by Calculated Risk on 7/16/2009 01:00:00 PM

Thursday, July 16, 2009

NAHB: Builder Confidence Increases Slightly In July

Click on graph for larger image in new window.

Click on graph for larger image in new window.

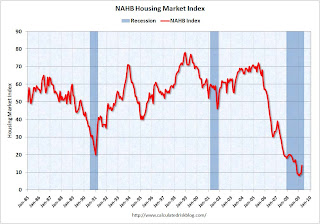

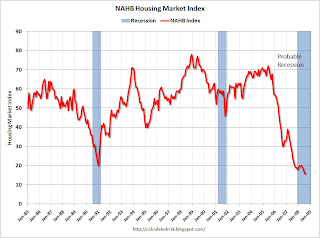

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 17 in July from 15 in June. The record low was 8 set in January.

This is still very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added):

Builder confidence in the market for newly built, single-family homes notched up two points in July to its highest level since September 2008, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI rose two points to 17 in July as builders saw an improvement in current sales conditions but continued to express concerns about the future.

...

“Although today’s HMI is positive news that helps confirm the market is bouncing around a bottom, the gain was entirely contained in the component gauging current sales conditions, while the component gauging sales expectations for the next six months remained virtually flat for a fourth consecutive month,” noted NAHB Chief Economist David Crowe. “Builders recognize the recovery is going to be a slow one and that we are facing a number of substantial negative forces.”

Monday, June 15, 2009

NAHB: Builder Confidence Decreases Slightly in June

by Calculated Risk on 6/15/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

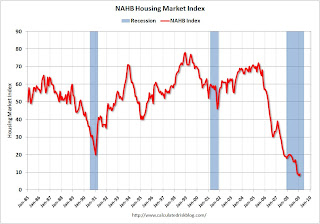

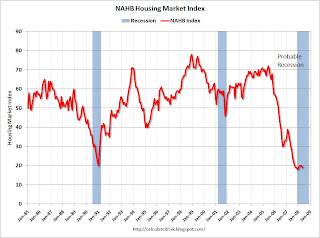

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 15 in June from 16 in May. The record low was 8 set in January.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added): Builder Caution Reflects Fragile Housing Market In June

Indicating that single-family home builders remain cautious and concerned about the fragile state of today’s economy and housing market, the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) declined one point to 15 in June.

...

“As expected, the housing market continues to bump along trying to find a bottom,” said NAHB Chief Economist David Crowe. “Meanwhile, builders are taking their cue from consumers, who remain uncertain about the economy and their own situation. Builders are also finding it difficult to complete a sale because customers cannot sell their existing homes.”

...

Two out of three of the HMI’s component indexes were unchanged in June, including the index gauging current home sales, which held at 14, and the index gauging traffic of prospective buyers, which held at 13. Meanwhile, the index gauging expectations for the next six months declined a single point, to 26.

Regionally, the decline was entirely focused in the South, which is the nation’s largest housing market. There, the HMI declined 3 points to 15, while the rest of the regions posted gains. The Northeast had a one-point gain to 20, the Midwest, a one-point gain to 15, and the West, a two-point gain to 14.

Monday, May 18, 2009

NAHB: Builder Confidence Increases in May

by Calculated Risk on 5/18/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

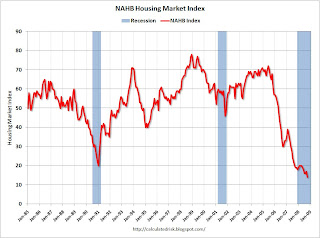

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 16 in May from 14 in April from. The record low was 8 set in January.

The increase in April and May followed five consecutive months at either 8 or 9.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added): Builder Confidence Continues To Rise In May

“The fact that the May HMI continued to tick up from April's five-point increase provides confirming evidence that the improved confidence level was no fluke,” added NAHB Chief Economist David Crowe. “This continued increase indicates that home builders feel we’re at or near the bottom of the market and that positive signs lie ahead for builders and potential home buyers, provided that builder access to production credit significantly improves.”

...

Two out of three of the HMI’s component indexes rose in May. The index gauging current sales conditions rose two points to 14, while the index gauging sales expectations for the next six months rose three points to 27. The index gauging traffic of prospective buyers remained unchanged, at 13.

Regionally, the Northeast posted a three-point gain in its HMI score, to 18, while the South posted a one-point gain to 18, the West rose four points to 12, and the Midwest held even at 14.

Wednesday, April 15, 2009

NAHB: Builder Confidence Increases in April

by Calculated Risk on 4/15/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 14 in April from 9 in March. The record low was 8 set in January.

The increase in April follows five consecutive months at either 8 or 9.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added): April Data Suggests Market At or Near Bottom

Builder confidence in the market for newly built, single-family homes rose five points in April to the highest level since October 2008, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This gain was the largest one-month increase recorded since May of 2003, and brings the HMI out of single-digit territory for the first time in six months – to 14. Every component of the HMI reflected the boost, with the biggest gain recorded for sales expectations in the next six months.

...

“This is a very encouraging sign that we are at or near the bottom of the current housing depression,” said NAHB Chief Economist David Crowe. “With the prime home buying season now underway, builders report that more buyers are responding to the pull of much-improved affordability measures, including low home prices, extremely favorable mortgage rates and the introduction of the $8,000 first-time home buyer tax credit.”

...

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations in the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Each of the HMI’s component indexes recorded substantial gains in April. The largest of these gains was a 10-point surge in the component gauging builder sales expectations for the next six months, which brought that index to 25. The component gauging current sales conditions and the component gauging traffic of prospective buyers each rose five points, to 13 and 14, respectively.

The HMI also rose in every region in April, with an eight-point gain to 16 in the Northeast, a six-point gain to 14 in the Midwest, a five-point gain to 17 in the South and a 4-point gain to 9 in the West.

Monday, March 16, 2009

Comparing the NAHB Housing Market Index and New Home Sales

by Calculated Risk on 3/16/2009 06:06:00 PM

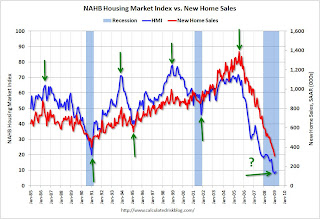

Here is a comparison of the National Association of Home Builders (NAHB) Housing Market Index and new home sales from the Census Bureau. Since new home sales are released with a lag, the NAHB index provides a possible leading indicator for sales.

Note: the NAHB index released this morning was for a March survey. New Home sales for February will be released on March 25th - so the NAHB is released almost 6 weeks ahead of the corresponding sales numbers. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows that major tops and bottoms (green arrows) for the two series line up pretty well (usually within 1 month). However both series are noisy month to month, and there are plenty of head fakes in between the significant peaks and troughs. Also the new home sales data is revised significantly (this graph uses revised data).

Just something to watch going forward ...

NAHB Housing Market Index Still Near Record Low

by Calculated Risk on 3/16/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was flat at 9 in March (same as February). The record low was 8 set in January.

This is the fifth month in a row at either 8 or 9.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB: Builder Sentiment Unchanged In March

Builder confidence in the market for newly built single-family homes remained unchanged in March as economic woes continued to take their toll on potential buyers, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI held steady at 9 in March, marking a fifth consecutive month of single-digit readings.

“Home builders are hopeful that the recent economic stimulus package, and particularly the first-time home buyer tax credit that it included, will have a positive impact on consumer behavior and home sales as the prime home buying season gets underway,” said NAHB Chairman Joe Robson, a home builder from Tulsa, Okla. “But it’s still too soon to tell how much of an impact that will be, especially as builders find potential buyers are reluctant because of uncertainty about their future job security and the overall economic outlook.”

“The economy continues to be the main drag on home sales activity right now, in terms of consumer confidence across most of the country,” acknowledged NAHB Chief Economist David Crowe. “What’s more, home builders report that tight credit conditions are posing a further hurdle, especially for potential first-time buyers, while potential trade-up buyers are finding it very tough to sell their existing homes so they can make a move.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Two out of three of the HMI’s component indexes were unchanged in March, with the index gauging current sales conditions holding at 7 and the index gauging sales expectations in the next six months holding at a record-low 15. Meanwhile, the index gauging traffic of prospective buyers declined two points to 9.

