by Calculated Risk on 12/31/2010 11:45:00 PM

Friday, December 31, 2010

Happy New Year!

Evening Reading

by Calculated Risk on 12/31/2010 08:24:00 PM

• From the WSJ: Euro-Zone Bonds to Start New Year With Old Problems

Portugal is the biggest question mark right now, and its borrowing costs have been soaring. Yields on its 10-year bonds jumped to 6.682% at the end of 2010, from 4.065% at the end of 2009.• From Reuters: Estonia joins crisis-hit euro club, others wary. Good luck to Estonia!

• From Catherine Rampell at the NY Times: Career Shift Often Means Drop in Living Standards (ht Ann)

A new study of American workers displaced by the recession sheds light on the sacrifices a large number have made to find work. Many, it turns out, had to switch careers and significantly reduce their living standards.• From Doug Short: Current Market Snapshot: S&P 500 Up 12.78% for the Year

The S&P 500 closed the day down 0.02%, the week up 0.07%, the month up 6.53%, and the year up an impressive 12.78%.

The index is 85.9% above the March 9 2009 closing low, which puts it 19.6% below the nominal all-time high of October 2007.

And a couple previous posts:

• Question #1 for 2011: House Prices

• A Summary of 2010 in Graphs

Question #1 for 2011: House Prices

by Calculated Risk on 12/31/2010 04:20:00 PM

Two weeks ago I posted some questions for next year: Ten Economic Questions for 2011. I'm working through the questions and trying to add some predictions, or at least some thoughts for each question before the end of year.

1) House Prices: How much further will house prices fall on the national repeat sales indexes (Case-Shiller, CoreLogic)? Will house prices bottom in 2011?

There is no perfect gauge of "normal" house prices. Changes in house prices depend on local supply and demand. Heck, there is no perfect measure of house prices!

That said, probably the three most useful measures of house prices are 1) real house prices, 2) the house price-to-rent ratio, and 3) the house price-to-median household income ratio. These are just general guides.

Real House Prices

The following graph shows the Case-Shiller Composite 20 index, and the CoreLogic House Price Index in real terms (adjusted for inflation using CPI less shelter).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

As I've noted before, I don't expect real prices to fall to '98 levels. In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope in real prices.

If real prices fall to 100 on this index (seems possible) that implies about a 10% decline in real prices. However what everyone wants to know is the change in nominal prices (not inflation adjusted). If real prices eventually fall 10%, that doesn't mean nominal prices will fall that far. House prices tend to be sticky downwards, except in areas with a large number of foreclosures. That is key a reason why prices have been falling for years, instead of adjusting immediately.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through October 2010 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph through October 2010 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

I'd expect this ratio to decline another 10% to 20%. That could happen with falling house prices or rents increasing (recent reports suggest rents are now increasing).

Price to Household Income

The third graph shows the Case Shiller National price index (quarterly) and the median household income (from the Census Bureau, 2010 estimated).

The third graph shows the Case Shiller National price index (quarterly) and the median household income (from the Census Bureau, 2010 estimated).

Once again this ratio is still a little high, and I'd expect this ratio might decline another 10%. That could be a combination of falling house prices and an increase in the median household income.

This isn't like in 2005 when prices were way out of the normal range by these measures, but it does appear prices are still a little too high.

House Prices and Supply

The final graph (repeat) shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

The final graph (repeat) shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

House prices are through October using the composite 20 index. Months-of-supply is through November.

We need to continue to watch inventory and months-of-supply closely for hints about house prices. Right now house prices are falling at about a 10% annual rate.

Note: there have been periods with high months-of-supply and rising house prices (see: Lawler: Again on Existing Home Months’ Supply: What’s “Normal?” ) so this is just a guide.

My guess:

I think national house prices - as measured by these repeat sales indexes - will decline another 5% to 10% from the October levels. I think it is likely that nominal house prices will bottom in 2011, but that real house prices (and the price-to-income ratio) will decline for another two to three years.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

House Price Predictions

by Calculated Risk on 12/31/2010 02:19:00 PM

Here are a few predictions on house prices (I'm working on mine):

• From Peter Schiff in the WSJ: Home Prices Are Still Too High

[The Case Shiller] index would need to decline an additional 20.3% from current levels just to get back to the trend line.So put Schiff down for another 30% or so.

...

With a bleak economic prospect stretching far out into the future, I feel that a 10% dip below the 100-year trend line is a reasonable expectation within the next five years ...

• From Gary Shilling: House Prices Will Now Drop Another 20%

• From Jan Hatzius at Goldman Sachs: Another 5% in 2011.

[W]e now expect house prices to fall another 5% during 2011. The reason is the still-large excess supply, as we have only unwound about one-third of the pre-bubble increase in the homeowner vacancy rate so far.I'll post my prediction soon.

Problem Banks: Stress by State

by Calculated Risk on 12/31/2010 10:25:00 AM

Some more interesting data from Surferdude808:

With the banking crisis ending its third year, it may prove useful to identify which states have experienced the most stress.

At year-end 2007, there were 8,536 insured institutions headquartered in the 50 states, D.C., and Puerto Rico. Since that time, 1,340 or 15.7 percent have either failed or made an appearance on the Unofficial Problem Bank List (see table below).

When ranking markets with a minimum of 15 institutions at year-end 2007, Arizona has experienced the most stress with 45.6 percent of its institutions having failed or being identified as a problem. Washington is a close second at 45.4 percent. The other stressed banking states that rank in the top ten include Nevada (43 percent), Oregon (40 percent), Florida (37 percent), Georgia (34 percent), California (34 percent), Utah (32 percent), Idaho (26 percent), and Colorado (25 percent).

