the most significant, what do we expect for the same-store group of properties which represent over 90% of our revenue? For the first six months of 2009, rents for renewal and replacement leases increased by 2.8%. For the third quarter they decreased by 13.9%. We expect this third quarter experience to repeat itself for the balance of 2009 and for 2010. We are projecting that rents for 2010 will decrease by 10 to 15% on a straightline basis.

emphasis added

LRY: In the second quarter we reported a pickup in [leasing] activity, more prospects and more tenants willing to make decisions, decisions which include taking advantage of real estate markets or advantageous rates. This trend continued in the third quarter where we signed leases for 3.5 million square feet of new, renewal and development pipeline space and 207 transactions. While there are deals in the market, there is clearly a bifurcation among landlords between the haves and the have-notes in terms of capital. Prospects and brokers are more concerned about a landlord's ability to deliver on its promises.And from the Q&A:

Although the troubled tenant phenomenon has significantly abated, leasing space is very much a deal by deal balancing act. The reality of the market is that the downward rental pressure is the norm, and most leases today are being signed at 10 to 15% below expiring rates. Pressure is more acute on new leases than on renewals. Concessions are primarily free rent and lower base rent. And tenant improvements are lower on renewals than replacement leases, but overall credit drives tenant improvement dollars. On the whole, market demand is well below that of a year ago. Most tenants are renewing and are either staying the same size or downsizing of the very few are expanding. In our markets, the average size of a new office and industrial lease is smaller by about 13%. In spite of weaker demand and lower rents, 85% of the renewals, and 90% of new leases contained contractual rent bumps, of 2% to 3% per year.

Analyst: Can you talk about what you might be looking for in terms of acquisitions from either by asset or market or return expectation?In their view, lenders are dealing with condos, hotels and some retail. Those are the most overbuilt areas of commercial real estate.

LRY: We've been following this fairly closely in a variety of ways, and it's pretty clear to us that what's happening to us in the market right now, is that the lending world, the banks, are dealing with an inflow of troubled real estate loans. What they're dealing with most immediately are condo projects, hotel projects, and a smattering of retail. There has been limited amount of office and industrial product that has kind of gotten into the -- all the way into the distress category and where the banks are taking it over. We think, though, that that might happen, that some product might get to that point and get recycled. Candidly I think the same lag effect with distress on these properties. These lenders are only gearing up sort of right now. There was one that somebody we talked to had 10 people in a workout unit and now they're up to 100. So they're kind of getting their arms around it.

Analyst: I just want to hear more on what's driving your viewpoint that industrial will rebound quicker than office.

LRY: The industrial space is going to respond to somewhat better consumer confidence. It's going to respond to increased trade activity. It's going to respond to any degree of stabilization in the housing market generally. So as the economy gets better, it's the easiest thing you can do, and you can do it very quickly, is put material back on racks in the warehouse and build up inventories. It takes employment increases to begin to put new seats -- new bodies in seats in offices. And given that the September job number still was a negative 263,000, that is to say we have yet to see a positive monthly job number, it just feels like that, that hiring aspect is a ways off, and once it starts, and we talked a little bit about this in some prior calls we think there is some amount of shadow space in the market, that is really manifesting itself in, you know, sort of every fifth desk in an office building is empty because of hiring freezes and job cuts over the last year and a half. So even when companies begin to hire we think they're going to first fill that desk before they need new space. And I think -- I think you really see the evidence of that, that is the shadow space, when you look at the average size of an office renewal in the markets we're in, I'm not talking about Liberty's performance, I'm talking about what is happening in the markets, and the average size of leases is down, which I think represents the fact that as leases expire and people come into the market, even to renew or to take a new space or taking less space than they had. Hence, the very significant absorption numbers we've seen in office. I think the way this plays out, materials back on racks in warehouses, I think that is why we're seeing some activity in the flex space. Because again that can be a smaller distribution play in a market. It can also be more of a tech company or a bio-tech kind of company, but that the classic office worker will be the last piece of this puzzle to come back into focus.

Analyst: What sort of job growth assumptions are in your occupancy target for next year. We're still bleeding jobs. If we have zero net jobs in the US next year do you think you hit your occupancy target?

LRY: Let me first talk about the job assumption number and then the question about the occupancy. Our opinion on this is that unfortunately we're going to see pretty timid job numbers. I think it's even conceivable that we have one or two more months of job losses. Our guess earlier this year was that we might hit 8 million jobs lost and we're at 7.3 so far, and jobs might not go positive until the beginning of next year, and I think you're going to see modest job numbers. You know, the kind of numbers that, you know, don't even keep up with population growth. So and as I said, and this is important in our thinking, we do believe that there is some amount of shadow space out there, that will eat up demand even when it begins to happen, so I think there's a quarter or two of lag in the office even when the job numbers get better before you start seeing it turn into positive absorption. So all of that net is we're assuming -- we're not looking for job growth to significantly affect our occupancy next year. We're looking at this plus or minus 1%, as a number that is consistent with where we see the world.

Home-Buyer Tax Credit and Unemployment

by Calculated Risk on 10/27/2009 01:53:00 PM

From the NY Times: The Case for More Stimulus. Excerpt:

... Washington is not providing a coherent plan for effective stimulus. The Senate has been hamstrung for nearly a month over the most basic relief-and-recovery boost: an extension of unemployment benefits. The Obama administration has called for an expensive crowd-pleaser of dubious effectiveness: sending every Social Security recipient an extra $250.It is hard to understand why the next round of stimulus should include any extension of the home-buyer tax credit. It has a minimal impact on unemployment, it is poorly targeted, and as the NY Times notes "It's waste".

...

Other measures being floated are less effective than unemployment benefits and aid to states. Many of the $250 checks to Social Security beneficiaries will not be spent quickly, because many recipients have no pressing need for the extra money. Proposals by some lawmakers to extend and expand the $8,000 tax credit for first-time homebuyers are even less well targeted. Since it was enacted in February, only an estimated 15 percent of buyers who claimed the credit needed the money to make the purchase. It’s not stimulus when you pay people to do something they would have done anyway. It’s waste.

emphasis added

Meanwhile, the AP is reporting of potential "massive" teacher layoffs in Arizona, and Tom Abate at the San Francisco Chronicle reports the underemployment rate in California is 21.9%: Underemployed compound state's jobless troubles:

The state Employment Development Department estimates that this underemployment rate hit 21.9 percent in September.The best help for the housing market is reducing unemployment and thereby encouraging new household formation. New household formation is always low during a recession as people double up or move into their parent's basements. Once these people become confident in their employment prospects, they will be looking to move out of the basement - excluding of course Matthew McConaughey's character in "Failure to Launch".

That figure includes 1.9 million jobless Californians, 1.4 million people who had to work part time, and 865,000 adults loosely described as discouraged.

"Underemployment is at the highest level since we started keeping these records in 1994," said economist Sylvia Allegretto of the Institute for Research on Labor and Employment at UC Berkeley.

Note: Reuters has more on the current status of the tax credit: Where's Home-Buyer Tax Credit Headed in the House, Senate?

Lawmakers in the Senate are debating whether to extend it, or even expand it, and a vote could come as early as Tuesday. The House, which would also need to approve the measure, has yet to act.

House Prices: Stress Test and Price-to-Rent

by Calculated Risk on 10/27/2009 10:35:00 AM

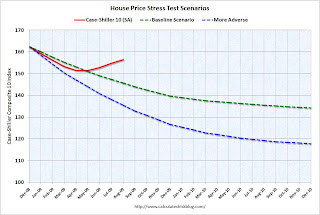

This following graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index (SA), August: 156.4

Stress Test Baseline Scenario, August: 145.6

Stress Test More Adverse Scenario, August: 135.5

House prices are 7.4% higher than the baseline scenario, and 15% higher than the more adverse scenario.

There were three key economic stress test parameters: house prices, GDP and unemployment. Both house prices and GDP are performing better than the baseline scenario, and unemployment is performing worse than both stress test scenarios.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through August 2009 using the Case-Shiller Composite Indices (SA): Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices. For rents, the national Owners' Equivalent Rent from the BLS is used.

