by Calculated Risk on 8/14/2019 07:00:00 AM

Wednesday, August 14, 2019

MBA: Mortgage Applications Increased Sharply in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 21.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 9, 2019.

... The Refinance Index increased 37 percent from the previous week to its highest level since July 2016, and was 196 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

“The 2019 refinance wave continued, as homeowners last week responded to extraordinarily low mortgage rates. Fears of an escalating trade war, combined with economic and geopolitical concerns, once again pulled U.S. Treasury rates lower. The 30-year fixed mortgage rate decreased eight basis points to 3.93 percent – the lowest level since November 2016 – and has now dropped more than 80 basis points this year,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “In just the last two weeks, rates have decreased 15 basis points and the refinance index has increased more than 50 percent, reaching its highest level since July 2016. The government refinance index, driven by a 25 percent increase in VA refinance applications, is now at its highest level since May 2013.”

Added Kan, “Purchase applications also benefited from these lower rates, with activity increasing 1.9 percent last week and 12 percent from a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to its lowest level since November 2016, 3.93 percent, from 4.01 percent, with points decreasing to 0.35 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to under 4%.

With lower rates, we saw a sharp increase in refinance activity.

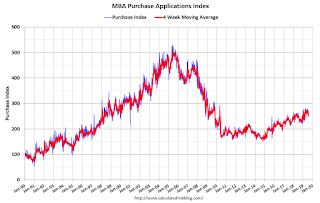

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 12% year-over-year.