by Calculated Risk on 12/26/2010 07:40:00 PM

Sunday, December 26, 2010

Vehicle Sales: Fleet Turnover Ratio

Way back, during the darkest days of the recession, I wrote a couple of optimistic posts about auto sales - Vehicle Sales (Jan 2009) and Looking for the Sun (Feb 2009). By request, here is an update to the U.S. fleet turnover graph.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate through November 2010 - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age or the composition of the fleet).

The wild gyrations in 2009 were due to the cash-for-clunkers program.

Note: Number of registered vehicles estimated. This is for total vehicles, not just light vehicles.

The estimated ratio for November was just under 20 years - still very high, but well below the peak of 26 years. The turnover ratio will probably decline to 15 or so over the next few years.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate. The current sales rate is still near the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

Light vehicle sales were at a 12.22 million seasonally adjusted annual rate (SAAR) in November. To bring the turnover ratio down to more normal levels, unit sales will have to rise to 14 or 15 million SAAR. Of course cars are lasting longer - note the general uptrend in the first graph - so the turnover ratio probably will not decline to the previous level. Also this says nothing about the composition of the fleet (perhaps smaller cars).

Earlier:

• Schedule for Week of December 26th

• Summary for Week ending December 25th

Question #7 for 2011: State and Local Governments

by Calculated Risk on 12/26/2010 03:29:00 PM

Last weekend I posted some questions for next year: Ten Economic Questions for 2011. I'm working through the questions and trying to add some predictions, or at least some thoughts for each question before the end of year.

7) State and Local Governments: How much of a drag will state and local budget problems have on economic growth and employment? Will there be any significant muni defaults?

The good news is it appears state and local government revenue has stabilized. The bad news is the budget gaps will still be huge in 2011. The National Conference of State Legislatures (NCSL) released a report earlier this month, "State Budget Update: November 2010," forecasting

an increasing majority of state legislative fiscal directors are reporting that the revenue outlook for the remaining seven months of FY 2011 looks promising. At the same time, however, most states also are forecasting significant budget gaps in FY 2012. ... Funds from the American Recovery and Reinvestment Act (ARRA) have helped support state budgets since FY 2009. States will face a $37.9 billion loss in federal funds in FY 2012 compared to FY 2011, according to the Federal Funds Information for States. This is expected to make big holes in state budgets, what many state officials call the "ARRA cliff effect."Including the loss of the ARRA funds, the state budget gaps are expected to total around $110 billion in 2011, down from $174 billion in 2010. This suggests further budget cuts for states.

In a recent research note, "Amid Stronger Growth, State and Local Drag Persists", Goldman Sachs' Andrew Tilton wrote:

The ability of states to defer adjustment is waning, based on public comments from state officials and budget analyst reports. Most states have tapped rainy day funds, privatized assets, decreased pension fund contributions, delayed wage or contractor payments, and so on. While there are many possible tactics, the hardest-hit jurisdictions have already exhausted the most practical and politically attractive options, and so further budget adjustments are more likely to be made through spending cuts.And spending cuts means more state and local layoffs. So far in 2010 most of the government job cuts have been at the local level (about 200,000 jobs lost), and the cuts will probably be fewer in 2011 - but still a drag on employment. Goldman's estimate is the state and local government budget problems will be about a 0.5% drag on national GDP in 2011.

The other key issue is possible state and local defaults. Analyst Meredith Whitney has made headlines recently predicting widespread defaults. On 60 Minutes she said: "You could see 50 sizeable defaults. Fifty to 100 sizeable defaults. More. This will amount to hundreds of billions of dollars' worth of defaults."

Several analysts have disputed Whitney's statement. Bloomberg columnist Joe Mysak wrote: Meredith Whitney Overreaches With Muni Meltdown Call

If pressed, I would say that we might see between 100 and 200 municipal defaults next year, maybe totaling in the $5 billion or $10 billion range.And that is an important point that Bond Girl recently made at Self-evident.org: Default and bankruptcy in the municipal bond market (part one)

...

Most defaults in the modern era aren’t governmental or what we might call municipal at all. The majority are corporate or nonprofit borrowings in the guise of some municipal conduit -- nursing homes, housing developments, biofuel refineries -- so they could qualify for tax-free financing.

