by Calculated Risk on 2/05/2009 08:42:00 AM

Thursday, February 05, 2009

Unemployment Claims Highest Since 1982

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 31, the advance figure for seasonally adjusted initial claims was 626,000, an increase of 35,000 from the previous week's revised figure of 591,000. The 4-week moving average was 582,250, an increase of 39,000 from the previous week's revised average of 543,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 24 was 4,788,000, an increase of 20,000 from the preceding week's revised level of 4,768,000.

Click on graph for larger image in new window.

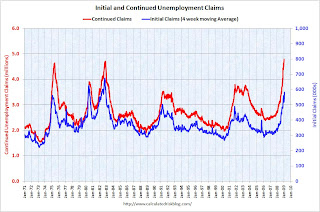

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 582,250, the highest since 1982.

Continued claims are now at 4.79 million - another new record - just above the previous all time peak of 4.71 million in 1982.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

A very weak report ...

Wednesday, February 04, 2009

$15,000 Tax Break for Homebuyers

by Calculated Risk on 2/04/2009 10:15:00 PM

From David Herszenhorn at the NY Times: Senate Approves Tax Break for Homebuyers

The measure would give buyers a tax credit of 10 percent of the price of a primary residence purchased within the year, up to $15,000 ...In early 1975, a $2000 tax credit on the purchase of only new homes only in calendar year 1975 was passed into law (I believe this is correct). The current tax credit is good for both new and existing home purchases. The difference is the purchase of new homes does stimulate the economy by creating construction jobs - the purchase of existing homes does not.

“We do have a history in this country with housing and it goes back to the crash of 1974, which actually in terms of inventory and price declines was comparable to what’s happening now,” [Senator Johnny Isakson, Republican of Georgia] said at a news conference. “Within one year of the inception of that tax credit, two-thirds of the available inventory that was on the market was gone. The market moved back to a balanced inventory, values stabilized and things became very healthy. The only reason I know all of that is I was selling houses in 1974, that’s what I was doing to feed my family and make a living.”

Click on graph for larger image.

Click on graph for larger image.New home sales increased from a 477 thousand SAAR in March 1975 to over 600 thousand SAAR later in the year. But that was from a depressed level as shown on the graph. The real boom in sales happened when the economy recovered - so I'm not sure of the actual impact of the 1975 tax credit.

2009 GDP Forecasts

by Calculated Risk on 2/04/2009 08:47:00 PM

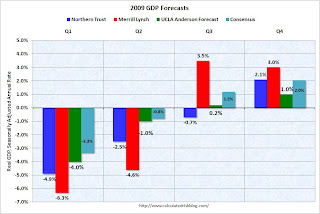

I was asked earlier today about UCLA Anderson Forecast's current outlook. They are forecasting a severe recession, with GDP turning slightly positive in the 2nd half of 2009, but unemployment to continue to rise into 2010.

Here are a few recent 2009 GDP forecasts from UCLA Anderson Forecast, Paul Kasriel at Northern Trust, and David Rosenberg at Merrill Lynch.

Rosenberg is fairly optimistic on GDP growth in the 2nd half of 2009 based on the impact of the stimulus package (although he thinks GDP growth in 2010 will be tepid). He sees unemployment rising to double digit rates in 2010.

Looking at the details, I'm more pessimistic than Merrill on non-residential structures, and a little less pessimistic on residential investment going forward. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Kasriel's forecast is available online and he is projecting unemployment to rise to 8.8% by the end of 2009. Although he thinks GDP growth will turn positive in Q4, he is concerned about a double dip recession.

Just some forecasts to discuss on the comments ...

MIT CRE Price Index Declines Sharply

by Calculated Risk on 2/04/2009 05:57:00 PM

Press Release: MIT commercial property price index posts record drop (hat tip Michael)

Transaction sale prices of commercial property sold by major institutional investors fell by more than 10 percent -- a record -- in the fourth quarter of 2008, according to an index developed and published at the MIT Center for Real Estate that also posted a record 15 percent drop for the year.Professor Geltner's comment about "as severe as that of the early 1990s for commercial property" is referring to the price decline, not the coming decline in non-residential investment. These are two different issues. The price declines will impact property owners who are now underwater and can't refinance, and also impact banks and other investors in CMBS who will experience see higher default rates. The coming decline in non-residential investment will impact GDP and construction employment, but that decline will probably not be as severe as after the S&L related boom.

