by Calculated Risk on 7/11/2011 05:51:00 PM

Monday, July 11, 2011

Distressed House Sales using Sacramento data

I've been following the Sacramento market to see the change in mix over time (conventional, REOs, and short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

I'm not exactly sure what I'm looking for, but hopefully I'll know it when I see it! As some point, the number (and percent) of distressed sales will start to decline without foreclosure moratoria, homebuyer tax credits or other distortions. There is no sign of a decline yet (except seasonal).

The percent of distressed sales in Sacramento declined slightly in June compared to May because of a seasonal pickup in conventional sales. In June 2011, 65.2% of all resales (single family homes and condos) were distressed sales. This is down from 65.6% in May, and up from 62.4% in June 2010.

Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer.

Notes: Prior to June 2009, it is unclear if short sales were included as REO or as "conventional" - or some of both. The tax credits might have also boosted conventional sales in 2009 and early 2010.

More Europe

by Calculated Risk on 7/11/2011 03:55:00 PM

Today was mostly about Europe.

As the Financial Times reported this weekend, European policymakers appear to be finally accepting some sort of default is inevitable for Greece. On Italy: the deficit is 4.6% of GDP (not horrible), but their debt is 120% of GDP - and their growth is slow.

From the NY Times: Italy Evolves Into E.U.’s Next Weak Link

In recent days, Italy has become Europe’s next weak link after Greece, Ireland and Portugal and Spain ... Italy’s banks are sound; they never speculated in a housing bubble. The current annual budget deficit is low, at around 4.6 percent of its gross domestic product. And while Italy issues the largest amount of bonds of any euro zone country, Italians own about half the debt, making it less vulnerable to the follies of financial markets.From the WSJ: Euro Zone Still Seeks Private-Sector Solution

But with interest rates rising, Italy’s economy is not growing fast enough to cover an accumulated debt load of 120 percent of gross domestic product, the second-highest in Europe, after Greece. The International Monetary Fund expects growth to rise only slightly, to 1.3 percent in 2012.

Several European officials said Monday that a significant private-sector contribution to a second bailout package remained critical even if the rating agencies branded it a default.Earlier I posted the bond yields in Europe with record highs for several countries (Greece, Ireland, Portugal and Italy).

"I am more searching for a solution than a rating," Belgian Finance Minister Didier Reynders said before a meeting of euro-zone finance ministers here. "If it's with a negative reaction from the rating agencies, that's not a problem."

AAR: Rail Traffic soft in June

by Calculated Risk on 7/11/2011 11:45:00 AM

The Association of American Railroads (AAR) reports carload traffic in June 2011 increased 0.9 percent compared with the same month last year (up slightly), and intermodal traffic (using intermodal or shipping containers) increased 4.6 percent compared with June 2010. On a seasonally adjusted basis, carloads in June 2011 were down 0.7% from May 2011; intermodal in June 2011 was down 2.4% from May 2011.

June 2011, like the previous couple of months, was not a great month for U.S. rail carload traffic. U.S. freight railroads originated 1,428,580 carloads in June 2011, an average of 285,716 per week — up 0.9% (13,232 carloads) over June 2010 and up 11.6% (148,793 carloads) over June 2009 on a non-seasonally adjusted basis.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows U.S. average weekly rail carloads (NSA).

As the first graph shows, rail carload traffic collapsed in November 2008, and now, 2 years into the recovery, carload traffic has recovered less than half way.

For the last few months, traffic has been tracking 2010 (little growth from last year).

According to the AAR, carloads for 14 of 20 commodities they track were up in June, but carloads for coal were down, and that really impacts overall traffic.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):June 2011 was a better month for U.S. intermodal traffic than for U.S. carload traffic, but intermodal growth slowed. U.S. railroads originated 1,152,432 intermodal trailers and containers in June 2011, up 4.6% over June 2010. That’s a decent year-over-year monthly increase, but it’s the lowest since January 2010.So intermodal traffic has been fairly strong, but carload traffic (commodities and autos) is only about half way back to pre-recession levels.

excerpts with permission

Europe: Bond Yields up Sharply for Italy, Greece, Ireland and Portugal

by Calculated Risk on 7/11/2011 08:35:00 AM

This doesn't look good ... (see table below).

The Greek 2 year yield is up to a record 31.1%.

The Portuguese 2 year yield is up to a record 18.3%.

The Irish 2 year yield is up to a record 18.1%.

And the big jump ... the Italian 2 year yield is up to a record 4.1%. Still much lower than Greece, Portugal and Ireland, but rising.

