by Calculated Risk on 1/03/2011 10:59:00 AM

Monday, January 03, 2011

Private Construction Spending increases in November

The Census Bureau reported overall construction spending increased in November compared to October.

[C]onstruction spending during November 2010 was estimated at a seasonally adjusted annual rate of $810.2 billion, 0.4 percent (±1.6%)* above the revised October estimate of $806.7 billion.Private construction spending also increased in November:

Spending on private construction was at a seasonally adjusted annual rate of $491.8 billion, 0.3 percent (±1.1%)* above the revised October estimate of $490.5 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending increased in November; private non-residential construction spending is still declining.

Residential spending is 65% below the peak early 2006, and non-residential spending is 38% below the peak in January 2008.

Sometime this year (in 2011), residential construction spending will probably pass non-residential spending. Although I expect the recovery in residential spending to be sluggish, Residential investment will probably make a positive contribution to GDP growth in 2011 for the first time since 2005.

ISM Manufacturing Index increases in December

by Calculated Risk on 1/03/2011 10:00:00 AM

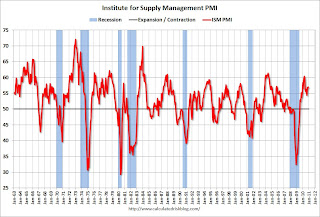

PMI at 57.0% in December, up slightly from 56.6% in November. The consensus was for an increase to 57.2%.

From the Institute for Supply Management: December 2010 Manufacturing ISM Report On Business®

Manufacturing continued to grow in December as the PMI registered 57 percent, an increase of 0.4 percentage point when compared to November's reading of 56.6 percent. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

...

ISM's New Orders Index registered 60.9 percent in December, which is an increase of 4.3 percentage points when compared to the 56.6 percent reported in November. This is the 18th consecutive month of growth in the New Orders Index. A New Orders Index above 50.2 percent, over time, is generally consistent with an increase in the Census Bureau's series on manufacturing orders

...

ISM's Employment Index registered 55.7 percent in December, which is 1.8 percentage points lower than the 57.5 percent reported in November. This is the 13th consecutive month of growth in manufacturing employment.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a long term graph of the ISM manufacturing index.

This was slightly below expectations and in line with the regional Fed manufacturing surveys.

State and Local Government budget cuts: A 2011 Theme

by Calculated Risk on 1/03/2011 08:54:00 AM

This will be a common story this year ...

From the NY Times: Cuomo Plans One-Year Freeze on State Workers’ Pay

Gov. Andrew M. Cuomo will seek a one-year salary freeze for state workers as part of an emergency financial plan he will lay out in his State of the State address on Wednesday, senior administration officials said.This weekend:

... the immediate budget savings from the freeze would be relatively modest — between $200 million and $400 million against a projected deficit in excess of $9 billion

• Summary for Week ending January 1st

• Schedule for Week of January 2, 2011

Sunday, January 02, 2011

Krugman: Deep Hole Economics

by Calculated Risk on 1/02/2011 11:59:00 PM

From Paul Krugman in the NY Times: Deep Hole Economics

If there’s one piece of economic wisdom I hope people will grasp this year, it’s this: Even though we may finally have stopped digging, we’re still near the bottom of a very deep hole.Even though I'm more optimistic about 2011 than 2010, I still think that growth will be sluggish relative to the slack in the system - and that the unemployment rate will stay elevated for some time. There is definitely a danger of becoming too optimistic.

Why do I need to point this out? Because I’ve noticed many people overreacting to recent good economic news. ...

Jobs, not G.D.P. numbers, are what matter to American families. ... Growth at a rate above 2.5 percent will bring unemployment down over time.

Suppose that the U.S. economy were to grow at 4 percent a year, starting now and continuing for the next several years. Most people would regard this as excellent performance, even as an economic boom; it’s certainly higher than almost all the forecasts I’ve seen.

Yet the math says that even with that kind of growth the unemployment rate would be close to 9 percent at the end of this year, and still above 8 percent at the end of 2012.

WSJ: Key to Real-Estate Rebound

by Calculated Risk on 1/02/2011 06:46:00 PM

From Nick Timiraos and Anton Troinovski at the WSJ: Key to Real-Estate Rebound: Solid Economic Growth

"The No. 1 biggest risk is that, for whatever reason, the overall economy does not grow sufficiently to produce any meaningful rebound in jobs," said Thomas Lawler, a housing economist in Leesburg, Va.The key to recovery in real estate is absorbing the excess supply. Lawler makes two key points: 1) We need job growth (and that would mean household formation absorbing the excess supply) and, 2) Housing completions are at record lows (not adding to the excess supply).