The 10.6 percent drop in the transactions-based index (TBI) for the fourth quarter is the largest quarterly decline in the gauge's history, which dates to 1984. The previous record was a 9 percent drop in the fourth quarter of 1987. The 15 percent fall in 2008 is also a record, topping the 10 percent and 9 percent declines in 1992 and 1991, respectively.

The index's performance means that prices in institutional commercial property deals that closed during the fourth quarter for properties such as office buildings, warehouses and apartment complexes are now 22 percent below their peak values attained in the second quarter of 2007. The index has fallen in five of the past six quarters, but the recent drop is by far the steepest.

"With the index already having fallen 22 percent in the current downturn, it now seems likely that this down market will be at least as severe as that of the early 1990s for commercial property," said Professor David Geltner, director of research at the Center for Real Estate. In the last major downturn in the U.S. commercial property market 20 years ago, the TBI declined a total of 27 percent from 1987 through 1992, with most of that drop occurring in 1991-92.

For price charts for various sectors, see Transactions-Based Index. It is interesting that prices for retail properties have only started to decline.

BRE Properties: Beginning of "Two Year Declining Rent Curve"

by Calculated Risk on 2/04/2009 04:32:00 PM

Here are some comments from BRE, an apartment REIT (hat tip Brian):

You know there really may not be an adequate description to frame what occurred during the fourth quarter with jobs and the nation's economy.Did

Our Enterprise priorities, like that of many real estate companies, lead with capital preservation and enhanced liquidity. And our tactical decisions are tied to the four key risks that we believe face our industry. First, the depth and duration of this recession, or depression, and the impact on operations and EBITDA; second, the availability and the cost of public capital both near and long term; third, the availability of secured debt from the GSEs; and finally transaction risks, or the ability to sell properties to source capital.

Existing home sales have picked up and standing inventories have declined, but in most markets the level of inventory ranges between five and ten months. There does remain a favorable rent-to-own gap in most of our markets, but it is being challenged.Note that apartments typically compete with lower priced homes. So when he is talking about a price bottom, he is talking about pricing in some lower priced neighborhoods with significant foreclosure activity.

With jobs, we expect the first quarter to rival the fourth quarter with respect to job losses. We then expect to see a deceleration in the layoff momentum with job losses continuing early into 2010 before stabilizing. With respect to housing we expect to see a continued clearing of inventories and the possibility of a bottom in home prices identified in the second half of the year. And finally we believe foreclosures will continue into 2010, but become less of a factor once the market identifies the bottom for prices. We believe we are looking at a negative rent curve for the next two years.

We believe on a composite basis, market rents in 2009 could fall between 3 and 6% from peak levels in 2008. And the rent cuts in 2010 could be deeper, depending on how this next phase of the economy plays out.

On New Development:

In early January, we announced the deceleration of our development program. We recorded a 5.1 million, non-routine charge to abandon three sites we had under control, two in the Inland Empire and one in San Jose.So they are cutting back on new development. And they are being hit by job cuts in retail:

...

The past quarter was an inflection point. The level of economic deterioration was strong enough to render certain [development] sites across the industry infeasible.

Operationally we are facing the toughest conditions in decades. As planned, since October, we have cut market rents more than 3% across the portfolio, with the deepest cuts in Southern California. We are seeing decent traffic and focusing on resident renewals and aggressive leasing to solve for occupancy.And on the Seattle market:

...

the job numbers for the fourth quarter and year end go beyond bleak. ... The headline is the retail impact. Retail job losses are at the top of most of our core markets. Many retail workers' rent, and these layoffs trigger higher move-outs and terminations; and we don't get the feeling the retail industry is finished with their job cuts.

Seattle is no longer immune to the economic fallout. During the fourth quarter Seattle shed 16,000 jobs or a drop of 1% in 90 days as market dropped all the job growth experienced in the first nine months of the year, bringing employment back to December '07 levels. During the fourth quarter the Washington Mutual job cuts kicked off, and in January Microsoft laid of 1,000 workers. Boeing announced it will cut 10,000 jobs, half of those in Seattle, and Starbucks announced another round of layoffs, estimated at 1,000 jobs.And on households "doubling up":

Certain sub-markets have already been impacted. Downtown rents have fallen almost 9% in the fourth quarter and are continuing to drop.

