by Calculated Risk on 2/28/2019 04:09:00 PM

Thursday, February 28, 2019

Fannie Mae: Mortgage Serious Delinquency Rate unchanged in January

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 0.76% in January, from 0.76% in December. The serious delinquency rate is down from 1.23% in January 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This matches the last two months as the lowest serious delinquency rate for Fannie Mae since August 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.71% are seriously delinquent. For loans made in 2005 through 2008 (5% of portfolio), 4.58% are seriously delinquent, For recent loans, originated in 2009 through 2018 (92% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q4 GDP: Investment

by Calculated Risk on 2/28/2019 01:02:00 PM

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) decreased in Q4 (-3.5% annual rate in Q4). Equipment investment increased at a 6.7% annual rate, and investment in non-residential structures decreased at a 4.2% annual rate.

On a 3 quarter trailing average basis, RI (red) is down slightly, equipment (green) is positive, and nonresidential structures (blue) is up slightly.

Recently RI has been soft, but the decrease is fairly small.

I'll post more on the components of non-residential investment once the supplemental data is released.

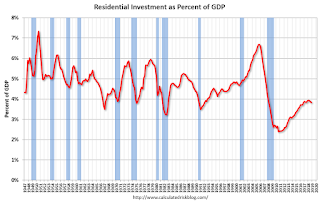

Residential Investment as a percent of GDP decreased in Q4, however RI has generally been increasing. RI as a percent of GDP is only just above the bottom of the previous recessions - and I expect RI to continue to increase further in this cycle.

The increase is now primarily coming from single family investment and home remodeling.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Kansas City Fed: "Tenth District Manufacturing Activity Up Only Slightly"

by Calculated Risk on 2/28/2019 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Up Only Slightly

The Federal Reserve Bank of Kansas City released the February Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity was up only slightly, while expectations for future activity remained positive but were slightly lower than in previous months.This was the last of the regional Fed surveys for February.

“Regional factories saw hardly any growth in February,” said Wilkerson. “More than three-quarters of firms reported difficulties in finding workers, despite wage increases.”

...

The month-over-month composite index was 1 in January, down from 5 in January and 6 in December. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factories expanded durable goods production, particularly machinery and transportation equipment, while manufacturing of more non-durable goods, including food and beverage products, declined. Most month-over-month indexes decreased in February, with production, shipments, and new orders dropping into negative territory. However, the month-over-month employment index expanded moderately.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through February), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be at about the same level in February as in January. The consensus forecast is for a reading of 55.0 (to be released on Friday, March 1st).

HVS: Q4 2018 Homeownership and Vacancy Rates

by Calculated Risk on 2/28/2019 10:09:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2018.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

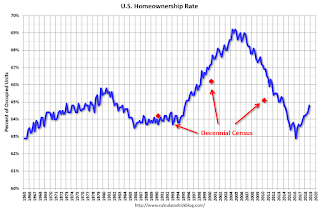

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 64.8% in Q4, from 64.4% in Q3.

I'd put more weight on the decennial Census numbers - given changing demographics, the homeownership rate has bottomed.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

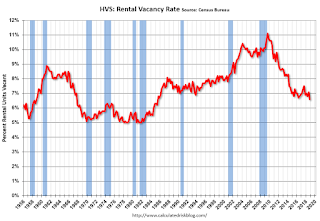

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate is close to the bottom for this cycle.

Weekly Initial Unemployment Claims increased to 225,000

by Calculated Risk on 2/28/2019 08:40:00 AM

The DOL reported:

In the week ending February 23, the advance figure for seasonally adjusted initial claims was 225,000, an increase of 8,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 216,000 to 217,000. The 4-week moving average was 229,000, a decrease of 7,000 from the previous week's revised average. The previous week's average was revised up by 250 from 235,750 to 236,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 229,000.

This was at the consensus forecast.

BEA: Real GDP increased at 2.6% Annualized Rate in Q4

by Calculated Risk on 2/28/2019 08:35:00 AM

From the BEA: Gross Domestic Product, Fourth Quarter and Annual 2018 (Initial Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the fourth quarter of 2018, according to the "initial" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.4 percent.The advance Q4 GDP report, with 2.6% annualized growth, was above expectations.

Due to the recent partial government shutdown, this initial report for the fourth quarter and annual GDP for 2018 replaces the release of the "advance" estimate originally scheduled for January 30th and the "second" estimate originally scheduled for February 28th.

