by Calculated Risk on 5/31/2011 07:32:00 PM

Tuesday, May 31, 2011

Lawler: Census 2010 and the US Homeownership Rate

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• Real House Prices and Price-to-Rent: Back to 1999

• The Excess Vacant Housing Supply

• Home Prices Graph Gallery

CR Note: The following is from economist Tom Lawler. He points out that the homeownership rate in April 2010 was significantly lower than previously thought. Tom also notes that the age adjusted homeownership rate was lower in April 2010 than in April 1990! Yeah, 1990.

Economist Tom Lawler writes: Census 2010 and the US Homeownership Rate: Where’s the Media?

While the data released for Census 2010 on households and housing was probably the most important “macro” housing data released by Census over the last several years, media coverage was surprisingly scant. (I am not including blogs in my definition of “media.) Many newspapers and other media that religiously report on the quarterly Housing Vacancy Survey data, especially the homeownership rate, failed to run stories highlighting that the homeownership rate last April was in fact substantially lower than previous HVS estimates had suggested, and was significantly below the homeownership rate in 2000. Indeed, a Bloomberg/Business Week story today entitled “Rising Rents Risk U.S. Inflation as Fed Restraint Questioned” noted that “the rate of homeownership has fallen to 66.4 percent, the lowest since 1998, data from the Census Bureau show,” citing HVS estimates for Q1/2011, but it failed to mention that new Census 2010 data indicated that the US homeownership rate in the middle of the first half of last year was 65.1%, far below the HVS estimate of 67%.

Here is a table from last week’s report on the various estimates of the US homeownership rate from different Census Bureau reports.

| Various Estimates, US Homeownership Rate | ||||

|---|---|---|---|---|

| HVS (Annual Avg) | ACS (Annual Avg) | Census (April 1) | CPS/ASEC (March) | |

| 1990 | 63.9% | N/A | 64.2% | 64.1% |

| 2000 | 67.5% | 65.3% | 66.2% | 67.2% |

| 2001 | 67.9% | 65.7% | 67.8% | |

| 2002 | 67.9% | 66.4% | 68.1% | |

| 2003 | 68.3% | 66.8% | 68.2% | |

| 2004 | 69.0% | 67.1% | 68.8% | |

| 2005 | 68.9% | 66.9% | 69.3% | |

| 2006 | 68.8% | 67.3% | 68.5% | |

| 2007 | 68.1% | 67.2% | 68.3% | |

| 2008 | 67.8% | 66.6% | 67.9% | |

| 2009 | 67.4% | 65.9% | 67.3% | |

| 2010 | 66.9% | N/A | 65.1% | 67.0% |

The Decennial Census numbers are far and away the most accurate. No one knows for sure why both the CPS/ASEC and the CPS/HVS estimates have been pretty far off the mark for over a decade.

Clearly, the housing and mortgage market collapse in the second half of last decade has resulted in a MUCH steeper drop in the US homeownership rate than previous CPS/HVS reports had suggested, though from what level is not crystal clear.

The decline in the US homeownership rate from 2000 to 2010 is especially striking given the fact that the age distribution of the US shifted materially to an “older” population. Older age groups typically have materially higher headship rates and homeownership rates than do younger households, and ceteris paribus a shift in the age distribution such as that seen over the last decade would have resulted in a HIGHER homeownership rate.

While Census has not yet released household and housing tenure by age groups from Census 2010, it has released the distribution of the population by age. Here is a comparison of Census 1990, Census 2000, and Census 2010 for various age groups. (These are the “official” 1990 and 2000 numbers).

| Census Population by Age | Percent of Total 15+ | |||||

|---|---|---|---|---|---|---|

| Age | 2010 | 2000 | 1990 | 2010 | 2000 | 1990 |

| 15-24 | 43,626,342 | 39,183,891 | 36,774,327 | 17.6% | 17.7% | 18.8% |

| 25-34 | 41,063,948 | 39,891,724 | 43,175,932 | 16.6% | 18.0% | 22.1% |

| 35-44 | 41,070,606 | 45,148,527 | 37,578,903 | 16.6% | 20.4% | 19.3% |

| 45-54 | 45,006,716 | 37,677,952 | 25,223,086 | 18.2% | 17.0% | 12.9% |

| 55-64 | 36,482,729 | 24,274,684 | 21,147,923 | 14.7% | 11.0% | 10.8% |

| 65-74 | 21,713,429 | 18,390,986 | 18,106,558 | 8.8% | 8.3% | 9.3% |

| 75+ | 18,554,555 | 16,600,767 | 13,135,273 | 7.5% | 7.5% | 6.7% |

| Percent greater than 45 | 49.2% | 43.8% | 39.8% | |||

| Percent less than 35 | 34.2% | 35.8% | 41.0% | |||

Here’s some history of homeownership rates and headship rates for these age groups. The “headship rate” shown is simply the number of households in each age group divided by the population in that age group.

| Homeownership Rate | Headship Rate | |||||

|---|---|---|---|---|---|---|

| 2010 | 2000 | 1990 | 2010 | 2000 | 1990 | |

| 15-24 | 17.9% | 17.1% | 14.1% | 13.7% | ||

| 25-34 | 45.6% | 45.3% | 45.9% | 46.0% | ||

| 35-44 | 66.2% | 66.2% | 53.1% | 54.3% | ||

| 45-54 | 74.9% | 75.3% | 56.5% | 56.7% | ||

| 55-64 | 79.8% | 79.7% | 58.7% | 58.5% | ||

| 65-74 | 81.3% | 78.8% | 62.6% | 63.6% | ||

| 75+ | 74.7% | 70.4% | 64.1% | 64.4% | ||

| US Total | 65.1% | 66.2% | 64.2% | |||

If 2010 headship rates and homeownership rates for each age group had been the same as in 1990, the US homeownership rate would have been 66.7% instead of 65.1%. If 2010 headship rates and homeownership rates had been the same as in 2000, the US homeownership rate would have been 67.3%!

In fact, the aggregate data suggest that in 2010 the homeownership for most age groups was probably below 1990 rates!!!

Last week’s report, then, was clearly the BIGGEST STORY ON US HOMEOWNERSHIP in many, many years. So ... why the lack of media coverage?

I can’t easily say, but there may be several reasons. First, of course, Census 2010 took a snapshot of the US over a year ago, and as such some reporters may have viewed the data as “stale,” and would rather report on more current data from the CPS/HVS even though that report has now been discredited. Second, trying to write a story on WHY the CPS/HVS data substantially overstated the US homeownership rate for at least a decade, with the “miss” clearly growing, in a fashion that readers could understand is not an easy task, requiring thought, analysis, and an ability to write about complex issues in an understandable way.

