by Calculated Risk on 8/15/2019 08:43:00 AM

Thursday, August 15, 2019

Retail Sales increased 0.7% in July

On a monthly basis, retail sales increased 0.7 percent from June to July (seasonally adjusted), and sales were up 3.4 percent from July 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for July 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $523.5 billion, an increase of 0.7 percent from the previous month, and 3.4 percent above July 2018. … The May 2019 to June 2019 percent change was revised from up 0.4 percent to up 0.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in July.

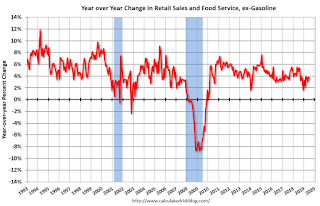

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.7% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.7% on a YoY basis.The increase in July was above expectations. Sales in June were revised down, and sales in May revised up. Overall a solid report.

Weekly Initial Unemployment Claims increased to 220,000

by Calculated Risk on 8/15/2019 08:33:00 AM

The DOL reported:

In the week ending August 10, the advance figure for seasonally adjusted initial claims was 220,000, an increase of 9,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 209,000 to 211,000. The 4-week moving average was 213,750, an increase of 1,000 from the previous week's revised average. The previous week's average was revised up by 500 from 212,250 to 212,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 213,750.

This was higher than the consensus forecast.

Wednesday, August 14, 2019

Thursday: Retail Sales, Unemployment Claims, Industrial Production, NY and Philly Fed Mfg Surveys, Homebuilder Confidence

by Calculated Risk on 8/14/2019 06:12:00 PM

Note: On October 23rd, I will be one of three speakers at the "2020 Economic Forecast featuring the UCI Paul Merage School of Business" in Newport Beach, California, sponsored by the Newport Beach Chamber of Commerce.

UCI Finance Professor Christopher Schwarz and I will be discussing the 2020 economic outlook, and Dr. Richard Afable will be discussing "The Future of the Healthcare System".

This is a lunch time event (from 11:15 am to 1:30 pm) at the Balboa Bay Resort.

Click here for more information and tickets. Tickets are $65 for members, and $75 for non-members and includes lunch. (I'm speaking for free).

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, down from 209 thousand last week.

• Also at 8:30 AM: Retail sales for July is scheduled to be released. The consensus is for 0.3% increase in retail sales.

• Also at 8:30 AM: The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 2.5, down from 4.3.

• Also at 8:30 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 11.1, down from 21.8.

• At 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to decrease to 77.8%.

• At 10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 66, up from 65. Any number above 50 indicates that more builders view sales conditions as good than poor.

Don't Freak Out about the Yield Curve

by Calculated Risk on 8/14/2019 03:06:00 PM

There are reasons to be concerned. The global economy is slowing. The US economy has slowed. Current policy (especially on trade) is a drag on growth.

But I wouldn't freak out about the yield curve.

In mid-1998 the spread between the 10 year and the 2 year went slightly negative, and a recession didn't start until 2001 - over 2 1/2 years later. Of course the Fed cut rates in 1998 - just like the current situation.

When the spread turned solidly negative in 2000, the Fed was raising rates. That would be a more concerning scenario.

Also, with overall yields so low, I'm not sure this indicator is as useful as it has been. The yield curve is indicating economic weakness, but I'm not currently on recession watch.

Here is a graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED.

Click on graph for larger image.

Click on graph for larger image.

Click here for interactive graph at FRED.

In general, I find new home sales and housing starts a better leading indicator for recessions than the yield curve. And Year-to-date (through June), new home sales are up 2.2% compared to the same period in 2018. Not indicating a recession!

Houston Real Estate in July: All Time Record One-Month Sales, Sales up 11% YoY, Inventory Up 10%

by Calculated Risk on 8/14/2019 11:33:00 AM

From the HAR: The Houston Real Estate Market Heats Up in July

Consumers kept Realtors across greater Houston busy in July, accounting for the greatest one-month volume of single-family home sales of all time. According to the latest monthly report from the Houston Association of Realtors® (HAR), July single-family home sales totaled 8,953. That is up 11.6 percent year-over-year and exceeds the last one-month sales volume record set in June 2018 (8,385). On a year-to-date basis, sales are 3.0 percent ahead of 2018’s record volume. Realtors point to low mortgage interest rates and the steady growth in inventory for the solid monthly performance.Total active inventory was up 9.6% YoY to 45,498 properties from 41,527 properties in July 2018. Sales are on pace for a record year.