Q: Can you just address with the drop in occupancy and the employment losses ... what's your sense in terms of where are people moving? Are they going to lower quality units, are they doubling up, going with parents, I mean, where are people going?They also noted that there will probably be few apartment transactions this year:

A: ... I think it's pretty similar to past cycles. ... while there's some exodus of households out of California the numbers aren't that great, so it would indicate that people are doubling up, tripling up, moving back to couches, moving back with mom and dad.

I don't think anybody feels a real sense of urgency to jump in and buy at the beginning of a two year declining rent curve. I think we'll probably see transactions begin to move up in the first half of '10 as you get closer to the end of that declining rent curve.

Preprivatize the Banks

by Calculated Risk on 2/04/2009 02:58:00 PM

From Martin Wolf, Why Davos Man is waiting for Obama to save him

Instead of an overwhelming fiscal stimulus, what is emerging is too small, too wasteful and too ill-focused. Instead of decisive action to recapitalise banks, which must mean temporary public control of insolvent banks, the US may be returning to the immoral and ineffective policy of bailing out those who now hold the “toxic assets”.And Yves Smith shreds the new plan: The Bad Bank Assets Proposal: Even Worse Than You Imagined

emphasis added

[T]his program is a crock ... it has [been] cooked up in the complete and utter absence of any serious due diligence on the toxic holdings of the big banks.Exactly. Get in there and find out what they are holding. If the banks are insolvent,

Say what? (funny things politicians say)

by Calculated Risk on 2/04/2009 12:27:00 PM

Here are a couple of quotes that are making the rounds:

"Every month that we do not have an economic recovery package 500 million Americans lose their jobs."Obviously she meant 500 thousand (she corrected herself later). And it appears likely that another 500,000+ jobs were lost in January.

Speaker of the House Nancy Pelosi

“We should agree, as a world, on a monetary and fiscal stimulus that will take the world out of depression.”Mr. Brown's office issued a correction later (recession, not depression). Here is a short video:

Prime Minister Gordon Brown, Feb 3, 2009

Forecast: San Diego Office Vacancy Rate to Top 20%

by Calculated Risk on 2/04/2009 11:30:00 AM

From the San Diego Union-Tribune: Offices' vacancy outlook gloomy

[T]he latest prediction from a survey conducted by the UCLA Anderson Forecast and real estate law firm Allen Matkins ... are grim. UCLA's computer models predict that office rents will continue to decline all the way through 2010. When adjusted for inflation, they are expected to be at levels seen in the mid-1990s.This still might be too optimistic.

Occupancy also is expected to fall over the next few years. UCLA's computer models have vacancies topping out at 22 percent by the end of 2010.

Today, office vacancies range from 14 percent to 17 percent, according to reports from local commercial brokers.

ISM Non-Manufacturing Index Shows Contraction

by Calculated Risk on 2/04/2009 10:03:00 AM

From the Institute for Supply Management: January 2009 Non-Manufacturing ISM Report On Business®

"The NMI (Non-Manufacturing Index) registered 42.9 percent in January, 2.8 percentage points higher than the seasonally adjusted 40.1 percent registered in December, indicating contraction in the non-manufacturing sector for the fourth consecutive month, but at a slightly slower rate. The Non-Manufacturing Business Activity Index increased 5.3 percentage points to 44.2 percent. The New Orders Index increased 2.7 percentage points to 41.6 percent, and the Employment Index decreased 0.1 percentage point to 34.4 percent. The Prices Index increased 6.4 percentage points to 42.5 percent in January, indicating a decrease in prices from December. According to the NMI, two non-manufacturing industries reported growth in January. Respondents are concerned about the global economy and the continued decline in business and spending."This is a weak report. The service sector is still contracting but at a slightly slower pace than in December. The employment numbers remain especially weak.

Corus: One-third of Outstanding Loans Nonperforming

by Calculated Risk on 2/04/2009 09:23:00 AM

From the WSJ: Condo King Corus Weighs Its Options (hat tip James)

Corus Bankshares ... reported a $260.7 million quarterly loss late Friday and said that more than one-third of its $4.1 billion in outstanding loans were nonperforming. Amid what it called a "precipitous decline" in property values, the Chicago lender also warned that banking regulators may soon strip Corus of its standing as a well-capitalized bank and impose higher cash requirements.Another candidate for Bank Failure Fridays. Corus is heavily exposed to condos and Construction & Development (C&D) loans. When the interest reserves run dry, these deals blow up. And down goes the lender ...

...

