by Calculated Risk on 1/23/2019 09:00:00 AM

Wednesday, January 23, 2019

Black Knight: National Mortgage Delinquency Rate Increased Seasonally in December, Lowest Year-End this Century

From Black Knight: Black Knight’s First Look: Delinquency Rate Entering 2019 Lowest of Any Year Since the Turn of the Century

• Despite rising seasonally in recent months, only 3.9 percent of mortgages were delinquent as of December month-end, the lowest year-end total since Black Knight began reporting the figure in 2000According to Black Knight's First Look report for December, the percent of loans delinquent increased 4.7% in December compared to November, and decreased 17.6% year-over-year.

• The national foreclosure rate, while also edging seasonally upward in December, posted the lowest year-end figure since 2005, with just 0.52 percent of mortgages in active foreclosure

• Foreclosure starts edged slightly upward with 46,300 starts reported for the month, a 2.4 percent uptick over November

• Foreclosure starts were also up 4 percent year-over-year in December, though this increase was primarily driven by suppressed foreclosure start volumes in late 2017 due to hurricane-related moratoriums

The percent of loans in the foreclosure process increased 1.2% in December and were down 19.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.88% in December, up from 3.71% in November.

The percent of loans in the foreclosure process increased slightly in December to 0.52% from 0.52% in November.

The number of delinquent properties, but not in foreclosure, is down 399,000 properties year-over-year, and the number of properties in the foreclosure process is down 60,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2018 | Nov 2018 | Dec 2017 | Dec 2016 | |

| Delinquent | 3.88% | 3.71% | 4.71% | 4.42% |

| In Foreclosure | 0.52% | 0.52% | 0.65% | 0.95% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,013,000 | 1,925,000 | 2,412,000 | 2,248,000 |

| Number of properties in foreclosure pre-sale inventory: | 271,000 | 268,000 | 331,000 | 483,000 |

| Total Properties | 2,283,000 | 2,193,000 | 2,743,000 | 2,731,000 |

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 1/23/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 18, 2019.

... The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 13 percent higher than the same week one year ago.

...

“Mortgage application activity cooled off last week after two consecutive weeks of sizeable increases. Both purchase and refinance applications saw declines but remained at healthy levels, with the purchase index remaining close to a nine-year high, and the refinance index hovering near its highest level since last spring,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Reversing the recent downward trend, borrowers saw increasing rates for most loan types last week, as better-than-expected unemployment claims, easing trade tensions and stabilization in the equity markets ultimately led to a rise in Treasury rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.75 percent from 4.74 percent, with points decreasing to 0.44 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

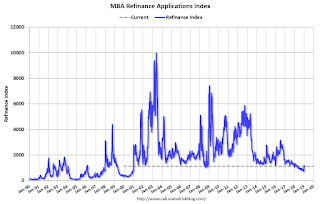

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity is close to the highest level since last Spring.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexThe purchase index is close to a 9 year high.

According to the MBA, purchase activity is up 13% year-over-year.

Tuesday, January 22, 2019

Wednesday: Richmond Fed, Architecture Billings Index

by Calculated Risk on 1/22/2019 07:31:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Dodging Some Risk For Now

As it happened, bonds staged a somewhat impressive recovery with help from investor concern about global growth. Oftentimes, a big loss in equities markets can send money running to the bond market where it benefits interest rates. This was the case overnight with Chinese stocks leading the way. The strong start in bonds allowed lenders to keep rates roughly unchanged and--in some cases--slightly lower. [30YR FIXED - 4.5%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for November 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for January.

• During the day, The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

Housing Inventory Tracking

by Calculated Risk on 1/22/2019 04:31:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 6.2% year-over-year (YoY) in December, this was the fifth consecutive month with a YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Phoenix and Sacramento and total existing home inventory as reported by the NAR (through December). (I'll be adding more areas).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 82% YoY in Las Vegas in December (red), the sixth consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up 13% year-over-year in Houston in December. With falling oil prices - along with higher mortgage rates - inventory will probably increase in Houston.

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect further increase in inventory in 2019.

Also note that inventory in Seattle was up 272% year-over-year in December, and Denver up 45% YoY (not graphed)!

Comments on December Existing Home Sales

by Calculated Risk on 1/22/2019 11:59:00 AM

Earlier: NAR: Existing-Home Sales Decreased to 4.99 million in December

A few key points:

1) The key for housing - and the overall economy - is new home sales, single family housing starts and overall residential investment. Unfortunately this key data is not currently being released due to the government shutdown. However, overall, this is still a somewhat reasonable level for existing home sales, and the weakness at the end of 2018 was no surprise given the increase in mortgage rates.

2) Inventory is still low, but was up 6.2% year-over-year (YoY) in December. This was the fifth consecutive month with a year-over-year increase in inventory, and the largest YoY increase since January 2014.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler; Early Read on Existing Home Sales in December: Big Drop. The consensus was for sales of 5.24 million SAAR, Lawler estimated the NAR would report 4.97 million SAAR in December, and the NAR actually reported 4.99 million SAAR.

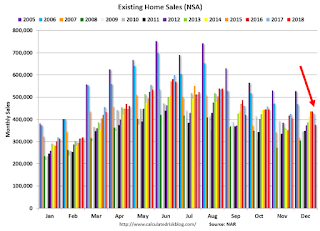

The current YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending. In 2018 (light blue arrow), inventory followed the normal seasonal pattern.

Although I expected inventory to increase YoY in 2018, I also expected inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase much more and still be at normal levels. No worries.

Sales NSA in December (377,000, red column) were below sales in December 2017 (427,000, NSA), and sales were the lowest for December since 2012.