The common theme among these is overexposure to commercial real estate lending, particularly residential construction & development loans, and the collapse of real estate markets. At the other end of the spectrum with comparatively little stress include Iowa (4.3 percent), New Hampshire (4.2 percent), and West Virginia (1.5 percent). Vermont is the only state that has not experienced a failed institution or one appearing on the Unofficial Problem Bank List.

| State | 2007 Count | 20101 | Removals2 | Failures3 | Total4 | % 5 | Rank |

|---|---|---|---|---|---|---|---|

| AK | 6 | 1 | 1 | 0.0% | 47 | ||

| AL | 160 | 24 | 4 | 28 | 17.5% | 16 | |

| AR | 150 | 14 | 2 | 2 | 18 | 12.0% | 25 |

| AZ | 57 | 15 | 2 | 9 | 26 | 45.6% | 1 |

| CA | 313 | 65 | 6 | 34 | 105 | 33.5% | 7 |

| CO | 159 | 33 | 4 | 3 | 40 | 25.2% | 10 |

| CT | 56 | 7 | 1 | 8 | 14.3% | 23 | |

| DC | 8 | 2 | 2 | 0.0% | 47 | ||

| DE | 33 | 3 | 3 | 9.1% | 33 | ||

| FL | 317 | 67 | 4 | 45 | 116 | 36.6% | 5 |

| GA | 352 | 64 | 4 | 51 | 119 | 33.8% | 6 |

| HI | 9 | 3 | 3 | 0.0% | 47 | ||

| IA | 391 | 14 | 2 | 1 | 17 | 4.3% | 44 |

| ID | 19 | 4 | 1 | 5 | 26.3% | 9 | |

| IL | 671 | 65 | 1 | 38 | 104 | 15.5% | 20 |

| IN | 162 | 13 | 3 | 1 | 17 | 10.5% | 27 |

| KS | 357 | 32 | 5 | 7 | 44 | 12.3% | 24 |

| KY | 206 | 16 | 3 | 1 | 20 | 9.7% | 29 |

| LA | 162 | 8 | 1 | 1 | 10 | 6.2% | 39 |

| MA | 181 | 8 | 1 | 1 | 10 | 5.5% | 41 |

| MD | 97 | 15 | 6 | 21 | 21.6% | 12 | |

| ME | 34 | 2 | 2 | 5.9% | 40 | ||

| MI | 164 | 22 | 3 | 10 | 35 | 21.3% | 13 |

| MN | 443 | 65 | 2 | 15 | 82 | 18.5% | 15 |

| MO | 361 | 26 | 3 | 11 | 40 | 11.1% | 26 |

| MS | 97 | 4 | 1 | 5 | 5.2% | 42 | |

| MT | 79 | 14 | 1 | 15 | 19.0% | 14 | |

| NC | 112 | 14 | 2 | 2 | 18 | 16.1% | 18 |

| ND | 97 | 4 | 1 | 5 | 5.2% | 42 | |

| NE | 248 | 10 | 5 | 2 | 17 | 6.9% | 38 |

| NH | 24 | 1 | 1 | 4.2% | 45 | ||

| NJ | 127 | 14 | 3 | 3 | 20 | 15.7% | 19 |

| NM | 53 | 7 | 2 | 9 | 17.0% | 17 | |

| NV | 44 | 8 | 1 | 10 | 19 | 43.2% | 3 |

| NY | 203 | 16 | 1 | 4 | 21 | 10.3% | 28 |

| OH | 265 | 19 | 2 | 4 | 25 | 9.4% | 31 |

| OK | 259 | 17 | 1 | 2 | 20 | 7.7% | 37 |

| OR | 40 | 9 | 1 | 6 | 16 | 40.0% | 4 |

| PA | 246 | 17 | 3 | 20 | 8.1% | 36 | |

| PR | 10 | 1 | 3 | 4 | 0.0% | 47 | |

| RI | 13 | 2 | 2 | 4 | 0.0% | 47 | |

| SC | 93 | 17 | 1 | 4 | 22 | 23.7% | 11 |

| SD | 89 | 7 | 1 | 8 | 9.0% | 34 | |

| TN | 203 | 17 | 1 | 18 | 8.9% | 35 | |

| TX | 659 | 48 | 7 | 8 | 63 | 9.6% | 30 |

| UT | 68 | 16 | 6 | 22 | 32.4% | 8 | |

| VA | 119 | 16 | 2 | 18 | 15.1% | 22 | |

| VT | 16 | 0 | 0.0% | 47 | |||

| WA | 97 | 28 | 2 | 14 | 44 | 45.4% | 2 |

| WI | 296 | 39 | 3 | 3 | 45 | 15.2% | 21 |

| WV | 68 | 1 | 1 | 1.5% | 46 | ||

| WY | 43 | 2 | 1 | 1 | 4 | 9.3% | 32 |

| Totals | 8,536 | 935 | 82 | 323 | 1,340 | 15.7% |

2 Unofficial Problem Bank List Removals (ex-Failures)

3 Failures (2008-2010)

4 Total Failures, UPBL, & UPBL Removals (ex-Failures)

5 Total failures, UBPL, and UPBL ex-failures to 2007 count (a percentage for states with less than 15 institutions is not determined because of possible skew to ranking).

Unofficial Problem Bank list increases to 935 Institutions

by Calculated Risk on 12/31/2010 09:05:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 31, 2010.

Changes and comments from surferdude808:

The FDIC finally released its enforcement actions for November 2010. After 18 additions and two removals, the Unofficial Problem Bank List finishes 2010 at 935 institutions and assets of $412.4 billion. The two removals were McClave State Bank, McClave, CO ($21 million) and First Resource Bank, Savage, MN ($17 million).

Among the 18 additions are Baylake Bank, Sturgeon, WI ($1.1 billion Ticker: BYLK); Signature Bank of Arkansas, Fayetteville, AR ($617 million); Regent Bank, Davie, FL ($471 million Ticker: RGTB); Grand Bank & Trust of Florida, West Palm Beach, FL ($463 million); United American Bank, San Mateo, CA ($344 million Ticker: UABK); Santa Lucia Bank, Atascadero, CA ($265 million Ticker: SLBA); and New Millennium Bank, New Brunswick, NJ ($246 million Ticker: NMNB).

Other changes include the Federal Reserve issuing a Prompt Corrective Action (PCA) order against BankEast, Knoxville, TN ($287 million). The FDIC terminated a PCA order against Bank 1st, Albuquerque, NM ($78 million).