Corus is one of the few lenders to report that the Treasury Department intends to reject the bank's application for funds from the ... TARP.

...

While it has been clear for months that thousands of condo projects were doomed, the full impact on financial institutions is only now being felt. Construction loans were structured with "interest reserves," provisions that gave developers funds to pay interest until the projects were complete. Now that projects are completed and failing to sell, the loans are going into default.

...

Corus has about $2 billion in unfunded construction commitments and that in the event of a federal takeover, regulators wouldn't be obligated to fund these commitments.

Late Night Thread

by Calculated Risk on 2/04/2009 12:10:00 AM

An open thread and a few posts today you might want to read:

With graphs on the rental vacancy rate, homeowner vacancy rate, and homeownerhip rate.

The economic outlook is grim. The unemployment rate will rise all year, house prices will fall, commercial real estate (CRE) will get crushed ... but a few areas will probably finally hit bottom.

An update from bacon_dreamz. Check it out. And check out the map of where the Mortgage Pigs have gone!

Tuesday, February 03, 2009

Update: Tanta Scholarship Fund

by Calculated Risk on 2/03/2009 09:28:00 PM

A word from bacon_dreamz:

I would like to thank everyone for the very generous response we have received to Tanta’s memorial scholarship and bench fund at ISU. There have been a large number of donations totaling just over $20,000 to date, and all of them are very greatly appreciated. The bench has already been purchased and will be placed on the ISU campus this spring (where Tanta’s parents will be able to visit it whenever they like), and the scholarship itself is very nearly fully endowed, so I’m hopeful that the first award will be next spring.Note from CR: To be fully endowed, The Doris Dungey Endowed Scholarship Fund at Illinois State University needs another $1,500 or so (I've dropped a few bills in the kitty today).

Tanta’s family has been very touched by the kindness and generosity of everyone here (as have I), and I know they have found comfort in the fact that she touched so many lives so deeply. My sincerest thanks to all of you for helping to make this happen in her memory.

Tanta_Vive!

Donations can be made at the link below by entering "Doris Dungey Endowed Scholarship" in the Gift Designation box. Checks made out to the ISU Foundation with “Doris Dungey” in the memo can also be mailed to:

attention: Mary Rundus

Illinois State University, Campus Box 8000

Normal, IL 61790.

http://www.development.ilstu.edu/credit/credit.phtml?id=8000

Also here is map of where the Mortgage Pigs are (from Tanta's brother-in-law):

Click on graph for larger image in new window.

Click on graph for larger image in new window.No Pigs in Florida?

A special thanks to bacon_dreamz for setting up the Scholarship Fund.

For much more on Tanta - tributes, charities, her writing - please see Tanta: In Memoriam

All my to best to everyone, CR

Looking for the Sun

by Calculated Risk on 2/03/2009 06:47:00 PM

2009 will be a grim economic year. The unemployment rate will rise all year, house prices will fall, commercial real estate (CRE) will get crushed ... but there might be a few rays of sunshine too.

Look at these three charts of Cliff Diving: Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly vehicle sales (autos and trucks) as reported by the BEA at a Seasonally Adjusted Annual Rate (SAAR).

Based on the sales reports today from Ford, GM, Toyota and Chrysler, it looks like vehicle sales were below 10 million units (SAAR) for the first time since the early '80s. My estimate is vehicle sales were at a 9.2 million SAAR in January. Ouch! The second cliff diving graph shows New Home Sales for the last 45 years.

The second cliff diving graph shows New Home Sales for the last 45 years.

Sales of new one-family houses in December 2008 were at 331 thousand (SAAR). This is the lowest level ever recorded by the Census Bureau (data collection started in 1963).

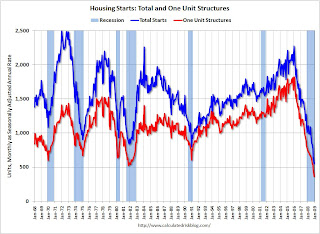

And the third graph shows total and single family housing starts since 1959.  Total starts were at 550 thousand (SAAR) in December, by far the lowest level since the Census Bureau began tracking housing starts in 1959. Single-family starts were at 398 thousand in December; also the lowest level ever recorded (since 1959). Single-family permits were at 363 thousand in November, suggesting single family starts may fall even further next month!

