by Calculated Risk on 4/29/2005 06:35:00 PM

Friday, April 29, 2005

Q1 GDP and Trade

Reviewing the first quarter 2005 (advance) GDP report, the first unusual item was inventories. Kash covered inventories in "Changes in Inventories".

Trade

UPDATE: All numbers are seasonally adjusted from the advance GDP report and the Trade report. So these numbers are correct. However, my calculation of $4.5 Billion in additional oil imports is not seasonally adjusted (I noted this in my previous post) so this might be a little less after adjustment.

But another area for concern is the balance of trade. The following table includes the reported trade balance, export and imports, for January and February and the projected numbers for March according to the GDP report.

| Trade | Exports | Imports | ||

| Balance | ||||

| January | -$58.5 | $100.4 | $158.9 | |

| February | -$61.0 | $100.5 | $161.5 | |

| March (est. from GDP) | -$59.9 | $110.3 | $170.1 | |

| Q1 TOTAL | -$179.4 | $311.2 | $490.6 |

We already know the dollar value of oil imports surged in March, probably adding another $4.5 Billion to imports. Therefore imports of $170 Billion is very possible. But why does the BEA expect exports to surge? The global slowdown is impacting other countries more than the US, so we might expect exports to be flat.

I expect the March trade deficit (due May 11) to be worse than the BEA estimate and to negatively impact GDP (preliminary) due on May 26th. Other factors may lead to a positive GDP revision.

Thursday, April 28, 2005

Macroblog to Roach: J'Défends!

by Calculated Risk on 4/28/2005 01:29:00 AM

In a four post series (1, 2, 3, 4) , Dr. Altig defends the Federal Reserve against Stephen Roach's most recent Fed bashing piece: "Original Sin".

Stripping aside Roach's hyperbole, I believe Roach makes three arguments:

1) that recent growth in the US economy has resulted from borrowing against inflated assets leading to "imbalances and distortions";

2) the FED should consider asset prices when setting interest rates and

3) that FED officials have made some irresponsible comments in recent years.

On the first point, I mostly agree with Roach. In my mind there is no question that the US has been buying growth with debt, both public (general fund deficit) and private (mortgage equity withdrawal).

On the second point, I believe the FED should not consider asset prices when setting interest rates, so I disagree with Roach. Much of Roach's scathing commentary is based on his belief that the FED should target asset prices.

And on the third point, I generally agree with macroblog that FED officials have, with the exception of Mr. Greenspan, been responsible in their comments, especially in recent months. I believe Chairman Greenspan has made several irresponsible and inaccurate comments when speaking for himself.

Perhaps the FED could have spoken out sooner on certain issues, like the general fund deficit and the housing bubble. As Dr. Thoma wrote in the macroblog comments concerning the 'behavior of congress over the deficit/trust fund':

"... watching out for the public interest is an important role of the Fed, but that's not something the Fed had direct control over and other than publicly denouncing such policy, they have little choice but to do their best in spite of poor policy elsewhere in government."In my view Roach's anger is misdirected. Although I agree with Roach's general economic assessment, I believe the problems are primarily due to poor fiscal and public policy.

Wednesday, April 27, 2005

More Signs of a Global Slowdown

by Calculated Risk on 4/27/2005 12:45:00 AM

UPDATE: The Economist (on Germany): If not now, when?

Germany:

NYTimes: Fears Mount That Germany Faces Recession

Financial Times: German business data add to eurozone gloom

Japan:

Bloomberg: Japan's Household Spending Falls; Economy Sheds Jobs

Financial Times: Japanese economy stuck in deflation

And the really dark side ...

$100 (US) oil, major recession seen as likely

Conference told of imminent price shocks as world demand rises while reserves fall

Tuesday, April 26, 2005

New Home Sales, Monthly Unadjusted

by Calculated Risk on 4/26/2005 08:21:00 PM

Here is a graph of actual monthly New Home Sales for the last 3 years.

Click on graph for larger image.

March is usually one of the strongest months of the year, and for March 2005, sales were a monthly record of 144 thousand units.

Interestingly the median sales price dropped significantly in March. The reason probably is due to the surge in sales in the South. Over half the sales in March (73 thousand) occured in the South (the Census bureau segments the data into four regions). The previous record for the South was 59 thousand last March.

So sales in the South increased 23% from last March, but only 10% over the other three regions.

Record New Home Sales

by Calculated Risk on 4/26/2005 12:54:00 AM

According to a Census Bureau report, New Home Sales set a record in March to a seasonally adjusted annual rate of 1.431 million vs. market expectations of 1.19 million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

Sales of new one-family houses in March 2005 were at a seasonally adjusted annual rate of 1,431,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.2 percent above the revised February rate of 1,275,000 and is 12.7 percent above the March 2004 estimate of 1,270,000.

The median sales price of new houses sold in March 2005 was $212,300; the average sales price was $281,300. The seasonally adjusted estimate of new houses for sale at the end of March was 433,000. This represents a supply of 3.6 months at the current sales rate.

There is a seasonal pattern to supply and 3.6 months is below the normal level of supply as compared to 2003 and 2004. Months of supply is based on sales, and the record sales in March makes the months of supply number smaller.

Monday, April 25, 2005

Lau and Stiglitz: China's Alternative to Revaluation

by Calculated Risk on 4/25/2005 07:40:00 PM

In a Financial Times commentary, Lawrence Lau and Joseph Stiglitz argue that an export tax would be a better choice for China.

"If China were to contemplate a revaluation, it should consider as an alternative the imposition of a tax on its exports. Export taxes are generally permitted under WTO rules. Indeed, China has already moved in a limited way in this direction on textiles. There are several reasons voluntary imposition of a tax on its exports may be preferable to a renminbi revaluation. Both would have similar effects on Chinese exports - they would make them appear more expensive to the rest of the world. Because of this similarity, an export tax would provide an empirical answer to the question of whether a revaluation would work. But it would do this without some of the significant costs attendant on revaluation.It seems a 5% export tax would just increase the US trade deficit with China and might lead to more inflation in the US. I'll be interested in Setser and Roubini's views on this proposal!

One of the advantages of an export tax is that, unlike a revaluation, it would not lead to financial losses for Chinese holders of dollar-denominated assets, such as the People's Bank of China or commercial banks and enterprises. China's central bank currently holds about $640bn (£334bn) in foreign exchange reserves. Assume that only 75 per cent is held in dollar-denominated assets. A renminbi revaluation of 10 per cent would result in a loss of $48bn or about 400bn yuan for the central bank.

Another cost of revaluation would be possible further deterioration in the distribution of income, including increasing the already large rural-urban wage gap. Revaluation would put downward pressure on domestic Chinese agricultural prices; an export tax would not. An export tax, by contrast, would have a beneficial side effect: it could generate substantial government revenue for China. Given the high import content of Chinese exports to the US, a 5 per cent export duty would be equivalent to a currency revaluation of some 15-25 per cent, generating about $30bn-$42bn a year.

Finally, an export tax would not reward currency speculators. It may even discourage the speculation that has complicated macro-economic management of China's economy. If potential speculators can be convinced that China would rather impose an export tax than revalue, less "hot money" will flow into China. By contrast, nothing encourages speculators more than a "victory", especially where, as here, it is likely to do little to correct the underlying problems."

