by Calculated Risk on 7/10/2011 05:42:00 PM

Sunday, July 10, 2011

How many jobs are needed over the next year to keep the unemployment rate steady?

Dean Baker writes: We Need 90,000 Jobs Per Month to Keep Pace With the Growth of the Population

In an article on the June employment report the NYT told readers that the economy needs 150,000 jobs per month to keep pace with the growth in the population. Actually, the Congressional Budget Office projects that the underlying rate of labor force growth is now just 0.7 percent annually. This comes to roughly 1,050,000 a year or just under 90,000 a month.Here is the CBO report that Baker mentions: CBO’s Labor Force Projections Through 2021

The number of jobs needed per month to keep up with population growth depends on the rate of population growth, and the participation rate. We also have to be clear on the time frame we are discussing. The CBO report is through 2021, and the CBO is projecting the participation rate to fall to 63% by 2021 due to an aging population.

If, instead, we asked how many jobs are needed over the next year to keep the unemployment rate steady using the CBO projection of the participation rate, the answer is very different. The CBO is projecting the participation rate will be at 64.6% in 2012 and the current participation rate is 64.1%.

I've been projecting some bounce back in the participation rate too - but it hasn't happened yet.

The following table uses the CBO projections and provides an estimate of the jobs needed per month (per the household survey1) to hold the unemployment rate steady.

The first column is actual for June 2011 as reported by the BLS. The second column is using the CBO projections, the third column is a modified CBO using the June 2011 population estimate and a lower estimate for the next 12 months (population only increases 1.8 million).

The fourth column is for the participation rate staying steady at 64.1% (no bounce back).

| Jobs needed over next 12 months to hold unemployment rate constant | Current | Projections | ||

|---|---|---|---|---|

| BLS | CBO | CBO modified2 | Participation Rate Unchanged | |

| Jun-11 | Jun-12 | Jun-12 | Jun-12 | |

| Civilian noninstitutional population, 16 and over (millions) | 239.5 | 242.8 | 241.3 | 241.3 |

| Participation Rate (Percent) | 64.1% | 64.6% | 64.6% | 64.1% |

| Labor Force (millions) | 153.4 | 156.8 | 155.9 | 154.7 |

| Employed (millions) | 139.3 | 142.4 | 141.5 | 140.4 |

| Unemployed (millions) | 14.1 | 14.4 | 14.3 | 14.2 |

| Unemployment Rate | 9.2% | 9.2% | 9.2% | 9.2% |

| Jobs needed to hold unemployment rate constant (millions) | 3.1 | 2.2 | 1.1 | |

| Jobs needed per month | 260,000 | 187,000 | 95,000 | |

| Lower Unemployment Rate to 8.2% | CBO | CBO Modified2 | Participation Rate Unchanged | |

| Unemployment Rate | 8.2% | 8.2% | 8.2% | |

| Employed (millions) | 144.0 | 143.1 | 142.0 | |

| Unemployed (millions) | 12.9 | 12.8 | 12.7 | |

| Jobs need to lower unemployment rate to 8.2% (millions) | 4.7 | 3.8 | 2.7 | |

| Jobs needed per month | 391,000 | 316,000 | 224,000 | |

1 This is all based on the household survey. The headline payroll number is from the establishment survey.

2 The modified CBO uses the actual population for June 2011 and assumes the population only increases 1.8 million over the next 12 months.

It would take 187,000 jobs added per month over the next year to hold the unemployment rate steady if the participation rate rises to 64.6%. If the participation rate stays steady, it will take 95,000 jobs added per month.

I also included the number of jobs needed to lower the unemployment rate by one percentage point to 8.2%. If the participation rate rises, then it would take 316,000 jobs per month. If the participation rate stays steady, it would take 224,000 jobs per month to lower the unemployment rate to 8.2%.

If the economy does start adding more jobs per month, I expect more people will then join the labor force - keeping the unemployment rate elevated. Of course more people could give up, and the labor force participation rate could fall further pushing down the unemployment rate - but that wouldn't be good news.

Report: EU Calls Emergency Meeting on Monday

by Calculated Risk on 7/10/2011 12:13:00 PM

From Reuters: Exclusive: EU calls emergency meeting as crisis stalks Italy(ht Rajesh, jb)

European Council President Herman Van Rompuy has called an emergency meeting of ... for Monday morning, reflecting concern that the crisis could spread to Italy, the region's third largest economy.Reuters reports that ECB President Jean-Claude Trichet, finance minister chairman Jean-Claude Juncker, European Commission President Jose Manuel Barroso and Olli Rehn, European Commissioner for Economic and Financial Affairs, will all attend.

