by Calculated Risk on 11/06/2012 08:51:00 AM

Tuesday, November 06, 2012

Greece Update

From Masa Serdarevic at the Financial Times Alphaville: Athens grinds to a halt

The Greek parliament will vote late Wednesday on the structural reforms and budget cuts demanded by the Troika. Reports suggest that the government will be able to get a majority. But in a last minute attempt to derail the vote, the country’s two main labour unions called a 48 hour general strike that started today.Alphaville has some photos of the strike - it looks like a complete mess. Live footage of the strike is here (or talking heads).

From the WSJ: Europe, Central Bank Spar Over Athens Aid

Europe's governments and the European Central Bank are at odds about who should shoulder the financial burden of giving Greece more time to repay its loans and remain part of the euro zone.Still no way out.

The search for a solution for Greece, whether by forgiving some of the money it owes or giving it yet more bailout loans, has come back to haunt the currency union ahead of the ECB's monthly policy meeting on Thursday.

Greece faces a key Treasury-bill repayment in less than two weeks, and the money isn't there unless governments provide additional aid or the ECB agrees to lend Greek banks the money to roll over the debt.

Monday, November 05, 2012

Tuesday: Presidential Election

by Calculated Risk on 11/05/2012 08:02:00 PM

The key event tomorrow is the US election.

Brad Plumer at the WaPo lists a number of projections: Pundit accountability: The official 2012 election prediction thread

Here are the electoral vote predictions from various modelers, political scientists and pundits from around the Internet. All predictions are as of Monday evening. And yes, this will be a fun thread to revisit the day after the election.There is quite a range of predictions. As I've noted, my economic forecasts assume President Obama will be reelected.

Ezra Klein had a great piece today: Neither Obama nor Romney will turn America into a bleak hellscape

We’re at the end of a long and bitter election, and so perhaps it’s worth taking a deep breath and admitting something that typically doesn’t get said until one candidate or the other delivers his concession speech: America will survive either way. Which isn’t to say the policy differences between the candidates aren’t real, and large. They are. But it’s not the end-times showdown that the two sides often suggest.Tuesday:

• At 10:00 AM ET, the Job Openings and Labor Turnover Survey for September will be released by the BLS. The number of job openings has generally been trending up, and openings were up about 13% year-over-year compared to August 2011.

Retailers expect solid Holiday Season

by Calculated Risk on 11/05/2012 04:54:00 PM

On Sunday I noted that October seasonal retail hiring gives a pretty good hint about holiday retail sales, see Retail: Seasonal Hiring vs. Retail Sales

The WSJ reports today: U.S. Retailers Expect Best Holiday Season Since 2007

Leading U.S. retailers expect a 3.7% increase in holiday same-store sales, according to a new survey by BDO USA.However Hurricane Sandy might have a negative impact, from the NY Times: A Storm-Battered Supply Chain Threatens Holiday Shopping

“While we haven’t returned to pre-recession levels of optimism, retailers are gearing up for what looks to be a promising holiday season,” said Doug Hart, partner in the retail and consumer product practice at BDO. “Still, consumers have more choices than ever, and retailers are looking to avoid showrooming by curating a mix of exclusive and top-selling products to get consumers in their door or on their site.”

BDO said despite uncertainty about how the presidential election will affect the economy and consumer spending, the expected increase marks the survey’s most optimistic forecast since 2007, when marketing heads projected a 5% increase in same-store sales.

In addition to shutting down shipping terminals and submerging warehouses, the storm also tangled up deliveries because of downed power lines, closed roads and scarce gasoline in parts of New York and New Jersey.But overall I expect a decent holiday shopping season.

The supply chain is backing up at a crucial time, just as retailers normally bring their final shipments into stores for the holiday shopping season, which retailers depend on for annual profitability.

“Things are slowing down,” said Chris Merritt, vice president for retail supply chain solutions at the trucking company Ryder. “This whole part of the supply chain is clogged up.”

Housing: Inventory down sharply in early November, Impacted by Hurricane Sandy

by Calculated Risk on 11/05/2012 02:22:00 PM

Here is another update using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), inventory is off 26.8% compared to the same week last year. However Hurricane Sandy clearly played a role; inventory in New York was off 55% week-over-week, Philadelphia off 66%, and Newark off 25%.

But even after adjusting for the areas impacted by Hurricane Sandy, overall inventory is down 22% year-over-year and probably at the lowest level since the early '00s.