Q1 2005: Housing Vacancies and Homeownership

by Calculated Risk on 4/25/2005 11:29:00 AM

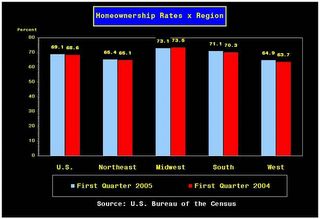

The Census Bureau released their Housing Vacancies and Homeownership report for Q1 2005 this morning.

National vacancy rates in the first quarter 2005 were 10.1 percent in rental housing and 1.8 percent in homeowner housing, the Department of Commerce and Census Bureau announced today. The Census Bureau said the rental vacancy rate was not different from the first quarter rate last year (10.4 percent) or the rate last quarter (10.0 percent). For homeowner vacancies, the current rate (1.8 percent) was also not different from the rate a year ago (1.7 percent), or the rate last quarter (1.8 percent). The homeownership rate (69.1 percent) for the current quarter was higher than the first quarter 2004 rate (68.6 percent) but not different from the rate last quarter (69.2 percent).

Click on graph for larger image.

Rental vacancies are still over 10% and homeownership rates are still climbing when compared to Q1 2004.

More on Housing

by Calculated Risk on 4/25/2005 01:55:00 AM

My most recent post, "After the Housing Boom: Impact on the Economy", is up on Angry Bear.

On Tuesday, New Home Sales will be released. I believe New Home Sales is a better leading indicator than Existing Home Sales (to be released on Monday). It appears that Sales for March were still strong, so I'm not expecting a significant drop-off in sales volumes reported this month.

Also the Census Bureau will release their quarterly Housing Vacancies and Homeownership report tomorrow.

A busy week for housing stats.

Best to all!

Friday, April 22, 2005

Fed's Kohn: Imbalances, Risks

by Calculated Risk on 4/22/2005 05:08:00 PM

Fed Governor Donald L. Kohn spoke today at the Hyman P. Minsky Conference in New York. Kohn made several cautionary comments on global imbalances. A few excerpts:

... beneath this placid surface are what appear to be a number of spending imbalances and unusual asset-price configurations. At the most aggregated level, the important imbalance is the large and growing discrepancy between what the United States spends and what it produces. This imbalance, measured by the current account deficit, has risen to a record level, both in absolute terms and as a ratio to GDP.

...

The sustainability of these large and growing imbalances has become especially suspect because it would require behavior that appears to be inconsistent with reasonable assumptions about how people spend and invest.

...

The current imbalances will ultimately give way to more sustainable configurations of income and spending. But that leaves open the question of the nature of that adjustment. Ideally, the transition would be made without disturbing the relatively tranquil macroeconomic environment that we now enjoy. But the size and persistence of the current imbalances pose a risk that the transition may prove more disruptive.

And on Real Estate:

A couple of years ago I was fairly confident that the rise in real estate prices primarily reflected low interest rates, good growth in disposable income, and favorable demographics. Prices have gone up far enough since then relative to interest rates, rents, and incomes to raise questions; recent reports from professionals in the housing market suggest an increasing volume of transactions by investors, who (along with homeowners more generally) may be expecting the recent trend of price increases to continue.In other words, a BUBBLE!

I take some comfort from the continuing disagreement among close students of the market about whether houses are overvalued, and, given the widespread press coverage of this issue, from my expectation that people should now be aware of the risks in the real estate market.

A very interesting speech and an extension of recent hard landing discussion. (see macroblog for a summary here, here and here)

Oil Prices Hurting less Developed Countries

by Calculated Risk on 4/22/2005 11:26:00 AM

It appears that oil prices have started to slow the US economy. But less developed countries are really feeling the pinch. Speaking at the Asia-Africa summit in Jakarta, Indonesia, Philippine President Gloria Macapagal-Arroyo warned that oil prices could lead to a "global recession".

Arroyo told the meeting in Jakarta, featuring some of the world’s leading oil consumers, that unsustainable prices were driving many countries to the brink of financial instability.

“There’s no question that the rising price of oil has the potential to put the brakes on economic expansion,” Arroyo said, urging delegates to work together to “prevent such a crisis”.

The rising trend of oil prices could worsen to levels that could halt economic growth or even prompt global economic recession, Arroyo said.

“It is stripping oil-importing Asia and Africa of our ability to manage for global competitiveness. It is preventing us from pursuing our economic development programmes with vigor. It is requiring us to face the spectre of economic decline,” she said.

Philippine Foreign Affairs Secretary Alberto Romulo made similar comments at the ministerial meeting of the conference.

"The current trend in oil prices points toward a situation that could halt global economic growth and further widen the gap between the rich and poor countries," Romulo said.

Spot oil prices reached $55 per barrel earlier today.

Thursday, April 21, 2005

Markets and Recessions

by Calculated Risk on 4/21/2005 09:01:00 PM

It is common wisdom on Wall Street that the market predicts recessions. This story today quoted a market analyst as saying: "The market typically turns down six months to a year before a recession. We could be seeing a recession in 2006."

We might see a recession in 2006, but the markets are not a good predicting tool.

Click on graph for larger image.

Here is the DOW's performance before and after the start of the last 5 recessions. For each recession, the DOW's value was normalized to 100 12 months prior to the start of the recession. The graph shows the median value, and the minimum and maximum for the DOW.

The best that can be said for the market is that it is a solid coincident indicator of a recession.

Here is a graph from a previous post about recession indicators. This shows the SP500's performance and the 1990's recession. The SP500 rallied into the recession and only sold-off after the recession started.

This is another common Wall Street "wisdom" that is incorrect. UPDATE: Fixed typo on graph.

"There are serious pocketbook issues lurking in America"

by Calculated Risk on 4/21/2005 02:36:00 AM

"There are serious pocketbook issues lurking in America," said Rep. Jim Leach (R- Iowa).

On the front page of Thursday's Washington Post is this analysis by Weisman and Balz, "Economic Worries Aren't Resonating on Hill" The authors make the argument that main street concerns are being ignored by Washington and the media.

The disconnect between pocketbook concerns of ordinary Americans and the preoccupations of their politicians has helped send President Bush's approval ratings on the economy down, while breeding discontent with Congress.And more:

"Many are rather upset at the Terri Schiavo issue," [Rep. Vernon Ehlers (R-Michigan)] said, even "moderately pro-life" voters. "I'm getting a lot of the, 'Why are you spending time on that when we don't have jobs?' type of thing."And this piece only scratches the surface of the serious economic challenges facing America.

In Michigan, jobs and the economy have vaulted to the No. 1 concern of 34 percent of voters, with the closest other issues, health care and education, at a distant 15 percent, said Ed Sarpolus, an independent Michigan pollster. "I haven't seen anything like that since the early '90s and crime," he said.

Wednesday, April 20, 2005

RE Executives: The Boom that won't Bust

by Calculated Risk on 4/20/2005 10:04:00 PM

At the Milken Institute Global Conference 2005 in LA, several Real Estate executives argued that there is no real estate bubble. A few comments from the "Real Estate: Investing for the Future" panel:

"We're in a market with real depth and real legs on it," said M.D.C. Chief Executive Larry Mizel.