...

The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, private inventory investment, and federal government spending. Those were partly offset by negative contributions from residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the fourth quarter reflected decelerations in private inventory investment, PCE, and federal government spending and a downturn in state and local government spending. These movements were partly offset by an upturn in exports and an acceleration in nonresidential fixed investment. Imports increased less in the fourth quarter than in the third quarter.

emphasis added

This puts annual GDP growth at 2.9%.

Personal consumption expenditures (PCE) increased at 2.8% annualized rate in Q4, down from 3.5% in Q3. Residential investment (RI) decreased 3.5% in Q4. Equipment investment increased at a 6.7% annualized rate, and investment in non-residential structures decreased at a 4.2% pace.

I'll have more later ...

Wednesday, February 27, 2019

Thursday: Q4 GDP, Unemployment Claims and More

by Calculated Risk on 2/27/2019 09:03:00 PM

Finally - Q4 GDP!

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 216 thousand the previous week.

• Also at 8:30 AM: Gross Domestic Product, 4th quarter 2018 (Initial estimate). The consensus is that real GDP increased 2.4% annualized in Q4, down from 3.4% in Q3.

• At 9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 55.8, down from 56.7 in January.

• At 10:00 AM: the Q4 2018 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM: the Kansas City Fed manufacturing survey for February. This is the last of regional manufacturing surveys for February.

Chemical Activity Barometer "Flat" in February

by Calculated Risk on 2/27/2019 06:45:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Is Flat In February

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), posted a 0.0 percent change in February on a three-month moving average (3MMA) basis. On a year-over-year (Y/Y) basis, the barometer is up 0.2 percent (3MMA).

...

“The Chemical Activity Barometer reading was essentially flat in February following three months of decline,” said Kevin Swift, chief economist at ACC. “The cumulative drop was 1.0 percent – still well below the 3.0 percent threshold for a recession signal. The latest CAB signals gains in U.S. commercial and industrial activity through mid-2019, but at a slower rate of growth as compared with a year earlier.”

The government shutdown resulted in delays in publishing many data series that ACC uses to compare the CAB. Such delays can make it more difficult to gauge current economic conditions.

…

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has softened recently, suggesting further gains in industrial production into 2019, but at a slower pace.

Zillow Case-Shiller Forecast: Smaller YoY House Price Gains in January

by Calculated Risk on 2/27/2019 12:30:00 PM

The Case-Shiller house price indexes for December were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: December Case-Shiller Results and January Forecast: Slowing home price gains

For years, the housing market has been anything but “normal” or “balanced.” But as the start of the busy home shopping season looms, someone squinting at the market might be able to find signs of both normalcy and balance as the market continues to cool off after a years-long sizzle.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to decline to 4.4% in January compared to 4.7% in December.

Annual home price growth, while still rapid in a handful of the most in-demand and/or affordable markets, has fallen to a pace not far off historic norms and feels largely sustainable for now at a national level of 4.7 percent year-over-year in December. That pace is down from 5.1 percent in November, according to the Case-Shiller home price index.

The Zillow forecast is for the 20-City index to decline to 3.5% YoY in January, and for the 10-City index to decline to 3.2% YoY.

The Zillow forecast is for the 20-City index to decline to 3.5% YoY in January, and for the 10-City index to decline to 3.2% YoY.

NAR: Pending Home Sales Index Increased 4.6% in January

by Calculated Risk on 2/27/2019 10:02:00 AM

From the NAR: Pending Home Sales Jump 4.6 Percent in January

Pending home sales rebounded strongly in January, according to the National Association of Realtors®. All four major regions saw growth last month, including the largest surge in the South.This was well above expectations of a 3% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 4.6 percent to 103.2 in January, up from 98.7 in December. Year-over-year contract signings, however, declined 2.3 percent, making this the thirteenth straight month of annual decreases.

...

The PHSI in the Northeast rose 1.6 percent to 94.0 in January, and is now 7.6 percent above a year ago. In the Midwest, the index rose 2.8 percent to 100.2 in January, 0.3 percent lower than January 2018.

Pending home sales in the South jumped 8.9 percent to an index of 119.8 in January, which is 3.1 percent lower than this time last year. The index in the West increased 0.3 percent in January to 87.3 and fell 10.1 percent below a year ago.

emphasis added