by Calculated Risk on 11/21/2008 01:57:00 AM

Friday, November 21, 2008

Singapore in Recession

From MarketWatch: Singapore falls into recession, cuts 2009 outlook

Singapore became the third major Asia-Pacific economy to fall into recession after data released Friday showed the economy had contracted for two straight quarters.Pretty soon it will be easier to list the countries NOT in recession ...

...

The contraction, which followed a revised 5.3% fall in the second quarter from the first, means Singapore technically follows Japan and Hong Kong into recession.

Thursday, November 20, 2008

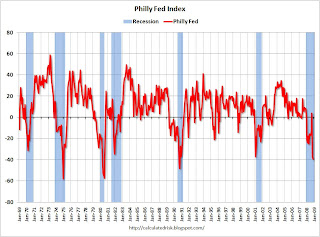

Philly Fed: Manufacturing sector index "lowest level since October 1990"

by Calculated Risk on 11/20/2008 10:41:00 AM

Until recently the manufacturing sector (except the automakers) was holding up pretty well. Not anymore ...

Here is the Philadelphia Fed Index for November activity released today: Business Outlook Survey.

Conditions in the region's manufacturing sector continued to deteriorate, according to firms polled for this month's Business Outlook Survey. Most broad indicators declined again in November, following sharp decreases in October. ... Most of the survey's indicators of future activity slid further into negative territory this month, suggesting that the region's manufacturing executives expect continued declines over the next six months.

...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from -37.5 in October to -39.3 this month. This index, which fell a dramatic 41 points last month, is now at its lowest level since October 1990.

...

The current employment index fell notably this month, declining seven points, to -25.2

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index vs. recessions for the last 40 years. The manufacturing sector is clearly in recession - although still not as bad as during earlier recessions.

Wednesday, November 19, 2008

Monday, November 17, 2008

How bad could Q4 be?

by Calculated Risk on 11/17/2008 08:59:00 PM

Goldman Sachs has a research note out tonight asking: Fourth-Quarter GDP – How Bad Could It Be? Their answer: pretty bad.

The Goldman forecast is for a 3.5% annualized decline in GDP for Q4. But in the research note tonight they calculate some alternative scenarios.

In a "just awful" scenario, Goldman estimates GDP could decline by 6% annualized in Q4, and in a "worst case" scenario by 7.8% (either would be the worst quarter since the early '80s). GDP was -7.8% annualized in Q2 1980 and -6.4% in Q1 1982.

Looking at the details, I think the "just awful" scenario is possible (with consumer spending off 5%), but the worst case is very unlikely. We will know more as PCE is released monthly.

Compare that to the National Association for Business Economics (NABE) forecast released this morning, from the WSJ NABE: ‘Prolonged’ Recession Expected:

According to NABE, 96% of survey respondents said the U.S. is in recession, with respondents split on whether it began in late 2007 to early 2008 or in the third quarter of this year. Gross domestic product contracted 0.3%, at an annual rate, during the third quarter. The NABE panel expects GDP to fall at a 2.6% rate this quarter and 1.3% in the first quarter of 2009.Even though most NABE economists finally recognize the recession, I think they are still too optimistic. But the consensus could be correct - guessing inventory changes, government spending and even net exports is always tricky.

But the number could be shockingly bad, even for those of us that expect a really bad number.

Sunday, November 16, 2008

Europe, Japan Recessions Confirmed

by Calculated Risk on 11/16/2008 07:08:00 PM

From The Independent: It's official: eurozone collapses into its first recession

Europe's economy officially collapsed into recession for the first time since its inception during the third quarter ... The eurozone, made up of the 15 countries that use the euro as their primary currency, shrank by 0.2 percentage points between July and the end of September, having contracted by the same margin during the preceding three months as well. ...From Bloomberg: Japan's Economy Shrinks 0.4%, Confirming Recession

Germany and Italy, the continent's largest and fourth largest economies, dragged the eurozone down – both slipped into recession during the third quarter. Spain also suffered its first quarter of negative growth in 15 years. However, France just managed to maintain a positive growth rate.

Japan's economy, the world's second largest, contracted more than economists expected in the third quarter, confirming it entered its first recession since 2001 as companies cut back spending.The U.S. is already in a recession too, although the NBER still hasn't called the start date. From the NBER:

Gross domestic product fell an annualized 0.4 percent in the three months ended Sept. 30 ...

