by Calculated Risk on 3/06/2020 06:27:00 PM

Friday, March 06, 2020

High Frequency Data: Movie Box Office

There are some sectors that will be hit hard over the next several months: hotels, airlines, restaurants, movie theaters, sporting events, and convention centers. People will probably avoid these places as part of social distancing.

I already track weekly hotel occupancy data from STR, and the occupancy data is starting to show some impact from COVID-19. I'll also be posting updates on monthly visitor and convention traffic in Las Vegas.

For high frequency data, I'm going to start tracking domestic box office numbers from Box Office Mojo every Friday.

This data shows cumulative domestic box office for this year (red) and the previous four years.

This data is through the week ending March 5, 2020.

There are many factors impacting box office numbers, but this will give an idea if people are avoiding theaters.

Currently 2020 is tracking close to 2019.

Q1 GDP Forecasts: 0.7% to 3.1%

by Calculated Risk on 3/06/2020 02:52:00 PM

From Merrill Lynch:

We mark to market our 1Q GDP forecast up to 1.5% from 1.0%, while taking down 2Q GDP by 0.6pp to 1.0% and 3Q GDP 0.2pp to 1.4%, reflecting wider disruption from the COVID-19 spread. [Mar 6 estimate]From Goldman Sachs:

emphasis added

Based on the downward revision to January wholesale inventories and the declines in US and global trade volumes, we lowered our Q1 GDP growth forecast by two-tenths to +0.7% (qoq ar). [Mar 6 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.7% for 2020:Q1 and 1.3% for 2020:Q2 [Mar 6 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 3.1 percent on March 6, up from 2.7 percent on March 2. [Mar 6 estimate]CR Note: These early estimates suggest real GDP growth will be between 0.7% and 3.1% annualized in Q1.

AAR: February Rail Carloads down 7.3% YoY, Intermodal Down 8.9% YoY

by Calculated Risk on 3/06/2020 02:19:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Total U.S. rail carloads fell 7.3% (73,058 carloads) in February 2020 from February 2019, their 13th straight decline, but the decline disappears if you take away coal and grain (whose carloads tend to rise or fall for reasons that have little to do with the state of the economy).

...

U.S. intermodal originations fell 8.9% (96,897 units) in February 2020 and 7.0% (167,978 units) in the first two months of 2020. Around half of U.S. intermodal comes from international trade. Supply chain disruptions related to the coronavirus outbreak may have played some unquantifiable role in February’s decline, but intermodal has been falling for more than a year, so more is going on, including economic uncertainty and trade frictions that pre-date the virus.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

Total originated carloads were 7.3% lower, or 73,058 carloads, in February 2020 from February 2019, their 13th consecutive year-over-year monthly decline. Total carloads averaged 231,771 per week in February 2020. That’s the lowest for any month since 1988, when our data begin.

Coal bears most of the blame. Carloads of coal in February were down 67,770 carloads, or 21.1%, their biggest percentage decline since mid-2016.

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):U.S. intermodal originations were down 8.9%, or 96,897 containers and trailers, in February 2020, their 13th straight decline. Weekly average originations in February 2020 were 249,421, the lowest for February since 2015. Year-to-date volume through February was down 7.0%, or 167,978 units. If, as the American Association of Port Authorities recently suggested, cargo volumes at many U.S. ports will fall by 20% or more in Q1 2020 from Q1 2019 because of the coronavirus, it might be a while before U.S. intermodal volumes move back into growth mode.

Comments on February Employment Report

by Calculated Risk on 3/06/2020 10:41:00 AM

The headline jobs number at 273 thousand for February was well above consensus expectations of 175 thousand, and the previous two months were revised up 85 thousand, combined. The unemployment rate decreased to 3.5%. Note: It appears weather boosted employment in February - I'll have more on this later.

Earlier: February Employment Report: 273,000 Jobs Added (266,000 ex-Census), 3.5% Unemployment Rate

In February, the year-over-year employment change was 2.409 million jobs including Census hires.

Average Hourly Earnings

Wage growth was at expectations. From the BLS:

"In February, average hourly earnings for all employees on private nonfarm payrolls increased by 9 cents to $28.52. Over the past 12 months, average hourly earnings have increased by 3.0 percent."

