by Calculated Risk on 1/27/2019 07:09:00 PM

Sunday, January 27, 2019

Sunday Night Futures

Weekend:

• Schedule for Week of January 27, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for December. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for January. This is the last of regional manufacturing surveys for January.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 5 and DOW futures are down 35 (fair value).

Oil prices were down over the last week with WTI futures at $53.32 per barrel and Brent at $61.26 per barrel. A year ago, WTI was at $66, and Brent was at $70 - so oil prices are down about 15% to 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.26 per gallon. A year ago prices were at $2.56 per gallon, so gasoline prices are down 30 cents per gallon year-over-year.

January 2019: Unofficial Problem Bank list increased to 78 Institutions

by Calculated Risk on 1/27/2019 11:55:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for January 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for January 2019. During the month, the list increased by a net of one institution to 78 banks after two removals and three additions. Aggregate assets increased slightly to $55.2 billion from $54.8 billion at year-end. A year ago, the list held 101 institutions with assets of $20.7 billion.

This month, actions were terminated against Northside Bank, Adairsville, GA ($126 million) and Millennial Bank, Leeds, AL ($66 million), which was previously known as Covenant Bank.

Additions this month include Southwest Capital Bank, Albuquerque, NM ($369 million) and Beacon Business Bank, National Association, San Francisco, CA ($140 million). In addition, the FDIC issued Gunnison Valley Bank, Gunnison, UT ($71 million) a Prompt Corrective Action in October 2018. Gunnison Valley Bank has the dubious distinction of making a return appearance on the list after being removed in September 2017.

Saturday, January 26, 2019

Schedule for Week of January 27th

by Calculated Risk on 1/26/2019 08:11:00 AM

Special Note on Government Opening: Now that the Government is open, the data releases that were postponed will be released soon. The BEA and Census will probably provide an updated schedule early next week. Some releases on the weekly schedule below will probably be delayed (like Q4 GDP).

The key reports scheduled for this week are the January employment report and Q4 GDP. Other key indicators include December Personal Income and Outlays, November Case-Shiller house prices, and January vehicle sales.

For manufacturing, the January ISM manufacturing survey, and the Dallas Fed manufacturing survey will be released.

The FOMC meets this week, and no change to policy is expected at this meeting.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January. This is the last of regional manufacturing surveys for January.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 4.9% year-over-year increase in the Comp 20 index for November.

10:00 AM: the Q4 2018 Housing Vacancies and Homeownership from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 167,000 payroll jobs added in January, down from 271,000 added in December.

8:30 AM: Gross Domestic Product, 4th quarter 2018 (Advance estimate). The consensus is that real GDP increased 2.6% annualized in Q4, down from 3.4% in Q3.

10:00 AM: Pending Home Sales Index for December. The consensus is for a 0.1% increase in the index.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 213 thousand the previous week.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 62.5, down from 65.4 in December.

8:30 AM: Employment Report for January. The consensus is for 158,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

8:30 AM: Employment Report for January. The consensus is for 158,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.There were 213,000 jobs added in December, and the unemployment rate was at 3.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In December the year-over-year change was 2.638 million jobs.

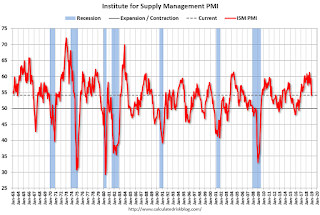

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 54.0, down from 54.1 in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 54.0, down from 54.1 in December.Here is a long term graph of the ISM manufacturing index.

The PMI was at 54.1% in December, the employment index was at 56.2%, and the new orders index was at 51.1%.

10:00 AM: Construction Spending for December. The consensus is for a 0.2% increase in construction spending.

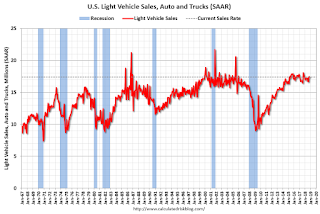

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 17.2 million SAAR in January, unchanged from 17.2 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 17.2 million SAAR in January, unchanged from 17.2 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate (The BEA hasn't released December sales yet).

Friday, January 25, 2019

NMHC: Apartment Market Tightness Index remained negative for 13th Consecutive Quarter

by Calculated Risk on 1/25/2019 03:53:00 PM

The National Multifamily Housing Council (NMHC) released their January report: January NMHC Quarterly Survey Shows Little Overall Change

Apartment market conditions were mixed in the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for January. The Market Tightness (46) and Equity Financing (50) indexes showed little change in those conditions from October, while the Debt Financing Index (59) showed improving conditions. By contrast, the Sales Volume Index (33) showed further slowing in property sales.This index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. And it also helped me call the bottom in vacancy rate more recently.

Notably, a significant majority of respondents found that recent tariffs have driven up costs across the board and in a variety of markets throughout the country. "While the four indexes each changed somewhat over the last quarter, overall market conditions remained fairly static. Debt market financing conditions improved somewhat over the last three months," said NMHC Chief Economist Mark Obrinsky. "By contrast equity market financing conditions are little changed, as considerable capital continues to seek investment in the apartment sector."

The Market Tightness Index increased from 41 to 46. Less than one-quarter (22 percent) of respondents reported looser market conditions than three months prior, compared to 13 percent who reported tighter conditions. Nearly two-thirds (64 percent) of respondents felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

This is the thirteenth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to continue to slow.