"The big boom of the last 10 years was not seen all through the United States," KB Home Chief Executive Bruce Karatz said. "There's a supply-and-demand balance that I think will stay good for many years."

"The housing bubble has been created more by the business press than reality," said Sam Zell, chairman of Equity Office Properties Trust and Equity Group Investments LLC. "You can't have a crash without oversupply."

I will address the supply issue in a future post. But the final comment from the article is worth highlighting:

"The executives pegged the southwestern U.S. and Florida as best real estate buys"Enough said.

The Economist on House Prices

by Calculated Risk on 4/20/2005 05:36:00 PM

The Economist asks: Will the walls come falling down?

A few excerpts:

The increasing riskiness of mortgages is not the only sign that America is experiencing a housing bubble. The ratio of house prices to rents is well above its historical average, as is the ratio of prices to median incomes. And people seem increasingly to be basing their house-buying decisions on the notion that the large capital returns of the past few years—house prices in America are up by 65% since 1997—will continue indefinitely. As with a stockmarket bubble, if this confidence is shaken, prices could begin to fall rapidly.More likely prices will deflate slowly over a multi-year period. Housing: After the Boom on Angry Bear looked at the impact on prices and volume transactions in previous busts. Prices deflated slowly, but transactions dropped precipitously.

A fall in American house prices could be bad news not just for American homeowners, but for the rest of the world. Robust American demand has supported export-driven growth in many economies, particularly emerging markets and Asia. If American consumers have to raise their abysmal savings rate, exporting nations will feel the pinch.

And finally this:

Most worryingly, a collapse in American export demand could trigger a vicious cycle. In order to keep their currencies low against the dollar, and thus boost exports to America, Asian central banks have been accumulating dollar reserves, which they have poured into Treasury bonds. This has increased the supply of capital in America, and thus been at least partly responsible for the borrowing binge that fuelled the housing boom. If house prices fall, and suddenly poorer Americans have to cut back on their purchases, this will shrink the supply of cheap credit from Asian central banks, pushing up interest rates and causing house prices to fall even further. Those who thought that housing was a haven may be in for a nasty surprise.Emphasis added.

For a diagram on how this might work, see Housing and Trade: Virtuous Cycle about to Become Vicious? Check out The Economist article and the interesting chart on the global nature of the housing boom.

Bruce Bartlett Whispers the "R" Word

by Calculated Risk on 4/20/2005 01:22:00 AM

Bartlett believes that talk of a recession is "premature", but he expresses his general concerns that "the financial sector of the economy is under growing strain that could burst and spill over into the real economy suddenly and without warning."

He concludes:

... there are the dreaded “twin deficits” looming over financial markets. Huge budget and current account deficits mean that vast amounts of capital flows are necessary to keep them funded. So far, this has gone well, but that is largely because the Chinese have been so accommodating about financing them—effectively financing their own exports by buying large quantities of U.S. Treasury securities with their export earnings.My question: Great skill? By whom? Is there anyone in the Administration even thinking about these issues?

But now the U.S. is strongly pressuring China to stop doing this in order to allow its currency to rise against the dollar. It is hoped that this will reduce China’s production advantage in dollar terms and bring down the bilateral trade deficit. However, the cost to the U.S. economy if this happens could be greater than the potential gain. At least in the short run, any scale-back in China’s buying of Treasury securities might cause interest rates to spike very quickly. This could prick the housing bubble and bring down home prices, eroding personal wealth and putting a squeeze on those with floating rate mortgages.

Hopefully, this can all be managed smoothly and without either a recession or a market break. But it will take great skill and a lot of luck to avoid both.

UPDATE: pgl and William Polley add some comments. Make sure to read the comments in response to pgl's post.

Tuesday, April 19, 2005

Housing Starts

by Calculated Risk on 4/19/2005 06:29:00 PM

Angry Bear and Macroblog have commented on housing starts being lower than expected. Usually sales are a better indicator than starts, so look for the New Home Sales announcement next week.

This was an interesting comment buried in the story:

One concern among builders, [Dave Seiders, chief economist with the National Association of Home Builders] said, is that speculators are buying in new housing developments, which drives demand in the short term but could show up as excess supply down the road. "If the investor community should get worried, we could have a wholesale tumbling."I believe speculation is the key to any bubble. This post on Angry Bear discussed the storage aspect of speculation - the "excess supply down the road" that Mr. Seiders is discussing. From the Angry Bear post:

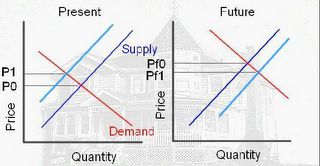

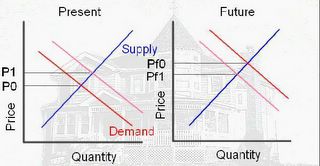

Click on diagram for larger image.

This diagram shows the motive for the speculator. If he buys today, at price P0, he believes he can sell in the future at price Pf0 (price future zero), because of higher future demand. The speculation would return: Profit = Pf0-P0-storage costs (the storage costs are mortgage, property tax, maintenance, and other expenses minus any rents).

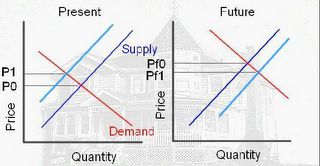

In this model, speculation is viewed as storage; it removes the asset from the supply. The following diagram shows the impact on price due to the speculation:

Since speculation removes the asset from the supply, the Present supply curve shifts to the left (light blue) and the price increases from P0 to P1. In the second diagram, when the speculator sells, the supply increases (shifts to the right). The future price will fall from PF0 to PF1. As long as (PF1 – storage costs) is greater than P1 the speculator makes a profit.

However, if the price does not rise, the speculator must either hold onto the asset or sell for a loss. If the speculator chooses to sell, this will add to the supply and put additional downward pressure on the price.

There is more in the Angry Bear post including a discussion of leverage as speculation.

I know I repeat myself sometimes - an old habit - sometimes I think certain ideas are worth revisiting. Best Regards to All.

Monday, April 18, 2005

Inflation Preview

by Calculated Risk on 4/18/2005 04:15:00 PM

UPDATE: Macroblog has a nice review of today's numbers. Look to Angry Bear tomorrow after the CPI is released.

The BLS reports PPI tomorrow and CPI on Wednesday. Over the last year, both the CORE PPI and CPI, less Food and Energy, have been steadily increasing on a year over year basis.

Click on graph for larger image.

Also plotted is the intended FED Funds Rate. A neutral Fed Funds rate would probably be about 150 to 200 basis points above CPI less food and energy. The Fed funds rate is currently at 2.75% with core inflation running about 2.5% to 3%.

The Fed Funds rate is still very accommodative unless the FED expects future inflation rates to fall. Dr. Krugman suggested that we may be seeing "A Whiff of Stagflation"; a slowing economy with rising inflation.

UPDATE: I probably should have include the FED's favorite measure of inflation, the PCE deflator (around 1.6%). The PCE is also steadily increasing and still puts the neutral rate around 3.25% to 3.5%.

The PPI and CPI numbers deserve close scrutiny this week.

Bubble Employment

by Calculated Risk on 4/18/2005 11:12:00 AM

Here are a couple of charts on real estate related employment.