The committee places particular emphasis on two monthly measures of activity across the entire economy: (1) personal income less transfer payments, in real terms and (2) employment.It is close - and subject to revision - but based on these measures I think the NBER will decide the U.S. recession started in Dec '07 or Jan '08.

Friday, November 14, 2008

LA Ports in October: Export Traffic Below 2007

by Calculated Risk on 11/14/2008 09:20:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic has peaked for the year as retailers have already imported most of the goods for the holiday season. Inbound traffic is about 7% below last October.

This slowdown in exports (inbound traffic to the U.S.) is hitting countries like China hard, from the NY Times: Factories Shut, China Workers Are Suffering

[A]n export slowdown that began earlier this year and that has been magnified by the global financial crisis of recent months is contributing to the shutdown of tens of thousands of small and mid-size factories here and in other coastal regions, forcing laborers to scramble for other jobs or return home to the countryside.But even more concerning for the U.S. is that export traffic is declining. For the LA area ports, outbound traffic fell off a cliff in September, and was even lower in October. Outbound traffic was about 8% below the level of October 2007.

The key supports for the economy earlier this year - consumer spending, exports, and investment in non-residential structures - are all declining sharply now.

Thursday, November 13, 2008

Mervyn King: UK Worst Economic Downturn in 30 years

by Calculated Risk on 11/13/2008 01:06:00 AM

From The Times: Economy faces sharpest downturn for 30 years

The British economy faces its toughest year in almost three decades, the Governor of the Bank of England said yesterday. Mervyn King gave warning of “very difficult times” ahead and an even sharper recession than that of the early Nineties.

...

In a dire forecast, the Bank predicted that the economy would shrink next year by up to 2 per cent. A slump on this scale would outstrip even the brutal downturn of 1991, when GDP fell 1.4 per cent. It would mark the economy’s gravest year since 1980 ...

The report said that the slowdown could be deeper and longer lasting if banks continued to curb their lending, if consumers and businesses had to cut spending even more sharply and if unemployment climbed even more rapidly than is feared.

Wednesday, November 12, 2008

Intel Warns "Fourth-Quarter Below Expectations"

by Calculated Risk on 11/12/2008 05:17:00 PM

Press Release: Intel's Fourth-Quarter Business Below Expectations

The company now expects fourth-quarter revenue to be $9 billion, plus or minus $300 million, lower than the previous expectation of between $10.1 billion and $10.9 billion. Revenue is being affected by significantly weaker than expected demand in all geographies and market segments. In addition, the PC supply chain is aggressively reducing component inventories.That is a huge cut in guidance.

Dimon: Recession may be worse than Credit Crisis

by Calculated Risk on 11/12/2008 04:17:00 PM

From Bloomberg: Dimon Says Recession May Be Worse Than Credit Crisis

``We think the economy could be worse than the capital- markets crisis,'' [JPMorgan Chase & Co. Chief Executive Officer Jamie] Dimon said. ``You really need to separate them because they have completely different effects on our businesses and on most businesses.''Not to be outdone, John Thain, chairman and chief executive of Merrill Lynch compared the current contraction to the Great Depression, from the Financial Times: Merrill chief sees severe global slowdown

“Right now, the US economy is contracting very rapidly. We are looking at a period of global slowdown,” [Thain] told investors. “This is not like 1987 or 1998 or 2001. The contraction going on is bigger than that. We will in fact look back to the 1929 period to see the kind of slowdown we’re seeing now.”

...

"There is no such thing as decoupling. ... Each individual economy will be more or less affected, depending on reliance on global trade and commerce.”

Best Buy "rapid, seismic changes in consumer behavior"

by Calculated Risk on 11/12/2008 09:25:00 AM

"Since mid-September, rapid, seismic changes in consumer behavior have created the most difficult climate we've ever seen. Best Buy simply can't adjust fast enough to maintain our earnings momentum for this year."From WSJ: Sales Slump Pounds Best Buy

Brad Anderson, vice chairman and chief executive officer of Best Buy, Nov 12, 2008.

Best Buy Co. lowered its earnings outlook as the U.S. economic downturn has been quickly eroding sales at the consumer-electronics giant.Ouch.