Q4 GDP Forecasts: Mid-to-High 2s

by Calculated Risk on 1/25/2019 11:44:00 AM

Update: GDPNow model has been updated.

The Q4 advanced GDP release is scheduled for next Wednesday, but even if the government is opened this weekend, that release will probably be delayed.

From Merrill Lynch:

4Q GDP tracking remains at 2.8%. With the shutdown ongoing, we revise down 1Q GDP to 2.0% from 2.2% [Jan 25 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.6% for 2018:Q4 and 2.2% for 2019:Q1. [Jan 25 estimate]And from the Altanta Fed: GDPNow

The current GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.7 percent, down from 2.8 percent on January 18. The nowcast of fourth-quarter real residential investment growth declined from -2.6 percent to -4.3 after the existing-home sales release on Tuesday, January 22, from the National Association of Realtors. [Jan 25 estimate]CR Note: These estimates suggest GDP in the mid-to-high 2s for Q4.

Flying Blind: Data Held Hostage

by Calculated Risk on 1/25/2019 10:45:00 AM

Once again policy makers and analysts are flying blind without key economic data due to a government shutdown. As an example, the new home sales report for December wasn't released this morning (this is the second month in a row without a new home sales report).

I think the four most important releases are 1) the monthly employment report, 2) the quarterly GDP report, 3) the monthly housing starts report and 4) the monthly new home sales report. Only the employment report is currently being released. Of course many other reports flow into the quarterly GDP report - so those missing reports are also important.

All business people know that when there is a problem, a key first step is to measure the problem. And everyone knows housing has been soft recently, so we need the housing starts and new home sales reports to understand how soft.

In the short term this is a minor inconvenience compared to the widespread suffering related to the shutdown, but these missing reports are important for understanding what is happening with the economy.

Thursday, January 24, 2019

Friday: Durable Goods, New Home Sales (Postponed)

by Calculated Risk on 1/24/2019 07:14:00 PM

Probably the four most important data releases for tracking the economy are 1) the monthly employment report, 2) the quarterly GDP report, 3) the monthly housing starts report, and 4) the new home sales report. Only the employment report is being released on time.

The government shutdown is delaying 3 out of 4 of these critical reports - so we are flying blind.

Friday:

• At 8:30 AM, Durable Goods Orders for December from the Census Bureau. The consensus is for a 1.8% increase in durable goods orders.

• At 10:00 AM, POSTPONED New Home Sales for December from the Census Bureau. The consensus is for 565 thousand SAAR.

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 1/24/2019 04:06:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 19 January

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 13-19 January 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 14-20 January 2018, the industry recorded the following:

• Occupancy: +5.0% to 58.4%

• Average daily rate (ADR): +3.4% to US$124.32

• Revenue per available room (RevPAR): +8.5% to US$72.54

STR analysts partially attribute the week’s substantial growth figures to a calendar shift. Growth for Monday of the week was especially pronounced due to comparison with Martin Luther King, Jr. Day last year: 14 January 2019 (standard business day) vs. 15 January 2018 (MLK Day). Significant performance increases were also noticeable on Saturday of the week. That was likely due in part to the Women’s March as well as the long weekend that ended with this year’s MLK Day.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A solid start for 2019.

Seasonally, the occupancy rate will increase over the next couple of months.

Data Source: STR, Courtesy of HotelNewsNow.com

LA area Port Traffic in December; Imports Up YoY, Exports Down

by Calculated Risk on 1/24/2019 12:13:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 1.3% compared in December to the rolling 12 months ending in November. Outbound traffic was down 0.8% compared to the rolling 12 months ending in November.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have mostly moved sideways over the last 8 years.

Kansas City Fed: Regional Manufacturing Activity "Continued to Grow Modestly" in January, Negative Impact from Shutdown

by Calculated Risk on 1/24/2019 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Continued to Grow Modestly

The Federal Reserve Bank of Kansas City released the January Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to grow modestly, and expectations for future growth remained solid.So far, most of the regional surveys have indicated slower growth in January than in December (and December was the weakest month for the ISM index in over 2 years).

“Regional factories had another month of sluggish growth in January,” said Wilkerson. “About one-sixth of the firms in the survey said the partial government shutdown had negatively affected their business.”

...

The month-over-month composite index was 5 in January, similar to 6 in December, and lower than 17 in November. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The slow and steady increase in factory activity was driven by durable goods producers, particularly wood products, fabricated metals, electrical equipment and appliances, and furniture manufacturing. Month-over-month indexes were somewhat mixed. The production index jumped back into positive territory, while the order backlog index turned negative for the first time since June 2017. Most year-over-year factory indexes eased from the previous month, and the composite index decreased from 38 to 31. Future factory activity expectations remained solid. The future composite index eased slightly from 22 to 18, while the future production index increased.

…

This month contacts were asked special questions about how the partial federal government shutdown has affected their business, and how credit conditions have changed over the past year. Nearly 17 percent of manufacturing contacts reported negative effects from the federal government shutdown on their business. Of the firms that reported negative effects from the shutdown, most noted permit delays or trade disruptions due to federal agencies being closed. Over the past year, more than 13 percent of firms reported that access to credit had increased while only seven percent of firms said access had decreased (Chart 4). However, 54 percent of contacts reported that the cost of credit increased over the past year.

emphasis added