Transition Matrix

With the passage of another quarter, it is time to update the transition matrix. The Unofficial Problem Bank List debuted on August 7, 2009 with 389 institutions with assets of $276.3 billion (see table below). Over the past 16 months, 163 institutions have been removed from the original list with 114 due to failure, 35 due to action termination, and 14 due to unassisted merger. Almost 30 percent of the 389 institutions on the original list have failed, which is substantially higher than the 12 percent figure usually cited by the media as the failure rate for institutions on the FDIC Problem Bank List. Failed bank assets have totaled $161 billion or nearly 59 percent of the $276.3 billion on the original list.

Since the publication of the original list, another 844 institutions have been added. However, only 709 of those 844 additions remain on the current list as 135 institutions have been removed in the interim. Of the 135 interim removals, 102 were due to failure, 23 were due to unassisted merger, 8 from action termination, and two from voluntary liquidation. In total, 1,296 institutions have made an appearance on the Unofficial Problem Bank List and 216 or 16.7 percent have failed. Of the 298 removals, failure is the primary form of exit (216 or 72 percent) while only 43 or 14.4 percent have been rehabilitated. The average asset size of removals because of failure is $1.1 billion. Currently, the average asset size of institutions on the current list is $441 million versus $710 million on the original list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 35 | (5,158,906) | |

| Unassisted Merger | 14 | (2,176,310) | |

| Failures | 114 | (161,735,942) | |

| Asset Change | (14,407,340) | ||

| Still on List at 7/02/2010 | 226 | 92,834,931 | |

| Additions | 709 | 319,519,339 | |

| End (12/31/2010) | 935 | 412,354,270 | |

| Interperiod Deletions1 | |||

| Action Terminated | 8 | 14,115,832 | |

| Unassisted Merger | 23 | 22,357,619 | |

| Voluntary Liquidation | 2 | 833,567 | |

| Failures | 102 | 75,345,146 | |

| Total | 135 | 112,652,164 | |

| 1Institution not on 8/7/2009 or 12/31/2010 list but appeared on a list between these dates. | |||

Thursday, December 30, 2010

Housing: Hank Paulson takes a loss

by Calculated Risk on 12/30/2010 10:45:00 PM

From Reuters: Ex-Treasury chief Paulson loses $1 mln on DC home

Paulson bought the home for $4.3 million in August 2006, and sold the home for $3.25 million on Dec 21st this year. A decline of almost 25%. Ouch.

That is about normal for D.C.

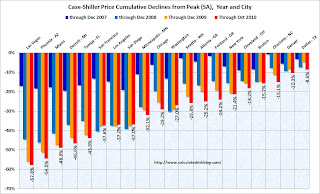

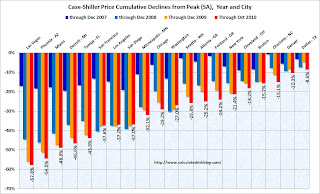

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the graph of the price declines for the 20 Case-Shiller cities.

Washington D.C. is off 27% from the peak. The price peak was in March 2006, and prices had already declined about 3% by August when Paulson bought.

He could have done worse. Prices in D.C. are up since March 2009.

Note: For those who missed it, yesterday I posted A few for Graphs for 2010. Enjoy!

Hotels: RevPAR up 3.6% compared to same week in 2009

by Calculated Risk on 12/30/2010 08:18:00 PM

A weekly update on hotels from HotelNewsNow.com: STR: US performance for week ending 25 Dec.

In year-over-year comparisons, occupancy increased 2.2 percent to 34.6 percent, average daily rate was up 1.4 percent to US$87.13, and revenue per available room finished the week up 3.6 percent to US$30.16.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

This is the slow season for hotels, and the key will be if business travel picks up early next year.

When 2010 started, hotel occupancy was running about the same rate as in 2009 - the worst year for hotels since the Great Depression. In the spring, the occupancy rate increased, and by mid-year occupancy had caught up with 2008 (2008 was weak year for hotels). For the last couple of months the occupancy rate has been running ahead of 2008. The year-over-year comparisons will look great in early 2011, but an important comparison will be with the median for '00 through '07.

A few comments from Jeff Higley at HotelNewsNow.com: There’s more than one way to describe 2010

I don’t fall in the camp that believes the United States hotel industry is in the midst of a full recovery just yet.Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Sure, there are signs the worst is over as hoteliers across the country are trying to dig out from the economic mess of the past two years. 2010 has been a year of extremes for the industry. It seems every week sends a different signal regarding the industry’s trek to recovery.

...

One full-service property I stayed at had a 7% occupancy rate on one of the nights of my visit; another property had 12 cars in the parking lot during the overnight hours. ... One the other hand, more roomnights were sold during July than any other month EVER, according to STR data.

...

In a nutshell, the hotel industry is seeing positive signs, but there’s still a long way to go before it can say it is in a true recovery. There are plenty of ways to measure success, but in this business there’s only one that truly counts: rates. When we see at least four months of year-over-year increases in rate and when the overall average daily rate gets to within five bucks of its $107 peak in 2008 (it’s about $10 off right now), it will be time to truly break out the recovery bubbly.

LPS: Over 4.3 million loans 90+ days or in foreclosure

by Calculated Risk on 12/30/2010 04:05:00 PM

LPS Applied Analytics released their November Mortgage Performance data. According to LPS:

• The average number of days delinquent for loans in foreclosure is a record 499 days

• Over 4.3 million loans are 90 days or more delinquent or in foreclosure

• Delinquency rates are down across all products as more loans entered foreclosure and new delinquencies declined.

• Foreclosure inventory increases are being driven both by elevated levels of foreclosure starts as well as a very limited amount of foreclosure sale activity.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 9.02% of mortgages are delinquent (down from 9.29% in October), and another 4.08% are in the foreclosure process (up from 3.92% in October) for a total of 13.10%. It breaks down as:

• 2.61 million loans less than 90 days delinquent.

• 2.16 million loans 90+ days delinquent.

• 2.16 million loans in foreclosure process.

For a total of 6.92 million loans delinquent or in foreclosure.

