by Calculated Risk on 1/21/2020 12:38:00 PM

Tuesday, January 21, 2020

Revisiting: Has Housing Market Activity Peaked?

I wrote this in July 2018 (see: Has Housing Market Activity Peaked? and Has the Housing Market Peaked? (Part 2)

First, I think it is likely that existing home sales will move more sideways going forward. However it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.Since that post, existing home sales have mostly moved sideways, and both new home sales and single family starts have hit new cycle highs.

...

For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."

If new home sales and single family starts have peaked that would be a significant warning sign. Although housing is under pressure from policy (negative impact from tax, immigration and trade policies), I do not think housing has peaked, and I think new home sales and single family starts will increase further over the next couple of years.

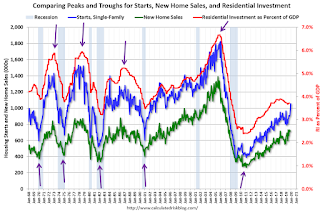

Here is the graph I like to use to track tops and bottoms for housing activity. This is a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

Click on graph for larger image.

Click on graph for larger image.The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

RI as a percent of GDP has been sluggish recently, mostly due to softness in multi-family residential. However, both single family starts and new home sales have set new cycle highs this year.

Also, look at the relatively low level of RI as a percent of GDP, new home sales and single family starts compared to previous peaks. To have a significant downturn from these levels would be surprising.

Retired Workers and the Overall Labor Force Participation Rate

by Calculated Risk on 1/21/2020 09:08:00 AM

In December I wrote Ten Economic Questions for 2020. I noted that I expect the overall participation rate to start declining again in 2020, pushing down the unemployment rate.

Note: Every month, with the employment report, I focus on the prime participation rate because of changing demographics - but this post is about the overall participation rate.

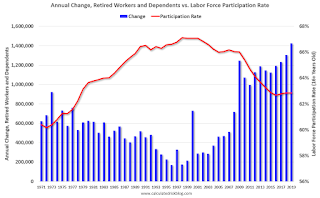

Here is a graph of the annual change in Retired workers and dependent receiving Old-Age Social Security benefits and the annual Labor Force Participation Rate since 1970. This doesn't mean these people are actually retiring (they may still be working), but this gives us an idea of how many people are retiring per year.

The number of people retiring per year was declining until the late '90s, and then started increasing.

The annual overall (16+ years old) participation rate peaked around 2000, and has generally been decreasing as more people retire.

Note: There are other factors involved in the decline in the overall participation rate - such as more people staying in school - but retiring workers is a key.

A few years ago, I predicted the overall participation rate would move mostly sideways or increase slightly as solid employment growth offset the large number of retirements. Now, given demographics, I expect to see a downward trend for the overall participation rate over the next decade, even with a healthy job market.

Monday, January 20, 2020

Monday Night Futures

by Calculated Risk on 1/20/2020 06:28:00 PM

Weekend:

• Schedule for Week of January 19, 2020

Tuesday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up slightly over the last week with WTI futures at $58.82 per barrel and Brent at $65.20 barrel. A year ago, WTI was at $53, and Brent was at $62 - so oil prices are up 5% to 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.55 per gallon. A year ago prices were at $2.24 per gallon, so gasoline prices are up 31 cents per gallon year-over-year.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 1/20/2020 09:46:00 AM

The NAR is scheduled to release Existing Home Sales for December at 10:00 AM, Wednesday, Jan 22nd.

The consensus is for 5.43 million SAAR, up from 5.35 million in November. Housing economist Tom Lawler estimates the NAR will report sales of 5.40 million SAAR and that inventory will be down 11.1% year-over-year. Based on Lawler's estimate, I expect existing home sales to be close to the consensus.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 10 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Last month the consensus was for sales of 5.45 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated the NAR would report 5.43 million, and the NAR reported 5.35 million (as usual Lawler was closer than the consensus).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last 10 years, the consensus average miss was 141 thousand, and Lawler's average miss was 67 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | 5.42 |

| Aug-19 | 5.38 | 5.42 | 5.49 |

| Sep-19 | 5.45 | 5.36 | 5.38 |

| Oct-19 | 5.49 | 5.36 | 5.46 |

| Nov-19 | 5.45 | 5.43 | 5.35 |

| Dec-19 | 5.43 | 5.40 | --- |

| 1NAR initially reported before revisions. | |||

Sunday, January 19, 2020

Phoenix Real Estate in December: Sales up 18.5% YoY, Active Inventory Down 31.2% YoY

by Calculated Risk on 1/19/2020 09:51:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 7,585 in December, up from 6,974 in November, and up from 6,403 in December 2018. Sales were up 8.8%% from November 2019 (last month), and up 18.5% from December 2018.

2) Active inventory was at 12,425, down from 18,089 in December 2018. That is down 31.2% year-over-year.

3) Months of supply decreased to 2.05 in December from 2.49 months in November. This remains relatively low.

This is another market with increasing sales and falling inventory.

