by Calculated Risk on 2/07/2009 11:25:00 PM

Saturday, February 07, 2009

The Competing Stimulus Bills

From the NY Times: Congress Is Divided Over Competing Stimulus Bills

The price tag for the Senate plan is now only slightly more than the $820 billion cost of the measure adopted by the House.This might be a serious problem since the differences are significant.

...

But the competing bills now reflect substantially different approaches. The House puts greater emphasis on helping states and localities avoid wide-scale cuts in services and layoffs of public employees. The Senate cut $40 billion of that aid from its bill, which is expected to be approved Tuesday.

The Senate plan, reached in an agreement late Friday between Democrats and three moderate Republicans, focuses somewhat more heavily on tax cuts, provides far less generous health care subsidies for the unemployed and lowers a proposed increase in food stamps.

Bank Failure Haiku

by Calculated Risk on 2/07/2009 04:36:00 PM

For each bank failure, reader Soylent Green is People has been writing a Haiku.

Here are the ones yesterday ...

From the FDIC: FirstBank Financial Services, McDonough, GA

First Bank, number seven gone

Still no end in sight.

From the FDIC: Alliance Bank, Culver City, CA

F.D.I.C., plus U.S.

Eight In Oh Nine Now.

From the FDIC: County Bank, Merced, California

Trifecta is now complete

A Quinella next?

Very clever. Thanks!

The Homebuyer Tax Credit

by Calculated Risk on 2/07/2009 01:49:00 PM

The Senate has apparently kept the $15,000 homebuyer tax credit in the stimulus package. The tax credit sponsors, Senators Johnny Isakson and Joe Lieberman, estimated the cost would be $18.5 billion. Several analysts (like Dean Baker) made fun of this estimate, and the new is estimate is a cost of $35.5 billion. But this post isn't about the poor math skills of Senators ...

First the details (as far as I can tell):

Clearly this favors higher income tax payers as compared to the current $7,500 tax credit. Ryan Donmoyer at Bloomberg has more: Senate’s Tax Credit Favors Higher-Income Homebuyers

The Cost

The first cost estimate of $18.5 billion from Isakson and Lieberman was absurd.

There were 4.9 existing homes bought in 2008, and another 482 thousand new homes. Even with a decline in sales in 2009, probably close to 5 million homes will be sold.

Of course many low end REOs are being bought by cash flow investors (to rent), and these buyers would not qualify (only primary residences qualify), and 2nd home purchases are excluded too, but 3 to 4 million homebuyers will probably qualify over the next 12 months. Not all homebuyers will receive the entire credit, but even at $12,000 per buyer (the credit can be spread over two years), the cost will be $36 billion to $48 billion. So the new estimate is probably close.

The Purpose

This tax credit is being compared to the 1975 tax credit for homebuyers. However in 1975 the tax credit was for new homes only, and was intended to reduce the inventory of new homes, and help put residential construction workers back to work. A boom in new home sales followed the enactment of the 1975 tax credit, but the cause and effect is debatable because the economy was emerging from a recession anyway. The tax credit probably helped.

Although new home inventory was a little high in 1975, there were few other excess housing units. The homeowner vacancy rate was 1.2% (compared to 2.9% today) and the rental vacancy rate in 1975 was 6% (compared to 10.1% today). So the supply dynamics were very different.

In this case the tax credit is for both existing and new homes. This is more of an incentive to get people to move as opposed to putting people back to work. Whereas there were few excess units in 1975 (except excess new home inventory), there are far too many excess units today.

The sponsors and supporters of this tax credit believe this will support house prices - a mistake because this will mostly just shuffle homeowners between homes, and not reduce the excess supply.

If the incentive was for new homes only, the credit would probably help create some construction jobs. However, the job creation would be limited because of the competing oversupply of existing homes.

The tax credit for existing homes does almost nothing to help the economy. Some might argue that this is more work for agents and home inspectors, and might help with furniture sales, but the impact will be minor. Remember existing home sales are already at a normal level compared to the stock of owner occupied units, so agents are doing fine already (just not compared to the bubble years).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows sales and inventory of existing homes as a percent of Owner Occupied Units (a measure of turnover).

By this measure sales are still above the normal range of about 6% per year. Inventory is above the usual range too. With 76 million owner occupied households, a normal range for existing homes sales is about 4.5 million per year.

The key problem for housing is prices are too high. How does this tax credit help reduce prices? Why are we trying to artificially increase the turnover rate? And why are we targeting a tax credit at higher income individuals?

This tax credit seems ill-conceived, and probably should be removed from the stimulus package. No one has adequately explained how this helps "fix housing first".