From the Telegraph: Italy debt contagion fears hit markets as top EU officials meet

Herman Van Rompuy, the president of the European Council, will meet European Central Bank President Jean-Claude Trichet and Jean-Claude Juncker, the chairman of the Eurogroup, for talks in Brussels at around midday, ahead of a meeting of the 17 euro zone finance ministers later on Monday.Here are the links for bond yields for several countries (source: Bloomberg):

Mr Van Rompuy's spokesman described the gathering as a "coordination, not a crisis meeting". He added that Italy would not be on the agenda, as ministers focused on thrashing out terms of a second Greek rescue package.

The meeting comes as the Financial Times reported that leaders are prepared to accept that Athens should default on some of its bonds.

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Sunday, July 10, 2011

Report: EU to consider Greek Default

by Calculated Risk on 7/10/2011 10:12:00 PM

From the Financial Times: EU stance shifts on Greece default

The Financial Times is reporting that European leaders will now accept that "Athens should default on some of its bonds" to reduce the overall debt burden of Greece.

This would be a major shift. The Financial Times suggests this will be discussed at the meeting of finance ministers on Monday and probably ends the plan suggested by France.

From the Irish Times: European leaders to consider default as part of Greek rescue

EURO ZONE finance ministers are considering a fundamental revision of their strategy in the Greek debt crisis ... At issue as the ministers meet today in Brussels is whether they agree to look again at a German debt-swap plan in which Greek investors would be urged to exchange their bonds for debt with a longer maturity.Another interesting week in Europe.

This plan was scrapped weeks ago on the basis that it would lead to a default rating on Greek debt, something which is resolutely opposed by the European Central Bank.

...

Also on the table is the revival of a plan rejected four months ago in which the euro zone bailout fund — the European Financial Stability Facility — would intervene in markets to buy Greek debt at a discount to its original value.

Consideration may also be given to another lowering of the interest rate on Greece’s rescue loans.

How many jobs are needed over the next year to keep the unemployment rate steady?

by Calculated Risk on 7/10/2011 05:42:00 PM

Dean Baker writes: We Need 90,000 Jobs Per Month to Keep Pace With the Growth of the Population

In an article on the June employment report the NYT told readers that the economy needs 150,000 jobs per month to keep pace with the growth in the population. Actually, the Congressional Budget Office projects that the underlying rate of labor force growth is now just 0.7 percent annually. This comes to roughly 1,050,000 a year or just under 90,000 a month.Here is the CBO report that Baker mentions: CBO’s Labor Force Projections Through 2021

The number of jobs needed per month to keep up with population growth depends on the rate of population growth, and the participation rate. We also have to be clear on the time frame we are discussing. The CBO report is through 2021, and the CBO is projecting the participation rate to fall to 63% by 2021 due to an aging population.

If, instead, we asked how many jobs are needed over the next year to keep the unemployment rate steady using the CBO projection of the participation rate, the answer is very different. The CBO is projecting the participation rate will be at 64.6% in 2012 and the current participation rate is 64.1%.

I've been projecting some bounce back in the participation rate too - but it hasn't happened yet.

The following table uses the CBO projections and provides an estimate of the jobs needed per month (per the household survey1) to hold the unemployment rate steady.

The first column is actual for June 2011 as reported by the BLS. The second column is using the CBO projections, the third column is a modified CBO using the June 2011 population estimate and a lower estimate for the next 12 months (population only increases 1.8 million).

The fourth column is for the participation rate staying steady at 64.1% (no bounce back).

| Jobs needed over next 12 months to hold unemployment rate constant | Current | Projections | ||

|---|---|---|---|---|

| BLS | CBO | CBO modified2 | Participation Rate Unchanged | |

| Jun-11 | Jun-12 | Jun-12 | Jun-12 | |

| Civilian noninstitutional population, 16 and over (millions) | 239.5 | 242.8 | 241.3 | 241.3 |

| Participation Rate (Percent) | 64.1% | 64.6% | 64.6% | 64.1% |

| Labor Force (millions) | 153.4 | 156.8 | 155.9 | 154.7 |

| Employed (millions) | 139.3 | 142.4 | 141.5 | 140.4 |

| Unemployed (millions) | 14.1 | 14.4 | 14.3 | 14.2 |

| Unemployment Rate | 9.2% | 9.2% | 9.2% | 9.2% |

| Jobs needed to hold unemployment rate constant (millions) | 3.1 | 2.2 | 1.1 | |

| Jobs needed per month | 260,000 | 187,000 | 95,000 | |

| Lower Unemployment Rate to 8.2% | CBO | CBO Modified2 | Participation Rate Unchanged | |

| Unemployment Rate | 8.2% | 8.2% | 8.2% | |

| Employed (millions) | 144.0 | 143.1 | 142.0 | |

| Unemployed (millions) | 12.9 | 12.8 | 12.7 | |

| Jobs need to lower unemployment rate to 8.2% (millions) | 4.7 | 3.8 | 2.7 | |

| Jobs needed per month | 391,000 | 316,000 | 224,000 | |

1 This is all based on the household survey. The headline payroll number is from the establishment survey.

2 The modified CBO uses the actual population for June 2011 and assumes the population only increases 1.8 million over the next 12 months.