Saturday, January 18, 2020

Schedule for Week of January 19, 2020

by Calculated Risk on 1/18/2020 08:11:00 AM

The key report scheduled for this week is December Existing Home sales.

For manufacturing, the January Kansas City Fed manufacturing survey will be released.

All US markets will be closed in observance of Martin Luther King Jr. Day

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

9:00 AM: FHFA House Price Index for November 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.43 million SAAR, up from 5.35 million.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.43 million SAAR, up from 5.35 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 5.40 million SAAR.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 216,000 initial claims, up from 214,000 last week.

11:00 AM: the Kansas City Fed manufacturing survey for December.

10:00 AM: State Employment and Unemployment (Monthly) for December 2019

Friday, January 17, 2020

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/17/2020 02:44:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.40 million in December, up 0.9% from November’s preliminary pace and up 8.0% from last December’s weak seasonally-adjusted pace. Unadjusted sales should show a significantly higher YOY gain, with the SA/NSA difference reflecting this December’s higher business day count comparted to last December.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of December was down by about 11.1% from a year earlier.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 7.0% from last December.

CR Note: The National Association of Realtors (NAR) is scheduled to release December existing home sales on Wednesday, January 22, 2020 at 10:00 AM ET. The consensus is for 5.43 million SAAR.

CAR on California December Housing: Sales up 7.4% YoY, Inventory down 26.5%, Lowest Inventory in "nearly seven years"

by Calculated Risk on 1/17/2020 02:26:00 PM

The CAR reported: Low interest rates boost housing market in second half of year as home prices post strong gains in December, C.A.R. reports

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 398,880 units in December, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the December pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

December’s sales total was down 1.0 percent from the 402,880 level in November and marked the first time in six months that sales fell below the 400,000 benchmark. Still, sales were up a solid 7.4 percent from December 2018’s revised 371,410 figure. For the year 2019, annual home sales fell for the second consecutive year to a preliminary 397,910 closed escrow sales in California, down from 2018’s pace of 402,640.

“Despite a sales slowdown at year-end, home sales were up from a year ago as interest rates remained low. It’s important to note, however, that the increase was due partly to low housing demand in the prior year,” said 2020 C.A.R. President Jeanne Radsick, a second-generation REALTOR® from Bakersfield, Calif. “Looking ahead, low rates should continue to provide support to the market as buyers have become more motivated to get back into the market, and home sales in California should see an improvement at the start of the year.”

...

“With housing supply dropping to the lowest level in nearly seven years, California experienced an unusual jump in its median price at the end of the year when the market is supposed to cool down,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “While low rates have been fueling demand in the second half of 2019, supply constraints continued to put a drag on the market and undercut the positive effect of low rates. The surge in price is a byproduct of the imbalance between supply and demand as market competition continues to heat up.”

...

California’s housing supply recorded back-to-back drops of more than 20 percent at the end of 2019, with active listings declining 26.5 percent in December after a 22.5 percent decrease in November. December marked the sixth consecutive month of year-over-year decline in supply, and it was the largest since April 2013. The number of active listings in December was, in fact, the lowest level in nearly seven years.

emphasis added

Q4 GDP Forecasts: 1.2% to 2.0%

by Calculated Risk on 1/17/2020 02:18:00 PM

From Merrill Lynch

On balance retail sales cut our 4Q GDP tracking by 0.2pp to 2.0% qoq saar. [Jan 17 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.2% for 2019:Q4 and 1.7% for 2020:Q1. [Jan 17 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 1.8 percent on January 17, unchanged from January 16 after rounding. After this morning’s housing starts report from the U.S. Census Bureau and industrial production release from the Federal Reserve Board of Governors, a decrease in the nowcast of fourth-quarter real personal consumption expenditures growth from 1.6 percent to 1.4 percent was partly offset by an increase in the nowcast of real residential investment growth from 4.3 percent to 5.5 percent. [Jan 17 estimate]CR Note: These estimates suggest real GDP growth will be between 1.2% and 2.0% annualized in Q4.

Comments on December Housing Starts

by Calculated Risk on 1/17/2020 12:22:00 PM

Earlier: Housing Starts increased to 1.608 Million Annual Rate in December

Total housing starts in December were well above expectations and revisions to prior months were positive.

The housing starts report showed starts were up 16.9% in December compared to November, and starts were up 40.8% year-over-year compared to December 2018.

These were blow out numbers! This was the highest level for starts since December 2006 (end of the bubble). However, the weather was very nice in December, and the weather probably had a significant impact on the seasonally adjusted housing starts number. The winter months of December and January have the largest seasonal factors, so nice weather can really have an impact. Note that Permits were more inline with expectations (still solid).

Single family starts were up 29.6% year-over-year, and multi-family starts were up 74.6% YoY.

This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Starts were up 40.8% in December compared to December 2018.

For the year, starts were up 3.2% compared to 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the comparison was easy in December.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - then completions caught up with starts- although starts are picking up a little again.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.