by Calculated Risk on 1/24/2019 08:33:00 AM

Thursday, January 24, 2019

Weekly Initial Unemployment Claims decreased to 199,000, Lowest since 1969

The DOL reported:

In the week ending January 19, the advance figure for seasonally adjusted initial claims was 199,000, a decrease of 13,000 from the previous week's revised level. This is the lowest level for initial claims since November 15, 1969 when it was 197,000. The previous week's level was revised down by 1,000 from 213,000 to 212,000. The 4-week moving average was 215,000, a decrease of 5,500 from the previous week's revised average. The previous week's average was revised down by 250 from 220,750 to 220,500.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 215,000.

This was lower than the consensus forecast.

Wednesday, January 23, 2019

Thursday: Unemployment Claims, Kansas City Fed Mfg Survey

by Calculated Risk on 1/23/2019 08:52:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 213 thousand the previous week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

Chemical Activity Barometer Declines in January

by Calculated Risk on 1/23/2019 02:11:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Shows Signs of Slower Growth in U.S. Economy

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), posted a 0.3 percent decline in January on a three-month moving average (3MMA) basis. This marks the barometer’s third consecutive month-over-month drop and suggests a slower rate of U.S. economic growth. On a year-over-year (Y/Y) basis, the barometer is up 0.8 percent (3MMA), a pronounced slowdown in the pace of growth as compared with late last year.

...

“The CAB continues to signal gains in U.S. commercial and industrial activity through mid-2019, but at a much slower pace as growth (as measured by year-earlier comparisons) has turned over,” said Kevin Swift, chief economist at ACC. “Despite three straight months of decline in the barometer, the cumulative decline is 1.0 percent – well below the 3.0 percent that would signal negative growth in the U.S. economy.”

…

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has softened recently, suggesting further gains in industrial production into 2019, but at a slower pace.

AIA: "Architecture billings slow, but close 2018 with growing demand"

by Calculated Risk on 1/23/2019 11:30:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings slow, but close 2018 with growing demand

Architecture firm billings growth softened in December but remained positive for the fifteenth consecutive month, according to a new report released today from The American Institute of Architects (AIA). AIA’s Architecture Billings Index (ABI) score for December was 50.4 compared to 54.7 in November. Despite the positive billings, a softening in growth was seen across several regions and sectors, as well as in project inquiries and design contracts.

“Given the concerns over the ongoing tariff situation, it is not surprising to see a bit of a slowdown in progress on current projects,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Growing anxiety over unstable business conditions and the partial shutdown of the government may lead to further softening in the coming months.”

...

• Regional averages: Midwest (56.3), Northeast (51.6), South (49.4), West (49.2)

• Sector index breakdown: institutional (53.1), commercial/industrial (51.2), mixed practice (50.2), multi-family residential (49.8

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.4 in December, down from 54.7 in November. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 15 consecutive months, suggesting a further increase in CRE investment in 2019.

Richmond Fed: "Fifth District Manufacturing Activity Was Soft in January"

by Calculated Risk on 1/23/2019 10:04:00 AM

From the Richmond Fed: Fifth District Manufacturing Activity Was Soft in January

Fifth District manufacturing activity was soft in January, according to the latest survey from the Richmond Fed. The composite index rose from −8 in December to −2 in January but continued to indicate weak growth. The rise from December came from increases in the component indexes of employment and shipments, although the shipments index remained negative. The third component, new orders, dropped to −11, its lowest reading since June 2016. Meanwhile, the index for backlog of orders fell to −21, its lowest reading since May 2009. However, manufacturers remained optimistic that conditions would improve in the coming months.This was another weak regional manufacturing reading for January.

Survey results indicated continued growth in employment and wages in January, but firms still struggled to find workers with the skills they need. Respondents expected this struggle to continue, along with employment and wage growth, in the near future.

emphasis added

Black Knight: National Mortgage Delinquency Rate Increased Seasonally in December, Lowest Year-End this Century

by Calculated Risk on 1/23/2019 09:00:00 AM

From Black Knight: Black Knight’s First Look: Delinquency Rate Entering 2019 Lowest of Any Year Since the Turn of the Century

• Despite rising seasonally in recent months, only 3.9 percent of mortgages were delinquent as of December month-end, the lowest year-end total since Black Knight began reporting the figure in 2000According to Black Knight's First Look report for December, the percent of loans delinquent increased 4.7% in December compared to November, and decreased 17.6% year-over-year.

• The national foreclosure rate, while also edging seasonally upward in December, posted the lowest year-end figure since 2005, with just 0.52 percent of mortgages in active foreclosure

• Foreclosure starts edged slightly upward with 46,300 starts reported for the month, a 2.4 percent uptick over November

• Foreclosure starts were also up 4 percent year-over-year in December, though this increase was primarily driven by suppressed foreclosure start volumes in late 2017 due to hurricane-related moratoriums

The percent of loans in the foreclosure process increased 1.2% in December and were down 19.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.88% in December, up from 3.71% in November.

