by Calculated Risk on 11/17/2017 08:37:00 AM

Friday, November 17, 2017

Housing Starts increased to 1.290 Million Annual Rate in October

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,290,000. This is 13.7 percent above the revised September estimate of 1,135,000, but is 2.9 percent below the October 2016 rate of 1,328,000. Single-family housing starts in October were at a rate of 877,000; this is 5.3 percent above the revised September figure of 833,000. The October rate for units in buildings with five units or more was 393,000.

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,297,000. This is 5.9 percent above the revised September rate of 1,225,000 and is 0.9 percent above the October 2016 rate of 1,285,000. Single-family authorizations in October were at a rate of 839,000; this is 1.9 percent above the revised September figure of 823,000. Authorizations of units in buildings with five units or more were at a rate of 416,000 in October.

emphasis added

Click on graph for larger image.

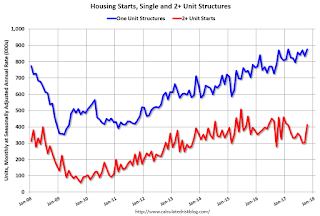

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in October compared to Septeber. However Multi-family starts are down year-over-year.

Multi-family is volatile month-to-month, but has been mostly moving down recently.

Single-family starts (blue) increased in October, and are up slightly year-over-year.

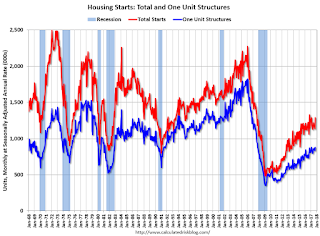

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in October were above expectations. Starts for August and September were revised down slightly, combined.

I'll have more later ...

Thursday, November 16, 2017

Friday: Housing Starts

by Calculated Risk on 11/16/2017 06:25:00 PM

Friday:

• At 8:30 AM, Housing Starts for October. The consensus is for 1.188 million SAAR, up from the September rate of 1.127 million.

• At 10:00 AM, State Employment and Unemployment (Monthly) for October 2017

• At 11:00 AM, the Kansas City Fed manufacturing survey for November.

Phoenix Real Estate in October: Sales up 4%, Inventory down 10% YoY

by Calculated Risk on 11/16/2017 03:01:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in October were up 4.3% year-over-year (including homes, condos and manufactured homes).

2) Active inventory is now down 10.1% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the twelfth consecutive month with a YoY decrease in inventory, and prices are rising a little faster this year (3.7% through August or 5.7% annual rate).

| October Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Oct-08 | 5,384 | --- | 1,348 | 25.0% | 55,7031 | --- |

| Oct-09 | 8,121 | 50.8% | 2,688 | 33.1% | 39,312 | -29.4% |

| Oct-10 | 6,591 | -18.8% | 2,800 | 42.5% | 45,252 | 15.1% |

| Oct-11 | 7,561 | 14.7% | 3,336 | 44.1% | 27,266 | -39.7% |

| Oct-12 | 7,020 | -7.2% | 3,081 | 43.9% | 22,702 | -16.7% |

| Oct-13 | 6,038 | -14.0% | 1,910 | 31.6% | 26,267 | 15.7% |

| Oct-14 | 6,186 | 2.5% | 1,712 | 27.7% | 27,760 | 5.7% |

| Oct-15 | 6,308 | 2.0% | 1,570 | 24.9% | 24,702 | -11.0% |

| Oct-16 | 7,102 | 12.6% | 1,494 | 21.0% | 24,950 | 1.0% |

| Oct-17 | 7,408 | 4.3% | 1,578 | 21.3% | 22,427 | -10.1% |

| 1 October 2008 probably includes pending listings | ||||||

Earlier: Philly Fed Manufacturing Survey showed "Activity Continues to Expand" in November

by Calculated Risk on 11/16/2017 12:11:00 PM

Earlier from the Philly Fed: November 2017 Manufacturing Business Outlook Survey

Regional manufacturing activity continued to expand in November, according to results from this month’s Manufacturing Business Outlook Survey. The indexes for general activity and shipments fell from their October readings but remained positive, while the survey’s index for new orders rose. The employment index fell but remained elevated. Almost all of the future indicators rose, and firms continue to expect growth in both activity and employment over the next six months.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The diffusion index for current manufacturing activity in the region remained positive but decreased from a reading of 27.9 in October to 22.7 in November. The index has been positive for 16 consecutive months. ... Firms continued to report increases in employment, though at a slower pace relative to last month. While the current employment index has been positive for 12 consecutive months, it fell 8 points to 22.6 in November.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through November), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

This suggests the ISM manufacturing index might decline in November, but still show solid expansion.

NAHB: Builder Confidence increased to 70 in November

by Calculated Risk on 11/16/2017 10:06:00 AM

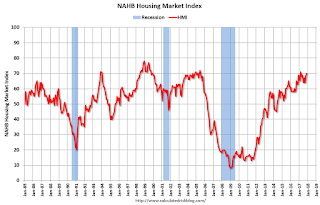

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 70 in November, up from 68 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Climbs to 8 Month High in November

Builder confidence in the market for newly-built single-family homes rose two points to a level of 70 in November on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This was the highest report since March, and the second highest on record since July 2005.