But ... it’s a pretty sad statement about journalists covering the US housing market!! Ditto, by the way, on vacancies, but that’s another piece!

CR Note: This indicates that the age adjusted homeownership rate has fallen below the 1990 homeownership rate. All my previous analysis was based on the HVS data, and now that Census 2010 data has been released, the previous analysis is unfortunately incorrect (I need to think about the implications).

Here is a spreadsheet of Lawler's tables, plus a calculation of the age adjusted homeownership rates using the 1990 and 2000 data. Most of the increase in the homeownership rate in the from 1990 to 2000 was simply due to the aging of the population (older people generally have a higher homeownership rate).

As Lawler mentions, this means that when the Census 2010 age group homeownership rate data is released, the homeownership rates for most age groups will probably below both the 1990 and 2000 rates.

Renters and the Mini-Boom in Miami

by Calculated Risk on 5/31/2011 03:43:00 PM

From Arian Campo-Flores at the WSJ: Miami Renters Fuel a Boomlet

When the real estate market collapsed five years ago, this city's downtown soon became an emblem of the worst excesses of the building boom. Glittering new towers sat mostly vacant.This is an example of excess inventory being absorbed. Many of these condos were bought by international buyers and / or investors, and many are now occupied by renters. These are not "accidental landlords" (homeowners who rented their homes because they couldn't sell) - these are cash flow investors. Yes, some investors will sell if prices start to increase, keeping prices from rising quickly, but they can also be patient since many paid cash - so I wouldn't count this as shadow inventory.

Those towers are filling up much sooner than some analysts predicted. The new arrivals, mostly renters, are spurring the establishment of restaurants, bars and shops.

...

Condo sales here began surging after property owners slashed prices about two years ago, sometimes by 50% or more. ... Fewer than 4,000 out of the 22,000 new units built since 2003 remain unsold, according to Condo Vultures.

Note: The Case-Shiller index indicated prices in Miami are off 50.4% from the peak - and many of these condos sold for more than half off.

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• Real House Prices and Price-to-Rent: Back to 1999

• The Excess Vacant Housing Supply

• Home Prices Graph Gallery

Real House Prices and Price-to-Rent: Back to 1999

by Calculated Risk on 5/31/2011 12:35:00 PM

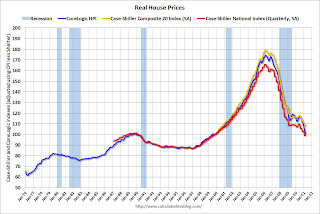

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 1999/2000 levels.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through March) and CoreLogic House Price Indexes (through March) in nominal terms (as reported).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

In nominal terms, the Case-Shiller National index is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is slightly above the May 2009 lows (and close to June 2003 levels), and the CoreLogic index is back to January 2003.

Note: The not seasonally adjusted Case-Shiller Composite 20 Index (NSA) is back to April 2003 levels.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to October 2000, and the CoreLogic index back to November 1999.

A few key points:

• In real terms, all appreciation in the last decade is gone.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range. In many areas - with an increasing population and land constraints - there is an upward slope to real prices (see: The upward slope of Real House Prices)

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

This graph shows the price to rent ratio (January 1998 = 1.0).

Note: the measure of Owners' Equivalent Rent (OER) was mostly flat for two years - so the price-to-rent ratio mostly followed changes in nominal house prices. In recent months, OER has been increasing - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to December 1999.

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• The Excess Vacant Housing Supply

Chicago PMI shows sharply slower growth, Manufacturing Activity Expands in Texas

by Calculated Risk on 5/31/2011 10:58:00 AM

• From the Chicago Business Barometer™ Dropped: The overall index decreased to 56.6 from 67.6 in April. This was below consensus expectations of 62.3. Note: any number above 50 shows expansion.

"Breadth of EMPLOYMENT expansion softened but remained strong." The employment index decreased to a still strong 60.8 from 63.7. The new orders index decreased to 53.5 from 66.3.

• From the Dallas Fed: Texas Manufacturing Activity Expands

Texas factory activity increased in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 8 to 13 with 27 percent of respondents noting output increased from April.This is the last of the regional Fed surveys for May. The regional surveys provide a hint about the ISM manufacturing index - and most of the regional surveys were weak this month as the following graph shows.

Other measures of current manufacturing conditions also indicated growing activity, although the pace of new orders slowed. ... Labor market indicators reflected more hiring and longer workweeks. The employment index came in at 12, with the share of manufacturers adding workers reaching its highest level this year. The hours worked index jumped up from -1 in April to 13 in May.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through May), and averaged five Fed surveys (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

The regional surveys suggest the ISM manufacturing index will fall to the mid-50s or so. The ISM index for May will be released tomorrow, June 1st, and expectations are for a decrease to 57.5 from 60.4 in April (I think the consensus is too high).

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

Case Shiller: National Home Prices Hit New Low in 2011 Q1

by Calculated Risk on 5/31/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March (actually a 3 month average of January, February and March).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities), plus the Q1 2011 quarterly national house price index.

Note: Case-Shiller reports NSA, I use the SA data.

From S&P:National Home Prices Hit New Low in 2011 Q1

Data through March 2011 ... show that the U.S. National Home Price Index declined by 4.2% in the first quarter of 2011, after having fallen 3.6% in the fourth quarter of 2010. The National Index hit a new recession low with the first quarter’s data and posted an annual decline of 5.1% versus the first quarter of 2010. Nationally, home prices are back to their mid-2002 levels.

...

As of March 2011, 19 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down compared to March 2010. Twelve of the 20 MSAs and the 20-City Composite also posted new index lows in March. With an index value of 138.16, the 20-City Composite fell below its earlier reported April 2009 low of 139.26. Minneapolis posted a double-digit 10.0% annual decline, the first market to be back in this territory since March 2010 when Las Vegas was down 12.0% on an annual basis. In the midst of all these falling prices and record lows, Washington DC was the only city where home prices increased on both a monthly (+1.1%) and annual (+4.3%) basis.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.8% from the peak, and down 0.1% in March (SA). The Composite 10 is still 1.6% above the May 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.6% from the peak, and down 0.2% in March (SA). The Composite 20 is only 0.1% above the May 2009 post-bubble bottom seasonally adjusted, and at a new post-bubble low not seasonally adjusted (NSA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 2.8% compared to March 2010.

