by Calculated Risk on 1/04/2020 08:11:00 AM

Saturday, January 04, 2020

Schedule for Week of January 5, 2020

The key report this week is the December employment report on Friday.

Also the Q4 quarterly Reis surveys for office and malls will be released this week.

Early: Reis Q4 2019 Office Survey of rents and vacancy rates.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $43.9 billion. The U.S. trade deficit was at $47.2 billion in October.

10:00 AM: the ISM non-Manufacturing Index for December. The consensus is for an increase to 54.5 from 53.9..

Early: Reis Q4 2019 Mall Survey of rents and vacancy rates.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 156,000 payroll jobs added in December, up from 67,000 added in November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 222,000 initial claims, unchanged from 222,000 last week.

8:30 AM: Employment Report for December. The consensus is for 160,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

8:30 AM: Employment Report for December. The consensus is for 160,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.There were 266,000 jobs added in November, and the unemployment rate was at 3.5%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In November, the year-over-year change was 2.204 million jobs.

Friday, January 03, 2020

Q4 GDP Forecasts: 1.1% to 2.3%

by Calculated Risk on 1/03/2020 01:00:00 PM

From Merrill Lynch

4Q tracking rose to 2.0% qoq saar, boosted by trade and inventories data. [Jan 3 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.1% for 2019:Q4 and 1.0% for 2020:Q1. [Jan 3 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 2.3 percent on January 3, unchanged from December 23. [Jan 3 estimate]CR Note: These estimates suggest real GDP growth will be between 1.1% and 2.3% annualized in Q4.

Construction Spending Increased in November

by Calculated Risk on 1/03/2020 11:36:00 AM

From the Census Bureau reported that overall construction spending increased in November:

Construction spending during November 2019 was estimated at a seasonally adjusted annual rate of $1,324.1 billion, 0.6 percent above the revised October estimate of $1,316.8 billion. The November figure is 4.1 percent above the November 2018 estimate of $1,271.4 billion. During the first eleven months of this year, construction spending amounted to $1,201.6 billion, 0.8 percent below the $1,211.8 billion for the same period in 2018.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $985.5 billion, 0.4 percent above the revised October estimate of $981.1 billion. ...

In November, the estimated seasonally adjusted annual rate of public construction spending was $338.6 billion, 0.9 percent above the revised October estimate of $335.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018. Now it is increasing again, but is still 21% below the bubble peak.

Non-residential spending is 8% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 4% above the previous peak in March 2009, and 29% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 3%. Non-residential spending is up slightly year-over-year. Public spending is up 12% year-over-year.

This was above consensus expectations, and construction spending for September and October were revised up. A strong report.

Reis: Apartment Vacancy Rate increased in Q4 to 4.7%

by Calculated Risk on 1/03/2020 11:12:00 AM

Reis reported that the apartment vacancy rate was at 4.7% in Q4 2019, up from 4.6% in Q3, and down from 4.8% in Q4 2018. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From economist Barbara Byrne Denham at Reis:

The apartment vacancy rate increased to 4.7% from 4.6% in the third quarter. It was 4.8% in the fourth quarter of 2018 and 4.6% at year-end 2017.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.5% in the fourth quarter. At $1,498 per unit (asking) and $1,426 per unit (effective), the average rents have increased 3.7% and 3.8%, respectively, from the fourth quarter of 2018. This was the lowest annual growth rate in more than two years.

Net absorption of 21,500 units was lower than the previous quarter’s absorption of 46,511 units. Likewise, construction was 30,159 units, lower than the 51,992 completions in the third quarter. With new completions of 176,565 units in 2019, overall apartment supply growth fell well short of the 2018 addition of 265,041 units. Likewise, net absorption of 177,599 units in 2019 fell short of the 2018 total of 235,786 units.

...

Demand for apartments should remain healthy, although it could face new competition from the housing market that could accelerate given the rosier economy and very low mortgage rates. As we have stated in previous reports, the housing vs. apartment markets are not a zero-sum game. As long as job growth remains healthy, the demand for both will stay positive shoring up home prices and rents equally.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate has mostly moved sideways for the last two years - after increasing from the low in 2016.

Apartment vacancy data courtesy of Reis.

ISM Manufacturing index Decreased to 47.2 in December, Fifth Consecutive Month of Contraction

by Calculated Risk on 1/03/2020 10:06:00 AM

The ISM manufacturing index indicated contraction in December. The PMI was at 47.2% in December, down from 48.1% in November. The employment index was at 45.1%, down from 46.6% last month, and the new orders index was at 46.8%, down from 47.2%.

From the Institute for Supply Management: December 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in December, and the overall economy grew for the 128th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The December PMI® registered 47.2 percent, a decrease of 0.9 percentage point from the November reading of 48.1 percent. This is the PMI®'s lowest reading since June 2009, when it registered 46.3 percent. The New Orders Index registered 46.8 percent, a decrease of 0.4 percentage point from the November reading of 47.2 percent. The Production Index registered 43.2 percent, down 5.9 percentage points compared to the November reading of 49.1 percent. The Backlog of Orders Index registered 43.3 percent, up 0.3 percentage point compared to the November reading of 43 percent. The Employment Index registered 45.1 percent, a 1.5-percentage point decrease from the November reading of 46.6 percent. The Supplier Deliveries Index registered 54.6 percent, a 2.6-percentage point increase from the November reading of 52 percent. The Inventories Index registered 46.5 percent, an increase of 1 percentage point from the November reading of 45.5 percent. The Prices Index registered 51.7 percent, a 5-percentage point increase from the November reading of 46.7 percent. The New Export Orders Index registered 47.3 percent, a 0.6-percentage point decrease from the November reading of 47.9 percent. The Imports Index registered 48.8 percent, a 0.5-percentage point increase from the November reading of 48.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 49.0%, and suggests manufacturing contracted further in December.

Thursday, January 02, 2020

Friday: ISM Mfg, Construction Spending, Auto Sales

by Calculated Risk on 1/02/2020 06:56:00 PM

Friday:

• At 10:00 AM ET, ISM Manufacturing Index for December. The consensus is for the ISM to be at 49.0, up from 48.1 in November.

• Also at 10:00 AM, Construction Spending for November. The consensus is for a 0.3% increase in construction spending.

• All day, Light vehicle sales for December. The consensus is for light vehicle sales to be 17.0 million SAAR in December, down from 17.1 million in November (Seasonally Adjusted Annual Rate).

Question #1 for 2020: How much will the economy grow in 2020?

by Calculated Risk on 1/02/2020 03:24:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

1) Economic growth: Economic growth was probably just over 2% in 2019, down from 2.9% in 2018. The FOMC is expecting more of the same with growth around 1.9% next year. Some analysts are expecting growth to pick up a little in the coming year as the trade war eases and global growth increases. How much will the economy grow in 2020?

First, since I'm frequently asked, I don't see a recession starting in 2020.

Here is a table of the annual change in real GDP since 2005. Economic activity has mostly been in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%., although demographics are improving somewhat (more prime age workers).

Note: This table includes both annual change and q4 over the previous q4 (two slightly different measures). For 2019, I used a 2.0% annual growth rate in Q4 2019 (this gives 2.3% Q4 over Q4 or 2.3% real annual growth).

| Real GDP Growth | ||

|---|---|---|

| Year | Annual GDP | Q4 / Q4 |

| 2005 | 3.5% | 3.1% |

| 2006 | 2.9% | 2.6% |

| 2007 | 1.9% | 2.0% |

| 2008 | -0.1% | -2.8% |

| 2009 | -2.5% | 0.2% |

| 2010 | 2.6% | 2.6% |

| 2011 | 1.6% | 1.6% |

| 2012 | 2.2% | 1.5% |

| 2013 | 1.8% | 2.6% |

| 2014 | 2.5% | 2.9% |

| 2015 | 2.9% | 1.9% |

| 2016 | 1.6% | 2.0% |

| 2017 | 2.4% | 2.8% |

| 2018 | 2.9% | 2.5% |

| 20191 | 2.3% | 2.3% |

| 1 2019 estimate based on 2.0% Q4 annualized real growth rate | ||

The FOMC is projecting real GDP growth of 2.0% to 2.2% in 2020 (Q4 over Q4).