This graph shows the NAR estimate of existing home inventory through September (left axis) and the HousingTracker data for the 54 metro areas through early November.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. So inventory will probably decline for the next several months before increasing again next year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early November listings, for the 54 metro areas, declined 26.8% from the same period last year.

HousingTracker reported that the early November listings, for the 54 metro areas, declined 26.8% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already pretty low. Barring a major disaster, it seems very unlikely we will see 20%+ year-over-year declines next summer!

Trulia: Asking House Prices increased in October

by Calculated Risk on 11/05/2012 11:59:00 AM

Press Release: Trulia Reports October Asking Prices Rise 2.9% Year-over-Year, But Rents Rise Faster at 5.1%

In October, asking prices rose 0.7% month-over-month, for a 2.9% year-over-year increase – the biggest yearly gain in the Trulia Price Monitor to date. More than two thirds of large metros – 69 out of 100 – had year-over-year price increases. The month-over-month and quarter-over-quarter price increases are larger when foreclosures are included than when they’re excluded – which means foreclosure prices are now rising faster than prices on non-distressed homes.These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a SA basis.

...

Rents Up 5.1% Year-over-Year – and Rising Even in Markets Where Prices are Falling

Rents have increased year-over-year in 24 of the 25 largest rental markets – all except Las Vegas. Rents are rising alongside big price gains in Oakland, Denver, and San Francisco; people looking for a home in these markets will find bargains disappearing whether they’re looking to rent or own. But rents are also rising sharply in Chicago and Philadelphia, despite falling for-sale prices.

...

“Continued widespread price increases are good for homeowners but not for home-seekers,” said Jed Kolko, Trulia’s Chief Economist. “For homeowners, rising prices add to their wealth and help bring underwater borrowers closer to positive equity. For home-seekers, however, rising prices could put homeownership out of reach. In markets like Denver, San Francisco, and Oakland, where prices and rents are both rising, higher prices mean higher down payments, but rising rents make it harder to save enough.”

More from Jed Kolko, Trulia Chief Economist: Asking Prices Rise Yet Again in October, But Rents Rise Faster

ISM Non-Manufacturing Index decreases in October

by Calculated Risk on 11/05/2012 10:00:00 AM

The October ISM Non-manufacturing index was at 54.2%, down from 55.1% in September. The employment index increased in October to 54.9%, up from 51.1% in September. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: October 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in October for the 34th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 54.2 percent in October, 0.9 percentage point lower than the 55.1 percent registered in September. This indicates continued growth this month at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 55.4 percent, which is 4.5 percentage points lower than the 59.9 percent reported in September, reflecting growth for the 39th consecutive month. The New Orders Index decreased by 2.9 percentage points to 54.8 percent. The Employment Index increased by 3.8 percentage points to 54.9 percent, indicating growth in employment for the third consecutive month. The Prices Index decreased 2.5 percentage points to 65.6 percent, indicating prices increased at a slower rate in October when compared to September. According to the NMI™, 13 non-manufacturing industries reported growth in October. The majority of the respondents' comments reflect a positive but guarded outlook on business conditions and the economy."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.9% and indicates slower expansion in October than in September. The internals were mixed with the employment index up, but new orders down.

Gasoline Prices down 30 cents over last month

by Calculated Risk on 11/05/2012 08:29:00 AM

From the SacBee: Gas prices decline sharply in October, trend may continue through end of the year

"Gas prices at the end of October were dropping at the fastest speeds in nearly four years," said Beth Mosher, director of public affairs for AAA Chicago. "If this trend continues, motorists could be paying less than last year to fill up their cars."Gasoline prices in California have fallen sharply following the recent spike due to refinery issues, and most areas are now under $4 per gallon.

Assuming a smooth restart to production following Hurricane Sandy, AAA predicts that gas prices will continue to drop through the end of the year. ... The Northeast is a significant gasoline consumer and not a major producer, so it is expected that the decline in demand from people not driving will outweigh any disruption in gasoline production.

Brent crude is now down to $105.33 per barrel. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.47 per gallon. That is about 3 cents below the current level according to Gasbuddy.com.

