by Calculated Risk on 8/16/2018 07:22:00 PM

Thursday, August 16, 2018

Houston: Existing Home Sales up 9.1% YoY, Inventory down 3.5% YoY

From the HAR: Houston Real Estate Stays Hot in July

Houston home sales showed no let-up in July, but the pace was not enough to rival the record-setting volume and pricing set in June. Inventory remained constrained at a 4.2-months supply, and the lease market saw waning consumer interest.CR Note: Houston activity has likely been boosted by the sharp increase in oil prices over the last year.

According to the latest monthly report from the Houston Association of REALTORS® (HAR), 8,108 single-family homes sold in July compared to 7,433 a year earlier, accounting for a 9.1-percent increase. On a year-to-date basis, home sales are running 3.4 percent ahead of 2017’s record volume.

California: "Housing market retreats", Inventory up 11.9% YoY

by Calculated Risk on 8/16/2018 03:22:00 PM

The CAR reported today: California’s housing market retreats for third straight month as affordability crunch dampens demand

California’s housing market backpedaled in July on an annual basis for the third consecutive month as higher interest rates and rising home prices eroded housing affordability and dampened demand, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some data from the NAR and CAR (ht Tom Lawler)

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 406,920 units in July, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2018 if sales maintained the July pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

July’s sales figure was down 0.9 percent from the revised 410,800 level in June and down 3.4 percent compared with home sales in July 2017 of 421,460.

“In the midst of the peak home-buying season, high home prices and rising interest rates combined to crimp housing affordability, which in turn is subduing home sales,” said C.A.R. President Steve White. “Some of the reluctance by buyers appears to be driven by fears that the market may be peaking. Additionally, the lack of a federal tax incentive for homeownership could be at play given that much of the weakness is in the lower-priced, first-time buyer segment of the market.”

…

“While home sales continued to decline in recent months, the softening of the market is more indicative of a market shift rather than a major market correction,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “Despite the slowdown, there were some silver linings in the market in July. For example, homes priced between $500,000 and $1 million posted modest gains of about 5 percent in July thanks to growing inventory. Additionally, every price segment above $1 million continued to enjoy double-digit sales gains.”

...

Statewide active listings improved for the fourth consecutive month after 33 straight months of declines, increasing 11.9 percent from the previous year. July’s listings increase was the biggest in more than three years, and the number of active listings was the greatest supply of homes on the market in nearly two years.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | 0.5% | 8.1% |

| Jul-18 | --- | 11.9% |

Earlier: Philly Fed Manufacturing Survey "Growth in activity slowed" in August

by Calculated Risk on 8/16/2018 01:43:00 PM

From the Philly Fed: August 2018 Manufacturing Business Outlook Survey

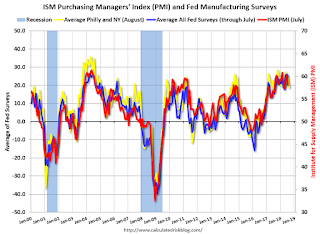

Growth in regional manufacturing activity slowed in August, according to results from this month’s Manufacturing Business Outlook Survey. All the broad indicators remained positive but fell from their readings in July.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The diffusion index for current general activity decreased 14 points this month to 11.9, its lowest reading in 21 months. Nearly 32 percent of the manufacturers reported increases in overall activity this month, while 20 percent reported decreases. The new orders index fell 22 points to 9.9. More than 34 percent of the firms reported an increase in new orders, while 24 percent reported a decrease.

The firms continued to report overall higher employment, but increases were less widespread this month. Just 18 percent of the responding firms reported increases in employment this month, down from 24 percent last month. Only 4 percent of the firms reported decreases in employment. The current employment index fell 3 points to 14.3. The current average workweek index declined 3 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through August), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

This suggests the ISM manufacturing index might decline in August, but still show solid expansion.

Comments on July Housing Starts

by Calculated Risk on 8/16/2018 11:01:00 AM

Earlier: Housing Starts at 1.168 Million Annual Rate in July

Housing starts in July were disappointing once again, and starts for May and June were revised down. However this was just the second month of disappointing starts, and most of the decline was in multi-family starts that are volatile month-to-month.

The housing starts report released this morning showed starts were up 0.9% in July compared to June (only up because June was revised down), and starts were down 1.4% year-over-year compared to July 2017.

Multi-family starts were down 9.6% year-over-year, and single family starts were up 2.7% year-over-year.

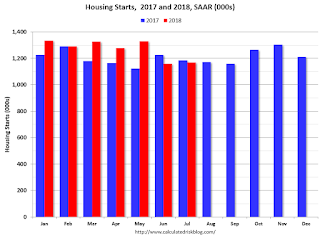

This first graph shows the month to month comparison for total starts between 2017 (blue) and 2018 (red).

Starts were down 1.4% in July compared to July 2017.

Through seven months, starts are up 6.2% year-to-date compared to the same period in 2017. Even with the weakness over the last two months, that is still a decent increase.

Single family starts were up 2.7% year-over-year, and up 0.9% compared to July 2018.

Multi-family starts were down 9.6% year-over-year, and up 3.1% compared to June 2018 (multi-family is volatile month-to-month).

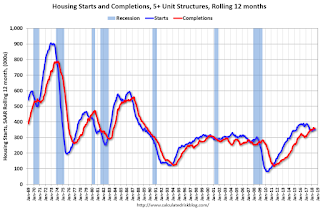

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but has turned down recently. Completions (red line) had lagged behind - however completions have passed starts (more deliveries).

It is likely that both starts and completions, on rolling 12 months basis, will now move mostly sideways.

As I've been noting for a few years, the significantly growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a couple more years, or more, of increasing single family starts and completions.

