by Calculated Risk on 8/15/2019 06:55:00 PM

Thursday, August 15, 2019

Friday: Housing Starts

Friday:

• At 8:30 AM ET: Housing Starts for July. The consensus is for 1.260 million SAAR, up from 1.253 million SAAR in June.

• At 10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for August).

• At 10:00 AM: State Employment and Unemployment (Monthly) for July 2019

Earlier: NY and Philly Fed Mfg Surveys

by Calculated Risk on 8/15/2019 04:44:00 PM

Earlier from the Philly Fed: August 2019 Manufacturing Business Outlook Survey

Manufacturing activity in the region continued to grow, according to results from the August Manufacturing Business Outlook Survey. The survey's broad indicators remained positive, although their movements were mixed this month: The general activity, shipments, and employment indicators decreased from their readings last month, but the indicator for new orders increased. The survey’s future activity indexes remained positive, suggesting continued optimism about growth for the next six months.Earlier from the NY Fed: Empire State Manufacturing Survey

The diffusion index for current general activity fell 5 points this month to 16.8, after increasing 22 points in July

emphasis added

Business activity increased modestly in New York State, according to firms responding to the August 2019 Empire State Manufacturing Survey. The headline general business conditions index was little changed at 4.8. New orders increased after declining for the prior two months, and shipments continued to expand. Unfilled orders fell, delivery times were steady, and inventories increased. The employment and average workweek indexes were both slightly below zero, pointing to sluggishness in labor market conditions.This was above the consensus forecasts for both surveys. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through August), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

These early reports suggest the ISM manufacturing index will probably increase in August.

CAR on California: "California home sales perk up in July"

by Calculated Risk on 8/15/2019 02:29:00 PM

The CAR reported: California home sales perk up in July for first time in more than a year, C.A.R. reports

The lowest mortgage interest rates in nearly three years helped jump start California’s housing market to post the first year-over-year sales gain and highest sales level in 15 months, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler). Note that this is the first YoY decrease in inventory since early 2018.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 411,630 units in July, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the July pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

July’s sales figure was up 5.6 percent from the 389,730 level in June and up 1.1 percent from home sales in July 2018 of 407,030.

“Mortgage rates that dipped to the lowest level in nearly three years has helped reduce monthly mortgage payments for the past five consecutive months, giving buyers more purchasing power,” said C.A.R. President Jared Martin. “The boost in demand gave the housing market its first yearly gain since April 2018.”

...

Active listings, which had been increasing year-over-year for the past 15 months, fell 2.1 percent from a year ago.

The decrease in active listings and an increase in home sales contributed to a year-over-year decline in unsold inventory for the first time in 15 months. The Unsold Inventory Index (UII), which is a ratio of inventory over sales, was 3.2 months in July, down from 3.4 months in June and down from 3.3 months in July 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 4.8% | 30.6% |

| Jan-19 | 4.6% | 27% |

| Feb-19 | 3.2% | 19.2% |

| Mar-19 | 1.8% | 13.4% |

| Apr-19 | 1.7% | 10.8% |

| May-19 | 2.1% | 7.4% |

| Jun-19 | 0.0% | 2.4% |

| Jul-19 | NA | -2.1% |

NAHB: "Builder Confidence Trending Higher as Interest Rates Move Lower"

by Calculated Risk on 8/15/2019 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 66 in August, up from 65 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Trending Higher as Interest Rates Move Lower

Builder confidence in the market for newly-built single-family homes rose one point to 66 in August, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. Sentiment levels have held at a solid 64-to-66 level for the past four months.

“Even as builders report a firm demand for single-family homes, they continue to struggle with rising construction costs stemming from excessive regulations, a chronic shortage of workers and a lack of buildable lots,” said NAHB Chairman Greg Ugalde, a home builder and developer from Torrington, Conn.

“While 30-year mortgage rates have dropped from 4.1 percent down to 3.6 percent during the past four months, we have not seen an equivalent higher pace of building activity because the rate declines occurred due to economic uncertainty stemming largely from growing trade concerns,” said NAHB Chief Economist Robert Dietz. “Although affordability headwinds remain a challenge, demand is good and growing at lower price points and for smaller homes.”

…

The HMI index gauging current sales conditions increased two points to 73 and the component measuring traffic of prospective buyers rose two points to 50. The measure charting sales expectations in the next six months fell one point to 70.

Looking at the three-month moving averages for regional HMI scores, the South moved one point higher to 69, the West was also up one point to 73 and the Midwest inched up a single point to 57. The Northeast fell three points to 57.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was at the consensus forecast.

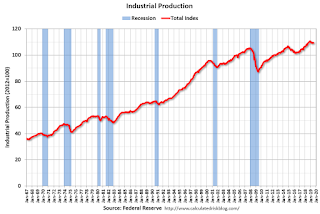

Industrial Production Decreased in July

by Calculated Risk on 8/15/2019 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production declined 0.2 percent in July. Manufacturing output decreased 0.4 percent last month and has fallen more than 1-1/2 percent since December 2018. In July, mining output fell 1.8 percent, as Hurricane Barry caused a sharp but temporary decline in oil extraction in the Gulf of Mexico. The index for utilities rose 3.1 percent. At 109.2 percent of its 2012 average, total industrial production was 0.5 percent higher in July than it was a year earlier. Capacity utilization for the industrial sector decreased 0.3 percentage point in July to 77.5 percent, a rate that is 2.3 percentage points below its long-run (1972–2018) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.5% is 2.3% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in July at 109.2. This is 25% above the recession low, and 3.7% above the pre-recession peak.