...

The talks were organized after a sharp sell-off in Italian assets on Friday, which has increased fears that Italy, with the highest sovereign debt ratio relative to its economy in the euro zone after Greece, could be next to suffer in the crisis.

The finance ministers will meet later in the day. On Friday, the European bank stress test results will be released. It will be a busy week for U.S. economic releases, and there will be plenty of news from Europe too.

Yesterday:

• Summary for Week Ending July 8th

• Schedule for Week of July 10th

• Graph Galleries

Home Sales "Surge" in Las Vegas

by Calculated Risk on 7/10/2011 09:22:00 AM

Home sales are strong in Las Vegas, but mostly because of distressed sales. According to the following article 47.2% of the sales in June were bank-owned properties, and another 21.6% were short sales.

The high level of distressed sales will keep downward pressure on house prices. Note: The articles mentions median prices, and the median is impacted by the mix of homes sold.

From Buck Wargo at the Las Vegas Sun: Las Vegas home sales surge in June as prices continue to fall

The Greater Las Vegas Association of Realtors reported today that the 3,629 sales of single-family homes on the Multiple Listing Service were up 16.7 percent over May and were 8 percent higher than June 2010.A market with almost 70% distressed sales is a long way from normal. And with all the delinquent and in-foreclosure mortgages in Nevada - and with most property owners "underwater" on their mortgages - the number of distressed sales will remain very high for some time.

...

GLVAR President Paul Bell said the June sales figures were the third-best month ever for existing homes in Southern Nevada using the Realtor-based MLS. Non-Realtor transactions will be released later in the month by local research firms.

Foreclosures continue to drive the market with the GLVAR reporting 47.2 percent of existing home sales in June were bank-owned properties, up from 43.8 percent in May. In a sign that investor activity remains strong, some 50 percent of homes sold in June were purchased with cash, down from 51.4 percent in May.

...

In June, 21.6 percent of existing homes sold were short sales in which the bank agrees to sell the property for less than is owed on the mortgage.

...

The inventory of single-family homes fell slightly in June to 22,702, down 0.3 percent from May. About half of those homes don’t have offers on them.

Saturday, July 09, 2011

Schedule for Week of July 10th

by Calculated Risk on 7/09/2011 05:57:00 PM

Earlier:

• Summary for Week Ending July 8th

Employment posts yesterday:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Return of the Teen! and Unemployment by Duration and Education

• Employment graph gallery

Several key reports will be released this week: U.S. Trade, Retail Sales, Industrial Production, and the Consumer Price Index (CPI). In addition, Fed Chairman Ben Bernanke will present his semiannual Monetary Policy Report to Congress.

Retail sales were probably weak in June due to lower auto sales and lower gasoline prices - and many people will focus on retail sales excluding autos and gasoline. Also the Empire State manufacturing survey for July might show a return to expansion.

The Consumer Price Index (CPI) and the Producer Price Index (PPI) will probably show less inflation in June since energy prices declined last month.

Note: The European bank stress tests will be released on Friday.

No scheduled releases.

7:30 AM: NFIB Small Business Optimism Index for June.

7:30 AM: NFIB Small Business Optimism Index for June. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index decreased to 90.9 in May from in 91.2 in April. This index had been trending up, although optimism has declined for three consecutive months now.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the monthly U.S. exports and imports in dollars through April 2011.

The consensus is for the U.S. trade deficit to be around $42.7 billion, down slightly from $43.7 billion in April.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS. In general job openings have been trending up, however overall labor turnover remains low.

2:00 PM: FOMC Minutes, Meeting of June 21-22, 2011

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through summer (not counting all cash purchases).

8:30 AM: Import and Export Prices for June. The consensus is a for a 0.7% decrease in import prices.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for June (a measure of transportation). Some increase in transportation is expected.

10:00 AM: Fed Chairman Ben Bernanke, "Semiannual Monetary Policy Report to the Congress", Before the Committee on Financial Services, U.S. House of Representatives

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims has been elevated for the last couple of months. The consensus is for a decrease to 405,000 from 418,000 last week.

