by Calculated Risk on 12/22/2010 04:20:00 PM

Wednesday, December 22, 2010

Question #9 for 2011: Inflation

Over the weekend I posted some questions for next year: Ten Economic Questions for 2011. I'll try to add some predictions, or at least some thoughts for each question - working backwards - before the end of year.

Remember, I have no crystal ball and I'm sure many people will disagree, especially about inflation. There are some people who have been predicting an imminent sharp rise in inflation for almost 2 years (it is always just around the corner). And many people argue that the standard inflation measures don't capture what they are actually seeing. I understand - each household has their own inflation measure, but we need to use some sort of aggregate measure.

Here was the question ...

9) Inflation: With all the slack in the system, will the U.S. inflation rate stay below target? Will there be any spillover from rising inflation rates in China and elsewhere?

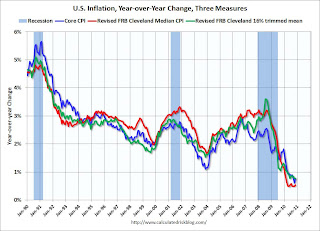

First lets look at the current situation. Over the last 12 months, several key measures of inflation have shown small increases: CPI (Consumer Price Index) rose 1.1%, the median CPI increased 0.5%, the trimmed-mean CPI increased 0.8%, core CPI (less food and energy) increased 0.8%, and core PCE prices increased 1.2% (Q3 2009 to Q3 2010).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows core CPI, median CPI and trimmed-mean CPI on a year-over-year basis.

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year.

This makes sense because of the slack in the system (unemployment rate, capacity utilization, residential vacancy rates and more). Also inflation expectation measures are not indicating a significant increase in inflation.

It does appear that residential vacancy rates are now falling (from high levels), and rents appear to have bottomed, but it doesn't appear that rents will be rising rapidly any time soon.

For more on inflation, and a discussion of inflation measures, see Dr. Dave Altig's post today: An inflation (or lack thereof) chart show. Altig concludes:

I believe this is basically the bottom line: whether we look at headline inflation (straight-up, component-by-component, or in terms of the long-run trend), core inflation measures (of virtually any sensible variety), or inflation expectations (survey or market based), there is little a hint of building inflationary pressure.I agree with Dr. Altig. My view is:

• I think the inflation rate (by these measures) will stay below the Fed's 2% target throughout 2011 (I'll guess close to 1%).

• I think rising prices in China, and rising commodity prices (like oil at $90 per barrel), will cause little spillover into U.S. inflation in 2011.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy