by Calculated Risk on 7/31/2015 06:27:00 PM

Friday, July 31, 2015

Fannie Mae: Mortgage Serious Delinquency rate declined in June, Lowest since August 2008

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in June to 1.66% from 1.70% in May. The serious delinquency rate is down from 2.05% in June 2014, and this is the lowest level since August 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has only fallen 0.39 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

The "normal" serious delinquency rate is under 1%, so maybe serious delinquencies will be close to normal in 2017. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Restaurant Performance Index declined in June

by Calculated Risk on 7/31/2015 04:16:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Dampened Outlook Causes Restaurant Performance Index Decline in June

As a result of a somewhat dampened outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) declined in June for the second consecutive month. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.0 in June, down 0.4 percent from May and its lowest level in nine months. Despite the decline, June represented the 28th consecutive month in which the RPI stood above 100, which signifies continued expansion in the index of key industry indicators.

“Although same-store sales and customer traffic levels remained positive in June, the overall RPI declined as a result of dampened optimism among restaurant operators,” said Hudson Riehle, Senior Vice President of the Research and Knowledge Group for the Association. “The proportion of restaurant operators expecting sales growth fell to its lowest level in nine months, while operators’ outlook for the economy turned negative for the first time in nearly two years.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 102.0 in June, down from 102.4 in May. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. Even with the decline in the index, this is a solid reading.

Freddie Mac: Mortgage Serious Delinquency rate declined in June, Lowest since November 2008

by Calculated Risk on 7/31/2015 01:24:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in June to 1.53%, down from 1.58% in May. Freddie's rate is down from 2.07% in June 2014, and the rate in June was the lowest level since November 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for May later today.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.54 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until mid-2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Chicago PMI increases, Final July Consumer Sentiment at 93.1

by Calculated Risk on 7/31/2015 10:02:00 AM

Chicago PMI July 2015: July Chicago Business Barometer Up 5.3 Points to 54.7

The Chicago Business Barometer increased 5.3 points to 54.7 in July led by a double digit gain in Production and accompanied by gains in New Orders and the other three components.This was well above the consensus forecast of 50.0.

...

Companies reported a strong revival in output in July after five months of relatively weak business activity. Production rose sharply by 12.0 points to 61.8 amid a bounceback in inventory growth to the highest since April underpinned by a solid gain in New Orders.

...

Chief Economist of MNI Indicators Philip Uglow said, “The recent weakness in the Chicago Business Barometer had sounded a few alarm bells over the resilience of the US economic recovery. The positive start to the third quarter, however, suggests that activity bounced back firmly as firms saw orders and output increase sharply.“

emphasis added

Click on graph for larger image.

The final University of Michigan consumer sentiment index for July was at 93.1, down from the preliminary reading of 93.3, and down from 96.1 in June.

This was below the consensus forecast of 94.1.

Thursday, July 30, 2015

Friday: Employment Cost Index, Chicago PMI, Consumer Sentiment

by Calculated Risk on 7/30/2015 08:46:00 PM

From Tim Duy: Fed Watch: GDP Report

The second quarter GDP report, while not a blockbuster by any measure, will nudge the Fed further in the direction of a September rate hike. At first blush this might seem preposterous - 2.3% growth is nothing to write home about in comparison to history. But history is deceiving in this case. It remains important to keep in mind that 2% is the new 4%.Friday:

...

Bottom Line: An unspectacular recovery, but sufficient to keep the Fed on track for raising rates this year. The case for September further strengthens.

• At 8:30 AM ET, the Q2 Employment Cost Index

• At 9:45 AM, the Chicago Purchasing Managers Index for July. The consensus is for a reading of 50.0, up from 49.4 in May.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 94.1, up from the preliminary reading of 93.3.

Zillow Forecast: Expect Case-Shiller National House Price Index up 4.3% year-over-year change in June

by Calculated Risk on 7/30/2015 04:01:00 PM

The Case-Shiller house price indexes for May were released on Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Expected to Maintain Holding Pattern in June

The May S&P/Case-Shiller (SPCS) data published today showed home prices continuing to rise at an annual rate of five percent for the 20-city composite and 4.7 percent for the 10-city composite (seasonally adjusted). The national index has risen 4.4 percent since May 2014.This suggests the year-over-year change for the June Case-Shiller National index will be about the same as in the May report.

The non-seasonally adjusted (NSA) 10-City Index was up one percent month-over-month, while the 20-City index rose 0.8 percent (NSA) from April to May. We expect the change from May to June to show increases of 1 percent (NSA) for the 10-city index and 0.8 percent for both the 20-city and national indices.

All Case-Shiller forecasts are shown in the table below. These forecasts are based on today’s May SPCS data release and the June 2015 Zillow Home Value Index (ZHVI).The SPCS Composite Home Price Indices for June will not be officially released until Tuesday, August 25.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| May Actual YoY | 4.7% | 4.7% | 4.9% | 4.9% | 4.4% | 4.4% |

| June Forecast YoY | 4.6% | 4.6% | 4.7% | 4.7% | 4.3% | 4.3% |

| June Forecast MoM | 1.0% | 0.1% | 0.8% | -0.1% | 0.8% | 0.0% |

Q2 GDP: Investment

by Calculated Risk on 7/30/2015 12:52:00 PM

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline early last year was not a concern.

