by Calculated Risk on 11/03/2012 07:53:00 AM

Saturday, November 03, 2012

Schedule for Week of Nov 4th

Note: I'll post the weekly summary soon.

The most anticipated event this week will be the US election on Tuesday.

The key US report for this week will be the September trade balance report on Thursday.

Note: We might see some impact from Hurricane Sandy on weekly unemployment claims on Thursday.

10:00 AM: Trulia Price Rent Monitors for October. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS.

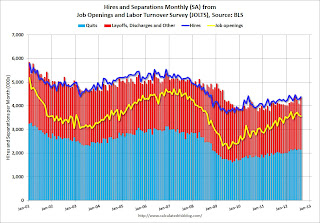

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011.

3:00 PM: Consumer Credit for September. The consensus is for credit to increase $10.2 billion.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 363 thousand.

8:30 AM: Trade Balance report for September from the Census Bureau.

8:30 AM: Trade Balance report for September from the Census Bureau. This graph is through August. Both exports and imports decreased in August. It appears that the global economic weakness is impacting both exports and imports.

The consensus is for the U.S. trade deficit to increase to $45.4 billion in August, up from from $44.2 billion in August. Export activity to Europe will be closely watched due to economic weakness.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for sentiment to increase slightly to 83.3.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.3% increase in inventories.