8:30 AM: Producer Price Index for June. The consensus is for a 0.3% decrease in producer prices (0.2% increase in core).

8:30 AM: Retail Sales for June.

8:30 AM: Retail Sales for June. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The consensus is for retail sales to be flat in June, and for a 0.1% increase ex-auto.

Retail sales were impacted by falling gasoline prices, so ex-gasoline will be the key number.

10:00 AM: Manufacturing and Trade: Inventories and Sales for May. The consensus is for a 0.8% increase in inventories.

10:00 AM: Fed Chairman Ben Bernanke, "Semiannual Monetary Policy Report to the Congress", Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

8:30 AM: Consumer Price Index for June. The consensus is for a 0.2% decrease in prices. The consensus for core CPI is an increase of 0.2%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for July. This is the first of regional surveys for July. The consensus is for a reading of 8.0, indicating expansion, after a reading of -7.8 in June (contraction).

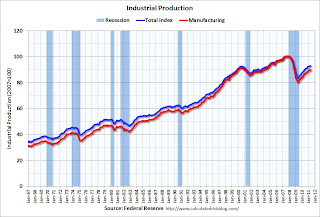

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June. This graph shows industrial production since 1967. Industrial production edged up slightly in May to 93.0.

The consensus is for a 0.4% increase in Industrial Production in June, and an increase to 76.9% (from 76.7%) for Capacity Utilization.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for July. The consensus is for a slight decrease to 71.0 from 71.5 in June.

Unofficial Problem Bank list increases to 1,004 Institutions

by Calculated Risk on 7/09/2011 02:43:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources. This post includes an update to stress rates at the state level (see comments and sortable table at bottom).

Here is the unofficial problem bank list for July 8, 2011.

Changes and comments from surferdude808:

The FDIC decided to send Chairman Bair off with a small salute by closing three banks this Friday. The failures were in Colorado and Illinois, but given the 65 failures in the state of Georgia on Chair Bair’s watch, perhaps it may have been more fitting to have another failure in Georgia. This week there were four additions and three removals. The changes result in the Unofficial Problem Bank List having 1,004 institutions with assets of $418.8 billion.And a related article from Dow Jones: US Bank Failures Abate In 1st Half But Likely To Stay Elevated

The removals are the three failures this week including First Chicago Bank & Trust, Chicago, IL ($959 million); Colorado Capital Bank, Castle Rock, CO ($718 million); and Signature Bank, Windsor, CO ($67 million).

The additions include Greeneville Federal Bank, FSB, Greeneville, TN ($207 million); Worthington Federal Bank, Huntsville, AL ($177 million); Pacific Global Bank, Chicago, IL ($162 million); and Belt Valley Bank, Belt, MT ($65 million).

Other changes this week include Prompt Corrective Action Orders issued against Bank of the Commonwealth, Norfolk, VA ($1.0 billion Ticker: CWBS); and American Eagle Savings Bank, Boothwyn, PA ($21 million). Next week we anticipate for the OCC to release its actions through mid-June 2011.

U.S. bank failures have slowed in 2011 from the flood of recent years, but a large reservoir of problem banks will keep the failure rate relatively high as regulators slog through the backlog.Yes, quite a backlog!

Earlier:

• Summary for Week Ending July 8th

Employment posts yesterday:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Return of the Teen! and Unemployment by Duration and Education

• Employment graph gallery

Summary for Week Ending July 8th

by Calculated Risk on 7/09/2011 08:21:00 AM

The key story of the week was the June employment report - and the report was dismal.

There were only 18,000 total payroll jobs added in June, and 57,000 private sector payroll jobs. Also the BLS revised down April and May payrolls showing 44,000 fewer jobs were added than previously reported.

Basically every number was ugly: The unemployment rate increased from 9.1% to 9.2%, and the participation rate declined to 64.1%. The employment population ratio fell to 58.2%, matching the lowest level during the current employment recession. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased to 16.2%, the highest level this year.

The average workweek declined slightly to 34.3 hours, and average hourly earnings ticked down.

As I noted yesterday, the only good news was that June is over.

Europe was also in the news, with more discussions about Greece, and bond yields rising sharply for Portugal, Ireland and even Italy. The results of the European bank stress tests will be released this coming Friday, and the European financial crisis will remain headline news.