...

New housing construction is stuck at its lowest levels in more than 40 years. "That will help absorb supply in ways that a lot of people underestimate," Mr. Lawler said.

Earlier:

• Summary for Week ending January 1st

• Schedule for Week of January 2, 2011

Question #3 for 2011: Delinquencies and Distressed house sales

by Calculated Risk on 1/02/2011 02:10:00 PM

Earlier:

• Summary for Week ending January 1st

• Schedule for Week of January 2, 2011

Two weeks ago I posted some questions for next year: Ten Economic Questions for 2011. These are some topics to think about this year including European debt, and state and local government issues, employment (and unemployment), house prices and more. I'm trying to add some thoughts and a few predictions for each question. Here is number 3:

3) Distressed house sales: Foreclosure activity is very high, although activity has slowed recently - probably because of "foreclosure gate" issues. The number of REOs (Real Estate Owned by lenders) is increasing again, although still below the levels of late 2008. How much will foreclosure activity pick up in 2011? Will the number of REOs peak in 2011 and start to decline?

Here are three charts on REOs. The first is just inventory for Fannie, Freddie and the FHA.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The REO inventory for the "Fs" increased sharply over the last year, from 153,007 at the end of Q3 2009 to a record 293,171 at the end of Q3 2010.

This just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs.

The 2nd chart is an estimate of Fannie, Freddie, FHA and also private-label RMBS REO inventory from economist Tom Lawler. This does not include bank and thrift REO holdings, although those probably increased in Q3 too.

|

Recall that back in 2007 and 2008 delinquencies on loans backing PL RMBS exploded upward, and the “timelines” from serious delinquency to in-foreclosure to completed foreclosure sale were much shorter. In addition, servicers of PL RMBS were initially a “little slow” in disposing of SF REO (sticker shock on prices?), and REO exploded upward in the first ten months of 2008.The third graph (via Lawler) is based on data from Barclays. They break it down differently, but this shows the same pattern as the 2nd chart.

The height of the 2nd peak depends on the number of foreclosures, and the how quickly the lenders can sell the REOs. The foreclosure-gate related moratoriums have slowed the foreclosure process, but foreclosures will probably pick up again in early 2011. My guess is the 2nd peak will happen in 2011 and be close to the same height as in 2008.

One of the key issues is the number of delinquent loans (and loans in the foreclosure process). I use the Mortgage Bankers Association (MBA) quarterly data and LPS Applied Analytics monthly data to track delinquencies.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph based on the MBA quarterly data shows the percent of loans delinquent by days past due. The MBA reported that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This was down from 14.42 percent in Q2 2010.

Most of the decline in the overall delinquency rate was in the seriously delinquent categories (90+ days or in foreclosure process). Part of the reason is lenders were being more aggressive in foreclosing in Q3 (before the foreclosure pause) - hence the surge in REO inventory in the first graphs! Some of the decline was probably related to modifications too.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages through November.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages through November.The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 9.02% of mortgages are delinquent (down from 9.29% in October), and another 4.08% are in the foreclosure process (up from 3.92% in October) for a total of 13.10%.

With falling house prices, the delinquency rate could start rising again since more homeowners will have negative equity. However just because a homeowner has negative equity doesn't mean they will default. It usually takes another factor such as loss of employment, divorce, or a medical emergency for the homeowner to default.

On the other hand, an improving labor market will help push down the delinquency rate. My guess is the overall delinquency rate has peaked, although I expect the delinquency rate to stay elevated for some time.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Summary for Week ending January 1st

by Calculated Risk on 1/02/2011 08:55:00 AM

Note: here is the economic Schedule for Week of January 2, 2011.

Below is a summary of the previous week, mostly in graphs.

• Case-Shiller: Home Prices Weaken Further in October

S&P/Case-Shiller released the monthly Home Price Indices for October last week (actually a 3 month average of August, September and October).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.7% from the peak, and down 0.9% in October(SA).

The Composite 20 index is off 30.5% from the peak, and down 1.0% in October (SA).

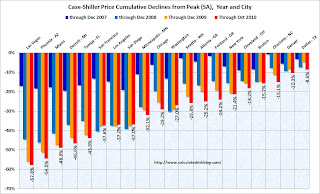

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased in only 2 of the 20 Case-Shiller cities in October seasonally adjusted (SA); only Denver and Wash, D.C. saw small price increases (SA). Prices fell in all cities NSA.

Prices increased in only 2 of the 20 Case-Shiller cities in October seasonally adjusted (SA); only Denver and Wash, D.C. saw small price increases (SA). Prices fell in all cities NSA.