At the peak of the housing bubble it was obvious that prices were out of line with fundamentals. Now most of the adjustment in the price-to-rent ratio is behind us. It appears the ratio is still a little high, and I expect some further decline in prices - especially with rents now falling.

The BLS reported for September:

The increase [in CPI] occurred despite declines in the indexes for rent and owners' equivalent rent, the first decreases in those indexes since 1992.The decrease in OER was at an annual rate of 1.7% and based on media reports, and apartment surveys, it appears rents will continue to decline for some time. This will push up the price-to-rent ratio unless house prices fall.

Note: some would argue the price-to-rent ratio being a little too high is reasonable based on mortgage rates and "affordability".

Case-Shiller Home Price Index Increases in August

by Calculated Risk on 10/27/2009 09:15:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for August this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted data - some sites report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and up about 1.0% in August.

The Composite 20 index is off 31.3% from the peak, and up 1.0% in August. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 10.7% from August 2008.

The Composite 20 is off 11.4% from August 2008.

This is still a very significant YoY decline in prices.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (SA) in 16 of the 20 Case-Shiller cities in August.

Prices increased (SA) in 16 of the 20 Case-Shiller cities in August.

In Las Vegas, house prices have declined 55.6% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.8% from the peak - and up in 2009. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

The debate continues - is the price increase because of the seasonal mix (distressed sales vs. non-distressed sales), the impact of the first-time home buyer frenzy on prices, less supply because of modifications and the general slowdown in the foreclosure process, or have prices actually bottomed? My guess is we will see further house price declines in many areas.

I'll compare house prices to the stress test scenarios soon.

Case-Shiller Composite 20 Home Price Index Increases 1.2% in August

by Calculated Risk on 10/27/2009 09:10:00 AM

From MarketWatch: U.S. home prices rise 1.2% in Aug.: Case-Shiller

The market value of U.S. homes in 20 major cities rose by 1.2% compared with July [not seasonally adjusted] ... In August prices rose in 17 of 20 citiesJust headlines ... I'll post graphs after the data is released online.

Johnson and Kwak: The home-buyer tax credit: Throwing good money after bad

by Calculated Risk on 10/27/2009 08:18:00 AM

While we wait for the August Case-Shiller house prices ...

Simon Johnson and James Kwak write in the WaPo: The home-buyer tax credit: Throwing good money after bad.

What happens when you artificially prop up housing prices? Imagine the credit were expanded to all home buyers and made permanent. This would simply boost housing prices at the low end of the market by close to $8,000, since all buyers would be willing to pay $8,000 more. (Prices would rise by a little less than $8,000 because at higher prices, more people would be willing to sell.) Whom does this benefit? Not first-time home buyers. It benefits people who already own houses (and their real estate agents) because it's a one-time boost in housing values. This would be just the latest chapter in a long history of government policies to boost housing prices -- the mortgage interest tax deduction, the capital gains exclusion on houses, the extension of the mortgage interest tax deduction to second houses, etc. Each of these policies pushes up prices just once; if you want to keep pushing up housing prices, you have to keep adding sweeteners.

A temporary tax credit has a similar effect, but for a shorter period of time. It boosts the price of a transaction that would have happened anyway. It may create additional transactions, but is that a good thing? If someone could not have afforded a house without the tax credit, then what is he or she going to do when the tax credit goes away and the price of the house falls? In effect, the tax credit is a way of making houses temporarily affordable that would not otherwise be affordable, and we know where that leads.

emphasis added

Monday, October 26, 2009

A Little Good News for Retail CRE in Britain

by Calculated Risk on 10/26/2009 10:14:00 PM

From The Times: Land Securities calls halt to softer retail rent deals as demand rises

Francis Salway, the chief executive of Land Securities [Britain’s biggest property developer], said that he would no longer offer rental deals amid signs of increasing demand for space. ... "[W]e do not believe across-the-board changes to agreed contracts are appropriate.”Rents might fall further - because of high vacancy rates - but it seems there is some increase in demand, and Land Securities is no longer willing to offer across-the-board concessions to existing contracts (but they will cut deals in special cases).