I am just writing this post to demystify a process that evidently needs demystifying. ...Bond Girl has followed up with another post about the Chapter 9 bankruptcy process: Default and bankruptcy in the municipal bond market (part two)

One of the more frustrating aspects of muni market coverage in the news and blogosphere is the tendency to talk about municipal debt as if only one type of bond is issued and traded. There is actually considerable diversity among borrowers in the muni market (e.g., they are not all government entities), and by extension, the types of commitments that are made for the repayment of the debt. Although the relative health of the muni market has macroeconomic consequences, this is in many ways a market that defies generalization. ...

Clearly Bond Girl disagrees with Whitney (I'll side with Bond Girl). There will be defaults, but they probably will not lead to anything on the scale that Whitney is predicting with "hundreds of billions of dollars' worth of defaults".

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Summary for Week ending December 25th

by Calculated Risk on 12/26/2010 08:29:00 AM

Note: here is the economic schedule for the coming week.

Below is a summary of the previous week, mostly in graphs.

• November Existing Home Sales: 4.68 million SAAR, 9.5 months of supply

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2010 (4.68 million SAAR) were 5.6% higher than last month, and were 27.9% lower than November 2009.

According to the NAR, inventory decreased to 3.71 million in November from 3.86 million in October. Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall. Although inventory decreased from October to November, inventory increased 5.4% YoY in November.

According to the NAR, inventory decreased to 3.71 million in November from 3.86 million in October. Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall. Although inventory decreased from October to November, inventory increased 5.4% YoY in November.

The year-over-year increase in inventory is especially bad news because the reported inventory is very high (3.71 million), and the 9.5 months of supply in November is well above normal.

The bottom line: Sales were weak in November, and existing home sales will continue to be weak for some time. Inventory is very high, and the year-over-year increase in inventory is very concerning. The high level of inventory will continue to put downward pressure on house prices.

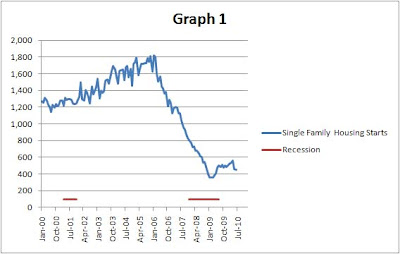

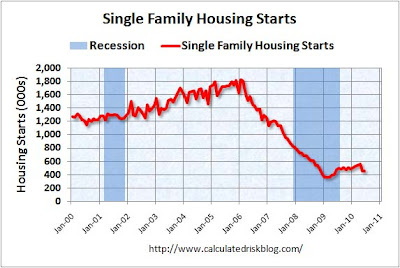

• New Home Sales weak in November

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The Census Bureau reported New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 290 thousand. This is up from a revised 275 thousand in October.

Months of supply decreased to 8.2 in November from 8.8 in October. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

Months of supply decreased to 8.2 in November from 8.8 in October. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

The 290 thousand annual sales rate for November is just above the all time record low in August (274 thousand). This was the weakest November on record and below the consensus forecast of 300 thousand. This was another very weak report.

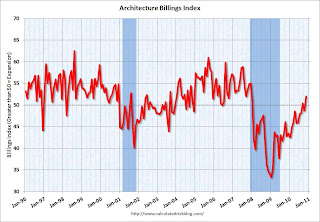

• AIA: Architecture Billings Index showed expansion in November

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996.

This graph shows the Architecture Billings Index since 1996.

From the American Institute of Architects: Firm Billings Rebound in November. "At 52.0, the AIA’s Architecture Billings Index (ABI) recorded a three point gain from the previous month, and reached its strongest level since December 2007."

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end next summer.

• Moody's: Commercial Real Estate Prices increased in October

Moody's reported this week that the Moody’s/REAL All Property Type Aggregate Index increased 1.3% in October. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices and make the index very volatile.

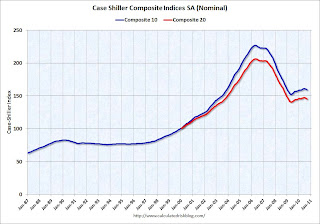

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are about 42% below the peak in 2007.

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

• Other Economic Stories ...