Total starts were at 550 thousand (SAAR) in December, by far the lowest level since the Census Bureau began tracking housing starts in 1959. Single-family starts were at 398 thousand in December; also the lowest level ever recorded (since 1959). Single-family permits were at 363 thousand in November, suggesting single family starts may fall even further next month!

And none of this data is adjusted for changes in population.

No sunshine here. But wait ... we all know this cliff diving will stop sometime, and probably not at zero.

First, look at auto sales ... This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

The estimated ratio for January is 27 years, by far the highest ever. The actual in December was close to 24 years. This is an unsustainable level, and the ratio will probably decline over the next few years. This could happen with vehicles being removed from the fleet, but more likely because of an increase in sales. (For more analysis, see: Vehicle Sales)

This suggests vehicle sales have fallen too far. And if vehicle sales just stablize, the auto companies can stop laying off workers, and the drag on GDP will stop.

New home sales is a little more difficult because of the huge overhang of excess inventory that needs to be worked off. But some people will always buy new homes, and we can be pretty sure that sales won't fall another 270 thousand in 2009 (like in 2008), because that would put sales at 60 thousand SAAR in December 2009. That is not going to happen.

So, at the least, the pace of decline in new home sales will slow in 2009. More likely sales will find a bottom - to the surprise of many.

And we know for certain that single family starts will not fall as far in 2009 as in 2008, because starts can't go negative! So, once again, the pace of decline will at least slow. And more likely starts will find a bottom too (although any rebound will be weak because of the excess inventory problem).

Even though most of the economic news will be ugly in 2009, my guess is all three of these series will find a bottom (or at least the pace of decline will slow significantly). This means that the drag on employment in these industries, and the drag on GDP, will slow or stop.

These will be rays of sunshine in a very dark season. That doesn't mean a thaw, but it will be a beginning ...

Markopolos's Testimony to Congress on Madoff and the SEC

by Calculated Risk on 2/03/2009 06:17:00 PM

Harry Markopolos will testify before Congress tomorrow regarding his many attempts to get the SEC to investigage Madoff.

From the WSJ: Madoff Whistle-Blower Cites 'Abject Failure' by Regulatory Agencies

Harry Markopolos, an independent fraud investigator, said in more than 300 pages of testimony before a House committee that he was repeatedly ignored or given the brush-off by SEC officials.Here is Markopolos' prepared testimony. Fascinating reading.

...

In the documents provided to the committee, he describes his efforts, which began as early as 1999, like a military intelligence operation. Mr. Markopolos said he and his team of investigators collected "intelligence reports from field" operatives and developed networks of contacts to provide information on Mr. Madoff's operation and the feeder funds that allegedly contributed to the Ponzi scheme.

The Residential Rental Market Update

by Calculated Risk on 2/03/2009 03:01:00 PM

Last month I provided an overview of the Residential Rental Market. Here is an update based on the Q4 2008 housing data from the Census Bureau.

See this earlier post for graphs of the homeownership rate, and homeowner and rental vacancy rates.

The supply of rental units has been surging: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been almost 4.1 million units added to the rental inventory. Note: please see caution on using this data - this number is probably too high, but the concepts are the same even with a lower increase.

This increase in units almost offset the recent strong migration from ownership to renting, so the rental vacancy rate has only declined slightly (from a peak of 10.4% in 2004 to 10.1% in the most recent quarter).

Where did these approximately 4.1 rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.05 million units completed as 'built for rent' since Q2 2004. Although we don't have the Q4 2008 data yet, we know completions were pretty low in Q4, so this means that another 3.0 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

Although there are several factors increasing the supply, I believe the main factors are a surge in REO sales to cash flow investors, and frustrated sellers putting their homes up for lease. This is increasing the supply of rental properties, and is finally pushing down rents in many areas.

A caution on Housing Vacancies and Homeownership report

by Calculated Risk on 2/03/2009 02:59:00 PM

This morning the Census Bureau released the Housing Vacancies and Homeownership for Q4 2008. This is a very useful report, and earlier I posted graphs of the decline in the homeownership rate, and changes in the homeowner and rental vacancy rates.

Nerd alert: I've mentioned this before, but as a reminder readers should use caution when using the Estimates of the Housing Inventory. The homeownership and vacancy rates come from a survey of a sample of households, but the inventory data is based on two year old housing unit controls. See the discussion at the bottom of Table 4. Estimates of the Total Housing Inventory

The totals shown above have a two-year time lag (4Q2007 uses 2005 housing unit controls from Population Division, which are projected forward and 4Q2008 uses 2006 housing unit controls from Population Division which are projected forward).We can clearly see the inventory increases are too high for 2007 and 2008. First, the inventory each year increases by the number of housing units completed, minus scrappage and net manufactured homes added (a few scrapped housing units may be rehab'd, but that is minor).

