by Calculated Risk on 12/23/2018 08:59:00 PM

Sunday, December 23, 2018

Sunday Night Futures

Note: Treasury Secretary Steven Mnuchin put out a strange statement today saying that major banks have told him they "have ample liquidity available for lending". Uh, weird - since no one is concerned about liquidity at this time.

Weekend:

• Schedule for Week of December 23, 2018

• Review: Ten Economic Questions for 2018

Monday:

• At 8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

• At The NYSE and the NASDAQ will close early at 1:00 PM ET.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are up slightly (fair value).

Oil prices were down sharply over the last week with WTI futures at $45.49 per barrel and Brent at $53.58 per barrel. A year ago, WTI was at $58, and Brent was at $65 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.31 per gallon. A year ago prices were at $2.43 per gallon, so gasoline prices are down 12 cents per gallon year-over-year.

Review: Ten Economic Questions for 2018

by Calculated Risk on 12/23/2018 11:26:00 AM

At the end of last year, I posted Ten Economic Questions for 2018. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2018 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

Here is a review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

My sense is the low end of the housing market will be fine. The Mortgage Interest Deduction (MID) will be capped at interest on a mortgage up to $750,000 instead of $1,000,000, so the lower priced markets will not be hit by the reduction in the MID. There might be some additional taxes for these buyers due to the limits on SALT and property taxes, but this should be minor.It does appear that housing in states like California were negatively impacted by the new tax law. Many areas are now seeing a year-over-year increase in inventory (probably mostly due to higher mortgage rates, but some due to the new tax law) - and price growth has slowed.

I also expect the high end of the market to be fine. The high end is already doing well even with the MID capped at $1 million. For these buyers, the bigger impact will be the SALT and property tax limitations, but there will be offsets for these buyers due to the lower rates - and these buyers will likely benefit from the corporate tax cuts. Many of these buyers will also benefit from the changes to the Alternative Minimum Tax (AMT).

It is the upper-mid-range in the certain markets that will probably slow. This might be in the $750,000 to $1.5 million price range. These potential buyers probably don't benefit from the AMT or corporate changes, but they will likely be hit by the SALT and property tax limits.

9) Question #9 for 2018: Will housing inventory increase or decrease in 2018?

… right now my guess is active inventory will increase in 2018 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2018).According to the November NAR report on existing home sales, inventory was up 4.2% year-over-year in November. Also some areas are reporting sharply higher YoY increases, and it is clear inventory will be up this year.

8) Question #8 for 2018: What will happen with house prices in 2018?

Inventories will probably remain low in 2018, although I expect inventories to increase on a year-over-year basis by December of 2018. Low inventories, and a decent economy suggests further price increases in 2018.The recent CoreLogic data showed prices up 5.4% year-over-year in October. This was the slowest appreciation in nearly two years. It appears likely that price appreciation will slow as expected.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2018, it seems likely that price appreciation will slow to the low-to-mid single digits.

7) Question #7 for 2018: How much will Residential Investment increase?

Most analysts are looking for starts to increase to around 1.25 to 1.3 million in 2018, and for new home sales of around 650 thousand.Through November, starts were up about 5% year-over-year compared to the same period in 2017, and on pace for about 1.26 million this year. New home sales were also up about 3% year-over-year and on pace for about 620 thousand in 2018.

I also think there will be further growth in 2018. My guess is starts will increase to just over 1.25 million in 2018 and new home sales will be just over 650 thousand.

6) Question #6 for 2018: How much will wages increase in 2018?

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3% in 2018 according to the CES.Through November 2018, nominal hourly wages were up 3.1% year-over-year. This is faster than last year, and it appears wages will increase at a slightly faster rate in 2018 than in 2017.

5) Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

My current guess is the Fed will hike three times in 2018.The Fed hiked four times in 2018.

As an aside, many new Fed Chairs have faced a crisis early in their term. A few examples, Paul Volcker took office in August 1979, and inflation hit almost 12% (up from 7.9% the year before), and the economy went into recession as Volcker raised rates. Alan Greenspan took office in August 1987, and the stock market crashed almost 34% within a couple months of Greenspan taking office (including over 20% in one day!). And Ben Bernanke took office in February 2006, just as house prices peaked - and he was challenged by the housing bust, great recession and financial crisis.

Hopefully Jerome Powell will see smoother sailing.

4) Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

The Fed is projecting core PCE inflation will increase to 1.7% to 1.9% by Q4 2018. However there are risks for higher inflation with the labor market near full employment, and new tax law providing some fiscal stimulus.As of November, inflation has moved up close to the Fed's target.

I do think there are structural reasons for low inflation, but currently I think PCE core inflation (year-over-year) will increase in 2018 and be closer to 2% by Q4 2018 (up from 1.4%), but too much inflation will still not be a serious concern in 2018.