• From Reuters: Fitch cuts Portugal rating one notch on debt levels

• From Bloomberg: Hungary's Credit Rating Cut by Fitch on Budget; Debt Grade Nears `Abyss'

• From John Carney at CNBC: Bank of America Loses Key Battle In Mortgage Fraud Fight

• From the American Trucking Association: ATA Truck Tonnage Index Fell 0.1 Percent in November

• DOT: Vehicle miles driven increased in October

• From Tom Lawler: Overall Housing Stock Growth Likely to Slow Even Further in 2011

Best wishes to all!

Saturday, December 25, 2010

Schedule for Week of December 26th

by Calculated Risk on 12/25/2010 02:45:00 PM

This will be a light week for economic news. The Case-Shiller house price index will be released on Tuesday, and several regional manufacturing surveys will be released during the week.

10:30 AM: Dallas Fed Manufacturing Survey for December. The Texas survey showed expansion last month (at 13.1), and is expected to show expansion again in December.

The regional Fed surveys provide a hint about the ISM manufacturing index, as the following graph shows. Both the Philly Fed, and Empire State indexes showed improvement in December.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through December), and averaged five Fed surveys (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

The ISM manufacturing index will released on Monday, Jan 3, 2011.

9:00 AM: S&P/Case-Shiller Home Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October. The consensus is for prices to decline about 0.4% in October; the fourth straight month of house price declines.

This graph shows the seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000) through September.

This graph shows the seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000) through September.Prices are falling again, although still above the lows set in early 2009.

Prices in October might show a year-over-year decline for the composite indexes for the first time since 2009.

10:00 AM: Conference Board's consumer confidence index for December. The consensus is for an increase to 57.4 from 54.1 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. The consensus is for a reading of 11 (expansion), a slight increase from 9 last month.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly since then.

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last couple of months. The consensus is for the same as last week at 420,000.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for the same as in November at 62.5.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 1% increase in contracts signed. It usually takes 45 to 60 days to close, so this will provide an early indication of closings in January.

11:00 AM: Kansas City Fed regional Manufacturing Survey for December. The index was at 14 in November.

Markets will be open on New Year's Eve.

12:00 AM: Happy New Year!

Happy Holidays!

by Calculated Risk on 12/25/2010 08:50:00 AM

Happy Holidays and Merry Christmas to all!

• First some news: From the WSJ: China Raises Rates Amid Inflation Fight

The People's Bank of China said Saturday that effective Sunday, it will raise the one-year yuan lending rate by a quarter of a percentage point to 5.81% from 5.56% ...• For your enjoyment, here are the galleries of most of the graphs I post. The Galleries are grouped by Employment, New Home Sales, Existing Home Sales, Housing (like starts), Manufacturing, GDP, and much more. There are tabs for each gallery at the top.

Clicking on a tab will load a gallery. Then thumbnails will appear below the main graph for all of the graphs in the selected gallery. Clicking on the thumbnails will display each graph. Enjoy!

• And a little gift ... a common question, using excel, is how do you get from this:

Thanks to all. Happy Holidays!

Friday, December 24, 2010

Question #8 for 2011: Europe and the Euro

by Calculated Risk on 12/24/2010 06:15:00 PM

Last weekend I posted some questions for next year: Ten Economic Questions for 2011. I'll try to add some predictions, or at least some thoughts for each question - working backwards - before the end of year.

8) Europe and the Euro: What will happen in Europe? When will the next blowup happen? How much of a drag will the problems in Europe have on U.S. growth?

The situation in Europe is fluid. Just look at the bond yields - Greece, Ireland, Portugal, Spain - all near record highs. It seems the question is when, not if, another "blowup" will happen. By blowup, I mean another set of emergency weekend meetings, and another Sunday "bailout" announced.

The European Financial Stability Facility (EFSF) is large enough to handle Portugal, but that is about it. So I guess that means Portugal is next.

Michael Pettis offered some thoughts on 2011, and he focused on Europe: In 2011, the euro zone will hang together or hang separately

DURING 2011 Europe should confront and decide the issue of fiscal union. If it chooses union, the euro will survive. If not, the euro will almost certainly break up. 2011 is important because in most European countries the leaders of all the major political parties tend to be emotionally and ideologically committed to the euro project.So Pettis thinks 2011 is the make or break year for the euro. Either way some countries will probably eventually default (haircuts for the bond holders).

