by Calculated Risk on 3/17/2008 01:01:00 PM

Monday, March 17, 2008

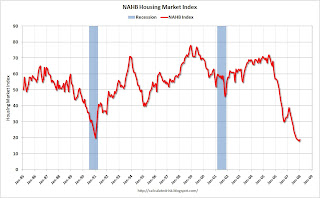

NAHB: Builder Confidence Unchanged

| Click on graph for larger image. The NAHB reports that builder confidence was at 20 in March, unchanged from 20 in February. |  |

From NAHB: Builder Confidence Remains Unchanged In March

Builder confidence in the market for new single-family homes remained unchanged in March, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI held firm at 20, which is near its historic low of 18 set in December of 2007 (the series began in January of 1985).

...

Two out of three of the HMI’s component indexes were unchanged in March from the previous month. The index gauging current sales conditions for newly built single-family homes held firm at 20 while the index gauging traffic of prospective buyers stayed at 19 following a significant gain in February. The index gauging sales expectations for the next six months edged downward by a single point to 26.

Regionally, the HMI was mixed, with the Northeast posting a two-point decline to 21, the Midwest holding even at 16, the South reporting a two-point gain to 26 and the West showing a one-point decline to 15.

Tuesday, March 04, 2008

NAHB on Housing: "Deepest, most rapid downswing since the Great Depression"

by Calculated Risk on 3/04/2008 04:08:00 PM

From MarketWatch: Rapid deterioration

Housing is in its "deepest, most rapid downswing since the Great Depression," the chief economist for the National Association of Home Builders said Wednesday, and the downward momentum on housing prices appears to be accelerating.There were 774 thousand new homes sold in 2007, so a 22% decline would be about 600 thousand in 2008. Last month there were 588 thousand new homes sold SAAR (seasonally adjusted annual rate). So Seiders thinks sales are near the bottom.

The NAHB's latest forecast calls for new-home sales to drop 22% this year, bringing sales 55% under the peak reached in late 2005. Housing starts are predicted to tumble 31% in 2008, putting starts 60% off their high of three years ago.

"More and more of the country is now involved in the contraction, where six months ago it was not as widespread," said David Seiders, the NAHB's chief economist, on a conference call with reporters. "Housing is in a major contraction mode and will be another major, heavy weight on the economy in the first quarter."

...

Vacant homes for sale in the U.S. now number about 2 million, Seiders said, an increase of 800,000 from 2005.

There were 1.35 million starts in 2007 (including apartment, condos, and owner built units), and a 31% decline would be about 934 thousand in 2008. Last month there were 1,012 thousand starts SAAR - so Seiders sees a further decline in starts.

Tuesday, February 19, 2008

NAHB: Builders Remain Cautious

by Calculated Risk on 2/19/2008 01:00:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence was at 20 in February, up from 19 in January. |  |

NAHB: Builders Remain Cautious as Buyer Traffic Improves in February

Builder confidence in the market for new single-family homes edged marginally higher in February as traffic of prospective buyers through model homes improved considerably, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI rose a single point to 20 this month, still close to its recent historic low reading of 18 (the series began in January of 1985).

“While builders remain very cautious about the outlook for new-home sales given today’s economic environment, the fact that more consumers appear to be checking out their options is a good sign,” said Sandy Dunn, a home builder from Point Pleasant, W.Va. and the newly elected 2008 president of the National Association of Home Builders (NAHB).

...

“Some potential buyers who have been sitting on the sidelines are starting to at least research a new home purchase given improving affordability factors and the large selection of units on the market,” said NAHB Chief Economist David Seiders. “That said, builders know there’s a difference between people looking and people buying, and their current outlook remains quite subdued. Additional stimulative measures on the legislative and policy side are definitely needed to bolster consumer confidence and help bring about a housing and economic recovery.”

...

In February, the index gauging current sales conditions for single-family homes rose one point to 20, while the index gauging sales expectations for the next six months declined one point to 27. Meanwhile, the index gauging traffic of prospective buyers rose five points to 19, its highest level since July of 2007.