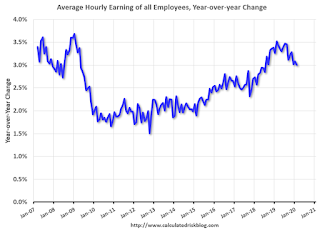

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.0% YoY in February.

Wage growth had been generally trending up, but weakened in 2019 and early 2020.

Prime (25 to 54 Years Old) Participation

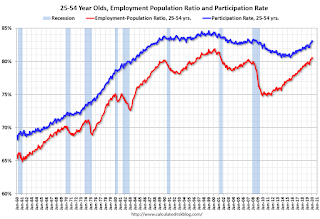

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in February to 83.0%, and the 25 to 54 employment population ratio decreased to 80.5%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 4.3 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in February to 4.318 million from 4.182 million in January. The number of persons working part time for economic reason has been generally trending down.

Part time workers will be something to watch over the next several months.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.0% in February.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.102 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.166 million in January.

This was the lowest level for long term unemployed since December 2006.

Summary:

The headline jobs number was well above expectations, and the previous two months were revised up. The headline unemployment rate decreased to 3.5%; however wage growth slowed to 3.0% year-over-year. Overall this was a solid report, although there was probably some boost from the weather.

Las Vegas Real Estate in February: Sales up 23% YoY, Inventory down 39% YoY

by Calculated Risk on 3/06/2020 10:08:00 AM

Note: Las Vegas will probably see a significant decline in visitor and convention traffic over the next several months due to COVID-19. We will see if this has a significant impact on local real estate. Sales in February were strong, and prices finally hit new highs (there was a huge bubble in Las Vegas).

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices finally break all-time record while supply keeps shrinking; LVR housing statistics for February 2020

The total number of existing local homes, condos and townhomes sold during February was 3,089. Compared to the same time last year, February sales were up 25.7% for homes and up 14.0% for condos and townhomes.1) Overall sales were up 23.2% year-over-year to 3,089 in February 2020 from 2,508 in February 2019.

...

By the end of February, LVR reported 4,240 single-family homes listed for sale without any sort of offer. That’s down 40.6% from one year ago. For condos and townhomes, the 1,214 properties listed without offers in February represented a 30.8% drop from one year ago.

…

Meanwhile, the number of so-called distressed sales remains near historically low levels. The association reported that short sales and foreclosures combined accounted for 2.5% of all existing local property sales in February. That compares to 2.6% of all sales one year ago, 3.8% two years ago and 10.6% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 8,888 in February 2019 to 5,454 in February 2020. Note: Total inventory was down 38.6% year-over-year. This is the fourth consecutive month with a year-over-year decrease in inventory, and that follows 16 consecutive months with a YoY increase in inventory. And months of inventory is still low.

3) Low level of distressed sales.

Trade Deficit decreased to $45.3 Billion in January

by Calculated Risk on 3/06/2020 09:07:00 AM

Note: This data was for January and the outbreak of COVID-19 probably had little or no on impact at that time.

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $45.3 billion in January, down $3.3 billion from $48.6 billion in December, revised.

January exports were $208.6 billion, $0.9 billion less than December exports. January imports were $253.9 billion, $4.2 billion less than December imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in January.

Exports are 26% above the pre-recession peak and up 1% compared to January 2019; imports are 9% above the pre-recession peak, and down 2% compared to January 2019.

In general, trade both imports and exports have moved more sideways or down recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $61.93 per barrel in January, up from $61.34 in December, and up from $54.35 in January 2019.

The trade deficit with China decreased to $26.1 billion in January, from $34.5 billion in January 2019.

February Employment Report: 273,000 Jobs Added (266,000 ex-Census), 3.5% Unemployment Rate

by Calculated Risk on 3/06/2020 08:42:00 AM

From the BLS:

Total nonfarm payroll employment rose by 273,000 in February, and the unemployment rate was little changed at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in health care and social assistance, food services and drinking places, government, construction, professional and technical services, and financial activities.

...

Federal employment increased by 8,000, reflecting the hiring of 7,000 temporary workers for the 2020 Census.

...