Finally Reis released their Q2 office, mall and apartment vacancy rates. Apartment vacancy rates are declining, office vacancy rates are moving sideways, and mall vacancy rates are still increasing.

There wasn't much data last week, but it sure finished ugly.

Below is a summary of economic data last week mostly in graphs:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

Click on graph for larger image in graph gallery.

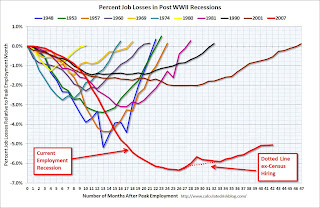

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the start of the recession.

In this post, the graph showed the job losses aligned at maximum job losses.

In terms of percentage payroll jobs, the 2007 recession is by far the worst since WWII.

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 9.2% (red line).

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 9.2% (red line).

The Labor Force Participation Rate declined to 64.1% in June (blue line). This is the percentage of the working age population in the labor force. This is the lowest level since the early '80s when

The Employment-Population ratio declined to 58.2% in June (black line). This ties the lowest level during the recession.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased slightly to 8.552 million in June.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased slightly to 8.552 million in June.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.2% in June from 15.8% in May. This is the highest level this year (highest since December 2010).

The next graph shows the duration of unemployment as a percent of the civilian labor force.

The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Two key categories are moving up again. The 27 weeks and more (the long term unemployed) has moved up for two consecutive months and is now at 6.3 million workers, or 4.1% of the labor force.

Also, the 'less than 5 weeks' category is increasing again and that indicates recent weakness in the labor market.

Here are the employment posts from yesterday:

1) June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

2) Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

3) Return of the Teen! and Unemployment by Duration and Education

4) Employment graph gallery

• ISM Non-Manufacturing Index indicates slower expansion in June

From the Institute for Supply Management: June 2011 Non-Manufacturing ISM Report On Business®

The June ISM Non-manufacturing index was at 53.3%, down from 54.6% in May. The employment index increased in June to 54.1%, up from 54.0% in May. Note: Above 50 indicates expansion, below 50 contraction.

The June ISM Non-manufacturing index was at 53.3%, down from 54.6% in May. The employment index increased in June to 54.1%, up from 54.0% in May. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.0%.

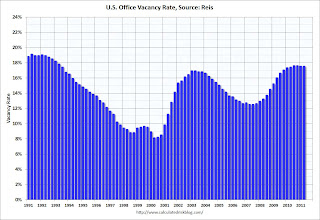

• Reis: Office, Mall and Apartment Vacancy Reports

Reis reported the Q2 office, mall and apartment vacancy rates. Apartment vacancy rates are declining, office vacancy rates are moving sideways, and mall vacancy rates are still increasing.

This graph shows the office vacancy rate starting in 1991.

This graph shows the office vacancy rate starting in 1991.

Reis reported the office vacancy rate was at 17.5% in Q2 2011, the same rate as in Q1, and up from 17.4% in Q2 2010. It appears the office vacancy rate might have peaked - and is now moving sideways. It will be a good sign when the vacancy rate starts falling.

From Reuters: Sluggish economy slows US office market rebound

Reis reported that the apartment vacancy rate (82 markets) fell to 6.0% in Q2 from 6.2% in Q1. The vacancy rate was at 7.8% in Q2 2010 and peaked at 8.0% at the end of 2009.

Reis reported that the apartment vacancy rate (82 markets) fell to 6.0% in Q2 from 6.2% in Q1. The vacancy rate was at 7.8% in Q2 2010 and peaked at 8.0% at the end of 2009.

From the WSJ: Rents Rise, Vacancies Go Down

This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

From Reuters: US mall vacancies rise in 2nd quarter, rents flat

From Reuters: US mall vacancies rise in 2nd quarter, rents flat

"Preliminary figures by real estate research firm Reis show the vacancy rate at ... regional malls rose to 9.3 percent ... up from 9.1 percent in the first quarter. ... The vacancy rate at these local retail strips was 11 percent versus 10.9 percent in the first quarter, almost matching the 11.1 percent record set 20 years ago"

• Other Economic Stories ...

• From the American Bankruptcy Institute: Consumer Bankruptcy Filings Down 8 Percent Through the First Half of 2011

• From National Federation of Independent Business (NFIB): NFIB Jobs Statement: June is a Bust, but July Looks Hopeful

• ADP: Private Employment increased by 157,000 in June

Have a great weekend!

