by Calculated Risk on 12/27/2018 04:06:00 PM

Thursday, December 27, 2018

Hotels: Occupancy Rate Increased Year-over-year

From HotelNewsNow.com: STR: US hotel results for week ending 15 December

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 9-15 December 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 10-16 December 2017, the industry recorded the following:

• Occupancy: +1.3% to 57.3%

• Average daily rate (ADR): +3.2% to US$119.10

• Revenue per available room (RevPAR): +4.6% to US$68.25

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This is the fourth strong year in a row for hotel occupancy. The occupancy rate, year-to-date, is just ahead of the record year in 2017.

Seasonally, the occupancy rate will be low through January.

Data Source: STR, Courtesy of HotelNewsNow.com

Question #10 for 2019: Will housing inventory increase or decrease in 2019?

by Calculated Risk on 12/27/2018 12:50:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

10) Housing Inventory: Housing inventory increased in 2018 from very low levels. Will inventory increase or decrease in 2019?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see red arrow on first graph below) helped me call the top for house prices in 2006.

This graph shows nationwide inventory for existing homes through November 2018.

According to the NAR, inventory decreased seasonally to 1.74 million in November from 1.85 million in October. However inventory in November was up from 1.67 million in November 2017.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

Note that inventory is still 15% to 20% below the levels for November 2014 and 2015.

Inventory increased 4.2% year-over-year in November compared to November 2017. Months of supply was at 3.9 months in November.

This increase followed several years of declining year-over-year inventory (see blue line).

A year ago I wrote: "The recent change in the tax law might lead to more inventory in certain areas, and I'll be tracking that over the course of the year." And sure enough, in certain areas, inventory was up significantly year-over-year (but still relatively low). For example, inventory in California was up 31% year-over-year. However months-of-supply in California only increased to 3.7 months from 2.9 months a year earlier. This is still on the low side.

I expect to see inventory up again year-over-year in December 2019. My reasons for expecting more inventory are 1) inventory is still historically low (inventory in November 2018 was the second lowest since 2000), 2) higher mortgage rates, and 3) further negative impact in certain areas from new tax law.

If correct, this will keep house price increases down in 2019 (probably lower than the 5% or so gains in 2018).

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Philly Fed: State Coincident Indexes increased in 43 states in November

by Calculated Risk on 12/27/2018 12:13:00 PM

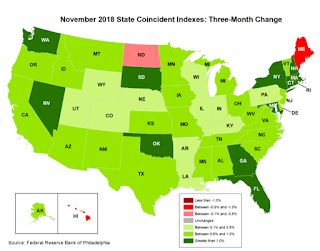

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2018. Over the past three months, the indexes increased in 47 states and decreased in three states, for a three-month diffusion index of 88. In the past month, the indexes increased in 43 states, decreased in three states, and remained stable in four, for a one-month diffusion index of 80.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In November, 45 states had increasing activity (including minor increases).

Data and the #TrumpShutdown

by Calculated Risk on 12/27/2018 10:00:00 AM

If the shutdown doesn't end quickly - the one in January 2018 lasted just two days - several agencies will not release regular government reports. For the current week, the November new home sales report will be delayed.

Update: The BLS is fully funded, and the December employment report will be released on time.

Private data - like the pending home sales report this week - will still be released. All Federal Reserve data will continue to be released (separate funding).

Also, the DOL will continue to process unemployment claims and release the weekly initial unemployment claims report.

If the shutdown lasts through this week, we should see a spike in claims in the report released the following week.

The following graph shows the 4-week moving average of weekly claims since January 2000 with various event driven spikes labeled.

Note the spike related to the 2013 government shutdown. Weekly claims jumped 66,000 in the week following the shutdown in 2013. We will probably see a similar spike in the report released the week of December 31st (if the shutdown does not end quickly).

Another impact from the shutdown will be on mortgage lending.

In 2013, the IRS stopped processing 4506-T forms (the required two years of tax returns for mortgage lending). For loans ready to close, this will not be a problem. And lenders can still accept applications, but this could slow closings a few weeks depending on the duration of the shutdown.

