by Calculated Risk on 7/25/2015 08:15:00 AM

Saturday, July 25, 2015

Schedule for Week of July 26, 2015

The key reports this week are Q2 GDP on Thursday, and Case-Shiller house prices on Tuesday.

The FOMC meets on Tuesday and Wednesday, and no change to policy is expected at this meeting.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 3.1% increase in durable goods orders.

10:30 AM: Dallas Fed Manufacturing Survey for July.

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May prices.

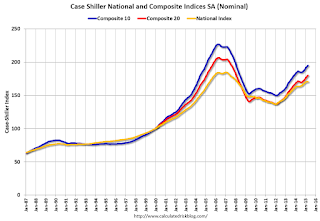

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the April 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.6% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 4.0% year-over-year in May.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July.

10:00 AM: Q2 Housing Vacancies and Homeownership survey.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for June. The consensus is for a 1.0% increase in the index.

2:00 PM: FOMC Meeting Announcement. No change is expected to policy.

8:30 AM: Gross Domestic Product, 2nd quarter 2015 (advance estimate); Includes historical revisions. The consensus is that real GDP increased 2.9% annualized in Q2.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 272 thousand from 255 thousand.

8:30 AM: The Q2 Employment Cost Index

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a reading of 50.0, up from 49.4 in May.

10:00 AM: University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 94.1, up from the preliminary reading of 93.3.