3) Question #3 for 2018: What will the unemployment rate be in December 2018?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the high 3's by December 2018 from the current 4.1%.The unemployment rate was at 3.7% in November.

2) Question #2 for 2018: Will job creation slow further in 2018?

So my forecast is for gains of around 150,000 to 167,000 payroll jobs per month in 2018 (about 1.8 million to 2.0 million year-over-year) . Lower than in 2017, but another solid year for employment gains given current demographics.Through November 2018, the economy has added 2,268,000 thousand jobs, or 206,000 per month. This is above my forecast, and the economy will add more jobs in 2018 than in 2017.

1) Question #1 for 2018: How much will the economy grow in 2018?

It is possible that there will be a pickup in growth in 2018 due to a combination of factors.GDP growth was at 2.2% in Q1, 4.2% in Q2, and 3.4% in Q3. Most estimates suggest growth in the mid to high 2s in Q4. This would put GDP growth at close to 3% for 2018.

The new tax policy should boost the economy a little in 2018, and there will probably be some further economic boost from oil sector investment in 2018 since oil prices have increased recently. Also the housing recovery is ongoing, however auto sales are mostly moving sideways.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2018. And a 3% handle is possible if there is some pickup in productivity.

In March 2018, I wrote When the Story Changes, Be Alert. I noted that the economic winds were shifting, and there were more downside risks to the economy. As the year progressed, those downside risks started impacting the economy, but still, overall, 2018 unfolded about as expected, although employment gains were somewhat higher than I forecast.

Saturday, December 22, 2018

Schedule for Week of December 23, 2018

by Calculated Risk on 12/22/2018 08:11:00 AM

Happy Holidays and Merry Christmas!

The key economic reports this week are November New Home sales, and October Case-Shiller House Prices.

Note: If the government is shutdown, the new home sales report will probably be delayed.

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

The NYSE and the NASDAQ will close early at 1:00 PM ET.

All US markets will be closed in observance of the Christmas Holiday.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.

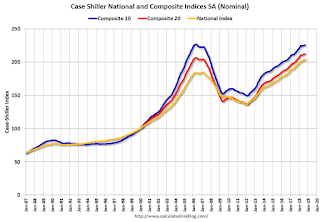

9:00 AM ET: S&P/Case-Shiller House Price Index for October.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 5.0% year-over-year increase in the Comp 20 index for October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 214 thousand the previous week.

9:00 AM: FHFA House Price Index for October 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 560 thousand SAAR, up from 544 thousand in October.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for a reading of 62.4, down from 66.4 in November.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 1.5% increase in the index.

Friday, December 21, 2018

BLS: Unemployment Rates Lower in 6 states in November; Idaho, Missouri, New York at New Series Lows

by Calculated Risk on 12/21/2018 04:50:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in November in 6 states, higher in 2 states, and stable in 42 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eighteen states had jobless rate decreases from a year earlier and 32 states and the District had little or no change.

...

Hawaii and Iowa had the lowest unemployment rates in November, 2.4 percent each. The rates in Idaho (2.6 percent), Missouri (3.0 percent), and New York (3.9 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Four states have unemployment rates above 5%; Alaska, D.C., Louisiana and West Virginia.

Three states were at new series lows, and a total of nine states are at the series low.

Q4 GDP Forecasts: Mid-to-High 2s

by Calculated Risk on 12/21/2018 03:14:00 PM

And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.7 percent on December 21, down from 2.9 percent on December 18. The nowcast of fourth-quarter real personal consumption expenditures growth decreased from 4.1 percent to 3.7 percent after this morning's personal income and outlays release from the U.S. Bureau of Economic Analysis. [Dec 21 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.5% for 2018:Q4 and 2.1% for 2019:Q1. [Dec 21 estimate]CR Note: These estimates suggest GDP in the mid-to-high 2s for Q4.

Reis: Apartment Vacancy Rate unchanged in Q4 at 4.8%

by Calculated Risk on 12/21/2018 12:15:00 PM

Reis reported that the apartment vacancy rate was at 4.8% in Q4 2018, unchanged from 4.8% in Q3, and up from 4.6% in Q4 2017. This ties last month as the highest vacancy rate since Q3 2012. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From Reis:

The apartment vacancy rate was flat in the quarter at 4.8%. At year-end 2017 it was 4.6%, while at year-end 2016 it was 4.2%.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.8% in the fourth quarter. At $1,440 per unit (market) and $1,370 per unit (effective), the average rents have increased 4.9% and 4.6%, respectively, from the fourth quarter of 2017.

Net absorption was 39,732 units, lower than the previous quarter’s absorption of 50,502 units and below the average quarterly absorption of 2017 of 46,926 units. Construction was 49,944 units, also below the third quarter’s 62,313 units and below the 2017 quarterly average of 61,869 units.