The percent of loans in the foreclosure process increased slightly in December to 0.52% from 0.52% in November.

The number of delinquent properties, but not in foreclosure, is down 399,000 properties year-over-year, and the number of properties in the foreclosure process is down 60,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2018 | Nov 2018 | Dec 2017 | Dec 2016 | |

| Delinquent | 3.88% | 3.71% | 4.71% | 4.42% |

| In Foreclosure | 0.52% | 0.52% | 0.65% | 0.95% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,013,000 | 1,925,000 | 2,412,000 | 2,248,000 |

| Number of properties in foreclosure pre-sale inventory: | 271,000 | 268,000 | 331,000 | 483,000 |

| Total Properties | 2,283,000 | 2,193,000 | 2,743,000 | 2,731,000 |

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 1/23/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 18, 2019.

... The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 13 percent higher than the same week one year ago.

...

“Mortgage application activity cooled off last week after two consecutive weeks of sizeable increases. Both purchase and refinance applications saw declines but remained at healthy levels, with the purchase index remaining close to a nine-year high, and the refinance index hovering near its highest level since last spring,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Reversing the recent downward trend, borrowers saw increasing rates for most loan types last week, as better-than-expected unemployment claims, easing trade tensions and stabilization in the equity markets ultimately led to a rise in Treasury rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.75 percent from 4.74 percent, with points decreasing to 0.44 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

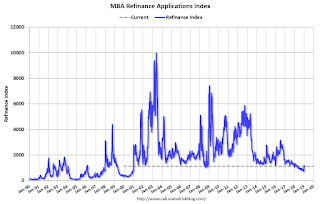

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity is close to the highest level since last Spring.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexThe purchase index is close to a 9 year high.

According to the MBA, purchase activity is up 13% year-over-year.

Tuesday, January 22, 2019

Wednesday: Richmond Fed, Architecture Billings Index

by Calculated Risk on 1/22/2019 07:31:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Dodging Some Risk For Now

As it happened, bonds staged a somewhat impressive recovery with help from investor concern about global growth. Oftentimes, a big loss in equities markets can send money running to the bond market where it benefits interest rates. This was the case overnight with Chinese stocks leading the way. The strong start in bonds allowed lenders to keep rates roughly unchanged and--in some cases--slightly lower. [30YR FIXED - 4.5%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for November 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for January.

• During the day, The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

Housing Inventory Tracking

by Calculated Risk on 1/22/2019 04:31:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 6.2% year-over-year (YoY) in December, this was the fifth consecutive month with a YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Phoenix and Sacramento and total existing home inventory as reported by the NAR (through December). (I'll be adding more areas).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 82% YoY in Las Vegas in December (red), the sixth consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up 13% year-over-year in Houston in December. With falling oil prices - along with higher mortgage rates - inventory will probably increase in Houston.

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect further increase in inventory in 2019.

Also note that inventory in Seattle was up 272% year-over-year in December, and Denver up 45% YoY (not graphed)!

Comments on December Existing Home Sales

by Calculated Risk on 1/22/2019 11:59:00 AM

Earlier: NAR: Existing-Home Sales Decreased to 4.99 million in December

A few key points:

1) The key for housing - and the overall economy - is new home sales, single family housing starts and overall residential investment. Unfortunately this key data is not currently being released due to the government shutdown. However, overall, this is still a somewhat reasonable level for existing home sales, and the weakness at the end of 2018 was no surprise given the increase in mortgage rates.

2) Inventory is still low, but was up 6.2% year-over-year (YoY) in December. This was the fifth consecutive month with a year-over-year increase in inventory, and the largest YoY increase since January 2014.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler; Early Read on Existing Home Sales in December: Big Drop. The consensus was for sales of 5.24 million SAAR, Lawler estimated the NAR would report 4.97 million SAAR in December, and the NAR actually reported 4.99 million SAAR.

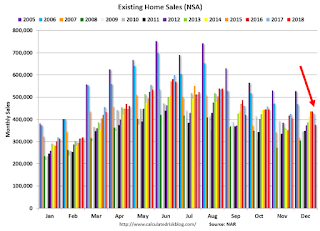

The current YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending. In 2018 (light blue arrow), inventory followed the normal seasonal pattern.

Although I expected inventory to increase YoY in 2018, I also expected inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase much more and still be at normal levels. No worries.

Sales NSA in December (377,000, red column) were below sales in December 2017 (427,000, NSA), and sales were the lowest for December since 2012.

For the year, sales totaled 5.342 million, down 3.1% from 5.511 million in 2017. This was also below sales in 2016 (5.452 million).