Housing inventory continues to outpace 2018 with a 4.3-months supply compared to a 4.1-months supply last July. However, inventory peaked in June 2019 at a 4.4-months supply. Housing inventory is now holding at levels that prevailed before Hurricane Harvey struck in August 2017 and is providing a broader array of options for home buyers.

Sales of all property types rose 10.9 percent in July, setting a new record with a total of 10,478 units. The previous high for total property sales in a single month was 10,115 in June 2018, which marked the first time that figure ever broke 10,000. Total dollar volume for the month increased 12.8 percent to $3.1 billion.

“July was a strong month for home sales and rentals across the Houston area,” said HAR Chair Shannon Cobb Evans with Heritage Texas Properties. “We believe that the Houston real estate market is on track for another record year, and that is directly attributed to a healthy local economy, low mortgage interest rates and an improving supply of homes.”

emphasis added

MBA: Mortgage Applications Increased Sharply in Latest Weekly Survey

by Calculated Risk on 8/14/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 21.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 9, 2019.

... The Refinance Index increased 37 percent from the previous week to its highest level since July 2016, and was 196 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

“The 2019 refinance wave continued, as homeowners last week responded to extraordinarily low mortgage rates. Fears of an escalating trade war, combined with economic and geopolitical concerns, once again pulled U.S. Treasury rates lower. The 30-year fixed mortgage rate decreased eight basis points to 3.93 percent – the lowest level since November 2016 – and has now dropped more than 80 basis points this year,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “In just the last two weeks, rates have decreased 15 basis points and the refinance index has increased more than 50 percent, reaching its highest level since July 2016. The government refinance index, driven by a 25 percent increase in VA refinance applications, is now at its highest level since May 2013.”

Added Kan, “Purchase applications also benefited from these lower rates, with activity increasing 1.9 percent last week and 12 percent from a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to its lowest level since November 2016, 3.93 percent, from 4.01 percent, with points decreasing to 0.35 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to under 4%.

With lower rates, we saw a sharp increase in refinance activity.

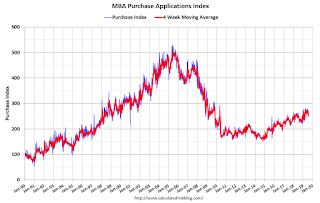

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 12% year-over-year.

Tuesday, August 13, 2019

Early Look at 2020 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 8/13/2019 03:59:00 PM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.7 percent over the last 12 months to an index level of 250.236 (1982-84=100). For the month, the index rose 0.2 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2018, the Q3 average of CPI-W was 246.352.

The 2018 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.7% year-over-year in July, and although this is early - we need the data for July, August and September - my current guess is COLA will probably be under 2.0% this year, the smallest increase since 2016.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2018 yet, but wages probably increased again in 2018. If wages increased the same as in 2017, then the contribution base next year will increase to around $137,600 in 2020, from the current $132,900.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in July, Core PCE below 2%

by Calculated Risk on 8/13/2019 12:49:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.4% annualized rate) in July. The 16% trimmed-mean Consumer Price Index also rose 0.3% (3.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for July here. Motor fuel was up 34% annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (4.1% annualized rate) in July. The CPI less food and energy also rose 0.3% (3.6% annualized rate) on a seasonally adjusted basis.

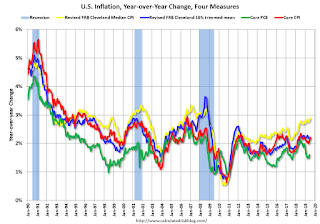

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.9%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.2%. Core PCE is for June and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 3.4% annualized, trimmed-mean CPI was at 3.3% annualized, and core CPI was at 3.6% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%).

NY Fed Q2 Report: "Total Household Debt Climbs for 20th Straight Quarter as Mortgage Debt and Originations Rise"

by Calculated Risk on 8/13/2019 11:09:00 AM

From the NY Fed: Total Household Debt Climbs for 20th Straight Quarter as Mortgage Debt and Originations Rise

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which shows that total household debt increased by $192 billion (1.4%) to $13.86 trillion in the second quarter of 2019. It was the 20th consecutive quarter with an increase, and the total is now $1.2 trillion higher, in nominal terms, than the previous peak of $12.68 trillion in the third quarter of 2008.