Residential investment (RI) increased at a 6.6% annual rate in Q2. Equipment investment decreased at a 4.1% annual rate, and investment in non-residential structures decreased at a 1.6% annual rate. On a 3 quarter trailing average basis, RI is positive (red), equipment is slightly negative (green), and nonresidential structures are also negative (blue).

Note: Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a decline. Other areas of nonresidential are now increasing significantly.

I expect investment to be solid going forward (except for energy and power), and for the economy to grow at a decent pace for the remainder of 2015.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but it still below the levels of previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

I'll add details for investment in offices, malls and hotels after the supplemental data is released.

Weekly Initial Unemployment Claims increased to 267,000

by Calculated Risk on 7/30/2015 09:21:00 AM

The DOL reported:

In the week ending July 25, the advance figure for seasonally adjusted initial claims was 267,000, an increase of 12,000 from the previous week's unrevised level of 255,000. The 4-week moving average was 274,750, a decrease of 3,750 from the previous week's unrevised average of 278,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 274,750.

This was lower than the consensus forecast of 272,000, and the low level of the 4-week average suggests few layoffs.

BEA: Real GDP increased at 2.3% Annualized Rate in Q2

by Calculated Risk on 7/30/2015 08:33:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2015 (Advance Estimate); Includes Historical Revisions

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 2.3 percent in the second quarter of 2015, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.6 percent (revised).The advance Q2 GDP report, with 2.3% annualized growth, was below expectations of a 2.9% increase, however Q1 was revised up to 0.6% annualized growth (from a 0.2% decline).

...

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), exports, state and local government spending, and residential fixed investment that were partly offset by negative contributions from federal government spending, private inventory investment, and nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

...

The price index for gross domestic purchases, which measures prices paid by U.S. residents, increased 1.4 percent in the second quarter, in contrast to a decrease of 1.6 percent in the first. Excluding food and energy prices, the price index for gross domestic purchases increased 1.1 percent, compared with an increase of 0.2 percent.

Real personal consumption expenditures increased 2.9 percent in the second quarter, compared with an increase of 1.8 percent in the first.

Personal consumption expenditures (PCE) increased at a 2.9% annualized rate in Q2.

I'll have more on the annual revision later ...

Wednesday, July 29, 2015

Thursday: Q2 GDP and Revisions, Unemployment Claims

by Calculated Risk on 7/29/2015 08:01:00 PM

The GDP revisions will be especially important this year.

Excerpts from a research piece by Michelle Meyer at Merrill Lynch:

The moment of truthAnd on Q2:

• The annual revision to GDP growth on July 30th will adjust estimates of growth over the past few years. If growth is indeed revised higher it would help solve the puzzle of low productivity growth.

• This will also be the first release of the new GDP and GDI composite. This will show a stronger trend of growth given that GDI has outpaced GDP recently.

• Taking a step back and examining a range of indicators reveals an economy expanding at a mid-2% pace, largely consistent with the Fed’s forecasts.

...

On July 30th, along with the first release of 2Q GDP, the Bureau of Economic Analysis (BEA) will release the 2015 annual NIPA revision. We will be looking for the following:

1. Will GDP growth be revised higher over the past few years? If so, this would imply faster productivity growth, which has been puzzlingly slow.

2. How will the revision to seasonal factors adjust the “residual seasonality” issue to 1Q GDP growth over the years?

3. Will the new aggregated GDP and GDI figure take the spotlight away from GDP?

Although it is hard to say with any certainty, we believe GDP growth is likely to be revised up modestly. This will likely leave the Fed comfortable arguing that the economy is making progress closing the output gap, allowing a gradual hiking cycle to commence.

The first estimate of 2Q GDP is likely to show growth of 3.0%, which would be a bounce from the contraction of 0.2% in 1Q. However, it is important to remember that the history will be revised along with this report.A few excerpts from a research note by economists at Nomura:

Q2 GDP, first estimate (Thursday): Economic activity in Q2 bounced back after slowing in Q1. However, some factors such as low energy prices and the strong dollar likely continued to weigh on business activity. We expect the BEA to report that the rebound in activity was concentrated in the consumer, housing and government sectors. As such we forecast a 2.8% increase in Q2 GDP, with real final sales growing by 3.1% as we expect inventory investment to subtract 0.3pp from GDP growth.Thursday:

The annual revisions to GDP will also be released. Revisions will be mostly applied to data between 2012 and Q1 2015. The most notable features the annual revisions will introduce are 1) the average of GDP, gross domestic income and final sales, 2) an upgrade to its presentation of exports and imports, and 3) improvements to seasonal adjustment of certain GDP components. Furthermore, our work suggests that there is material residual seasonality in top-line GDP in Q1, as it tends to be below trend due to strong seasonal patterns in defense spending. Therefore, we might see some revision to the distribution of GDP growth in the first part of this year. As such, there is more uncertainty around the Q2 GDP estimate than usual.

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2015 (advance estimate); Includes historical revisions. The consensus is that real GDP increased 2.9% annualized in Q2.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 272 thousand from 255 thousand.

Duy on FOMC: "Somewhat more hawkish as the Fed gears up to hike rates later this year"

by Calculated Risk on 7/29/2015 03:41:00 PM

From Tim Duy: FOMC Recap

The July FOMC meeting yielded the widely expected outcome of no policy change. Very little change in the statement either - pulling out any useful information is about as easy as reading tea leaves or chicken bones. But that won't stop me from trying! On net, I would count it was somewhat more hawkish as the Fed gears up to hike rates later this year. By no means, however, did the statement make any definitive signal about September. The Fed continues to hold true to its promise to make the next move about the data. The era of handholding fades further into memory.There is much more in Professor Duy's piece. A rate hike in September is possible. It depends on the data.