“November’s builder confidence reading is close to a post-recession high — a strong indicator that the housing market continues to grow steadily,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas. “However, our members still face supply-side constraints, such as lot and labor shortages and ongoing building material price increases.”

“Demand for housing is increasing at a consistent pace, driven by job and economic growth, rising homeownership rates and limited housing inventory,” said NAHB Chief Economist Robert Dietz. “With these economic fundamentals in place, we should see continued upward movement of the single-family housing market as we close out 2017.”

...

Two out of the three HMI components registered gains in November. The component gauging current sales conditions rose two points to 77 and the index measuring buyer traffic increased two points to 50. Meanwhile, the index charting sales expectations in the next six months dropped a single point to 77.

Looking at the three-month moving averages for regional HMI scores, the Northeast jumped five points to 54 and the South rose one point to 69. Both the West and Midwest remained unchanged at 77 and 63, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast, and a strong reading.

Industrial Production Increased 0.9% in October

by Calculated Risk on 11/16/2017 09:25:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.9 percent in October, and manufacturing increased 1.3 percent. The index for utilities rose 2.0 percent, but mining output fell 1.3 percent, as Hurricane Nate caused a sharp but short-lived decline in oil and gas drilling and extraction. Even so, industrial activity was boosted in October by a return to normal operations after Hurricanes Harvey and Irma suppressed production in August and September. Excluding the effects of the hurricanes, the index for total output advanced about 0.3 percent in October, and the index for manufacturing advanced about 0.2 percent.

With modest upward revisions for July through September, industrial production is now estimated to have only edged down 0.3 percent at an annual rate in the third quarter; the previously published estimate showed a decrease of 1.5 percent.

Total industrial production has risen 2.9 percent over the past 12 months; output in October was 106.1 percent of its 2012 average. Capacity utilization for the industrial sector was 77.0 percent, a rate that is 2.9 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.0% is 2.9% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in October to 106.1. This is 21.8% above the recession low, and just above the pre-recession peak.

Weekly Initial Unemployment Claims increase to 249,000

by Calculated Risk on 11/16/2017 08:33:00 AM

The DOL reported:

In the week ending November 11, the advance figure for seasonally adjusted initial claims was 249,000, an increase of 10,000 from the previous week's unrevised level of 239,000. The 4-week moving average was 237,750, an increase of 6,500 from the previous week's unrevised average of 231,250.The previous week was unrevised.

Claims taking procedures continue to be severely disrupted in the Virgin Islands. The ability to take claims has improved in Puerto Rico and they are now processing backlogged claims

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 237,750.

This was above the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, November 15, 2017

Thursday: Unemployment Claims, Philly Fed Mfg, Industrial Production, Homebuilder Survey

by Calculated Risk on 11/15/2017 08:20:00 PM

Earlier from the NY Fed: Empire State Manufacturing Survey: General Business Conditions Index Fell Eleven Points

Business activity continued to grow strongly in New York State, according to firms responding to the November 2017 Empire State Manufacturing Survey. Though the headline general business conditions index fell eleven points from the multiyear high it reached last month, it remained firmly in positive territory at 19.4. The new orders index climbed to 20.7 and the shipments index came in at 18.4—readings that pointed to ongoing solid gains in orders and shipments. Delivery times were slightly shorter than last month, and inventory levels edged higher. Labor market indicators reflected moderate employment gains and little change in hours worked. Both input prices and selling prices rose at a pace that was little changed from last month. Indexes assessing the six-month outlook suggested that firms were very optimistic about future business conditions.Thursday:

emphasis added

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, down from 239 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of 25.0, down from 27.9.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 76.2%.

• At 10:00 AM, The November NAHB homebuilder survey. The consensus is for a reading of 67, down from 68 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

Can investors use macro analysis?

by Calculated Risk on 11/15/2017 04:06:00 PM

Update: Here are five questions that people ask me all the time.

1. Are house prices in a bubble?

2. Is a recession imminent (within the next 12 months)?

3. Is the stock market a bubble?

4. Can investors use macro analysis?

5. Will Mr. Trump have a negative impact on the economy?

Two weeks ago I posted five economic questions I'm frequently asked.

Since then I've discussed:

1) Are house prices in a new bubble?

2) Is a recession imminent (within the next 12 months)?

3) Is the stock market a bubble?

Today I will discuss: Can investors use macro analysis?

Macro is the analysis of the economy as a whole (GDP, Unemployment, inflation, demographics), as opposed to the analysis of individual companies (or individuals). Sometimes we can use macro trends to help with sector analysis.

An example of the later would the apartment sector. It was in 2010 that I started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive. My analysis was based on three factors: low volume of new supply, a large cohort moving into their 20s (the prime renting age), and people moving from owning to renting (the foreclosure crisis). 2010 and 2011 was a great time to invest in apartments.

Another example of macro sector analysis was in January 2009, when I wrote about the auto sector: Vehicle Sales. It was pretty easy to predict sales were near a bottom, and that auto sales would "increase significantly" going forward.