The Composite 20 SA is down 3.5% compared to March 2010.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.From S&P (NSA):

“This month’s report is marked by the confirmation of a double-dip in home prices across much of the nation. The National Index, the 20-City Composite and 12 MSAs all hit new lows with data reported through March 2011. ... Home prices continue on their downward spiral with no relief in sight.” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Since December 2010, we have found an increasing number of markets posting new lows. In March 2011, 12 cities - Atlanta, Charlotte, Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Portland (OR) and Tampa - fell to their lowest levels as measured by the current housing cycle. Washington D.C. was the only MSA displaying positive trends with an annual growth rate of +4.3% and a 1.1% increase from its February level.There could be some confusion between the SA and NSA numbers. The National index and Composite 20 (NSA) are both at new post-bubble lows.

I'll have more soon ...

Monday, May 30, 2011

The Excess Vacant Housing Supply

by Calculated Risk on 5/30/2011 09:45:00 PM

Last week economist Tom Lawler looked at the national excess vacant housing supply by using the Census 2010 data and comparing to the 2000 and 1990 census data.

I've been looking at the same data, but on a state by state basis. As Tom noted, trying to determine the excess supply as of April 1, 2010 requires an estimate of the normal vacancy rates. Some states always have high vacancy rates on April 1st because of the large number of second homes - like Maine - so what we need to do is compare the 2010 state vacancy rates to the previous census vacancy rates.

But we also have to remember what was happening in 1990 and 2000. There was a regional housing bubble in California, Arizona and several other states in the late '80s, and the 2000 Census happened at the end of stock bubble when the demand for housing was strong (so the excess vacant inventory was probably below normal).

So calculating excess inventory by comparing to the 2000 Census probably gives a number that is too high - and comparing to the 1990 Census gives a number that is too low. So, like Lawler, I also calculated an excess supply based on a combination of the 1990 and 2000 data.

A few notes:

• For those interested, here is the spreadsheet (with the 1990, 2000, and 2010 data and some calculations).

• Just because a state appears to have no vacant excess inventory doesn't mean there isn't any inventory - this calculation is based on an estimate of a normal level of inventory.

• Remember that this is for April 1, 2010. The builders have a completed a record low number of housing units over the last 14 months, and the excess supply is probably lower now.

• House prices depend on local supply and demand - and also on the number of distressed homes on the market (forced sellers). But the excess vacant inventory is important for forecasting when new construction will increase - assuming the builders can compete with all the distressed homes on the market (that story yesterday on San Diego was interesting).

The columns are sortable in the following table. My guess is the excess inventory was above 1.8 million on April 1, 2010, and that the excess is probably several hundred thousand units lower now. Tom Lawler thought the excess was in the 1.6 to 1.7 million range on April 1, 2010, and is probably in the 1.2 to 1.4 million range now.

It is no surprise that Florida has the largest number of excess vacant units and that Nevada has the largest percentage of excess vacant units. What might be a surprise to some is that California is below the U.S. average.

Weekend ...

• Summary for Week Ending May 27th

• Schedule for Week of May 29th

Even more Negative Sentiment for Homeownership

by Calculated Risk on 5/30/2011 05:05:00 PM

As I've noted before, I've been looking for a change in sentiment for homeowership. A shift in sentiment doesn't mean housing prices have bottomed - it just means the market is getting closer. In previous busts it seemed like negative sentiment lasted for a few years. Earlier posts on this with anecdotal evidence: Housing: Feeling the Hate, More "Hate" for Housing, More "Hate" for Homeownership and More Negative Sentiment for Homeownership.

A few excerpts from David Streitfeld's article at the NY Times: Index Expected to Show New Low in House Prices

“The emotional scars left by the collapse are changing the American psyche,” said Pete Flint, chief executive of the housing Web site Trulia. “There was a time when owning a home was a symbol you had made it. Now it’s O.K. not to own.”Weekend ...

Trulia, a real estate search engine for buyers and renters ... is a hive of renters, including Mr. Flint. “I’m in no rush at all to buy,” he said.

...

Tim Hebb, a Los Angeles systems engineer ... sold his bungalow in August 2006, then leased it back for a year. Since then [he] rented a succession of apartments.

“I have flirted with buying again many times over the past few years,” said Mr. Hebb. “Let’s face it, people are not rational creatures.”

...

“We have more of what we call ‘renters by choice’ than I’ve seen in the 40 years I’ve been in the apartment business,” said Jeffrey I. Friedman, chief executive of [Associated Estates Realty Corporation, which owns 13,000 apartments in Georgia, Indiana, Michigan and other Midwest and Southeast states]

...

Susan Lindsey, a San Diego software programmer, was once eagerly waiting for the housing market to crash. She said she would have no guilt about swooping in on some foreclosed owner who had bought a place he could not afford.

With prices now down by a third, however, she is content to stay in her $2,500-a-month rental.

• Summary for Week Ending May 27th

• Schedule for Week of May 29th

Oil and Gasoline Price Update

by Calculated Risk on 5/30/2011 12:23:00 PM

Oil and gasoline prices are probably the biggest downside risk to the economy right now. Oil prices are off slightly today, from the WSJ: Oil Prices Ease

The front-month July Brent contract on London's ICE futures exchange was recently down 35 cents, or 0.3%, at $114.68 a barrel. The front-month July contract on the New York Mercantile Exchange was trading lower 43 or 0.4%, at $100.16 per barrel.Looking at the following graph, it appears that gasoline prices are off about 18 cents nationally from the peak. This graph suggests - with oil prices around $100 per barrel that gasoline prices will fall into the $3.50 - $3.60 per gallon range in the next few weeks.

However that just takes us back to March pricing - and that was already a drag on consumer spending. I'll have more on the overall economy later.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Reports: Next Greek bailout to include external supervision

by Calculated Risk on 5/30/2011 08:50:00 AM

From the Financial Times: Greece set for severe bail-out conditions

European leaders are negotiating a deal that would lead to unprecedented outside intervention in the Greek economy, including international involvement in tax collection and privatisation of state assets ... the package would also include incentives for private holders of Greek debt voluntarily to extend Athens’ repayment schedule, as well as another round of austerity measuresFrom Reuters: EU racing to draft second Greek bailout: sources

excerpts with permission

The European Union is working on a second bailout package for Greece in a race to release vital loans next month and avert the risk of the euro zone country defaulting ... a new 65 billion euro package could involve a mixture of collateralized loans from the EU and IMF, and additional revenue measures, with unprecedented intrusive external supervision of Greece's privatisation program.The bond yields in Europe are fairly stable this morning. Here are the links for bond yields for several countries (source: Bloomberg):

...

