by Calculated Risk on 4/14/2019 09:06:00 PM

Sunday, April 14, 2019

Sunday Night Futures

Weekend:

• Schedule for Week of April 14, 2019

Monday:

• 8:30 AM, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 6.8, up from 3.7.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $63.45 per barrel and Brent at $71.24 per barrel. A year ago, WTI was at $67, and Brent was at $73 - so oil prices are down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.83 per gallon. A year ago prices were at $2.70 per gallon, so gasoline prices are up 13 cents per gallon year-over-year.

LA area Port Traffic Down Year-over-year in March

by Calculated Risk on 4/14/2019 11:28:00 AM

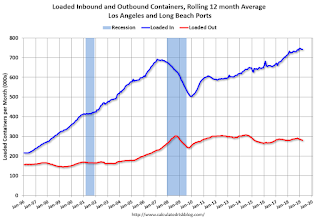

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted two years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.1% in March compared to the rolling 12 months ending in February. Outbound traffic was down 0.5% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have mostly moved sideways over the last 8 years.

Saturday, April 13, 2019

Schedule for Week of April 14, 2019

by Calculated Risk on 4/13/2019 08:11:00 AM

The key reports this week are March housing starts and retail sales. Other key reports include March industrial production and the February trade deficit.

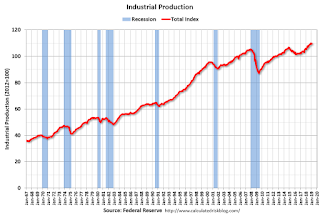

For manufacturing, the March Industrial Production report and the April NY and Philly Fed manufacturing surveys will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 6.8, up from 3.7.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 63, up from 62. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $53.7 billion. The U.S. trade deficit was at $51.1 billion in January.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 206 thousand initial claims, up from 196 thousand the previous week.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for 0.8% increase in retail sales.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for 0.8% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 3.2% on a YoY basis in February.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 10.2, down from 13.7.

8:30 AM ET: Housing Starts for March.

8:30 AM ET: Housing Starts for March. This graph shows single and total housing starts since 1968.

The consensus is for 1.230 million SAAR, up from 1.162 million SAAR in February.

10:00 AM: State Employment and Unemployment (Monthly) for March 2019

Friday, April 12, 2019

The Longest Expansions in U.S. History

by Calculated Risk on 4/12/2019 02:29:00 PM

According to NBER, the four longest expansions in U.S. history are:

1) From a trough in March 1991 to a peak in March 2001 (120 months).

2) From a trough in June 2009 to today, April 2019 (118 months and counting).

3) From a trough in February 1961 to a peak in December 1969 (106 months).

4) From a trough in November 1982 to a peak in July 1990 (92 months).

So the current U.S. expansion is currently the second longest on record, and it seems extremely likely that the current expansion will surpass the '90s expansion in a few months.

As I noted in late 2017 in Is a Recession Imminent? (one of the five questions I'm frequently asked)

Expansions don't die of old age! There is a very good chance this will become the longest expansion in history.A key reason the current expansion has been so long is that housing didn't contribute for the first few years of the expansion. Also the housing recovery was sluggish for a few more years after the bottom in 2011. This was because of the huge overhang of foreclosed properties coming on the market. Single family housing starts and new home sales both bottomed in 2011 - so this is just the eight year of housing expansion - and I expect further increases in starts and sales over the next year or longer.

Q1 GDP Forecasts: Around 2%

by Calculated Risk on 4/12/2019 11:43:00 AM

From Merrill Lynch:

We continue to track 1.9% for 1Q GDP growth. [April 12 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.4% for 2019:Q1 and 2.0% for 2019:Q2. [Apr 12 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2019 is 2.3 percent on April 8, up from 2.1 percent on April 2. [Apr 8 estimate]CR Note: These estimates suggest real GDP growth will be around 2% annualized in Q1.

Housing and Recessions

by Calculated Risk on 4/12/2019 10:04:00 AM

Following the recent bounce back in some of the housing reports, I'd like to update a couple of graphs.

For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."

For the bottoms and troughs for key housing activity, here is a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

RI as a percent of GDP has been sluggish recently, mostly due to softness in multi-family residential.

Also, look at the relatively low level of RI as a percent of GDP, new home sales and single family starts compared to previous peaks. To have a significant downturn from these levels would be surprising.

Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. The one exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust.

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As I noted in earlier posts, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

Although new home sales were down towards the end of 2018, the decline wasn't that large historically. As I noted last Fall, I wasn't even on recession watch.

Thursday, April 11, 2019

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 4/11/2019 05:15:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 6 April

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 31 March through 6 April 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 1-7 April 2018, the industry recorded the following:

• Occupancy: +0.4% to 68.7%

• Average daily rate (ADR): +1.5% to US$130.79

• Revenue per available room (RevPAR): +1.9% to US$89.90

STR analysts note that performance growth was lifted due to comparison with Easter Sunday and the days immediately following in 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019 - close, to-date, compared to the previous 4 years.

Seasonally, the occupancy rate will mostly move sideways during the Spring travel season, and then increase during the Summer.

Data Source: STR, Courtesy of HotelNewsNow.com

Housing Inventory Tracking

by Calculated Risk on 4/11/2019 11:33:00 AM

Another Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 3.2% year-over-year (YoY) in February, this was the seventh consecutive month with a YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, and Sacramento (through March) and Phoenix, and total existing home inventory as reported by the NAR (through February).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 92% YoY in Las Vegas in March (red), the eight consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY last year as oil prices increased. Inventory was up 17.5% year-over-year in Houston in March.

Inventory is a key for the housing market. Right now it appears the inventory build that started last year is slowing.

Also note that inventory in Seattle was up 136% year-over-year in March (not graphed)!

Sacramento Housing in March: Sales Down 5% YoY, Active Inventory up 4% YoY

by Calculated Risk on 4/11/2019 10:04:00 AM

From SacRealtor.org: Spring sales season kicks off in March

March ended with 1,320 total sales, a 30% increase from the 1,015 sales of February. Compared to the same month last year (1,395), the current figure is down 5.4%.CR Note: Inventory is still low - months of inventory is at 1.4 months, probably closer to 4 months would be normal - and this is the smallest YoY increase since October 2017.

...

The Active Listing Inventory decreased 5.6%, dropping from 1,994 to 1,883 units. The Months of Inventory decreased 30% from 2 to 1.4 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. [Note: Compared to March 2018, inventory is up 3.6%] .

...

The Median DOM (days on market) dropped for the first time since May 2018, falling from 27 to 18 from February to March. The Average DOM also decreased, dropping from 43 to 37. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

Weekly Initial Unemployment Claims decreased to 196,000

by Calculated Risk on 4/11/2019 08:35:00 AM

The DOL reported:

In the week ending April 6, the advance figure for seasonally adjusted initial claims was 196,000, a decrease of 8,000 from the previous week's revised level. This is the lowest level for initial claims since October 4, 1969 when it was 193,000. The previous week's level was revised up by 2,000 from 202,000 to 204,000. The 4-week moving average was 207,000, a decrease of 7,000 from the previous week's revised average. This is the lowest level for this average since December 6, 1969 when it was 204,500. The previous week's average was revised up by 500 from 213,500 to 214,000The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 207,000.

This was below the consensus forecast.