Note: I've seen some people include these 7 million delinquent loans as "shadow inventory". This is not correct because 1) some of these loans will cure, and 2) some of these homes are already listed for sale (so they are included in the visible inventory).

Two key numbers to watch in 2011 are:

• New delinquencies. With falling house prices, delinquencies could start to increase again.

• Foreclosures. With the end of the foreclosure moratoriums, foreclosure sales should increase - and the number of homes in the foreclosure process should decline. However REOs (Real Estate Owned) will increase unless the homes are sold.

Question #4 for 2011: U.S. Economic Growth

by Calculated Risk on 12/30/2010 02:19:00 PM

A week ago I posted some questions for next year: Ten Economic Questions for 2011. I'm working through the questions and trying to add some predictions, or at least some thoughts for each question before the end of year.

4) Economic growth: After I took the "over" for 2011 back in November, a number of analysts have upgraded their forecasts. As an example, Goldman Sachs noted Friday, Dec 17th:

The US economic outlook for 2011 has improved further with enactment of the fiscal compromise, as well as a stronger trend in recent data. As we forewarned, we are revising up our forecasts to incorporate this news and now expect real GDP to rise 3.4% in 2011 and 3.8% in 2012 (up from 2.7% and 3.6%) ...It does appear GDP growth will increase in 2011, although GDP growth will probably still be sluggish relative to the slack in the system. How much will the economy grow in 2011?

For 2010 there were a number of forecasts for a "V-shaped" recovery (4% to 6% real GDP growth range) - and also a number of forecasts for a double dip recession. Both wrong.

I took the boring middle ground: sluggish and choppy growth, but no double dip. The key reasons were 1) recoveries from financial crisis tend to be sluggish, and 2) the drag from residential investment (RI) would be less in 2010 (so a double dip seemed less likely).

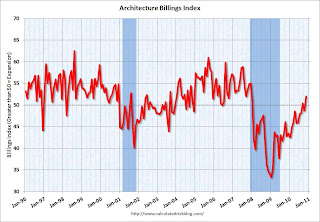

There are still plenty of scars from the financial crisis (excessive debt, high unemployment, excess capacity, excess supply of housing, a large number of homeowners with negative equity, and high foreclosure activity), but the economy is slowly healing. And even though residential investment will be weak in 2011, I think RI will make a positive contribution to GDP growth for the first time since 2005. And another sector, non-residential investment in structures, will probably bottom in 2011 based on the Architecture Billings index.

There are still plenty of downside risks: financial contagion from Europe, budget problems at state and local governments, and falling house prices all could lead to slower U.S. growth.

However my guess is growth will be sluggish relative to the slack in the system, but above the 2010 growth rate. Usually I don't forecast a specific number, but for personal reasons I will this year (probably jinxing myself). For 2011 I'll take 3.7% real GDP growth. That is consistent with my employment / unemployment rate forecasts, and that would also be the highest growth rate since Clinton was President (not saying much because the '00s were so bad).

As a reminder - this will not feel like a recovery for the millions of unemployed workers, and for the millions more who are working part time or for lower wages. This will not feel like an economic recovery until the unemployment rate drops sharply and real income for the middle class starts to increase.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Kansas City Fed: Manufacturing activity "continued at a solid pace" in December

by Calculated Risk on 12/30/2010 11:00:00 AM

From the Kansas City Fed: Survey of Tenth District Manufacturing

Tenth District manufacturing activity continued at a solid pace in December, and producers were increasingly optimistic about future activity. Price indexes in the survey rose further, with a marked increase in raw materials prices.This is the last of the regional Fed surveys for December. The regional surveys provide a hint about the ISM manufacturing index, as the following graph shows.

The net percentage of firms reporting month-over-month increases in production in December was 21, unchanged from 21 in November and up from 10 in October. ... The employment index increased to its highest level in three years, while the new orders for exports index edged down from 11 to 7.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through December), and averaged five Fed surveys (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

The regional surveys suggest an increase in manufacturing activity in December.

The ISM manufacturing index will released on Monday, Jan 3, 2011.

Pending Home Sales index increases 3.5% in November

by Calculated Risk on 12/30/2010 10:00:00 AM

From the NAR: Pending Home Sales Continue Recovery

The Pending Home Sales Index,* a forward-looking indicator, rose 3.5 percent to 92.2 based on contracts signed in November from a downwardly revised 89.1 in October [revised down from 89.3]. The index is 5.0 percent below a reading of 97.0 in November 2009. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This suggests existing home sales in December and January will be somewhat higher than in November.

Also ...

• The Chicago PMI for December (released this morning) was stronger than expected. The headline index was 68.6, well above the 62.5 expected.

The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER achieved its highest level since July 1988, expanding for the fifteenth consecutive month.Production (at 74.0) "reached its highest levels since October 2004", and new orders (73.6) "improved to 2005 levels". The employment index increased to 60.2 from 56.3 in November. This continues the trend of stronger reports recently.

Weekly Initial Unemployment Claims below 400,000, Lowest since July 2008

by Calculated Risk on 12/30/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 25, the advance figure for seasonally adjusted initial claims was 388,000, a decrease of 34,000 from the previous week's revised figure of 422,000. The 4-week moving average was 414,000, a decrease of 12,500 from the previous week's revised average of 426,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 12,500 to 414,000.

Even though weekly claims are seasonally adjusted, sometimes data for holiday weeks can be a little off.

In general the four-week moving average has been declining and that is good news. If weekly unemployment claims remain below 400,000 that would suggest a better labor market.

Wednesday, December 29, 2010

Case Shiller House Prices: Which cities will hit post bubble lows next?

by Calculated Risk on 12/29/2010 08:41:00 PM

In the S&P/Case-Shiller report for October, S&P noted:

[S]ix markets – Atlanta, Charlotte, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices started to fall in 2006 and 2007S&P reports the data Not Seasonally Adjusted (NSA) because of concerns about foreclosures impacting the seasonal factor.

Using the Seasonally Adjusted (SA) series, eleven cities were at post bubble lows; the six cities listed above plus Phoenix, Chicago, Detroit, New York and Las Vegas.

