by Calculated Risk on 12/31/2018 03:58:00 PM

Monday, December 31, 2018

Question #7 for 2019: How much will wages increase in 2019?

Earlier I posted some questions for next year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

7) Real Wage Growth: Wage growth picked up in 2018 (up 3.1% year-over-year as of November). How much will wages increase in 2019?

The most followed wage indicator is the “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report.

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth had been running close to 2% since 2010, and picked up a little in 2015, and more in 2016.

The red line is real wage growth (adjusted using headline CPI). Real wages increased during the crisis because CPI declined sharply. CPI was very low in 2015 - due to the decline in oil prices - so real wage growth picked up in 2015.

Real wage growth trended down in 2017, and picked up a little in 2018.

There are two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different, and most of the focus recently has been the CES series (used in the graph above).

![]() The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid).

The Atlanta Fed Wage tracker showed nominal wage growth close to 4% in late 2016, but dipped in 2017. At the end of 2018, wage growth was back up to close to 4%.

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3.5% in 2019 according to the CES.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Question #8 for 2019: How much will Residential Investment increase?

by Calculated Risk on 12/31/2018 01:13:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

8) Residential Investment: Residential investment (RI) was sluggish in 2018, and new home sales were mostly unchanged from 2017. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2019? How about housing starts and new home sales in 2019?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2018:

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the start of the recovery was sluggish.

Residential investment finally turned positive during 2011 and made a solid positive contribution to GDP every year through 2017.

We don't have the data for Q4 2018 yet, but it appears RI will make a small negative contribution to GDP in 2018.

RI as a percent of GDP is still low - close to the lows of previous recessions.

Housing starts are on pace to increase close to 5% in 2018, although growth slowed toward the end of 2018.

Even after the significant increase over the last several years, the approximately 1.26 million housing starts in 2018 will still be the 18th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the seven lowest years were 2008 through 2014). The other lower years were the bottoms of previous recessions.

Note: Due to the government shutdown, New Home sales for November are not available.

New home sales in 2018, through October, were up about 3% compared to the same period in 2017. However, sales were soft in Q4, and I estimate sales were about the same in 2018 as in 2017.

Here is a table showing housing starts and new home sales since 2005. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will increase further over the next few years.

| Housing Starts and New Home Sales (000s) | ||||

|---|---|---|---|---|

| Housing Starts | Change | New Home Sales | Change | |

| 2005 | 2,068 | --- | 1,283 | --- |

| 2006 | 1,801 | -12.9% | 1,051 | -18.1% |

| 2007 | 1,355 | -24.8% | 776 | -26.2% |

| 2008 | 906 | -33.2% | 485 | -37.5% |

| 2009 | 554 | -38.8% | 375 | -22.7% |

| 2010 | 587 | 5.9% | 323 | -13.9% |

| 2011 | 609 | 3.7% | 306 | -5.3% |

| 2012 | 781 | 28.2% | 368 | 20.3% |

| 2013 | 925 | 18.5% | 429 | 16.6% |

| 2014 | 1,003 | 8.5% | 437 | 1.9% |

| 2015 | 1,112 | 10.9% | 501 | 14.7% |

| 2016 | 1,174 | 5.6% | 561 | 12.0% |

| 2017 | 1,203 | 2.5% | 613 | 9.3% |

| 20181 | 1,263 | 5.0% | 613 | 0.0% |

| 12018 estimated | ||||

Most analysts are looking for starts and new home sales to increase to slightly in 2019. For example, the NAHB is forecasting a slight increase in starts (to 1.269 million), and no change in home sales in 2019. And Fannie Mae is forecasting a slight increase in starts (to 1.265 million), and for new home sales to increase to 619 thousand in 2019.

My sense is the weakness in late 2018 will continue into 2019, and starts will be down year-over-year, but not a huge decline. My guess is starts will decrease slightly in 2019 and new home sales will be close to 600 thousand.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Dallas Fed: "Texas Manufacturing Expands Modestly, Outlook Worsens"

by Calculated Risk on 12/31/2018 10:38:00 AM

From the Dallas Fed: Texas Manufacturing Expands Modestly, Outlook Worsens

Texas factory activity continued to expand rather modestly in December, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, inched down one point to 7.3.This was the last of the regional Fed surveys for December.

Other indexes of manufacturing activity also suggested modest growth in December, although demand growth picked up a bit. The capacity utilization index fell from 9.4 to 7.6, and the shipments index dipped to 6.1. Meanwhile, the new orders index moved up five points to 14.4, and the growth rate of new orders index edged up to 5.8.