Three out of four regions posted HMI gains for the month, including a three-point gain to 24 in the Northeast, a two-point gain to 24 in the South and a 2-point gain to 15 in the West. The Midwest registered no change for the month at 16.

Wednesday, January 16, 2008

NAHB: Builder Confidence Still at Record Lows

by Calculated Risk on 1/16/2008 12:55:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence was at 19 in January, up from a revised 18 in December. Confidence in January would have been at a record low without the revision to December. |  |

NAHB: Builder Confidence Virtually Unchanged In January

Builder confidence in the market for new single-family homes was virtually unchanged for a fourth consecutive month in January as mortgage-market problems and inventory issues continued to pose challenges, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI rose a single point to 19 this month following a downwardly revised 18 reading in December and 19 readings in both October and November of 2007.

...

“The HMI has held within a narrow two-point range for the past five months, indicating that builder views of housing market conditions essentially haven’t changed over that time,” said NAHB Chief Economist David Seiders. ...

In January, the index gauging current sales conditions for single-family homes remained unchanged at 19, while the index gauging sales expectations for the next six months rose two points to 28. Meanwhile, the index gauging traffic of prospective buyers rose one point to 14.

Regionally, the HMI results were mixed in January. The Northeast posted no change at 20, while the Midwest reported a two-point gain to 17 and the South registered a three-point gain to 23. The West posted a five-point decline to an HMI reading of 13.

Monday, December 17, 2007

NAHB: Builder Confidence Unchanged at Record Low

by Calculated Risk on 12/17/2007 01:11:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence was unchanged at a record low 19 in December. |  |

Builder confidence in the market for new single-family homes remained unchanged for a third consecutive month in December as problems in the mortgage market and excess inventory issues continued, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI held even at 19 this month, its lowest reading since the series began in January 1985.

“Builders continue to look for signs of improvement in the ongoing mortgage market crisis that is weighing on housing and the overall economy,” said NAHB President Brian Catalde, a home builder from El Segundo, Calif. ...

“Today’s report shows that builders’ views of housing market conditions haven’t changed in the past several months, and there clearly are signs of stabilization in the HMI,” noted NAHB Chief Economist David Seiders. “At this point, many builders are bracing themselves for the winter months when home buying traditionally slows, scaling down their inventories and repositioning themselves for the time when market conditions can support an upswing in building activity – most likely by the second half of 2008.”

...

In December, the index gauging current sales conditions for single-family homes improved by a single point, to 19, and the index gauging sales expectations for the next six months rose two points to 26. Meanwhile, the index gauging traffic of prospective buyers declined three points to 14.

Regionally, the HMI results were mixed in December. The Midwest and South each posted two-point gains in their HMI readings, to 15 and 21, respectively. The West held even at 18, and the Northeast, which experienced wetter weather conditions than normal in the survey period, posted a seven-point decline to 19. All regions were down on a year-over-year basis.

Monday, November 19, 2007

NAHB: Builder Confidence Unchanged at Record Low

by Calculated Risk on 11/19/2007 01:00:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence was at 19 in November, the same as October (revised). |  |

Builder confidence in the market for new single-family homes remained unchanged in November due to continuing mortgage market problems, a substantial inventory overhang and ongoing concerns about the effects of negative media coverage, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The November HMI held even with October’s upwardly revised 19 reading, its lowest point since the series began in January of 1985.

...

“The message from today’s report is that builders do not see any significant change in housing market conditions as compared to last month,” said NAHB Chief Economist David Seiders. “While they continue to work down inventories of unsold homes and reposition themselves for the market’s eventual recovery, they realize it will be some time before market conditions support an upswing in building activity – most likely by the second half of 2008.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

In November, the index gauging current sales conditions for single-family homes remained flat at 18, while the index gauging sales expectations for the next six months declined a single point to 25. The index gauging traffic of prospective buyers rose two points to 17.