Goldman Sachs recently projected: "Easier financial conditions, the end of the inventory adjustment, and strength in consumer spending also suggest a solid growth outlook, and we expect growth to accelerate modestly to 2.25-2.5% in 2020."

The most recent CBO forecast is for 2.1% real GDP growth in 2020.

Note: The Trump administration projected 3.5% annual real growth over Mr. Trump's term: "Boost growth to 3.5 percent per year on average, with the potential to reach a 4 percent growth rate." (now removed from Trump website). That didn't happen.

As expected, there was a slowdown in growth in 2019 due to a combination of factors. The fiscal boost faded in 2019, housing was under pressure early in the year from higher mortgage rates and the new tax policy, and the negative impact from the trade war.

Looking to 2020, fiscal policy will likely have a minor impact. Trade tensions have eased somewhat. Oil prices have increased in 2019, and this will be a slight positive on economic growth in certain states in 2020. Housing is getting a boost from lower mortgage rates. However, auto sales are mostly moving sideways.

These factors suggest real GDP growth probably in the 2% to 2.5% range in 2020.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

by Calculated Risk on 1/02/2020 10:32:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

2) Employment: Through November 2019, the economy added 1,969,000 jobs, or 179,000 per month. This was down from 2018. Will job creation in 2020 be as strong as in 2019? Will job creation pick up in 2020? Or will job creation slow further in 2020?

For review, here is a table of the annual change in total nonfarm, private and public sector payrolls jobs since 1997. For total and private employment gains, 2014 was the best year since the '90s, and it appears job growth peaked for this cycle in 2014.

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,407 | 3,212 | 195 |

| 1998 | 3,048 | 2,735 | 313 |

| 1999 | 3,179 | 2,718 | 461 |

| 2000 | 1,936 | 1,672 | 264 |

| 2001 | -1,725 | -2,276 | 551 |

| 2002 | -509 | -742 | 233 |

| 2003 | 117 | 159 | -42 |

| 2004 | 2,039 | 1,892 | 147 |

| 2005 | 2,524 | 2,338 | 186 |

| 2006 | 2,100 | 1,891 | 209 |

| 2007 | 1,141 | 853 | 288 |

| 2008 | -3,552 | -3,732 | 180 |

| 2009 | -5,053 | -4,979 | -74 |

| 2010 | 1,035 | 1,251 | -216 |

| 2011 | 2,075 | 2,387 | -312 |

| 2012 | 2,174 | 2,241 | -67 |

| 2013 | 2,302 | 2,369 | -67 |

| 2014 | 3,006 | 2,879 | 127 |

| 2015 | 2,729 | 2,574 | 155 |

| 2016 | 2,318 | 2,116 | 202 |

| 2017 | 2,153 | 2,068 | 85 |

| 20181 | 2,679 | 2,583 | 96 |

| 20192 | 2,204 | 2,042 | 162 |

| 1Job growth in 2018 and early 2019 is expected to be revised down significantly. 22019 is year-over-year job gains through November | |||

The good news is job market still has solid momentum heading into 2020.

Note: Some people compare to the '80s and '90s, without thinking about changing demographics. The prime working age population (25 to 54 years old) was growing 2.2% per year in the '80s, and 1.3% per year in the '90s. The prime working age population has actually declined slightly in the '10s. Note: The prime working age population appears to be growing slowly again, and growth should pick up in the 2020s.

Note that some people will be confused by the Census hiring and firing. In May 2010, the Census hired 411,000 people. More than half were let go in June - the rest over the next several months. The Census will distort the headline employment numbers again in 2020, especially in April, May, June and July.

The second table shows the change in construction and manufacturing payrolls starting in 2006.

| Construction Jobs (000s) | Manufacturing (000s) | |

|---|---|---|

| 2006 | 152 | -178 |

| 2007 | -195 | -269 |

| 2008 | -789 | -896 |

| 2009 | -1,047 | -1,375 |

| 2010 | -187 | 120 |

| 2011 | 144 | 207 |

| 2012 | 113 | 158 |

| 2013 | 208 | 123 |

| 2014 | 361 | 209 |

| 2015 | 339 | 70 |

| 2016 | 193 | -7 |

| 2017 | 268 | 190 |

| 2018 | 307 | 264 |

| 20191 | 146 | 56 |

| 12019 is Year-over-year job gains through November | ||

Energy related construction and manufacturing hiring was solid in 2017 and 2018 as oil prices increased. However, in 2019, energy related employment was probably weak since oil price had fallen sharply at the end of 2018. Also, there was general weakness in manufacturing in 2019 due to the trade war, and the lack of growth in the auto sector. With easing trade tensions, manufacturing employment gains might increase in 2020, and with a pickup in construction activity, construction employment might increase too.