Click on graph for larger image.

This graph is from The Big Picture.

For RE agents, California alone has added 113,307 licensed RE agents since July 2000. The total RE agents in California (427,389) represents 1.9% of the total working population of California. Many of these agents only work part-time, but that is still a substantial loss of income if RE volumes drop 30 to 40% - like a typical RE slowdown.

Thanks to ild and Elroy for the second chart.

Just like RE agents, there has been a significant increase in mortgage brokers. There has been a similar increase in residential building trades, appraisers, home inspectors and other housing related occupations. The impact of a housing slowdown on employment will be significant.

Sunday, April 17, 2005

More on Housing

by Calculated Risk on 4/17/2005 11:22:00 PM

My most recent post, Housing: After the Boom, is up on Angry Bear.

I know some people don't think there is a bubble. For those people I recommend: "In Real Estate Fever, More Signs of Sickness". Also my post on Speculation might be useful - if you don't mind a few Supply-Demand charts.

For me the more interesting topic is what happens AFTER the boom. This not only has implications for housing, but for the general US economy and the World economy.

A couple of references:

Please see Patrick's blog for a nice list of recent articles on housing.

And Ben's site, appropriately named "The Housing Bubble" has daily analysis of, what else, the housing bubble!

UPDATE: Here is another nice housing bubble blog.

Saturday, April 16, 2005

John Snow: Misinformed or Mendacious?

by Calculated Risk on 4/16/2005 10:25:00 PM

US Treasury Secretary John Snow made the following comments at the G7 meeting in Washington regarding the US budget deficit:

-Snow said the US is strongly committed to cutting its budget deficit.

The White House motto apparently is: "Promise Prudence, Deliver Squander". Actions speak louder than words, and there are no actions that indicate the Bush Administration is committed to cutting the budget deficit. After four years of progressively worse deficits, only a fool would take their word. And next year's budget promises more of the same (see Another Budget, Another Disaster).

-[John Snow] said the budget deficit is expected to be 3.5 pct of GDP this year which is 'still too large', but the Bush administration's plans mean that the deficit should be cut to well under 2 pct of GDP by 2009.

This statement is simply untrue. The budget deficit will be close to $650 Billion this year or about 5.5% of GDP. Mr. Snow is using the Enron style "unified budget" that includes the Social Security surplus to offset Bush's deficit. A close approximation to the General Fund deficit is the annual increase in the National Debt. Anyone can check the increase in the debt by checking the US Treasury site.

As of April 14, 2005 the National Debt is $7.79 Trillion. At the start of the current fiscal year (Sept 30, 2004) the National Debt was $7.38 Trillion. That is a 6 1/2 month deficit of $408 Billion (close to 6% of GDP) and there are still 5 1/2 months remaining in the fiscal year.

There are no public plans to cut the deficit to under 2% of GDP by 2009. If they have a secret plan, they should tell the American people. More likely the deficit will be over 7% of GDP in 2009.

-'Deficits matter, they are unwelcome, and must come down,' [John Snow] said.

Tell that to Vice President Dick Cheney who, according to former Treasury Secretary Paul O'Neill, said "Reagan proved deficits don't matter." Since the Bush Administration's actions mirror Cheney's alleged comments, why should we believe Mr. Snow?

Is John Snow mendacious or just misinformed? Either choice is troubling.

G7 Preview: Oil, Renminbi and more

by Calculated Risk on 4/16/2005 01:58:00 AM

With global imbalances becoming more serious, the G7 will meet in Washington this weekend. Unfortunately, once again the US seems out of step with the rest of the World.

While the US is calling for "immediate flexibility on renminbi", Japan is saying the G7 will not press China for flexibility.

And US Treasury Secretary John Snow is calling for reforms in Europe and Japan saying: "They [Europe and Japan] clearly need to grow faster. They need to get rid of impediments and obstacles to growth in those economies. They have to grow faster. That is absolutely certain and that will be my principle message to my G7 colleagues."

But Jeroen Kremers, the Dutch IMF director stated: “Global external imbalances are caused by the US and Asia, not by Europe. Involving Europe in the call for action to correct external imbalances confuses the issue and has provided an excuse for inaction in the US.”

Perhaps the only area of agreement is that oil prices are too high and that better transparency of oil stocks is needed. Of course the Europeans think the US encourages waste with low taxes on oil. And the US thinks European taxes are too high.

And finally, I believe any discussion of global imbalances needs to start with the burgeoning US fiscal deficit, so it is no surprise that Mr. Snow has rarely mentioned it. To say the least, I'm not sanguine.

Friday, April 15, 2005

Housing: New Records in California

by Calculated Risk on 4/15/2005 01:57:00 AM

Both Northern and Southern California are reporting record sales for March according to DataQuick. Highlights for Northern California, Record Prices, Near-Record Sales:

Home prices in the Bay Area rose to new highs in March as sales for that month were at their highest level in sixteen years.

Prices are going up at their fastest pace in four years.

The typical monthly mortgage payment that Bay Area buyers committed themselves to paying was $2,566 in March, an all-time high. A year ago it was $2,052.

Indicators of market distress are still largely absent.

And the highlights for Southern California, Records and Near-Records in SoCal:

home prices in Southern California hit a new peak last month

Sales were near record levels

The typical monthly mortgage payment that Southland buyers committed themselves to paying was $1,983 last month, up from $1,905 for the previous month, and up from $1,602 for March a year ago.

Indicators of market distress are still largely absent.

Everything looks great, and yet ...

Social Security: Krugman, Marshall and Tanner Debate Video

by Calculated Risk on 4/15/2005 12:18:00 AM

On March 15, Dr. Paul Krugman, Talking Points Josh Marshall and Cato's Michael Tanner debated Social Security at the New York Society for Ethical Culture. The video of the debate is now available.

VIDEO Parts One and Two.

UPDATE: pgl at Angry Bear has some interesting comments: Social Security: Tanner v. Krugman and Marshall

And since I mentioned Krugman, be sure to read his Friday Op-Ed: "The Medical Money Pit". This piece covers most of the same ground as Kash and AB over on Angry Bear. An excerpt:

The authors concluded that Americans spend far more on health care than their counterparts abroad - but they don't actually receive more care. The title of their article? "It's the Prices, Stupid."

Why is the price of U.S. health care so high? One answer is doctors' salaries: although average wages in France and the United States are similar, American doctors are paid much more than their French counterparts. Another answer is that America's health care system drives a poor bargain with the pharmaceutical industry.

Above all, a large part of America's health care spending goes into paperwork. A 2003 study in The New England Journal of Medicine estimated that administrative costs took 31 cents out of every dollar the United States spent on health care, compared with only 17 cents in Canada.

In my next column in this series, I'll explain why the most privatized health care system in the advanced world is also the most bloated and bureaucratic.

Thursday, April 14, 2005

IBM: More Evidence of a Global Slowdown

by Calculated Risk on 4/14/2005 07:25:00 PM

IBM reported that earnings would fall short of expectations: "IBM Misses Quarterly Earnings Forecast". Perhaps more important than the earnings announcement was this comments by IBM's Chairman and CEO Samuel J. Palmisano:

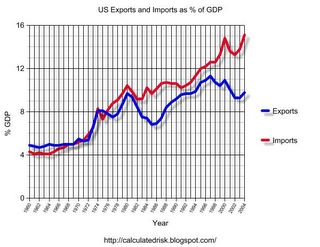

"After a strong start, we had difficulty closing transactions in the final weeks of the quarter, especially in countries with soft economic conditions, as well as with short-term Global Services signings,"This comment does not bode well for the US trade and current account deficits. The following graph shows the total US imports and exports since 1960.