Note: Last month, in response to numerous articles discussing the "slowing housing market" and some suggesting "housing has peaked", I wrote: Has Housing Market Activity Peaked? and Has the Housing Market Peaked? (Part 2). My view currently remains the same, but if the weakness in housing starts and new home sales persist, I'll revisit my outlook. My guess is the weakness will not continue, and new home sales and single family starts will increase further.

MBA: Mortgage Delinquency Rate decreased in Q2

by Calculated Risk on 8/16/2018 10:34:00 AM

From the MBA: Mortgage Delinquencies Down in 2nd Quarter of 2018

The delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 4.36 percent of all loans outstanding at the end of the second quarter of 2018.

The delinquency rate was down 27 basis points from the previous quarter, but was up 12 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The percentage of loans on which foreclosure actions were started dropped four basis points from the last quarter to 0.24 percent, its lowest level since the second quarter of 1987.

“We continue to see improvement in the overall mortgage delinquency rate as the impact of the hurricanes from one year ago lessens, particularly for conventional loans,” according to Marina Walsh, Vice President of Industry Analysis at MBA. “Among the various loan types, the delinquency rate for conventional loans was two basis points lower than one year ago, prior to the hurricanes. While delinquencies for both FHA and VA loans were up from one year ago, they were improved over the previous quarter.”

...

Mortgage delinquencies dropped across all stages of delinquency in the second quarter of 2018 compared to the first quarter of 2018. The 30-day delinquency rate dropped two basis points from the previous quarter, while the 60-day and 90-day delinquency buckets dropped by eight and 18 basis points respectively.

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 1.05 percent, down 11 basis points from the first quarter of 2018 and 24 basis points lower than one year ago. This was the lowest foreclosure inventory rate since the third quarter of 2006.

...

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.30 percent in the second quarter of 2018, a decrease of 31 basis points from last quarter, and a decrease of 19 basis points from last year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans delinquent decreased in Q2, as "the impact of the hurricanes from one year ago lessens".

The percent of loans in the foreclosure process continues to decline, and is close to normal levels.

Housing Starts at 1.168 Million Annual Rate in July

by Calculated Risk on 8/16/2018 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,168,000. This is 0.9 percent above the revised June estimate of 1,158,000, but is 1.4 percent below the July 2017 rate of 1,185,000. Single-family housing starts in July were at a rate of 862,000; this is 0.9 percent above the revised June figure of 854,000. The July rate for units in buildings with five units or more was 303,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,311,000. This is 1.5 percent above the revised June rate of 1,292,000 and is 4.2 percent above the July 2017 rate of 1,258,000. Single-family authorizations in July were at a rate of 869,000; this is 1.9 percent above the revised June figure of 853,000. Authorizations of units in buildings with five units or more were at a rate of 410,000 in July.

emphasis added

Click on graph for larger image.

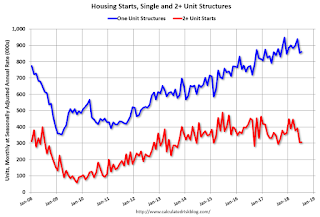

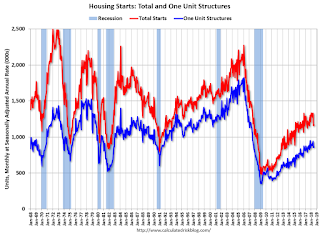

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased slightly in July compared to June. Multi-family starts were down 12% year-over-year in July.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years. This is the bottom of the range.

Single-family starts (blue) increased in July, and were up 2.7% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in July were well below expectations, and starts for May and June were both revised down.

I'll have more later ...

Weekly Initial Unemployment Claims decreased to 212,000

by Calculated Risk on 8/16/2018 08:33:00 AM

The DOL reported:

In the week ending August 11, the advance figure for seasonally adjusted initial claims was 212,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 213,000 to 214,000. The 4-week moving average was 215,500, an increase of 1,000 from the previous week's revised average. The previous week's average was revised up by 250 from 214,250 to 214,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 215,500.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, August 15, 2018

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 8/15/2018 06:51:00 PM

Thursday:

• At 8:30 AM ET, Housing Starts for July. The consensus is for 1.271 million SAAR, up from 1.173 million SAAR.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 213 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for August. The consensus is for a reading of 22.3, down from 25.7.

LA area Port Traffic Mostly Unchanged YoY in July

by Calculated Risk on 8/15/2018 01:41:00 PM

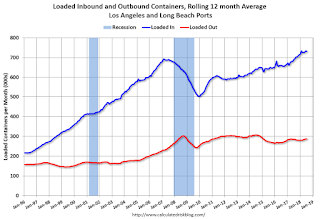

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.1% compared to the rolling 12 months ending in June. Outbound traffic was up 0.2% compared to the rolling 12 months ending in June.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have mostly moved sideways over the last 6 or 7 years.

It is still too early to tell about the impact of the tariffs.

Earlier from the NY Fed: Manufacturing "Business activity remained robust in New York State"

by Calculated Risk on 8/15/2018 01:11:00 PM

From the NY Fed: Empire State Manufacturing Survey

Business activity remained robust in New York State, according to firms responding to the August 2018 Empire State Manufacturing Survey. The headline general business conditions index climbed three points to 25.6. New orders and shipments grew strongly, and firms reported an increase in unfilled orders. Delivery times continued to lengthen, and inventories held steady. Labor market indicators pointed to solid gains in employment and longer workweeks. Price indexes were little changed and remained elevated, indicating ongoing significant price increases. Looking ahead, firms stepped up their capital spending plans and were fairly optimistic about the six-month outlook.This was above the consensus forecast and a solid reading.

…

The index for number of employees edged lower, but at 13.1, pointed to a pickup in employment levels. The average workweek index was 8.9, indicating a modest increase in hours worked.

emphasis added