Prices in Las Vegas are off 57.8% from the peak, and prices in Dallas only off 8.6% from the peak.

Prices are now falling - and falling just about everywhere. As S&P noted "six markets – Atlanta, Charlotte, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices started to fall in 2006 and 2007". More cities will join them soon.

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

House prices are through October using the composite 20 index. Months-of-supply is through November.

We need to watch inventory and months-of-supply closely for hints about house prices. The recent surge in existing home inventory - and increase in the months-of-supply - is one of the reasons I expect house prices to fall another 5% to 10%.

• Weekly Initial Unemployment Claims below 400,000, Lowest since July 2008

From the DOL: "In the week ending Dec. 25, the advance figure for seasonally adjusted initial claims was 388,000, a decrease of 34,000 from the previous week's revised figure of 422,000."

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 12,500 to 414,000.

In general the four-week moving average has been declining and that is good news.

• Regional Fed surveys suggest increasing manufacturing activity

Three regional surveys were released last week:

1) From the Dallas Fed: Texas Manufacturing Activity Continues to Grow

2) From Kansas City Fed: Manufacturing activity "continued at a solid pace" in December

3) From the Richmond Fed: Manufacturing Activity Expanded at a Solid Pace in December

This graph compares the regional Fed surveys and the ISM manufacturing index.

This graph compares the regional Fed surveys and the ISM manufacturing index.

The New York and Philly Fed surveys are averaged together (dashed green, through December), and averaged five Fed surveys (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

The regional surveys suggest an increase in manufacturing activity in December.

The ISM manufacturing index will released on Monday, Jan 3, 2011.

• Other Economic Stories ...

• From the NAR: Pending Home Sales Continue Recovery

• Unofficial Problem Bank list increases to 935 Institutions

Best wishes to all!

Saturday, January 01, 2011

2007: Tanta breaks down the MSM Barrier

by Calculated Risk on 1/01/2011 07:28:00 PM

There was a nice mention of Calculated Risk this week by Alen Mattich in the WSJ: The Best Economics Blogs. Thank you - I sincerely appreciate the mention!

The first sentence caught my eye:

Only a few years ago, blogs were too outlandish for the mainstream media even to acknowledge, never mind to mention or, shock horror, to quote.Not all blogs were "outlandish", but they were definitely all considered outlandish! Back before 2007 the MSM would quote econ professors, but not "unknown" bloggers.

My co-blogger Doris "Tanta" Dungey broke down that barrier in March 2007 with her brilliant piece: Media Inquiries Policy. The entire piece is worth reading (I've heard that it is assigned reading in some college journalism courses). An excerpt:

Dear reporters, we quote your stuff periodically, giving credit both to the reporter and the publication, under fair use terms. We have no objection to your returning the favor. If you have an editor who will not allow that, and you think that the problem can be solved by getting one of us to drop our online personas, give you our real names, and say the same thing to you over the phone, so that you can get your editor to accept it as something other than just blogging, which everybody knows is untrustworthy ranting by anonymous nuts, you are making a faulty assumption about the relationship among us, our birthdays, and yesterday. Neither CR nor Tanta wishes to play into a set of assumptions that render what we say on the blog as unworthy of coverage by the Big Media, but what we might say on the phone to Intrepid Reporter as good dirt and straight skinny.Within a week, Calculated Risk was mentioned in several major publications including the WSJ for the first time. Now econ bloggers are routinely mentioned, and we all should remember to thank Tanta!

What about those Option ARMs?

by Calculated Risk on 1/01/2011 02:15:00 PM

I've seen versions of the following chart being used to warn about Option ARM defaults in 2011. This chart is from the IMF in early 2007: Assessing Risks to Global Financial Stability

This chart from Credit Suisse, via the IMF, showed the substantial subprime resets in 2007 and 2008, and it showed the potential reset/recast problems with Alt-A and Option ARM loans in 2010 through 2012.

There were many subprime defaults in 2007 and 2008, and many people have been worried about a "2nd wave" of Option ARM and Alt-A defaults.

Here is an updated chart from Zach Fox at SNL Financial as of February 2010: Credit Suisse: $1 trillion worth of ARMs still face resets

Most of the resets are expected to occur through 2012. Between 2010 and 2012, the chart indicates that $253.25 billion of option ARMs will adjust, while Alt-A loans totaling $163.71 billion will reset over that time. Altogether, $1.010 trillion worth of ARMs will reset or recast during the three-year period.

excerpts with permission

Click on graph for larger image in new window.

Click on graph for larger image in new window.Source: SNL Financial.

The chart is labeled "resets" with a comment on "recasts" at the bottom. Resets are not a problem right now with low interest rates.