The next scheduled meeting of euro zone finance ministers is on June 20 in Luxembourg

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Weekend ...

• Summary for Week Ending May 27th

• Schedule for Week of May 29th

Sunday, May 29, 2011

ECB Official: "Orderly" Greek restructuring is a "fairy tale"

by Calculated Risk on 5/29/2011 11:03:00 PM

Another update on Europe - the IMF, the European Central Bank and the European Commission are trying to decide on the next step for Greece.

Lorenzo Bini Smaghi, an ECB executive board member told the Financial Times in an interview that a Greek "soft" restructuring is a "fairy tale". Here is quote:

LBS: There is no such thing as an “orderly” debt restructuring in the current circumstances. It would be a mess. And I haven’t mentioned contagion – which would come on top.And from the WSJ: Bond Auctions Set to Measure Contagion Fears

If you look at financial markets, every time there is mention of word like restructuring or “soft restructuring,” they go crazy ... “soft restructurings” “re-profilings” do not exist. They are catchwords that politicians have tried to use, but without any content.

excerpt with permission

A team of European and International Monetary Fund officials is scheduled to conclude a closely watched examination of Greek government finances this week as bellwether bond auctions are expected to provide a sign of whether anxiety over Greece's debts is infecting investor appetite for sovereign bonds elsewhere in the euro zone.The crisis in Greece doesn't seem to be impacting Spain or Italy ... yet.

Italy will seek to raise as much as €8.5 billion ($12.1 billion) from bond investors Monday, while Spain is seeking an estimated €3.5 billion ...

Yesterday ...

• Summary for Week Ending May 27th

• Schedule for Week of May 29th

San Diego: Home Builders opening more communities for sale

by Calculated Risk on 5/29/2011 05:40:00 PM

From Eric Wolff at the North County Times: HOUSING: Builders feeling hopeful, opening lots for sale

The North San Diego County and Southwest Riverside County housing markets are glutted with bank-owned houses and short sales, which put a drag on local house prices. ... Yet builders opened 18 new communities in San Diego County in the first three months of 2011, five more than in the same period of 2010, and 16 opened in Riverside County, six more than during the same period last year, according to MarketPointe Realty Advisers.I've talked to builders in some other areas who are able to compete with distressed home pricing based on a combination of cheaper land prices, lower labor costs and also building smaller homes. (note: Eric didn't mention house size in his article).

...

Builders have also been able to slash costs: Many have laid off staff and found ways to become more efficient, and they're able to take advantage of reduced prices from contractors desperate to stay in business. ... Developers acquired unfinished communities at fire-sale prices from banks and desperate sellers.

...

"Every piece of property that we've bought in the last two years has been a distressed sale of some kind or another," said Brent Anderson, vice president for investor relations for Meritage. "All of these communities we're buying ---- they're distressed assets we're picking up for pennies on the dollar."

Cheap land, along with stiff competition among contractors, allows builders to slash their selling prices.

These are still quite a few distressed homes available, but they don't appeal to every buyer. Perhaps the homes are too large, too beat up, or just too difficult to buy (short sales) - so there is still a market for new homes. I doubt this indicates a significant increase in new home construction, although we might see a little pick up later this year in a few areas as the local excess supply continues to shrink.

Yesterday ...

• Summary for Week Ending May 27th

• Schedule for Week of May 29th

House Prices: Will the March Case-Shiller indexes be at new post bubble lows?

by Calculated Risk on 5/29/2011 01:41:00 PM

Just a quick note: The publicly available S&P Case-Shiller release on Tuesday will include the two composite indexes (10 and 20 cities) for March, the National Index for Q1, and the indexes for 20 cities.

In nominal terms, the two Case-Shiller composite indexes for February were still above the previous post bubble lows set in April 2009. The Case-Shiller national index (released quarterly), hit a new post bubble low in Q4 2010.

I expect both the National Index and the Composite 20 index to be at new post bubble nominal lows in March. Radar Logic provides a forecast each month that has been pretty close. Here is their estimate for the March Case-Shiller indexes (Not Seasonally Adjusted, NSA):

Last month, we predicted that the S&P/Case-Shiller 10-City composite for February 2010 would be about 153 and the 20-City composite would be roughly 139. In fact, the 10-City composite was 152.70 and the 20-City composite was 139.27.That would put the composite 20 at a new low (both NSA and SA), but the Composite 10 would still be about 1% above the low in April 2009.

This month, we expect the March 2011 10-City composite index to be about 152 and the 20-City index to be roughly 138.

Arizona Lands sells for 8 percent of peak price

by Calculated Risk on 5/29/2011 08:53:00 AM

From Bloomberg: Arizona Land Sells for 8% of Price Calpers Group Paid at Peak (ht Justin)

A 10,200-acre desert site in Arizona sold for $32.5 million this week, five years after a group with investors including the California Public Employees’ Retirement System paid $400 million for the land.This was one of those crazy deals that happened right at the peak.

...

The site ... had been planned for a 42,000-home community by the Calpers- financed group when it was purchased in 2006.

I suppose paying under $10,000 per lot sounded good to someone in 2005, but the new owners are more realistic: “This won’t be developed in my lifetime.” said Kent Kleinman, a spokesman for the buyer ...

Yesterday ...

• Summary for Week Ending May 27th

• Schedule for Week of May 29th

Saturday, May 28, 2011

Hotels: Occupancy Rate continues to improve after soft patch

by Calculated Risk on 5/28/2011 10:02:00 PM

Here is the weekly update on hotels from HotelNewsNow.com: US hotels post 11.6% weekly RevPAR gain

The U.S. hotel industry recorded an 11.6% revenue-per-available-room gain for the week ending 21 May 2011, according to data from STR.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The increase pushed RevPAR to US$67.52 for the week. The industry’s occupancy rose 6.2% to 65.4%, and its average daily rate increased 5.1% to US$103.23.

"The U.S. hotel industry reported its strongest weekly performance since early April," said Steve Hood, senior VP at STR.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate using a four week average for the occupancy rate.

Back in March the four week average was almost back to 2008 levels, but then hotels hit a soft patch. Over the last couple of weeks, the occupancy rate has increased again - and the four week average is now back close to 2008 levels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Earlier ...

