by Calculated Risk on 10/27/2009 10:35:00 AM

Tuesday, October 27, 2009

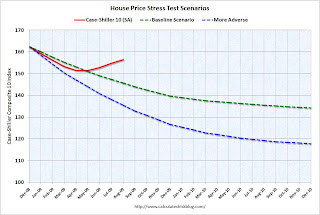

House Prices: Stress Test and Price-to-Rent

This following graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index (SA), August: 156.4

Stress Test Baseline Scenario, August: 145.6

Stress Test More Adverse Scenario, August: 135.5

House prices are 7.4% higher than the baseline scenario, and 15% higher than the more adverse scenario.

There were three key economic stress test parameters: house prices, GDP and unemployment. Both house prices and GDP are performing better than the baseline scenario, and unemployment is performing worse than both stress test scenarios.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through August 2009 using the Case-Shiller Composite Indices (SA): Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices. For rents, the national Owners' Equivalent Rent from the BLS is used.

At the peak of the housing bubble it was obvious that prices were out of line with fundamentals. Now most of the adjustment in the price-to-rent ratio is behind us. It appears the ratio is still a little high, and I expect some further decline in prices - especially with rents now falling.

The BLS reported for September:

The increase [in CPI] occurred despite declines in the indexes for rent and owners' equivalent rent, the first decreases in those indexes since 1992.The decrease in OER was at an annual rate of 1.7% and based on media reports, and apartment surveys, it appears rents will continue to decline for some time. This will push up the price-to-rent ratio unless house prices fall.

Note: some would argue the price-to-rent ratio being a little too high is reasonable based on mortgage rates and "affordability".