From Tanta on resets and recasts:

"Reset" refers to a rate change. "Recast" refers to a payment change. ... "Recast" is really just a shorter word for "reamortize": you take the new interest rate, the current balance, and the remaining term of the loan, and recalculate a new payment that will fully amortize the loan over the remaining term.Looking at the 2nd chart, it appears there is another wave coming in 2011 and 2012 - but probably not a large wave for several reasons.

First, many of the loans have already defaulted. There is a difference between the original recast date, and the actual recast date - because negatively amortizing loans hit the recast ceiling earlier than the original forecast - and those loans have already defaulted (or have been modified).

Second, some of these loans were modified (Option ARMs and Alt-A loans were targeted by the banks for internal modification programs), and some of these borrowers have probably refinanced - the few that had some equity.

Also some of the loans (mostly Wells Fargo with 10 year recast) will probably recast later than the Credit Suisse chart.

There was a peak on the 2nd chart in 2010, and so far there hasn't been a huge surge in Option ARM and Alt-A defaults (they were already defaulting in large numbers). Here are a couple of graph from LPS Applied Analytics' November Mortgage Performance data.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph provided by LPS Applied Analytics shows the percent delinquent by product type. As the graph shows, the Option ARM and Alt-A loans have already been defaulting in large numbers.

The Option ARM defaults did increase in 2010 but nothing like what the Credit Suisse chart seemed to suggest.

We also need to include the loans in the foreclosure process. The percent in the foreclosure process is trending up recently because of the foreclosure moratoriums.

We also need to include the loans in the foreclosure process. The percent in the foreclosure process is trending up recently because of the foreclosure moratoriums. But what these graphs don't show is a huge spike in Option ARM and Alt-A loans delinquent or in the foreclosure process. Although there will probably be more delinquent Option ARM and Alt-A loans next year, I'm more concerned about falling house prices and negative equity than a huge wave of Option ARM and Alt-A defaults.

Schedule for Week of January 2, 2011

by Calculated Risk on 1/01/2011 08:30:00 AM

Happy New Year!

The key report for this week will be the December employment report to be released on Friday, Jan 7th. Other key reports include the ISM manufacturing index on Monday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Wednesday.

10:00 AM: ISM Manufacturing Index for December. The consensus is for an increase to 57.2 from 56.6 in November.

10:00 AM: Construction Spending for November. The consensus is for a 0.2% increase in construction spending.

10:00 AM: Manufacturers' Shipments, Inventories and Orders for November. The consensus is for a 0.2% decrease in orders.

2:00 PM: FOMC Minutes, Meeting of December 14, 2010.

All day: Light vehicle sales for December. Light vehicle sales are expected to increase slightly to 12.3 million (Seasonally Adjusted Annual Rate), from 12.2 million in November.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.If correct, this will be the highest sales rate since September 2008, excluding Cash-for-clunkers in August 2009.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate.

Edmunds is forecasting:

Edmunds.com analysts predict that December's Seasonally Adjusted Annualized Rate (SAAR) will be the year’s highest, 12.34 million, up from 12.21 in November 2010.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index for the last two weeks. This index has only recovered slightly over the last few months - suggesting reported home sales through early 2011 will be weak. Also refinance activity has collapsed over the last few weeks as mortgage rates have increased.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for +100,000 payroll jobs in December, up from the +93,000 jobs reported in November.

10:00 AM: ISM non-Manufacturing Index for December. The consensus is for a slight increase to 55.5 from 55.0 in November.

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last couple of months. The consensus is for an increase to 400,000 from 388,000 last week.

8:30 AM: Employment Report for December.

The consensus is for an increase of 140,000 non-farm payroll jobs in December, after the disappointing 39,000 jobs added in November.

The consensus is for an increase of 140,000 non-farm payroll jobs in December, after the disappointing 39,000 jobs added in November. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The estimate for December is in blue.

The consensus is for the unemployment rate to decline to 9.7% from 9.8% in November.

9:30 AM: Fed Chairman Ben S. Bernanke, Testimony before the Committee on the Budget, U.S. Senate, Washington, D.C. "The Economic Outlook and Monetary and Fiscal Policy"

3:00 PM: Consumer Credit for November. The consensus is for consumer credit to be unchanged.

After 4:00 PM: The FDIC will probably have another busy Friday afternoon ...

4:30 PM: Panel Discussion, Fed Vice Chair Janet L. Yellen, "The Federal Reserve's Asset Purchase Program", Denver, Colorado

December Personal Bankruptcy Filings

Reis is expected to release their Q4 Office, Mall and Apartment vacancy rate reports.