...

A spokesman for British Land, the UK’s second-biggest property company, said: "British Land is seeing more demand from new and existing tenants. ..."

Of course the "good news" is relative ... the retail vacancy rate in the U.K. is up significantly from last year - From RetailWeek: Vacancy rates almost treble

Vacant shops on the UK high street have almost trebled in the last year from just over 4 per cent to 12 per cent at the end of June.

Big cities such as Liverpool, Leeds and Derby are now suffering over 20 per cent vacancy rates ...

CRE Prices: Healthy and Distressed

by Calculated Risk on 10/26/2009 06:59:00 PM

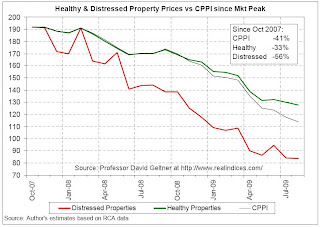

Last week it was reported CRE prices were off 41% according to the Moodys/REAL Commercial Property Price Index (CPPI).

MIT Professor David Geltner discusses the index and the differences between price declines for healthy and distressed properties: Where we are in the aggregate: A two-year anniversary ... (pdf)

Note: Dr. Geltner's column appears on Real Estate Analytics LLC website on the lower right under "Professor's Corner".

From Dr. Geltner:

August 2009 marks the two-year anniversary of the CPPI’s “real peak”, that is, the price index peak adjusted for inflation (the nominal peak was two months later). To celebrate, the CPPI fell for the eleventh month in a row, dropping another 3.5 points, or 3%, to a value just above 114, down from 192 in October 2007. Through August the index is down 29% in 2009, 33% over the past 12 months, and close to 41% since that 192 value in October 2007. The current index level of 114 implies average market transaction prices in August 2009 at levels where they were in the spring of 2003.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from Dr. Geltner shows the price declines for healthy and distressed properties.

Based on the same repeat-sales database as the CPPI, the chart uses RCA’s identification of “troubled assets” to produce separate indices of “healthy” and “distressed” property price movements since the October 2007 peak. The chart reveals that, through August 2009, while the overall CPPI has dropped 41%, “distressed” properties (indicated by the RCA “troubled asset” designation) have dropped 56%, while “healthy” properties (those not flagged by the RCA “troubled asset” designation) have dropped “only” 33%.** See Dr. Geltner's piece for a description of the methodology.

The chart of the “healthy” and “distressed” property price movements since the peak provides a compelling visualization of the bifurcation in the U.S. commercial property market that many industry participants have noted anecdotally.There is much more in the piece.

...

Sales of “healthy” properties has remained nearly stagnant. Distressed property transactions made up a record 25% of the repeat-sales observations in the August CPPI.

SF Fed: Recent Developments in Mortgage Finance

by Calculated Risk on 10/26/2009 03:30:00 PM

From San Francisco Fed Senior Economist John Krainer: Recent Developments in Mortgage Finance

As the U.S. housing market has moved from boom in the middle of the decade to bust over the past two years, the sources of mortgage funding have changed dramatically. The government-sponsored enterprises—Fannie Mae, Freddie Mac, and Ginnie Mae—now own or guarantee an overwhelming share of originations. At the same time, non-agency mortgage securitization and loans retained in lender portfolios have largely dried up.

Click on graph for slightly larger in new window.

Click on graph for slightly larger in new window.This is figure 3 from the Economic Letter. This shows the surge in non-agency securitized loans, and loans held in bank portfolios, in 2004 through 2006 (the worst loans).

[T]he sources of mortgage finance have shifted as the housing market has gone from boom to bust. Figure 3 plots the evolution of these funding sources over the past decade. Fannie Mae and Freddie Mac combined have consistently been the largest players in the market, owning or guaranteeing about half or more of the mortgages in the sample at any given time. Non-agency securitization peaked in the first quarter of 2006, when it accounted for nearly 40% of new originations. Finally, the share of mortgages retained in the originating institution's portfolio averaged about 15% throughout the boom, but has fallen considerably since.Although Krainer doesn't mention it, notice the increase in bank portfolio loans in early 2007 - that was probably because the banks were stuck with loans when the securitization market seized up.