CRE Underwater

by Calculated Risk on 2/07/2009 11:50:00 AM

From the NY Times: Sam Zell’s Empire, Underwater in a Big Way (hat tip Gary)

It was, for a brief shining moment, the real estate deal of the century.Nice timing.

In 2007, Sam Zell, the billionaire Chicago investor, sold a portfolio of 573 properties he had assembled over three decades, Equity Office Properties Trust, to the Blackstone Group for $39 billion. It was the largest private equity deal in history, but Blackstone did not stop there: it immediately flipped hundreds of the buildings for $27 billion.

Today, the wreckage of those purchases is strewn across the country, from Southern California to Austin, Tex., to Chicago to New York. Many of the 16 companies that bought Equity Office buildings are now stuck with punishing debt, properties whose values are plummeting and millions of feet of office space they cannot fill.

...

Buyers purchased buildings at what, in retrospect, were vastly inflated prices. Lenders provided lavish, even excessive, financing based on unrealistic expectations of rising rents. And now that values are tumbling, vacancy rates are rising and credit has become impossibly tight, many on both sides are struggling against default, foreclosure or bankruptcy.

...

The buyers found lenders only too willing to finance as much as 90 percent or more of the purchase price, even as profit margins shrank, on a bet that rents and values would continue to rise. The investment banks, including Morgan Stanley, Wachovia, Goldman Sachs, Bear Stearns and Lehman Brothers, in turn collected their fees as they packaged the loans as securities and sold them to investors.

In April 2008 at the Milken conference, Zell said CRE would be fine. Here is what I wrote from the conference:

Sam Zell started by saying we need to separate commercial from residential. Commercial will be fine in his view (not my view). Also Zell thinks losses are overstated for investment banks and CDOs. ... He feels there is too much global demand ("liquidity") for prices to fall too far - especially for Class-A buildings.I think his actions spoke louder than his words!

Bank Failure #9 in 2009: County Bank, Merced, California

by Calculated Risk on 2/07/2009 01:37:00 AM

From the FDIC: Westamerica Bank, San Rafael, California, Acquires All the Deposits of County Bank, Merced, California

County Bank, Merced, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Westamerica Bank, San Rafael, California, to assume all of the deposits of County Bank.Missed this one. Three this week again ...

...

As of February 2, 2009, County Bank had total assets of approximately $1.7 billion and total deposits of $1.3 billion. In addition to assuming all of the failed bank's deposits, including those from brokers, Westamerica Bank agreed to purchase all of County Bank's assets.

The FDIC and Westamerica Bank entered into a loss-share transaction. Westamerica Bank will share in the losses on the asset pools covered under the loss-share agreement. The loss-sharing arrangement is projected to maximize returns on the assets covered by keeping them in the private sector. The agreement also is expected to minimize disruptions for loan customers as they will maintain a banking relationship.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $135 million. Westamerica Bank's acquisition of all deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. County Bank is the ninth bank to fail in the nation this year, and the third in California.

Update: Haiku from Soylent Green is People:

Trifecta is now complete

A Quinella next?

Friday, February 06, 2009

Fed's Yellen: Economic Outlook and Community Banks

by Calculated Risk on 2/06/2009 10:31:00 PM

From San Francisco Fed President Janet Yellen: The Economic Outlook for 2009 and Community Banks. A few excerpt on a common topic: CRE and non-residential investment:

Nonresidential construction declined modestly at the end of last year but, surprisingly enough, has not yet shown the steep declines that have been expected for some time. However, such declines are almost surely imminent. With business activity slowing and new buildings coming on line, vacancy rates on office, industrial, and retail space are all on the rise. For developers, financing is indeed extremely hard to get. The market for commercial mortgage-backed securities has all but dried up. Banks and other traditional lenders have also become less willing to extend funding. It’s no wonder that my contacts are talking about substantial cutbacks on new projects and planned capital improvements on existing buildings.

...

Many community banks have significant commercial real estate concentrations, and these loans are a particular concern in the current environment. At present, the performance of such loans has deteriorated only mildly. But, as I suggested earlier, we can’t count on that situation to continue, since the downturn in commercial real estate construction is just getting started and is likely to be quite challenging.

Senate Reaches Deal on Stimulus Package

by Calculated Risk on 2/06/2009 08:11:00 PM

From the WSJ: Senate Leaders Reach Compromise on Stimulus Plan

Senate Democrats have struck a deal on a $767 billion economic stimulus package, several senators said Friday.It sounds like the ill-conceived homebuyer tax credit made the cut, as CNBC reports:

The deal is expected to bring on enough Republicans to ensure support of passage in the Senate, which will likely require 60 votes. Sen. Sherrod Brown (D., Ohio) told reporters late Friday, "We have a deal."