The following graph shows the percent above the post bubble lows for the 20 Case-Shiller cities and the two composite indexes using both SA and NSA data.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. Las Vegas was slightly above the post bubble low NSA (it isn't apparent on the graph).

We can probably guess the cities that will set new post bubble lows in November. Using the NSA data, Las Vegas, New York and Detroit will all probably join the list above setting new lows.

Using the SA data, Dallas, Cleveland, Denver, and maybe the Composite 20 index will be at new lows.

Note: Earlier I posted A few for Graphs for 2010. Enjoy!

Lawler Forecast for 2011: Housing Starts and New Home Sales

by Calculated Risk on 12/29/2010 04:25:00 PM

Earlier I posted A few for Graphs for 2010. Enjoy!

A 2011 forecast from economist Tom Lawler:

| 2010 (estimate) | 2011 (forecast) | |

|---|---|---|

| Total Starts | 588 | 665 |

| .... Single Family | 473 | 520 |

| .... Multi Family | 115 | 145 |

| New Home Sales | 320 | 365 |

Note: Tom already forecast completions would be at a record low next year, but he thinks starts will increase "with most of the increase coming in the second half of the year".

A special thanks to Tom Lawler for sharing his insights with me this year - and allowing me to share some of them!

BLS Change on Unemployment Duration

by Calculated Risk on 12/29/2010 02:47:00 PM

To make this clear (since I mentioned this change earlier): This change will have no impact on the number of unemployed or the unemployment rate. This will only impact the average duration of unemployment.

From the BLS: Changes to data collected on unemployment duration

Effective with data for January 2011, the Current Population Survey (CPS) will be modified to allow respondents to report longer durations of unemployment. Presently, the CPS accepts unemployment durations of up to 2 years; any response of unemployment duration greater than this is entered as 2 years. Starting with data for January 2011, respondents will be able to report unemployment durations of up to 5 years. This change will likely affect estimates of average (mean) duration of unemployment. The change will not affect the estimate of the number of unemployed persons and will not affect other data series on the duration of unemployment.Currently if someone says they have been unemployed longer than 2 years, they are listed at 2 years (the current maximum). This new change will allow for responses up to 5 years and will probably have a small impact on the average (mean) duration of unemployment, but will have no impact on the median duration - or on the number unemployed or the unemployment rate.

A few Graphs for 2010

by Calculated Risk on 12/29/2010 11:36:00 AM

Click on graphs for a larger image in graph gallery.

Click on graphs for a larger image in graph gallery.

The first graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

As of November there were 7.4 million fewer payroll jobs in the U.S. compared to the peak of employment in 2007. If the U.S. economy adds 200,000 jobs per month, it will take 3 years to get back to the previous peak (2 years at 300,000 per month). And that doesn't include jobs needed to offset population growth (about 125,000 jobs per month).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate.

Two of the key stories in 2010 were the unemployment rate (red line) stayed near 10% (at 9.8% in November), and the Labor Force Participation Rate declined to 64.5% in November (blue line). This is the percentage of the working age population in the labor force - and the decline suggests that a large number of people have just given up looking for work.

And now to housing ...

This graph shows existing home sales (left axis) and new home sales (right axis) through November.

This graph shows existing home sales (left axis) and new home sales (right axis) through November.

A key story in 2010 was the collapse in home sales following the expiration of the homebuyer tax credit (Note: the tax credit is widely viewed as a failure).

Existing home sales are back to the levels of 1997 / 1998 and new home sales fell to record lows in the 2nd half of 2010.

As existing home sales declined, existing home inventory and months-of-supply increased.

As existing home sales declined, existing home inventory and months-of-supply increased.

This graph shows the year-over-year change in inventory and the months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Inventory increased 5.4% YoY in November and the months-of-supply (9.5 months in November) is well above normal.

And the high level of inventory has pushed down house prices. This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

And the high level of inventory has pushed down house prices. This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

With the increase in inventory (and months-of-supply), it was no surprise that house prices started declining again in the 2nd half of 2010.

The good news is housing starts stayed near record low levels. This is helping to reduce the excess inventory of housing units.

The good news is housing starts stayed near record low levels. This is helping to reduce the excess inventory of housing units.

This graph shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight up and down over the last six months due to the home buyer tax credit.

Another piece of "good news" is it appears that mortgage delinquencies might have peaked.

This graph based on quarterly data from the MBA shows the percent of loans delinquent by days past due.

This graph based on quarterly data from the MBA shows the percent of loans delinquent by days past due.

Although delinquencies might have peaked, the level is still very high and there are many more foreclosures in the pipeline.

Note: With declining house prices, the number of homeowners with negative equity will increase - and the delinquency rate might start increasing again.

Some "bad news" for housing is that REO (Real Estate Owned) inventories at Fannie, Freddie and the FHA are at record levels.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2010.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2010.

The REO inventory for the "Fs" has increased sharply over the last year, from 153,007 at the end of Q3 2009 to a record 293,171 at the end of Q3 2010.

Remember this is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs, and the overall REO inventory is below the peak in 2008.

On manufacturing, there was a pickup in capacity utilization and industrial production, but there is still a large amount of excess capacity.

On manufacturing, there was a pickup in capacity utilization and industrial production, but there is still a large amount of excess capacity.

This graph shows Capacity Utilization. This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.2% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Another key story in 2010 is that the consumer has started spending again.

Another key story in 2010 is that the consumer has started spending again.

This graph shows real Personal Consumption Expenditures (PCE) through November (2005 dollars).

The two-month method of estimating real PCE growth for Q4 (a fairly accurate method), suggests real PCE growth of 4.3% in Q4! So this looks like a pretty strong quarter for growth in personal consumption. The last time real PCE grew at more than 4% was in 2006.

And the final graph is a little bit of good news for commercial real estate.

And the final graph is a little bit of good news for commercial real estate.

In 2010, investment in non-residential structures was a drag on GDP growth. However, this graph of the Architecture Billings Index shows expansion in billings for the first time in almost 3 years. (above 50 is expansion).

