by Calculated Risk on 12/26/2020 07:04:00 PM

Saturday, December 26, 2020

December 26 COVID-19 Test Results; Be Careful with Holidays Numbers

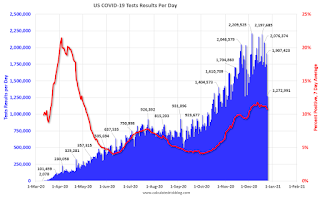

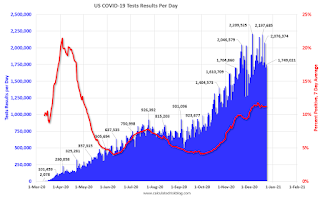

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 2,133,757 test results reported over the last 24 hours.

There were 189,268 positive tests.

Almost 64,000 US deaths have been reported so far in December, surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.9% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

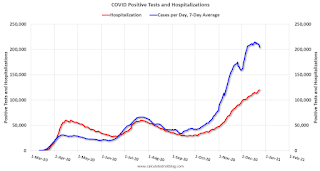

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

Schedule for Week of December 27, 2020

by Calculated Risk on 12/26/2020 08:11:00 AM

Happy New Year! Wishing you all the best in 2021.

Note: If the government shuts down, some government data will be delayed (the DOL initial weekly unemployment claims was still released during the last shutdown). All Fed Reserve data will still be released.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 7.2% year-over-year increase in the National index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:45 AM: Chicago Purchasing Managers Index for December.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.2% increase in the index.

8:30 AM: The initial weekly unemployment claims report will be released.

All US markets will be closed in observance of the New Year's Day Holiday.

Friday, December 25, 2020

December 25 COVID-19 Test Results; Holiday Decline in Numbers

by Calculated Risk on 12/25/2020 07:16:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,272,991 test results reported over the last 24 hours.

There were 124,498 positive tests.

Over 62,000 US deaths have been reported so far in December, surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.8% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

Ten Economic Questions for 2021

by Calculated Risk on 12/25/2020 01:11:00 PM

Here is a review of the Ten Economic Questions for 2020

Below are my ten questions for 2021. These are just questions, I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2021, and if there are surprises - like in 2020 - to adjust my thinking.

1) Economic growth: Economic growth was probably around negative 3% in 2020 due to the pandemic (maybe 2.5% Q4 over Q4). The FOMC is expecting growth of 3.7% to 5.0% Q4-over-Q4 in 2021. How much will the economy grow in 2021?

2) Employment: Through November 2020, the economy lost 9.37 million jobs. By April 2020, the economy had lost 21.7 million jobs, and then added back 12.33 million jobs by November. But job growth slowed over the last few months. Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

3) Unemployment Rate: The unemployment rate was at 6.7% in November, up 3.2 percentage points year-over-year, but down from the peak of 14.7% in April. Currently the FOMC is forecasting the unemployment rate will be in the 4.7% to 5.4% range in Q4 2021. What will the unemployment rate be in December 2021?

4) Participation Rate: In November 2020, the overall participation rate was at 61.5%, down year-over-year from 63.2% in November 2019. Long term, the BLS has been projecting the overall participation rate will decline to 61.2% by 2028 due to demographics. Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

5) Inflation: Core PCE was only up 1.4% YoY through November. Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

6) Monetary Policy: The Fed cut rates to zero in 2020 in response to the pandemic, and has signaled they will be on hold for some time. Will the Fed raise rates in 2021? Will the Fed end - or taper - the asset purchase program?

7) Residential Investment: Residential investment (RI) was solid in 2020, and housing was a strong sector during the pandemic. Through November, starts were up 7.0% year-over-year compared to the same period in 2019. New home sales were up 19.1% year--to-date through November. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2021? How about housing starts and new home sales in 2021?

8) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up around 8% to 9% in 2020. What will happen with house prices in 2021?

9) Housing Inventory: Housing inventory decreased sharply in 2020 to record lows. Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

10) Economic Scarring: Some sectors were hit especially hard during the pandemic, like travel (hotels, airlines, cruise ships), and entertainment (restaurants, theaters, concerts). Also some areas of Commercial Real Estate (retail, hotels, offices) might suffer long term damage. How much damage did the pandemic do to certain sectors?

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

A Christmas Present for UberNerds

by Calculated Risk on 12/25/2020 08:11:00 AM

NOTE: If you are not familiar with Tanta, please read about her here. You will be happy you did - she was amazing.

A special present for UberNerds - an unpublished Tanta post written Dec 31, 2007: (I did post this for Christmas once before)

And from Tanta's 2007 Post: A Very Nerdy Christmas (see her post for an explanation of the origins of the Mortgage Pig™)Pig Rulz

There have been some misconceptions in the comments about Mortgage Pig™. I do not wish to enter a new year on the wrong track.

Mortgage Pig™ does not have a "name" except Mortgage Pig™. Assertions about Mortgage Pig™'s "name," "address," "job," "significant other," or favorite swill are not canonical. Anyone who asserts knowledge of such things in any communication, written or otherwise, is creating an Internet Urban Legend. Next thing you know they'll be telling you that you can Get Rich Qwik in RE investing.

Happy Holidays to all! CR

Thursday, December 24, 2020

December 24 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 12/24/2020 07:16:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,889,205 test results reported over the last 24 hours.

There were 199,375 positive tests.