...

Bottom Line: All else equal, the next two labor reports will factor strongly into the Fed's decision in September. A continuation of recent labor trends is likely sufficient to induce them to pull the trigger. Further signs of stronger wage growth would make a September move a certainty.

emphasis added

FOMC Statement: No Change in Policy, No Clues for September

by Calculated Risk on 7/29/2015 02:02:00 PM

Information received since the Federal Open Market Committee met in June indicates that economic activity has been expanding moderately in recent months. Growth in household spending has been moderate and the housing sector has shown additional improvement; however, business fixed investment and net exports stayed soft. The labor market continued to improve, with solid job gains and declining unemployment. On balance, a range of labor market indicators suggests that underutilization of labor resources has diminished since early this year. Inflation continued to run below the Committee's longer-run objective, partly reflecting earlier declines in energy prices and decreasing prices of non-energy imports. Market-based measures of inflation compensation remain low; survey‑based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of earlier declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.

How large will the first Fed Funds Rate increase be?

by Calculated Risk on 7/29/2015 11:49:00 AM

Just wondering ...

No one expects a rate hike from the FOMC today. And most of the focus has been on WHEN the first rate hike will happen - and also how quickly the Fed will subsequently raise rates. Note: Most analysts expect the first rate hike in either September or December - and some think the Fed will wait until 2016.

But how large will the first rate hike be? Most analysts seem to expect a 25 bps increase - but what does that mean?

In December 2008, the Fed lowered the Fed Funds rate from 1.0% to a range of 0.0% to 0.25%. From December 2008:

"The Federal Open Market Committee decided today to establish a target range for the federal funds rate of 0 to 1/4 percent."So is a 25 bps increase from zero to 0.25%? Or is it from the top of the range to 0.5%?

It seems unlikely the FOMC will increase the range to 0.25% to 0.5%.

Currently the effective Fed Funds rate is at 0.14%. This bounces around every day, but it has been close to 1/8 percent on average.

So it is possible the FOMC will raise rates 25 bps to 3/8 percent (0.375%).

NAR: Pending Home Sales Index decreased 1.8% in June, up 8% year-over-year

by Calculated Risk on 7/29/2015 10:02:00 AM

From the NAR: Pending Home Sales Dip in June

After five consecutive months of increases, pending home sales slipped in June but remained near May's level, which was the highest in over nine years, according to the National Association of Realtors®. Modest gains in the Northeast and West were offset by larger declines in the Midwest and South.This was below expectations of a 1.0% increase.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 1.8 percent to 110.3 in June but is still 8.2 percent above June 2014 (101.9). Despite last month's decline, the index is the third highest reading of 2015 and has now increased year-over-year for ten consecutive months.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Index up 18% YoY

by Calculated Risk on 7/29/2015 07:00:00 AM

From the MBA: Refinance Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 24, 2015. ...

The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.1 percent from one week earlier. The unadjusted Purchase Index increased 0.2 percent compared with the previous week and was 18 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.17 percent, the lowest level since June 2015, from 4.23 percent, with points increasing to 0.36 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With higher rates, refinance activity is very low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 18% higher than a year ago.

Tuesday, July 28, 2015

Wednesday: FOMC, Pending Home Sales

by Calculated Risk on 7/28/2015 07:25:00 PM

A few excerpts from an FOMC preview by Goldman Sachs economist Zach Pandl:

The July 28-29 FOMC meeting is shaping up to be the calm before the storm. Short-term interest rate markets imply a zero probability that the committee will raise policy rates next week, but show a high likelihood of at least one hike before the end of the year. Thus, although changes to the stance of policy look very unlikely, the upcoming statement will be closely watched for any clues on the precise timing of liftoff (we continue to see December as most likely). We will be focused on three main items:Wednesday:

...

• First, the description of economic conditions will likely acknowledge the decline in the unemployment rate. We expect the statement to drop its prior reference to stable oil prices, but to leave other comments about inflation unchanged.

• Second, we do not expect additional language intended to prepare for rate hikes in the statement. In 2004 the FOMC used the “measured” phrase for this purpose, but Fed Chair Yellen downplayed the need for new guidance at the June press conference. A change along these lines is a risk for next week, however.

• Third, we do not expect dissents, but see them as a risk from President Evans (dovish) and President Lacker (hawkish).

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Pending Home Sales Index for June. The consensus is for a 1.0% increase in the index.

• Also at 2:00 PM, FOMC Meeting Announcement. No change is expected to policy.

Real Prices and Price-to-Rent Ratio in May

by Calculated Risk on 7/28/2015 01:11:00 PM

A great discussion from Nick Timiraos at the WSJ: Are Home Prices Again Breaking Records? Not Really

The National Association of Realtors‘ monthly home sales report made a big splash last week with news that median home prices in June had broken the record set in 2006 at the peak of the housing bubble, reaching a nominal high of $236,400.The price-to-rent does seem a little high (last graph below), but the speculation associated with a bubble isn't present. No worries.

Does this mean we have another problem on our hands? Not really.

...[see data and graphs]

...

There may be other reasons to worry about housing affordability by comparing prices with incomes or prices with rents for a given market. But crude comparisons of nominal home prices with their 2006 and 2007 levels shouldn’t be used to make cavalier claims about a new bubble.