The change in industrial production and decrease in capacity utilization were below consensus.

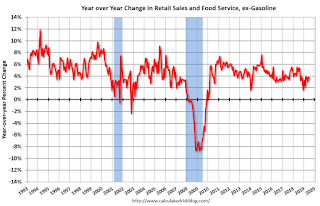

Retail Sales increased 0.7% in July

by Calculated Risk on 8/15/2019 08:43:00 AM

On a monthly basis, retail sales increased 0.7 percent from June to July (seasonally adjusted), and sales were up 3.4 percent from July 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for July 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $523.5 billion, an increase of 0.7 percent from the previous month, and 3.4 percent above July 2018. … The May 2019 to June 2019 percent change was revised from up 0.4 percent to up 0.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in July.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.7% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.7% on a YoY basis.The increase in July was above expectations. Sales in June were revised down, and sales in May revised up. Overall a solid report.

Weekly Initial Unemployment Claims increased to 220,000

by Calculated Risk on 8/15/2019 08:33:00 AM

The DOL reported:

In the week ending August 10, the advance figure for seasonally adjusted initial claims was 220,000, an increase of 9,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 209,000 to 211,000. The 4-week moving average was 213,750, an increase of 1,000 from the previous week's revised average. The previous week's average was revised up by 500 from 212,250 to 212,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 213,750.

This was higher than the consensus forecast.

Wednesday, August 14, 2019

Thursday: Retail Sales, Unemployment Claims, Industrial Production, NY and Philly Fed Mfg Surveys, Homebuilder Confidence

by Calculated Risk on 8/14/2019 06:12:00 PM

Note: On October 23rd, I will be one of three speakers at the "2020 Economic Forecast featuring the UCI Paul Merage School of Business" in Newport Beach, California, sponsored by the Newport Beach Chamber of Commerce.

UCI Finance Professor Christopher Schwarz and I will be discussing the 2020 economic outlook, and Dr. Richard Afable will be discussing "The Future of the Healthcare System".

This is a lunch time event (from 11:15 am to 1:30 pm) at the Balboa Bay Resort.

Click here for more information and tickets. Tickets are $65 for members, and $75 for non-members and includes lunch. (I'm speaking for free).

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, down from 209 thousand last week.

• Also at 8:30 AM: Retail sales for July is scheduled to be released. The consensus is for 0.3% increase in retail sales.

• Also at 8:30 AM: The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 2.5, down from 4.3.

• Also at 8:30 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 11.1, down from 21.8.

• At 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to decrease to 77.8%.

• At 10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 66, up from 65. Any number above 50 indicates that more builders view sales conditions as good than poor.

Don't Freak Out about the Yield Curve

by Calculated Risk on 8/14/2019 03:06:00 PM

There are reasons to be concerned. The global economy is slowing. The US economy has slowed. Current policy (especially on trade) is a drag on growth.

But I wouldn't freak out about the yield curve.

In mid-1998 the spread between the 10 year and the 2 year went slightly negative, and a recession didn't start until 2001 - over 2 1/2 years later. Of course the Fed cut rates in 1998 - just like the current situation.

When the spread turned solidly negative in 2000, the Fed was raising rates. That would be a more concerning scenario.

Also, with overall yields so low, I'm not sure this indicator is as useful as it has been. The yield curve is indicating economic weakness, but I'm not currently on recession watch.

Here is a graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED.

Click on graph for larger image.

Click on graph for larger image.

Click here for interactive graph at FRED.

In general, I find new home sales and housing starts a better leading indicator for recessions than the yield curve. And Year-to-date (through June), new home sales are up 2.2% compared to the same period in 2018. Not indicating a recession!

Houston Real Estate in July: All Time Record One-Month Sales, Sales up 11% YoY, Inventory Up 10%

by Calculated Risk on 8/14/2019 11:33:00 AM

From the HAR: The Houston Real Estate Market Heats Up in July

Consumers kept Realtors across greater Houston busy in July, accounting for the greatest one-month volume of single-family home sales of all time. According to the latest monthly report from the Houston Association of Realtors® (HAR), July single-family home sales totaled 8,953. That is up 11.6 percent year-over-year and exceeds the last one-month sales volume record set in June 2018 (8,385). On a year-to-date basis, sales are 3.0 percent ahead of 2018’s record volume. Realtors point to low mortgage interest rates and the steady growth in inventory for the solid monthly performance.Total active inventory was up 9.6% YoY to 45,498 properties from 41,527 properties in July 2018. Sales are on pace for a record year.

Housing inventory continues to outpace 2018 with a 4.3-months supply compared to a 4.1-months supply last July. However, inventory peaked in June 2019 at a 4.4-months supply. Housing inventory is now holding at levels that prevailed before Hurricane Harvey struck in August 2017 and is providing a broader array of options for home buyers.

Sales of all property types rose 10.9 percent in July, setting a new record with a total of 10,478 units. The previous high for total property sales in a single month was 10,115 in June 2018, which marked the first time that figure ever broke 10,000. Total dollar volume for the month increased 12.8 percent to $3.1 billion.

“July was a strong month for home sales and rentals across the Houston area,” said HAR Chair Shannon Cobb Evans with Heritage Texas Properties. “We believe that the Houston real estate market is on track for another record year, and that is directly attributed to a healthy local economy, low mortgage interest rates and an improving supply of homes.”

emphasis added