This index usually leads investment in non-residential structures by about 6 to 9 months.

Best to all

Leonhardt on 2010: A Year That Fizzled

by Calculated Risk on 12/29/2010 07:57:00 AM

Note: There will be no release this week of mortgage applications from the Mortgage Bankers Association.

From David Leonhardt at the NY Times: In the Rearview, a Year That Fizzled

When 2010 began, hiring and consumer spending were finally picking up. ... By the summer, the unemployment rate was rising again, and Americans’ attitudes about the future were again souring.This graphic has two charts - the second one shows the "long road back" to full employment (below 6% unemployment rate). According to Moody's, if the economy adds 200,000 jobs per months, it will take until 2020. At a 250,000 per month pace, it will take until 2016. A long long time ...

...

To look back at 2010 and to look ahead, we have put together a series of charts. If there is an overall message, it’s that the economy still needs a whole lot of work.

No wonder the Census Bureau is adding another long term unemployed category. From the USA Today (ht Nanette)

Citing what it calls "an unprecedented rise" in long-term unemployment, the federal Bureau of Labor Statistics (BLS), beginning Saturday, will raise from two years to five years the upper limit on how long someone can be listed as having been joblessAnd here are some more graphs from Leonhardt Snapshots of the Economy

Tuesday, December 28, 2010

Misc: Households 'Doubling Up', Bank Failures, Vegas Convention business looking up

by Calculated Risk on 12/28/2010 09:45:00 PM

A few interesting unrelated stories:

• From Michael Luo in the NY Times: ‘Doubling Up’ in Recession-Strained Quarters

Census Bureau data released in September showed that the number of multifamily households jumped 11.7 percent from 2008 to 2010, reaching 15.5 million, or 13.2 percent of all households. It is the highest proportion since at least 1968, accounting for 54 million people.The article discusses the difficulties of 'doubling up', and the strains it puts on families and friends.

Even that figure, however, is undoubtedly an undercount of the phenomenon social service providers call “doubling up,” which has ballooned in the recession and anemic recovery. The census’ multifamily household figures, for example, do not include such situations as when a single brother and a single sister move in together, or when a childless adult goes to live with his or her parents.

• From the WSJ: Hard Call for FDIC: When to Shut Bank. The FDIC disputes that it is dragging its feet closing banks due to a lack of manpower.

• And some upbeat news from Richard Velotta at the Las Vegas Sun: Signs of a surge in Las Vegas conventions

After more than a year of lethargic convention attendance in Las Vegas ... next year’s visitor numbers are expected to reach levels on par with late 2005 or early 2006 ... After stellar 2007, convention traffic tanked.Looking at the Las Vegas visitors data, convention attendance declined in 2008, but really collapsed (off 24%) in 2009. Attendance was about the same this year as in 2009, so this would be quite an increase.

The recession hit Las Vegas in August 2008 when convention traffic fell 22.3 percent from the same month a year earlier. ... In 2009, convention traffic was off 23.9 percent for the year and August 2009 was down a stunning 58.9 percent from that ugly August 2008 number.

Earlier:

• Case-Shiller: Home Prices Weaken Further in October

• House Prices and Months-of-Supply, and Real House Prices

Question #5 for 2011: Employment

by Calculated Risk on 12/28/2010 05:25:00 PM

A week ago I posted some questions for next year: Ten Economic Questions for 2011. I'm working through the questions and trying to add some predictions, or at least some thoughts for each question before the end of year.

5) Employment: The U.S. economy added about 87 thousands payroll jobs per month in 2010 through November. This was extremely weak payroll growth for a recovery. How many payroll jobs will be added in 2011?

The U.S. will add around 1.2 million private sector jobs in 2010. And this despite the construction sector losing over 100 thousand jobs in 2010 (the fourth year in a row of construction job losses).

It now appears that job creation is picking up, and it also appears that the construction sector will add employees for the first time since 2006. There were over 2 million construction jobs lost during the downturn, and a relatively small number will be added next year - but every little bit will help.

This suggests to me that private payroll employment will increase by over 2 million jobs next year, maybe as high as 3 million jobs! My guess is around 2.4 million jobs as shown on the following graph.

Of course state and local governments will probably lose some jobs, but it looks like 2011 will be the best year for private job creation since the '90s.

However, this doesn't mean the unemployment rate will decline significantly. The economy needs to add about 125,000 jobs per month to offset population growth, and I expect the participation rate to increase too - so any decline in the unemployment rate will be slow.

With over 15 million unemployed workers - and 6.3 million unemployed for more than 26 weeks - adding 2.4 million private sector jobs will not seem like much of job recovery for many Americans. Hopefully I'm too pessimistic.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Misc: Richmond Fed Manufacturing Survey, Consumer Confidence

by Calculated Risk on 12/28/2010 02:32:00 PM

A couple of earlier releases:

• From the Richmond Fed: Manufacturing Activity Expanded at a Solid Pace in December

In December, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — rose sixteen points to 25 from November's reading of 9. Among the index's components, shipments jumped twenty-three points to 30, new orders rose nineteen points to finish at 29, and the jobs index increased four points to 14.This was above expectations of an increase to 11. The last of the regional surveys (Kansas City) will be released on Thursday. I'll update the Fed-ISM graph then.

• The Conference Board reported their consumer confidence index was at 52.5 (1985=100), down from 54.3 in November. This was below expectations of an increase to 57.4. Confidence is a coincident indicator, but this shows consumers remain cautious.

Earlier:

• Case-Shiller: Home Prices Weaken Further in October

• House Prices and Months-of-Supply, and Real House Prices

House Prices and Months-of-Supply, and Real House Prices

by Calculated Risk on 12/28/2010 11:35:00 AM

This morning S&P/Case-Shiller released the monthly Home Price indexes for October (a three month average). Here is a look at house prices and existing home months-of-supply, and also real house prices (2nd graph).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

House prices are through October using the composite 20 index. Months-of-supply is through November.

We need to watch inventory and months-of-supply closely for hints about house prices. The recent surge in existing home inventory - and increase in the months-of-supply - is one of the reasons I expected house prices to fall another 5% to 10%. S&P is also forecasting additional price declines.

