by Calculated Risk on 11/04/2019 08:55:00 PM

Monday, November 04, 2019

Tuesday: Trade Deficit, Job Openings, ISM Non-Mfg

From Matthew Graham at Mortgage News Daily: Mortgage Rates Holding Gain, But Volatility Could Increase

Mortgage rates were flat to slightly higher today after dropping at fairly quick pace last week. In fact, if we're only examining one-day changes in rates, Thursday's drop was the quickest drop in months! That may sound slightly more impressive than it is, however. In terms of hard numbers, we're talking about roughly $22/month on a $300k loan.Tuesday:

Most of those savings are still intact today, but the risk of volatility remains. [Most Prevalent Rates 30YR FIXED 3.625-3.75%]

emphasis added

• At 8:30 AM ET, Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $52.5 billion in September, from $54.9 billion in August.

• At 10:00 AM, the ISM non-Manufacturing Index for October. The consensus is for an increase to 53.5 from 52.6.

• Also at 10:00 AM, Job Openings and Labor Turnover Survey for September from the BLS.

BEA: October Vehicles Sales decreased to 16.6 Million SAAR

by Calculated Risk on 11/04/2019 04:37:00 PM

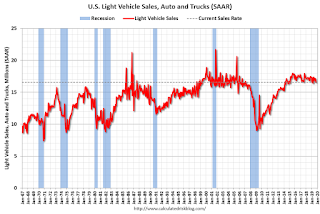

The BEA released their estimate of October vehicle sales this morning. The BEA estimated sales of 16.55 million SAAR in October 2019 (Seasonally Adjusted Annual Rate), down 3.4% from the September sales rate, and down 5.3% from October 2019.

Sales in 2019 are averaging 16.91 million (average of seasonally adjusted rate), down 1.6% compared to the same period in 2018.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for October (red).

The GM strike might have impacted sales in October.

A small decline in sales to date this year isn't a concern - I think sales will move mostly sideways at near record levels.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Note: dashed line is current estimated sales rate of 16.55 million SAAR.

Zillow Case-Shiller Forecast: Similar YoY Price Gains in September compared to August

by Calculated Risk on 11/04/2019 02:03:00 PM

The Case-Shiller house price indexes for August were released last week. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: August Case-Shiller Results and September Forecast: Stabilizing, not Swooning

The S&P CoreLogic Case-Shiller U.S. National Home Price Index® rose 3.2% year-over-year in August (non-seasonally adjusted), up from 3.1% in July. Annual growth in the smaller 10-city index was slightly slower than July, and was unchanged in the 20-city index.

…

September data as reported by Case-Shiller are expected to show continued modest deceleration in annual growth in the 10-city and U.S. National indices, while growth in the 20-city index is expected to remain the same. S&P Dow Jones Indices is expected to release data for the September S&P CoreLogic Case-Shiller Indices on Tuesday, Nov. 26.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.1% in September, down from 3.2% in August.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.1% in September, down from 3.2% in August. The Zillow forecast is for the 20-City index to be unchanged at 2.0% YoY in September from 2.0% in August, and for the 10-City index to decline to 1.4% YoY compared to 1.5% YoY in August.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 11/04/2019 12:06:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now mostly unchnaged year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Nov 4, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 5% from a year ago, and CME futures are up 30% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war is a factor with reports that lumber exports to China have declined by 40% since last September.

Black Knight Mortgage Monitor for September: "Early-Stage Delinquencies Continue to Rise Among Purchase Loans"

by Calculated Risk on 11/04/2019 09:27:00 AM

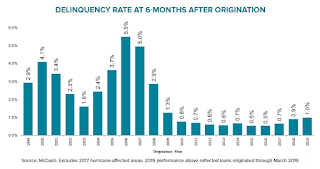

CR Note: Early-stage delinquencies are still historically very low, but have been increasing (see second graph).

Black Knight released their Mortgage Monitor report for September today. According to Black Knight, 3.53% of mortgages were delinquent in September, down from 3.97% in September 2018. Black Knight also reported that 0.48% of mortgages were in the foreclosure process, down from 0.52% a year ago.

This gives a total of 4.05% delinquent or in foreclosure.

Press Release: Black Knight’s September 2019 Mortgage Monitor: First-Time Homebuyers Under Pressure as Early-Stage Delinquencies Continue to Rise Among Purchase Loans

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, Black Knight looked at the current trend of rising early-stage delinquencies, particularly among purchase loans. As Black Knight Data & Analytics President Ben Graboske explained, the number of loans that were delinquent six months following origination has been increasing over the past 24 months, with first-time homebuyers being impacted most heavily.

“We’ve seen early-stage delinquencies rise over the last several years, with the increase being driven primarily by purchase loans,” said Graboske. “About 1% of loans originated in Q1 2019 were delinquent six months after origination. While that’s less than one-third of the 2000-2005 average of 2.95%, it represents a more than 60% increase over the last two years and is the highest it’s been since late 2010. Early-stage GSE delinquencies currently stand at 0.6%, up two tenths of a percentage point over the past 24 months, but still 40% below the market average and 60% below their own 2000-2005 average of 1.3%. Though there has been some softening in GSE purchase loan performance, it hasn’t been to the extent seen among entry-level buyers. All in all, first-time homebuyer originations combined between the GSEs and GNMA increased by nearly 50% between 2014 and 2018. However, whereas first-time homebuyers represent just over 40% of GSE purchase loans, they make up 70% of the GNMA purchase market.

“That concentration is contributing to a more significant increase in early-stage delinquencies among GNMA loans, which saw 3.3% of loans delinquent six months after origination. That’s up 1.2 percentage points from two years ago, and though still roughly half the 2000-2005 pre-crisis average, it represents the sharpest increase we’ve seen in the market in recent years. However, performance among repeat purchasers with GNMA-securitized loans has remained relatively steady overall, with the rise more pronounced among first-time homebuyers. Rising debt-to-income ratios due to tight affordability and declining first-time homebuyer credit scores stand out as likely drivers here. With a growing population of first-time homebuyers poised to enter the market, this is a trend Black Knight will continue to monitor.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the Foreclosure Sales over time.

From Black Knight:

• Foreclosure sales (completions) are down 14% year-over-year, and have now set new record lows in each of the past five quartersThe second graph shows early stage delinquencies:

• The 35.7K foreclosure sales in Q3 are nearly 50% below the pre-recession (2000-2005) average

• Florida, New York and Illinois led all states with 3.2K, 2.5K and 2.4K foreclosure completions respectively in Q3

• Despite having the largest number of foreclosure sales, Florida's sale activity declined by 19% from the year prior, while in New York, sales actually edged slightly upward year-over-year (+4% Y/Y)

• Early-stage delinquencies among recent originations continue to trend upwardThere is much more in the mortgage monitor.

• Nearly 1% of Q1 2019 originations were delinquent six months post-origination; though less than a third of 2000-2005 average of 2.93%, that’s up more than 60% over the past 24 months and the highest since 2010

• This increase has primarily been driven by a rise in early-stage delinquencies among purchase loans, and to a lesser degree by cash-out refinances

• While performance of rate/term refinances has remained relatively flat, early-stage delinquencies among cash-out refis – though lower than the market as a whole – have also moved upward in recent years

• Should the rise in delinquencies among more recent originations continue, we may ultimately see an increase in overall delinquency rates

Sunday, November 03, 2019

Sunday Night Futures

by Calculated Risk on 11/03/2019 07:40:00 PM

Weekend:

• Schedule for Week of November 3, 2019

Monday:

• All day, Light vehicle sales for October.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 3 and DOW futures are up 25 (fair value).

Oil prices were down over the last week with WTI futures at $56.11 per barrel and Brent at $61.59 barrel. A year ago, WTI was at $63, and Brent was at $73 - so oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.59 per gallon. A year ago prices were at $2.73 per gallon, so gasoline prices are down 14 cents year-over-year.