Three out of four regions saw no change in their HMI reading in March. The Midwest, South and West each held at near-record lows of 8, 12, and 5, respectively. The Northeast rose a single point from a record low of 8 in February to 9 in March.

Tuesday, February 17, 2009

NAHB Housing Market Index Near Record Low

by Calculated Risk on 2/17/2009 01:00:00 PM

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased slightly to 9 in February from the record low of 8 set in January.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB: Builder Sentiment Remains At Historic Lows In February

The National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today, held in the single digits for a fourth consecutive month in February. The HMI rose a single point to 9 – virtually unchanged from an all-time record low in the previous month – indicating that home builders have seen essentially no improvement in the market for new, single-family homes.

“Clearly, the market for new single-family homes remains very weak at this time,” said NAHB Chairman Joe Robson, a home builder from Tulsa, Okla. “However, looking forward, we are certainly hopeful that the newly passed economic stimulus bill, which includes some favorable elements for first-time home buyers and small businesses, will have a positive impact that will help get housing and the economy back on track.”

...

“Home builders are especially concerned about the continually rising number of foreclosures and short sales, which are flooding the market with excess inventory and undermining overall home values,” noted NAHB Chief Economist David Crowe. “This is one reason that home builder expectations for the next six months declined in the February HMI even though traffic of prospective buyers has improved somewhat and present sales conditions were basically unchanged. We are therefore looking forward to working with the Treasury Department as details of its plan to address the urgent foreclosure problem emerge.”

...

Two out of three of the HMI’s component indexes gained a bit of ground in February, with the index gauging current sales conditions rising a single point to 7 and the index gauging traffic of prospective buyers rising three points to 11. Meanwhile, the index gauging sales expectations in the next six months fell two points to a new record low of 15.

Regionally, the HMI rose a single point in both the South and West, to 12, and 5, respectively, in February. The Midwest posted a two-point gain, to 8, and the Northeast registered a one-point decline, to 9.

Wednesday, January 21, 2009

NAHB Housing Market Index Falls to New Record Low

by Calculated Risk on 1/21/2009 12:59:00 PM

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The builder confidence index was at 8 in January, a new record low.

Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey).

Press release from the NAHB: Builder Confidence Edges Down Further In January

Concerns about the faltering economy and reluctant home buyers pushed builder confidence in the market for newly built single-family homes down further in January, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI edged down a single point to a new record low of 8 in January.

...

All of the HMI’s component indexes remained at or near historic lows in January. The index gauging current sales conditions recorded the greatest change, with a two-point decline to 6. Meanwhile, the indexes gauging sales expectations for the next six months and traffic of prospective buyers each rose a single point, to 17 and 8, respectively.

Regionally, the HMI fell one point to 10 in the Northeast, held even at 6 in the Midwest, rose one point to 11 in the South and fell three points to new record low of 4 in the West in January.

Tuesday, January 20, 2009

National Association of Home Builders: Prices to Fall 29% in 2009

by Calculated Risk on 1/20/2009 10:28:00 PM

The building industry trade show started today in Las Vegas. The Las Vegas Review Journal has some details: Economists say housing market to remain unstable

David Crowe of the National Association of Home Builders said he was quite negative in his housing and economic outlook last year, but not negative enough.There are negative comments from other economists in the article too.

...

"We have consumer confidence at or near a historic low," the economist said Tuesday at the building industry trade show, "and it will probably deteriorate in 2009."

The S&P/Case-Shiller Home Price Index fell 25.3 percent from March 2006 to October 2008.

Crowe said he expects prices to fall another 29 percent this year and new home sales to decline 14 percent.

... The nation has an excess "overhang" of 6.2 million homes for sale, about 1.5 million too many, he said.

The WSJ has more: Builders Predict More Housing Pain

Economists from Freddie Mac, the government-backed lending agency, mortgage insurer PMI Group Inc. and the Portland Cement Association trade group also predicted this year would be worse than 2008 in terms of starts and overall housing activity.Grim and grimmer. Must be a fun convention.

...

Frank Nothaft, chief economist for Freddie Mac, predicted the U.S. unemployment rate will jump to 8.7% by the fourth quarter of 2009 from 7.2% as of December.

...

The Portland Cement Association held a separate news conference Tuesday at which its chief economist sounded even more pessimistic about prospects for a recovery. "I see another full two years almost before a significant gain," said Mr. Sullivan, who was one of the first industry economists to predict the current downturn.

Monday, December 15, 2008

NAHB Index Stays at Record Low

by Calculated Risk on 12/15/2008 12:56:00 PM

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The builder confidence index was at 9, tying the record low set in November.

Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey).

Press release from the NAHB: Builder Confidence Remains At Record Low In December

Builder confidence in the market for newly built single-family homes held at a record low in December as deepening economic turmoil, a deteriorating job market, and an ongoing flow of foreclosed homes onto the market continued to negatively impact sales conditions. The National Association of Home Builders/Wells Fargo Housing Market Index (HMI) did not budge this month from November’s all-time low reading of 9, with two out of three component indexes losing further ground.

“The crisis continues,” said NAHB Chairman Sandy Dunn, a home builder from Point Pleasant, W. Va. “While builders are doing everything we can in the way of price and non-price incentives to move new homes off the books, buyers are afraid to move forward, and in any case there is almost no way to compete with the cut-rate product that is continually flooding the market from mounting foreclosures.” ...

“We have seen no improvement over the past month in terms of sales conditions for new homes,” said NAHB Chief Economist David Crowe. “In fact, certain factors have gotten progressively worse, not the least of which is the job market, where massive layoffs are having a devastating effect on consumer confidence.” ...

Two out of three of the HMI’s component indexes registered some further deterioration in December. The index gauging current sales conditions and the index gauging sales expectations for the next six months each declined to new record lows, falling one point to 8 and two points to 16, respectively. The index gauging traffic of prospective buyers held at a record low of 7 for the month.

Two out of four regions posted declining builder confidence readings in December, with the Midwest and South edging down one point and two points, to 6 and 10, respectively. The Northeast held even with the previous month’s 11 reading, while the West posted a one-point gain to 7.

Tuesday, November 18, 2008

NAHB Market Index Hits Record Low

by Calculated Risk on 11/18/2008 01:03:00 PM

From MarketWatch:Home builders' index falls to record-low 9 in November

U.S. home builders have never been as anguished about their industry as they were in early November, with their monthly market index gauge plunging five points to a record low 9, the National Association of Home Builders reported Tuesday. "We are in a crisis," said Sandy Dunn, chairman of the NAHB.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The builder confidence index was at a record low in November.

Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey).

Press release from the NAHB: Builder Confidence Plummets; Congress Needs To Act

Builder confidence in the market for newly built single-family homes plunged in November as worsening problems in the financial markets, job market weakness and overwhelming uncertainty about the economy continued to negatively impact consumer behavior, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI sank five points to 9, the lowest level recorded since the series was created in January of 1985.

“Today’s report shows that we are in a crisis situation. If there’s any hope of turning this economy around, Congress and the Administration need to focus on stabilizing housing,” said NAHB Chairman Sandy Dunn, a home builder from Point Pleasant, W.Va.. “Tremendous economic uncertainties have driven consumers from the housing market, and it’s going to take some major incentives to bring them back. Beyond the work that is being done to help reduce foreclosures, Congress must immediately incorporate such incentives for qualified buyers in a new economic recovery package.”

“The housing downturn has already cost America three million jobs in construction and related industries, and this downward momentum cannot be stemmed without substantive government intervention,” agreed NAHB’s new Chief Economist, David Crowe.

Tuesday, October 21, 2008

Graphs: Housing Starts and Builder Confidence

by Calculated Risk on 10/21/2008 12:41:00 AM

Here are the graphs for housing starts and builder confidence based on the data released while out I was out hiking last week. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at an annual pace of 817K units in September, the lowest rate since Jan 1991 (798K SAAR).

Starts for single family structures (544K) were the lowest since Feb 1982 (541K). The Census Bureau has been tracking starts since Jan 1959, and the lowest month for single family structures was Oct 1981 (523K units SAAR) - so it is possible that a new record low will be set in October 2008.  The second graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The second graph shows the builder confidence index from the National Association of Home Builders (NAHB).

Builder confidence index was at a record low in October.

Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey).

Thursday, October 16, 2008

NAHB Housing Market Index Hits Record Low

by Calculated Risk on 10/16/2008 01:00:00 PM

From MarketWatch:Home builders' confidence tanks in October

The National Association of Home Builders/Wells Fargo index fell three points to 14 in October, two points below the previous low, NAHB said. The survey has been conducted monthly for 23 years. "Not surprisingly, builder confidence has taken a heavy hit from the recent financial market crisis," said Sandy Dunn, president of the NAHB and a builder from Point Pleasant, West VaI'm traveling and I'll post a graph later.

From the NAHB: BUILDER SENTIMENT RETREATS IN OCTOBER

Reflecting profound uncertainties tied to the financial market shocks of recent weeks, builder confidence in the market for new single-family homes receded to a new record low this month. The National Association of Home Builders/Wells Fargo Housing Market Index (HMI) declined three points to 14 in October after having edged up slightly in the previous month.

“Not surprisingly, builder confidence has taken a heavy hit from the recent financial market crisis,” noted NAHB Chairman Sandy Dunn, a home builder from Point Pleasant, W. Va. “We applaud the coordinated government efforts that have been undertaken to try to stem the panic on Wall Street and ease the impacts on Main Street, and we stand ready to support additional efforts to help stabilize housing and the national economy going forward.”

“Undoubtedly, today’s HMI reflects builder assessments of the recent events on Wall Street, the rapid deterioration in job markets and the corresponding weakness in consumer confidence,” noted NAHB Chief Economist David Seiders. “This report provides clear evidence that an additional economic stimulus package is needed, including a substantial incentive to spur home buying. The impacts of the record-breaking housing contraction have spilled over to other key sectors of the economy and weighed heavily on financial markets, and stabilizing housing is now the best chance we have to limit the severity of recession.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes fell this month. The indexes gauging current sales conditions and sales expectations for the next six months each hit new lows, falling three points to 14 and nine points to 19, respectively. The index gauging traffic of prospective buyers declined two points, returning to July’s record low of 12.

Every region posted declines in builder confidence in October, with four-point declines recorded in the Northeast and South, to 17 and 16, respectively, a three-point decline to 10 registered for the West, and a one-point decline to 14 posted in the Midwest.

Tuesday, September 16, 2008

NAHB: Builder Confidence Near Record Low

by Calculated Risk on 9/16/2008 01:00:00 PM

UPDATE: The NAHB has updated their site - the NAHB initially reported September at 17.

The NAHB reports that builder confidence was at 18 in Septemer, up slightly from August. Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Current sales activity and Traffic of Prospective Buyers increased slightly.

NAHB Press Release: Builder Confidence Rises In September

Builder confidence in the market for newly built single-family homes rose for the first time in seven months this September, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI gained two points to 18, rising from its record low of the previous two months.

...

“Nearly half of the builders in our September survey indicated that they expect to see a positive impact from the tax credit in their market areas,” said NAHB Chief Economist David Seiders. “Of those respondents, 20 percent said their market has already experienced some of this effect. Meanwhile, consumer confidence has risen and more households are saying that now is a good time to buy a home. All of these factors, along with the recent downward movements in mortgage rates, suggest that new-home sales will be stabilizing in the final quarter of the year.”

Monday, August 18, 2008

NAHB: Builder Confidence at Record Low

by Calculated Risk on 8/18/2008 01:20:00 PM

The NAHB reports that builder confidence was at 16 in August, unchanged from July. Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Current sales activity is near a record low of 16. Traffic of Prospective Buyers

is at a record low of 12.

NAHB Press Release: Builder Confidence Holds Steady In August

Anticipating positive impacts of newly enacted housing stimulus legislation, single-family home builders registered some improvement in their outlook for home sales in the next six months, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for August, released today. The overall confidence measure held even this month at 16, while the component gauging sales expectations rose two points to 25.

...

“While our overall measure of builder confidence remains at a record low at this time, it is a good sign that two out of three of the HMI’s component indexes rose in August, and this may be an indication that we are nearing the bottom of the long downswing in new-home sales,” said NAHB Chief Economist David Seiders. “Our current forecast shows stabilization of sales during the second half of this year, followed by solid recovery in 2009 and beyond.”

Wednesday, July 16, 2008

NAHB: Builder Confidence Declines to Record Low

by Calculated Risk on 7/16/2008 01:00:00 PM

The NAHB reports that builder confidence was at 16 in July, down from 18 in June. Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey).

Current sales activity is at a record low of 16. Traffic of Prospective Buyers

at a record low of 12!

NAHB Press Release: Builder Confidence Declines Further In July (excerpts below graph)

Builder confidence in the market for newly built single-family homes fell for a third consecutive month in July, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI fell below its previous record low of 18 in June to a new record low of 16 in July, with each of its three component indexes also hitting record lows.

“The worsening housing slump and the near-meltdown in financial markets last week makes it even more urgent for Congress to complete action on the housing bill now, a move that will help stabilize and restore confidence in housing and the U.S. economy,” said NAHB President Sandy Dunn, a home builder from Point Pleasant, W.Va.

...

“Builders are reporting that traffic of prospective buyers has fallen off substantially in recent months,” said NAHB Chief Economist David Seiders. “Given the systematic deterioration of job markets, rising energy costs and sinking home values aggravated by the rising tide of foreclosures, many prospective buyers have simply returned to the sidelines until conditions improve,” he said.

emphasis added

Monday, June 16, 2008

NAHB Builder Confidence: Congress needs to act "Urgently"

by Calculated Risk on 6/16/2008 01:00:00 PM

Paraphrasing: The outlook is grim. Congress needs to act "urgently". Americans are losing their jobs, losing their homes, losing their home equity. We need help!!!

NAHB wants a tax credit for homebuyers. Builders no longer asking for extension of Net Operating Loss (NOL) carry forward (this was getting too much bad publicity I think).

More: "Buyers are only buying for need (like relocations), not want." People can't move up - they can't sell their homes. Note: this is why the mobility issue I discussed last week is so critical.

"Activity so slow, companies aren't hiring any teenagers this summer."

Builder confidence hits record low.

The NAHB reports that builder confidence was at 18 in June, down from 19 in May. Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Current sales activity at record low of 17.

Chief Economist David Seiders: Expects further declines in new home sales. This survey was before the major run-up in interest rates. Interest rates is another threat to the housing market.

Caroline Baum Asks (my on the fly transcript):

"We've just been through the biggest housing bubble, housing bust in history. Housing is already tax advantaged. Why do we want to artificially stimulate demand when prices are still too high?"More: Seiders still has sales at bottoming at the middle of this year. He now says risk to his forecast are to the downside - because of this HMI report and higher interest rates.

"Risk (for sales) are piling up on downside. Price erosion (for new homes) through 2009."

Seiders, June, 2008

NAHB Conference Call for Housing Market Index

by Calculated Risk on 6/16/2008 12:03:00 PM

National Association of Home Builders (NAHB) CEO Jerry Howard and Chief Economist David Seiders will announce the June Housing Market Index (HMI) results during the teleconference to representatives from the media and other interested parties on Monday at 1:00 p.m. Howard will focus on the policy side and will discuss the importance of passing economic stimulus legislation, while Seiders will analyze the June HMI numbers and explain how they fit into his overall housing forecast.Source.

Members of the media will be given the opportunity to ask questions at the conclusion of the call. A press release and related data charts will also be released following the call, and will be posted at www.nahb.org/teleconference.

To participate in the call, please dial 1-800-860-2442 (toll-free) and ask for the "NAHB Housing Market Index Call."

If you are unable to participate in the teleconference, you may listen to a full replay of the call after the teleconference has concluded by calling 877-344-7529 and entering 420480 followed by the # sign when prompted for the account number. The replay will be accessible beginning at 4:00pm ET on June 16, and will available until 9:00am ET on July 1.

I don't know why they are holding a conference call. I doubt it's because builder confidence has improved - or why would they be pleading for help from Congress?

Thursday, May 15, 2008

NAHB: Home Builder Confidence Slides

by Calculated Risk on 5/15/2008 01:00:00 PM

"[T]he message is very clear: The single-family housing market is still deteriorating..."

NAHB President Sandy Dunn

"[T]he housing market has shown no evidence of improvement thus far. In fact, conditions have continued to deteriorate in recent times...”

NAHB Chief Economist David Seiders

| Click on graph for larger image. The NAHB reports that builder confidence was at 19 in May, from 20 in April. Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey). |  |

From NAHB: Builder Confidence Edges Downward In May

Home builders remained considerably downbeat as market conditions continued to erode in May, according to the NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI fell a single point to 19, bringing it within one point of the record low 18 set in December 2007 (the series began in January of 1985).

“With the HMI hovering in the historically low two-point range that’s prevailed over the past nine months, the message is very clear: The single-family housing market is still deteriorating ..." said NAHB President Sandy Dunn, a home builder from Point Pleasant, W.Va. ...

“Despite the Federal Reserve’s concerted efforts to lower short-term interest rates, free up credit markets and shore up the national economy, the housing market has shown no evidence of improvement thus far. In fact, conditions have continued to deteriorate in recent times,” said NAHB Chief Economist David Seiders. “The latest HMI shows that even fewer builders now foresee market conditions improving over the next six months compared with our April survey, and builder ratings of buyer traffic through model homes also have dropped off over the past month on a seasonally adjusted basis. ...”

...

The HMI’s component index gauging current sales conditions declined one point to 17 in May — its lowest level since the series began in January 1985. Meanwhile, the component gauging sales expectations for the next six months declined three points to 27, and the component gauging traffic of prospective buyers declined two points to 17.

The HMI fell in three out of four regions in May, with a four-point decline to 18 registered in the Northeast, a three-point decline to 12 registered in the Midwest (also an all-time low) and a two-point decline to 22 posted in the South. The West posted a three-point gain to 20 this month but remained well below the level of a year earlier.

Tuesday, April 15, 2008

NAHB: Builder Confidence Unchanged at Near Record Lows

by Calculated Risk on 4/15/2008 01:00:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence was at 20 in April, unchanged from 20 in March. Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey). |  |

From NAHB: Builder Confidence Remains Unchanged In April

Builder confidence in the market for new single-family homes remained unchanged for a third consecutive month in April, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI held at 20, up marginally from the record low of 18 set in December of 2007 (the series began in January of 1985).Also from the NAHB: Nation Now In Mild Recession, Says NAHB Chief Economist

“With the traditional home buying season now well underway, we have not seen the bump in sales activity that we normally would this time of year,” said Sandy Dunn, NAHB president and a home builder from Point Pleasant, W.Va. “At this point, all eyes are on Congress and its efforts to craft meaningful legislation to help support the housing market and stabilize our nation’s economy before it heads deeper into recession.”

emphasis added

The deepening slump in the nation’s housing markets has seriously eroded consumer sentiment and pushed the economy into a mild recession, according to the chief economist for the National Association of Home Builders (NAHB).

“The worse-than-anticipated housing downturn, combined with systematic weakening of the labor market and rapidly rising energy and food prices, has taken a heavy toll on American consumers,” said NAHB’s David Seiders. “It’s now clear that we have entered what we anticipate will be a mild recession, running through the first half of this year, and there are substantial downside risks to this economic scenario.”

...

Given the ongoing erosion in housing finance markets and buyer demand, Seiders has adjusted NAHB’s official housing forecast to indicate continuing downward movement in housing starts through the end of 2008, bringing the decline for the year to 30 percent. A month ago, Seiders expected housing starts to bottom out in the third quarter, with a 27 percent decline for 2008.

“This change in our forecast indicates that, barring immediate action by Congress to stimulate housing and the economy, the housing sector will continue to be a serious drag on economic growth until the beginning of 2009,” Seiders said.