For the year, sales totaled 5.342 million, down 3.1% from 5.511 million in 2017. This was also below sales in 2016 (5.452 million).

NAR: Existing-Home Sales Decreased to 4.99 million in December

by Calculated Risk on 1/22/2019 10:12:00 AM

From the NAR: Existing-Home Sales See 6.4 Percent Drop in December

After two consecutive months of increases, existing-home sales declined in the month of December, according to the National Association of Realtors®. None of the four major U.S. regions saw a gain in sales activity last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 6.4 percent from November to a seasonally adjusted rate of 4.99 million in December. Sales are now down 10.3 percent from a year ago (5.56 million in December 2017).

...

Total housing inventory at the end of December decreased to 1.55 million, down from 1.74 million existing homes available for sale in November, but represents an increase from 1.46 million a year ago. Unsold inventory is at a 3.7-month supply at the current sales pace, down from 3.9 last month and up from 3.2 months a year ago.

emphasis added

Click on graph for larger image.

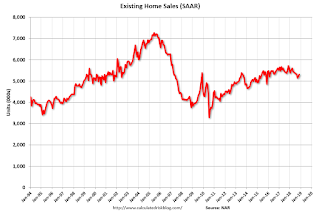

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December (4.99 million SAAR) were down 6.4% from last month, and were 10.3% below the December 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.55 million in December from 1.74 million in November. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.55 million in December from 1.74 million in November. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 6.2% year-over-year in December compared to December 2017.

Inventory was up 6.2% year-over-year in December compared to December 2017. Months of supply was at 3.7 months in December.

For existing home sales, a key number is inventory - and inventory is still low, but appears to have bottomed. I'll have more later ...

Monday, January 21, 2019

Tuesday: Existing Home Sales

by Calculated Risk on 1/21/2019 06:36:00 PM

Weekend:

• Schedule for Week of January 20, 2019

Tuesday:

• At 10:00 AM ET, Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.24 million SAAR, down from 5.32 million. Housing economist Tom Lawler expects the NAR to report sales of 4.97 million SAAR for December.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 10 and DOW futures are down 90 (fair value).

Oil prices were up over the last week with WTI futures at $53.90 per barrel and Brent at $62.84 per barrel. A year ago, WTI was at $64, and Brent was at $69 - so oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.24 per gallon. A year ago prices were at $2.52 per gallon, so gasoline prices are down 28 cents per gallon year-over-year.

Existing Home Sales for December: Take the Under

by Calculated Risk on 1/21/2019 08:31:00 AM

The NAR is scheduled to release Existing Home Sales for December at 10:00 AM on Tuesday, January 22nd.

The consensus is for 5.24 million SAAR, down from 5.32 million in November. Housing economist Tom Lawler estimates the NAR will reports sales of 4.97 million SAAR for December and that inventory will be up 5.5% year-over-year. Based on Lawler's estimate, I expect existing home sales to be well below the consensus for December.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 9 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Last month, in November 2018, the consensus was for sales of 5.19 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated the NAR would report 5.23 million, and the NAR reported 5.32 million (as usual Lawler was closer than the consensus).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last eight plus years, the consensus average miss was 143 thousand, and Lawler's average miss was 67 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | --- |

| 1NAR initially reported before revisions. | |||

Sunday, January 20, 2019

Oil: A huge drop in rig counts

by Calculated Risk on 1/20/2019 10:43:00 AM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on January 18, 2019:

• A huge drop in oil rig counts, -21 to 852

• Horizontal oil rig count collapsed, -17 to 765

• The Permian lost 10 horizontal oil rigs, ‘Other US’ lost 16

• Curiously, the Williston (+2), the Eagle Ford (+2) and the Cana Woodford (+5) all gained horizontal oil rigs

• Breakeven to add rigs fell rose to $61 WTI compared to $52.60 WTI on the screen as of the writing of this report.

• The model continues to predict big rig roll-offs in the next several weeks.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Saturday, January 19, 2019

Schedule for Week of January 20th

by Calculated Risk on 1/19/2019 08:11:00 AM

Special Note on Government Shutdown: If the Government shutdown continues, then some additional releases will be delayed. For example, this coming week, the new home sales and durable goods reports will not be released if the government remains shutdown - and probably delayed even if the government opens. (see bottom for key releases already delayed).

The key reports scheduled for this week are December New and Existing Home sales.

For manufacturing, the January Richmond and Kansas City Fed manufacturing surveys will be released.

All US markets will be closed in observance of Martin Luther King Jr. Day

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.24 million SAAR, down from 5.32 million.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.24 million SAAR, down from 5.32 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.97 million SAAR for December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for November 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 213 thousand the previous week.

11:00 AM: the Kansas City Fed manufacturing survey for December.

8:30 AM: Durable Goods Orders for December from the Census Bureau. The consensus is for a 1.8% increase in durable goods orders.

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for October (November was not released).

The consensus is for 565 thousand SAAR.

New Home Sales (Census) for November from the Census Bureau. The consensus was for 560 thousand SAAR, up from 544 thousand in October.

Construction Spending (Census) for November. The consensus was for a 0.3% increase in construction spending.

Light vehicle sales (BEA) for December. The consensus was for light vehicle sales to be 17.2 million SAAR in December, down from 17.4 million in November (Seasonally Adjusted Annual Rate).

Trade Balance report (Census) for November from the Census Bureau. The consensus was the trade deficit would be $53.9 billion. The U.S. trade deficit was at $55.5 billion in October.

Retail sales for December. (Census) The consensus was for a 0.2% increase in retail sales.

Housing Starts for December. (Census) The consensus was for 1.256 million SAAR, unchanged from 1.256 million SAAR.