Notes: Add a California city to the graph - like Los Angeles or San Francisco - and you will see the recent sharp increase and decrease. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Sunday, November 04, 2012

Monday: ISM Service Index

by Calculated Risk on 11/04/2012 08:40:00 PM

A couple of earlier posts that might interest some readers:

• Retail: Seasonal Hiring vs. Retail Sales

• Update: Further Discussion on Labor Force Participation Rate

A few scary articles on Europe:

• From the WSJ: Europe's Bank Reviews Collateral

The European Central Bank is looking into whether it is treating Spanish government Treasury bills too generously when commercial banks present them as collateral for loans, potentially reviving concerns over the safety of the central bank's €3 trillion ($3.85 trillion) balance sheet.• From the WSJ: Greece's Siren Call

An ECB spokeswoman confirmed the collateral examination Sunday after Germany's Welt am Sonntag newspaper reported, based on its own research, that the ECB hasn't followed its own rules when banks presented some Spanish government securities.

Voting in the Greek parliament on the passage of €13.5 billion ($17.33 billion) of austerity measures, labor reforms and the 2013 budget will also be a focus for financial markets. ... The immediate risk is that Greece fails to approve the new austerity measures. ... The next vote is needed to unlock €31.5 billion of bailout funding, much of which will go to recapitalize Greece's banks. Again, PASOK's behavior will be key.• From the Telegraph: Angela Merkel: eurozone crisis will last at least another five years

If Greece jumps that hurdle, it still needs an extension of two years from the rest of Europe on its budget targets, as its economy has suffered far more than forecast.

“We need a long breath of five years and more,” [Merkel] told a conference in Sternberg, GermanyFive more years?

Monday:

• At 10:00 AM ET, the ISM non-Manufacturing Index for October will be released. The consensus is for a decrease to 54.9 from 55.1 in September. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Trulia Price Rent Monitors for October will be released. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors and seems like a decent leading indicator for house prices.

The Asian markets are mostly red tonight, with the Nikkei down 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 8.

Oil prices are falling with WTI futures at $84.78 per barrel and Brent down to $105.44 per barrel. This is the lowest level since July. And gasoline prices are falling too!

Weekend:

• Summary for Week Ending Nov 2nd

• Schedule for Week of Nov 4th

Two more questions this week for the November economic prediction contest and four question for the November contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Update: Further Discussion on Labor Force Participation Rate

by Calculated Risk on 11/04/2012 02:31:00 PM

Last month I wrote Understanding the Decline in the Participation Rate. As a follow on, I wrote: Further Discussion on Labor Force Participation Rate. Here is a repeat with some added data, graphs and commentary.

Definitions from the BLS:

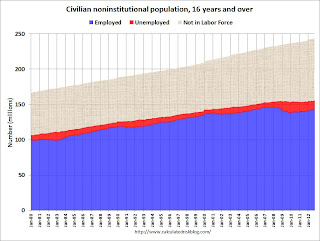

Civilian noninstitutional population: "consists of persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities and homes for the aged) and who are not on active duty in the Armed Forces". If you look at the first graph below, the total of the Blue, Red, and light brown areas is the Civilian noninstitutional population.

"The civilian labor force consists of all persons classified as employed or unemployed". This is Blue and Red combined on the first graph.

"The labor force participation rate represents the proportion of the civilian noninstitutional population that is in the labor force." So this is Blue and Red, divided by all areas combined.

"The employment-population ratio represents the proportion of the civilian noninstitutional population that is employed." This is Blue divided by the total area.

"The unemployment rate is the number of unemployed as a percent of the civilian labor force." This is Red divided by Red and Blue combined. This is the REAL unemployment rate (some claim U-6 is the "real rate", but that is nonsense - although U-6 is an alternative measure of underemployment, it includes many people working part time).

Click on graph for larger image.

Click on graph for larger image.

There are some bumps in the total area - usually when there is a decennial census. These are due to changes in population controls.

Note that the Blue area collapsed in 2008 and early 2009, and started increasing in 2010. This shows the increase in employment over the last few years. Over the last few years, the red area (unemployment) has been decreasing.

However the combined area, the civilian labor force, has not increased much - even though the civilian noninstitutional population has been increasing. Some people argue that this evidence of a large number of people who left the labor force because of the weak labor market - and that the actual unemployment rate should be much higher than 7.9%.

However, as I noted last month, some decrease in the labor force participation rate was expected, and it appears most of the decline in the participation rate can be explained by demographic shifts.