• Summary for Week Ending May 27th

• Schedule for Week of May 29th

Schedule for Week of May 29th

by Calculated Risk on 5/28/2011 05:25:00 PM

Earlier ...

• Summary for Week Ending May 27th

There will probably be a series of weak economic reports this week, including Case-Shiller house prices on Tuesday, the ISM manufacturing index on Wednesday, May vehicle sales also on Wednesday, and the May employment report on Friday.

Memorial Day: All US markets will be closed in observance of the Memorial Day holiday.

9:00 AM: S&P/Case-Shiller Home Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

House prices have continued to decline, and the Composite 20 index will probably be at post-bubble low in March. The consensus is for prices to decline about 0.2% in March; the ninth straight month of house price declines.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a sharp decrease to 62.3, down from 67.6 in April.

10:00 AM: Conference Board's consumer confidence index for May. The consensus is for a slight increase to 66.5 from 65.4 last month due to slightly lower gasoline prices.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for +178,000 payroll jobs in May, about the same as the 179,000 reported in April.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through mid-year (not counting all cash purchases).

10:00 AM: Construction Spending for April. The consensus is for a 0.5% increase in construction spending.

10:00 AM: ISM Manufacturing Index for May. The consensus is for a decrease to 57.5 from 60.4 in April. Based on the regional manufacturing surveys, I expect the ISM index to be in the mid-50s.

All day: Light vehicle sales for May. Light vehicle sales are expected to decrease to 12.8 million (Seasonally Adjusted Annual Rate), from 13.1 million in April.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate. Edmunds is forecasting: "Edmunds.com analysts predict that May’s Seasonally Adjusted Annualized Rate (SAAR) will be 12.2 million, down from 13.2 million in April 2011."

The supply chain disruption is now impacting sales and I think the consensus is too high.

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims increased over the last month. The consensus is for a decrease to 420,000 from 424,000 last week.

10:00 AM: Manufacturers' Shipments, Inventories and Orders for April. The consensus is for a 0.9% decrease in orders.

8:30 AM: Employment Report for May.

The consensus is for an increase of 190,000 non-farm payroll jobs in May, down from the 244,000 jobs added in April.

The consensus is for an increase of 190,000 non-farm payroll jobs in May, down from the 244,000 jobs added in April. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The estimate for May is in blue.

The consensus is for the unemployment rate to decline to 8.9% in May (from 9.0% in April).

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions through April - aligned at maximum job losses.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions through April - aligned at maximum job losses.This shows the severe job losses during the recent recession - there are currently 6.96 million fewer jobs in the U.S. than when the recession started in 2007.

Once again I think the consensus is too high.

10:00 AM: ISM non-Manufacturing Index for May. The consensus is for a slight increase to 54.0 in May.

Best wishes to All!

Unofficial Problem Bank list increases to 997 Institutions

by Calculated Risk on 5/28/2011 02:54:00 PM

Earlier ...

• Summary for Week Ending May 27th

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 27, 2011.

Changes and comments from surferdude808:

Activities of the FDIC contributed to many changes to the Unofficial Problem Bank List this week as they closed a bank and released their enforcement actions through April 2011. In all, there were 12 additions and three removals, which leaves the list at 997 institutions with assets of $415.4 billion compared with 988 institutions and assets of $423.9 billion last week.CR Note: The FDIC Q1 Quarterly Bank Profile showed 888 problem institutions on the official problem bank list. The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

Asset figures were updated from 2010q4 to 2011q1, which caused aggregate assets to drop by $9.8 billion. The net of additions and removals this week caused assets to rise $1.4 billion.

The removals include the failed First Heritage Bank, Snohomish, WA ($173 million) and action terminations against CB&S Bank, Inc., Russellville, AL ($1.3 billion); and Alliance Banking Company, Winchester, KY ($60 million).

Among the 12 additions are Four Oaks Bank & Trust Company, Four Oaks, NC ($961 million); Frontier State Bank, Oklahoma City, OK ($517 million); Security First Bank, Fresno, CA ($114 million Ticker: SFRK); and Central Florida State Bank, Belleview, FL ($85 million Ticker: CEFB).

Other changes include Prompt Corrective Actions order issued by the FDIC against Community South Bank, Parsons, TN ($658 million); First International Bank, Plano, TX ($321 million); and Community Bank of Central Wisconsin, Colby, WI ($104 million).

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest. In general the unofficial list has tracked the official list, although currently there more institutions on the unofficial list.

Summary for Week Ending May 27th

by Calculated Risk on 5/28/2011 08:15:00 AM

The economic data was soft again last week. The Richmond Fed manufacturing survey showed contraction in May, and the Kansas City Fed manufacturing survey showed growth had "stalled". The second estimate of Q1 GDP was disappointing (unrevised at 1.8% annualized real growth rate, but the underlying details were weaker than in the advance estimate). And weekly initial unemployment claims increased again. Also the personal income and outlays report for April indicated a slowdown in consumer spending.

There might have been a little bit of good news in a surprising sector: housing. New home sales were up a little (still very low), and although mortgage delinquencies increased slightly, the increase was probably seasonal, with both Fannie and Freddie reporting another decline in seriously delinquent loans. Also lender Real Estate Owned (REO) is now declining. Baby steps ...

Also gasoline prices are now down about 16 cents per gallon nationally from the recent peak - and that probably showed up in a small increase in May consumer sentiment.

Below is a summary of economic data last week mostly in graphs:

• New Home Sales in April at 323 Thousand SAAR, Ties Record low for April

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 323 thousand. This was up from a revised 301 thousand in March (revised from 300 thousand).

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed. This graph shows the three categories of inventory starting in 1973.

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed. This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale fell to 67,000 units in April. The combined total of completed and under construction is at the lowest level since this series started.

The following graph shows existing home sales (left axis) and new home sales (right axis) through April.

The gap is due mostly to the flood of distressed sales. This has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

The gap is due mostly to the flood of distressed sales. This has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

I expect this gap to close over the next few years once the number of distressed sales starts to decline.

Although above the consensus forecast of 300 thousand, this ties the record low for April - and new home sales have averaged only 298 thousand SAAR over the last 12 months ... moving sideways at a very low level.

• Three Graphs of REO Inventory

Here are three graphs of lender Real Estate Owned (REO) inventory. The first is for Fannie, Freddie and the FHA. Then we add Private Label Securities, and finally FDIC insured banks and thrifts.