Click on graph for larger image.

Imports have been rising fairly steadily since the early '70s. Exports have also been rising, but they have been more erratic. There have been two large declines in exports, the first in the early '80s and the other recently. Both declines were associated with a strong dollar as the next graphs indicate.

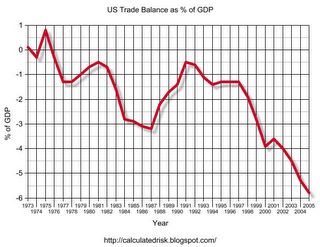

This graph shows the exchange rate since 1973 for the dollar against major currencies as calculated by the Federal Reserve. The second graph for the same time period shows the trade balance as a % of GDP.

NOTE: The 2005 trade deficit is estimated at $720 Billion with a 6% nominal increase in GDP.

The signing of the Plaza Accord in 1985 is very clear as the value of the dollar started to drop. The dollar stopped dropping in 1987 with the Louvre Accord. The weaker dollar clearly led to an increase in American exports.

With the recent dramatic drop in the value of the dollar, many people are hoping that the US exports will start to increase again in relation to imports. But with overseas economies faltering and the US economy still strong, US exports will probably continue to decline in relation to imports.

An improvement in the trade balance requires either overseas economies to strengthen or a slowdown / recession in the US.

New Inflation Tool at the Cleveland Fed

by Calculated Risk on 4/14/2005 12:32:00 PM

The Cleveland Fed has introduced "Inflation Central", a Worldwide database of inflation measures.

See World Inflation From The Cleveland Fed at Macroblog for much more.

I was surprised to discover that Bangladesh has had more inflation than Albania. But what do I do with that information?

Wednesday, April 13, 2005

More on Health Care

by Calculated Risk on 4/13/2005 06:39:00 PM

The highest priority fiscal problem in the US is the budget deficit; we will add close to $650 Billion in debt this fiscal year alone! The second highest priority is the US health care system.

In "Ailing Health Care", Paul Krugman tries to change the debate from Social Security to health care. As Krugman wrote, the issue is "health care reform," not "Medicare reform." The problem is far larger than Medicare alone, and yet the Medicare shortfall dwarfs the projected Social Security shortfall.

Earlier this year, the GAO pointed out that health care is the largest and perhaps most difficult part of the long-term fiscal challenges. The GAO calculated the Social Security shortfall at $3.7 Trillion (over 75 years) and the Medicare shortfall at almost $28 Trillion over the same period; more than 7 times larger than the Social Security shortfall. And Medicare is only a portion of the health care crisis!

As a follow up to Krugman, Kash compared some outcomes and expenses in the US to several other developed Nations.

Today, Kash followed up with more comments on the "Performance of the US Health Care System."

Angry Bear followed up with the first in a three part series: "Health Care in The U.S. And The World, Part I: How much do we spend?"

If it was up to me, I would change the debate to the deficit. But real budget solutions are probably unachievable in this ideologically driven period. Doesn't that apply to health care too? So what is the solution? Do nothing for four years?

Tuesday, April 12, 2005

The Mug's Game Challenge: Predict the Start of the Next Recession

by Calculated Risk on 4/12/2005 05:47:00 PM

A recession is probably not imminent, but there are reasons to be concerned. General Glut ventured this today:

The "hard versus soft" landing debate is stale. The real question now is only "how hard?"The next question is: When?

The Mug's Game Challenge

Here is a simple contest to predict the start of the next recession. The rules:

1) Enter a month and a year in the comments at any time right up to the recession being announced (one entry per person). Please feel free to state your reasons. I will feature those comments for the winners.

NOTE: You do not need to enter now. I am still waiting before I make my prediction. But early entries will be rewarded. I will update the contest every month as a reminder.

2) Scoring:

A) The Starting Month: The official starting month will be determined by the NBER. This usually occurs several months after the recession starts.

B) A pick will be considered correct if it is within +/- 2 months of the NBER determination (a 5 month window centered on the month picked). It is VERY difficult to pick the exact month, and being within a couple of months is quite an achievement.

C) All correct picks will be ranked by the number of months prior to the recession that the pick was entered. As an example, say the recession starts in Oct 2005: If someone correctly picks any month August 2005 through December 2005 (+/- 2 months) during April 2005, they will be rated a "6". This rewards picking the recession early.

All correct picks will be featured when the recession is announced and ranked by earliest picks.

Earlier I offered some thoughts on leading indicators for recessions. Several people have suggested other leading indicators to me. No one wants a recession, but we might as well have some fun!

Good luck to all!

UPDATE: Prize? The winners get their names mentioned, their comments featured, the admiration of their peers, and a free subscription to Calculated Risk!

UPDATE 2&3&4: Elaine is already a winner! Here are the picks so far (updates in bold):

Aug 2005 Kirk Spencer, wharf rat

Sep 2005 Vernon Bush

Oct 2005 BE, David Bennett

Nov 2005 David Yaseen, Fernando Margueirat, steve kyle, Nguyen Khuu

Jan 2006 Yusef Asabiyah, dryfly, Frank, redfish

Feb 2006 Mish, E.Robinson

Mar 2006 Colin H, ChasHeath, Alan Greenspend, Movie Guy, F.Hagan

Apr 2006 battlepanda

May 2006 Ken Houghton, navin

Jun 2006 DOR

Aug 2006 Jason Wright

Mar 2008 dilbert dogbert

Jul 2008 jl

Nov 2008 Elaine Supkis

March, 2011 Paul

NEVER Larry Kudlow's doppelganger

Posters can take the same month.

Record US Trade Deficit: $61 Billion for February

by Calculated Risk on 4/12/2005 08:49:00 AM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis released the monthly trade balance report today for February:

"... total February exports of $100.5 billion and imports of $161.5 billion resulted in a goods and services deficit of $61.0 billion, $2.5 billion more than the $58.5 billion in January, revised.

February exports were $0.1 billion more than January exports of $100.4 billion. February imports were $2.6 billion more than January imports of $158.9 billion."

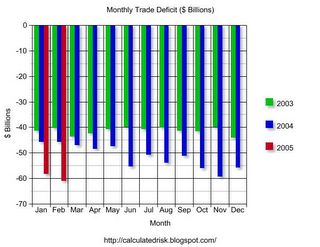

Click on graph for larger image.

This graph shows the monthly trade balances for 2003, 2004 and 2005 and depicts the worsening year over year trade imbalance. The February trade deficit was an all time record, as exports stalled and imports continued to climb.

The recent increase in oil prices did not impact the February trade deficit. In fact, Oil imports were down slightly in February. The following graph shows the impact of imported oil on the trade deficit.

This graph shows oil imports per month for 2003, 2004 and the first two months of 2005. Oil imports are less than 20% of the trade deficit and just over 1% of GDP (as discussed in this post on Angry Bear). Even without oil, the trade deficit would be 5% of GDP - a serious problem.

The recent run up in oil prices will impact the trade deficit for March.

UPDATE: The average contract price for crude oil in Feb was $36.85 per barrel. According to the DOE, the average price will be almost $10 higher for March. That will add $4.5 Billion to the trade deficit, before seasonal adjustments - or another $3.5+ Billion to imports in March.

I expect the trade deficit for March to even be worse!

Monday, April 11, 2005

More on Oil

by Calculated Risk on 4/11/2005 04:50:00 AM

My most recent post on Angry Bear, Oil: The Impact on the US Economy, is now up.

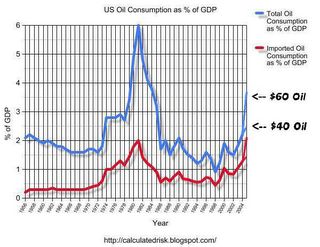

On the following graph, I plotted total oil consumption and imported oil consumption as a % of GDP. The plot for imported oil is slightly different than from my previous post (if you have a microscope!).

Click on graph for larger image.

The reason for the difference is I used different data sources. For this post, I used the DOE's data and for the previous post, I used the Census Bureau's trade data. They were very close, but I was able to plot a longer time series with the DOE's data.

I did not discuss peak oil in this analysis. That is a separate topic. I tried to stick to the question of the immediate impact on the US economy of the current price of oil.

Best Regards to All! And thanks for all the comments.

Friday, April 08, 2005

Oil Imports as % of GDP

by Calculated Risk on 4/08/2005 07:24:00 PM

Dr. Altig's graph this morning compared US energy production and consumption (in BTUs) divided by real GDP. Altig defines the difference between consumption and production as our energy dependence. The following graph shows another measure of energy dependence.

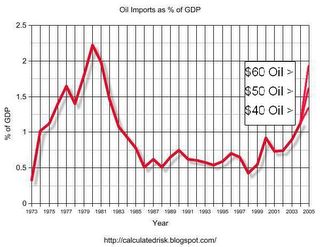

Click on graph for larger image.

This graph shows the nominal dollar value of oil imports as a percent of nominal GDP. The data is from the Census Bureau's U.S. Imports of Crude Oil and only goes back to 1973.

For 2004, oil imports were 1.13% of GDP, the highest level since 1982. I plotted three alternatives for 2005: $40 oil, $50 oil and $60 oil. It is important to note that the average contract price paid for oil is usually $5 to $10 below the spot prices. With Oil priced at $53.32 per barrel today, the average import contract price is probably in the mid to high $40s.

For GDP in 2005, I assumed a nominal increase of 6%.

From this chart, $60 oil would be 1.9% of GDP, just below the peak years of 1980 (2.22%) and 1981 (1.98%). For $50 oil, imports would be 1.59% of GDP.

To reach the record 2.22%, with 6% nominal GDP growth, the average price of imported oil would have to be $69 per barrel. Of course we had a recession in 1980, and $60+ imported oil would probably slow GDP growth in 2005 too. With slower growth, oil imports would reach the record as a percentage of GDP somewhere in the mid to low $60s.

Thursday, April 07, 2005

DOE: Short-Term Energy Outlook

by Calculated Risk on 4/07/2005 04:39:00 PM

The Department of Energy released their Short-Term Energy Outlook today. The DOE is now projecting monthly average gas prices to peak at about $2.35 per gallon in May. That probably means around $2.60 per gallon for regular unleaded in California.

This graph from the DOE shows average US gas prices for the last 2 years.

The average U.S. price right now for regular grade gasoline is $2.22. California is $2.46. So the DOE is expecting approximately another $0.13 increase over the next 30 days.

For crude oil: WTI prices are projected to remain above $50 per barrel for the rest of 2005 and 2006.  The second graph (DOE slide 3) shops the DOE predictions. Bear in mind that every month, for almost a year, the DOE has projected oil prices to flatten or decrease, and every month prices have exceeded their base case expectations.

The second graph (DOE slide 3) shops the DOE predictions. Bear in mind that every month, for almost a year, the DOE has projected oil prices to flatten or decrease, and every month prices have exceeded their base case expectations.

The high end of the DOE's projected range for the next two years (95% confidence) is $65 per barrel (WTI) and the low end is $45 per barrel.

Click on graph for larger image.

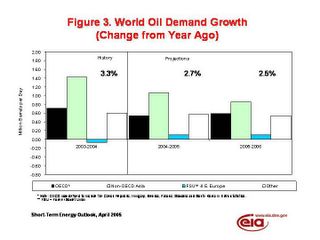

The third graph(DOE slide 4) shows the DOE's expected increase in World demand for crude oil in 2005 and 2006.

The DOE is expecting world oil demand to grow 2.7% in 2005 and 2.5% in 2006, compared to 3.3% in 2004. With worldwide demand at over 80 million bbd, a 2.7% increase would add 2.2 million bbd. So when OPEC announces they are adding 0.5 million bbd that is just a portion of the expected demand increase.

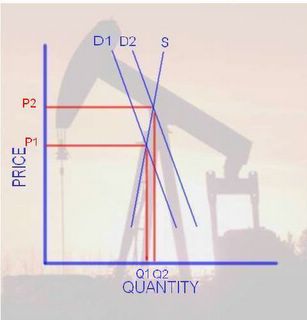

From a previous post on the oil situation: Both the supply and demand curves for oil are very steep. We all know this intuitively. If there is little unused capacity, it takes time for more oil production to become available since this involves huge capital intensive projects. And, in the short term, demand is fairly inelastic over a wide range of prices; for the most part people stay with their routines and keep their same vehicle. With two steep curves (supply and demand) we get the following:

With a small increase in Demand (from D1 to D2), we see a small increase in Quantity (Q1 to Q2), but a large change in Price (from P1 to P2). Also a large price increase would occur if we had a small decrease in supply such as disruption to production, transport or refining (like hurricane Ivan in the GOM last year).

Of course the opposite is also true. A relatively small decrease in demand (or increase in supply) would cause a significant drop in price. If the DOE’s estimate of demand is correct, we will probably continue to see high energy prices.

No wonder the IMF warned today on the risk of a "permanent oil shock". From the FT article:

Raghuram Rajan, IMF chief economist, said: “We should expect to live with high oil prices.”Sorry for all the gloom and doom lately. At least the price of oil was off a little today.

“Oil prices will continue to present a serious risk to the global economy,” he added.

“The shock we see is a permanent shock that is going to continue... and countries need to adjust to that,” said David Robinson, deputy IMF chief economist.

UPDATE:

This graph shows the average price of regular unleaded in California and the US for the last 2 years. The graph is from GasBuddy. Give it a try for prices in your area (by state or city). Thanks to Jim Teter!

Note that the DOE prices were for April 4th ($2.22 for US, $2.46 for California). This graph shows that prices have climbed over the last 3 days, especially in California.

UPDATE 2:

Kash at Angry Bear has an interesting chart tracking economists' predictions, "Oil Prices and Recession".

Dave at Macroblog also has an interesting post "Energy Prices: Not The 1970s Redux (?)" on oil today.

With all this commentary, does that mean prices have peaked?