Note: there have been periods with high months-of-supply and rising house prices (see: Lawler: Again on Existing Home Months’ Supply: What’s “Normal?” ) so this is just a guide.

The following graph shows the Case-Shiller Composite 20 index, and the CoreLogic House Price Index in real terms (adjusted for inflation using CPI less shelter).

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

A few key points:

• This is worth repeating: the real price indexes are at post-bubble lows. Those who argued prices bottomed some time ago are already wrong in real terms, and will probably be wrong in nominal terms soon.

• Don't expect real prices to fall to '98 levels. In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope in real prices.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range.

• With high levels of inventory, prices will probably fall some more. (I'll update my price forecast soon).

Case-Shiller: Home Prices Weaken Further in October

by Calculated Risk on 12/28/2010 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October (actually a 3 month average of August, September and October).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: U.S. Home Prices Weaken Further as Six Cities Make New Lows

Data through October 2010, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show a deceleration in the annual growth rates in 18 of the 20 MSAs and the 10- and 20-City Composites in October compared to what was reported for September 2010. The 10-City Composite was up only 0.2% and the 20-City Composite fell 0.8% from their levels in October 2009. Home prices decreased in all 20 MSAs and both Composites in October from their September levels. In October, only the 10-City Composite and four MSAs – Los Angeles, San Diego, San Francisco and Washington DC – showed year-over-year gains. While the composite housing prices are still above their spring 2009 lows, six markets – Atlanta, Charlotte, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices started to fall in 2006 and 2007, meaning that average home prices in those markets have fallen beyond the recent lows seen in most other markets in the spring of 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.7% from the peak, and down 0.9% in October(SA).

The Composite 20 index is off 30.5% from the peak, and down 1.0% in October (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 0.2% compared to October 2009.

The Composite 20 SA is down 0.8% compared to October 2009. This is the first year-over-year decline since 2009.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in only 2 of the 20 Case-Shiller cities in October seasonally adjusted. Only Denver and Wash, D.C. saw small price increases (SA) in October, and prices fell in all cities NSA.

Prices increased (SA) in only 2 of the 20 Case-Shiller cities in October seasonally adjusted. Only Denver and Wash, D.C. saw small price increases (SA) in October, and prices fell in all cities NSA. Prices in Las Vegas are off 57.8% from the peak, and prices in Dallas only off 8.6% from the peak.

Prices are now falling - and falling just about everywhere. As S&P noted "six markets – Atlanta, Charlotte, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices started to fall in 2006 and 2007". More cities will join them soon.

Monday, December 27, 2010

Evening Reading

by Calculated Risk on 12/27/2010 09:48:00 PM

I'm always skeptical of these early reports, but from the NY Times: Defying the Pessimists, Holiday Sales Rebound

After a 6 percent free fall in 2008 and a 4 percent uptick last year, retail spending rose 5.5 percent in the 50 days before Christmas, exceeding even the more optimistic forecasts, according to MasterCard Advisors SpendingPulse, which tracks retail spending.I'm still working my way through the Ten Economic questions for 2011:

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Economic release schedule for tomorrow:

9:00 AM: S&P/Case-Shiller Home Price Index for October. The consensus is for prices to decline about 0.4% in October; the fourth straight month of house price declines.

10:00 AM: Conference Board's consumer confidence index for December. The consensus is for an increase to 57.4 from 54.1 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. The consensus is for a reading of 11 (expansion), a slight increase from 9 last month.

Happy Holidays to All.

Freddie Mac: 90+ Day Delinquency Rate increases in November

by Calculated Risk on 12/27/2010 06:11:00 PM

Freddie Mac reported that the serious delinquency rate increased to 3.85% in November from 3.82% in October. The following graph shows the Freddie Mac serious delinquency rate (loans that are "three monthly payments or more past due or in foreclosure"):

Some of the rapid increase last year was probably because of foreclosure moratoriums, and from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The increases in October and November are probably related to the new foreclosure moratoriums. The rate will probably start to decrease again in 2011.

Note: Fannie Mae reported the serious delinquency rate declined slightly in October (they are a month behind Freddie Mac).

Question #6 for 2011: Unemployment Rate

by Calculated Risk on 12/27/2010 01:16:00 PM

A week ago I posted some questions for next year: Ten Economic Questions for 2011. I'm working through the questions and trying to add some predictions, or at least some thoughts for each question before the end of year.

6) Unemployment Rate: The post-Depression record for consecutive months with the unemployment rate above 9% was 19 months in the early '80s. That record will be broken this month, and it is very possible that the unemployment rate will still be above 9% in December 2011. This high level of unemployment - and the number of long term unemployed - is an economic tragedy. The economy probably needs to add around 125 thousand payroll jobs per month just to keep the unemployment rate from rising (payroll jobs and unemployment rate come from two different surveys, so there is no perfect relationship, and the rate also depends on the participation rate). What will the unemployment rate be in December 2011?

First, here is a graph showing the current unemployment rate (red) and the participation rate (blue). The unemployment rate depends both on job creation and the labor force participation rate.

Click on graphs for large images in graphics gallery.

Click on graphs for large images in graphics gallery.

The unemployment rate is currently at 9.8%, and the Labor Force Participation Rate (blue) was at 64.5% in November. This is the percentage of the working age population in the labor force.

Although I expect the participation rate to decline over the next couple of decades as the population ages, I think the participation rate will rise over the next few years - perhaps as high as 66%.

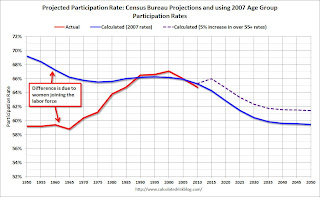

The following graph is a projection from a previous post: Labor Force Participation Rate: What will happen?

This graph uses the participation rates by age group for 2007, and historical data and age group population projections from the Census Bureau, to calculate a participation rate based on demographics.

This graph uses the participation rates by age group for 2007, and historical data and age group population projections from the Census Bureau, to calculate a participation rate based on demographics.

