by Calculated Risk on 11/17/2017 03:55:00 PM

Friday, November 17, 2017

Lawler: Early Read on Existing Home Sales in October

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I predict that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.60 million in October, up 3.9% from September’s preliminary estimate and up 1.3% from last October’s seasonally-adjusted pace. Unadjusted sales should register a higher YOY gain, reflecting this October’s higher business day count compared to last October’s.

On the inventory front, local realtor/MLS data suggest that the NAR’s estimate of the number of existing homes for sale at the end of October will be about 1.88 million, down 1.1% from September’s preliminary estimate and down 6.5% from last October’s estimate.

Finally, realtor/MLS data suggest that the NAR’s estimate of the median existing SF home sales price last month was up 5.8% from last October.

CR Note: Existing home sales for October are scheduled to be released next Tuesday. The consensus is for sales of 5.40 million SAAR. Take the over on Tuesday!

Lawler: Has US Household Growth Slowed, and If So, Why?

by Calculated Risk on 11/17/2017 01:31:00 PM

From housing economist Tom Lawler: Has US Household Growth Slowed, and If So, Why?

Yesterday the Census Bureau released estimates of America’s Families and Living Arrangements (which includes household estimates) based on the Annual Social and Economic Supplement of the CPS for March 2017, and the estimates suggested that US household growth slowed considerably in the 12-month period ending this March – though by less than that shown in the Census Bureau’s tables.

According to the data released yesterday, the CPS/ASEC-based estimate of the number of US households in March 2017 was 126.224 million, up just 405,000 from the March 2016 household estimate of 125.819 million from the 2016 CPS/ASEC. As I noted in an earlier report, however, this meager yearly gain is understated, because the 2016 CPS/ASEC estimates were based on “2015 Vintage” population estimates for 2016, and last year Census (in its “2016 Vintage” release) revised down considerably its population estimates for 2016 (and for earlier years.) Annoyingly, Census does not go back and revise earlier year CPS/ASEC household estimates to reflect revisions in population estimates.

For example, CPS/ASEC tables show an increase in the US adult (18+) civilian non-institutionalized population of just 0.59%, from March 2016 to March 2017, while Census’ updated population estimates shown an increase of 0.89% over this period (again, reflecting a downward revision to 2016 estimates).

If one were to adjust the 2016 CPS/ASEC household estimate to reflect the downward revisions in 2016 population estimates, the “adjusted” CPS/ASEC household estimate would be about 125.445 million, and the “adjusted” increase in the CPS/ASEC household estimate for 2017 would be about 779,000. This “adjusted” gain still represents a marked slowed in estimated household growth.

The CPS/ASEC-based slowdown in household growth for 2017 (an “adjusted” increase of 0.62%, compared to an “adjusted” increase in the adult population of 0.89%) reflects, by arithmetic, an increase in the average household size and a decrease in the aggregate adult “headship” rate. The lower headship rates for 2017 compared to 2016 were not driven by a gain in the number of young adults living with parents (which decreased slightly from last year’s elevated levels), but instead by a decline in the number of people living alone (mainly in the 35+ group).

The other major CPS household estimate, based on the Housing Vacancy Survey (HVS) supplement to the CPS, has also showed a marked deceleration in growth. The CPS/HVS estimate of the number of US households in the third quarter of 2017 was 119.085 million, up only 407,000 from the estimate for the third quarter of 2016. (Reminder: the CPS/ASEC household estimate is “controlled” to independent population estimates, while the CPS/HVS household estimate is “controlled” to independent housing stock estimates.)

One other household estimate produced by Census comes from the American Community Survey, though only annual estimates are available. For 2016 the ACS-based US household estimate was 118.860 million, up just 652,000 from the 2016 ACS estimate. The ACS household estimate is also effectively “controlled” to independent housing stock estimates.