Hotels: Occupancy Rate Decreased Year-over-year, RevPAR upcycle Near End

by Calculated Risk on 11/03/2019 10:37:00 AM

From Jan Freitag at HotelNewsNow.com: US hotels post RevPAR losses for second month in 2019

The RevPAR upcycle is now in its 115th month, and 112 of those months had positive RevPAR change. So, I wonder if it’s time to retire the term “upcycle” if RevPAR is declining, as it did in September. The long-run monthly RevPAR growth chart now looks like this, but the header needs a qualifier (“three small interruptions”) and so it may be time to come up with a better descriptor.From HotelNewsNow.com: STR: US hotel results for week ending 26 October

The U.S. hotel industry reported overall flat year-over-year results in the three key performance metrics during the week of 20-26 October 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 21-27 October 2018, the industry recorded the following:

• Occupancy: -0.2% to 70.5%

• Average daily rate (ADR): +0.2% to US$135.00

• Revenue per available room (RevPAR): flat at US$95.15

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will now start to decline into the winter.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, November 02, 2019

Schedule for Week of November 3, 2019

by Calculated Risk on 11/02/2019 08:11:00 AM

The key reports this week are October vehicle sales, and the September trade deficit.

All day: Light vehicle sales for October.

All day: Light vehicle sales for October.The consensus is for sales of 17.0 million SAAR, down from 17.2 million SAAR in September (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $52.5 billion in September, from $54.9 billion in August.

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $52.5 billion in September, from $54.9 billion in August.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

10:00 AM: the ISM non-Manufacturing Index for October. The consensus is for an increase to 53.5 from 52.6.

10:00 AM ET: Job Openings and Labor Turnover Survey for September from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in August to 7.051 million from 7.174 million in July.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, down from 218,000 last week.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for November).

Friday, November 01, 2019

Comments on October Employment Report

by Calculated Risk on 11/01/2019 01:31:00 PM

The headline jobs number at 148 thousand for October ex-Census (128K total including temp Census hires and layoffs) was above consensus expectations of 93 thousand, and the previous two months were revised up 95 thousand, combined. The unemployment rate increased to 3.6%.

Earlier: October Employment Report: 148,000 Jobs Added ex-Census, 3.6% Unemployment Rate

In October, the year-over-year employment change was 2.093 million jobs including Census hires (note: this will be revised down in February with the benchmark revision).

Seasonal Retail Hiring

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 137 thousand workers (NSA) net in October. Note: this is NSA (Not Seasonally Adjusted).

This is more than last year in October.

Average Hourly Earnings

Wage growth was below expectations. From the BLS:

"In October, average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents to $28.18. Over the past 12 months, average hourly earnings have increased by 3.0 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.0% YoY in October.

Wage growth had been generally trending up, but has weakened recently.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was increase in October to 82.8% from September at 82.6%, and the 25 to 54 employment population ratio was increased to 80.3% from 80.1%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 4.4 million, changed little in October. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in October to 4.438 million from 4.350 million in September. The number of persons working part time for economic reason has been generally trending down.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.0% in October.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.264 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.314 million in September.

Summary:

The headline jobs number was above expectations, and the previous two months were revised up. The headline unemployment rate increased to 3.6%; and, wage growth was below expectations. Factoring in the temporary Census fires, the GM strike, and the upward revisions to prior months, this was a solid report.

In 2019, the economy has added 1.662 million jobs through October 2019 ex-Census, down from 2.256 million jobs during the same period of 2018 (although 2018 will be revised down with benchmark revision to be released in February 2020). So job growth has slowed.

Construction Spending Increased in October, Down 2.0% YoY

by Calculated Risk on 11/01/2019 11:20:00 AM

From the Census Bureau reported that overall construction spending increased slightly in August:

Construction spending during September 2019 was estimated at a seasonally adjusted annual rate of $1,293.6 billion, 0.5 percent above the revised August estimate of $1,287.1 billion. The September figure is 2.0 percent below the September 2018 estimate of $1,319.7 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $961.7 billion, 0.2 percent above the revised August estimate of $959.9 billion. ...

In September, the estimated seasonally adjusted annual rate of public construction spending was $331.9 billion, 1.5 percent above the revised August estimate of $327.2 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018 - and is now 25% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 2% above the previous peak in March 2009, and 27% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 4%. Non-residential spending is down 6% year-over-year. Public spending is up 7% year-over-year.

This was above consensus expectations.