Mortgage balances—the largest component of household debt—rose by $162 billion in the second quarter to $9.4 trillion, surpassing the high of $9.3 trillion in the third quarter of 2008. Mortgage originations, which include mortgage refinances, also increased by $130 billion to $474 billion, the highest volume seen since the third quarter of 2017.

…

“While nominal mortgage balances are now slightly above the previous peak seen in the third quarter of 2008, mortgage delinquencies and the average credit profile of mortgage borrowers have continued to improve,” said Wilbert van der Klaauw, senior vice president at the New York Fed. “The data suggest a more nuanced picture for other forms of household debt, with credit card delinquency rates continuing to rise.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q2. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Aggregate household debt balances increased by $192 billion in the second quarter of 2019, a 1.4% increase, and now stand at 13.86 trillion. Balances have been steadily rising for five years and in aggregate are now $1.2 trillion higher, in nominal terms, than the previous peak (2008Q3) peak of $12.68 trillion. Overall household debt is now 24.3% above the 2013Q2 trough.

Mortgage balances shown on consumer credit reports on June 30 stood at $9.4 trillion, a $162 billion increase from 2019Q1. Balances on home equity lines of credit (HELOC) continued the declining trend in place since 2009, with a decline of $7 billion, and now stand at $399 billion. Non-housing balances increased by $37 billion in the second quarter, with a $17 billion increase in auto loan balances and a $20 billion increase in credit card balances offsetting an $8 billion decline in student loan balances.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate decreased in Q2. From the NY Fed:

Aggregate delinquency rates improved in the second quarter of 2019. As of June 30, 4.4% of outstanding debt was in some stage of delinquency. Of the $604 billion of debt that is delinquent, $405 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have previously been charged off although the lenders are continuing collection attempts). The share of credit card balances transitioning into 90+ day delinquency has been rising since 2017, and continued to do so in Q2. Meanwhile the flow into 90+ day delinquency for auto loan balances has risen more than 70 bps since 2012 and experienced a slight seasonal decline this quarter. Student loan delinquency transition rates remain at high levels relative to other types of debt, and increased this quarter; 9.9% of student loan balances became seriously delinquent in the second quarter (at an annual rate).There is much more in the report.

MBA: "Mortgage Delinquencies Rise in the Second Quarter of 2019"

by Calculated Risk on 8/13/2019 10:38:00 AM

From the MBA: Mortgage Delinquencies Rise in the Second Quarter of 2019

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.53 percent of all loans outstanding at the end of the second quarter of 2019, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey. The foreclosure inventory rate, the percentage of loans in the foreclosure process, was 0.90 percent last quarter - the lowest since the fourth quarter of 1995.

The delinquency rate was up 11 basis points from the first quarter of 2019 and 17 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the second quarter rose by two basis points to 0.25 percent.

"The unemployment rate remains quite low, but the national mortgage delinquency rate in the second quarter rose from both the first quarter and one year ago. The economy is slowing, and this poses the risk of further increases in delinquency rates," said Marina Walsh, MBA's Vice President of Industry Analysis. "Across loan types, the FHA delinquency rate posted the largest variance, increasing 29 basis points from last quarter and 52 basis points from a year ago."

Added Walsh, "Heavy rains and flooding, extreme heat, and tornadoes in certain states during the spring, may have also contributed to the increase in the delinquency rate, as some borrowers likely faced disruption or hardship."

...

Compared to last quarter, the seasonally adjusted mortgage delinquency rate increased for all loans outstanding. By stage, the 30-day delinquency rate increased four basis points to 2.62 percent, the 60-day delinquency rate remained unchanged at 0.81 percent, and the 90-day delinquency bucket increased seven basis points to 1.10 percent.

...

The delinquency rate includes loans that are at least one payment past due, but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 0.90 percent, down two basis points from the first quarter of 2019 and 15 basis points lower than one year ago. This is the lowest foreclosure inventory rate since the fourth quarter of 1995.

...

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was at 1.95 percent - a decrease of 1 basis point from last quarter and a decrease of 35 basis points from last year.

…

The five states with the largest increases in their overall delinquency rate were affected by weather-related issues. This may have resulted in an increase in delinquencies over the previous quarter of the following magnitude: West Virginia (86 basis points), Mississippi (81 basis points), Alabama (73 basis points), Indiana (73 basis points), and New Mexico (65 basis points).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. There was an increase in delinquencies in Q2 - probably due to weather - but the overall level is low.

The percent of loans in the foreclosure process continues to decline, and is now at the lowest level since 1995.