...

The size of the package has been reduced to around $767 billion from the original $885 billion plan the Senate brought to the floor on Monday, Sen. Kent Conrad (D., N.D.), the chairman of the Senate Banking Committee said.

The spending side has been reduced from $349 billion to $263 billion, while the tax credits have been reduced from $342 billion to $324 billion, Conrad said.

Senator Kent Conrad, a Democrat from North Dakota, said measures including a homebuyer tax credit and auto tax credit would remain in the final package.We need to see the details, but it sounds like they made the package smaller and the composition worse.

Bank Failure #8 in 2009: Alliance Bank, Culver City, CA

by Calculated Risk on 2/06/2009 07:51:00 PM

From the FDIC: California Bank and Trust, San Diego, CA, Acquires All of the Deposits of Alliance Bank, Culver City, CA

Alliance Bank, Culver City, California, was closed today by the California Department of Financial Institutions, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with California Bank & Trust, San Diego, California, to assume all of the deposits of Alliance Bank.The FDIC goes for two this week ...

...

As of December 31, 2008, Alliance Bank had total assets of approximately $1.14 billion and total deposits of $951 million. In addition to assuming all of the deposits of the failed bank, including those from brokers, California Bank & Trust agreed to purchase approximately $1.12 billion in assets at a discount of $9.9 million. The FDIC will retain the remaining assets for later disposition.

The FDIC and California Bank & Trust entered into a loss-share transaction. California Bank & Trust will share in the losses on the asset pools covered under the loss-share agreement. The loss-sharing arrangement is projected to maximize returns on the assets covered by keeping them in the private sector. The agreement also is expected to minimize disruptions for loan customers as they will maintain a banking relationship.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $206.0 million. California Bank & Trust's acquisition of all deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Alliance Bank is the eighth to fail in the nation this year, and the second in California. The last bank to fail in the state was 1st Centennial Bank, Redlands, on January 23.

Update: Haiku from Soylent Green is People:

F.D.I.C., plus U.S.

Eight In Oh Nine Now.

Bank Failure #7 in 2009: FirstBank Financial Services, McDonough, GA

by Calculated Risk on 2/06/2009 05:47:00 PM

From the FDIC: Regions Bank, Birmingham, AL, Acquires All the Deposits of FirstBank Financial Services, McDonough, GA

FirstBank Financial Services, McDonough, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Regions Bank, Birmingham, Alabama, to assume all of the deposits of FirstBank Financial Services.Now you know it is Friday!

...

As of December 31, 2008, FirstBank had total assets of approximately $337 million and total deposits of $279 million. In addition to assuming all of the failed bank's deposits, including those from brokers, Regions agreed to purchase approximately $17 million in assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $111 million. Regions Bank's acquisition of all deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. FirstBank is the seventh bank to fail in the nation this year. The last bank to fail in Georgia was Haven Trust Bank, Duluth, on December 12, 2008.

Update: Haiku from Soylent Green is People:

First Bank, number seven gone

Still no end in sight.

Wells Fargo Offers to Reduce Some Wachovia Mortgages

by Calculated Risk on 2/06/2009 04:49:00 PM

From Bloomberg: Wells Fargo May Cut Loans for Some Wachovia Customers

Wells Fargo ... offered to cut mortgage balances for some Wachovia Corp. customers by 20 percent ... Wells Fargo mailed letters to those borrowers, asking for proof of current income and a 2007 income-tax statement, bank spokeswoman Debora Blume said today in an e-mail. ...The real cost of the Wachovia purchase was the pending losses on the Wachovia loan portfolio - and most of those losses will come from the $118.7 billion portfolio of “Pick-a-Pay” option ARMs Wachovia acquired in the Golden West Financial acquisition in 2006.

“We are encouraged by the response we are getting to our outreach efforts, as it means we will be able to help more people with a solution that works,” Blume wrote.

... San Francisco-based Wells Fargo inherited billions of dollars in future losses when it bought Wachovia for $12.7 billion. Wells Fargo said last week that Wachovia’s option adjustable-rate mortgage portfolio has close to $60 billion of impaired loans.

The Wells offer is probably mostly to ex-Golden West borrowers. We can be pretty sure that Wells thinks this will minimize their losses on these loans. Remember Wells is also receiving favorable tax treatment that makes this more palatable (a somewhat hidden bailout from the taxpayers).