Perceptions of broader business conditions turned slightly negative in December. The general business activity index plummeted 23 points to -5.1, hitting its lowest level since mid-2016. The company outlook index also fell markedly, dropping 17 points to -3.4, also a two-and-a-half-year low. More than 20 percent of manufacturers noted their outlook worsened this month.

Labor market measures suggested continued but slightly slower employment growth and longer workweeks in December. The employment index retreated five points to 11.0, a level still above average.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will decline significantly in December and probably be below the consensus forecast of 58.0 (to be released on Thursday, January 3rd).

Sunday, December 30, 2018

Sunday Night Futures

by Calculated Risk on 12/30/2018 08:58:00 PM

Weekend:

• Schedule for Week of December 30, 2018

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 12 and DOW futures are up 130 (fair value).

Oil prices were down slightly over the last week with WTI futures at $45.40 per barrel and Brent at $53.27 per barrel. A year ago, WTI was at $60, and Brent was at $67 - so oil prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.25 per gallon. A year ago prices were at $2.49 per gallon, so gasoline prices are down 24 cents per gallon year-over-year.

December 2018: Unofficial Problem Bank list declined to 77 Institutions, Q4 2018 Transition Matrix

by Calculated Risk on 12/30/2018 08:21:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for December 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for December 2018. During the month, the list fell by one to 77 institutions after three removals and two additions. Assets increased by $915 million to $54.8 billion. A year ago, the list held 103 institutions with assets of $20.9 billion.

This month, actions have been terminated against Persons Banking Company, Forsyth, GA ($312 million); The Citizens State Bank, Okemah, OK ($86 million); and Bison State Bank, Bison, KS ($10 million). Additions this month include Patriot Bank, National Association, Stamford, CT ($915 million Ticker: PNBK); and Quontic Bank, Astoria, NY ($407 million).

With it being the end of the fourth quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,738 institutions have appeared on a weekly or monthly list since the start of publication. Only 4.4 percent of the banks that have appeared on a list remain today as 1,661 institutions have transitioned through the list. Departure methods include 976 action terminations, 406 failures, 261 mergers, and 18 voluntary liquidations. Of the 389 institutions on the first published list, only 6 or 1.5 percent, are still designated as being in a troubled status more than nine years later. The 406 failures represent 23.4 percent of the 1,738 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 179 | (68,279,301) | |

| Unassisted Merger | 41 | (10,072,112) | |

| Voluntary Liquidation | 5 | (10,672,586) | |

| Failures | 158 | (186,397,337) | |

| Asset Change | 204,571 | ||

| Still on List at 12/31/2018 | 6 | 1,096,664 | |

| Additions after 8/7/2009 | 71 | 53,724,357 | |

| End (6/30/2018) | 77 | 54,821,021 | |

| Intraperiod Removals1 | |||

| Action Terminated | 797 | 323,352,219 | |

| Unassisted Merger | 220 | 82,620,807 | |

| Voluntary Liquidation | 13 | 2,515,855 | |

| Failures | 248 | 125,152,210 | |

| Total | 1,278 | 533,641,091 | |

| 1Institution not on 8/7/2009 or 12/31/2018 list but appeared on a weekly list. | |||

Saturday, December 29, 2018

Schedule for Week of December 30th

by Calculated Risk on 12/29/2018 08:11:00 AM

Happy New Year!

Special Note on Government Shutdown: If the Government shutdown continues, then some releases will be delayed. As an example, this week, construction spending will not be released if the government is shutdown. However, the BLS will release the December employment report as scheduled.

The key report this week is the December employment report on Friday.

Other key indicators include the December ISM manufacturing index, and December auto sales.

Also the Q4 quarterly Reis surveys for office and malls will be released this week.

On Friday, Fed Chair Jay Powell, and former Fed Chairs Ben Bernanke and Janet Yellen will be interviewed.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

All US markets will be closed in observance of the New Year's Day Holiday.

10:00 AM: Corelogic House Price index for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 175,000 payroll jobs added in December, down from 179,000 added in November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, down from 216 thousand the previous week.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0, down from 59.3 in November.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0, down from 59.3 in November.Here is a long term graph of the ISM manufacturing index.

The PMI was at 59.3% in November, the employment index was at 58.4%, and the new orders index was at 62.1%.

10:00 AM: Construction Spending for November. The consensus is for a 0.3% increase in construction spending.

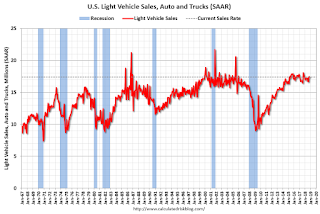

All day: Light vehicle sales for December. The consensus is for light vehicle sales to be 17.2 million SAAR in December, down from 17.4 million in November (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for December. The consensus is for light vehicle sales to be 17.2 million SAAR in December, down from 17.4 million in November (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate.