Friday, July 08, 2011

Greece: More Discussions about Debt Reduction

by Calculated Risk on 7/08/2011 10:28:00 PM

From the WSJ: Greek Bailout Talks Shift to Attack on Debt

Discussions between bankers and government officials about Greece have undergone a fundamental shift in recent days, turning toward reducing the country's mountainous debt burden instead of just staving off a near-term financial crisis ... Finance ministers from the 17 nations that use the euro are expected to discuss the proposals at a meeting Monday in Brussels. They are expected to debate options that they previously discarded, including the use of European bailout funds to finance purchases of Greek debt.The key is to reduce the debt. This is similar to the problem mortgage lenders face in reducing mortgage principal - it might make sense for one borrower, but then many other borrowers will want a principal reduction.

If Greece gets a debt reduction, Portugal, Ireland, Spain and Italy will all get in line. Every one likes free money.

Some more from the Financial Times: EU leaders differ over Greek default

Here are the earlier employment posts:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Return of the Teen! and Unemployment by Duration and Education

• Employment graph gallery

Bank Failure #51: Signature Bank, Windsor, Colorado

by Calculated Risk on 7/08/2011 08:02:00 PM

"Where can we turn for more cash?"

Go Points West, young man.

by Soylent Green is People

From the FDIC: Points West Community Bank, Julesburg, Colorado, Assumes All of the Deposits of Signature Bank, Windsor, Colorado

As of March 31, 2011, Signature Bank had approximately $66.7 million in total assets and $64.5 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $22.3 million. ... Signature Bank is the 51st FDIC-insured institution to fail in the nation this year, and the 4th in Colorado.

Bank Failures #49 & 50 in 2011

by Calculated Risk on 7/08/2011 07:16:00 PM

It's been tough but nicely done

Best to you Ms. Bair

Capital combust

Chicago concurrently

Cashless corpses crash

by Soylent Green is People

Farewell to Sheila Bair.

From the FDIC: Northbrook Bank & Trust Company, Northbrook, Illinois, Assumes All of the Deposits of First Chicago Bank & Trust, Chicago, Illinois

As of March 31, 2011, First Chicago Bank & Trust had approximately $959.3 million in total assets and $887.5 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $284.3 million. ... First Chicago Bank & Trust is the 49th FDIC-insured institution to fail in the nation this year, and the fifth in Illinois.From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of Colorado Capital Bank, Castle Rock, Colorado

As of March 31, 2011, Colorado Capital Bank had approximately $717.5 million in total assets and $672.8 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $283.8 million. ... Colorado Capital Bank is the 50th FDIC-insured institution to fail in the nation this year, and the third in Colorado.

European Financial Crisis: Italy

by Calculated Risk on 7/08/2011 06:04:00 PM

A top European analyst put out a research note last night calling Italy "the elephant in the room". Those fears sent the Italian 2 year yield to 3.5% - nothing compared to Greece, Portugal and Ireland, but a significant increase. The 10 year yield increased to 5.3%.

From the LA Times: Italy and Spain rocked by fears of spreading debt 'contagion'

The “contagion” that has forced Greece, Ireland and Portugal to seek bailouts from the rest of Europe now is threatening Italy, as investors demand ever-higher interest rates on Italian government bonds.The next round of European bank stress tests will be released next Friday, from Dow Jones: EU Fears For Stress Test Credibility As Deadline Nears

The yield on two-year Italian bonds surged to 3.51% on Friday, the fifth straight increase and up from 3.32% on Thursday. On Monday the yield was 3.04%.

Likewise, Spanish two-year government bond yields jumped to 3.77% on Friday from 3.66% on Thursday and 3.35% on Monday.

Under the terms of the tests, banks that fail to prove that they can preserve a certain capital ratio in the event of a severe downturn are supposed to fill the gap, at the latest, within six months of the results being published. That date has now been confirmed as next Friday, July 15.There are fears about some of the large Italian banks, however from the Dow Jones article:

In the event that those ailing the test also find themselves unable to raise the required capital, national governments are supposed to step in with "backstop mechanisms" to recapitalize or restructure the banks in question.

Mario Draghi, the incoming president of the European Central Bank, said Friday that he is sure that the five Italian banks taking the test will pass "with [a] rather meaningful, significant margin."I'm sure people will be asking if the stress tests were credible.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |