by Calculated Risk on 2/19/2009 10:00:00 AM

Thursday, February 19, 2009

Philly Fed Survey: Employment index at Record Low

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

Conditions in the region's manufacturing sector continued to deteriorate this month, according to firms polled for the February Business Outlook Survey. All of the survey's broad indicators for current activity remained negative and fell from their already low levels in January. Employment losses were more substantial this month, and nearly half of the surveyed firms reported declines in both employment and average hours worked. Firms continued to report declines in input prices and prices for their own manufactured goods. Most of the survey's indicators of future activity improved, continuing to suggest that the region's manufacturing executives expect declines to bottom out over the next six months.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, declined from a reading of -24.3 in January to -41.3 this month, its lowest reading since October 1990. The index has been negative for 14 of the past 15 months ...

In special questions this month, firms were asked about their current inventory situation. Nearly 44 percent of the firms indicated that their inventories were too high and were expected to decrease during the first quarter; 67 percent said their customers' inventory plans had also decreased.

The current employment index fell for the fifth consecutive month, dropping seven points, to -45.8, its lowest reading in the history of the survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index vs. recessions for the last 40 years.

"The index has been negative for 14 of the past 15 months, a period that corresponds to the current recession."

Wednesday, February 18, 2009

Capacity Utilization and Industrial Production Cliff Diving

by Calculated Risk on 2/18/2009 09:25:00 AM

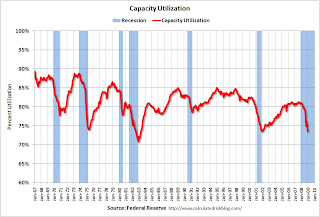

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Federal Reserve reported that industrial production fell 1.8 percent in January, and output in January was 10.0% below January 2008. The capacity utilization rate for total industry fell to 72.0%, the lowest level since 1983.

This is a very sharp decline in industrial output. Industrial production is a key to the depth of the economic slowdown. Up until late last Summer, export growth had been strong, and the decline in industrial production had been mild. Now, with the global economy slowing sharply, industrial production and capacity utilization are falling off a cliff.

Also the significant decline in capacity utilization suggests less investment in non-residential structures for some time.

Monday, February 09, 2009

Job Losses During Recessions

by Calculated Risk on 2/09/2009 02:44:00 PM

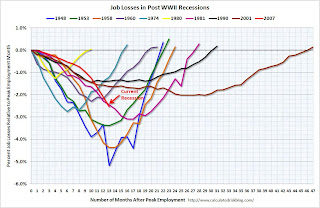

Barry Ritholtz provides us with the following chart: Job Losses in Post WWII Recessions Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows job losses during recessions from the peak month of employment until jobs recover.

The current recession has had the most job losses and the 2001 recession had the weakest job recovery.

However this graph is not normalized for increases in the work force. The second graph (that Barry asked me for) shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph (that Barry asked me for) shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession is about as bad as the 1981 recession in percentage terms at this point.

In the earlier post-war recessions, there were huge swings in manufacturing employment. Now manufacturing is a much smaller percentage of the economy, and the swings aren't as significant because of technological advances. This is the main reason that job losses were larger in those earlier recessions.

Here is Barry's updated post (with another graph). Barry asks: Are recessions taking longer to recover from? The answer appears to be yes. And I expect unemployment to be elevated for some time (even after the economy starts to recover).

CNBC: Dr. Doom & the Black Swan

by Calculated Risk on 2/09/2009 02:37:00 PM

Video from CNBC: Predicting Crisis: Dr. Doom & the Black Swan (hat tip Dwight)

Nouriel Roubini and Nassim Taleb discuss the recession.

Thursday, January 29, 2009

"Unprecedented and shocking" Decline in Air Cargo

by Calculated Risk on 1/29/2009 02:48:00 PM

More cliff diving ...

From the International Air Transport Association: Cargo Plummets 22.6% in December (hat tip Bob_in_MA)

In the month of December global international cargo traffic plummeted by 22.6% compared to December 2007. The same comparison for international passenger traffic showed a 4.6% drop. The international load factor stood at 73.8%.

For the full-year 2008, international cargo traffic was down 4.0%, passenger traffic showed a modest increase of 1.6%, and the international load factor stood at 75.9%.

“The 22.6% free fall in global cargo is unprecedented and shocking. There is no clearer description of the slowdown in world trade. Even in September 2001, when much of the global fleet was grounded, the decline was only 13.9%,” said Giovanni Bisignani, IATA’s Director General and CEO.” Air cargo carries 35% of the value of goods traded internationally.

...

“2009 is shaping up to be one of the toughest years ever for international aviation. The 22.6% drop in international cargo traffic in December puts us in un-charted territory and the bottom is nowhere in sight. Keep your seatbelts fastened and prepare for a bumpy ride and a hard landing,” said Bisignani.

emphasis added

Philly Fed: Activity Declined in Every State in December

by Calculated Risk on 1/29/2009 12:04:00 PM

Here is a new record that will never be broken! The Philly Fed index shows - for the first time ever - declining activity in all states in December (see bottom graph).

Here is the Philadelphia Fed state coincident index release for December.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for all 50 states for December 2008. The indexes decreased in all 50 states for the month (a one-month diffusion index of -100). For the past three months, the indexes increased in three states, Louisiana, North Dakota, and Wyoming, and remained unchanged in one state, Alaska.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. Almost all states are showing declining activity over the last three months.

This is what a widespread recession looks like based on the Philly Fed states indexes.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. For the first time ever, the Philly Fed index showed no states with increasing activity.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. For the first time ever, the Philly Fed index showed no states with increasing activity. The indexes decreased in all 50 states for the month (a one-month diffusion index of -100).Most of the U.S. was has been in recession since December 2007 based on this indicator - and now ALL states are see declining activity.

Friday, January 23, 2009

Britain Officially in Recession

by Calculated Risk on 1/23/2009 11:17:00 AM

From The Times: It's official - Britain is in recession

Britain is in the grip of its sharpest recession for three decades, grim official figures confirmed today ... The economy suffered a brutal 1.5 per cent drop in Gross Domestic Product (GDP) during the past three months, shrinking at its fastest quarterly pace since 1980.This brings up a couple of interesting points:

Coming on the heels of an already steep 0.6 per cent plunge in GDP in the third quarter of last year, the news means that the widely accepted definition of recession as two consecutive quarters of falling output has finally been met.

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators.

China reports the year-over-year change in real GDP for the quarter, so the 6.8% GDP for Q4 recently reported includes the changes in Q1 through Q3 too. As Roubini noted:

The Chinese came out today with their 6.8% estimate of Q4 2008 growth. China publishes its quarterly GDP figure on a year over year basis, differently from the U.S. and most other countries that publish their GDP growth figure on a quarter on quarter annualized seasonally adjusted (SAAR) basis.Here is the Britain report: UK output decreased by 1.5% in Q4 2008

When growth is slowing down sharply the Chinese way to measure GDP is highly misleading as quarter on quarter growth may be negative while the year over year figure is positive and high because of the momentum of the previous quarters’ positive growth.

Indeed if one were to convert the 6.8% y-o-y figure in the more standard quarter over quarter annualized figure Chinese growth in Q4 would be close to zero if not negative.

Gross Domestic Product (GDP) contracted by 1.5 per cent in the fourth quarter of 2008, compared with a decrease of 0.6 per cent in the third quarter. The increased rate of decline in output was due to weaker services and production industries output.

Construction output decreased by 1.1 per cent, compared with a decrease of 0.2 per cent in the previous quarter.

Friday, January 16, 2009

Capacity Utilization and Industrial Production Cliff Diving

by Calculated Risk on 1/16/2009 09:15:00 AM

From Greg Robb at MarketWatch: U.S. Dec. industrial production down 2%, down 11.5% in Q4

Capacity utilization ... fell to 73.6% from 75.2%. This is the lowest level since December 2001. Industrial output fell at an 11.5% rate in the fourth quarter.

emphasis added

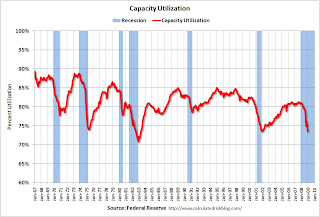

Click on graph for larger image in new window.

Click on graph for larger image in new window.This is a very sharp decline in industrial output, and industrial production is a key to the depth of the economic slowdown. Up until recently export growth had been strong, and the decline in industrial production had been mild. Now, with the global economy slowing sharply, industrial production and capacity utilization are falling off a cliff.

Also the significant decline in capacity utilization suggests less investment in non-residential structures for some time.

Thursday, January 15, 2009

LA Area Port Traffic Collapses in December

by Calculated Risk on 1/15/2009 09:05:00 PM

Both imports and exports declined sharply in November, but just wait until we see the December trade numbers. Based on LA area port traffic numbers released today, trade volumes collapsed in December. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 19% below last December. This slowdown in exports (inbound traffic to the U.S.) is hitting Asian countries hard.

But even more shocking and important for the U.S. economy is that export traffic has collapsed. For the LA area ports, outbound traffic continued to decline in December, and was 30% below the level of December 2007. Export traffic is now at about the same level as in late 2005. So much for the export boom!

Now it is the export bust.

Schwarzenegger: California Faces Insolvency within Weeks

by Calculated Risk on 1/15/2009 01:28:00 PM

UPDATE: from the WSJ: Facing Budget Gap, Schwarzenegger Urges Lawmakers to Bridge Divide

"This disruption has stopped work on levees, schools, roads, everything," Mr. Schwarzenegger plans to say. "It has thrown thousands and thousands of people out of work at a time when our unemployment rate is rising. How could we let something like that happen? I know that everyone in this room wants to hear again the sound of construction. No one wants unemployment checks replacing paychecks."Headlines (hat tip Brian). Click on headlines for larger image ...

Thursday, January 08, 2009

Roubini: Two Year Recession

by Calculated Risk on 1/08/2009 04:30:00 PM

From Rex Nutting at MarketWatch: Roubini forecasts recession will last 2 years

The U.S. recession will last two full years, with gross domestic product falling a cumulative 5%, said Nouriel Roubini, ... For 2009, Roubini predicts GDP will fall 3.4%, with declines in every quarter of the year. The unemployment rate should peak at about 9% in early 2010 ...Roubini is forecasting a pretty serious recession, but far short of a "depression" which is usually defined as a 10% decline in real GDP.

The concensus (and the Fed forecast) is that the economy will bottom in Q2 2009 with a sluggish recovery in the 2nd half of this year.

Tuesday, January 06, 2009

Fed Fears Long Recession

by Calculated Risk on 1/06/2009 02:17:00 PM

The Fed projects GDP to decline in 2009 "as a whole", and unemployment to "rise significantly into 2010". The Fed also expects disinflationary pressures to continue into 2010.

From the FOMC Minutes:

In the forecast prepared for the meeting, the staff revised down sharply its outlook for economic activity in 2009 but continued to project a moderate recovery in 2010. Real GDP appeared likely to decline substantially in the fourth quarter of 2008 as conditions in the labor market deteriorated more steeply than previously anticipated; the decline in industrial production intensified; consumer and business spending appeared to weaken; and financial conditions, on balance, continued to tighten. Rising unemployment, the declines in stock market wealth, low levels of consumer sentiment, weakened household balance sheets, and restrictive credit conditions were likely to continue to hinder household spending over the near term. Homebuilding was expected

to contract further. Business expenditures were also likely to be held back by a weaker sales outlook and tighter credit conditions. Oil prices, which dropped significantly during the intermeeting period, were assumed to rise over the next two years in line with the path indicated by futures market prices, but to remain below the levels of October 2008. All told, real GDP was expected to fall much more sharply in the first half of 2009 than previously anticipated, before slowly recovering over the remainder of the year as the stimulus from monetary and assumed fiscal policy actions gained traction and the turmoil in the financial system began to recede. Real GDP was projected to decline for 2009 as a whole and to rise at a pace slightly above the rate of potential growth in 2010. Amid the weaker outlook for economic activity over the next year, the unemployment rate was likely to rise significantly into 2010, to a level higher than projected at the time of the October 28-29 FOMC meeting. The disinflationary effects of increased slack in resource utilization, diminished pressures from energy and materials prices, declines in import prices, and further moderate reductions in inflation expectations caused the staff to reduce its forecast for both core and overall PCE inflation. Core inflation was projected to slow considerably in 2009 and then to edge down further in 2010.

emphasis added

Tuesday, December 23, 2008

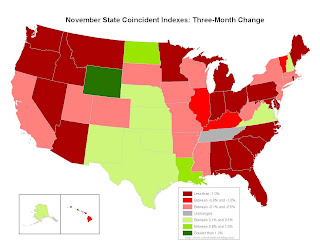

Philly Fed November State Coincident Indicators

by Calculated Risk on 12/23/2008 02:48:00 PM

Here is the Philadelphia Fed state coincident index release for September.

The Federal Reserve Bank of Philadelphia has released coincident indexes for all 50 states for November 2008. The indexes increased in eight states for the month, decreased in 37, and were unchanged in the remaining five (a one-month diffusion index of -58). For the past three months, the indexes increased in 11 states, decreased in 38, and remained unchanged only in Tennessee (a three-month diffusion index of -54).

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. Most states are in recession, although a portion of the central U.S. is still growing (from Texas up to Wymong). This might change with falling oil prices.

This is what a recession looks like based on the Philly Fed states indexes.

This is a graph of the monthly Philly Fed data of the number of states with one month increasing activity.

This is a graph of the monthly Philly Fed data of the number of states with one month increasing activity.Note: the Philly Fed calls some states unchanged with minor changes.

Most of the U.S. was has been in recession since late last year based on this indicator.

Sunday, December 21, 2008

Japan Exports Decline 27%

by Calculated Risk on 12/21/2008 09:01:00 PM

From Bloomberg: Japan Exports Plunge Record 27% as Recession Deepens

Japan’s exports plunged the most on record in November as global demand for cars and electronics collapsed ... Exports fell 26.7 percent from a year earlier ...And this isn't just because of exports to the U.S. or Europe:

Exports to Asia fell 27 percent, the most since 1986, after the first decline in six years in October. Shipments to China, Japan’s largest trading partner, fell 25 percent, the steepest drop in 13 years.This looks like a worldwide recession including China (see: Forecaster: Negative Q4 GDP in China)

Wednesday, December 10, 2008

Setser: On Global Trade and China

by Calculated Risk on 12/10/2008 11:40:00 AM

From Brad Setser: Global trade is shrinking, fast

China’s November trade data (a 2.2% year over year fall in exports; a 17.9% year over year fall in imports — see Andrew Batson of the Wall Street Journal) suggests that global trade is contracting quite rapidly. And since trade accounts for a rising share of global activity, it suggests that the global economy has stalled — and perhaps is contracting.But China may still run a strong surplus, because the decline in imports (because of falling commodity prices) will more than offset the decline in exports:

The fall in China’s exports suggests global demand is falling. And the fall in China’s imports on first blush seems larger than can be explained just by the fall in demand for imported components for China’s exports and sliding commodity prices: it suggests that Chinese domestic demand is quite weak ...

The November data from Korea and Taiwan tells a similar story. All experienced far larger falls in year over year falls in their exports than China did.

[R]ight now there isn’t any much reason to think that China’s trade surplus will shrink in 2009. Exports will fall. But so will imports. And the fall in commodity prices implies that the terms of trade have shifted in China’s favor.See Brad's post for more. The recession has gone global.

Thursday, December 04, 2008

I Read the News Today ... Oh Boy

by Calculated Risk on 12/04/2008 10:50:00 AM

From the WSJ: November Is as Bad as Feared

Retailers reported some of the weakest sales figures in years for November, with many missing downbeat expectations, but Wal-Mart Stores Inc. continued its recent outperformance as it topped estimates on increased store traffic and transaction size.Layoffs everywhere it seems:

From Bloomberg: AT&T Plans to Reduce 12,000 Jobs, Spending as Slump Deepens

From Bloomberg: State Street Joins Fidelity, Legg Mason in Shedding Fund Jobs

State Street Corp., the world’s largest money manager for institutions, plans to cut 1,700 jobs, the latest in a wave of financial-sector layoffs during the worst year for U.S. stocks since the Great Depression.From MarketWatch: DuPont cuts view, plans major workforce reduction

State Street will shed about 6 percent of its 28,700 employees by March ...

DuPont Co. slashed its fourth-quarter earnings forecast on Thursday and announced plans to dismiss 6,500 workers, including contractors, due to the downturn in the construction market and a sharp drop off in consumer spending.And from the WSJ: Nokia Sees Shrinking Handset Market

Nokia Corp., the world's largest mobile handset maker, Thursday cut its global handset market forecasts for the second time in three weeks, warning that the slowdown has accelerated more rapidly than expected.From Bloomberg: Factory Orders in the U.S. Decrease 5.1%, Most in 8 Years

Orders placed with U.S. factories in October fell by the most in 8 years, signaling a decline in manufacturing will contribute to deepening the recession.This isn't intended to be exhaustive - just a sample of the headlines.

Demand dropped 5.1 percent, more than forecast and the biggest fall since July 2000, after a revised 3.1 percent decrease in September, the Commerce Department said today in Washington. ...

``The general deterioration in both domestic and external demand suggests bleaker times lie ahead for America's factories,'' Sal Guatieri, a senior economist at BMO Capital Markets in Toronto, said before the report.

Monday, December 01, 2008

NBER: December 2007 Peak in Economic Activity

by Calculated Risk on 12/01/2008 12:14:00 PM

The National Bureau of Economic Research (NBER) has decided economic activity peaked last year and that December 2007 marks the beginning of the current U.S. recession. That means all my charts (with the recession starting in Dec '07) are correct.

From NBER: Determination of the December 2007 Peak in Economic Activity

The Business Cycle Dating Committee of the National Bureau of Economic Research met by conference call on Friday, November 28. The committee maintains a chronology of the beginning and ending dates (months and quarters) of U.S. recessions. The committee determined that a peak in economic activity occurred in the U.S. economy in December 2007. The peak marks the end of the expansion that began in November 2001 and the beginning of a recession. The expansion lasted 73 months; the previous expansion of the 1990s lasted 120 months.There you have it - the U.S. economy has officially been in a recession for one year.

...

The committee believes that the two most reliable comprehensive estimates of aggregate domestic production are normally the quarterly estimate of real Gross Domestic Product and the quarterly estimate of real Gross Domestic Income, both produced by the Bureau of Economic Analysis. In concept, the two should be the same, because sales of products generate income for producers and workers equal to the value of the sales. However, because the measurement on the product and income sides proceeds somewhat independently, the two actual measures differ by a statistical discrepancy. The product-side estimates fell slightly in 2007Q4, rose slightly in 2008Q1, rose again in 2008Q2, and fell slightly in 2008Q3. The income-side estimates reached their peak in 2007Q3, fell slightly in 2007Q4 and 2008Q1, rose slightly in 2008Q2 to a level below its peak in 2007Q3, and fell again in 2008Q3. Thus, the currently available estimates of quarterly aggregate real domestic production do not speak clearly about the date of a peak in activity.

Other series considered by the committee—including real personal income less transfer payments, real manufacturing and wholesale-retail trade sales, industrial production, and employment estimates based on the household survey—all reached peaks between November 2007 and June 2008.

Cliff Diving: ISM Manufacturing Index

by Calculated Risk on 12/01/2008 11:41:00 AM

From Rex Nutting at MarketWatch: November manufacturing activity falls, prices plummet

The November ISM reading for U.S. manufacturing activity decreased to 36.2%, the lowest reading since May 1982, from 38.9% in the prior month. Readings above 50% indicate an expansion of the manufacturing economy, while readings below indicate a contraction.Manufacturing had been holding up pretty compared to other recessions. This was partly due to strong U.S. exports, but exports have now slowed sharply.

It seems all of the previously relatively strong areas of the economy - consumer spending, investment in non-residential structures, and exports (and manufacturing) - are all in a steep slide.

Thursday, November 27, 2008

Japan's Economy: "the world stopped turning"

by Calculated Risk on 11/27/2008 09:45:00 PM

From Bloomberg: Japan’s Recession Deepens as Output Falls, Consumers Spend Less

Japan’s recession deepened last month as companies cut production, consumers spent less and fewer people looked for work.And also from Bloomberg: Panasonic Cuts Profit Forecast on Prices, Demand Drop

Factory output fell 3.1 percent from September .... Household spending slid 3.8 percent ...

Companies surveyed said they plan the sharpest production cuts in 35 years as exports decline in the wake of the worst financial crisis since the Great Depression.

...

“This is an unprecedented export recession,” said Richard Jerram, chief economist at Macquarie Securities Ltd. in Tokyo. “The world stopped turning for about a month and a half after the middle of September ...

Panasonic said prices for flat-panel TVs will probably drop 30 percent this fiscal year ... because of deteriorating demand for consumer electronics.Shutting down the Home ATM equals far fewer flat screen TVs. Hoocoodanode?

...

``Even such a successful company as Panasonic can't weather this harsh economic environment,'' said Naoki Fujiwara, who oversees about $720 million at Shinkin Asset Management Co. ``Plasma TVs, digital cameras, camcorders and DVD players: demand for these products has completely died down.''

Friday, November 21, 2008

Goldman Slashes GDP forecast

by Calculated Risk on 11/21/2008 08:29:00 AM

From Bloomberg: Goldman Slashes U.S. Growth Forecasts, Says Recession Deepens

In a research note released this morning, Goldman Sachs slashed their Q4 GDP forecast from a decline of 3.5%, to a decline of 5% in Q4 (at an annual rate). They are now forecasting unemployment will reach 9% by Q4 2009.

They are also forecasting (not in Bloomberg article) that unemployment will rise to 6.8% in November with 350,000 in reported job losses.

This isn't quite the "just awful" scenario, but it is pretty close.