by Calculated Risk on 10/15/2011 03:41:00 PM

Saturday, October 15, 2011

Schedule for Week of Oct 16th

Earlier:

• Summary for Week Ending Oct 14th

Three key housing reports will be released this week: October homebuilder confidence on Tuesday, September housing starts on Wednesday, and September existing home sales on Thursday.

For manufacturing, the October NY Fed (Empire state) survey will be released on Monday, the October Philly Fed survey on Thursday, and the September Industrial Production and Capacity Utilization report on Monday. The high frequency surveys (Empire state, Philly Fed, and weekly initial unemployment claims) are all expected to show some improvement.

On prices, the September Producer Price index (PPI) will be released Tuesday, and CPI will be released Wednesday.

Fed Chairman Ben Bernanke speaks on Tuesday, and several regional Fed presidents speak throughout the week. On Sunday, Oct 23rd, the European leaders will hold a summit meeting.

8:30 AM ET: NY Fed Empire Manufacturing Survey for October. The consensus is for a reading of -3.25, up slightly from -8.82 in September (below zero is contraction).

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for September. This graph shows industrial production since 1967. Industrial production increased in August to 94.0 (although earlier months were revised down).

The consensus is for a 0.2% increase in Industrial Production in September, and an increase to 77.5% (from 77.4%) for Capacity Utilization. The Ceridian index suggests Industrial Production declined in September.

8:30 AM: Producer Price Index for September. The consensus is for a 0.3% increase in producer prices (0.1% increase in core).

10 AM ET: The October NAHB homebuilder survey. The consensus is for a reading of 15, up slightly from 14 in September. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for four years.

1:15 PM: Speech, Fed Chairman Ben Bernanke, "The Effects of the Great Recession on Central Bank Doctrine and Practice", At the Federal Reserve Bank of Boston 56th Economic Conference, Boston, Massachusetts

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

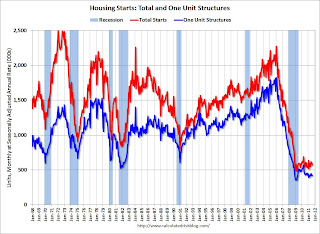

8:30 AM: Housing Starts for September. After collapsing following the housing bubble, housing starts have mostly been moving sideways for almost three years.

8:30 AM: Housing Starts for September. After collapsing following the housing bubble, housing starts have mostly been moving sideways for almost three years. Total housing starts were at 571 thousand (SAAR) in August, down 5.0% from the revised July rate of 601 thousand (revised from 604). Single-family starts declined 1.4% to 417 thousand in August.

The consensus is for an increase to 590,000 (SAAR) in September. More sideways ...

8:30 AM: Consumer Price Index for September. The consensus is for a 0.3% increase in prices. The consensus for core CPI is an increase of 0.2%. CPI-W for September will be released too. This index is used for Social Security Cost-of-living and other adjustments, and COLA is currently on track to increase by about 3.5% for next year.

2:00 PM: Federal Reserve Beige Book for early October, Informal review by the Federal Reserve Banks of current economic conditions in their Districts

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 400,000 from 404,000 last week. If the consensus is correct, the 4-week average would fall to the lowest level since early April.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 4.93 million at a Seasonally Adjusted Annual Rate (SAAR) in September, down from 5.03 million SAAR in August. This is probably a little high - economist Tom Lawler estimates the NAR will report sales of 4.80 million.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 4.93 million at a Seasonally Adjusted Annual Rate (SAAR) in September, down from 5.03 million SAAR in August. This is probably a little high - economist Tom Lawler estimates the NAR will report sales of 4.80 million.Update 10/18/2011: Lawler has upped his forecast to 4.83 million.

Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). There is no firm date for the release of these revisions.

10:00 AM: Philly Fed Survey for Septmeber. The consensus is for a reading of -9.0 (below zero indicates contraction), up from -17.5 last month.

10:00 AM: Conference Board Leading Indicators for September. The consensus is for a 0.3% increase in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for September 2011

European Union leaders will hold a summit meeting.

Lawler: Early Read on Existing Home Sales in September

by Calculated Risk on 10/15/2011 01:37:00 PM

From economist Tom Lawler:

Based on the information I have so far from local realtor associations/MLS/boards, I estimate that existing home sales as calculated by the National Association of Realtors ran at a seasonally adjusted annual rate [SAAR] of around 4.80 million, down 4.6% from August’s pace, but pretty darned close to the average monthly sales pace for the past four months. Existing home inventories clearly declined significantly from August to September, and while available listings data and the NAR inventory numbers often don’t “track” well month to month, my best guess is that the NAR inventory number for September will be down by about 3.8%, which would put the YOY inventory drop as measured by the NAR to about 14%.CR Note: The NAR will release September Existing-Home Sales on Thursday, Oct 20th at 10:00 AM ET. The consensus forecast is for 4.93 million sales in September (SAAR).

Based on Tom's estimate, inventory would fall to 3.44 million in September, down from 3.58 million in August, and months-of-supply would increase to 8.6 months from 8.5 months in August. This would be the lowest level inventory for September since 2005 (2.77 million in Sept 2005). The peak inventory for September was in 2007 at 4.37 million.

Earlier:

• Summary for Week Ending Oct 14th

Summary for Week Ending Oct 14th

by Calculated Risk on 10/15/2011 08:15:00 AM

The European financial crisis is nearing a critical point. The enhanced EFSF has been approved, and it appears Greece will receive the next loan installment in early November. Now the discussion is focused on recapitalizing European banks and on how to leverage the EFSF (probably some sort of insurance plan). A couple of articles this morning:

From the WSJ: Germany, France Close In on Crisis Plan

The plan taking shape is built on three central elements: the new bailout for Greece, an effort to shore up the banks affected by Greek losses (and fearful of Italian and Spanish losses) and additional firepower for the bailout fund to provide a reassuring backstop.And from the Financial Times: Investor threat to second Greek bail-out

The lead negotiator for private holders of Greek debt has said that investors are unwilling to accept greater losses on their bonds than the 21 per cent agreed in July, jeopardising eurozone plans to finalise a second Greek bail-out by the end of next week.The next key date is Sunday October 23rd when European Union leaders will hold a summit meeting. Germany and France have promised a comprehensive plan by November 4th.

excerpt with permission

Also there is a summit of G20 finance ministers in Paris today, and the ministers are expected to show support for European leaders.

There was little U.S. economic data released last week. Retail sales were strong in September, and the trade deficit was unchanged in August from July. Both better than expected. Consumer sentiment was still very low, as was small business confidence.

Next week will be a little busier!

Here is a summary in graphs:

• Retail Sales increased 1.1% in September

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a monthly basis, retail sales were up 1.1% from August to September (seasonally adjusted, after revisions), and sales were up 7.9% from September 2010. Retail sales excluding autos increased 0.6% in September. Sales for August were revised up to a 0.3% increase.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 18.9% from the bottom, and now 4.5% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 6.4% on a YoY basis (7.9% for all retail sales). The consensus was for retail sales to increase 0.8% in September, and for a 0.4% increase ex-auto. This was a strong report, especially with the upward revisions to both July and August.

• Trade Deficit unchanged at $45.6 billion in August

"[T]otal August exports of $177.6 billion and imports of $223.2 billion resulted in a goods and services deficit of $45.6 billion, virtually unchanged from July, revised." This was slightly below the consensus forecast of $46 billion.

"[T]otal August exports of $177.6 billion and imports of $223.2 billion resulted in a goods and services deficit of $45.6 billion, virtually unchanged from July, revised." This was slightly below the consensus forecast of $46 billion.This graph shows the monthly U.S. exports and imports in dollars through August 2011. Exports and imports were mostly unchanged in August (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to August 2010; imports have stalled recently and are up about 11% compared to August 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The second graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $102.62 per barrel in August, down slightly from $104.27 per barrel in July. The trade deficit with China increased to a record $29 billion; trade with China remains a significant issue.

Imports have been moving sideways for the last several months - partially due to slightly lower oil prices. However the trade deficit with China continues to increase. Exports are still generally trending up.

• NFIB: Small Business Optimism Index increases slightly in September

From the National Federation of Independent Business (NFIB): Small-Business Confidence Sees Modest Gain: The Start of a Trend, or a Blip?

From the National Federation of Independent Business (NFIB): Small-Business Confidence Sees Modest Gain: The Start of a Trend, or a Blip? This graph shows the small business optimism index since 1986. The index increased to 88.9 in September from 88.1 in August.

Optimism had declined for six consecutive months and this is just a small increase. Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

This graph shows the net hiring plans for the next three months.

This graph shows the net hiring plans for the next three months.Hiring plans were still low in September, but still positive and the trend is up.

According to NFIB: “Over the next three months, 11 percent plan to increase employment (unchanged), and 12 percent plan to reduce their workforce (unchanged), yielding a seasonally adjusted 4 percent of owners planning to create new jobs, also down 1 point from August."

This index has been slow to recover - probably due to a combination of the recent economic weakness, and also the high concentration of real estate related companies in the index.

• BLS: Job Openings "little changed" in August

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Notice that hires (dark blue) and total separations (red and blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Notice that hires (dark blue) and total separations (red and blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.In general job openings (yellow) has been trending up, and are up about 7% year-over-year compared to August 2010. Layoffs and discharges are down about 10% year-over-year.

Quits increased in August, and have been trending up - and quits are now up about 10% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• Weekly Initial Unemployment Claims at 404,000

This graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 408,000.

This is the lowest level for the 4-week average of weekly claims since August. This is still elevated, but the decline in the 4-week average is a positive.

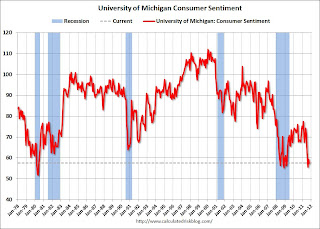

• Consumer Sentiment declines in October

The preliminary October Reuters / University of Michigan consumer sentiment index declined to 57.5 from 59.4 in September.

The preliminary October Reuters / University of Michigan consumer sentiment index declined to 57.5 from 59.4 in September.In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate. History suggests it usually takes 2 to 4 months to bounce back from an event (If we can call the threat of default an "event"). So sentiment might increase over the next couple of months.

And, of course, any bounce back from the debt ceiling debate would be to an already weak reading. This was a very weak reading.

• Other Economic Stories ...

• From the NY Times: Recession Officially Over, U.S. Incomes Kept Falling

• From Reuters: EU leaders delay summit to agree crisis plan

• EC, IMF, ECB says aid likely for Greece

• Ceridian-UCLA: Diesel Fuel index declined in September

• FOMC Minutes: "Considerable uncertainty surrounding the outlook for a gradual pickup in economic growth"

Friday, October 14, 2011

Stand-up economist Yoram Bauman on Chinese Housing

by Calculated Risk on 10/14/2011 09:10:00 PM

This isn't a comedy routine - except about the hot water heater. Instead Bauman talks about the housing market in Beijing. (ht Merle Hazard)

For more discussion, see Paul Solman on PBS NewsHour: Chinese Housing Bubble: A Troubling Update from Beijing

In this video post, Bauman also includes one piece of what we like to call anecdata. Practicing his Mandarin Chinese (fun to watch) with Han Jing, a Beijing realtor, Bauman learns that she bought her own apartment for the equivalent of $80,000 five years ago. It's now worth $400,000, she says. Yet she can only rent it for the equivalent of $600 a month. ... Bauman's conclusion? Beijing prices and its glut of vacant apartment buildings seem as fishy as the mechanics of the hot water heater in his apartment. Wait til you see how it's hooked up.What Bauman doesn't mention is that most of these properties are bought with large downpayments (little leverage).

Bank Failure #80: Country Bank, Aledo, Illinois

by Calculated Risk on 10/14/2011 07:14:00 PM

Country Bank is mown over

Blackhawk taking down.

by Soylent Green is People

From the FDIC: Blackhawk Bank & Trust, Milan, Illinois, Assumes All of the Deposits of Country Bank, Aledo, Illinois

As of June 30, 2011, Country Bank had approximately $190.6 million in total assets and $167.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $66.3 million. ... Country Bank is the 80th FDIC-insured institution to fail in the nation this year, and the eighth in Illinois.That makes four today.

Bank Failures #77 through 79: In Georgia, North Carolina and New Jersey

by Calculated Risk on 10/14/2011 05:33:00 PM

It's banker hunting season

Throughout the states South

by Soylent Green is People

From the FDIC: State Bank and Trust Company, Macon, Georgia, Assumes All of the Deposits of Piedmont Community Bank, Gray, Georgia

As of June 30, 2011, Piedmont Community Bank had approximately $201.7 million in total assets and $181.4 million in total depositsFrom the FDIC: Bank of North Carolina, Thomasville, North Carolina, Assumes All of the Deposits of Blue Ridge Savings Bank, Inc., Asheville, North Carolina

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $71.6 million. ... Piedmont Community Bank is the 77th FDIC-insured institution to fail in the nation this year, and the twentieth in Georgia.

As of June 30, 2011, Blue Ridge Savings Bank, Inc. had approximately $161.0 million in total assets and $158.7 million in total deposits.From the FDIC: Northfield Bank, Staten Island, New York, Assumes All of the Deposits of First State Bank, Cranford, New Jersey

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $38.0 million. ... Blue Ridge Savings Bank, Inc. is the 78th FDIC-insured institution to fail in the nation this year, and the second in North Carolina.