The year-over-year increase in prices is mostly moving sideways now at a little over 4%. In October 2013, the National index was up 10.9% year-over-year (YoY). In May 2015, the index was up 4.4% YoY.

Here is the YoY change since last May for the National Index:

| Month | YoY Change |

|---|---|

| May-14 | 7.1% |

| Jun-14 | 6.3% |

| Jul-14 | 5.6% |

| Aug-14 | 5.1% |

| Sep-14 | 4.8% |

| Oct-14 | 4.7% |

| Nov-14 | 4.6% |

| Dec-14 | 4.6% |

| Jan-15 | 4.4% |

| Feb-15 | 4.3% |

| Mar-15 | 4.2% |

| Apr-15 | 4.3% |

| May-15 | 4.4% |

Most of the slowdown on a YoY basis is now behind us (I don't expect price to go negative this year). This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.6% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

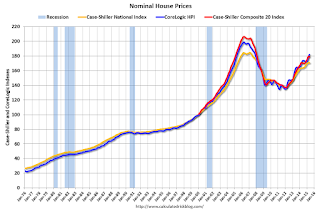

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through March) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through March) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to June 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to April 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to May 2003, and the CoreLogic index back to October 2003.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.6% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to March 2003 levels, the Composite 20 index is back to March 2003 levels, and the CoreLogic index is back to August 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

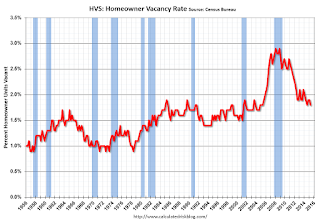

HVS: Q2 2015 Homeownership and Vacancy Rates

by Calculated Risk on 7/28/2015 10:16:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q2 2015.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 63.4% in Q2, from 63.7% in Q1.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Are these homes becoming rentals?

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate, but this does suggest the rental vacancy rate is the lowest in decades.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

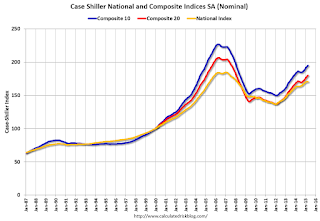

Case-Shiller: National House Price Index increased 4.4% year-over-year in May

by Calculated Risk on 7/28/2015 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Lead Housing According to the S&P/Case-Shiller Home Price Indices

The 10-City Composite and National indices showed slightly higher year-over-year gains while the 20-City Composite had marginally lower year-over-year gains when compared to last month. The 10-City Composite gained 4.7% year-over-year, while the 20-City Composite gained 4.9% year-over-year. The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 4.4% annual increase in May 2015 versus a 4.3% increase in April 2015.

...

Before seasonal adjustment, in May the National index, 10-City Composite and 20-City Composite all posted a gain of 1.1% month-over-month. After seasonal adjustment, the National index was unchanged; the 10-City and 20-City Composites were both down 0.2% month-over-month. All 20 cities reported increases in May before seasonal adjustment; after seasonal adjustment, 10 were down, eight were up, and two were unchanged.

...

“As home prices continue rising, they are sending more upbeat signals than other housing market indicators,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Nationally, single family home price increases have settled into a steady 4%-5% annual pace following the double-digit bubbly pattern of 2013. Over the next two years or so, the rate of home price increases is more likely to slow than to accelerate."

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.4% from the peak, and down 0.2% in May (SA).

The Composite 20 index is off 13.3% from the peak, and down 0.2% (SA) in May.

The National index is off 7.5% from the peak, and unchanged (SA) in May. The National index is up 24.9% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to May 2014.

The Composite 20 SA is up 4.9% year-over-year..

The National index SA is up 4.4% year-over-year.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in May seasonally adjusted. (Prices increased in 20 of the 20 cities NSA) Prices in Las Vegas are off 39.5% from the peak, and prices in Denver are at a new high (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 51% above January 2000 (51% nominal gain in 15 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 11% above the change in overall prices due to inflation.

Two cities - Denver (up 65% since Jan 2000) and Dallas (up 48% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston, Charlotte, San Francisco, Portland). Detroit prices are barely above the January 2000 level.

This was close to the consensus forecast. I'll have more on house prices later.

Monday, July 27, 2015

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg Survey

by Calculated Risk on 7/27/2015 08:14:00 PM

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May prices. The consensus is for a 5.6% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 4.0% year-over-year in May.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for July.

• Also at 10:00 AM, Q2 Housing Vacancies and Homeownership survey.

To put the recent 5 day sell-off in perspective, here is a graph (click on graph for larger image) from Doug Short and shows the S&P 500 since the 2007 high ...

Vehicle Sales Forecasts for July: Over 17 Million Annual Rate Again, Best July in a Decade

by Calculated Risk on 7/27/2015 04:51:00 PM

The automakers will report July vehicle sales on Monday, August 3rd. Sales in June were at 17.1 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in July will be over 17 million SAAR again.