It would take 187,000 jobs added per month over the next year to hold the unemployment rate steady if the participation rate rises to 64.6%. If the participation rate stays steady, it will take 95,000 jobs added per month.

I also included the number of jobs needed to lower the unemployment rate by one percentage point to 8.2%. If the participation rate rises, then it would take 316,000 jobs per month. If the participation rate stays steady, it would take 224,000 jobs per month to lower the unemployment rate to 8.2%.

If the economy does start adding more jobs per month, I expect more people will then join the labor force - keeping the unemployment rate elevated. Of course more people could give up, and the labor force participation rate could fall further pushing down the unemployment rate - but that wouldn't be good news.

Report: EU Calls Emergency Meeting on Monday

by Calculated Risk on 7/10/2011 12:13:00 PM

From Reuters: Exclusive: EU calls emergency meeting as crisis stalks Italy(ht Rajesh, jb)

European Council President Herman Van Rompuy has called an emergency meeting of ... for Monday morning, reflecting concern that the crisis could spread to Italy, the region's third largest economy.Reuters reports that ECB President Jean-Claude Trichet, finance minister chairman Jean-Claude Juncker, European Commission President Jose Manuel Barroso and Olli Rehn, European Commissioner for Economic and Financial Affairs, will all attend.

...

The talks were organized after a sharp sell-off in Italian assets on Friday, which has increased fears that Italy, with the highest sovereign debt ratio relative to its economy in the euro zone after Greece, could be next to suffer in the crisis.

The finance ministers will meet later in the day. On Friday, the European bank stress test results will be released. It will be a busy week for U.S. economic releases, and there will be plenty of news from Europe too.

Yesterday:

• Summary for Week Ending July 8th

• Schedule for Week of July 10th

• Graph Galleries

Home Sales "Surge" in Las Vegas

by Calculated Risk on 7/10/2011 09:22:00 AM

Home sales are strong in Las Vegas, but mostly because of distressed sales. According to the following article 47.2% of the sales in June were bank-owned properties, and another 21.6% were short sales.

The high level of distressed sales will keep downward pressure on house prices. Note: The articles mentions median prices, and the median is impacted by the mix of homes sold.

From Buck Wargo at the Las Vegas Sun: Las Vegas home sales surge in June as prices continue to fall

The Greater Las Vegas Association of Realtors reported today that the 3,629 sales of single-family homes on the Multiple Listing Service were up 16.7 percent over May and were 8 percent higher than June 2010.A market with almost 70% distressed sales is a long way from normal. And with all the delinquent and in-foreclosure mortgages in Nevada - and with most property owners "underwater" on their mortgages - the number of distressed sales will remain very high for some time.

...

GLVAR President Paul Bell said the June sales figures were the third-best month ever for existing homes in Southern Nevada using the Realtor-based MLS. Non-Realtor transactions will be released later in the month by local research firms.

Foreclosures continue to drive the market with the GLVAR reporting 47.2 percent of existing home sales in June were bank-owned properties, up from 43.8 percent in May. In a sign that investor activity remains strong, some 50 percent of homes sold in June were purchased with cash, down from 51.4 percent in May.

...

In June, 21.6 percent of existing homes sold were short sales in which the bank agrees to sell the property for less than is owed on the mortgage.

...

The inventory of single-family homes fell slightly in June to 22,702, down 0.3 percent from May. About half of those homes don’t have offers on them.

Saturday, July 09, 2011

Schedule for Week of July 10th

by Calculated Risk on 7/09/2011 05:57:00 PM

Earlier:

• Summary for Week Ending July 8th

Employment posts yesterday:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Return of the Teen! and Unemployment by Duration and Education

• Employment graph gallery

Several key reports will be released this week: U.S. Trade, Retail Sales, Industrial Production, and the Consumer Price Index (CPI). In addition, Fed Chairman Ben Bernanke will present his semiannual Monetary Policy Report to Congress.

Retail sales were probably weak in June due to lower auto sales and lower gasoline prices - and many people will focus on retail sales excluding autos and gasoline. Also the Empire State manufacturing survey for July might show a return to expansion.