The combined REO inventory for Fannie, Freddie and the FHA decreased to 287,380 at the end of Q1, from a record 295,307 units at the end of Q4. The REO inventory increased 37% compared to Q1 2010 (year-over-year comparison).

The combined REO inventory for Fannie, Freddie and the FHA decreased to 287,380 at the end of Q1, from a record 295,307 units at the end of Q4. The REO inventory increased 37% compared to Q1 2010 (year-over-year comparison).

The REO inventory for the "Fs" increased sharply in 2010, but may have peaked in Q4 2010. The Fs acquired 101,997 REO units in Q1, but sold 110,023. Both are records, and the numbers will probably increase all year.

The second graph includes the data for the Fs and adds Private Label Securities (PLS).

The PLS blew up first because it contained the worst of the worst loans; poorly underwritten subprime and Alt-A.

The PLS blew up first because it contained the worst of the worst loans; poorly underwritten subprime and Alt-A.

Also the PLS wasn't set up to effectively manage REO and they just dumped houses on the market. Usually house prices are sticky downwards - prices decline, but slowly. However this dump of REOs led to what Tom Lawler called "destickification" with house prices falling rapidly in many low end areas with high foreclosure rates.

Now about half of the REOs are owned by the Fs and they are little more careful in releasing REO to the market.

From Tom Lawler: "The FDIC released its Quarterly Banking Profile for the first quarter of 2011. ... On the REO front [lender Real Estate Owned], the carrying value of 1-4 family residential real estate owned on FDIC-insured institutions’ balance sheet on 3/31/11 was $13.2795 billion, down from $14.0498 billion on 12/31/10 and $14.5527 billion last March. ... Using [$150,000 per REO], here is a chart of REO holdings of Fannie, Freddie, FHA, and FDIC-insured institutions.

From Tom Lawler: "The FDIC released its Quarterly Banking Profile for the first quarter of 2011. ... On the REO front [lender Real Estate Owned], the carrying value of 1-4 family residential real estate owned on FDIC-insured institutions’ balance sheet on 3/31/11 was $13.2795 billion, down from $14.0498 billion on 12/31/10 and $14.5527 billion last March. ... Using [$150,000 per REO], here is a chart of REO holdings of Fannie, Freddie, FHA, and FDIC-insured institutions.

Note that this is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories. ... If one “grossed up” the estimates shown in the chart by this factor – which probably produces a “too high” number – then one estimate of the total REO inventory for 1-4 family properties would be around 615,000.

• LPS: Mortgage Delinquency Rates increased slightly in April, Foreclosure pipeline "Bloated"

According to LPS, 7.97% of mortgages were delinquent in April, up from 7.78% in March, but down from 8.80% in February and down from 9.52% in April 2010. Some of this increase is the normal seasonal pattern.

LPS reports that 4.14% of mortgages were in the foreclosure process, down from the record 4.21% in March. This gives a total of 12.11% delinquent or in foreclosure. It breaks down as:

• 2.24 million loans less than 90 days delinquent.

• 1.96 million loans 90+ days delinquent.

• 2.18 million loans in foreclosure process.

For a total of 6.39 million loans delinquent or in foreclosure in April.

What is surprising is the large percentage in the 90+ days delinquent bucket that are more than 12 months delinquent and haven't moved to the "in foreclosure process" bucket. About 40% of loans in the 90+ days bucket - or about 800,000 loans - have been delinquent over a year.

The second graph - from the March report - shows the aging of loans in the foreclosure process.

"31% of loans in foreclosure have not made a payment in over 2 years." So about one third of the 2.2 million loans in the foreclosure process haven't made a payment in over 2 years.

"31% of loans in foreclosure have not made a payment in over 2 years." So about one third of the 2.2 million loans in the foreclosure process haven't made a payment in over 2 years.

These two graphs show the "bloated" backlog of seriously delinquent loans (90+ days and in foreclosure).

The good news is the improvement in the early stages, however there is still an enormous number of seriously delinquent loans.

• Personal Income and Outlays increased 0.4% in April

This graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars).

This graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars).

PCE increased 0.4% in April, but real PCE only increased 0.1% as the price index for PCE increased 0.3 percent in April.

It appears growth in real consumer spending has slowed over the last couple of months.

• Consumer Sentiment increased in May

The final May Reuters / University of Michigan consumer sentiment index increased to 74.3 from the preliminary reading of 72.4, and from 69.8 in April.

The final May Reuters / University of Michigan consumer sentiment index increased to 74.3 from the preliminary reading of 72.4, and from 69.8 in April.

This was above expectations for a reading of 72.5.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

This is still a low reading, but sentiment probably improved a little possible due to the decline in gasoline prices.

• Other Economic Stories ...

• ATA Trucking index decreased 0.7% in April

• Chicago Fed: Economic activity weakened in April

• Q1 real GDP growth unrevised at 1.8% annualized rate

• Kansas City Manufacturing Survey: Activity was largely unchanged in May

• Richmond Fed shows contraction

Best wishes to all!

Friday, May 27, 2011

Bank Failure #44 in 2011: First Heritage Bank, Snohomish, Washington

by Calculated Risk on 5/27/2011 10:34:00 PM

From the FDIC: Columbia State Bank, Tacoma, Washington, Assumes All of the Deposits of First Heritage Bank, Snohomish, Washington

As of March 31, 2011, First Heritage Bank had approximately $173.5 million in total assets and $163.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $34.9 million. ... First Heritage Bank is the 44th FDIC-insured institution to fail in the nation this year, and the second in Washington.Friday arrives late ...

European Bond and CDS Spreads

by Calculated Risk on 5/27/2011 07:27:00 PM

Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released yesterday (graph as of May 24th).

From the Atlanta Fed:

Since the April FOMC meeting, peripheral European bond spreads over German bonds continue to be elevated, with those of Greece, Ireland, and Portugal setting record highs.

Since the April FOMC meeting, the 10-year Greece-to-German bond spread has widened by 192 basis points (bps), through May 24. The spreads for Ireland and Portugal have soared higher by 91 bps and 68 bps, respectively, over the same period.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The spreads for Greece, Ireland and Portugal were all at record highs.

Spreads for Spain and Italy have increased recently, but are still much lower than for Greece, Ireland and Portugal.

The second graph shows the Credit Default Swap (CDS) spreads:

From the Atlanta Fed:

From the Atlanta Fed: The CDS spread on Greek debt has widened about 47 basis points (bps) since the April FOMC meeting, while those on Portuguese and Irish debt continue to be high.The WSJ mentioned a new unreleased IMF paper that examines "debt restructurings by countries using a common currency": In Standoff Over Greece, Will ECB Have to Fold?