Regionally, the HMI results were mixed, with two regions reporting modest HMI gains and two reporting slight declines. The HMI for the Northeast gained one point to 27 and the HMI for the West gained three points to 18. Meanwhile, the HMI for the Midwest declined one point to 13 and the HMI for the South declined two points to 19.

Tuesday, October 16, 2007

NAHB: Builder Confidence Falls to Record Low in October

by Calculated Risk on 10/16/2007 01:00:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence fell to 18 in October, from 20 in September. |  |

Builder confidence in the market for new single-family homes was further shaken in October due to continuing problems in the mortgage market, substantial inventories of unsold units and the perceived effect that negative media coverage is having on potential buyers, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI fell two more points to 18 in October, its lowest point since the series began in January of 1985.

“Builders in the field are reporting that, while their special sales incentives are attracting interest among consumers, many potential buyers are either holding out for even better deals or hesitating due to concerns about negative and confusing media reports on home values,” said NAHB President Brian Catalde.

“Consumers are still trying to sort out market realities and get the best deals they can,” noted NAHB Chief Economist David Seiders. “Many prospective buyers may very well have unrealistic expectations regarding new-home prices as well as how much they can expect to receive for their existing homes. When the market is in proper balance, people can recognize a good deal when it comes along; at this point, they view a good deal as a moving target.”

The positive news from today’s report, said Seiders, is that builder expectations for sales conditions in the next six months held steady at 26. “Builders believe they are taking the right steps to reduce inventories and position themselves for the market recovery that lies ahead,” he said. “Indeed, NAHB’s housing forecast indicates that home sales should stabilize within the next six months and show significant improvement during the second half of next year.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

Two out of three component indexes of the HMI declined in October. The index gauging current single-family home sales and the index gauging traffic of prospective buyers each declined two points, to 18 and 15, respectively, while the index gauging sales expectations for the next six months remained unchanged at 26.

Regionally, the West accounted for a substantial portion of the decline in builder confidence this month, with a four-point reduction in its HMI to 14. The Northeast and South each reported one-point declines to 26 and 21, respectively, while the Midwest posted a two-point gain to 15.

Tuesday, September 18, 2007

NAHB: Builder Confidence Falls to Record Low in September

by Calculated Risk on 9/18/2007 01:00:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence fell to 20 in September, from 22 in August. This ties the record low of 20 in January 1991. |  |

NAHB Press Release: Builder Confidence Continues Downward In September

Concerns about the substantial inventory of new homes for sale and the effects that deepening mortgage market problems are having on buyer demand caused builder confidence to decline for a seventh consecutive month in September, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI dropped two points to 20, tying its record low reached in January of 1991 (the series began in January 1985).

...

Two out of three component indexes declined in September. The index gauging current single-family home sales declined two points to 20, while the index gauging sales expectations for the next six months fell five points to 26. The index gauging traffic of prospective buyers held steady at 16 for the month.

All four regions of the country reported declines in their September HMI readings. The Northeast posted a three-point decline to 26, while the Midwest posted a single-point decline to 13, the South posted a two-point decline to 22, and the West posted a four-point decline to 18.

Wednesday, August 15, 2007

NAHB: Builder Confidence Falls in August

by Calculated Risk on 8/15/2007 01:00:00 PM

Click on graph for larger image.

Click on graph for larger image.

The NAHB reports that builder confidence fell to 22 in August, from 24 in July. The record low was 20 in January 1991.

NAHB Press Release: Credit Tightening Weighing On Builder Confidence In August

Highly visible problems in the housing finance system are contributing to a wait-and-see attitude among prospective home buyers and reducing builder confidence in the single-family housing market, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI declined two points to 22 in August, its lowest level since January 1991.

“Builders realize that issues related to mortgage credit cost and availability have become more acute, filtering some prospective buyers out of the market and prompting others to delay their decision to purchase a new home,” said NAHB President Brian Catalde, a home builder from El Segundo, Calif. “Builders are responding by trimming prices and stepping up non-price incentives to bolster sales and limit cancellations, although we’re dealing in a difficult market environment.”