Here is a table showing the latest yearly increase in household estimates from various surveys compared to the average annual increases in the previous 5-year period

| Recent Increases in Estimated Number of Households, Various Surveys (000's) | ||||

|---|---|---|---|---|

| Latest Yearly Increase | Time Period | Average Increase, Previous 5 Years | Time Period | |

| CPS/ASEC Reported | 405 | 3/16-3/17 | 1,178 | 3/11-3/16 |

| Adjusted* | 779 | 3/16-3/17 | 1,103 | 3/11-3/16 |

| CPS/HVS | 407 | Q3/16-Q3/17 | 1,049 | Q3/11-Q3/16 |

| ACS | 654 | 2015-2016 | 728 | 2010-2015 |

| *Adjusted by LEHC to reflect downward revisions in 2016 population estimates | ||||

One of the striking things to note is that all of these surveys suggest that US household growth in either 2016 or part of 2017 was slower that was the case in the previous 5-year period, and (not shown) well below the average annual gains of last decade. If true, then the recent declines in headship rates may either be more “structural” than “cyclical,” or may be reflective of societal shifts and other economic factors. (more on this later).

Of course, one needs to be cautious of using any of these surveys to gauge “actual” trends, as none matches up that well with Decennial Census results. However, the latest data suggest that some of the most “bullish” cases for housing demand based on “demographics” and “pent-up demand” may be “bull.”

On the latter score, Census still plans to release updated US population projections sometime before the end of this year. These projections will almost certainly show slower projected population growth than the latest available projections released in 2014, and that had unrealistically high assumptions about net international immigration.

MBA: Mortgage Delinquency Rate increases in Q3 mostly due to Hurricanes

by Calculated Risk on 11/17/2017 10:41:00 AM

From the MBA: Delinquencies Up in MBA’s National Delinquency Survey for Q3 2017

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.88 percent of all loans outstanding at the end of the third quarter of 2017. The delinquency rate was up 64 basis points from the previous quarter, and was 36 basis points higher than one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 0.25 percent, a decrease of one basis point from the previous quarter, and five basis points lower than one year ago. The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 1.23 percent, down 6 basis points from the previous quarter and 32 basis points lower than one year ago.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.52 percent in the third quarter, up 3 basis points from the previous quarter, but 44 basis points lower than one year ago.

Marina Walsh, MBA’s Vice President of Industry Analysis, offered the following commentary on the survey:

“In the third quarter of 2017, the overall delinquency rate rose by 64 basis points over the previous quarter, with the 30-day delinquency rate accounting for 50 basis points of this variance. Hurricanes Harvey, Irma and Maria caused disruptions and destruction in numerous states. Florida, Texas, neighboring states, as well as devastated Puerto Rico, saw substantial increases in their past due rates. While forbearance is in place for many borrowers affected by these storms, our survey asks servicers to report these loans as delinquent if the payment was not made based on the original terms of the mortgage regardless of any forbearance plans in place.

“Mortgage delinquencies increased across all loan types – FHA, VA and conventional – on a seasonally-adjusted basis. The FHA delinquency rate increased to 9.40 percent from 7.94 percent in the second quarter, a 146 basis-point increase and the highest quarter-over-quarter increase reported in the history of our survey. The VA delinquency rate increased 52 basis points to 4.24 percent from 3.72 percent in the second quarter. The conventional delinquency rate increased 50 basis points to 3.97 percent from 3.47 percent in the second quarter.

“While the storms played a critical factor in explaining the rise in the overall delinquency rate, there are other factors to consider, especially given delinquency rate increases in other states not directly impacted by the storms. First, there were timing issues associated with the last day of the month being a Saturday. Processing for mortgage payments made over the weekend did not occur until Monday, October 2 and thus these mortgage payments were identified as 30-days delinquent per NDS definitions.

“Second, delinquency rates were already at historic lows in the second quarter of 2017. The FHA and VA delinquency rates were at their lowest levels since 1996 and 1979 respectively, while the conventional delinquency rate reached its lowest level since 2005. It would not be unexpected for delinquencies to eventually increase from these levels.

...

“It will likely take about three or four more quarters for the effects of the most recent hurricanes on the survey results to dissipate. That said, we see loan performance as still healthy and strong, supported by a positive employment and wage outlook. Thus far in 2017, job growth is averaging 169,000 jobs per month, unemployment rate has decreased from 4.8 to 4.1 percent, and wage growth is 3.8 percent on a year over year basis.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent increased in Q3, primarily due to the hurricanes.

The 90 day bucket increased in Q3, and remains a little elevated.

The percent of loans in the foreclosure process continues to decline, and is close to normal levels.