We can also use macro analysis to follow the business cycle. However analysts have a poor track record in calling turns in the business cycle. As an example, ECRI called a recession in September 2011, and finally threw in the towel in May 2015. If investors sold when ECRI first made their recession call in Sept 2011, they would have missed close to a 75% increase in the market!

Note: This is partially from a previous post and is NOT intended as investment advice.

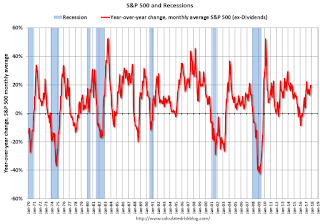

Why are investors so focused on the business cycle? Obviously earnings decline in a recession, and stock prices fall too. The following graph shows the year-over-year (YoY) change in the S&P 500 (using average monthly prices) since 1970. Notice that the market usually declines YoY in a recession.

Note: Because this is “year-over-year” there is a lag to the S&P 500 data.

So calling a recession isn’t just an academic exercise, there is some opportunity to preserve capital.

Not all downturns in the stock market are associated with recessions. As an example, the 1987 market crash was during an economic expansion. And the stock bubble collapse lasted from March 2000 through early 2003 – and the only official economic recession during that period was 7 months in 2001.

Although I don’t give investment advice, I think investors should measure their performance with some index. Warren Buffett likes to use the S&P 500 index, so I also used the S&P 500 for this exercise.

Imagine if we could call recessions in real time, and if we could predict recoveries in advance. The following table shows the performance of a buy-and-hold strategy (with dividend reinvestment), compared to a strategy of market timing based on 1) selling when a recession starts, and 2) buying 6 months before a recession ends.

For the buy and sell prices, I averaged the S&P 500 closing price for the entire month (no cherry picking price – just cherry picking the timing with 20/20 hindsight).

I assumed an investor started at five different times, in January of 1970, 1980, 1990, 2000 and 2010.

| Annual Return from Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | 9.3% | 13.3% | 12.4% | 13.0% | 13.2% | 12.7% |

| Jan-80 | 10.3% | 13.8% | 13.7% | 13.7% | 14.0% | 13.3% |

| Jan-90 | 8.6% | 12.9% | 12.6% | 12.8% | 12.9% | 12.4% |

| Jan-00 | 3.3% | 9.2% | 9.7% | 9.5% | 9.3% | 9.4% |

| Jan-10 | 14.2% | 14.2% | --- | --- | --- | --- |

The “recession timing” column gives the annualized return for each of the starting dates. Timing the recession correctly always outperforms buy-and-hold. The last four columns show the performance if the investor is two months early (both in and out), one month early, one month late, and two months late. The investor doesn’t have to be perfect!

Note: This includes dividends, but not taxes. Also I assumed no interest earned when the investor is out of the market (money in the mattress).

The second table provides the same information, but this time in dollars (assuming a $10,000 initial investment)..

| Value based on Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | $528,040 | $2,711,990 | $1,920,410 | $2,443,700 | $2,632,340 | $2,152,660 |

| Jan-80 | $307,240 | $907,270 | $869,690 | $870,620 | $955,130 | $779,090 |

| Jan-90 | $77,240 | $204,690 | $190,090 | $200,650 | $201,980 | $180,780 |

| Jan-00 | $16,260 | $36,960 | $39,370 | $38,270 | $37,490 | $38,080 |

| Jan-10 | $18,970 | $18,970 | --- | --- | --- | --- |

Unfortunately forecasters have a terrible record of predicting downturns. The running joke is that forecasters have predicted 9 of the last 5 recessions! Although a forecaster doesn’t have to be perfect, they still have to be right. And that is very rare.

As economist Victor Zarnowitz said way back in 1960: “The record of predicting turning points — changes in the direction of economic activity — is on the whole poor." Forecasting hasn't improved much since then.

As an example, here are some comments from then Fed Chairman Alan Greenspan in 1990 (a recession began in July 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].”I'd say he missed that downturn. Of course Wall Street and Fed Chairmen are notoriously bad at calling downturns.

Chairman Greenspan, July 1990

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.”

Greenspan, August 1990

“... the economy has not yet slipped into recession.”

Greenspan, October 1990

But the track record for calling recoveries isn’t much better. ... I was very lucky with the recent recession, but the key wasn’t calling the end in June 2009 (I thought it ended in July), but looking for the bottom in early 2009 (that is why I posted several times in early 2009 that I was looking for the sun).

This is NOT intended as investment advice. I am NOT an investment advisor. Just some (hopefully) fun musing ...

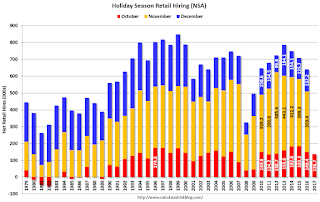

Seasonal Retail Hiring

by Calculated Risk on 11/15/2017 01:53:00 PM

According to the BLS employment report, retailers hired seasonal workers in October at a lower pace than the last few years.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 137 thousand workers (NSA) net in October. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are a little cautious about the holiday season - or are having difficulty finding seasonal workers. Note: There is a decent correlation between October seasonal retail hiring and holiday retail sales.