The Consumer Price Index (CPI) and the Producer Price Index (PPI) will probably show less inflation in June since energy prices declined last month.

Note: The European bank stress tests will be released on Friday.

No scheduled releases.

7:30 AM: NFIB Small Business Optimism Index for June.

7:30 AM: NFIB Small Business Optimism Index for June. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index decreased to 90.9 in May from in 91.2 in April. This index had been trending up, although optimism has declined for three consecutive months now.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the monthly U.S. exports and imports in dollars through April 2011.

The consensus is for the U.S. trade deficit to be around $42.7 billion, down slightly from $43.7 billion in April.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS. In general job openings have been trending up, however overall labor turnover remains low.

2:00 PM: FOMC Minutes, Meeting of June 21-22, 2011

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through summer (not counting all cash purchases).

8:30 AM: Import and Export Prices for June. The consensus is a for a 0.7% decrease in import prices.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for June (a measure of transportation). Some increase in transportation is expected.

10:00 AM: Fed Chairman Ben Bernanke, "Semiannual Monetary Policy Report to the Congress", Before the Committee on Financial Services, U.S. House of Representatives

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims has been elevated for the last couple of months. The consensus is for a decrease to 405,000 from 418,000 last week.

8:30 AM: Producer Price Index for June. The consensus is for a 0.3% decrease in producer prices (0.2% increase in core).

8:30 AM: Retail Sales for June.

8:30 AM: Retail Sales for June. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The consensus is for retail sales to be flat in June, and for a 0.1% increase ex-auto.

Retail sales were impacted by falling gasoline prices, so ex-gasoline will be the key number.

10:00 AM: Manufacturing and Trade: Inventories and Sales for May. The consensus is for a 0.8% increase in inventories.

10:00 AM: Fed Chairman Ben Bernanke, "Semiannual Monetary Policy Report to the Congress", Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

8:30 AM: Consumer Price Index for June. The consensus is for a 0.2% decrease in prices. The consensus for core CPI is an increase of 0.2%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for July. This is the first of regional surveys for July. The consensus is for a reading of 8.0, indicating expansion, after a reading of -7.8 in June (contraction).

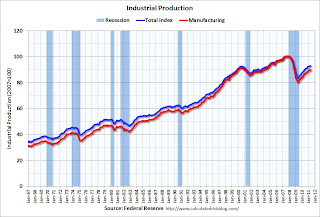

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June. This graph shows industrial production since 1967. Industrial production edged up slightly in May to 93.0.

The consensus is for a 0.4% increase in Industrial Production in June, and an increase to 76.9% (from 76.7%) for Capacity Utilization.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for July. The consensus is for a slight decrease to 71.0 from 71.5 in June.

Unofficial Problem Bank list increases to 1,004 Institutions

by Calculated Risk on 7/09/2011 02:43:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources. This post includes an update to stress rates at the state level (see comments and sortable table at bottom).

Here is the unofficial problem bank list for July 8, 2011.

Changes and comments from surferdude808:

The FDIC decided to send Chairman Bair off with a small salute by closing three banks this Friday. The failures were in Colorado and Illinois, but given the 65 failures in the state of Georgia on Chair Bair’s watch, perhaps it may have been more fitting to have another failure in Georgia. This week there were four additions and three removals. The changes result in the Unofficial Problem Bank List having 1,004 institutions with assets of $418.8 billion.And a related article from Dow Jones: US Bank Failures Abate In 1st Half But Likely To Stay Elevated

The removals are the three failures this week including First Chicago Bank & Trust, Chicago, IL ($959 million); Colorado Capital Bank, Castle Rock, CO ($718 million); and Signature Bank, Windsor, CO ($67 million).

The additions include Greeneville Federal Bank, FSB, Greeneville, TN ($207 million); Worthington Federal Bank, Huntsville, AL ($177 million); Pacific Global Bank, Chicago, IL ($162 million); and Belt Valley Bank, Belt, MT ($65 million).

Other changes this week include Prompt Corrective Action Orders issued against Bank of the Commonwealth, Norfolk, VA ($1.0 billion Ticker: CWBS); and American Eagle Savings Bank, Boothwyn, PA ($21 million). Next week we anticipate for the OCC to release its actions through mid-June 2011.

U.S. bank failures have slowed in 2011 from the flood of recent years, but a large reservoir of problem banks will keep the failure rate relatively high as regulators slog through the backlog.Yes, quite a backlog!

Earlier:

• Summary for Week Ending July 8th

Employment posts yesterday:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Return of the Teen! and Unemployment by Duration and Education

• Employment graph gallery