As of June 30, 2011, First State Bank had approximately $204.4 million in total assets and $201.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $45.8 million. ... First State Bank is the 79th FDIC-insured institution to fail in the nation this year, and the first in New Jersey.Another bank in Georgia - and a pretty large percentage loss too!

Misc: Market and Foreclosure Auction

by Calculated Risk on 10/14/2011 04:11:00 PM

This graph (click on graph for larger image) from Doug Short shows the recent market increase.

I'm at a foreclosure auction in California. The auction is ongoing ... 50+ properties were postponed. The first several properties went to the beneficiary.

We just saw a bidding war starting at $356,000 and the property was bought at $520,100. Pretty wild.

See-Saw Economy or a Series of Shocks?

by Calculated Risk on 10/14/2011 01:25:00 PM

Kelly Evans at the WSJ makes an interesting observation: Economy in Full Swing (Watch Your Head)

So far, incoming September economic reports have been surprisingly firm. Auto sales rebounded to their highest level since April. Chain-store sales posted year-on-year growth of 5.5%. The economy added 103,000 jobs, and manufacturing sentiment improved a bit. [Retail sales increased 1.1% in September]

...Monthly GDP isn't released by the Bureau of Economic Analysis (BEA). Evans is using an estimate from Macroeconomic Advisers.

If this feels like a 180-degree turn from August, that's because it basically is. It would be one thing if this were a special case, or a broad turning point in the economy. But, in fact, this kind of volatility, these jerky swings in growth, have become the norm. Consider what has happened so far this year: Real gross domestic product shrank in January and February, according to tracking firm Macroeconomic Advisers. Then it surged by more than 1% in March. It contracted again in May and June—only to jump by more than 1% again in July.

This isn't typical. Since 1992, monthly GDP has fallen about a third of the time when the economy hasn't been in recession. This year, even assuming a small gain in August, monthly GDP has fallen about half the time.

The BEA does release monthly Personal Consumption Expenditures (PCE) data, and the following graph shows the monthly change in real PCE back to 1995.

Click on graph for larger image.

Click on graph for larger image.Real PCE has declined in three months this year through August (September will be positive based on the retail report). We have seen multiple declines in a year before - outside of a recession - like in 1995 and 2005. Many of the monthly declines were during recessions, but many monthly declines were event driven (like hurricanes Katrina and Rita in 2005). The sharp decline in September 2009 was due to the end of "cash-for-clunkers" (another event).

Although growth is sluggish - due to the significant slack in the system (excess capacity, lack of demand) and also high levels of household debt, I think the volatility this year can be blamed on a series of events including extreme weather (significant snow storms, flooding, hurricane Irene), the oil price increase related to the "Arab Spring", the tsunami in Japan, and the debt ceiling debate in D.C. during late July and early August.

Also the ongoing European financial crisis keeps flaring up and impacting the U.S. economy.

Yes, the economy is very sluggish - 103,000 jobs was a weak report, just better than low expectations - but I think the economic volatility is related to events and hopefully not some new normal.

Consumer Sentiment declines in October

by Calculated Risk on 10/14/2011 09:55:00 AM

The preliminary October Reuters / University of Michigan consumer sentiment index declined to 57.5 from 59.4 in September.

Click on graph for larger image in graph gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate. History suggests it usually takes 2 to 4 months to bounce back from an event (If we can call the threat of default an "event"). So sentiment might increase over the next couple of months.

And, of course, any bounce back from the debt ceiling debate would be to an already weak reading.

This was very weak, and below the consensus forecast of 60.0.

Retail Sales increased 1.1% in September

by Calculated Risk on 10/14/2011 08:30:00 AM

On a monthly basis, retail sales were up 1.1% from August to September (seasonally adjusted, after revisions), and sales were up 7.9% from September 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $395.5 billion, an increase of 1.1 percent (±0.5%) from the previous month and 7.9 percent (±0.7%) above September 2010. Total sales for the July through September 2011 period were up 8.0 percent (±0.7%) from the same period a year ago. The July to August 2011 percent change was revised from virtually unchanged (±0.5%)* to +0.3 percent (±0.2%).Retail sales excluding autos increased 0.6% in September. Sales for August were revised up to a 0.3% increase.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 18.9% from the bottom, and now 4.5% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.4% on a YoY basis (7.9% for all retail sales).

Retail sales ex-gasoline increased by 6.4% on a YoY basis (7.9% for all retail sales). The consensus was for retail sales to increase 0.8% in September, and for a 0.4% increase ex-auto.

This was a strong report, especially with the upward revisions to both July and August.