Bailout: Announcement Monday at Noon

by Calculated Risk on 2/06/2009 03:37:00 PM

From CNBC: Treasury's Geithner To Unveil Financial Plan Monday

The Treasury Department Friday said Secretary Timothy Geithner Monday would announce a "comprehensive plan" to stabilize the financial system.We know when, but not exactly what yet - although the article has more details, and I'm sure more will leak out over the weekend.

In a noon news conference, Geithner will lay out a "strategy to strengthen our economy by getting credit flowing again to families and businesses," the statement said.

To build confidence, this should not only be the first Obama administration bailout of the banks, but also the last. Let us hope they know what the word "comprehensive" means.

BofA CEO: No Additional Bailout Needed for BofA

by Calculated Risk on 2/06/2009 01:46:00 PM

From CNBC: BofA CEO Lewis: Bank Will Not Need More TARP Funds

Bank of America won't need any more bailout money from the government and hopes to pay back the $45 billion it's already received within three years, CEO Ken Lewis told CNBC.We will see.

... Lewis also dismissed speculation of a possible government nationalization of BofA as "absurd" and said the controversial acquisition of Merrill Lynch last year will "turn out to be a good investment over time."

...

"We're going to get on with doing business," he said. "And frankly, we had a pretty good January."

Employment Diffusion Index

by Calculated Risk on 2/06/2009 11:04:00 AM

In January, job losses were large and widespread across nearly all major industry sectors.Here is a look at how "widespread" the job losses are ...

BLS, January Employment Report

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the cumulative changes in employment starting in August 2007 (red line is total nonfarm employment). Total employment peaked in December 2007, but the graph starts earlier to show the three key areas - construction, retail and manufacturing - that all saw earlier job losses.

Until a few months ago, the total job losses were far less than the combined losses in construction, retail and manufacturing, suggesting other areas of the economy were doing OK.

However starting in September 2008, job losses in other areas of the economy started increasing rapidly. Still these three industries have been hit hard:

| Industry | Job Losses | Percent of Industry |

| Construction | 857,000 | 6.2% |

| Manufacturing | 1,113,000 | 14.6% |

| Retail | 512,000 | 3.3% |

| Total | 3,572,000 | 2.6% |

The employment diffusion index from the BLS tells the same story.

A diffusion index is a measure of the dispersion of change. This gives a feel for how widespread job gains and losses are across industries. The closer to 50, the more narrow the changes in employment.

A diffusion index is a measure of the dispersion of change. This gives a feel for how widespread job gains and losses are across industries. The closer to 50, the more narrow the changes in employment.Before September, the all industries employment diffusion index was close to 40, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. As of January the index is at 25.3, suggesting job losses are now widespread.

The manufacturing diffusion index has fallen even further, from 40 in May 2008 to just 7.8 in January 2009. Although construction employment has been hit hard (and will see further jobs in 2009 with the CRE bust), manufacturing is now the hardest hit industry.

January Employment Report: 598,000 Jobs Lost, Unemployment Rate 7.6%

by Calculated Risk on 2/06/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment fell sharply in January (-598,000) and the unemployment rate rose from 7.2 to 7.6 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Payroll employment has declined by 3.6 million since the start of the recession in December 2007; about one-half of this decline occurred in the past 3 months. In January, job losses were large and widespread across nearly all major industry sectors.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 598,00 in January, and the annual revision reduced employment by another 311,000 in 2008. The economy has lost almost 2.5 million jobs over the last 5 months!

The unemployment rate rose to 7.6 percent; the highest level since June 1992.

Year over year employment is now strongly negative (there were 3.5 million fewer Americans employed in Jan 2008 than in Jan 2007). This is another extremely weak employment report ...

Bailout: More Equity Stakes?

by Calculated Risk on 2/06/2009 01:04:00 AM

From the WSJ: Bailout Talks Turn to More Equity Stakes

The Obama administration's financial-rescue plan is shaping up to include capital injections with tougher terms than the first round and an expansion of an existing Federal Reserve lending facility that could potentially buy up toxic assets ...It is pretty amazing how the plan keeps shifting. I think they realize the bad bank is unworkable, but they can't take the next step and preprivatize the insolvent banks.

Instead of buying preferred shares, as it did before, the government is discussing taking convertible preferred stakes that automatically convert into common shares in seven years.

...

To deal with the toxic assets at the heart of the financial crisis, the administration is considering expanding the Fed's consumer-lending facility, known as the Term Asset-Backed-Securities Loan Facility.