...

Apartment construction started to accelerate in 2017 and has remained elevated throughout 2018. This had raised concerns that the apartment market was becoming overbuilt. Yet consistently, apartment occupancy growth has nearly kept pace with supply growth, as demand for apartments has been robust throughout 2018. Not only has job growth supported apartment demand, but the weaker housing market has also benefitted the apartment market: existing home sales climbed in October and November but had fallen in eight of the previous ten months and is down 7% from a year ago. Although mortgage rates have fallen over the last few weeks pushing applications up a bit, the housing market could continue to suffer given the recent stock market declines that have sent jitters throughout the market. Moreover, last year’s tax reform that doubled the standard deduction reduced the incentive to buy a home, which has also helped the apartment market.

We still expect construction to remain robust in 2019 before completions drop off in 2020. Occupancy is expected to remain positive, although vacancy rates are expected to increase, as new supply will outpace demand growth in most metros. That said, stronger apartment demand in a number of metros could push developers to file more permits, which could extend the construction cycle. This is especially likely in New York and Suburban Virginia where Amazon is building two new headquarters and creating 25,000 jobs over ten years.

Our outlook remains favorable given the current conditions of positive job growth and tepid housing sales. The recent momentum should keep rent growth positive even as vacancy rates are likely to edge up a bit in the next few quarters.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had mostly moved sideways for the last several years. However, the vacancy rate has bottomed and is now increasing. With more supply coming on line - and less favorable demographics - the vacancy rate will probably continue to increase over the next year.

Apartment vacancy data courtesy of Reis.

Kansas City Fed: Regional Manufacturing Activity "Growth Slowed" in December

by Calculated Risk on 12/21/2018 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Slowed

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity slowed, while expectations for future activity edged slightly higher.So far, all of the regional surveys have indicated slower growth in December than in November.

“Factories in our region reported a drop in production in December but continued growth in orders, employment, and capital spending” said Wilkerson. “Several contacts noted difficulties with weather or with having enough workers to meet demand.”

...

The month-over-month composite index was 3 in December, down from 15 in November and 8 in October. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The slowdown in factory growth was driven by both durable and nondurable goods producers, particularly metals, electronics, and petroleum/coal products. Most month-over-month indexes fell from the previous month’s reading, although the majority remained in positive territory. Exceptions included production, dropping from 24 to -18, and shipments, falling from 31 to -3, and new orders for exports, decreasing from 6 to -7. The employment index edged slightly higher, and new orders and order backlog indexes remained moderately positive. The materials inventory index rose from 15 to 19 and the finished goods inventory index also moved up.

emphasis added

Personal Income increased 0.2% in November, Spending increased 0.4%

by Calculated Risk on 12/21/2018 10:11:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $40.2 billion (0.2 percent) in November according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $37.8 billion (0.2 percent) and personal consumption expenditures (PCE) increased $54.4 billion (0.4 percent).The November PCE price index increased 1.8 percent year-over-year and the September PCE price index, excluding food and energy, increased 1.9 percent year-over-year.

Real DPI increased 0.2 percent in November and real PCE increased 0.3 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through November 2018 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was above expectations.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 3.6% annual rate in Q4 2018. (using the mid-month method, PCE was also increasing at 3.6%). This suggests solid PCE growth in Q4.

Government Shutdown: Economic Data Likely to be Delayed

by Calculated Risk on 12/21/2018 09:01:00 AM

In previous shutdowns, Government data from the BLS, BEA and Census Bureau were delayed. Data from the Federal Reserve was released on time.

As an example, if the government shuts down, I expect New Home sales - currently scheduled for next Thursday - to be delayed. Unemployment claims will probably be released on time.

The following week, the key report that will probably be delayed is the employment report for December.

If the shutdown continues, then data gathering will be impacted - and economic observers will be flying blind.

In addition, any shutdown will be expensive and impact Q1 GDP. Hopefully the shutdown will be avoided.

Q3 GDP Revised Down to 3.4% Annual Rate

by Calculated Risk on 12/21/2018 08:34:00 AM

From the BEA: Gross Domestic Product, 3rd quarter 2018 (third estimate); Corporate Profits, 3rd quarter 2018 (revised estimate)

Real gross domestic product (GDP) increased at an annual rate of 3.4 percent in the third quarter of 2018, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.2 percent.PCE growth was revised down from 3.6% to 3.5%. Residential investment was revised down from -2.6% to -3.6%. This was slightly below the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 3.5 percent. With this third estimate for the third quarter, personal consumption expenditures (PCE) and exports were revised down, and private inventory investment was revised up; the general picture of economic growth remains the same

emphasis added

Here is a Comparison of Third and Second Estimates.