Almost 61,000 US deaths have been reported so far in December, surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.6% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

Hotels: Occupancy Rate Declined 26.4% Year-over-year

by Calculated Risk on 12/24/2020 02:23:00 PM

From HotelNewsNow.com: STR US hotel results for week ending 19 December

U.S. weekly hotel occupancy decreased slightly from the previous week, according to the latest data from STR through 19 December.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

13-19 December 2020 (percentage change from comparable week in 2019):

• Occupancy: 36.8% (-26.4%)

• Average daily rate (ADR): US$85.50 (-21.9%)

• Revenue per available room (RevPAR): US$31.45 (-42.5%)

The industry also surpassed one billion unsold room nights for the first time on record.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect the occupancy rate to decline into the new year.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Since there is a seasonal pattern to the occupancy rate - see graph above - we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

This suggests no improvement over the last 3 months.

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

| 11/21 | -32.6% |

| 11/28 | -28.5% |

| 12/5 | -37.9% |

| 12/12 | -37.4% |

| 12/19 | -26.4% |

Review: Ten Economic Questions for 2020

by Calculated Risk on 12/24/2020 09:37:00 AM

Every year, I've posted a disclaimer that a recession could be caused by "An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons" (emphasis added).

Unfortunately 2020 saw one of those "low probability" events, and many of my predictions weren't even close. In a way, this is the point of the predictions. I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong. As an example, when the pandemic hit, I switched from being mostly positive on the economy to calling a recession in early March.

At the end of last year, I posted Ten Economic Questions for 2020. I followed up with a brief post on each question. Here is review (we don't have all data yet, but enough). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2020: Will housing inventory increase or decrease in 2020?

"Since I don't expect any change in fiscal policy during an election year, and monetary policy appears to be on hold - and I don't expect either a strong pickup in the economy (and higher rates) or an economic slump - it seems likely inventory will remain at about the same level through 2020."According to the November NAR report on existing home sales, inventory was down 22% year-over-year in November, and the months-of-supply was at a record low 2.3 months. In 2020, inventory really declined due to a combination of potential sellers keeping their properties off the market during a pandemic, and a pickup in buying due to record low mortgage rates, a move away from multi-family rentals and strong second home buying (to escape the high-density cities).

9) Question #9 for 2020: What will happen with house prices in 2020?

"If inventory remains at close to the same level, it seems likely that price appreciation will increase from the 2019 pace to the mid-single digits."The CoreLogic data for October showed prices up 7.3% year-over-year. The September Case-Shiller data showed prices up 7.0% YoY. With inventory lower than expected, house prices picked up more than expected.

8) Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

"My sense is the pickup that happened in the second half of 2019 will continue, and my guess is starts will be up year-over-year in 2020 by mid-to-high single digits. My guess is new home sales will be over 700 thousand in 2020 (for the first time since 2007) and will also be up mid-to-high single digits."Through November, starts were up 7.0% year-over-year compared to the same period in 2019. New home sales were up 19.1% year--to-date through November. Even with the pandemic, my guess was pretty close on starts - but new home sales were up much more than expected.

7) Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

"My guess is the Fed will stay on hold in 2020 and the FOMC will keep the federal funds rate at 1‑1/2 to 1-3/4 percent."With the onset of the pandemic, the Fed lowered rates to zero in March:

"In light of these developments, the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent."6) Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

"although I think core PCE inflation (year-over-year) will increase a little in 2020 (from the current 1.6%), I think too much inflation will still not be a serious concern in 2020."According to the November Personal Income and Outlays report, the November PCE price index increased 1.1 percent year-over-year and the November PCE price index, excluding food and energy, increased 1.4 percent year-over-year. Inflation was lower than expected, and definitely not a concern in 2020.

5) Question #5 for 2020: How much will wages increase in 2020?

I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase to the mid 3% range in 2020 according to the CES.With the pandemic, and the layoffs of many lower wage employees, the wage data isn't very useful in 2020.

4) Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

I expect the overall participation rate to decline in 2020 to just under 63% by the end of the year.The participation rate declined sharply with the pandemic, and the Labor Force Participation Rate was at 61.5% in November.

3) Question #3 for 2020: What will the unemployment rate be in December 2020?

it appears the unemployment rate will decline into the low 3's by December 2020 from the current 3.5%The unemployment rate increased sharply with the pandemic, and the unemployment rates was at 6.7% in November.

2) Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

"my forecast is for gains of around 125,000 to 150,000 payroll jobs per month in 2020 (about 1.5 million to 1.8 million year-over-year) . This would be the fewest job gains since 2010, but another solid year for employment gains given current demographics."Employment decreased sharply with the pandemic, and in November the year-over-year change was negative 9.19 million jobs.

1) Question #1 for 2020: How much will the economy grow in 2020?

These factors suggest real GDP growth probably in the 2% to 2.5% range in 2020.With the pandemic, it appears GDP will be down around 2.5% to 3.0% in 2020.

In 2020, with the impact of the pandemic, many of my predictions weren't close - especially employment and GDP.

Wednesday, December 23, 2020

December 23 COVID-19 Test Results; Record Hospitalizations, December Now Deadliest Month

by Calculated Risk on 12/23/2020 07:04:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,749,021 test results reported over the last 24 hours.

There were 220,834 positive tests.

Almost 58,000 US deaths have been reported so far in December, surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.6% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

A few Comments on November New Home Sales

by Calculated Risk on 12/23/2020 12:23:00 PM

New home sales for November were reported at 841,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised down sharply.

This was well below consensus expectations of 990,000, but sales were still up 20.8% from November 2019. The last five months were the highest sales rates since 2006.

Earlier: New Home Sales decrease to 841,000 Annual Rate in November.

Click on graph for larger image.

Click on graph for larger image.This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were up 20.8% year-over-year (YoY) in November. Year-to-date (YTD) sales are up 19.1% (This is even above my optimistic forecast for 2020!).

And on inventory: since new home sales are reported when the contract is signed - even if the home hasn't been started - new home sales are not limited by inventory (except if no lots are available). Inventory for new home sales is important in that it means there will be more housing starts if inventory is low (like right now) - and fewer starts if inventory is too high (not now).