BLS: Unemployment Rates Lower in 12 states in October; Alabama, Hawaii and Texas at New Series Lows

by Calculated Risk on 11/17/2017 10:29:00 AM

Note from the BLS on Puerto Rico:

The Puerto Rico household survey was conducted for the October 2017 reference period. However, the response rate was below average, in part as a result of difficulties accessing some remote areas that were significantly affected by Hurricanes Irma and Maria.From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in October in 12 states, higher in 1 state, and stable in 37 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Twenty-three states had jobless rate decreases from a year earlier, 2 states and the District had increases, and 25 states had little or no change. The national unemployment rate edged down to 4.1 percent in October and was 0.7 percentage point lower than a year earlier.

...

Hawaii had the lowest unemployment rate in October, 2.2 percent, followed by North Dakota, 2.5 percent. The rates in Alabama (3.6 percent), Hawaii (2.2 percent), and Texas (3.9 percent) set new series lows. ... Alaska had the highest jobless rate, 7.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

Fourteen states have reached new all time lows since the end of the 2007 recession. These fourteen states are: Alabama, Arkansas, California, Colorado, Hawaii, Idaho, Maine, Mississippi, North Dakota, Oregon, Tennessee, Texas, Washington, and Wisconsin.

The states are ranked by the highest current unemployment rate. Alaska, at 7.2%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently one state has an unemployment rate at or above 7% (light blue); Only two states and D.C. are at or above 6% (dark blue). The states are Alaska (7.2%) and New Mexico (6.1%). D.C. is at 6.6%.

Housing Starts increased to 1.290 Million Annual Rate in October

by Calculated Risk on 11/17/2017 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,290,000. This is 13.7 percent above the revised September estimate of 1,135,000, but is 2.9 percent below the October 2016 rate of 1,328,000. Single-family housing starts in October were at a rate of 877,000; this is 5.3 percent above the revised September figure of 833,000. The October rate for units in buildings with five units or more was 393,000.

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,297,000. This is 5.9 percent above the revised September rate of 1,225,000 and is 0.9 percent above the October 2016 rate of 1,285,000. Single-family authorizations in October were at a rate of 839,000; this is 1.9 percent above the revised September figure of 823,000. Authorizations of units in buildings with five units or more were at a rate of 416,000 in October.

emphasis added

Click on graph for larger image.

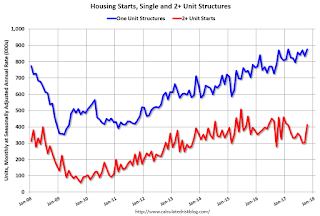

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in October compared to Septeber. However Multi-family starts are down year-over-year.

Multi-family is volatile month-to-month, but has been mostly moving down recently.

Single-family starts (blue) increased in October, and are up slightly year-over-year.

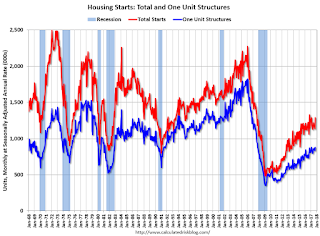

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in October were above expectations. Starts for August and September were revised down slightly, combined.

I'll have more later ...

Thursday, November 16, 2017

Friday: Housing Starts

by Calculated Risk on 11/16/2017 06:25:00 PM

Friday:

• At 8:30 AM, Housing Starts for October. The consensus is for 1.188 million SAAR, up from the September rate of 1.127 million.

• At 10:00 AM, State Employment and Unemployment (Monthly) for October 2017

• At 11:00 AM, the Kansas City Fed manufacturing survey for November.

Phoenix Real Estate in October: Sales up 4%, Inventory down 10% YoY

by Calculated Risk on 11/16/2017 03:01:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in October were up 4.3% year-over-year (including homes, condos and manufactured homes).

2) Active inventory is now down 10.1% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the twelfth consecutive month with a YoY decrease in inventory, and prices are rising a little faster this year (3.7% through August or 5.7% annual rate).

| October Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Oct-08 | 5,384 | --- | 1,348 | 25.0% | 55,7031 | --- |

| Oct-09 | 8,121 | 50.8% | 2,688 | 33.1% | 39,312 | -29.4% |

| Oct-10 | 6,591 | -18.8% | 2,800 | 42.5% | 45,252 | 15.1% |

| Oct-11 | 7,561 | 14.7% | 3,336 | 44.1% | 27,266 | -39.7% |

| Oct-12 | 7,020 | -7.2% | 3,081 | 43.9% | 22,702 | -16.7% |

| Oct-13 | 6,038 | -14.0% | 1,910 | 31.6% | 26,267 | 15.7% |

| Oct-14 | 6,186 | 2.5% | 1,712 | 27.7% | 27,760 | 5.7% |

| Oct-15 | 6,308 | 2.0% | 1,570 | 24.9% | 24,702 | -11.0% |

| Oct-16 | 7,102 | 12.6% | 1,494 | 21.0% | 24,950 | 1.0% |

| Oct-17 | 7,408 | 4.3% | 1,578 | 21.3% | 22,427 | -10.1% |

| 1 October 2008 probably includes pending listings | ||||||

Earlier: Philly Fed Manufacturing Survey showed "Activity Continues to Expand" in November

by Calculated Risk on 11/16/2017 12:11:00 PM

Earlier from the Philly Fed: November 2017 Manufacturing Business Outlook Survey

Regional manufacturing activity continued to expand in November, according to results from this month’s Manufacturing Business Outlook Survey. The indexes for general activity and shipments fell from their October readings but remained positive, while the survey’s index for new orders rose. The employment index fell but remained elevated. Almost all of the future indicators rose, and firms continue to expect growth in both activity and employment over the next six months.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The diffusion index for current manufacturing activity in the region remained positive but decreased from a reading of 27.9 in October to 22.7 in November. The index has been positive for 16 consecutive months. ... Firms continued to report increases in employment, though at a slower pace relative to last month. While the current employment index has been positive for 12 consecutive months, it fell 8 points to 22.6 in November.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through November), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

This suggests the ISM manufacturing index might decline in November, but still show solid expansion.

NAHB: Builder Confidence increased to 70 in November

by Calculated Risk on 11/16/2017 10:06:00 AM

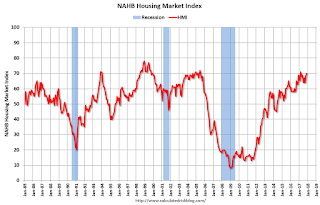

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 70 in November, up from 68 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Climbs to 8 Month High in November

Builder confidence in the market for newly-built single-family homes rose two points to a level of 70 in November on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This was the highest report since March, and the second highest on record since July 2005.

“November’s builder confidence reading is close to a post-recession high — a strong indicator that the housing market continues to grow steadily,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas. “However, our members still face supply-side constraints, such as lot and labor shortages and ongoing building material price increases.”

“Demand for housing is increasing at a consistent pace, driven by job and economic growth, rising homeownership rates and limited housing inventory,” said NAHB Chief Economist Robert Dietz. “With these economic fundamentals in place, we should see continued upward movement of the single-family housing market as we close out 2017.”

...

Two out of the three HMI components registered gains in November. The component gauging current sales conditions rose two points to 77 and the index measuring buyer traffic increased two points to 50. Meanwhile, the index charting sales expectations in the next six months dropped a single point to 77.

Looking at the three-month moving averages for regional HMI scores, the Northeast jumped five points to 54 and the South rose one point to 69. Both the West and Midwest remained unchanged at 77 and 63, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast, and a strong reading.

Industrial Production Increased 0.9% in October

by Calculated Risk on 11/16/2017 09:25:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.9 percent in October, and manufacturing increased 1.3 percent. The index for utilities rose 2.0 percent, but mining output fell 1.3 percent, as Hurricane Nate caused a sharp but short-lived decline in oil and gas drilling and extraction. Even so, industrial activity was boosted in October by a return to normal operations after Hurricanes Harvey and Irma suppressed production in August and September. Excluding the effects of the hurricanes, the index for total output advanced about 0.3 percent in October, and the index for manufacturing advanced about 0.2 percent.

With modest upward revisions for July through September, industrial production is now estimated to have only edged down 0.3 percent at an annual rate in the third quarter; the previously published estimate showed a decrease of 1.5 percent.

Total industrial production has risen 2.9 percent over the past 12 months; output in October was 106.1 percent of its 2012 average. Capacity utilization for the industrial sector was 77.0 percent, a rate that is 2.9 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.0% is 2.9% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in October to 106.1. This is 21.8% above the recession low, and just above the pre-recession peak.