However, my sense is the overall participation rate will decline slightly in 2020 (due to demographics), and employers will have more difficultly in finding employees to replace them.

So my forecast is for gains of around 125,000 to 150,000 payroll jobs per month in 2020 (about 1.5 million to 1.8 million year-over-year) . This would be the fewest job gains since 2010, but another solid year for employment gains given current demographics.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

Weekly Initial Unemployment Claims at 222,000

by Calculated Risk on 1/02/2020 08:34:00 AM

The DOL reported:

In the week ending December 28, the advance figure for seasonally adjusted initial claims was 222,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 222,000 to 224,000. The 4-week moving average was 233,250, an increase of 4,750 from the previous week's revised average. This is the highest level for this average since January 27, 2018 when it was 235,750. The previous week's average was revised up by 500 from 228,000 to 228,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 233,250.

This was close to the consensus forecast.

Wednesday, January 01, 2020

Question #3 for 2020: What will the unemployment rate be in December 2020?

by Calculated Risk on 1/01/2020 02:55:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

3) Unemployment Rate: The unemployment rate was at 3.5% in November, down 0.2 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.5% to 3.7% range in Q4 2020. What will the unemployment rate be in December 2020?

This first graph shows the unemployment rate since 1948.

The unemployment rate has declined steadily after peaking at 10% following the great recession.

The current unemployment rate (3.5%) is below the low (3.8%) at the end of the '90s expansion, and at the lowest rate since 1969.

As I've mentioned before, current demographics share some similarities to the '60s, and the unemployment rate bottomed at 3.4% in the '60s - and we might see the unemployment rate that low or lower in this cycle. If we look further back in time, the unemployment rate was as low as 2.5% in the 1950s.

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate.

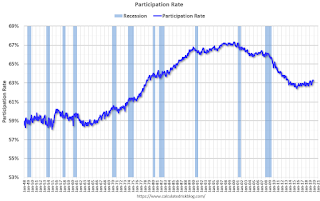

On participation: We can be pretty certain that the participation rate will decline over the next decade or longer based on demographic trends. However, over the last several years, the participation rate has been fairly steady as the strong labor market offset the long term trend.

The participation increased significantly starting in the late 60s as the Boomer generation entered the workforce and women participated at a much higher rate.

Since 2000, the participation rate has generally declined, mostly due to demographics.

Here is a table of the participation rate and unemployment rate since 2008.

| Unemployment and Participation Rate for December each Year | |||

|---|---|---|---|

| December of | Participation Rate | Change in Participation Rate (percentage points) | Unemployment Rate |

| 2008 | 65.8% | 7.3% | |

| 2009 | 64.6% | -1.2 | 9.9% |

| 2010 | 64.3% | -0.3 | 9.3% |

| 2011 | 64.0% | -0.3 | 8.5% |

| 2012 | 63.7% | -0.3 | 7.9% |

| 2013 | 62.9% | -0.8 | 6.7% |

| 2014 | 62.8% | -0.1 | 5.6% |

| 2015 | 62.7% | -0.1 | 5.0% |

| 2016 | 62.7% | 0.0 | 4.7% |

| 2017 | 62.7% | 0.0 | 4.1% |

| 2018 | 63.1% | 0.4 | 3.9% |

| 20191 | 63.2% | 0.1 | 3.5% |

| 12019 is for November 2019. | |||

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the low 3's by December 2020 from the current 3.5%. My guess is based on the participation rate declining slightly in 2020, and for decent job growth in 2020, but less than in 2019. If I'm wrong about the participation rate (the start of the decline might be delayed for another year or so), then the unemployment rate will likely be in the mid 3% range by December 2020.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?