There are many other impacts from the shutdown, and hopefully it will be resolved soon.

Weekly Initial Unemployment Claims decreased to 216,000

by Calculated Risk on 12/27/2018 08:34:00 AM

The DOL reported:

In the week ending December 22, the advance figure for seasonally adjusted initial claims was 216,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 214,000 to 217,000. The 4-week moving average was 218,000, a decrease of 4,750 from the previous week's revised average. The previous week's average was revised up by 750 from 222,000 to 222,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,000.

This was close to the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, December 26, 2018

Thursday: Unemployment Claims, New Home Sales (Postponed)

by Calculated Risk on 12/26/2018 06:45:00 PM

Note: New Home sales will not be released on Thursday due to the Government Shutdown.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Higher Today or Tomorrow

Mortgage rates were unchanged in some cases today and higher in others. The discrepancy is a result of the timing of today's market movements. The most important thing to know is that lenders who are unchanged today will almost certainly be higher tomorrow, unless the bond market stages an impressive comeback between now and tomorrow morning.Thursday:

...

In the bigger picture, the past few days of weakness are complicated. On the one hand, there is an argument to overlook them due to the idiosyncratic nature of holiday season trading. On the other hand, bonds have had 2 stellar months, and some of the movement we're seeing suggests they may be running into their first major correction against those 2 months of strength. In other words, rates have moved lower very nicely for 2 months and they're now threatening to bounce. [30YR FIXED - 4.625-4.75%]

emphasis added

• At 8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 214 thousand the previous week.

• At 9:00 AM: FHFA House Price Index for October 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM: POSTPONED New Home Sales for November from the Census Bureau. The consensus is for 560 thousand SAAR, up from 544 thousand in October.

Zillow Case-Shiller Forecast: Similar House Price Gains in November

by Calculated Risk on 12/26/2018 04:43:00 PM

The Case-Shiller house price indexes for October were released earlier. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: October Case-Shiller Results and November Forecast: Phoenix Replaces Seattle Among Top Three Home-Price Gainers

Home prices were steady in October, gaining 5.5 percent year-over-year, the same as September, according to the Case-Shiller home price index. The gain was slightly above Zillow’s forecast, and we expect another 5.5 percent year-over-year increase in November.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be about the same in November as in October.

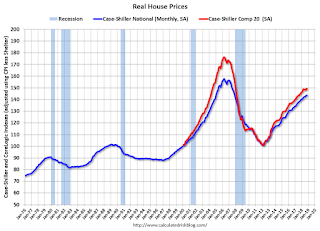

Real House Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/26/2018 01:28:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.5% year-over-year in October

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 11.4% above the previous bubble peak. However, in real terms, the National index (SA) is still about 8.9% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 12.4% below the bubble peak.

The year-over-year increase in prices has slowed to 5.5% nationally, and will probably slow more as inventory picks up.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $286,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to January 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/26/2018 11:06:00 AM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through October 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Richmond Fed: "Fifth District Manufacturing Activity Weakened in December"

by Calculated Risk on 12/26/2018 10:19:00 AM

From the Richmond Fed: Fifth District Manufacturing Activity Weakened in December

Fifth District manufacturing activity weakened in December, according to the latest survey from the Richmond Fed. The composite index dropped from 14 in November to −8 in December, weighed down by drops in the indexes for new orders and shipments. At −25, the shipments index was its lowest reading since April 2009. However, the third component, the index for employment, rose. Respondents indicated a deterioration in local business conditions, as this index fell to −25, its lowest reading on record, but most firms were optimistic that conditions would improve.This is the weakest reading for this survey since 2016. All of the regional manufacturing surveys have been weaker in December than in November (the Dallas Fed survey will be released Monday).

Survey results suggested employment growth among many manufacturing firms in December, but firms continued to struggle to find workers with the necessary skills. Respondents expected this problem to continue in the coming months but anticipated continued employment growth as well.

emphasis added