Note: There were 26 selling days in July, the same as in July 2014. Here are a few forecasts:

From J.D. Power: New-Vehicle Retail Sales SAAR in July to Hit 14 Million, Highest Level for the Month in a Decade

The forecast for new-vehicle retail sales in July 2015 is 1,260,200 units, a 2.5 percent increase compared with July 2014 and the highest retail sales volume for the month since July 2006, when sales hit 1,294,085. Retail transactions are the most accurate measure of consumer demand for new vehicles. [Total forecast 17.2 million SAAR]From Kelley Blue Book: New-Car Sales To Increase Nearly 3 Percent In July 2015, According To Kelley Blue Book

emphasis added

New-vehicle sales are expected to increase 2.6 percent year-over-year to a total of 1.47 million units in July 2015, resulting in an estimated 17.1 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book www.kbb.com ...From WardsAuto: 17 Million SAAR Streak Should Continue in July

...

"As the industry settles into the summer selling season, new-car sales are expected to remain consistent with last month's numbers, representing modest and slowing growth versus last year," said Alec Gutierrez, senior analyst for Kelley Blue Book. "Sales in the first half of the year totaled 8.5 million units, a year-over-year improvement of 4.4 percent and the highest first-half volume since 2005. Total sales in 2015 are projected to hit 17.1 million units overall, a 3.6 percent year-over-year increase and the highest industry total since 2001."

If the projected 17.3 million-unit seasonally adjusted annual rate is reached, it will mark the first time since 2000 that the monthly LV SAAR has exceeded 17 million units in three consecutive months, and would represent the highest July SAAR since 2005.Another strong month for auto sales.

...

At forecast levels, year-to-date sales through July would rise to 9.97 million units, up 4.4% over the first seven months of 2014.

ATA Trucking Index decreased 0.5% in June

by Calculated Risk on 7/27/2015 01:55:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Fell 0.5% in June

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index decreased 0.5% in June, following a revised gain of 0.8% during May. In June, the index equaled 131.1 (2000=100). The all-time high of 135.8 was reached in January 2015.

Compared with June 2014, the SA index increased 1.8%, which was above the 1.5% gain in May. Year-to-date through June, compared with the same period last year, tonnage was up 3.4%. ...

With flat factory output and falling retail sales, I’m not surprised tonnage was soft in June,” said ATA Chief Economist Bob Costello. “I also remain concerned over the elevated inventory-to-sales ratio for retailers, wholesalers, and manufacturers, which suggests soft tonnage in the months ahead until the ratio falls.

“I remain hopeful that the inventory correction will transpire this summer. When the correction ends, truck freight – helped by better personal consumption – will accelerate,” he said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up only 1.8% year-over-year.

Dallas Fed: "Texas Manufacturing Slump Moderates"

by Calculated Risk on 7/27/2015 10:57:00 AM

From the Dallas Fed: Texas Manufacturing Slump Moderates, Outlooks Improve

Texas factory activity declined slightly in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained negative but rose for a second month in a row to -1.9, suggesting further moderation in the decline in manufacturing output.The Dallas region has been especially hard hit by the decline in oil prices. This survey might be more negative in August since oil prices have declined again.

...

Perceptions of broader business conditions were mixed. The general business activity index remained negative, but it rose for a second month in a row and reached -4.6 in July. Manufacturers expect improved conditions ahead. The company outlook index surged nearly nine points and posted its first positive reading in seven months, coming in at 1.2.

Labor market indicators reflected slight employment declines and shorter workweeks. The July employment index was negative for a third month in a row and edged down to -3.3.

emphasis added

The Richmond Fed survey (last of the regional Fed surveys for July) will be released tomorrow.

Black Knight: House Price Index up 1.1% in May, 5.1% year-over-year

by Calculated Risk on 7/27/2015 09:14:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Up 1.1 percent for the Month; Up 5.1 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Home Price Index (HPI) report, based on May 2015 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The Black Knight HPI increased 1.1% percent in May, and is off 6.5% from the peak in June 2006 (not adjusted for inflation).

For a more in-depth review of this month’s home price trends, including detailed looks at the 20 largest states and 40 largest metros, please download the full Black Knight HPI Report.

The year-over-year increase in the index has been about the same for the last eight months.

The press release has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 39.3% from the peak in Las Vegas, off 32.5% in Orlando, and 28.1% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in New York, Tennessee and Texas, and several other cities around the country.

Note: Case-Shiller for May will be released tomorrow.

Sunday, July 26, 2015

Sunday Night Futures

by Calculated Risk on 7/26/2015 07:49:00 PM

From Ben Leubsdorf and Jon Hilsenrath at the WSJ: Fed Officials May Offer More Clarity on Rates

Federal Reserve officials are likely to emerge from their policy meeting Wednesday with short-term interest rates still pinned near zero, though they could send fresh hints that they’re getting closer to raising rates. ...CR Note: I don't expect an explicit signal at the FOMC meeting this week, instead I expect the FOMC to emphasize that they are data dependent - and that they would like to see further improvement in the labor market, and further evidence of inflation moving back towards 2%.

This leaves the Fed with a slight signaling challenge at the meeting this week. How aggressively should officials tip their hands about the timing of a rate increase later this year? Fed officials don’t want to take financial markets by surprise by raising the benchmark federal-funds rate for the first time since 2006 with no forewarning. At the same time, they want to keep their options open so they can adjust their stance as the economy evolves.

The September meeting could be interesting!

Weekend:

• Schedule for Week of July 26, 2015

Monday:

• At 8:30 AM, Durable Goods Orders for June from the Census Bureau. The consensus is for a 3.1% increase in durable goods orders.

• At 10:30 AM, Dallas Fed Manufacturing Survey for July.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up slightly and DOW futures are up 20 (fair value).

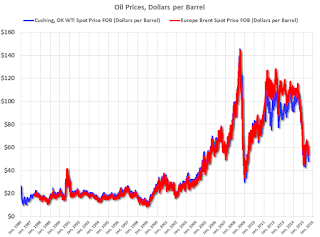

Oil prices were down over the last week with WTI futures at $48.04 per barrel and Brent at $54.62 per barrel. A year ago, WTI was at $103, and Brent was at $106 - so prices are down about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.71 per gallon (down about $0.80 per gallon from a year ago).

WSJ: More Oil Industry Layoffs Coming

by Calculated Risk on 7/26/2015 10:25:00 AM

From Lynn Cook at the WSJ: Sudden Drop in Crude-Oil Prices Roils U.S. Energy Firms’ Rebound

U.S. energy companies are planning more layoffs, asset sales and financial maneuvers to deal with a recent, sudden drop in U.S. crude-oil prices to under $50 a barrel, the lowest level in four months.

...

Nearly 50,000 energy jobs have been lost in the past three months on top of 100,000 employees laid off since oil prices started to tumble last fall, according to Graves & Co., a Houston energy consultancy.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices Friday added). According to Bloomberg, WTI was at $48.14 per barrel on Friday, and Brent at $54.62.

Prices are down about 50% year-over-year.

The second graph shows the prices over the last few years.

Some producers stopped cutting when prices started to rebound, but now prices are declining again - and there will probably be more layoffs in the oil sector.

Some producers stopped cutting when prices started to rebound, but now prices are declining again - and there will probably be more layoffs in the oil sector. Note: Several oil producing states are already in recession such as North Dakota, Oklahoma and Alaska, but overall lower oil prices will be a positive for the U.S. economy.

Saturday, July 25, 2015

Schedule for Week of July 26, 2015

by Calculated Risk on 7/25/2015 08:15:00 AM

The key reports this week are Q2 GDP on Thursday, and Case-Shiller house prices on Tuesday.

The FOMC meets on Tuesday and Wednesday, and no change to policy is expected at this meeting.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 3.1% increase in durable goods orders.

10:30 AM: Dallas Fed Manufacturing Survey for July.

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May prices.

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the April 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.6% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 4.0% year-over-year in May.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July.

10:00 AM: Q2 Housing Vacancies and Homeownership survey.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for June. The consensus is for a 1.0% increase in the index.

2:00 PM: FOMC Meeting Announcement. No change is expected to policy.

8:30 AM: Gross Domestic Product, 2nd quarter 2015 (advance estimate); Includes historical revisions. The consensus is that real GDP increased 2.9% annualized in Q2.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 272 thousand from 255 thousand.

8:30 AM: The Q2 Employment Cost Index

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a reading of 50.0, up from 49.4 in May.

10:00 AM: University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 94.1, up from the preliminary reading of 93.3.

Friday, July 24, 2015

Philly Fed: State Coincident Indexes increased in 40 states in June

by Calculated Risk on 7/24/2015 06:29:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for June 2015. In the past month, the indexes increased in 40 states, decreased in seven, and remained stable in three, for a one-month diffusion index of 66. Over the past three months, the indexes increased in 42 states, decreased in six, and remained stable in two, for a three-month diffusion index of 72.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

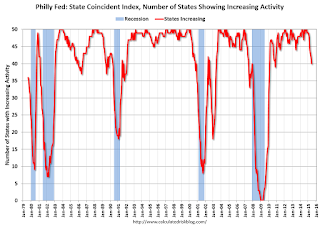

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In June, 40 states had increasing activity.

It appears we are seeing weakness in several oil producing states including Alaska, Oklahoma and North Dakota - and also in other energy producing states like West Virginia.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again. Note: Blue added for Red/Green issues.

Nomura on Q2 GDP and Annual Revision

by Calculated Risk on 7/24/2015 03:31:00 PM

A few excerpts from a research note by economists at Nomura:

Q2 GDP, first estimate (Thursday): Economic activity in Q2 bounced back after slowing in Q1. However, some factors such as low energy prices and the strong dollar likely continued to weigh on business activity. We expect the BEA to report that the rebound in activity was concentrated in the consumer, housing and government sectors. As such we forecast a 2.8% increase in Q2 GDP, with real final sales growing by 3.1% as we expect inventory investment to subtract 0.3pp from GDP growth.Earlier on GDP: Merrill on the Annual GDP Revision and Q2 GDP

The annual revisions to GDP will also be released. Revisions will be mostly applied to data between 2012 and Q1 2015. The most notable features the annual revisions will introduce are 1) the average of GDP, gross domestic income and final sales, 2) an upgrade to its presentation of exports and imports, and 3) improvements to seasonal adjustment of certain GDP components. Furthermore, our work suggests that there is material residual seasonality in top-line GDP in Q1, as it tends to be below trend due to strong seasonal patterns in defense spending. Therefore, we might see some revision to the distribution of GDP growth in the first part of this year. As such, there is more uncertainty around the Q2 GDP estimate than usual.

Comments on New Home Sales

by Calculated Risk on 7/24/2015 12:19:00 PM

The new home sales report for June was well below expectations at 482 thousand on a seasonally adjusted annual rate basis (SAAR), and there were also downward revisions to prior months. However sales are still up solidly for 2015 compared to 2014.

A key question is if there was some negative impact of higher mortgage rates on sales? - or was the decline in June mostly noise? Changes in rates would show up in New Home sales before Existing Home sales (that were strong in June) because New Home sales are reported when the contract is signed, and Existing Home sales are reported when the transaction closes. If there is an impact from higher rates, then the impact will show up in the Existing Home sales report for July or August.

Earlier: New Home Sales decreased to 482,000 Annual Rate in June.

The Census Bureau reported that new home sales this year, through June, were 274,000, not seasonally adjusted (NSA). That is up 21.2% from 226,000 sales during the same period of 2014 (NSA). That is a strong year-over-year gain for the first half of 2015!

Sales were up 18.1% year-over-year in June.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will probably be strong through July (the first seven months were especially weak in 2014), however I expect the year-over-year increases to slow later this year - but the overall year-over-year gain should be solid in 2015.

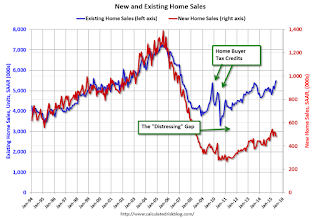

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways over the next few years (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales decreased to 482,000 Annual Rate in June

by Calculated Risk on 7/24/2015 10:16:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 482 thousand.

The previous three months were revised down by a total of 49 thousand (SA).

"Sales of new single-family houses in June 2015 were at a seasonally adjusted annual rate of 482,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.8 percent below the revised May rate of 517,000, but is 18.1 percent above the June 2014 estimate of 408,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still close to the bottoms for previous recessions.

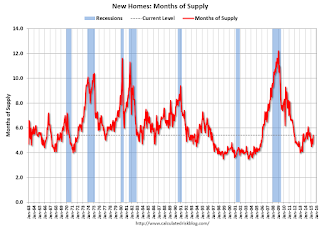

The second graph shows New Home Months of Supply.

The months of supply increased in June to 5.4 months.

The months of supply increased in June to 5.4 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of June was 215,000. This represents a supply of 5.4 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2015 (red column), 45 thousand new homes were sold (NSA). Last year 38 thousand homes were sold in June. This is the highest for June since 2008.

The all time high for June was 115 thousand in 2005, and the all time low for June was 28 thousand in both 2010 and 2011.

This was well below expectations of 550,000 sales in June, however new home sales are still on pace for solid growth in 2015. I'll have more later today.

Thursday, July 23, 2015

Goldman FOMC Preview

by Calculated Risk on 7/23/2015 08:05:00 PM

Friday:

• At 10:00 AM ET, 10:00 AM: New Home Sales for June from the Census Bureau. The consensus is for an increase in sales to 550 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 546 thousand in May.

A few excerpts from an FOMC preview by Goldman Sachs economist Zach Pandl:

The July 28-29 FOMC meeting is shaping up to be the calm before the storm. Short-term interest rate markets imply a zero probability that the committee will raise policy rates next week, but show a high likelihood of at least one hike before the end of the year. Thus, although changes to the stance of policy look very unlikely, the upcoming statement will be closely watched for any clues on the precise timing of liftoff (we continue to see December as most likely). We will be focused on three main items:

...

• First, the description of economic conditions will likely acknowledge the decline in the unemployment rate. We expect the statement to drop its prior reference to stable oil prices, but to leave other comments about inflation unchanged.

• Second, we do not expect additional language intended to prepare for rate hikes in the statement. In 2004 the FOMC used the “measured” phrase for this purpose, but Fed Chair Yellen downplayed the need for new guidance at the June press conference. A change along these lines is a risk for next week, however.

• Third, we do not expect dissents, but see them as a risk from President Evans (dovish) and President Lacker (hawkish).

Merrill on the Annual GDP Revision and Q2 GDP

by Calculated Risk on 7/23/2015 05:37:00 PM

Excerpts from a research piece by Michelle Meyer at Merrill Lynch:

The moment of truthAnd on Q2:

• The annual revision to GDP growth on July 30th will adjust estimates of growth over the past few years. If growth is indeed revised higher it would help solve the puzzle of low productivity growth.

• This will also be the first release of the new GDP and GDI composite. This will show a stronger trend of growth given that GDI has outpaced GDP recently.

• Taking a step back and examining a range of indicators reveals an economy expanding at a mid-2% pace, largely consistent with the Fed’s forecasts.

...

On July 30th, along with the first release of 2Q GDP, the Bureau of Economic Analysis (BEA) will release the 2015 annual NIPA revision. We will be looking for the following:

1. Will GDP growth be revised higher over the past few years? If so, this would imply faster productivity growth, which has been puzzlingly slow.

2. How will the revision to seasonal factors adjust the “residual seasonality” issue to 1Q GDP growth over the years?

3. Will the new aggregated GDP and GDI figure take the spotlight away from GDP?

Although it is hard to say with any certainty, we believe GDP growth is likely to be revised up modestly. This will likely leave the Fed comfortable arguing that the economy is making progress closing the output gap, allowing a gradual hiking cycle to commence.

The first estimate of 2Q GDP is likely to show growth of 3.0%, which would be a bounce from the contraction of 0.2% in 1Q. However, it is important to remember that the history will be revised along with this report.

Black Knight's First Look at June: Foreclosure Inventory at Lowest Level Since 2007

by Calculated Risk on 7/23/2015 02:45:00 PM

From Black Knight: Black Knight Financial Services’ “First Look” at June Mortgage Data: Foreclosure Inventory at Lowest Level Since 2007, Still Three Times “Normal” Rate

According to Black Knight's First Look report for June, the percent of loans delinquent decreased 3% in June compared to May, and declined 15.5% year-over-year.