However over the next two to three years as the debate over how to apportion the costs of the necessary adjustments intensifies—should workers pay in the form of wage deflation and rising unemployment? should countries abandon the euro and default, and so force the adjustment costs onto creditors? should taxes be raised or expenditures slashed, and which ones?—the political consensus will break apart and domestic politics will become increasingly unstable. In that case there will be almost no way to avert defaults and currency break up.

Note: Some Investor Guy wrote a great Sovereign Debt Series earlier this year covering a history of defaults and reviewing some possible scenarios.

Although my crystal ball is real cloudy on Europe, I think:

• The euro will somehow survive another year without losing any countries.

• The next blowup will be in the first couple of months. There is another round of stress tests scheduled for February, although there is still no agreement on criteria.

• There are two main channels that could impact the U.S. economy: trade, and financial spillover / credit tightening. The impact on trade will probably be minimal, even if the euro falls sharply against the dollar (a small percentage of U.S. GDP is from exports to Europe (edit)). The financial channel is much more of an unknown, and there is significant downside risk.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Hotels: RevPAR up 14% compared to same week in 2009

by Calculated Risk on 12/24/2010 02:51:00 PM

A weekly update on hotels from HotelNewsNow.com: STR: US performance for week ending 18 Dec.

In year-over-year measurements, the industry’s occupancy rose 9.4 percent to 46.5 percent, average daily rate increased 4.1 percent to US$91.66, and revenue per available room went up 14.0 percent to US$42.61.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 7.3% compared to last year and 3.3% below the median for 2000 through 2007. RevPAR (revenue per available room) was up 7.7% compared to the same week two years ago (in 2008).

This is the slow season for hotels, and the key will be if business travel picks up early next year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Update on Personal Saving Rate

by Calculated Risk on 12/24/2010 11:38:00 AM

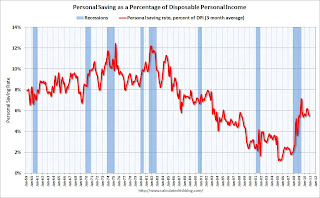

According to the BEA, the personal saving rate declined in November to 5.3%:

Personal saving -- DPI less personal outlays -- was $614.8 billion in November, compared with $622.8 billion in October. Personal saving as a percentage of disposable personal income was 5.3 percent in November, compared with 5.4 percent in October.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the November Personal Income report.

When the recession began, I expected the saving rate to rise to 8% or more. With a rising saving rate, consumption growth would be below income growth. But that 8% rate was just a guess.

It is possible the saving rate has peaked, or it might rise a little further, but either way most of the adjustment has already happened and consumption will probably mostly keep pace with income growth next year.

Home Sales: Distressing Gap

by Calculated Risk on 12/24/2010 08:45:00 AM

Thanks to everyone for reading and providing me feedback!

Here is an update to a graph I've been posting for several years. This graph shows existing home sales (left axis) and new home sales (right axis) through November. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Initially the gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The two spikes in existing home sales were due primarily to the homebuyer tax credits (the initial credit in 2009, followed by the 2nd credit in 2010). There were also two smaller bumps for new home sales related to the tax credits.

Note: it is important to note that existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

In a few years - when the excess housing inventory is absorbed and the number of distressed sales has declined significantly - I expect existing home-to-new home sales to return to this historical relationship.

I've guessed before at the eventual levels: The median turnover for existing homes is just over 6% of all owner occupied homes per year, and with about 75 million owner occupied homes that would suggest close to 5 million sales per year (no one should expect existing home sales to be over 7 million units per year any time soon!). And that would suggest new home sales at just over 800 thousand per year when the market eventually recovers (not 1.2 or 1.3 million per year).

Best to all!

Thursday, December 23, 2010

Repeat: Merle Hazard "Inflation or Deflation"

by Calculated Risk on 12/23/2010 11:13:00 PM

A little music. This is a repeat from last year, but the debate goes on ...

Earlier:

• Comments on November Personal Income and Outlays Report

• New Home Sales weak in November