The Census data shows inventory increased by 1.998 million in 2007, and 2.191 million in 2008. These numbers are based on two year old housing unit controls and are clearly way too high. Total completions in 2007 were 1.502 million (plus 95 thousand manufactured homes) and completions were 1.116 million in 2008. Add in some scrappage, and the housing inventory probably increased by less than 1 million in 2008 (less than half the amount the Census Bureau reported this morning).

This is just a reminder that users should use caution when using the inventory numbers.

GM sales fall 48.9%, Toyota Off 32%

by Calculated Risk on 2/03/2009 01:51:00 PM

UPDATE: MarketWatch headline: Chrysler U.S. sales down 54.8% to 62,157 vehicles in January

MarketWatch headline: GM U.S. sales fall 48.9% to 128,198 units in January

From the WSJ: Ford's Sales Fall 40%, Toyota's Drop 32%

Toyota Motor Corp. reported a 32% drop, as the Japanese company sold 117,287 vehicles in the U.S. last month. Its passenger-car sales dropped to 67,263 from 94,586, while its light-truck sales fell to 50,024 from 77,263.Chrysler usually reports last, and they have seen the largest sales declines recently (53% year over year in December).

The good news is auto sales have to be closer to the bottom than the top!

Ford sales fall 42.1% in January

by Calculated Risk on 2/03/2009 12:12:00 PM

From MarketWatch: Ford posts 42.1% drop in January U.S. sales

Ford Motor Co. on Tuesday reported a 42.1% decline in January U.S. sales to 90,596 cars and trucks, down from 156,391 vehicles a year earlier.This is worse than the 32.4% year over year decline Ford reported in December, and the 31.5% decline reported in November.

GM, Toyota and Chrysler report later today.

Fed: Extends Loan Programs because of "Continuing substantial strains"

by Calculated Risk on 2/03/2009 12:03:00 PM

The Federal Reserve on Tuesday announced the extension through October 30, 2009, of its existing liquidity programs that were scheduled to expire on April 30, 2009. The Board of Governors and the Federal Open Market Committee (FOMC) took these actions in light of continuing substantial strains in many financial markets.

The Board of Governors approved the extension through October 30 of the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF), the Commercial Paper Funding Facility (CPFF), the Money Market Investor Funding Facility (MMIFF), the Primary Dealer Credit Facility (PDCF), and the Term Securities Lending Facility (TSLF). The FOMC also took action to extend the TSLF, which is established under the joint authority of the Board and the FOMC.

In addition, to address continued pressures in global U.S. dollar funding markets, the temporary reciprocal currency arrangements (swap lines) between the Federal Reserve and other central banks have been extended to October 30.

emphasis added

Q4: Homeownership Rate Declines to 2000 Level

by Calculated Risk on 2/03/2009 10:01:00 AM

So much for the homeownership gains of the last 8+ years. Gone.

This morning the Census Bureau reported the homeownership and vacancy rates for Q4 2008. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate decreased slightly to 67.5% and is now back to the levels of late 2000.

Note: graph starts at 60% to better show the change.

The homeowner vacancy rate was 2.9% in Q4 2008. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

This leaves the homeowner vacancy rate almost 1.2% above normal, and with approximately 75 million homeowner occupied homes; this gives about 900 thousand excess vacant homes.

The rental vacancy rate increased slightly to 10.1% in Q4 2008, from 9.9% in Q3.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.1% to 8%, there would be 2.1% X 40 million units or about 820,000 units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.1% to 8%, there would be 2.1% X 40 million units or about 820,000 units absorbed.

This would suggest there are about 820 thousand excess rental units in the U.S.

There are also approximately 150 thousand excess new homes above the normal inventory level (for home builders) - plus some uncounted condos.

If we add this up, 820 thousand excess rental units, 900 thousand excess vacant homes, and 150 thousand excess new home inventory, this gives about 1.87 million excess housing units in the U.S. that need to be absorbed over the next few years. (Note: this data is noisy, so it's hard to compare numbers quarter to quarter, but this is probably a reasonable approximation).

These excess units will keep pressure on housing starts and prices for some time.

I'll have some more later today ...