by Calculated Risk on 7/09/2011 05:57:00 PM

Saturday, July 09, 2011

Schedule for Week of July 10th

Earlier:

• Summary for Week Ending July 8th

Employment posts yesterday:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Return of the Teen! and Unemployment by Duration and Education

• Employment graph gallery

Several key reports will be released this week: U.S. Trade, Retail Sales, Industrial Production, and the Consumer Price Index (CPI). In addition, Fed Chairman Ben Bernanke will present his semiannual Monetary Policy Report to Congress.

Retail sales were probably weak in June due to lower auto sales and lower gasoline prices - and many people will focus on retail sales excluding autos and gasoline. Also the Empire State manufacturing survey for July might show a return to expansion.

The Consumer Price Index (CPI) and the Producer Price Index (PPI) will probably show less inflation in June since energy prices declined last month.

Note: The European bank stress tests will be released on Friday.

No scheduled releases.

7:30 AM: NFIB Small Business Optimism Index for June.

7:30 AM: NFIB Small Business Optimism Index for June. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index decreased to 90.9 in May from in 91.2 in April. This index had been trending up, although optimism has declined for three consecutive months now.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the monthly U.S. exports and imports in dollars through April 2011.

The consensus is for the U.S. trade deficit to be around $42.7 billion, down slightly from $43.7 billion in April.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS. In general job openings have been trending up, however overall labor turnover remains low.

2:00 PM: FOMC Minutes, Meeting of June 21-22, 2011

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through summer (not counting all cash purchases).

8:30 AM: Import and Export Prices for June. The consensus is a for a 0.7% decrease in import prices.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for June (a measure of transportation). Some increase in transportation is expected.

10:00 AM: Fed Chairman Ben Bernanke, "Semiannual Monetary Policy Report to the Congress", Before the Committee on Financial Services, U.S. House of Representatives

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims has been elevated for the last couple of months. The consensus is for a decrease to 405,000 from 418,000 last week.

8:30 AM: Producer Price Index for June. The consensus is for a 0.3% decrease in producer prices (0.2% increase in core).

8:30 AM: Retail Sales for June.

8:30 AM: Retail Sales for June. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The consensus is for retail sales to be flat in June, and for a 0.1% increase ex-auto.

Retail sales were impacted by falling gasoline prices, so ex-gasoline will be the key number.

10:00 AM: Manufacturing and Trade: Inventories and Sales for May. The consensus is for a 0.8% increase in inventories.

10:00 AM: Fed Chairman Ben Bernanke, "Semiannual Monetary Policy Report to the Congress", Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

8:30 AM: Consumer Price Index for June. The consensus is for a 0.2% decrease in prices. The consensus for core CPI is an increase of 0.2%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for July. This is the first of regional surveys for July. The consensus is for a reading of 8.0, indicating expansion, after a reading of -7.8 in June (contraction).

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June.

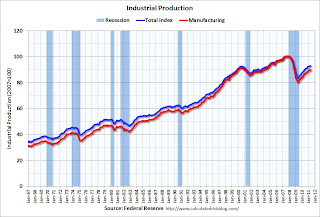

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June. This graph shows industrial production since 1967. Industrial production edged up slightly in May to 93.0.

The consensus is for a 0.4% increase in Industrial Production in June, and an increase to 76.9% (from 76.7%) for Capacity Utilization.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for July. The consensus is for a slight decrease to 71.0 from 71.5 in June.