by Calculated Risk on 12/12/2022 08:56:00 AM

Monday, December 12, 2022

Four High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of December 11th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 5.3% below the same week in 2019 (94.7% of 2019). (Dashed line)

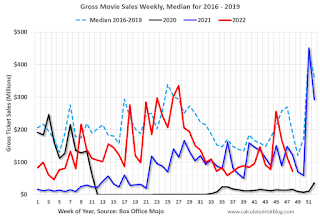

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $72 million last week, down about 63% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Dec 3rd. The occupancy rate was down 7.7% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of December 2nd, gasoline supplied was down 7.5% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, December 11, 2022

Sunday Night Futures

by Calculated Risk on 12/11/2022 06:13:00 PM

Weekend:

• Schedule for Week of December 11, 2022

• FOMC Preview: 50bp Hike, Increase "Terminal Rate"

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $71.02 per barrel and Brent at $76.10 per barrel. A year ago, WTI was at $71, and Brent was at $74 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.21 per gallon. A year ago, prices were at $3.33 per gallon, so gasoline prices are down $0.12 per gallon year-over-year.

FOMC Preview: 50bp Hike, Increase "Terminal Rate"

by Calculated Risk on 12/11/2022 10:21:00 AM

Expectations are the FOMC will announce a 50bp rate increase in the federal funds rate at the meeting this week and increase the "terminal rate" to 5-5.25%.

"A relatively soft November inflation report is unlikely to affect the Fed’s decision. It has clearly telegraphed a 50bp hike in December, which would take the federal funds rate to 4.25-4.5%. The big question is where the Fed goes next. We expect another 50bp rate hike in February and then a 25bp hike in March for a terminal rate of 5.0-5.25%. We think the Fed will need to see material weakening in the labor market to stop hiking."From Goldman Sachs:

emphasis added

"Aside from a widely expected 50bp rate hike, the main event at the December FOMC meeting is likely to be an increase in the projected peak for the funds rate in 2023. We expect the median dot to rise 50bp to a new peak of 5-5.25% ... We continue to expect three 25bp hikes in 2023 to a peak of 5-5.25%, though the risks are tilted toward 50bp in February."

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 0.1 to 0.3 | 0.5 to 1.5 | 1.4 to 2.0 | |

The unemployment rate was at 3.7% in November. So far, the economic slowdown has barely pushed up the unemployment rate, and the FOMC will likely revised down the 2022 projection but might revise 2023 up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 3.8 to 3.9 | 4.1 to 4.5 | 4.0 to 4.6 | |

As of October 2022, PCE inflation was up 6.0% from October 2021. This was below the cycle high of 7.0% YoY in June. There was a surge of inflation in Q4 2021, so with less inflation in Q4 this year, it is possible inflation will decline to the top of the projected year-over-year range in Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 5.3 to 5.7 | 2.6 to 3.5 | 2.1 to 2.6 | |

PCE core inflation was up 5.0% in October year-over-year. This was below the cycle high of 5.4% YoY in February. Core inflation has picked up more than expected and will likely be above the September Q4 projected range.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 4.4 to 4.6 | 3.0 to 3.4 | 2.2 to 2.5 | |

Saturday, December 10, 2022

Real Estate Newsletter Articles this Week: Mortgage Equity Withdrawal Still Solid in Q3

by Calculated Risk on 12/10/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Mortgage Equity Withdrawal Still Solid in Q3

• 2023 Housing Forecasts

• 1st Look at Local Housing Markets in November

• Q3 Update: Delinquencies, Foreclosures and REO

• Black Knight Mortgage Monitor: Home Prices Declined in October; Down 3.2% since June

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of December 11, 2022

by Calculated Risk on 12/10/2022 08:11:00 AM

The key economic reports this week are November CPI and Retail Sales.

For manufacturing, November Industrial Production, and the December New York and Philly Fed surveys, will be released this week.

The FOMC meets this week, and the FOMC is expected to announce a 50 bp hike in the Fed Funds rate.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for November.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 7.3% year-over-year and core CPI to be up 6.1% YoY.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to announce a 50 bp hike in the Fed Funds rate.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.2% decrease in retail sales.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.2% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, unchanged from 230 thousand last week.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of -1.0, down from 4.5.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of -12.0, up from -19.4.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to decrease to 79.8%.

No major economic releases scheduled.

Friday, December 09, 2022

COVID Dec 9, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 12/09/2022 09:16:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2🚩 | 458,986 | 306,773 | ≤35,0001 | |

| Hospitalized2🚩 | 29,598 | 26,015 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,981 | 1,844 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

NOTE: The data is probably catching up from the low levels during the holiday week, but this is the most cases since September, and the most deaths since early October.

Q4 GDP Tracking

by Calculated Risk on 12/09/2022 05:13:00 PM

From BofA:

The components of PPI that we use to deflate structures investment and inventories imply modestly more non-residential investment and inventory accumulation in the quarter than we were assuming. After rounding, our 4Q US GDP tracking estimate moved up one-tenth to 1.6% q/q saar. [Dec 9th estimate]From Goldman:

emphasis added

We lowered our Q4 GDP tracking estimate by 0.1pp to +1.7% (qoq ar). [Dec 9th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 3.2 percent on December 9, down from 3.4 percent on December 6. After this morning's releases from the US Census Bureau and the US Bureau of Labor Statistics, the nowcast of fourth-quarter gross private domestic investment growth decreased from 1.7 percent to 0.7 percent. [Dec 9th estimate]

Mortgage Equity Withdrawal Still Solid in Q3; Homeowners now relying on Home Equity lines to extract equity

by Calculated Risk on 12/09/2022 12:58:00 PM

Today, in the Real Estate Newsletter: Mortgage Equity Withdrawal Still Solid in Q3

Excerpt:

Here is the quarterly increase in mortgage debt from the Federal Reserve’s Financial Accounts of the United States - Z.1 (sometimes called the Flow of Funds report) released today. In the mid ‘00s, there was a large increase in mortgage debt associated with the housing bubble.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ (All ad free, most content free).

In Q3 2022, mortgage debt increased $209 billion, down from $258 billion in Q2, but still fairly high. Note the almost 7 years of declining mortgage debt as distressed sales (foreclosures and short sales) wiped out a significant amount of debt.

However, some of this debt is being used to increase the housing stock (purchase new homes), so this isn’t all Mortgage Equity Withdrawal (MEW).

Fed's Flow of Funds: Household Net Worth Decreased $0.4 Trillion in Q3

by Calculated Risk on 12/09/2022 12:24:00 PM

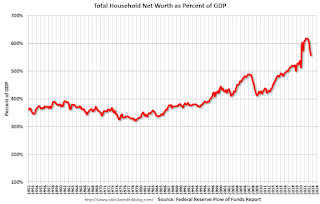

The Federal Reserve released the Q3 2022 Flow of Funds report today: Financial Accounts of the United States.

The net worth of households and nonprofits fell to $143.3 trillion during the third quarter of 2022. The value of directly and indirectly held corporate equities decreased $1.9 trillion and the value of real estate increased $0.8 trillion.

...

Household debt increased 6.3 percent at an annual rate in the third quarter of 2022. Consumer credit grew at an annual rate of 7 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 6.6 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

The second graph shows homeowner percent equity since 1952.

The second graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2022, household percent equity (of household real estate) was at 70.5% - unchanged from 70.5% in Q2, 2022. This is the highest percent equity since the early 1980s.

Note: This includes households with no mortgage debt.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.Mortgage debt increased by $209 billion in Q3.

Mortgage debt is up $1.66 trillion from the peak during the housing bubble, but, as a percent of GDP is at 48.1% - unchanged from Q3 - and down from a peak of 73.3% of GDP during the housing bust.

The value of real estate, as a percent of GDP, decreased slightly in Q3, and is well above the average of the last 30 years.

Leading Index for Commercial Real Estate Increases in November

by Calculated Risk on 12/09/2022 09:21:00 AM

From Dodge Data Analytics: Dodge Momentum Index Advances In November

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 3.8% (2000=100) in November to 207.2 from the revised October reading of 199.6. During the month, the DMI continued its steady ascent, with the commercial component rising 4.3%, and the institutional component ticking up 2.7%.

Commercial planning experienced a healthy increase in hotel and data center projects and modest growth in stores and office projects. While education and healthcare projects slowed in November, the institutional component remained net-positive alongside a robust increase in planning projects for government administrative buildings and religious facilities. On a year-over-year basis, the DMI was 25% higher than in November 2021, the commercial component was up 28%, and institutional planning was 21% higher.

...

“The Momentum Index continued to rise in November, conveying hopefulness from owners and developers that the construction sector will endure the possible economic slowdown next year,” said Sarah Martin, senior economist for Dodge Construction Network. “The rate of increase in the DMI, however, has steadied over the month. Labor and supply shortages, high material costs and high interest rates could temper planning activity over the next 12 months to a more modest pace.”

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 207.2 in November, up from 199.7 in October.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a solid pickup in commercial real estate construction into 2023.