“There is no question that problems in the subprime mortgage sector have spilled over to other components of housing finance, including the Alt.-A and jumbo markets, delaying a revival of the single-family housing market,” added NAHB Chief Economist David Seiders. “However, the government-related parts of the mortgage market still are functioning well and the underlying economic fundamentals promise to remain solid for some time – providing support to the longer-run housing outlook. We now expect to see home sales return to an upward path by early next year and we expect housing starts to begin a gradual recovery process by mid-2008. From there, the market will have plenty of room to grow in 2009 and beyond.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes declined in August. The index gauging current single-family home sales fell a single point, to 23, while the index gauging sales expectations for the next six months declined two points to 32 and the index gauging traffic of prospective buyers declined three points to 16.

Three out of four regions of the country posted declines in the August HMI. While the South’s HMI reading remained unchanged at 25, the West recorded a one-point decline to 23, the Northeast posted a two-point decline to 30 and the Midwest posted a five-point decline to 14.

Wednesday, July 25, 2007

NAHB Economist Cuts Forecast

by Calculated Risk on 7/25/2007 05:43:00 PM

John Spence as MarketWatch reports: Economist cuts housing forecasts

The chief economist for the National Association of Home Builders on Wednesday ... lowered his forecasts for new construction as the market has weakened further ...This means Seiders expects starts to average about 1.38 million per month, at a seasonally adjusted annual rate, for the 2nd half of '07. That is too much production, and I expect starts to fall even further.

"It's fair to say the performance of the housing market during the first half [of 2007] and the outlook for the second half and next year are a lot weaker than six months ago," said David Seiders ...

His outlook for 2007 single-family housing starts is now 9% lower than it was at the beginning of the year, while his 2008 forecast has been slashed by 15%, Seiders said on a conference call. His forecast is for housing starts of 1.42 million this year and 1.45 million in 2008.

Tuesday, July 17, 2007

Builder Confidence Falls in July

by Calculated Risk on 7/17/2007 12:53:00 PM

Click on graph for larger image.

Click on graph for larger image.

The NAHB reports that builder confidence fell to 24 in July.

NAHB Press Release: Builder Confidence Falls Further In July

A surplus of unsold homes on the market, combined with ongoing concerns in the subprime mortgage arena and affordability issues associated with tightened lending standards and higher interest rates, continue to take a significant toll on builder confidence, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI declined four points to 24 this month, which is its lowest level since January of 1991.

“The bottom line is that the single-family housing market is still in a correction process following the historic and unsustainable highs of the 2003-2005 period,” noted NAHB Chief Economist David Seiders. “Builders are actively trimming prices and offering buyer incentives to work down their inventories, but meanwhile there is a large supply of vacant existing homes on the market, and affordability problems persist despite efforts to attract buyers.

“In spite of these challenges, we expect to see home sales get back on an upward path late this year and we expect housing starts to begin a gradual recovery process by early next year. At that point, this market will be operating well below its long-term potential, providing plenty of room to grow in 2008 and beyond.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes declined in July. The index gauging current single-family sales and the index gauging sales expectations in the next six months each declined five points to 24 and 34, respectively, while the index gauging traffic of prospective buyers declined three points to 19.

Likewise, all four regions of the country posted declines in the July HMI. The Northeast and South each saw five-point declines, to 31 and 26, respectively, while the Midwest slipped a single point to 19 and the West declined three points to 25.

Monday, June 18, 2007

Builder Confidence Slips Again in June

by Calculated Risk on 6/18/2007 07:50:00 PM

Click on graph for larger image.

Click on graph for larger image.

NAHB Press Release: Builder Confidence Slips Again in June

Ongoing concerns about subprime-related problems in the mortgage market and newfound concerns about rising prime mortgage rates caused builder confidence to decline two more points in June, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), released today. With a reading of 28, the HMI now is at the lowest level in its current cycle and has reached the lowest point since February 1991.

“Builders continue to report serious impacts of tighter lending standards on current home sales as well as cancellations, and they continue to trim prices and offer a variety of nonprice incentives to work down sizeable inventory positions,” said NAHB President Brian Catalde, a home builder from El Segundo, California.

“It’s clear that the crisis in the subprime sector has prompted tighter lending standards in much of the mortgage market, and interest rates on prime-quality home mortgages have moved up considerably during the past month along with long-term Treasury rates,” added NAHB Chief Economist David Seiders. “Home sales most likely will erode somewhat further in the months ahead and improvements in housing starts probably will not be recorded until early next year. As a result, we expect housing to exert a drag on economic growth during the balance of 2007.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes declined in June. The index gauging current single-family sales slipped two points to 29, the index gauging sales expectations for the next six months fell two points to 39, and the index gauging traffic of prospective buyers fell one point to 21.

Three out of four regions posted declines in the June HMI. The Midwest posted a three- point decline to 19, the South posted a one-point decline to 32 and the West posted a five- point decline to 27. The Northeast recorded a three-point gain to 35 following a six-point loss in May.

Tuesday, May 15, 2007

Builder Confidence Slips Again In May

by Calculated Risk on 5/15/2007 01:56:00 PM

Click on graph for larger image.

Click on graph for larger image.

NAHB Press Release: Builder Confidence Slips Again In May

Ongoing concerns about subprime-related problems in the mortgage market caused builder confidence about the state of housing demand to decline three more points in May, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. With a current reading of 30, the HMI has now returned to the lowest level in its current cycle, which was previously hit in September of 2006.

“Builders are feeling the impacts of tighter lending standards on current home sales as well as cancellations, and they are bracing for continued challenges ahead,” said NAHB President Brian Catalde, a home builder from El Segundo, Calif.

“The crisis in the subprime sector has infected other parts of the mortgage market as well as consumer psychology, and as a result the housing outlook has deteriorated,” added NAHB Chief Economist David Seiders. “We’re now projecting that home sales and housing production will not begin improving until late this year, and we’re expecting the early stages of the subsequent recovery to be quite sluggish. There still are tremendous uncertainties regarding our baseline forecast going forward, owing largely to the subprime crisis that is having widespread effects throughout the mortgage market.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes declined in May. The index gauging current single-family sales slipped two points to 31, while the index gauging sales expectations for the next six months fell three points to 41 and the index gauging traffic of prospective buyers fell four points to 23.

Three out of four regions posted declines in the May HMI. The Northeast posted a six-point decline to 32, while the South posted a four-point decline to 33 and the West posted a three-point decline to 32. The Midwest eked out a one-point gain, to 23.

Monday, April 23, 2007

NAHB's Chief Economist Releases Housing Forecast

by Calculated Risk on 4/23/2007 02:11:00 PM

From Realty Times: NAHB's Chief Economist Releases Housing Forecast. See the link for excerpts from Seiders' forecast.

The overall economic forecast is still pretty positive on GDP growth with "major uncertainties" and significant downside risk. Seiders says the probability of recession later this year has risen, and he puts the odds around 25%.

The NAHB housing forecast is grim. Rising inventories, especially a record number of vacant housing units, combined with falling demand, because of the subprime and Alt-A debacle, "has downside implications for house prices and has prompted downward revisions to NAHB's forecasts of home sales and housing production for the balance of 2007-2008."

Nothing new here except that this is the forecast from the National Association of Home Builders!

Monday, April 16, 2007

Builder Confidence Recedes Further In April

by Calculated Risk on 4/16/2007 01:55:00 PM

Click on graph for larger image.

Click on graph for larger image.

NABH Press Release: Builder Confidence Recedes Further In April

Deepening problems in the subprime mortgage market continued to take a toll on builder confidence in April, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The index declined three points to 33 in April, its lowest level since December of 2006.

“The tightening of mortgage lending standards in connection with the subprime crisis has shaken the confidence of both consumers and builders, as reflected in this report,” said NAHB Chief Economist David Seiders. “Indeed, the unfolding effects of this crisis have compelled NAHB to trim our forecasts of home sales and housing production for both 2007 and 2008,” he said. “While we still expect to see some improvements in housing market activity beginning later this year, the downside risks and uncertainties surrounding that forecast are considerable.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes registered declines in April. The index gauging current single-family home sales fell three points to 33, while the index gauging sales expectations for the next six months declined six points to 44 and the index gauging traffic of prospective buyers declined a single point, to 27.

All four regions posted HMI declines in April, with the Northeast showing a one-point decline to 38, the Midwest registering a five-point decline to 22, the South posting a three-point decline to 37, and the West posting a two-point decline to 35.

“The subprime shakeout clearly is a serious matter for the single-family housing market,” noted NAHB President Brian Catalde, a home builder from El Segundo, Calif. “Builders in the field are reporting adverse effects on both sales and cancellations at this time, and it remains to be seen how serious these effects will be as we move through the spring home buying season.”

Monday, March 19, 2007

Builder Confidence Declines in March

by Calculated Risk on 3/19/2007 01:05:00 PM

Click on graph for larger image.

Click on graph for larger image.

UPDATE: NABH Press Release: Builder Confidence Slips In March

Builder confidence in the market for new single-family homes receded in March, largely on concerns about deepening problems in the subprime mortgage arena, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. After rising fairly steadily since its recent low last September, the HMI declined three points from a downwardly revised 39 reading in February to 36 in March.

“Builders are uncertain about the consequences of tightening mortgage lending standards for their home sales down the line, and some are already seeing effects of the subprime shakeout on current sales activity,” said NAHB Chief Economist David Seiders. “The fundamentals of today’s housing market still are relatively strong, including a favorable interest-rate structure, solid growth in employment and household income, lower energy prices and improving affordability in much of the single-family market – due in part to price cuts and non-price sales incentives offered by builders. NAHB continues to forecast modest improvements in home sales during the balance of 2007, although the problems in the mortgage market increase the degree of uncertainty surrounding our baseline (i.e., most probable) forecast.”

Derived from a monthly survey that NAHB has been conducting for 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes registered declines in March after having risen in the previous month. The index gauging current single-family home sales and the index gauging sales expectations for the next six months each declined three points, to 37 and 50, respectively. Meanwhile, the index gauging traffic of prospective buyers declined a single point, to 28.

Regionally, the HMI results were somewhat mixed. In the Midwest and West, the index gained one point to 28 and 36, respectively. In the Northeast, the HMI declined two points to 41, and in the South, it fell four points to 40.

Thursday, February 15, 2007

Builder Confidence Improves in February

by Calculated Risk on 2/15/2007 02:27:00 PM

Click on graph for larger image.

Click on graph for larger image.

The National Association of Home Builders/Wells Fargo Housing Market Index (HMI)increased from 35 in January to 40 in February, its highest level since June of 2006.

Here is the NAHB press release.

Wednesday, January 17, 2007

NAHB: Builder Confidence Improves in January

by Calculated Risk on 1/17/2007 12:59:00 PM

From NAHB: Builder Confidence Improves in January

Click on graph for larger image.

Click on graph for larger image.

Excerpts:

The HMI increased from an upwardly revised 33 in December to 35 in January, its highest level since July of 2006.

...

Two out of three component indexes registered improvement in January. The index gauging current single-family home sales and the index gauging traffic of prospective buyers each gained three points, to 36 and 26 respectively, while the index gauging sales expectations for the next six months remained unchanged at 49.

Meanwhile, three out of four regions surveyed in the HMI posted gains in January. Two-point gains were registered in the Northeast, Midwest and South, to 39, 24 and 41, respectively. The HMI for the West remained unchanged from the previous month at 32.