The change in total nonfarm payroll employment for December was revised up by 37,000 from +147,000 to +184,000, and the change for January was revised up by 48,000 from +225,000 to +273,000. With these revisions, employment gains in December and January combined were 85,000 higher than previously reported.

...

In February, average hourly earnings for all employees on private nonfarm payrolls increased by 9 cents to $28.52. Over the past 12 months, average hourly earnings have increased by 3.0 percent.

emphasis added

Click on graph for larger image.

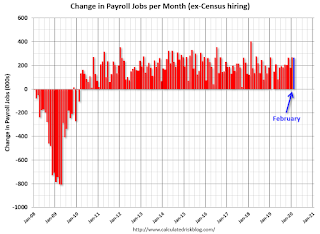

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 266 thousand in February ex-Census (private payrolls increased 228 thousand).

Payrolls for December and January were revised up 85 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 2.409 million jobs.

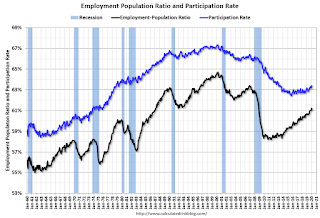

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 63.4% in February. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate was unchanged at 63.4% in February. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio decreased to 61.1% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in February to 3.5%.

This was well above consensus expectations of 175,000 jobs added, and December and January were revised up by 85,000 combined.

I'll have much more later ...

Thursday, March 05, 2020

Friday: Employment Report, Trade Deficit

by Calculated Risk on 3/05/2020 06:16:00 PM

My February Employment Preview.

Goldman's February Payrolls preview.

Friday:

• At 8:30 AM ET, Employment Report for February. The consensus is for 175,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

• Also at 8:30 AM, Trade Balance report for January from the Census Bureau. The consensus is the trade deficit to be $47.7 billion. The U.S. trade deficit was at $48.9 billion in December.

• At 3:00 PM, Consumer Credit from the Federal Reserve.

Goldman: February Payrolls Preview

by Calculated Risk on 3/05/2020 04:32:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 195k in February ... a 20-30k boost from weather … too early to show a meaningful impact of the coronavirus outbreak on hiring.

We estimate a one tenth decline in the unemployment rate to 3.5% ... We estimate average hourly earnings increased 0.3% month-over-month …

emphasis added

February Employment Preview

by Calculated Risk on 3/05/2020 11:37:00 AM

Special Note: The 2020 Decennial Census will increase hiring in early 2020. In reporting the employment report, the headline number should be reduced (or increased) by the change in Census temporary employment to show the underlying trend. Based on previous Census hiring, I expect the Census hired 10 to 20 thousand temporary workers in February.

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus is for an increase of 175,000 non-farm payroll jobs, and for the unemployment rate to be unchanged at 3.6%.

Last month, the BLS reported 225,000 jobs added in January (220,000 ex-Census).

Here is a summary of recent data:

• The ADP employment report showed an increase of 183,000 private sector payroll jobs in February. This was above consensus expectations of 170,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat above expectations.

• The ISM manufacturing employment index increased in February to 46.9%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased around 35,000 in February. The ADP report indicated manufacturing jobs decreased 4,000 in February.

The ISM non-manufacturing employment index increased in February to 55.6%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 225,000 in February.

Combined, the ISM surveys suggest employment gains at 190,000, suggesting gains somewhat above consensus expectations.

• Initial weekly unemployment claims averaged 213,000 in February, up slightly from 212,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 211,000, down from 223,000 during the reference week the previous month.

This suggests fewer layoffs (during the reference week) in February than in January.

• The final February University of Michigan consumer sentiment index increased to 101.0 from the January reading of 99.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker decreased in February to 144,000, down from 161,000 in January, suggesting fewer jobs added in February. This suggests job growth below consensus.

• Weather: The weather was mostly warm and dry during the reference period in January, and the San Francisco Fed estimates the favorable weather boosted employment gains in January by about 100,000. It is likely some hiring for February was pulled forward to January, suggesting some payback in the February report.

• Conclusion: In general the various reports suggest employment growth somewhat above expectations, however, factoring in some payback from the nice January weather, I expect employment gains, ex-Census hiring, below expectations.