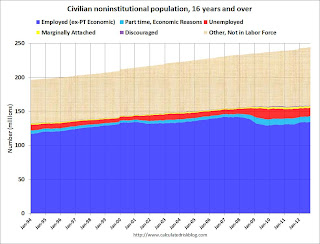

The second graph is similar to the first graph, but breaks the data down by a few more categories. Some of this data is only available since January 1994.

The second graph is similar to the first graph, but breaks the data down by a few more categories. Some of this data is only available since January 1994.

The light blue area is part time for economic reasons. "These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job." Some of the dark blue workers are working part time too, but that is by choice. The dark blue and light blue add to dark blue in the previous graph.

The yellow area is marginally attached workers. "These individuals were not in the labor force, wanted and were available for work, and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey."

The purple area is discouraged workers. "Discouraged workers are persons not currently looking for work because they believe no jobs are available for them."

Part time for economic reasons, marginally attached workers, and discouraged workers are all included in U-6, an alternate measure of labor underutilization.

The third graph shows the number of people in the US by age group from both the 2000 and 2010 decennial Census, and a recent Census Bureau projection for 2020.

The third graph shows the number of people in the US by age group from both the 2000 and 2010 decennial Census, and a recent Census Bureau projection for 2020.

This graph shows two key shifts. First, baby boomers are now moving into lower participation rate age groups. Look at the increase in the 55-to-59 and 60-to-64 groups from 2000 (blue) to 2010 (red).

A second key demographic is the significant increase in people in the 15-to-19 and 20-to-24 age groups. These groups have lower participation rates usually because of school enrollment - and enrollment has been increasing.

Taken together, it is clear why the labor force hasn't increase as quickly as the civilian noninstitutional population, and therefore, why a decline in the labor force participation rate was expected.

Also - in 2010, the group with the highest population was in the '45 to 49 age group, followed by the '50 to 54 age group. By 2020, the seven groups with the highest projected population will all be under 35! Sure, some geezers will hang around, and that will push down the overall participation rate - but there is a new engine of growth coming.

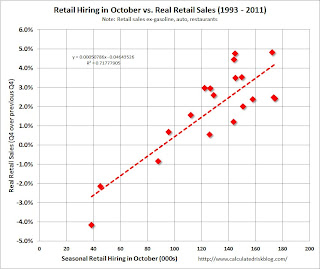

Retail: Seasonal Hiring vs. Retail Sales

by Calculated Risk on 11/04/2012 08:32:00 AM

On Friday I noted that retailers hired seasonal workers at slightly above the 2011 pace in October. At the bottom of this post is a graph showing the correlation between seasonal hiring and retail sales.

First, here is the NRF forecast for this year: NRF, Shop.org Expect Solid Growth This Holiday Season

Tempered by political and fiscal uncertainties but supported by signs of improvement in consumer confidence, holiday sales this year will increase 4.1 percent to $586.1 billion. NRF’s 2012 holiday forecast is higher than the 10-year average holiday sales increase of 3.5 percent. Actual holiday sales in 2011 grew 5.6 percent.Note: NRF defines retail sales as including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

“This is the most optimistic forecast NRF has released since the recession. In spite of the uncertainties that exist in our economy and among consumers, we believe we’ll see solid holiday sales growth this year,” said NRF President and CEO Matthew Shay. “Variables including an upcoming presidential election, confusion surrounding the ‘fiscal cliff’ and concern relating to future economic growth could all combine to affect consumers’ spending plans, but overall we are optimistic that retailers promotions will hit the right chord with holiday shoppers.”

Last year the NRF forecast sales to increase 2.8%. At the beginning of November 2011, I posted that that forecast seemed way too low based on seasonal hiring (the NRF related their forecast at the beginning of October). In fact retail sales increased 5.6% last year in November and December.

This is an old idea: Watch what they do, not what they say. And once again the retailers are hiring seasonal workers at a solid pace. Here is a repeat of the graph of retail hiring based on the BLS employment report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the historical net retail jobs added for October, November and December by year.

Retailers hired 130.1 thousand workers (NSA) net in October. This is slightly below the numbers in 2003 through 2006 and about the same as in 2011. Note: this is NSA (Not Seasonally Adjusted).

The scatter graph is for the years 1993 through 2011 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).

The scatter graph is for the years 1993 through 2011 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.72 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants.

With 130 thousand seasonal hires, this suggests a real gain of around 2.0% in Q4 (plus inflation), very close to the NRF forecast of 4.1% nominal (that includes inflation).