Early: Reis Q4 2018 Office Survey of rents and vacancy rates.

8:30 AM: Employment Report for December. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for December. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 155,000 jobs added in November, and the unemployment rate was at 3.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In November the year-over-year change was 2.443 million jobs.

Early: Reis Q4 2018 Mall Survey of rents and vacancy rates.

10:15 AM to 12:15 PM: Federal Reserve chairs: Joint Interview, Neil Irwin of the NY Times will interview Fed Chair Jay Powell, and former Fed Chairs Ben Bernanke and Janet Yellen.

Friday, December 28, 2018

Q4 GDP Forecasts: Mid 2s

by Calculated Risk on 12/28/2018 02:18:00 PM

From Goldman Sachs:

We also lowered our Q4 GDP tracking estimate by one tenth to +2.6% (qoq ar). [Dec 28 estimate)From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.5% for 2018:Q4 and 2.1% for 2019:Q1. [Dec 28 estimate]And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.7 percent on December 21, down from 2.9 percent on December 18 [Dec 21 estimate]CR Note: These estimates suggest GDP in the mid-2s for Q4.

Question #9 for 2019: What will happen with house prices in 2019?

by Calculated Risk on 12/28/2018 11:36:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up around 5% in 2018. What will happen with house prices in 2019?

The following graph shows the year-over-year change through October 2018, in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 4.7% compared to October 2017, the Composite 20 SA was up 5.1% and the National index SA was up 5.5% year-over-year. Other house price indexes have indicated similar gains (see table below).

The price increases in 2018 were lower than in 2017, and YoY price growth slowed towards the end of 2018.

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Oct-18 | 5.1% |

| Case-Shiller National | Oct-18 | 5.5% |

| CoreLogic | Oct-18 | 5.4% |

| FHFA Purchase Only | Oct-18 | 5.6% |

Inventories will probably increase further in 2019, but will probably still be somewhat low historically. Even though the housing market has slowed recently (fewer sales), and inventory has increased, there will be little panic selling because lending standards have been decent over the last several years. There are always people that have to sell because of the 3-Ds: Divorce, Death and Disease, but solid lending means there is no current need to sell because of a fourth D: Debt (like happened during the housing bust).

Low inventories, and a decent economy suggests further price increases in 2019.

Last year I wrote:

"Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year."That happened in 2018, and we might see more drag from the higher mortgage rates in 2019.

If inventory increases further year-over-year as I expect by December 2019, it seems likely that price appreciation will slow to the low single digits - maybe around 3%.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Chicago PMI Decreased Slighly in December

by Calculated Risk on 12/28/2018 10:29:00 AM

From the Chicago PMI: Chicago Business Barometer Moderates to 65.4 in December

The MNI Chicago Business Barometer eased to 65.4 in December, down 1.0 point from November’s 66.4.This was above the consensus forecast of 62.4.

...

After two consecutive months of higher readings, the Employment indicator receded in December, hitting a three-month low, although did remain above the neutral-50 mark.

…

“The MNI Chicago Business Barometer saw 2018 out in good health, assisted by a firm uptick in Production, cementing the best calendar quarter outturn in a year,” said Jai Lakhani, Economist at MNI Indicators.

“Encouragingly, inflationary pressures subsided for a fifth consecutive month and should this continue, it will ease the burden on firms‘ productive capacities. Still, concerns over tariffs continue to linger in the background and stir uncertainty,” he added.

emphasis added

NAR: Pending Home Sales Index Decreased 0.7% in November

by Calculated Risk on 12/28/2018 10:03:00 AM

From the NAR: Pending Home Sales See 0.7 Percent Drop in November

Pending home sales overall slipped in November, but saw minor increases in the Northeast and the West, according to the National Association of Realtors®.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 0.7 percent to 101.4 in November, down from 102.1 in October. However, year-over-year contract signings dropped 7.7 percent, making this the eleventh straight month of annual decreases.

...

The PHSI in the Northeast rose 2.7 percent to 95.1 in November, and is now 3.5 percent below a year ago. In the Midwest, the index fell 2.3 percent to 98.1 in November and is 7.0 percent lower than November 2017.

Pending home sales in the South fell 2.7 percent to an index of 115.7 in November, which is 7.4 percent lower than a year ago. The index in the West increased 2.8 percent in November to 87.2 and fell 12.2 percent below a year ago.

emphasis added