...

Best Buy said sales at stores open at least a year slumped 7.6% last month following a 1.3% decline in September. As such, Best Buy now expects the measurement for the year ending Feb. 28 to fall 1% to 8%, with results for the last four months of the fiscal year -- which encompass the all-important holiday-shopping season -- potentially tumbling by between 5% to 15%. Best Buy had been expecting 2% to 3% growth in same-store sales for the year.

Wednesday, November 05, 2008

ISM Services Index Declines Sharply in October

by Calculated Risk on 11/05/2008 10:07:00 AM

From the Institute for Supply Management (ISM): October 2008 Non-Manufacturing ISM Report On Business®

The report shows the service sector contracted sharply in October.

"The NMI (Non-Manufacturing Index) registered 44.4 percent in October, 5.8 percentage points lower than the 50.2 percent registered in September, indicating contraction in the non-manufacturing sector after two consecutive months of growth."There were a couple of interesting comments on discretionary spending:

Anthony Nieves, chair of the Institute for Supply Management

"Uncertainty is having the usual effect on business. Our response is traditional — stop all discretionary spending."This is exactly how businesses (and consumers) react to uncertainty - halt all discretionary spending. This is usually a temporary reaction until the business can adjust to changes in economic conditions.

"Business down significantly! Discretionary spending disappearing."

Monday, November 03, 2008

GM: "probably worst industry sales month in the post-WWII era."

by Calculated Risk on 11/03/2008 01:51:00 PM

From MarketWatch: GM U.S. October light vehicle sales fall 45.1%

General Motors said Monday that October U.S. light vehicle sales fell 45.1% to 168,719 units from 307,408 a year ago.The WSJ in a headline quoted GM executive Mark LaNeve as saying October was "probably worst industry sales month in the post-WWII era."

Thursday, October 30, 2008

Fed's Yellen: "Economy Contracting Significantly"

by Calculated Risk on 10/30/2008 03:57:00 PM

From San Francisco Fed President Dr. Janet Yellen: The Mortgage Meltdown, Financial Markets, and the Economy. Excerpt on the economic outlook:

[R]ecent data on the economy have been deeply worrisome. Data released this morning reveal that the economy contracted slightly in the third quarter. For the fourth quarter, it appears likely that the economy is contracting significantly. Mainly for this reason, inflationary risks have diminished greatly."It appears likely that the economy is contracting significantly". Strong words from a Fed president. Q4 is going to be ugly.

...

For consumers, the credit crunch is one of several negative factors accounting for the decline in spending in recent months. Consumer credit is costlier and harder to get: loan rates are up, loan terms are tougher, and increasing numbers of borrowers are being turned away entirely. This explains, in part, the exceptional weakness we have seen in auto sales. In addition, of course, employment has now declined for nine months in a row, and personal income, in inflation-adjusted terms, is virtually unchanged since April. Furthermore, household wealth is substantially lower as house prices have continued to fall and the stock market has declined sharply.

Business spending, too, is feeling the crunch in the form of a higher cost of capital and restricted access to credit. ... Some of our business contacts report that bank lines of credit are more difficult to negotiate, and many indicate that they have become cautious in managing liquidity, in committing to capital spending projects that can be deferred, and even in extending credit to customers and other

counterparties. Nonresidential construction also is headed lower largely because of the financial crisis; the market for commercial mortgage-backed securities, a mainstay for financing large projects, has all but dried up.

...

Until recently, weakness in domestic final demand was offset by a major boost from exporting goods and services to our trading partners. Unfortunately, economic growth in the rest of the world has slowed noticeably. ... As a result, exports will not provide as much of an impetus to growth as they did earlier in the year.

emphasis

added

Friday, October 24, 2008

Limit Down

by Calculated Risk on 10/24/2008 09:14:00 AM

From MarketWatch: S&P 500 futures contract triggers circuit breaker

The Chicago Mercantile Exchange's circuit-breaker rules went into effect Friday as plunging S&P 500 and Nasdaq 100 futures contracts reached pre-specified limits.This follows a night of cliff diving in Asia and Europe.

The CME limits the S&P 500 futures to a drop of a 60 points and the Nasdaq 100 futures to a drop of 85 points during electronic action.

As an example, the FTSE 100 is off 8.3% as the U.K. economy contracts:

The Office for National Statistics said Friday that the economy contracted a far-bigger-than-expected 0.5% in the third quarter, compared with zero growth in the second quarter. It is the first time the economy has contracted since the second quarter of 1992 and the biggest drop since the fourth quarter of 1990.Should be an interesting day ...

Thursday, October 23, 2008

Philly Fed September State Coincident Index

by Calculated Risk on 10/23/2008 02:20:00 PM

Here is the Philadelphia Fed state coincident index release for September.

The indexes increased in 15 states for the month, decreased in 28, and were unchanged in the remaining seven (a one-month diffusion index of -26).

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. Most states are in recession, although a portion of the central U.S. is still growing (from Texas up to Montana).

This is what a recession looks like based on the Philly Fed states indexes.

This is a graph of the monthly Philly Fed data of the number of states with one month increasing activity.

This is a graph of the monthly Philly Fed data of the number of states with one month increasing activity.Note: the Philly Fed calls some states unchanged with minor changes.

Most of the U.S. was has been in recession since late last year based on this indicator.

Tuesday, October 21, 2008

Mervyn King: A 'long march' out of recession

by Calculated Risk on 10/21/2008 08:31:00 PM

From The Times: Mervyn King warns of Britain's 'long march' out of recession

Britain is on the brink of recession and faces an extended and painful economic downturn, the Governor of the Bank of England said last night. Mervyn King admitted for the first time that “it now seems likely that the economy is entering a recession”. He told families and business to prepare for a prolonged period of hardship.Here is the story from Bloomberg: King Says Bank of England Will Act as Recession Seems Likely

“We now face a long, slow haul to restore lending to the real economy, and hence growth of our economy, to more normal conditions,” he said.

A squeeze on take-home pay, soaring living costs and the decline in consumer credit increased the risk of “a sharp and prolonged slowdown”. He said: “Over the past month, the economic news has probably been the worst in such a short period for a very considerable time.”

``The age of innocence -- when banks lent to each other unsecured for three months or longer at only a small premium to expected policy rates -- will not quickly, if ever, return,'' King said. ``I hope it is now understood that the provision of central bank liquidity, while essential to buy time, is not, and never could be, the solution to the banking crisis, nor to the problems of individual banks.''Usually when the Fed Chairman and the BofE Governor are talking recession, both countries have been in recession for some time!

...

``Not since the beginning of the First World War has our banking system been so close to collapse,'' King said.

...

Investors overseas may also be less willing to put their money in the U.K., King said. ``Unless they are replaced by other forms of external finance, the adjustments in the trade deficit and exchange rate will need to be larger and faster than would otherwise have occurred, implying a larger rise in domestic saving and weaker domestic spending in the short run.''

MSC Industrial Comments on Economy

by Calculated Risk on 10/21/2008 01:45:00 PM

MSC Industrial Supply (MSC) supplies industrial products to industrial customers. They had some interesting comments today on their conference call about the economy (hat tip Brian):

MSC: “In the last several weeks, customers' sentiment has turned dramatically downwards. Here are a few of the things we have recently heard and I'll quote a few of them. One quote is our new orders are down substantially in the last few weeks. Another is that corporate has told us to reduce inventory. What we have also heard is make due with what you have. And finally, another quote is capital expenditures are on hold. Customers are concerned about the economy and the lack of available credit. They're reducing inventories, orders, and order size and there has been a trend toward deferring capital expenditures. There is a lack of visibility and until that improves, customers will continue to act in this manner. This has affected the smaller manufacturers and machine shops that still make up a significant portion of MSC sales to a greater extent than our larger customers.”More real economy cliff diving.

Analyst: In terms of the environment we're dealing with here today, I am interested in all of your opinions, your viewpoint in terms of how does this current environment look to you relative to past downturns with we have seen.

MSC: David, we view this time as unprecedented in history. The economy is undergoing a huge change, how that is going to shake out all remains to be seen, but I think what is important to know is it's a huge change that, frankly, no one had a chance to see coming, so we than specifically in our customer base there is a tremendous amount of fear that is gripping customers and evidenced by what we have seen the last couple of weeks in October, almost buying paralysis, that is really the way that we think about it, and frankly, in speaking with so many customers what we see happening.... if you go back to 9/11, pre-9/11, the economy was coming down in fact on a sequential basis over a period of many, many months, it slowed down and then there was the obvious tragic event of 9/11. What is has happened here with the credit crisis is while the economy was by no means booming, it was kind of rolling along and we almost think that what typically would have taken six, seven, eight, 9, 12 months to start to come down happened almost literally overnight. If you think about the ISM being in a flat 49-ish, 50 range for many, many months throughout the year to have it swoon as it did in September at 43, which, by the way, as I am sure you know is at 9/11 levels. From all the time that the ISM has been tracked, I don't believe it's been a point where the ISM measurement ever dropped off the cliff as fast. Even pre-9/11, the ISM was drifting downward to ultimately hit that level but it was not at kind of the steady state where it was, which is, you know, with the slower economy but, frankly, with the latest measurements showing was that things fell off a cliff.

One more thing to also note that our customer base is much more diversified [from the 9/11 period]. Very different from back then. We were just getting started with our large customer segment, for example, when where today the large customer segment is a much larger and vibrant part of our growth equation and that will, as it's already shown, will help to diversify us from that small to midsize manufacturing customer where the pressure on them is just enormous.

emphasis added

Sunday, October 19, 2008

UK: Negative Equity to Reach 2 Million

by Calculated Risk on 10/19/2008 12:33:00 AM

From The Times: Negative equity ‘to reach 2 million’

Collapsing house prices are plunging 60,000 homeowners a month into negative equity, which means the country is on course for a worse crisis than the 1990s crash.The population of the UK is about 20% of the U.S., so using a ratio of population, this would compare to about 10 million homeowners in the U.S. with negative equity. Moody's estimates there are already 12 million homeowners in the U.S. with negative equity in the U.S. - so the problem appears to be worse in the U.S. than in the U.K.

At current trends, 2m households will enter negative equity by 2010, outstripping the 1.8m affected at the bottom of the last housing slump.

...

Economists believe house prices will fall by up to 35% from their peak by 2010. This compares with a drop of only 20% in the early 1990s.

...

Capital Economics, the City consultancy, expects up to 2m properties will be in negative equity by 2010 — more than in the recession of the early 1990s.

Friday, October 17, 2008

Krugman: Economic slump "nasty, brutish — and long"

by Calculated Risk on 10/17/2008 09:30:00 AM

Nobel prize winning economist Paul Krugman writes: Let’s Get Fiscal

Just this week, we learned that retail sales have fallen off a cliff, and so has industrial production. Unemployment claims are at steep-recession levels, and the Philadelphia Fed’s manufacturing index is falling at the fastest pace in almost 20 years. All signs point to an economic slump that will be nasty, brutish — and long.And Krugman argues for more government spending:

How nasty? The unemployment rate is already above 6 percent (and broader measures of underemployment are in double digits). It’s now virtually certain that the unemployment rate will go above 7 percent, and quite possibly above 8 percent, making this the worst recession in a quarter-century.

And how long? It could be very long indeed.

[T]here’s a lot the federal government can do for the economy. It can provide extended benefits to the unemployed, which will both help distressed families cope and put money in the hands of people likely to spend it. It can provide emergency aid to state and local governments, so that they aren’t forced into steep spending cuts that both degrade public services and destroy jobs. It can buy up mortgages (but not at face value, as John McCain has proposed) and restructure the terms to help families stay in their homes.At the start of the Depression, President Hoover kept trying to balance the budget - by cutting spending and raising the top marginal taxes from 25% to 63% - while the economy kept getting worse. It's unlikely that balancing the budget will be a priority in 2009.

And this is also a good time to engage in some serious infrastructure spending, which the country badly needs in any case.

Thursday, October 16, 2008

Industrial Production: Cliff Diving

by Calculated Risk on 10/16/2008 09:17:00 AM

From MarketWatch: U.S. Sept industrial output down 2.8%, biggest since Dec '74

The output of the nation's factories, mines and utilities plunged 2.8% in September, the Federal Reserve said Thursday. This is the biggest decline in output since December 1974. ... A strike at Boeing Co had a negative impact on production, as did Hurricane Gustav and Hurricane Ike. ... Capacity utilization fell to 76.4% from 78.7%.More evidence of a sharp slowdown in the U.S. economy in September.