...

In the present day, when Ginnie Mae's activities are included, the three GSEs are providing unprecedented support to the housing market—owning or guaranteeing almost 95% of the new residential mortgage lending.

Krainer concludes:

With the vast majority of current mortgage lending now intermediated in some form by the GSEs, it will be difficult for the housing market to return to normal.Note: Tanta wrote this last year on the naming of the GSEs: On Maes and Macs. An excerpt:

Trivia buffs will know that once upon a time there were three "agencies": the Government National Mortgage Association, the Federal National Mortgage Association, and the Federal Home Loan Mortgage Corporation. It didn't take all that long for market participants to start coming up with pronunciations for the abbreviations GNMA (Ginnie Mae), FNMA (Fannie Mae), and FHLMC (Freddie Mac, which makes no sense whatsoever except that nobody liked "Filly Mac." ... Old farts whose favorite childhood treat was a box of Pixies will remember the old-time candy company Fannie May, whose name is said to have inspired the whole thing, probably in the throes of a major sugar rush.

Report: First Time Homebuyer Tax Credit to be Phased Out

by Calculated Risk on 10/26/2009 01:01:00 PM

Update: The Reid/Baucus proposal is to extend the tax credit and phase it out over 2010. The credit would be $8,000 through the end of Q1 2010, and decline $2,000 per quarter after that ... ($6,000 in Q2, $4,000 in Q3, $2,000 in Q4 2010)

From Bloomberg: Housing Tax Credit Probably Won’t Be Extended in U.S., ISI Says

“There could be an agreement reached as early today on the Reid/Baucus amendment that would PHASE OUT (not extend, as we originally understood when the idea was first proposed last week) the home buyer tax credit,” ISI analysts said in the note.We should know more soon. Most economists oppose an extension of the tax credit because it is poorly targeted, very expensive per additional home sold, there was little job creation, fraud was widespread, and there are many serious unintended consequences.

ATA Truck Tonnage Index Declines in September

by Calculated Risk on 10/26/2009 11:28:00 AM

From the American Trucking Association: ATA Truck Tonnage Index Slipped 0.3 Percent in September Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.3 percent in September, after increasing 2.1 percent in both July and August. The latest decline lowered the SA index to 103.9 (2000=100). ...Trucking has benefited from some inventory restocking, and exports - two key positive areas for the economy, however further growth will probably be "modest" and "choppy" until there is a pickup in domestic end demand.

Compared with September 2008, SA tonnage fell 7.3 percent, which was the best year-over-year showing since November 2008. In August, the index was down 7.5 percent from a year earlier.

ATA Chief Economist Bob Costello said that the latest reading fits with the premise that the recovery will be moderate and choppy. “The trucking industry should not be alarmed by the very small decrease in September,” Costello noted. “We took two steps forward in July and August and this was a miniscule step backward.” He added that the industry should be prepared for ups and downs in the months ahead, but the general trend should be modest improvement. ...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.2 billion tons of freight in 2008. Motor carriers collected $660.3 billion, or 83.1 percent of total revenue earned by all transport modes.

Chicago Fed Index: Near Pre-Recession Levels

by Calculated Risk on 10/26/2009 08:50:00 AM

From the Chicago Fed: Index shows economic activity approaching pre-recessionary levels

The Chicago Fed National Activity Index was –0.81 in September, down from –0.65 in August. Three of the four broad categories of indicators made negative contributions to the index in September, but the production and income category made a positive contribution for the third consecutive month.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"At –0.63 in September (up from –0.96 in the previous month), the index’s three-month moving average, CFNAI-MA3, suggests that growth in national economic activity was below its historical trend. However, the CFNAI-MA3 in September improved to a level greater than –0.7 for the first time since the early months of this recession. For the four previous recessions, the first month when the CFNAI-MA3 was above –0.7 coincided closely with the end of each recession as eventually determined by the National Bureau of Economic Research."

This index suggests that the official recession might be over. However the index is still fairly weak.