Thursday, February 05, 2009

Stimulus, Bailout and Employment Report

by Calculated Risk on 2/05/2009 07:34:00 PM

Just a summary post:

A couple of stories:

From the NY Times: Democrats Ready to Press Ahead on Stimulus Vote

From Reuters: Geithner says must avert future crises

The Treasury chief is to make the administration's proposals for reinvigorating the financial system public in a speech on Monday, though no details about when and where it will be delivered were yet available.

Employment related stories this week:

The DOL reported tody: Unemployment Claims Highest Since 1982

From MarketWatch: Monster Employment Index Declines in January

Index dips 13 points as online recruitment activity slows for the fourth consecutive monthFrom ADP:

Year-over-year, the Index was down 26%, a more negative pace than that seen during the previous three months, suggesting further deterioration in labor market conditions to start 2009

Nonfarm private employment decreased 522,000 from December 2008 to January 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®From Reuters: Planned layoffs in January hit 7-year high

Planned layoffs at U.S. firms in January reached their highest monthly level in seven years, according to a report released on Wednesday, as the more than year-old U.S. recession took an increasingly heavy toll on employment.

...

Job cuts announced in January totaled 241,749, up 45 percent from December's 166,348. Layoffs were up from 74,986 in the year-ago period.

"Skips" in Dubai

by Calculated Risk on 2/05/2009 05:37:00 PM

With crashing house prices in Dubai, the owners are "driving away" as opposed to walking away ...

From The Times: Driven down by debt, Dubai expats give new meaning to long-stay car park (hat tip James)

[F]aced with crippling debts as a result of their high living and Dubai’s fading fortunes, many expatriates are abandoning their cars at the airport and fleeing home rather than risk jail for defaulting on loans.

Police have found more than 3,000 cars outside Dubai’s international airport in recent months. Most of the cars – four-wheel drives, saloons and “a few” Mercedes – had keys left in the ignition.

...

Those who flee the emirate are known as skips.

...

“There is no way of tracking actual numbers, but the anecdotal evidence is overwhelming. Dubai is emptying out,” said a Western diplomat.

CMBS on the Chopping Block

by Calculated Risk on 2/05/2009 02:40:00 PM

From Bloomberg: Moody’s to Review $302.6 Billion in Commercial Debt (hat tip Bob_in_MA, Brian for the post title!)

Moody’s Investors Service is reviewing the ratings of $302.6 billion in commercial mortgage-backed securities as real-estate values drop and property owners fall behind on payments.And so it begins for CMBS. First the reviews, then the downgrades, followed by the bank write-downs, and then more reviews ...

The review encompasses 52 percent of outstanding U.S. commercial mortgage-backed debt ranked by Moody’s ...

Zandi: "Looking For a Bottom"

by Calculated Risk on 2/05/2009 12:30:00 PM

From a presentation this morning titled "Looking For a Bottom", Moody's Economy.com chief economist Mark Zandi projected:

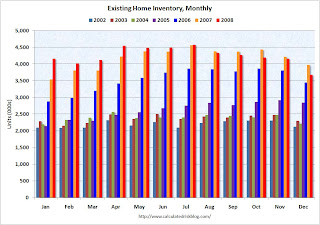

I think it is a little early to call the peak in inventories, although this is something I've been watching. Here is graph from a previous post: Existing Home Sales (NSA)

This graph shows inventory by month starting in 2002.

This graph shows inventory by month starting in 2002.Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been close to 2007 levels for most of 2008. In fact inventory for the last five months was below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle.

I agree with Zandi that housing starts will bottom in 2009. See: Looking for the Sun

However I think it is still too early to forecast the bottom in house prices, especially in the mid to high priced areas.

And it is important to note that Zandi might be starting to look for the bottom in some stats (like starts), but he is forecasting a very sluggish recovery.

CNBC: White House Plans Smaller Bank Bailout

by Calculated Risk on 2/05/2009 11:17:00 AM

From CNBC: White House Now Plans Limited Bank Aid Package

The Obama administration has decided on a new package of aid measures for the financial services industry, including a bad bank component, and is expected to announce them next Monday, according to a source familiar with the planningIf the government buys assets below the banks carrying value, then the banks will have to take additional write-downs and will need more capital. With this plan the taxpayers are still taking all the risk, and the shareholders of the banks receive the rewards. That still doesn't make sense.

The plan will be "smaller" than originally expected, said the industry source, and centered around government guarantees and insurance of troubled assets, what's called a "ring fence" concept.

...

Under the emerging plan, the government will buy toxic assets below the banks "carrying value," which is basically market value, but not at fire sale levels ...