There aren't many precedents for debt restructurings by countries using a common currency, but there are some. An IMF working paper, as yet unpublished, examines them. According to two people who have read the paper, it shows that orderly debt restructurings—for example by Ivory Coast, which uses the West African CFA franc, and Grenada and Dominica, users of the East Caribbean dollar—haven't affected the viability of their respective currency unions.Not great examples, but it isn't much of a jump to think this paper was motivated by the situation in Greece.

Fannie Mae and Freddie Mac Serious Delinquency Rates decline

by Calculated Risk on 5/27/2011 03:27:00 PM

Fannie Mae reported that the serious delinquency rate decreased to 4.27% in March from 4.44% in February. This is down from 5.47% in March 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the serious delinquency rate decreased to 3.57% in April from 3.63% in March. (Note: Fannie reports a month behind Freddie). This is down from 4.06% in March 2010. Freddie's serious delinquency rate also peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent.

Now the serious delinquency rate is falling as Fannie and Freddie work through the backlog of loans and either modify the loan, foreclose, short sale, or the loan cures. The serious delinquency rate is still very high ... but at least it is declining.

Real GDI and Personal Income less Transfer Payments still below pre-recession levels

by Calculated Risk on 5/27/2011 01:17:00 PM

There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). The BEA also released Q1 GDI yesterday as part of the second estimate for Q1 GDP. Recent research suggests that GDI is often more accurate than GDP.

For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. These differences have become particularly glaring over the latest cyclical downturn, which appears considerably worse along several dimensions when looking at GDI. ...The following graph is constructed as a percent of the previous peak in both GDP and GDI. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. It appears that GDP bottomed in Q2 2009 and GDI in Q3 2009. Real GDP finally reached the pre-recession peak in Q4 2010, but real GDI is still slightly below the previous peak.

Using GDI, the economy will be back to the pre-recession peak in Q2 2011.1

However, by other measures - like real personal less transfer payments and employment - the economy is still far below the pre-recession peak.

The second graph is based on the April Personal and Outlays report this morning, and shows that real personal income less transfer payments is still 3.4% below the previous peak.

The second graph is based on the April Personal and Outlays report this morning, and shows that real personal income less transfer payments is still 3.4% below the previous peak.And of course there are still 6.955 million fewer payroll jobs than at the beginning of the 2007 recession.

Finally, recoveries following the bursting of a credit bubble - with a financial crisis - are always sluggish. So this isn't surprising, but it is still very painful.

1 Last year I disagreed with St Louis Fed President James Bullard - and I argued that real GDI would probably be back to pre-recession levels in Q1 2011 (close, but it now looks like Q2).

Consumer Sentiment increases in May, Pending Home Sales decline sharply

by Calculated Risk on 5/27/2011 09:55:00 AM

From NAR: April Pending Home Sales Drop

The Pending Home Sales Index, a forward-looking indicator based on contract signings, dropped 11.6 percent to 81.9 in April from a downwardly revised 92.6 in March. The index is 26.5 percent below a cyclical peak of 111.5 in April 2010 when buyers were rushing to beat the contract deadline for the home buyer tax credit.This suggests a sharp decline in existing home sales in May or June.

The data reflects contracts but not closings, which normally occur with a lag time of one or two months.

Consumer Sentiment: The final May Reuters / University of Michigan consumer sentiment index increased to 74.3 from the preliminary reading of 72.4, and from 69.8 in April.

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.This was above expectations for a reading of 72.5.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

This is still a low reading, but sentiment probably improved a little possible due to the decline in gasoline prices.

Personal Income and Outlays increased 0.4% in April

by Calculated Risk on 5/27/2011 08:53:00 AM

The BEA released the Personal Income and Outlays report for April:

Personal income increased $46.1 billion, or 0.4 percent ... Personal consumption expenditures (PCE) increased $41.5 billion, or 0.4 percent.The following graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in April, the same increase as in March.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE increased 0.4% in April, but real PCE only increased 0.1% as the price index for PCE increased 0.3 percent in April. The graph shows the recent slowdown in the growth rate in real PCE.

Note: The PCE price index, excluding food and energy, increased 0.2 percent.

The personal saving rate was at 4.9% in April.

Personal saving -- DPI less personal outlays -- was $570.6 billion in April, compared with $576.7 billion in March. Personal saving as a percentage of disposable personal income was 4.9 percent in April, the same as in March.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the April Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the April Personal Income report.The saving rate has declined even as growth for real personal consumption expenditures has slowed. Part of this is due to higher overall inflation and higher oil / gasoline prices.

Thursday, May 26, 2011

Economic Slowdown: Temporary or Something Worse?

by Calculated Risk on 5/26/2011 07:55:00 PM

I'll have some thoughts on this topic in the next few days, but here are a couple of articles with differing views.

From David Leonhardt at the NY TimesThe Economy Is Wavering. Does Washington Notice?

The latest economic numbers have not been good. ... Macroeconomic Advisers ... tries to estimate the growth rate of the current quarter in real time, and it now says annualized second-quarter growth is running at only 2.8 percent ... Not so long ago, the firm’s economists thought second-quarter growth would be almost 4 percent.And from Patti Domm at CNBC: Some Economists Expect Recovery Later This Year

An economy that is growing this slowly will not add jobs quickly. For the next couple of months, employment growth could slow from about 230,000 recently to something like 150,000 jobs a month, only slightly faster than normal population growth. That is certainly not fast enough to make a big dent in the still huge number of unemployed people.

...

The latest signs of weakness suggest that policy makers remain too sanguine. It is easy to see how the rest of 2011 could end up disappointing, much as 2010 did.

"We can put our finger on the problems, and they're temporary, I think," said Mark Zandi of Moody's Economy.com. "Oil prices were a blow. You can see that in the consumer spending numbers in Q1, and prices are coming back down."The supply chain issues should be resolved over the next several months. And gasoline prices are falling and will continue to decline over the next few weeks, but oil at $100 a barrel is still a drag on the economy.

...

Goldman Sachs economists Andrew Tilton said the ripple effect from supply chain issues were a big part of the reason for the [slow down, however] "That doesn't explain all the weakness relative to our original forecast. There are other things going on, the most obvious of which is oil prices," he said.

... "If oil is coming back down you certainly wouldn't want to be cutting your growth forecast for the second half of the year," he said.

...