The percent of loans in the foreclosure process declined 2% in June and were down 23% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.82% in June, down from 4.96% in May.

The percent of loans in the foreclosure process declined in June to 1.46%. This was the lowest level of foreclosure inventory since 2007.

The number of delinquent properties, but not in foreclosure, is down 439,000 properties year-over-year, and the number of properties in the foreclosure process is down 212,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for June in early August.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2015 | May 2015 | June 2014 | June 2013 | |

| Delinquent | 4.82% | 4.96% | 5.70% | 6.68% |

| In Foreclosure | 1.46% | 1.49% | 1.88% | 2.93% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,549,000 | 1,591,000 | 1,728000 | 1,983,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 895,000 | 922,000 | 1,155,000 | 1,345,000 |

| Number of properties in foreclosure pre-sale inventory: | 739,000 | 754,000 | 951,000 | 1,458,000 |

| Total Properties | 3,183,000 | 3,268,000 | 3,834,000 | 4,785,000 |

Kansas City Fed: Regional Manufacturing Activity Declined Again in July

by Calculated Risk on 7/23/2015 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined Again

The Federal Reserve Bank of Kansas City released the July Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined again in July but less so than in previous months.Some of this recent decline in the Kansas City region has been due to lower oil prices.

“Our headline index was closer to zero than in May or June but was still negative, indicating further contraction in regional factory activity. However, firms expect a modest pickup in activity in coming months.”

...

Tenth District manufacturing activity declined again in July, but less so than in previous months. Producers’ remained slightly optimistic about future activity, although the majority of contacts indicated difficulties finding qualified labor. Most price indexes indicated continued rising prices, but the rate of increase slowed a bit for raw materials.

The month-over-month composite index was -7 in July, up from -9 in June and -13 in May ... the new orders index eased from -3 to -6, and the employment index dropped to its lowest level since April 2009, with many firms noting difficulties finding qualified workers.

emphasis added

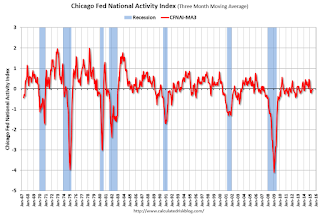

Chicago Fed: Index shows "Economic Growth Picked Up Slightly in June"

by Calculated Risk on 7/23/2015 09:48:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Growth Picked Up Slightly in June

Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) moved up to +0.08 in June from –0.08 in May. Three of the four broad categories of indicators that make up the index increased from May, and two of the four categories made positive contributions to the index in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, edged up to –0.01 in June from –0.07 in May. June’s CFNAI-MA3 suggests that growth in national economic activity was very close to its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in June (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Weekly Initial Unemployment Claims decreased to 255,000

by Calculated Risk on 7/23/2015 08:34:00 AM

The DOL reported:

In the week ending July 18, the advance figure for seasonally adjusted initial claims was 255,000, a decrease of 26,000 from the previous week's unrevised level of 281,000. This is the lowest level for initial claims since November 24, 1973 when it was 233,000. The 4-week moving average was 278,500, a decrease of 4,000 from the previous week's unrevised average of 282,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 278,500.

This was below to the consensus forecast of 279,000, and the low level of the 4-week average suggests few layoffs. This was also the reference week for the BLS employment report, and suggests few layoffs during the reference week.

Wednesday, July 22, 2015

Thursday: Unemployment Claims

by Calculated Risk on 7/22/2015 08:59:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 279 thousand from 281 thousand.

• Also at 8:30 AM, the Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 11:00 AM, the Kansas City Fed manufacturing survey for July.

A Few Random Comments on June Existing Home Sales

by Calculated Risk on 7/22/2015 03:04:00 PM

First, as always, new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale. Also I wouldn't be surprised if the seasonally adjusted pace for existing home sales slows over the next several months - due to limited inventory and higher mortgage rates.

Second, in general I'd ignore the median sales price because it is impacted by the mix of homes sold (more useful are the repeat sales indexes like Case-Shiller or CoreLogic). The NAR reported the median sales price was $236,400 in June, above the median peak of $230,400 in July 2006. That is 9 years ago, so in real terms, median prices are close to 20% below the previous peak. Not close.

Third, Inventory is still very low (up only 0.4% year-over-year in June). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases. This will be important to watch.

Note: I'm hearing reports of rising inventory in some mid-to-higher priced areas. However many low priced areas still have little inventory.

Also, the NAR reported total sales were up 9.6% from June 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales — foreclosures and short sales — fell to 8 percent in June (matching an August 2014 low) from 10 percent in May, and are below the 11 percent share a year ago. Six percent of June sales were foreclosures and 2 percent were short sales.Last year in June the NAR reported that 11% of sales were distressed sales.

A rough estimate: Sales in June 2014 were reported at 5.01 million SAAR with 11% distressed. That gives 551 thousand distressed (annual rate), and 4.46 million equity / non-distressed. In June 2015, sales were 5.49 million SAAR, with 8% distressed. That gives 439 thousand distressed - a decline of about 20% from June 2014 - and 5.05 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 13%.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in June (red column) were the highest for June since 2007 (NSA).

Earlier:

• Existing Home Sales in June: 5.49 million SAAR, Highest Pace in Eight Years