Housing Bubble: Foreclosures up 57%, Mostly Non-Bubble States

by Calculated Risk on 4/07/2005 12:30:00 AM

In a new report, U.S. foreclosures are up 57% from March 2004.

"The hardest hit states: Ohio, Texas, Michigan and Georgia, with more than 2,300 new foreclosures each."What is interesting is these are the non-bubble states according to an analysis by Richard J. DeKaser, Chief Economist at National City Corporation. Borrowers in these non-bubble states are getting in trouble first, probably because of job losses (their local economies are not as strong as the bubble states without the booming RE business) and they were not able to extract as much equity during the refinancing boom. The article cited higher interest rates and job losses:

Non-mortgage debt may help explain the troubling trend, [Marquette University economist David E. Clark] said. Most consumers opt for fixed-rate mortgages and thus are immune to rising interest rates, Clark noted. But their credit cards and home equity lines of credit carry variable interest rates - rates that have climbed in recent weeks.I am not surprised that the non-bubble states are seeing the impact of the housing slowdown first. But I think the real problem will start when the bubble states see a slowdown and a drop in transaction volumes.

"These (easy credit avenues) may have allowed people to get in rather dire straits financially, get overextended, and this is the final chapter of that process," Clark said.

Jim Houston, vice president with Foreclosure.com, said March's figures involve "the highest spike we've ever seen" in new foreclosures.

UPDATE: Here is the foreclosure.com press release with numbers by state.

Wednesday, April 06, 2005

Talk of the Nation: Schiller on Real Estate

by Calculated Risk on 4/06/2005 07:27:00 PM

Robert Schiller, Yale economics professor and author of "Irrational Exuberance" was on NPR's Talk of the Nation today. Click on listen.

A few Schiller quotes:

"In a sense the irrational exuberance never left the housing market. The housing market started to boom in the late '90s and it continues to go up. It wasn't interrupted by the earnings drop that we saw in stocks in 2001. It has just kept going."How much overvalued is the Real Estate market?

"I think its one of the amazing facts about statistics and econometrics that no one had collected a long time series of home prices in the U.S.. How can you get perspective about whether there are bubbles or not, if no one collects the data?

What I did is I went back and I found various fragmentary home price indexes that kept quality constant and linked them together and added, filled a gap. So I have a series back to 1890. When I plotted that I was quite surprised to see what happened.

The U.S. has basically has never been in a bubble like the one we are in now, with the possible exception of the period right after WWII when the soldiers came home and were bidding up home prices. It is a very rare phenomenon. So people who claim to have done statistical analysis - they can't have done it, they haven't had the data!"

"Some of these people will realize that their mortgage is worth - that the debt is greater than the value of the house and they will walk away. They will say that 'I'm making payments, huge payments on this house and its not even worth what I'm owing". If, as I expect, in many places prices will fall, defaults on mortgages will go up. There will be some disruption in people's lives."

"That varies very much by city. We looked at ratios of median home price to per capita personal income. We find that in many places in the U.S. that is only about 2, the median home is only like 2 years income or 3 years income. But in other cities it is 10 years income. So - I think that is getting a little - more than a little high. What supports it? Why would you live in a city were homes cost 10 years income, when you can live in a city were they cost 3 years income or 2 years income? You might say some cities are better than others and they have better job opportunities than others. But I think they are a bit overrated."In answer to a question:

"Miami had one of the most famous home price bubbles in 1925. In that year people began to think that land was running out in Florida and that you'd better buy now or it will be too late. Promoters started traveling all over the country and people started flowing in - there was a huge immigration into Florida at that time - but then the bubble burst in 1926. And it didn't rekindle in Florida until recently.

I think what is happening in Florida then and now are similar. Its a glamour story, a story of excitement, a story that land is running out that suddenly becomes prominent in people's minds."

Much more in interview. Enjoy!

World Bank: Economic Recovery Globally Has 'Peaked'

by Calculated Risk on 4/06/2005 11:04:00 AM

The World Bank warned Wednesday that the global economic recovery has "peaked" and said the severity of the coming slowdown will depend on the extent to which foreign investors lose their nerve about buying U.S.-dollar-denominated assets.And more:

"The global economy is at a turning point," said Francois Bourguignon, the bank's chief economist, in a foreword to the report. "Growth has peaked, and pressures to address global imbalances are growing, exposing important risks facing both developed and developing countries as the needed adjustments occur."

The bank said its best-case scenario calls for a mild slowdown in global economic growth over the next few years. The annual growth rate of gross domestic product, 3.8% in 2004, is likely to drop to 3.1% this year and hover about that level through 2007. Among developing countries, the rate is likely to slip from 6.6% last year to 5.7% in 2005, and 5.2% in 2006.

Still, the bank said, a new global recession is a possibility. "A reduction in the pace at which central banks are accumulating dollars, a weakening in investors' appetite for risk, or a greater-than-anticipated pickup in inflationary pressures could cause interest rates to rise farther than projected, providing a deeper-than-expected slowdown or even a global recession," it said.

The R word is starting to raise its ugly head. I'll be back to the Mug's game soon.

Monday, April 04, 2005

The Worsening General Fund Deficit

by Calculated Risk on 4/04/2005 06:07:00 PM

Here is the current Year over Year deficit number (April 1, 2004 to April 1, 2005). As of April 1, 2005 our National Debt is:

$7,783,719,222,961.24 (that is almost $7.8 Trillion)

As of April 1, 2004, our National Debt was:

$7,122,841,728,666.17

So the General Fund has run a deficit of $660.9 Billion over the last 12 months. SOURCE: US Treasury

Click on graph for larger image.

Click on graph for larger image.

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

It just keeps getting worse.

NOTE: I use the increase in National Debt as a substitute for the General Fund deficit. For technical reasons this is not exact, but it is close. Besides I think this is a solid measure of our indebtedness; it is how much we owe!

NAR: Pending Home Sales Index

by Calculated Risk on 4/04/2005 03:32:00 PM

The National Association of Realtors (NAR) has introduced a "Pending Home Sales Index".

Here is their first news release "Pending Home Sales Index Rises".

"The Pending Home Sales Index,* based on data collected for February, stands at 123.2, which was 2.2 percent above January and 10.4 percent above February 2004. The index is based on pending sales of existing homes, including single-family and condo. A home sale is pending when the contract has been signed but the transaction has not closed. Pending sales typically close within one or two months of signing.

David Lereah, NAR’s chief economist, said sales are looking strong for March and April. “Although home sales eased in February, housing activity appears to be firming with a modest uptrend in the months ahead,” he said. Data for March existing-home sales will be released April 25.

An index of 100 is equal to the average level of contract activity during 2001, the first year to be analyzed. Coincidentally, 2001 was the first of four consecutive record years for existing-home sales. 2001 sales are fairly close to the higher level of home sales expected in the coming decade relative to the norms experienced in the mid-1990s. As such, an index of 100 coincides with a historically high level of home sales activity."

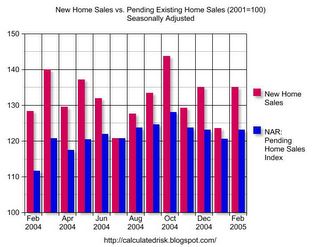

Click on graph for larger image.