"In so far as you think it's supply chain-related, the deeper the cutback due to supply chain factors now, the better you should feel about second half because it should bounce back," said Tilton.

Earlier:

• Weekly Initial Unemployment Claims increase to 424,000

• Q1 real GDP growth unrevised at 1.8% annualized rate

• LPS: Mortgage Delinquency Rates increased slightly in April, Foreclosure pipeline "Bloated"

• Lawler: Census 2010 Demographic Profile: Highlights, Excess Housing Supply Estimate, and Comparison to HVS

Lawler: Census 2010 Demographic Profile: Highlights, Excess Housing Supply Estimate, and Comparison to HVS

by Calculated Risk on 5/26/2011 04:14:00 PM

CR Note: This is a long piece from economist Tom Lawler. First Lawler looks at the Census 2010 data and compares to the Housing Vacancies and Homeownership (HVS). This is very important because the HVS is used by many analysts to estimate the excess housing supply.

Later in the piece, Lawler looks at several quick and dirty methods of estimating the national excess housing supply. I suspect housing analysts and journalists will want to read the entire post (the excess supply is critical and just about everyone uses the HVS). For those only interested in the excess supply section, scan down to "excess supply" NOTE: I've added a page break because this is very long!

I will work up my own estimate of the excess supply very soon. The following is from Tom Lawler ...

From economist Tom Lawler: Census 2010 Demographic Profile: Highlights, and Comparisons to the Now Officially Discredited HVS/CPS

Census released the decennial Census 2010 demographic profile of the United States today, and the data confirmed that other Census housing data derived from the Current Population Survey are based on a sample not representative of the US housing market as a whole.

On the homeownership front, the Census 2010 data showed that the US homeownership rate on April 1, 2010 was 65.1%, or 1.9 percentage points below estimates from both the Current Population Survey (CPS) Annual Social and Economic Supplement (ASEC) for March and the CPS Housing Vacancy Survey (HVS) for the first half of 2010.

According to Census, the 90% confidence interval for the annual CPS/HVS US homeownership rate was +/- 0.5 percentage points. Given the actual “gap” between the CPS/HVS estimate and the Census 2010 homeownership rate, it is pretty clear from a statistical standpoint that one can firmly reject the hypothesis that the sample used to generate housing tenure estimates from the CPS/HVS is NOT representative of the US as a whole.

Here is a chart showing homeownership rate estimates for (1) the last 3 decennial Censuses; (2) the CPS/ASEC; and (3) the CPS/HVS.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The differences among the various homeownership rate estimates were de minimus in 1990, but were significant in 2000 – with the CPS based homeownership rates significantly higher than the Census 2000 estimates. That gap widened dramatically in 2010. E.g., the CPS/ASEC and the CPS/HVS both suggested that the US homeownership rate from the middle of the first half of 2000 to the middle of the first half of 2010 declined just marginally – to 67.0% from 67.2%. The decennial Census, in marked contrast, suggests that from 2000 to 2010 the US homeownership rate fell to 65.1% from 66.2%. From a demographers’ standpoint, these are HUGE differences.

LPS: Mortgage Delinquency Rates increased slightly in April, Foreclosure pipeline "Bloated"

by Calculated Risk on 5/26/2011 12:40:00 PM

LPS Applied Analytics released their April Mortgage Performance data. From LPS:

•Delinquencies increased slightly in April. Delinquencies are down almost 10% on the year and over 25% from the peak in January 2010.According to LPS, 7.97% of mortgages were delinquent in April, up from 7.78% in March, but down from 8.80% in February and down from 9.52% in April 2010. Some of this increase is the normal seasonal pattern.

•The inventory of late stage delinquencies continues to age, with 40% of borrowers who are in 90+ delinquency status having not made a payment in over a year.

•Improvement continues in the early stages of the pipeline as new seriously delinquent loan rates have dropped to three year lows.

•Both foreclosure starts and sales declined in April -foreclosure sales are still well below the pre-moratoria levels of late 2010.

•The foreclosure pipeline remains bloated with overhang at every level and limited foreclosure sale activity

LPS reports that 4.14% of mortgages were in the foreclosure process, down from the record 4.21% in March. This gives a total of 12.11% delinquent or in foreclosure. It breaks down as:

• 2.24 million loans less than 90 days delinquent.

• 1.96 million loans 90+ days delinquent.

• 2.18 million loans in foreclosure process.

For a total of 6.39 million loans delinquent or in foreclosure in April.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph provided by LPS Applied Analytics shows the aging for the 90+ days delinquent bucket.

What is surprising is the large percentage in the 90+ days delinquent bucket that are more than 12 months delinquent and haven't moved to the "in foreclosure process" bucket. About 40% of loans in the 90+ days bucket - or about 800,000 loans - have been delinquent over a year.

The second graph - from the March report - shows the aging of loans in the foreclosure process.

"31% of loans in foreclosure have not made a payment in over 2 years." So about one third of the 2.2 million loans in the foreclosure process haven't made a payment in over 2 years.

"31% of loans in foreclosure have not made a payment in over 2 years." So about one third of the 2.2 million loans in the foreclosure process haven't made a payment in over 2 years.These two graphs show the "bloated" backlog of seriously delinquent loans (90+ days and in foreclosure).

The good news is the improvement in the early stages, however there is still an enormous number of seriously delinquent loans.

Note: Earlier today, RealtyTrac put out their monthly foreclosure report. The report included the statement: "[T]he current inventory of 1.9 million properties already on the banks’ books, or in foreclosure." I think that number is incorrect. RealtyTrac estimates about 872,000 REOs (Real Estate Owned) and another 1 million in foreclosure.

However, as LPS reported (the MBA has reported similar numbers), there about 2.2 million loans in the foreclosure process, and economist Tom Lawler has estimated the number of REO on lenders' books at about 600,000. Plus there are an additional 2 million loans 90+ days delinquent (about 800,000 are over 1 year delinquent). Some of these loans will cure because of modifications or other reasons. And some of these homes will be sold as short sales. But it appears the number of homes in the pipeline is well over 1.9 million. Just trying to get the numbers correct!

Final note: Recently I've seen seen some very high estimates of the percentage of distressed U.S. homes. So here are some numbers to use:

• There are just under 75 million owner occupied homes in the U.S.

• Just over 50 million homes have a mortgage (LPS estimated 54 million in 2010). The remaining are owned free and clear.

• There are 6.4 million loans delinquent, with about 4.1 million seriously delinquent (90+ days or in foreclosure).