This graph shows the calculated participation rate (blue) through 2050, and the actual participation rate since 1950 (red). The calculated participation rate, using 2007 data, is far too high for the earlier periods. This is mostly because of women joining the labor force.

Without other shifts in the labor force, the blue line would indicate the participation rate over the next 40 years. The dashed purple line indicates the participation rate with a 5 percentage point increase in the 'over 55' labor force participation rate - something that appears likely.

If the participation rate does increases - say to 65% over the next year, from the current 64.5% - then the U.S. economy will need an additional 1 million jobs just to hold the unemployment rate steady (not counting population growth). Add in 125,000 per month more jobs to offset population growth, and the economy would have to add 2.5 million jobs in 2011 to hold the unemployment rate steady (assuming a 0.5 percentage point increase in the participation rate). This suggests any decline in the unemployment rate will be slow.

Another way to look at the unemployment rate is using Okun's Law.

This graph uses a version of Okun's law showing the annual change in real GDP (x-axis) vs. the annual change in the unemployment rate (y-axis) through Q3 2010.

This graph uses a version of Okun's law showing the annual change in real GDP (x-axis) vs. the annual change in the unemployment rate (y-axis) through Q3 2010.

Note: For this graph I used a rolling four quarter change - so all the data points are not independent. However - remember - this "law" is really just a guide.

The following table summarizes several scenarios over the next year using this relationship (starting from the current 9.8% unemployment rate):

| Real GDP Growth | Unemployment Rate in One Year |

|---|---|

| 0.0% | 11.2% |

| 1.0% | 10.7% |

| 2.0% | 10.2% |

| 3.0% | 9.8% |

| 4.0% | 9.3% |

| 5.0% | 8.9% |

| 6.0% | 8.3% |

Back in November, I took the "over" on GDP growth in 2011. Since then most forecasts have been revised up, but using this graph, real GDP growth would probably have to be above about 3% to see a reduction in the unemployment rate.

Although I'm still looking at GDP and employment for 2011, I think the unemployment rate will decline - but slowly. A couple of predictions.

• The participation rate will rise in 2011, perhaps to 65%.

• The unemployment rate will fall in 2011, but probably still be above 9% in December 2011 (I hope this is way too pessimistic).

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Dallas Fed: Manufacturing Activity Continues to Grow

by Calculated Risk on 12/27/2010 10:35:00 AM

From the Dallas Fed: Texas Manufacturing Activity Continues to Grow

The production index, a key measure of state manufacturing conditions, was positive for the fourth consecutive month.This is not strong growth, but activity is increasing - and the labor indicators are good news.

Other indicators of current activity also remained positive, signaling continued growth in manufacturing. The shipments index held steady at a reading of 8, and the capacity utilization index rose from 10 to 15, with 29 percent of manufacturers reporting an increase. The new orders index declined in December but stayed in positive territory, with more than three-fourths of firms noting increased or unchanged order volumes.

Measures of general business conditions remained positive in December. The general business activity index came in at 13, with nearly a quarter of respondents noting improved activity. The company outlook index edged down to 15, although the share of manufacturers who said their outlook improved rose to its highest level since May.

Labor market indicators improved notably this month. The employment index rose from 6 in November to 15 in December, reaching its highest level since early 2007. Twenty-four percent of firms reported hiring new workers, compared with 9 percent reporting layoffs. Hours worked increased again this month, and the wages and benefits index rose from 5 to 10.

Foreclosure: Eviction "the weary epilogue"

by Calculated Risk on 12/27/2010 09:09:00 AM

From Megan Woolhouse at the Boston Globe: At housing court, final pleas to head off evictions

If foreclosure is the final chapter of homeownership, a court eviction hearing is the weary epilogue.I'm surprised by how many former homeowners are fighting eviction - and by some of the numbers in the article like a homeowner making $32,000 per year who had a monthly mortgage payment of $3,200 - how was that supposed to work? And a retiree whose mortgage interest rate jumped from 11.3% to 17.3%. Really? Who was the mortgage lender and what kind of loan did he have?

Just two years ago, hearings involving foreclosed homeowners were relatively rare, occurring once a month or less. But soaring foreclosures, which have continued to rise in recent months, have flooded the court with such eviction requests.

...

On this Thursday at Boston Housing Court, there were nearly 30 cases, involving people from many walks of life, from a single working mother to a 75-year-old retiree to a city police officer.

Some manage to postpone eviction, while others are not so lucky.

...

Usually, foreclosure is a kind of death sentence for homeowners. While state law protects renters living in foreclosed apartments from sudden eviction, banks are under no legal obligation to let former owners stay.

Sunday, December 26, 2010

Unofficial Problem Bank list at 919 Institutions

by Calculated Risk on 12/26/2010 11:37:00 PM

Earlier:

• Schedule for Week of December 26th

• Summary for Week ending December 25th

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 24, 2010.

Changes and comments from surferdude808:

The FDIC did not release its enforcement actions for November 2010 nor did they close any institutions this week, which contributed to a quiet week for the Unofficial Problem Bank List. There were three removals and two additions this week leaving the list at 919 institutions with assets of $407.9 billion.CR Note: The FDIC is probably finished closing banks for the year. The total was 157 failures in 2010, up from 140 failures in 2009.

The removals include the failed Community National Bank, North Branch, MN ($32 million), which was an oversight as they had moved their headquarters to Lino Lakes. In a press release, AB&T National Bank, Albany, GA ($142 million Ticker: ALBY) said the OCC had terminated the Formal Action it had been operating under since 2006. The other removal was Bank Midwest, National Association, Kansas City, MO ($3.9 billion) as it merged with Armed Forces National Bank, NA, Fort Leavenworth, KS ($811 million), which is also operating under a Consent Order from the OCC.

The two additions are Provident Community Bank, National Association, Rock Hill, SC ($429 million Ticker: PCBS); and Security Federal Savings Bank, Logansport, IN ($191 million). The other change is a Prompt Corrective Action Order issued by the OTS against Liberty Federal Savings Bank, Enid, Ok ($148 million).

Perhaps next week the FDIC will release its actions for November 2010.