This graph compares New Home Sales vs. the new Pending Home Sales Index (2001 = 100 for both series - all data seasonally adjusted). Sources: NAR and Census Bureau.

Previously I have ignored Existing Home Sales since it lagged New Home Sales by a couple of months. Maybe this new index will be more useful.

More on Housing Speculation

by Calculated Risk on 4/04/2005 02:49:00 AM

My most recent post is up on Angry Bear.

Housing: Speculation is the Key

Although my post on Angry Bear is about speculation and the housing bubble, I am mostly concerned with the impact of a housing slowdown on the general economy. Here is my thinking process:

1) Is there a bubble? Yes.

2) If there is a bubble, how widespread?

3) How and when will it end?

4) What will be the impact on the general economy (and the trade deficit, and interest rates)? Click on Graph for larger image.

Click on Graph for larger image.

This graph is part of the answer to "how widespread?" The graph shows home appreciation, in both nominal and real terms, over the last 5 years by region (and the US total). In some of the Central areas, there has been very little appreciation, but I would still be interested in leveraged financing and Mortgage Equity Withdrawal numbers in those areas.

Best Regards to All!

Housing: Speculation is the Key

by Calculated Risk on 4/04/2005 02:21:00 AM

I have taken to calling the housing market a "bubble". But how do I define a bubble?

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation - the topic of this post. Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the "bubble" bursts.

Speculation is the key.

A recent report by the National Association of Realtors (NAR) reported that 23% of all homes nationwide were bought by investors. Another 13% of homes were purchased as second homes. In Miami, it was reported that 85% of "all condominium sales in the downtown Miami market are accounted for by investors and speculators". This is clear evidence of speculation.

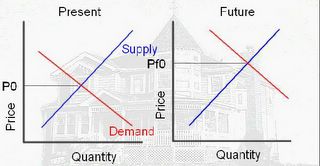

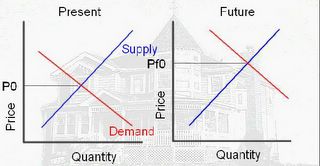

The following supply demand diagrams illustrate this type of speculation.

Click on diagram for larger image.

Click on diagram for larger image.

The above diagram shows the motive for the speculator. If he buys today, at price P0, he believes he can sell in the future at price Pf0 (price future zero), because of higher future demand. The speculation would return: Profit = Pf0-P0-storage costs (the storage costs are mortgage, property tax, maintenance, and other expenses minus any rents).

In this model, speculation is viewed as storage; it removes the asset from the supply. The following diagram shows the impact on price due to the speculation:

Since speculation removes the asset from the supply, the Present supply curve shifts to the left (light blue) and the price increases from P0 to P1. In the second diagram, when the speculator sells, the supply increases (shifts to the right). The future price will fall from PF0 to PF1. As long as (PF1 – storage costs) is greater than P1 the speculator makes a profit.

Since speculation removes the asset from the supply, the Present supply curve shifts to the left (light blue) and the price increases from P0 to P1. In the second diagram, when the speculator sells, the supply increases (shifts to the right). The future price will fall from PF0 to PF1. As long as (PF1 – storage costs) is greater than P1 the speculator makes a profit.

However, if the price does not rise, the speculator must either hold onto the asset or sell for a loss. If the speculator chooses to sell, this will add to the supply and put additional downward pressure on the price.

This type of speculation appears to be rampant only in certain regions, mostly the coastal areas. However, something akin to speculation is more widespread – homeowners using substantial leverage with escalating financing such as ARMs or interest only loans.

Leverage as Speculation.

In this LA Times article "They're In — but Not Home Free", the writer describes a woman that is "able to afford, barely, her first home". She has taken out "an adjustable-rate mortgage that won't require her to pay any principal for three years". She is already strapped, working overtime to pay her bills, and doesn’t know what she will do in three years. She is a gambling that either her income will increase or that the value of her home will rise enough to sell at a profit.

Californians are adopting a "buy now, pay later" strategy on a massive scale. The boom in interest-only loans — nearly half the state's home buyers used them last year, up from virtually none in 2001— is the engine behind California's surging home prices.See article for graphic on “Risky Debt”. Here is a similar article in the Sunday Washington Post, "Homeowners in Harm's Way" and a summary of financing options from the WSJ Online: "Buy Now, Pay Later"

This type of leveraged activity pulls demand from future periods. Starting with the first diagram above, these leveraged financing programs shift the demand curve to the right (light red) and increase the price from P0 to P1. In the future, the demand will be shifted to the left and the future price will be Pf1. If Pf1 is less than P1 (the LA Times buyer's price), then her house might be foreclosed, increasing the supply too!

One way to prolong the bubble is to offer ever more leveraged financing. And here it is - a 35 year loan, interest only for the first 5 years, with no money down and 103% Loan To Value (to cover closing costs). Amazing.

One way to prolong the bubble is to offer ever more leveraged financing. And here it is - a 35 year loan, interest only for the first 5 years, with no money down and 103% Loan To Value (to cover closing costs). Amazing.How many people are on the ragged edge? From the LA Times article:

The number of buyers falling into this category in any given month is unclear. But a California home builder recently got a sense when he sought to answer this question: How many of the potential buyers of his houses could still afford them if interest rates went up even a little?Only one in six buyers qualified for a slightly higher financing package. I believe that means we are close to the end of the housing cycle. Both types of activities are increasing prices: speculation is reducing supply and leverage is increasing demand.

To find out, the builder conducted a little experiment.

His firm's preferred lender had pre-qualified 90 potential buyers for a group of new houses. Since the houses wouldn't be ready for another six months, the builder tightened the loan criteria. He didn't want buyers to sign up for a house and then get frightened into canceling by rising rates.

He raised the threshold from a fully variable loan, the easiest to get since it immediately moves upward when rates increase, to a mortgage that was fixed for the first three years. That would shield buyers from rate jumps for at least a little while, but it's also more expensive.

Under the higher threshold, only about 15 of the buyers still qualified.

The Bust

Housing "bubbles" typically do not "pop", rather prices deflate slowly in real terms, over several years. Historically real estate prices display strong persistence and are sticky downward. Sellers tend to want a price close to recent sales in their neighborhood, and buyers, sensing prices are declining, will wait for even lower prices.

This means real estate markets do not clear immediately, and what we usually observe is a drop in transaction volumes. That is my expectation for this year: stable prices (maybe declining slightly on the coasts) and declining volumes. Stable or lower prices will halt speculation and increase the supply. And if rates rise further, or lenders become more discerning, demand will also decrease. Either spells bust for the current bubble.

Originally posted on Angry Bear.

Saturday, April 02, 2005

The Young Americans’ Employment Opportunity Act of 2005

by Calculated Risk on 4/02/2005 08:22:00 PM

Build your own Bush Administration. The guidelines are in this very funny post. A sample:

Change the terminology of the debate. Of course you can’t come right out and say, “Today I am calling for a repeal of the laws banning child labor.” Instead, give your approach a user-friendly, euphemistic title. Words to use include “America” (or “Americans”), “Opportunity,” “Freedom,” “Patriot,” “Tax-reduction,” etc. With the right words, a bill repealing child labor laws can easily become “The Young Americans’ Employment Opportunity Act of 2005.”Enjoy!